I. General provisions

1. These Regulations establish the rules for the formation in accounting of information about the organization’s fixed assets. An organization is further understood as a legal entity under the laws of the Russian Federation (with the exception of credit organizations and state (municipal) institutions). (as amended by Order of the Ministry of Finance of the Russian Federation dated October 25, 2010 N 132n)

2. Item excluded. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

3. This Regulation does not apply to:

machines, equipment and other similar items listed as finished products in the warehouses of manufacturing organizations, as goods - in the warehouses of organizations engaged in trading activities;

items handed over for installation or to be installed that are in transit;

capital and financial investments.

4. An asset is accepted by an organization for accounting as fixed assets if the following conditions are simultaneously met:

a) the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization, or to be provided by the organization for a fee for temporary possession and use or for temporary use;

b) the object is intended to be used for a long time, i.e. a period exceeding 12 months or the normal operating cycle if it exceeds 12 months;

c) the organization does not intend the subsequent resale of this object;

d) the object is capable of bringing economic benefits (income) to the organization in the future.

A non-profit organization accepts an object for accounting as fixed assets if it is intended for use in activities aimed at achieving the goals of creating this non-profit organization (including in business activities carried out in accordance with the legislation of the Russian Federation), for management needs non-profit organization, as well as if the conditions established in subparagraphs “b” and “c” of this paragraph are met.

The useful life is the period during which the use of an item of fixed assets brings economic benefits (income) to the organization. For certain groups of fixed assets, the useful life is determined based on the quantity of products (volume of work in physical terms) expected to be received as a result of the use of this object. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

5. Fixed assets include: buildings, structures, working and power machines and equipment, measuring and control instruments and devices, computer equipment, vehicles, tools, production and household equipment and accessories, working, productive and breeding livestock, perennial plantings, on-farm roads and other relevant facilities.

The following are also taken into account as part of fixed assets: capital investments for radical improvement of land (drainage, irrigation and other reclamation works); capital investments in leased fixed assets; land plots, environmental management objects (water, subsoil and other natural resources).

Fixed assets intended exclusively for provision by an organization for a fee for temporary possession and use or for temporary use for the purpose of generating income are reflected in accounting and financial statements as part of profitable investments in tangible assets. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

Assets in respect of which the conditions provided for in paragraph 4 of these Regulations are met, and with a value within the limit established in the organization’s accounting policy, but not more than 40,000 rubles per unit, may be reflected in accounting and financial statements as part of inventories. In order to ensure the safety of these objects in production or during operation, the organization must organize proper control over their movement. (as amended by Orders of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n, dated December 24, 2010 N 186n)

6. The accounting unit for fixed assets is an inventory item. An inventory item of fixed assets is an object with all its fixtures and accessories, or a separate structurally isolated item intended to perform certain independent functions, or a separate complex of structurally articulated items that constitute a single whole and are intended to perform a specific job. A complex of structurally articulated objects is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only as part of the complex, and not independently.

If one object has several parts, the useful lives of which differ significantly, each such part is accounted for as an independent inventory item. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

An item of fixed assets owned by two or more organizations is reflected by each organization as part of fixed assets in proportion to its share in the common property.

Tax reporting on time and without errors! We are giving access for 3 months to Kontur.Ektern!

Try it

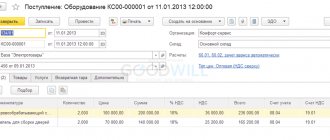

Some typical transactions for account 01

In correspondence with the credit of account 08, the debit of account 01 reflects the initial cost of the fixed assets put into operation. The same posting records the attribution to the cost of fixed assets of the amounts spent on their improvement and major repairs. The revaluation of fixed assets, which led to an increase in its value, is reflected by posting Dt 01 Kt 83. If the revaluation led to a decrease in the initial value of the fixed assets, then the posting has the opposite form: Dt 83 Kt 01.

Posting Dt 91 Kt 01 is used when decommissioning fixed assets and decommissioning them. In this case, in the process of writing off a fixed asset, a sub-account can be opened under account 01, the credit of which reflects the accumulated depreciation, and the debit of which reflects the cost of the disposed asset.

