To crush or not to crush - that is the question

The transition from the OSN to the simplified tax system is possible only once a year, subject to notification of the tax service before December 31 of the current year.

The advantages of simplification are obvious:

1

Reducing the tax burden. Simplified residents are exempt from 4 taxes: profit, property, VAT and personal income tax (for individual entrepreneurs).

2

The tasks of the accounting department in maintaining tax and accounting records are simplified. For example, invoices are not prepared and there are no income tax registers.

3

The right to choose one of 2 options for paying a single tax: “income 6%” or “income minus expenses 15%”, which is paid in advance payments quarterly, and the final amount is paid at the end of the year.

There are exceptions in the Tax Code of the Russian Federation and in regional legislation, which you need to pay attention to before switching to the simplified tax system.

When to send reports using the simplified tax system

Tax according to the simplified tax system must be paid every quarter:

- I quarter - no later than April 25;

- II quarter - no later than July 25;

- III quarter - no later than October 25;

- IV quarter (for the year) - the deadline for LLCs is set no later than March 31 of the next year, and for individual entrepreneurs no later than April 30 of the next year.

This applies to transferring money, not filing a return.

The tax return must be filed once a year. LLCs must submit a declaration for 2019 no later than April 2, 2021, individual entrepreneurs no later than April 30.

The declaration is submitted online in the electronic reporting system, taken in person to the tax office or sent by registered mail with a list of attachments.

Special mode is not for everyone

The conditions for the transition from the OSN to the simplified tax system are established by law in the Tax Code. It is possible to change the tax system if the organization meets 2 main conditions for the revenue limit and staff size:

- number of employees is less than 100 people;

- income and residual value of fixed assets as of October 1 do not exceed 150 million rubles.

For organizations and individual entrepreneurs, the transition from the OSN to the simplified tax system is further complicated by the presence of branches, the share of participation of other companies above 25% and income over 112.5 million rubles. based on the results of 9 months before filing an application to change the tax regime.

In addition to the above, the law establishes a ban on simplifying the nature of activities for such organizations as banking, microfinance, insurance, budgetary organizations, agricultural producers, non-state pension funds, pawnshops and a number of others (more details here).

Selecting an object of taxation

It is necessary to clearly define the object of taxation before switching to a simplified taxation system. This is the part of your income on which you will have to pay tax.

There are 2 objects of taxation:

- “Revenue”, that is, the tax will be 6% of the total volume of financial receipts, regardless of expenses - a 15% tax is calculated on the profit that remains after deducting all the company’s expenses.

The choice of object directly depends on the economic activity of the enterprise itself. For example, during the year the Astra studio earns 1.5 million rubles. The cost of the studio's needs is 800 thousand rubles. The same studio "Alliance" has the same 1.5 million per year. But at the same time, he spends significantly less on his own needs, only 300 thousand.

Splitting your business is tempting, but is it safe?

Exceeding the income limit over 150 million rubles. forces big business to split the organization into several independent companies or open an individual entrepreneur under the simplified tax system. However, tax inspectors are constantly looking for illegal tax benefit schemes from “special regimes”, especially in cases where simplified organizations are engaged in the same types of activities.

The courts are inundated with appeals from entrepreneurs trying to prove that the division of business was not a violation of the law. Over the past 3 years (2016-2018), more than 450 cases on similar issues have passed through Russian arbitration courts. An average of 30 million rubles was recovered from taxpayer organizations that sued the Federal Tax Service. At risk are large companies whose income has grown to the maximum limit for the simplified account.

At the same time, judicial practice shows that you can win in proceedings with tax authorities if you approach the transition to a special regime correctly. Our company, which has experience in participating in such courts, offers legal support and accounting services for businesses during the transition period.

When an entrepreneur or LLC loses the right to a special regime

If the operating conditions no longer meet the requirements for working on the simplified tax system, the LLC or entrepreneur must switch to OSNO. This occurs when the following limits are exceeded:

- annual income from activities exceeded 150 million rubles;

- the number of hired workers increased and became more than 100 people;

- the residual value of fixed assets has crossed the mark of 150 million rubles;

- the organization has branches and (or) the share of other legal entities in the authorized capital exceeds 25%;

- the taxpayer has engaged in one of the types of activities for which the application of the simplified taxation system is not permitted.

