Insurance premiums are deductions from employee income to extra-budgetary funds at established rates. Insurance contributions are mandatory and are the employer's expenses. The employee himself does not incur any losses; contributions are not deducted from his salary. Contributions are calculated by the employer on a monthly basis by multiplying the base by the prevailing rate. The base is determined at the end of each month by summing up all payments made by the employer to its employee, starting in January of the current year. If the resulting value reaches the maximum value (the maximum base for insurance premiums) approved by the Government of the Russian Federation, then premiums are either not charged or are calculated at a lower rate. This value is called the marginal base for calculating insurance premiums. Every year this parameter is indexed taking into account changes in the average salary in the Russian Federation, new values are approved by legislative document.

The amount (rate) of insurance contributions to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation in 2015, 2021 - 2021

Currently and subsequent years, the following deductions are established:

- Pension Fund of Russia (PFR) within the maximum amount of taxable income from the beginning of the year - 22%

, above the limit -

10%

; - Federal Compulsory Medical Insurance Fund (FFOMS RF) in – in the amount 5,1%

; - Social Insurance Fund of the Russian Federation (FSS RF) - in the amount of 2.9%

(Part 1.1 Article 58.2 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation , Federal Compulsory Medical Insurance Fund").

Let us remind you that from January 1, 2021

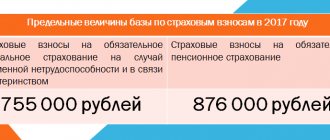

New maximum values of the base for calculating insurance premiums are also established:

- in the FSS of the Russian Federation it will be 718 thousand rubles

.,

- for contributions to the Pension Fund – 796 thousand rubles.

This base is calculated for each individual on an accrual basis from the beginning of the year.

Document:

Decree of the Government of the Russian Federation of November 26, 2015 No. 1265 “On the maximum value of the base for calculating insurance contributions to the Social Insurance Fund of the Russian Federation and the Pension Fund of the Russian Federation from January 1, 2021”).

What payments are included in the base?

When calculating insurance deductions, you should compare the base with the maximum value. To correctly calculate the base, you should know which payments need to be taken into account and which not.

Taken into account:

- Salary, according to the time worked (read about salary payments in the article ⇒ “Deadlines for payment of wages in 2021”);

- Bonuses, allowances, interest on wages - incentive payments;

- Compensatory additional payments in the form of a regional coefficient in 2021;

- Compensation for unspent vacation days in the event of a break in the employment relationship;

- Severance pay in excess of triple average monthly earnings (six times for workers in the RKS and equivalent territories);

- Payments under GPC agreements in relation to contributions to the Pension Fund and the Compulsory Medical Insurance Fund;

- Remuneration in kind – based on their documentary value;

- Remunerations for copyright orders, under agreements for the implementation of the exclusive right to such intangible assets as scientific, literary works, objects of art, and the rights to use these intangible assets are defined as income under the contract or order minus expenses justified by documentation.

Not taken into account:

- Hospital benefits;

- Benefits calculated in connection with pregnancy, maternity and raising a child;

- Other types of government benefits;

- Compensatory payments related to payment for accommodation, food, fuel, clothing, additional training and advanced training, compensation for harm caused to health;

- Remuneration of individuals under GPC agreements for the purpose of determining contributions to the Social Insurance Fund;

- Payments covering expenses under GPC agreements;

- Financial assistance up to 4000 rubles. (support provided in connection with emergency events, death of family members is not fully taken into account, at the birth of a new family member - within 50,000 per child);

- Payments for travel expenses;

- Income of foreign persons.

The full list of payments not taken into account when determining the base is enshrined in Article 9. Law No. 212-FZ.

If the employee has been working since the middle of the year

If we consider a situation where an employee works at one place of work for the whole year, then everything is simple - the base for calculating contributions is considered an accrual total from January to the end of each month. At the end of each month, it is enough to add up the income and remuneration of each month and compare the resulting value with the maximum base.