A decrease in the initial value of a retired fixed asset (sale or liquidation) as a result of depreciation is reflected by posting Dt 02 Kt 01. If damage to the insured asset has occurred, then, due to insurance compensation, the write-off of the residual value is reflected by posting Dt 76 Kt 01.

II. Valuation of fixed assets

7. Fixed assets are accepted for accounting at their original cost.

8. The initial cost of fixed assets acquired for a fee is recognized as the amount of the organization’s actual costs for acquisition, construction and production, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

The actual costs for the acquisition, construction and production of fixed assets are:

amounts paid in accordance with the contract to the supplier (seller), as well as amounts paid for delivering the object and bringing it into a condition suitable for use; (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

amounts paid to organizations for carrying out work under construction contracts and other contracts;

amounts paid to organizations for information and consulting services related to the acquisition of fixed assets;

Paragraph - Deleted. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

customs duties and customs fees; (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

non-refundable taxes, state duties paid in connection with the acquisition of fixed assets; (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

remunerations paid to the intermediary organization through which the fixed asset was acquired;

other costs directly related to the acquisition, construction and production of fixed assets. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

General and other similar expenses are not included in the actual costs of acquisition, construction or production of fixed assets, except when they are directly related to the acquisition, construction or production of fixed assets.

Paragraph - Deleted. (as amended by Order of the Ministry of Finance of the Russian Federation dated November 27, 2006 N 156n)

8.1. An organization that has the right to use simplified methods of accounting, including simplified accounting (financial) statements, can determine the initial cost of fixed assets: (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

a) when purchased for a fee - at the price of the supplier (seller) and installation costs (if there are such costs and if they are not included in the price); (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

b) during their construction (manufacturing) - in the amount paid under construction contracts and other agreements concluded for the purpose of acquiring, constructing and manufacturing fixed assets. (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

In this case, other costs directly related to the acquisition, construction and production of fixed assets are included in expenses for ordinary activities in full in the period in which they were incurred. (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

9. The initial cost of fixed assets contributed to the contribution to the authorized (share) capital of the organization is recognized as their monetary value, agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

10. The initial cost of fixed assets received by an organization under a gift agreement (free of charge) is recognized as their current market value on the date of acceptance for accounting as investments in non-current assets. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

11. The initial cost of fixed assets received under contracts providing for the fulfillment of obligations (payment) in non-monetary means is recognized as the value of the assets transferred or to be transferred by the organization. The value of assets transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets.

If it is impossible to determine the value of assets transferred or to be transferred by the organization, the value of fixed assets received by the organization under contracts providing for the fulfillment of obligations (payment) in non-monetary means is determined based on the cost at which similar fixed assets are acquired in comparable circumstances.

12. The initial cost of fixed assets accepted for accounting in accordance with clauses 9, 10 and 11 is determined in relation to the procedure given in clause 8 of these Regulations. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

13. Capital investments in perennial plantings and for radical land improvement are included in fixed assets annually in the amount of costs related to the areas accepted for operation in the reporting year, regardless of the completion date of the entire complex of works.

14. The cost of fixed assets in which they are accepted for accounting is not subject to change, except in cases established by this and other accounting provisions (standards). (as amended by Order of the Ministry of Finance of the Russian Federation dated December 24, 2010 N 186n)

Changes in the initial cost of fixed assets, in which they are accepted for accounting, are allowed in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets. (as amended by Order of the Ministry of Finance of the Russian Federation dated May 18, 2002 N 45n)

15. A commercial organization may revalue groups of similar fixed assets at current (replacement) cost no more than once a year (at the end of the reporting year). (as amended by Orders of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n, dated December 24, 2010 N 186n)

When making a decision on revaluation of such fixed assets, it should be taken into account that subsequently they are revalued regularly so that the cost of fixed assets at which they are reflected in accounting and reporting does not differ significantly from the current (replacement) cost.