In all of the above cases, individual entrepreneurs and organizations lose the right to work under the simplified system and are considered to be using OSNO from the beginning of the quarter in which the violation or excess occurred, even if this was not immediately detected.

From the beginning of the quarter, it is necessary to recalculate taxes as under OSNO, pay them, submit missing reports for VAT, income tax or personal income tax and property tax. At the same time, there will be no penalties or interest for late payments or late submission of OSNO reports.

The emergence of a separate division in an organization without the characteristics of a branch does not entail the loss of the right to a simplified regime and transfer to the main taxation system. The ban applies only to branches. If a separate division does not have its own balance sheet and is not listed in the Unified State Register of Legal Entities, the organization can continue to apply the special regime legally.

Is it possible to switch to the simplified tax system again if the taxpayer once lost this right?

Yes, such an opportunity is provided, but not earlier than in a year (clause 7 of Article 346.13 of the Tax Code of the Russian Federation), provided that it meets all the requirements for applying the simplified tax system. Get a savings estimate

How to prove the legality of business division?

The following actions will help you avoid additional tax assessments under OSN:

1

Organizations transferred to the simplified tax system actually existed, carried out activities, and independently paid taxes under a simplified system.

2

The optimal division of technological processes between companies will be evidence in court. The scale of business division (into 2 companies or 10) does not matter.

3

Business is not only divided between companies, but they conduct various types of business activities independently of each other, have their own management apparatus and make independent administrative decisions.

4

Newly created enterprises have their own suppliers, business partners and clients, different from the parent company, use the services of other service organizations, have personal certificates, licenses, all the necessary permits, have their own equipment and their own staff.

5

The Federal Tax Service's accusation that a group of companies (general director) has a single management cannot become grounds for deprivation of rights to a special regime.

These and other actions proposed by our company when transferring part of the business from the OSN to the simplified tax system, features

HR and management decisions for a newly created company will help you calmly conduct business without tedious lawsuits.

The transitional stage needs good legal support

, the price of which is hundreds of times lower than a possible tax penalty.

How to choose a taxable object

The object of taxation can only be income or income minus expenses. If the company's profit is small, it is more profitable to choose income taxation. It is preferable to report significant company income by deducting expenses.

When choosing an object of taxation, it is worth considering various factors. The roughest calculations are made by comparing parts of income and expenses. If income exceeds 40 percent, it is better to pay tax on income. Otherwise, it makes more sense to use an income-expense system. In addition, the activities of the company and the type of taxpayer should be taken into account. The selected object is marked in the document. Changes are available at the beginning of the billing period.

It is important to note that the discrepancy between the specified object for taxation and actual calculations is a violation that is recorded by the tax authorities. If such a discrepancy is identified, the tax authorities make a recalculation and may also impose administrative liability.

Examples of common mistakes

Example No. 1. Court decision A50-10873/2017

The founders formally divided the LLC into 2 organizations using the simplified tax system. The organization suffered losses in the form of penalties from the Federal Tax Service of more than 40 million rubles.

Where is the mistake?

They used common labor resources, common software, and common material resources. The dependent company did not have permission to carry out the work. The companies also had an excess of the limit of employees for the special regime of the simplified tax system (more than 100), the same suppliers and buyers. After analyzing the movement of funds and interrogating employees of both companies, tax officials proved the presence of intent to evade taxes.

H3: Example No. 2. Judgment A59-2443/2017.

The construction company involved 5 interdependent companies using the simplified tax system for work under a contract. According to the court decision, the company had to pay over 226 million rubles to the budget. additional tax payments.

Where is the mistake?

The counterparties did not have their own production bases, warehouses, vehicles, etc. The construction company had accounts receivable to contractors, did not have its own working capital to pay off the debt, and also lacked its own funds for financial stability.

Becoming a simplifier couldn't be easier

The method of transition to simplified taxation is not complicated. If an organization or individual entrepreneur fits the conditions of the regime, it has no restrictions under Art. 346.12 of the Tax Code of the Russian Federation, then the entire further process consists of submitting a notice of application of the simplified tax system in form No. 26.2-1 to the tax service at the location of the business. When switching from the OSN to the simplified tax system, the deadline for filing an application is established by law - from October to December 31 of the current year.