If an employee has been working for a given employer not since January of the current year, for example, has been officially employed since the middle of the year, then the basis for calculating insurance contributions should be calculated based on the income that was paid to the employee by this employer. Income received from other employers this year is not taken into account.

If several agreements are concluded with the employee

There are situations when an employer enters into several agreements with the same person - an employment contract on permanent work, on part-time work, a civil service contract. If the employer makes payments under each such agreement, the basis is calculated by adding the income from all agreements.

When accounting for payments under GPC agreements, it should be remembered that these incomes should be included in the base for calculating pension and medical contributions, and should not be included in the base for calculating social contributions.

The maximum value of the base for calculating insurance premiums in 2016 in the Compulsory Medical Insurance Fund

There is no limit for the MHIF.

Contributions for compulsory health insurance at a general rate of 5.1 percent, as in 2015, will need to be calculated on the full amount of payments to employees, regardless of their income. Tariffs for employers who are not eligible for reduced tariffs

| Conditions for applying the tariff | Fund | Limit value of the calculation base for calculating insurance premiums (rub., per year) 1 | Tariff, % | Base |

| From payments: – to Russian citizens; – foreigners (stateless persons) who permanently or temporarily reside in Russia and are not highly qualified specialists; – citizens of the EAEU member states, regardless of status5 | Pension Fund | Up to 800,000 rub. inclusive | 22,0 | Federal Law of November 28, 2015 No. 347-FZ “On Amendments to Article 33-1 of the Federal Law “On Compulsory Pension Insurance in the Russian Federation” and Article 58-2 of the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, Fund social insurance of the Russian Federation, Federal Compulsory Medical Insurance Fund" |

| —//— | —//— | Over 800,000 rub. | 10,0 | —//— |

| —//— | FSS | Up to 723,000 rub. inclusive | 2,9 | —//— |

| —//— | —//— | Over 723,000 rub. | 0,0 | —//— |

| —//— | FFOMS | Not installed | 5,1 | —//— |

| From payments to foreigners (stateless persons) who are temporarily staying in Russia and are not highly qualified specialists Exception: citizens of EAEU member states5 | Pension Fund | Up to 800,000 rub. inclusive | 22,0 | Federal Law of November 28, 2015 No. 347-FZ “On Amendments to Article 33-1 of the Federal Law “On Compulsory Pension Insurance in the Russian Federation” and Article 58-2 of the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, Fund social insurance of the Russian Federation, Federal Compulsory Medical Insurance Fund”, Part 1, Art. 7, part 2.1 art. 22, part 1 art. 22.1 and art. 33.1 of the Law of December 15, 2001 No. 167-FZ |

The maximum base grows annually by at least 10%

The maximum base for calculating mandatory contributions is growing annually. According to the Government of the Russian Federation, this is due to an increase in wages. The marginal base is simply indexed taking into account the growth of average wages in the Russian Federation.

True, in commercial structures wages fell with the exception of two or three industries. Yes, officials' salaries have increased. But, in general, the country’s income continues to decline for the 6th year in a row.

If in 2012, in order to overcome the limit on insurance contributions, an employee had to pay 50,000 rubles. Now in 2021, in order to reach the limit on pension contributions, the employee’s salary must be at least 118,000 rubles. this figure is not achievable for most companies. And this is one of the reasons holding back real wage growth.

Billing and reporting periods

Insurance premiums in 2021

stipulate that the settlement period for them is the 2016 calendar year. It consists of reporting periods: first quarter, half a year, nine months. Insurance premiums in 2021 must be paid monthly to the following funds:

- Russian Pension Fund;

- Social Insurance Fund of Russia (FSS of Russia) (for compulsory social insurance for temporary disability and in connection with maternity);

- to the Federal Compulsory Medical Insurance Fund (FFOMS).

Privileges

For taxpayers from among beneficiaries who have chosen a simplified tax payment system, of the three social contributions, only pension contributions are provided with a rate reduced by 2%, that is, in the amount of 20%. If the amount of income exceeds 800 thousand rubles, no deduction of insurance premiums is made.

