According to the current laws of the Russian Federation, some beginning businessmen working under a simplified system or on a patent have the right not to pay the basic tax at the start of their career. In our review, we will take a detailed look at what it is - tax holidays for new individual entrepreneurs on the simplified tax system and special tax system, who is entitled to them and what types of activities they apply to, and we will also look in detail at how to get them.

What are the benefits and where do they apply?

Tax leave for entrepreneurs is one of the types of government support. In the first stages of running your own small business, when it is not yet entirely clear whether everything will go according to plan and whether the business will become profitable, the obligation to make contributions to the state budget can be disastrous.

To help new businessmen, the government has developed a number of legislative acts that exempt them from paying taxes for a certain period of time. However, in order to fall under the law, a number of mandatory requirements must be met. Next, we will look at who is granted tax holidays, what conditions and tax grace periods exist for newly opened individual entrepreneurs.

Leave to the Federal Tax Service is not an absolute deferment from all payment obligations. You will not have to pay only the basic tax on a patent or the simplified tax system. The entrepreneur must make other calculations as usual. This includes insurance contributions from wages, personal income tax, transport duty, property tax, according to its cadastral valuation, etc.

A detailed set of rules regarding the application of reducing the financial burden is described in the relevant legislative acts for “simplified” - this is Article 346.20 of the Tax Code of the Russian Federation, for the PNS - 346.50. Please note that in order for a businessman to take advantage of the benefits provided, the latter must also be established at the regional level.

A beginning entrepreneur has a guaranteed right to use the 0 rate only for a limited time - two tax periods from the date of registration. The duration of the latter depends on which taxation system he has chosen. For a simplified one it is one year, for a patent one – from 1 month to a year.

In order to be freed as much as possible from mandatory payments to the treasury, it is necessary to register an individual entrepreneur in the first weeks of January. Please note that according to recent amendments to the Tax Code of the Russian Federation, the holiday will be valid until the end of 2023. Therefore, in order to get the greatest benefit for himself, a businessman must register his business no later than the beginning of 2021.

Is it possible to save on insurance premiums?

Paying insurance premiums for individual entrepreneurs is a serious financial burden. Unfortunately, tax holidays do not apply to insurance premiums. This means that from the very beginning of his activities, the entrepreneur is fully obliged to fulfill all the obligations of the insurer to extra-budgetary funds - this equally applies to contributions from the salaries of individual entrepreneurs’ employees, and to the entrepreneur’s contributions for himself.

Officials, when asked about the exemption of individual entrepreneurs from paying contributions during tax holidays, note the following (letter of the Ministry of Finance of Russia dated October 18, 2017 No. 03-11-11/68194):

- The status of an individual entrepreneur is not only the opportunity to exercise certain rights and guarantees, but also the assumption of risks and responsibilities: according to the rules of doing business, fulfilling tax and non-tax obligations, including the payment of insurance premiums.

- At the expense of insurance contributions received by extra-budgetary funds, insurance guarantees are provided for the insured persons: for the payment of pensions, temporary disability benefits, social benefits in connection with maternity, etc.

Officials proceed from the fact that the state does not force a citizen to engage in one or another type of business activity. Before receiving the status of an individual entrepreneur, he himself assesses his readiness for this process in terms of education, skills, finances and property, including the ability to bear the burdens inherent in an individual entrepreneur.

Who and under what conditions can “go” on a tax holiday?

The government program itself was designed to stimulate entrepreneurial activity in Russia. It is designed for the period from 2015 to 2023, but a specific entity has the right to work with a zero rate for no more than 2 years. For the basic law to come into force, each region is obliged to establish benefits by its local regulatory act.

To receive a tax holiday, an entrepreneur must fulfill the following requirements:

- Be a registered individual entrepreneur for the first time. Federal Tax Service inspectors can easily identify those who have already been engaged in individual business (since the TIN assigned to an individual does not change throughout life), so the option to deregister and then re-register will not work here.