The notification form is available on the Federal Tax Service website and can be downloaded. If any difficulties arise, our company can assist in filling out this form.

Transition from OSN to simplified tax system. Algorithm for 2021

The transition to a simplified taxation system (USN, “simplified”) promises considerable savings. But the question of how to switch to the simplified tax system must be worked out in advance to avoid mistakes.

We will describe the procedure for the transition of an organization from the general taxation regime (GTS) to the simplified taxation system (STS).

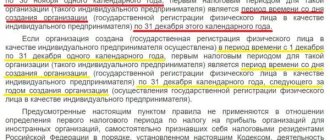

You can switch to the simplified tax system from the new year if the taxpayer company meets certain requirements and has time to submit a notification of the transition to the “simplified system” to its tax office by December 31, 2021 (Clause 1 of Article 346.13 of the Tax Code of the Russian Federation) in form No. 26.2-1 (approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] ).

So, transition to the simplified tax system. Which is correct? We recommend following the following algorithm of actions.

Restore “input” VAT

First of all, it is necessary to restore the “input” VAT for payment to the budget on assets acquired during the use of the OSN, which will be used in the “simplified” period.

This must be done because:

- organizations using the simplified tax system do not pay VAT (clause 2 of article 346.11 of the Tax Code of the Russian Federation)

- The law obliges the restoration of VAT previously accepted for deduction on goods (work, services) purchased before the transition to the simplified tax system, but not used in current activities (subclause 3, clause 2, subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation).

The restoration must be made in the fourth quarter of the year preceding the transition to the simplified tax system (paragraph 5, subparagraph 2, paragraph 3, article 170 of the Tax Code of the Russian Federation), i.e. if there is a desire to switch to the simplified tax system from 2021, then VAT must be restored in the fourth quarter 2021. During the same period, it is necessary to restore the “input” VAT on fixed assets (fixed assets) and intangible assets (intangible assets), which will continue to be used in economic activities.

The amount of recoverable VAT on the specified assets is determined by the following formula (paragraph 2, subparagraph 2, paragraph 3, article 170 of the Tax Code of the Russian Federation):

VAT to be restored = Amount of VAT accepted for deduction when acquiring fixed assets or intangible assets x Residual value of fixed assets or intangible assets in accounting as of December 31 of the year preceding the transition to the simplified tax system / Initial cost of fixed assets or intangible assets in accounting.

The procedure for reflecting the restored VAT is not regulated. Therefore, you need to define it yourself and consolidate it in the accounting policy (part 4 of article 8 of the law on accounting, clause 7 of PBU 1/2008).

Depending on the decision of the taxpayer, the restored VAT is taken into account as part of expenses for ordinary activities or as part of other expenses (clause 4, PBU 10/99). This is easy to explain: on the one hand, the refundable VAT can be considered an expense incurred as part of ordinary business activities, and this amount can be recognized as a management expense. On the other hand, the restoration of tax amounts can also be assessed as an operation not related to the production and sale of products, and in this case the restored tax is qualified as another expense.

Reflection of restored VAT on accounting accounts is also possible in two ways:

- with preliminary use of account 19 “Value added tax on acquired assets”;

- without using the specified account, i.e. by recording the debit of account 91-2 (26) and the credit of account 68 “Calculations for taxes and fees”.

Invoices for which VAT is restored are registered in the sales book for the fourth quarter of the year preceding the transition to the simplified tax system (clause 14 of the Rules for maintaining the sales book used in VAT calculations, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). When calculating income tax, the restored VAT should be included in other expenses (paragraph 3, subparagraph 2, paragraph 3, Article 170 of the Tax Code of the Russian Federation). You cannot increase the initial cost of goods (materials, fixed assets or intangible assets) by this amount.

The restored VAT is taken into account in other expenses in the last year of application of the OSN (see, for example, the explanations of the Ministry of Finance given in letters dated 04/01/2010 No. 03-03-06/1/205, dated 01/27/2010 No. 03-07-14/03) . Thus, when switching to the simplified tax system from 2021, the restored VAT must be included in other expenses for 2017.