It will also be useful for this category of the population to know what pension indexation is expected in 2021.

The table lists which industries have the right to take advantage of the above benefits for making deductions. An exhaustive list of areas of business in which deductions are not made or tariffs are reduced is provided in Article 58 of Federal Law No. 212 (clause 1, subclause 8). The specified type of activity must be the main one for the enterprise.

| Kind of activity | Which paragraph of subclause 8 of clause 1 provides benefits | Codes according to the All-Russian Classifier of Economic Activities |

| Production | ||

| Food | A | from 15.1 to 15.8 |

| Drinks (except alcoholic) | B | 15.98 |

| Textiles and clothing products | IN | 17 and 18 |

| Leather products, shoes | G | 19 |

| Wood products | D | 20 |

| Chemical industry products | E | 24 |

| Plastic and rubber products | AND | 25 |

| Other mineral products not of metal | Z | 26 |

| Finished metal products | AND | 28 |

| Mechanical engineering products | TO | 29 |

| Electronic and optical equipment | L | from 30 to 33 |

| Transport and equipment for it | M | 34 and 35 |

| Furniture | N | 36.1 |

| Sports goods | ABOUT | 36.4 |

| Toys and games | P | 36.5 |

| Paper products | E | 21 |

| Musical instruments | YU | 36.3 |

| Other products | I | 36.6 |

| Bent steel profiles | i.9 | 27.33 |

| Steel wire | i.10 | |

| Service sector and other types activities other than production | ||

| Scientific activity | R | 73 |

| Educational services | WITH | 80 |

| Social and health services | T | 85 |

| Work in the field of sports infrastructure functioning | U | 92.61 |

| Other sporting activities | F | 92.62 |

| Work with raw materials obtained from waste | X | 37 |

| Construction | C | 45 |

| Automotive transport (repair and maintenance) | H | 50.2 |

| Work with wastewater and waste | Sh | 90 |

| Transport and communications | SCH | from 60 to 64 |

| Support activities in the transport industry | SCH | 63 |

| Personal services | Y | 93 |

| Maintenance of household items | I.1 | 52.7 |

| Real estate related work | I.2 | 70.32 |

| Cinematography (production, distribution and exhibition of films) | I.3 | 92.1 |

| Library, archival work, work of club-type establishments (in addition to clubs) | I.4 | 92.51 |

| Museum work. Protection of sites and buildings of historical value | I.5 | 92.52 |

| Work of nature reserves, zoos and botanical gardens | I.6 | 92.53 |

| Work in the field of information technology, except for certain types of activities | I.7 | 72 |

| Retail sales of medical goods and medicines | I.8 | 52.31 and 52.32 |

Who pays contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund

Insurance contributions to these extra-budgetary funds are required to be paid to the following categories of entrepreneurs:

- organizations with employees who are paid wages and (or) contractors - individuals who receive remuneration for their work;

- Individual entrepreneurs with employees who are paid wages, and (or) contractors - individuals who receive remuneration for their work;

- Individuals without individual entrepreneur status who pay salaries to employees and (or) remuneration to contractors - individuals;

- Individual entrepreneurs and individuals who are engaged in private practice (notaries, lawyers, doctors) and work for themselves and not for an employer.

Criminal liability for non-payment of insurance premiums

Companies will be held criminally liable for evading payment of insurance contributions to the Pension Fund and the Social Insurance Fund. The draft to which the corresponding amendments are made

in Articles 199.3 and 199.4 of the Criminal Code of the Russian Federation, the Government of the Russian Federation introduced it to the State Duma.

For non-payment of insurance premiums by a company, the maximum possible punishment will be imprisonment for three years, for an entrepreneur - for a year. As in the case of taxes, the culprit will be held accountable - the one who decided to underestimate contributions. Usually this is the director. The chief accountant is a witness unless it is proven that he plays a key role in the company (for example, he is a co-founder) and participated in organizing the schemes.