- The exemption applies to 2 tax periods, but this does not mean that it is valid for two full years.

- It is necessary to register entrepreneurial activity only after the resolution of the local government agency comes into force. Today, almost all regions have already adopted such documents. If such decisions have not been made in your constituent entity of the Russian Federation, this automatically means that the region does not want to exercise the right to reduce the financial burden for its residents.

- The leave is valid only in two systems – simplified and patent. Therefore, at the final stages of registration, a businessman is obliged to submit a petition to the Federal Tax Service to switch to one of these regimes. Otherwise, he will work under basic taxation and pay contributions under general conditions.

- Only individuals whose work is related to the scientific field, production, the provision of household services, social programs or the hotel business have the right to cancel payments. There are no benefits for trade.

- Part of the revenue from these types of activities must be more than 2/3 of total income.

- The decision of regional authorities may regulate additional amendments to the basic law. For example, local management has the right to reduce the annual income limit under the simplified system by ten or more times (from 150 million rubles to 15) and limit the number of employees.

- Regardless of the availability of an exemption, an individual is required to pay insurance premiums in full.

You can find out more information about regional regulations on the official website of the Federal Tax Service, at the local inspectorate office or city administration.

In order for a startup to become successful and bring the desired profit in the future, we recommend that all business processes be automated as much as possible. is one of the leading software developers for solving various problems in trade, manufacturing enterprises, and government agencies. With us you will find simple, functional and reliable mobile systems that allow you to get your work done much more efficiently.

Tax holidays - 2020-2021

Tax holidays for individual entrepreneurs are an opportunity not to pay tax under a simplified tax regime or a patent for two years after state registration as an individual entrepreneur, subject to certain conditions (clause 4 of article 346.20, clause 3 of article 346.50 of the Tax Code of the Russian Federation).

This bonus:

- allows individual entrepreneurs to reduce the tax burden;

- makes it possible to use saved funds for business development.

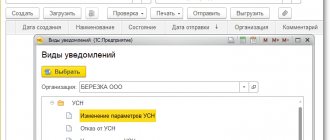

Individual entrepreneurs acquired the right to pay tax under the simplified tax system and special tax system at a rate of 0% back in 2015. Are there tax holidays for starting individual entrepreneurs at present? Yes, I have. Initially, the validity period of this event was set until 12/31/2020, but it has now been extended until 01/01/2024.

Thus, individual entrepreneurs will have the opportunity to take advantage of this tax preference for a long time if they:

- work in a region where a regulatory act on tax holidays has been adopted;

- use simplified taxation system or PSN;

- carry out business activities in the field of personal services, production, scientific and (or) social spheres, provide personal services or provide places for temporary residence;

- the share of income from preferential activities is at least 70%.

Regional authorities may establish additional restrictions on the use of preferential holidays for individual entrepreneurs - see more about this below.

A person has registered for the second time, can he count on benefits?

Sometimes there are situations when a businessman stopped working and officially deregistered, and then registered again, but after the regional government’s decree on introducing a reduction in financial burden came into force. Are tax holidays (exemption from taxes) valid for entrepreneurs (IP) on a patent and the simplified tax system in this case?

Until recently, there was active debate on this issue in the legal sphere. Thus, the Ministry of Finance made it clear that benefits are granted exclusively to those citizens who, for the first time in their lives, decided to register a business activity. This automatically “weeded out” those deregistered and re-registered taxpayers (after the adoption of the law on the 0-rate).

However, some businessmen, with the help of the courts, tried to beat the position of the Ministry of Finance. The Supreme Court of the Russian Federation put the final point in the disagreement. The essence of the law on tax holidays for individual entrepreneurs is that all individuals who were previously in this status and who completed their business and then resumed it again, but after the amendments to the legislative framework that established tax holidays came into force, have the right at an interest-free rate.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

How to apply for tax exemption and how to report?