Example 1 The initial cost of an asset used for management needs in accounting and tax accounting is 70,000 rubles. The residual value of fixed assets as of December 31 of the year preceding the transition to the simplified tax system is 50,000 rubles. VAT in the amount of RUB 12,600. accepted for deduction. The VAT recovery operation should be reflected as follows:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| In the month of VAT restoration in connection with the organization’s transition to the simplified tax system | ||||

| VAT recovered from the residual value of an asset is included in management expenses (50,000 x 12,600 / 70,000) | 91-2 (, 44) | /VAT | 9000 | Invoice, accounting certificate-calculation |

The invoice on the basis of which VAT is accepted for deduction is registered in the sales book for the amount of tax to be restored (clause 14 of the Rules for maintaining the sales book used in VAT calculations, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

VAT on advances received. Identify and return

It is necessary to identify VAT on advances received, shipment for which will take place after the transition to the simplified tax system. This is a direct indication of the law: if before the transition to the simplified tax system the taxpayer received an advance payment, then VAT had to be charged on its amount (clause 1 of article 154 of the Tax Code of the Russian Federation). This amount can be deducted after the shipment of goods (provision of services) (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).

However, after the transition to the simplified tax system, you no longer need to pay VAT (clause 2 of Article 346.11 of the Tax Code of the Russian Federation), therefore, the newly minted “simplified” person is also deprived of the right to deduct VAT from the advance received. To avoid this, it is necessary to return the “advance” VAT to the buyer (clause 5 of Article 346.25 of the Tax Code of the Russian Federation). There are two ways to do this.

Method No. 1: return only “advance” VAT

The procedure in this case will be as follows:

- we agree with the buyer to reduce the price of goods (works, services) by the amount of VAT;

- we sign an agreement on this;

- We return the “advance” VAT to the buyer.

This entire procedure must be completed before the beginning of the year of transition to the simplified tax system, for example, when transitioning in 2021 - no later than December 31, 2017.

“Advance” VAT is accepted for deduction in the fourth quarter of the year preceding the transition to the simplified tax system (clause 5 of article 346.25 of the Tax Code of the Russian Federation). The invoice drawn up upon receipt of an advance from the buyer is registered in the purchase book for this quarter (clause 22 of the Rules for maintaining the purchase book used in VAT calculations, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Method number 2: return the entire advance amount

Before January 1 of the year from which you intend to work on the simplified tax system, you must:

- conclude an agreement with the buyer on the return of the advance payment (or on termination of the contract);

- transfer the entire advance payment to the buyer, including VAT;

- register in the purchase book the invoice that the organization compiled when receiving an advance from the buyer (clause 22 of the Rules for maintaining the purchase book used in VAT calculations, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137);

- deduct VAT from the returned advance (clause 5 of Article 171 of the Tax Code of the Russian Federation).

“Transitional” period: identify and take into account

Situation: an advance was received using the simplified tax system, and goods (work, services) will be shipped when applying the simplified tax system. These advances are not taken into account when calculating income tax for the year preceding the transition to the simplified tax system. But on January 1 of the first year of application of the simplified tax system, the amount of these advances is included in income (subclause 1, clause 1, article 346.25 of the Tax Code of the Russian Federation), that is, taken into account when calculating the “simplified” tax for the first quarter of the “simplified” year.

Example 2 From 2021 it is planned to switch to the simplified tax system. In 2021, the company operates on OSN. When calculating income tax, income and expenses, the accrual method was used. Let’s say that on December 30, 2021, an advance will be received for the provision of consulting services to him, and the services themselves will be provided in February-March 2018. The organization does not take this advance into account when calculating income tax for 2021, but from January 1, 2021, the company includes the amount of the advance in income recognized under the simplified tax system, i.e., it will take this amount into account when calculating the “simplified” tax for the first quarter of 2021.

Shipment to OSN, payment to USN

Another common situation: goods (work, services) were shipped during the period of application of the simplified tax system, and payment will be received during the period of application of the simplified tax system.

In this case, proceeds from the sale of goods (works, services) should be taken into account when calculating income tax. It does not matter that during the period of receipt of payment the taxation regime will be different: with the accrual method, the date of payment does not matter (clause 1 of Article 271 of the Tax Code of the Russian Federation). The amount received from the buyer is not included in the income recorded on the simplified tax system (subclause 3, clause 1, article 346.25 of the Tax Code of the Russian Federation).