The funds hope that the law will force debtors to repay the arrears. Decisions to initiate cases will be made by investigators, and funds will not be able to influence them. But the Pension Fund and the Social Insurance Fund will have the opportunity to put pressure on debtors, promising criminal prosecution.

The draft amends Article 199.2 of the Criminal Code of the Russian Federation, which provides for liability for concealing property from collection. It will apply to both taxes and contributions - their amounts will be plus. But the project shares responsibility for concealing property on a large and especially large scale. In the case of a large size (2–10 million rubles for companies and 0.6–3 million rubles for entrepreneurs), the maximum penalty will be softer than now—not five years in prison, but three. This reduces the statute of limitations for prosecution from six to two years.

Why are employers limited in their ability to increase wages?

Of course, wages depend on many factors: growth or decline in company revenue, growth or reduction in taxes and fees, market favorability, and so on.

We will now focus on only one factor - the increase in contributions that employers pay to the funds.

Let's consider how much the amount of contributions to the Pension Fund and the Social Insurance Fund has increased over the past 5 years.

As initial data, we take the following calculated figures:

The employee's salary is 50,000 rubles. per month and 100,000 rubles per month.

The employee's salary for the year is:

- with a salary of 50,000 rubles – 600,000 rubles

- with a salary of 100,000 rubles – 1,200,000 rubles.

Between 2012 and 2014

With an employee’s annual salary of 600,000 rubles in 2014, the company paid contributions in full. The total amount of contributions for the year was:

600,000 rub. x 30% = 180,000 rub.

Total contributions for 2014 from an employee’s salary of 50,000 rubles per month amounted to: 180,000 rubles.

From an employee’s annual salary of 1,200,000 rubles in 2014, the company pays contributions taking into account the maximum base. From the amount of 624,000 rubles - in full.

From the excess amount (1,200,000 rubles – 624,000 rubles = 576,000 rubles), the company pays contributions to the Pension Fund at a rate of 10% and pays nothing to the Social Insurance Fund.

The amount of contributions will be:

624,000 rub. x 30% = 187,200 rub.

RUB 576,000 x 10% + 576,000 rub. x 5.1% = 86,976 rub.

Total contributions for 2014 from an employee’s salary of 100,000 rubles per month amounted to: 274,176 rubles.

In 2021

With an employee’s annual salary of 600,000 rubles in 2021, the company will pay contributions in the same amount as before 2015. This amount of annual salary is less than the established limits for payment of insurance premiums.

Total contributions for 2021 from an employee’s salary of 50,000 rubles per month are: 600,000 rubles. x 30% = 180,000 rub.

From an employee’s annual salary of 1,200,000 rubles in 2021, the company will pay contributions, taking into account the maximum bases for calculating contributions.

The company will pay 22% of the entire annual salary to the Pension Fund. Because The maximum base for calculating contributions to the Pension Fund is 1,292,000 rubles. It is higher than the annual salary.

The company will pay 2.9% to the Social Insurance Fund on the amount of 912,000 rubles. From the amount exceeding RUB 380,000. There is no need to pay insurance premiums.

The Federal Insurance Fund does not establish maximum bases. The company will pay 5.1% of the entire amount.

So what happens.

Contributions to the Pension Fund will be: RUB 1,200,000. x 22% = 264,000 rub.

Contributions to the Social Insurance Fund will be: 912,000 rubles. x 2.9% = 26,448 rub.

Contributions to the Federal Insurance Fund will be: RUB 1,200,000. x 5.1% = 61,200 rub.

Total contributions for 2021 from the employee’s salary are 100,000 rubles. per month will be: 351,648 rubles.

In order to cross the threshold values of the maximum base for calculating contributions to the Pension Fund in 2021, the employee’s salary must be at least 117,000 rubles, and more or less tangible savings on contributions will appear only with a salary of more than 150,000 rubles.