How to apply for tax holidays for individual entrepreneurs? Do I need to notify the tax authority that an individual entrepreneur is subject to tax holidays? The law does not require this. But it is better for the entrepreneur to check with his inspection whether any additional papers are needed from him in this regard.

Practice shows that sometimes additional clarification is indispensable - inspectors may not see any reason to apply a zero rate to individual entrepreneurs. This may be due to technical difficulties in correctly qualifying individual activities.

Tax authorities may deny an individual entrepreneur a zero rate if the wording in the regional law and the name of its type of activity look different. Then the individual entrepreneur can give the necessary explanations in writing, which will help convince controllers and obtain the right to a zero rate.

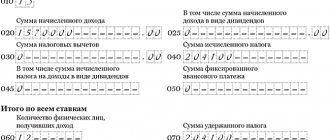

Holidays for individual entrepreneurs exempt them from taxes, but do not require reporting - individual entrepreneurs using the simplified tax system as usual submit a declaration at the end of the year indicating a zero tax rate. Entrepreneurs with a patent do not need to report to the tax office.

The individual entrepreneur is not required to submit any additional reports related to the application of the zero rate during the holidays.

How to use it correctly

At the registration stage, within a month after being registered, a person must submit to the Federal Tax Service an application about his desire to work under a simplified system. And when submitting a declaration for the year, he will need to indicate a tax duty of 0%. If during this period reports were submitted according to the standard procedure, you will no longer be able to return payments. An application is submitted similarly when registering an individual entrepreneur for a patent.

Detailed list of subjects of the Russian Federation

The decision on the possibility of providing preferences and the conditions under which they can be issued are determined by local authorities. The situation is different in different parts of the country. In some places you can get as many as three full vacation periods, in other places - only one. There are restrictions on the use of the zero rate, in the form of the number of employees of the enterprise, the amount of annual income, during the holidays. While the deadline for receiving benefits is extended until the beginning of 2021, only a few regions have officially extended the final period until 2023.

| The subject of the Russian Federation | The date from which a tax holiday was established in a constituent entity of the Russian Federation for individual entrepreneurs using |

| USN, PSN | |

| Adygea | until December 31, 2023 |

| Altai | until December 31, 2023 |

| Bashkortostan | extended until January 1, 2024 |

| Buryatia | until 12/31/2020 |

| Dagestan | until 12/31/2020 |

| Ingushetia | until 12/31/2020 |

| Kabardino-Balkarian Republic | until December 31, 2020, but |

| Republic of Kalmykia | until January 1, 2022 |

| Karachay-Cherkess Republic | until 12/31/2020 |

| Karelia | until 12/31/2020 |

| Komi | until January 1, 2024 |

| Crimea | until 12/31/2020 |

| Mari El | until 12/31/2020 |

| Mordovia | valid until 12/31/2017 |

| Sakha (Yakutia) | until 12/31/2020 |

| Tyva | until December 31, 2020, but extend |

| Udmurt republic | extend until December 31, 2023 |

| Khakassia | until January 1, 2024 |

| Chechen Republic | until 12/31/2020 |

| Chuvashia | valid until December 31, 2017, until 2024 |

| Altai region | Until 12/31/2020 |

| Transbaikal region | until 12/31/2020 |

| Kamchatka Krai | 31.12.2020 |

| Krasnodar region | valid until 2021, no information about extension yet |

| Krasnoyarsk region | until 12/31/2020 |

| Perm region | until December 31, 2020, but extend |

| Primorsky Krai | until 12/31/2020, no information about extension yet |

| Stavropol region | until January 1, 2024 |

| Khabarovsk region | until 12/31/2020 |

| Amur region | |

| Arhangelsk region | extended until December 31, 2023 |

| Astrakhan region | information about the extension on the website of the Ministry of Economic Development of the Astrakhan Region |