Revaluation of an object of fixed assets is carried out by recalculating its original cost or current (replacement) cost, if this object was revalued earlier, and the amount of depreciation accrued for the entire period of use of the object. (as amended by Order of the Ministry of Finance of the Russian Federation dated May 18, 2002 N 45n)

The results of the revaluation of fixed assets carried out at the end of the reporting year are subject to reflection in accounting separately. (as amended by Orders of the Ministry of Finance of the Russian Federation dated May 18, 2002 N 45n, dated December 24, 2010 N 186n)

The amount of revaluation of an object of fixed assets as a result of revaluation is credited to the additional capital of the organization. The amount of revaluation of an item of fixed assets, equal to the amount of its depreciation carried out in previous reporting periods and attributed to the financial result as other expenses, is credited to the financial result as other income. (as amended by Orders of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n, dated December 24, 2010 N 186n)

The amount of depreciation of an item of fixed assets as a result of revaluation is included in the financial result as other expenses and must be disclosed in the financial statements of the organization. The amount of depreciation of an object of fixed assets is included in the reduction of the organization’s additional capital formed from the amounts of the additional valuation of this object carried out in previous reporting periods. (as amended by Orders of the Ministry of Finance of the Russian Federation dated May 18, 2002 N 45n, dated December 24, 2010 N 186n)

When an item of fixed assets is disposed of, the amount of its revaluation is transferred from the organization's additional capital to the organization's retained earnings.

16. Item excluded. (as amended by Order of the Ministry of Finance of the Russian Federation dated November 27, 2006 N 156n)

How to choose an approach to determine fair value

As we have already noted, the Standard does not predetermine the choice of approach for specific cases, but establishes a strict hierarchy of source data. The choice of approach will depend on the available data.

Let's try to figure out how an accountant can determine the fair value of an asset in practice.

If there are initial level 1 data

The only applicable approach is the market one. In effect, this means that IFRS 13 gives priority to the market approach when determining fair value: if an active market can be found for exactly the same asset or liability, then the fair value will be determined from such market data. Other approaches don't even need to be considered.

Start keeping accounting records according to the new rules

If Level 2 inputs are used

The simplest one will also be the market approach. In this case, adjustments are applied to the observed data on similar assets, for example, for location, condition, and other objective characteristics of the asset being valued in comparison with the analogue asset.

Theoretically, when using level 2 source data, it is also possible to apply the income and cost approaches, but this is almost never encountered in practice.

If Level 3 inputs are used

Any of three approaches can be used. However, even in this case, the market one, as a rule, gives the most accurate result, since it involves fewer subjective assessments.

The next priority is the income approach, since in the case of clear and objectively measured cash flows, it gives quite accurate results.

For example, if you are determining the fair value of a non-residential property and there is no active market for similar residential properties, then the fair value can be determined using the discounted cash flow method. When using it, the evaluation algorithm will be as follows:

- Determine the amount of rental income (given a known amount of rent, this is a one-step task);

- Determine the amount of expenses that the owner bears in connection with the receipt of income;

- Determine the net cash flows that renting out the premises will bring;

- Determine the applicable discount rate and the present value of all future flows.

The sum of the present values of future cash flows will give the fair value of the premises.

The most subjective and complex is the costly approach. It involves recreating the valuation object, and for complex objects (buildings, structures, etc.) this may require qualifications that the accountant does not have.

Summarize

In most situations, the market approach using data on identical assets, and if this is not possible, on similar assets can be considered a priority.

If using the market approach does not work, but there is a clear and definable income that the asset generates, it is better to use the income approach. And only if it is impossible to use the market and income approaches, use the cost approach.

III. Depreciation of fixed assets

17. The cost of fixed assets is repaid through depreciation, unless otherwise established by these Regulations.

For objects of fixed assets used for the implementation of the legislation of the Russian Federation on mobilization preparation and mobilization, which are mothballed and not used in the production of products, when performing work or providing services, for the management needs of the organization or for provision by the organization for a fee for temporary possession and use or for temporary use, depreciation is not charged. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

Depreciation is not charged for fixed assets of non-profit organizations. Based on them, information on the amounts of depreciation accrued in a straight-line manner in relation to the procedure given in paragraph 19 of these Regulations is compiled on the off-balance sheet account. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

For housing assets that are accounted for as part of profitable investments in material assets, depreciation is calculated in accordance with the generally established procedure. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

Objects of fixed assets whose consumer properties do not change over time are not subject to depreciation (land plots; environmental management facilities; objects classified as museum objects and museum collections, etc.). (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

18. Depreciation of fixed assets is calculated in one of the following ways:

linear method;

reducing balance method;

method of writing off value by the sum of the numbers of years of useful life;

method of writing off cost in proportion to the volume of products (works).