Example 3 In December 2021, the contractor provided information services to the client in the amount of 100,000 rubles. The act of provision of services of the party was signed on December 28, 2021, the client transferred the money in January 2021. And when calculating income tax for 2017, the contractor included 100,000 rubles in income. In January 2021, the amount received from the client will not be reflected in the income taken into account by the contractor on the simplified tax system.

“Transition” expenses: identify and reflect

“Transitional” expenses are taken into account “simplified” with the object “income minus expenses” (clause 2 of article 346.18 of the Tax Code of the Russian Federation). An organization with the object “income” will not be able to take into account any expenses, either current or “transitional” (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Expenses paid for the simplified tax system, but relate to the period of application of the simplified tax system

This situation may arise if raw materials were not transferred to production before the transition to the simplified tax system, or about the work performed (services rendered), the act of provision of which will be signed when the organization switches to the “simplified tax system,” or about the balance of direct costs attributable to to "unfinished". The taxpayer has the right to take into account these expenses when calculating the tax paid in connection with the simplified tax system (subclause 4, clause 1, article 346.25 of the Tax Code of the Russian Federation), since they are paid and relate to the period of application of the simplified tax system (clause 2, article 346.17 of the Tax Code of the Russian Federation). The procedure for accounting for “transition” expenses depends on their type.

“Transitional” expenses paid on the OSN and taken into account on the simplified tax system

The procedure for accounting for “transitional” expenses paid under the general system and accounted for under the simplified taxation system is as follows.

| Type of expenses | When are included in expenses under the simplified taxation system? |

| Expenses for payment for work or services of third parties | On the day of signing the act of performing work or providing services (subclause 1, clause 2, article 346.17, subclause 4, clause 1, article 346.25 of the Tax Code of the Russian Federation). |

| Cost of raw materials and materials that were not transferred to production before the transition to the simplified tax system | On the day of acceptance for registration (subclause 1, clause 2, article 346.17, subclause 4, clause 1, article 346.25 of the Tax Code of the Russian Federation) |

| Cost of goods that were not sold before the transition to the simplified tax system | On the day of transfer of goods to the buyer (subclause 2, clause 2, article 346.17, subclause 4, clause 1, article 346.25 of the Tax Code of the Russian Federation) |

| Direct costs related to work in progress or unsold product balances | As of January 1 of the first year of application of the simplified taxation system (see letter of the Ministry of Finance dated October 30, 2009 No. 03-11-06/2/233) |

Example 4 In the fourth quarter, a batch of goods was purchased at a price of 177,000 rubles. (including VAT RUB 27,000). From January 1 of the next year, the organization switches to the simplified tax system. In the first quarter of next year, goods were sold for 250,000 rubles. (excluding VAT), payment from the buyer was received in the 2nd quarter. In the accounting of a trade organization, the acquisition of goods and their subsequent sale, if the goods were purchased while the organization was on the simplified tax system using the accrual method, and sold to the buyer and paid to the supplier after the organization switched to using the simplified tax system with the object “income minus expenses” should be reflected as follows:

| Contents of operations | Debit | Credit | Sum, rub. | Primary document |

| Accounting records for the fourth quarter | ||||

| When purchasing goods | ||||

| The actual cost of goods (177,000 - 27,000) | 150 000 | Shipping documentation supplier, Acceptance certificate goods | ||

| The VAT presented is reflected supplier of goods | 27 000 | Invoice | ||

| Accepted for VAT deduction, presented by the supplier goods | /VAT | 27 000 | Invoice | |

| When restoring VAT in connection with the transition to the use of the simplified tax system | ||||

| VAT has been restored goods not sold before switching to simplified tax system | 19 | 68 | 27 000 | Invoice |

| Recovered VAT amount included in expenses | 44 (91-2) | 19 | 27 000 | Accounting reference-calculation |

| Accounting records for the first quarter of the current year | ||||

| When selling goods | ||||

| Revenue from sales recognized goods | 62 | 90-1 | 250 000 | Commodity invoice |

| Actual written off cost of sales goods | 90-2 | 41 | 150 000 | Accounting reference-calculation |

| When paying for goods | ||||

| Paid for goods to supplier | 60 | 51 | 177 000 | Bank statement current account |

| Accounting entry for the second quarter of the current year | ||||

| Received payment for goods from buyer | 51 | 62 | 250 000 | Bank statement current account |

Expenses are taken into account for the simplified tax system, but will be paid after the transition to the simplified tax system

In this case, expenses cannot be recognized when calculating the “simplified” tax (subclause 5, clause 1, Article 346.25 of the Tax Code of the Russian Federation), since we have already reduced the tax base for another tax - income tax - by these amounts. So these “transitional” expenses relate to the simplified tax system, and there is no reason to take them into account on the simplified tax system. The fact of payment after switching to the special regime does not change matters.