| Belgorod region | until 12/31/2020 |

| Bryansk region | extended until January 1, 2024 |

| Vladimir region | until January 1, 2024 |

| Volgograd region | until December 31, 2023 |

| Vologda Region | until 12/31/2020 |

| Voronezh region | until 12/31/2020 |

| Ivanovo region | until January 1, 2024 |

| Irkutsk region | until 12/31/2020 |

| Kaliningrad region | valid until 12/31/18 |

| Kaluga region | until 12/31/2020 |

| Kemerovo region - Kuzbass | until 12/31/2020 |

| Kirov region | until 12/31/2020 |

| Kostroma region | until January 1, 2024 |

| Kurgan region | until 12/31/2020 |

| Kursk region | extend until January 1, 2024 |

| Leningrad region | until 12/31/2020 |

| Lipetsk region | until January 1, 2024 |

| Magadan Region | until 12/31/2020, no information about extension yet |

| Moscow region | until 12/31/2020 |

| Murmansk region | until 12/31/2020 |

| Nizhny Novgorod Region | until 12/31/2020 |

| Novgorod region | until 12/31/2020 |

| Omsk region | until 12/31/2020 |

| Orenburg region | until 12/31/2020 |

| Oryol Region | until 12/31/2020 |

| Penza region | until 12/31/2020 |

| Pskov region | until December 31, 2023 |

| Rostov region | until 12/31/2020, but extended until January 1, 2024 |

| Ryazan Oblast | until January 1, 2024 |

| Samara Region | extended until December 31, 2023 |

| Saratov region | until December 31, 2020, but extend |

| Sakhalin region | until December 31, 2023 |

| Sverdlovsk region | until 12/31/2020 |

| Smolensk region | extended until December 31, 2023 |

| Tambov Region | until January 1, 2024 |

| Tver region | until 12/31/2020 |

| Tomsk region | until January 1, 2024 |

| Tula region | until January 1, 2024 |

| Tyumen region | until 12/31/2020, but |

| Ulyanovsk region | until 12/31/2020 |

| Chelyabinsk region | until 12/31/2020 |

| Yaroslavl region | until December 31, 2023 |

| Moscow | until 12/31/2020 |

| Saint Petersburg | extend until December 31, 2023 |

| Sevastopol | until January 1, 2024 |

| Jewish Autonomous Region | until 12/31/2020 |

| Nenets Autonomous Okrug | until 12/31/2020 |

| Khanty-Mansiysk Autonomous Okrug - Ugra | until 12/31/2020 |

| Yamalo-Nenets Autonomous Okrug | until 12/31/2023 |

Types of preferences

Having found out whether there are tax holidays for beginning individual entrepreneurs (IP), how long they last and to whom they apply, you must also take into account the type of activity that you will be engaged in.

- When using a simplified taxation system, the following operate: agricultural enterprises, workshops for the production of semi-finished products and food products, footwear and light industry, woodworking and wood products, pulp and paper industry, chemical sector, production of rubber and plastic products, metallurgy, automobile production, equipment, education, healthcare, tourism, research activities.

- Those to whom the 1 percent rate applies: spinning cotton threads, preparing textiles and fabrics, sewing children's clothing and accessories, making wooden parts, toys, educational games, ceramic accessories, cork products and other folk and artistic crafts.

- A rate of three percent is levied on: cultivation of vegetables and mushrooms, seeds, berry crops, fishing, raising seedlings, livestock, beekeeping, making canned fish, shellfish, etc., production of fermented milk and cheese products, preschool education, work of guides and tour guides, operation sanatorium and resort complexes, providing social assistance to vulnerable segments of the population.

- When using the patent system, the following work works: repair and tailoring of shoes and clothing from various materials, maintenance of machinery and equipment, furniture restoration, services of photo studios and salons, film laboratories, training, tutoring, care services for the disabled, children, the elderly, folk art products, carpet manufacturing, cook services, pharmaceutical industry, rental services, forestry, dairy production, logging, drying of fruits and vegetables, activities related to translation and interpretation, production of bakery products, PC program development services, repair and maintenance of computer equipment , furniture production, etc.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

Which of the region's entrepreneurs will receive a zero interest rate?

Today we will talk about the types of business activities that fall under the “tax holiday” in the Ulyanovsk region.

Add this article to your favorites and bookmarks! Let us remind you that the regional bill regarding “tax holidays” was approved in mid-March. The document provides for a 0% tax rate for entrepreneurs operating on a simplified or patent tax system. The authorities believe that the introduction of a “tax holiday” will facilitate the registration of new individual entrepreneurs and the emergence of Ulyanovsk residents who carry out business activities without documents from the “shadow”.

Chairman of the Board of the Ulyanovsk Region Entrepreneurship Development Corporation Ruslan Gainetdinov explained to us that individual entrepreneurs who have registered since 2015 and switched to the simplified tax system are exempt from payments for two tax periods. The law is valid until 2021. The law will come into force on the day of its official publication.

So, what types of business activities fall under the “tax holiday” under the simplified taxation system? After the type of activity, separated by commas, for convenience, we will indicate codes according to the All-Russian Classifier of Types of Economic Activities.

SECTION I. PRODUCTION SPHERE Agriculture, hunting and provision of services in these areas, 01, with the exception of: Provision of services in the field of crop and livestock production, except for veterinary services, 01.4 Hunting and breeding of wild animals, including provision of services in these areas, 01.5

Forestry and provision of services in this area, 02, with the exception of: Provision of services in the field of forestry and logging, 02.02

Fishing, fish farming and the provision of services in these areas, 05, with the exception of: Provision of services in the field of fisheries, 05.01.3 Provision of services related to the reproduction of fish and aquatic biological resources, 05.02.2

Production of food products, including drinks, 15, with the exception of: Provision of services for heat treatment and other methods of processing meat products, 15.13.9 Provision of services for heat treatment and other methods of preparing vegetables and fruits for canning, 15.33.9

Production of distilled alcoholic beverages, 15.91 Production of ethyl alcohol from fermented materials, 15.92 Production of grape wine, 15.93 Production of cider and other fruit and berry wines, 15.94 Production of other non-distilled beverages from fermented materials, 15.95 Beer production, 15.96 Malt production, 15.97

Textile production, 17

Manufacture of wearing apparel; dressing and dyeing of fur, 18

Production of leather, leather goods and footwear production, 19

Wood processing and production of wood and cork products, except furniture, 20, with the exception of: Provision of wood impregnation services, 10.20.9

Production of cellulose, wood pulp, paper, cardboard and products made from them, 21

Newspaper printing, 22.21

Production of rubber and plastic products, 25, with the exception of: Provision of services in the field of production of plastic parts, 25.24.9

Production of other non-metallic mineral products, 26

Metallurgical production, 27

Production of finished metal products, 28

Production of machinery and equipment, 29, with the exception of: Provision of repair and maintenance services for central heating boilers, 28.22.9 Provision of installation, repair and maintenance services for steam boilers, except for central heating boilers, 28.30.9 Provision of forging and pressing services , volumetric and sheet stamping and sheet metal profiling, 28.40.1 Provision of services for the production of products by powder metallurgy, 28.40.2 Provision of services for the installation, repair and maintenance of engines and turbines, except for aircraft, automobile and motorcycle engines, 29.11.9 Provision installation, repair and maintenance services for pumps and compressors, 12.29.9 Provision of bearing repair services, 14.29.9 Provision of installation, repair and maintenance services for furnaces and furnace furnaces, 29.21.9 Provision of installation, repair and maintenance services handling equipment, 29.22.9 Provision of services for installation, repair and maintenance of industrial refrigeration and ventilation equipment, 29.23.9 Provision of services for installation, repair and maintenance of other general purpose equipment not included in other groups, 29.24.9 Provision services for installation, repair and maintenance of machines, 29.40.9 Production of machinery and equipment for the production of food products, including drinks, and tobacco products, 29.53 Provision of installation, repair and maintenance services for other special-purpose machines not included in other groups, 29.56.9