Example 5 Let's assume that in December 2021 the company uses the services of a law firm. Deed for the amount of 100,000 rubles. will be signed on December 31, 2021. In 2021, the company will switch to the simplified tax system. The debt to the law firm was repaid in January 2018. The company takes into account the costs of legal services in the amount of 100,000 rubles. when calculating income tax for 2021. Again, these costs are not taken into account when applying the simplified tax system.

Residual value of under-depreciated fixed assets and intangible assets. How to calculate

This will have to be done by “simplified” people with the object “income minus expenses”. First of all, it is necessary to identify all fixed assets and intangible assets that were acquired before the transition to the simplified tax system and were not fully depreciated.

For these objects, the residual value should be calculated as of December 31 of the year preceding the transition to the simplified tax system. In this case, one must be guided by tax accounting data and the following formula (clause 2.1 of Article 346.25 of the Tax Code of the Russian Federation):

Residual value of fixed assets or intangible assets = Purchase price (construction, manufacturing or creation) - Amount of accrued depreciation.

After switching to the simplified tax system, the organization includes in expenses the residual value of under-depreciated fixed assets and intangible assets (subclause 3, clause 3, article 346.16 of the Tax Code of the Russian Federation).

The write-off procedure depends on the useful life of the asset.

How to write off fixed assets and intangible assets that were purchased on the OSN before the transition to the simplified tax system

| Useful life of under-depreciated fixed assets or intangible assets | The procedure for including residual value in expenses |

| Up to three years inclusive | Completely during the first calendar year of application of the simplified taxation system. That is, quarterly 25% of the residual value of an asset or asset |

| Over three to 15 years inclusive | 50% of the residual value during the first calendar year of application of the simplified taxation system; 30% of the residual value during the second calendar year; 20% of the residual value during the third calendar year |

| Over 15 years | In equal shares during the first 10 years of application of the simplified taxation system |

During the year, these expenses are taken into account in equal shares (paragraph 5, subparagraph 3, paragraph 3, article 346.16 of the Tax Code of the Russian Federation). They are reflected in accounting on the last day of each quarter (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation).

T. D. Bursulaya, Lead Auditor of RIGHT WAYS LLC

Are there any disadvantages to switching to simplified language?

Among the negative consequences of the transition from the OSN to the simplified tax system are the following:

- the need for a transition period and possible difficulties in translating financial statements;

- the requirement of tax authorities during the transition from the OSN to the simplified tax system to restore VAT, first of all, input;

- for large deliveries - a decrease in income due to the departure of large clients working with VAT.

In a situation where the company is operating at a loss, the general regime becomes more profitable than the simplified one:

| Loss-making enterprise rates | |||

| OSN | simplified tax system "income" | Simplified tax system “income minus expenses” | |

| Income tax rate | 0 | 6% (depending on region) | 1% |

| VAT | 0 | No | No |

When switching from the OSN to the simplified tax system, it is necessary to adjust the VAT in contracts concluded before the new taxation. Starting from the new calendar year, simplifiers indicate the price with the note “VAT not subject to.”

conclusions

The tightening of tax legislation from 2021, expressed in 78 changes that also affected simplifiers, suggests that fiscal services are not going to calm down. After the release of No. 163-FZ of July 18, 2017, according to Article 54.1 of the Tax Code of the Russian Federation, the Federal Tax Service took up arms against entrepreneurs with even greater tax audits. The task of tax services is to combat business fragmentation and replenish the budget with additional funds.

The features of the transition from OSN to simplified taxation require a balanced decision. How to escape or avoid being targeted by tax inspectors? Contact MCOB. We will conduct an internal audit of accounting and organize business support. We work - you can easily develop your business!