Production of office equipment and computer equipment, 30, with the exception of: Provision of services for the installation of office equipment, 01/30/9

Production of electrical machines and electrical equipment, 31, with the exception of: Provision of services for installation, repair, maintenance and rewinding of electric motors, generators and transformers, 31.10.9 Provision of services for installation, repair and maintenance of electrical distribution and control equipment, 31.20.9 Provision services for installation, repair and maintenance of other electrical equipment not included in other groups, 31.62.9

Production of equipment for radio, television and communications, 32, with the exception of: Provision of services for installation, repair and maintenance of professional radio, television, sound recording and reproducing equipment and video equipment, 32.30.9

Production of medical equipment products, measuring instruments, optical instruments and equipment, watches, 33, with the exception of: Provision of services for installation, repair and maintenance of medical equipment and equipment, 10.33.9 Provision of services for installation, repair and maintenance of devices and tools for measurement, control, testing, navigation, location and other purposes, 33.20.9 Provision of repair and maintenance services for professional photographic and film equipment and optical instruments, 33.40.9 Provision of installation, repair and maintenance services for industrial instruments and measuring equipment time intervals, 33.50.9

Production of automobiles, trailers and semi-trailers, 34, with the exception of: Production of passenger cars, 34.10.2 Production of ships, aircraft and spacecraft and other vehicles, 35 Provision of repair and maintenance services, conversion and cutting into scrap of ships, floating platforms and structures, 35.11.9 Provision of services for the repair and maintenance of sports and tourist (recreational) vessels, 35.12.9 Provision of services for the repair, maintenance and alteration of railway locomotives, trams, 35.20.9 Provision of services for the repair, maintenance and alteration of aircraft vehicles and aircraft engines, 35.30.9 Production of motorcycles, mopeds and sidecars, 35.41 Production of furniture and other products not included in other categories 36

Production, transmission and distribution of electricity, gas, steam and hot water, 40, with the exception of: Electricity transmission, 40.10.2 Electricity distribution, 40.10.3 Activities to ensure the operability of power plants, 40.10.4 Activities to ensure the operability of electrical networks, 40.10.5 Distribution of gaseous fuels, 40.20.2 Transfer of steam and hot water (thermal energy), 40.30.2 Distribution of steam and hot water (thermal energy), 40.30.3 Activities to ensure the operability of boiler houses, 40.30.4 Activities to ensure the operability of heating networks, 40.30 .5 Excavation work, 45.11.2

Carrying out civil works, 45.21, with the exception of: Installation of buildings and structures from prefabricated structures, 45.21.7 Carrying out civil works for the construction of roads, railways and airfield runways, 45.23.1 Dredging and bank protection works, 45.24.3 Production underwater work, including diving, 45.24.4 Production of concrete and reinforced concrete work, 45.25.3 Production of stone work, 45.25.5 Production of other construction work requiring special qualifications, 45.25.6 Production of electrical installation work, 45.31 Production of insulation work, 45.32 Production of sanitary - technical work, 45.33 Production of plastering work, 45.41 Production of carpentry and carpentry work, 45.42 Production of glass work, 45.44.1 Production of painting work, 45.44.2 Production of other finishing and finishing works, 45.45.

SECTION II. SOCIAL SPHERE Activities of youth tourist camps and mountain tourist bases, 55.21 Activities of camping sites, 55.22 Activities of children's camps during the holidays, 55.23.1 Activities of boarding houses, rest homes, etc., 55.23.2 Activities of travel agencies, 63.30 Preschool and primary general education , 80.10 Basic general and secondary (complete) general education, 80.21 Medical practice, 85.12 Activities of paramedical personnel, 85.14.1 Provision of social services with accommodation, 85.31 Provision of social services without accommodation, 85.32 Activities of libraries, archives, club-type institutions, 92.51 Activities of museums and protection of historical sites and buildings, 92.52 Activities of botanical gardens, zoos and nature reserves, 92.53 Activities of sports facilities, 92.61 Sports and recreational activities, 93.04.

SECTION III. SCIENTIFIC FIELD Software development and consulting in this area, 72.20 Research and development in the field of natural and technical sciences, 73.10 Research and development in the field of social sciences and humanities, 73.20.

UNDER THE PATENT SYSTEM OF TAXATION But the types of entrepreneurial activities in the production and (or) social spheres provided for in lines 1, 15, 16, 20, 22, 23, 28, 32, 42, 52, 55 of the appendix to the Ulyanovsk region dated 10/02/2012 No. 129-ZO “On the patent taxation system in the Ulyanovsk region.”

Repair and sewing of clothing, fur and leather products, hats and textile haberdashery products, repair, sewing and knitting of knitwear; Services for training the population in courses and tutoring; Services for the supervision and care of children and the sick; Production of folk arts and crafts; Services for processing customer-supplied washed wool into knitted yarn, tanning animal skins, combing wool, grooming pets; Services for the repair and production of cooper's utensils and pottery; Manufacturing and repair of wooden boats; Repair and manufacturing services for spectacle optics; Conducting physical education and sports classes; Engagement in medical activities or pharmaceutical activities by a person licensed for these types of activities; Excursion services.

Prepared by Andrey Belov

How to guarantee a tax holiday and what reports to submit

If you chose the simplified tax system form when registering an enterprise, then you will not need to fill out any additional paperwork to receive preferences. After completing the paperwork, you just need to submit a regular application to switch to a simplified system for a period of 365 days, you are exempt from advance and other payments. After the time has passed, you must submit a reporting declaration indicating your income and a rate of 0%. The same must be done at the end of the second year.

Those who plan to work under the PTS need to find out in advance whether there are benefits and how to take advantage of tax holidays (vacation) when opening new individual entrepreneurs. Information about exemption from payments to the state must be indicated simultaneously with the submission of the package of documents for obtaining a patent. The form contains several fields for this purpose, where the amount of the fee and the entity establishing the preferences are indicated. There is no need to submit a declaration. Upon expiration of the document, immediately purchase the next one, since the simplified conditions are valid for 2 periods without interruption.

OKVED codes - tax holidays

Regions are allowed to independently choose preferential types of activities, indicating them according to the OKVED2 classifier. At the same time, many regions did not describe in detail in their laws which OKVED codes are involved in preferential treatment, limiting themselves to the name of services and manufactured goods. Some described the activities and codes in more detail. Therefore, individual entrepreneurs often experience difficulties when opening and selecting OKVED codes for a preferential type of activity.

Let's consider which areas are subject to preferential treatment and which sections of the OKVED classifier for tax holidays can be applied by regions:

1. Scientific field. This includes section M - OKVED codes included in classes 72 “Scientific research and development” and 74 “Other professional scientific and technical activities”. Accounting and legal services (OKVED class 69), consulting (70), architecture (71) and advertising (73) services are excluded from benefits. OKVED class codes 74 are also used with restrictions: classes in design (74.1), photography (74.2) and veterinary medicine (75) are excluded. But translation services according to OKVED class 74.30 are often used by regions for tax holidays.

2. Social sphere. This includes:

- section R “Education” - class OKVED 85, including preschool, secondary vocational and other types of education;

- section Q “Activities in the field of health care and social services” - classes 86, 87, 88, providing health care services, residential care and non-residential social services;

- section R “Activities in the field of culture, sports, leisure and entertainment” - OKVED class 93 in terms of sports, recreation and entertainment.

Also, codes for excursion or tourism services from section N on administrative activities and related services can be used for benefits. For example, in Moscow, one of the OKVED codes that falls under tax holidays is 79.90.2 (excursion services).

This also includes the household services sector. Many regions provide benefits for such types of OKVED as 95.2 “Repair of personal consumption and household items”, including repair of shoes, household appliances, watches, etc.

3. Production sector. These types of activities include most of the OKVED from Section C “Manufacturing industries”. Let us briefly list: production of food products, drinks, clothing, paper, computers, wood products, metal products, printing services, etc. Benefits do not include the following types of activities: production of tobacco (class OKVED 12), alcoholic (classes 11.01-11.06) products, petroleum products (19), medicines (21), chemicals (20), basic metals (24), ammunition ( 25.4) etc.

It is worth mentioning separately which popular OKVED and areas of activity will definitely not fall under the “tax holiday”:

- wholesale trade - section G, classes 45-47;

- retail trade - section G, class 46-47;

- construction – section F, OKVED classes 41-43

- transportation and storage - section H, OKVED classes 49-53.

What should those individuals do who did not know about the vacation and have already paid their fees?

There are no clear recommendations providing an answer to this question in the current legislation. It is believed that if a person did not know about the tax grace period for individual entrepreneurs and has already paid the bills, he has the right to submit an updated declaration with a 0 rate and return the funds paid. To do this, you must attach explanatory documents confirming your right to become a beneficiary. Keep in mind that representatives of the responsible service will carefully check this information, not wanting to simply return the money. If we talk about PSN, the matter is much more complicated. After all, you have already applied and paid a certain amount for the patent. In this case, it is recommended to seek detailed advice from the nearest Federal Tax Service department.

How long do preferences last?

If you already know what this means - tax holidays (benefits) for newly opened individual entrepreneurs under the simplified tax system, then you are probably asking yourself a new question: for how long is a beginning entrepreneur exempt from taxes. So, the interval for simplifiers is 2 24 months and for PSN two patent validity periods. In this case, the year when you registered the organization is considered to be the initial period of time.

You should also know that it will no longer be possible not to pay contributions to the state from 2023, however, if you managed to complete the documents before the end of 2022, then the grace period will last the entire expected period, including 2023.

Let's consider an example that you started working for the simplified tax system at the beginning of 2021 and are eligible for a tax holiday. The second payment for you will be the whole of 2022. If the registration date under the same conditions fell in October last year, then the first payment deadline will still fall in December. Accordingly, it is simply unprofitable to start operations in the fourth quarter.

Vacations for the owner of an enterprise on PSN can be much more modest. One tax period is equal to the period of validity of a patent issued for a period from 1 month to a year. That is, if a businessman received a six-month period twice, then his exemption from mandatory payments will last exactly one year, if immediately for 6 months, and then for the same amount - respectively, 12.

Where are tax holidays for individual entrepreneurs valid?

The decision to grant tax holidays, including their duration, is made by regional authorities. On the Internet you can find summary tables indicating in which region and under what conditions zero rates for the simplified tax system and special tax system for individual entrepreneurs were introduced. In particular, such information was also published by the Ministry of Finance.

But the fact is that many of these tables (including those of the Ministry of Finance) are no longer relevant. Regional legislation is changing - in some places tax holidays are abolished, in others they are introduced, and in others their conditions are changed. Therefore, it is best to find out reliable information by calling the tax hotline in a particular region. You can also make a written request, but the response will not be quick.

Additional restrictions

In order for an individual entrepreneur to take advantage of the benefits, his profit must be at least 70 percent, otherwise it is impossible to apply for a waiver of contributions. Conditions vary from region to region. Sometimes it depends on the number of employees. For example, no more than 100 people should be registered on the simplified tax system, and only 15 on the PSN (the situation varies depending on the region of the country). There are restrictions on the amount of income or certain OKVED codes. You can get acquainted with all the data on the territory where your company is registered in more detail by studying the corresponding tables. If just one of the points is violated, you immediately lose the right to a discount. Moreover, this means that you will be required to pay for the entire time when the 0% rate was canceled.