The use of one of the methods of calculating depreciation for a group of homogeneous fixed assets is carried out throughout the entire useful life of the objects included in this group.

Paragraph - Deleted. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

19. The annual amount of depreciation charges is determined:

with the linear method - based on the original cost or (current (replacement) cost (in case of revaluation) of an object of fixed assets and the depreciation rate calculated based on the useful life of this object;

with the reducing balance method - based on the residual value of the fixed asset item at the beginning of the reporting year and the depreciation rate calculated based on the useful life of this item and a coefficient not higher than 3, established by the organization; (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

when writing off the cost by the sum of the numbers of years of the useful life - based on the original cost or (current (replacement) cost (in case of revaluation) of an object of fixed assets and the ratio, the numerator of which is the number of years remaining until the end of the useful life of the object, and the denominator is the sum of the numbers of years of the useful life of the object.

During the reporting year, depreciation charges for fixed assets are accrued monthly, regardless of the accrual method used, in the amount of 1/12 of the annual amount.

For fixed assets used in organizations with a seasonal nature of production, the annual amount of depreciation charges on fixed assets is accrued evenly throughout the period of operation of the organization in the reporting year.

When writing off the cost in proportion to the volume of production (work), depreciation charges are calculated based on the natural indicator of the volume of production (work) in the reporting period and the ratio of the initial cost of the fixed asset item and the estimated volume of production (work) for the entire useful life of the fixed asset item.

An organization that has the right to use simplified methods of accounting, including simplified accounting (financial) reporting, can: (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

accrue the annual amount of depreciation at a time as of December 31 of the reporting year or periodically during the reporting year for periods determined by the organization; (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

charge depreciation of production and business equipment at a time in the amount of the original cost of objects of such assets when they are accepted for accounting. (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

20. The useful life of an item of fixed assets is determined by the organization when accepting the item for accounting.

The useful life of a fixed asset item is determined based on:

the expected life of the facility in accordance with its expected productivity or capacity;

expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, the repair system;

regulatory and other restrictions on the use of this object (for example, rental period).

In cases of improvement (increase) of the initially adopted standard indicators of the functioning of a fixed asset object as a result of reconstruction or modernization, the organization revises the useful life of this object.

21. Accrual of depreciation charges for an object of fixed assets begins on the first day of the month following the month in which this object was accepted for accounting, and is carried out until the cost of this object is fully repaid or this object is written off from accounting.

22. The accrual of depreciation charges for an object of fixed assets ceases from the first day of the month following the month of full repayment of the cost of this object or the write-off of this object from accounting.

23. During the useful life of an object of fixed assets, the accrual of depreciation charges is not suspended, except in cases where it is transferred by decision of the head of the organization to conservation for a period of more than three months, as well as during the period of restoration of the object, the duration of which exceeds 12 months.

24. Accrual of depreciation charges on fixed assets is carried out regardless of the results of the organization’s activities in the reporting period and is reflected in the accounting records of the reporting period to which it relates.

25. The amounts of accrued depreciation on fixed assets are reflected in accounting by accumulating the corresponding amounts in a separate account.

Calculation formulas, definitions

Fixed assets costing less than 40,000 rubles are not depreciated.

Types of calculation of the cost of fixed assets: balance sheet, residual, replacement. Article navigation

- What is the cost of fixed assets and how to calculate it

- Question of price

- Why is information about the cost of fixed assets needed and how is it provided?

- Types of cost of fixed assets

- Book value

- Residual value

- Replacement cost

- Initial cost

- Average annual cost

- As the arithmetic mean

- Calculation based on the full book value of fixed assets

- Balance sheet method

- About the active part of the OS

What is the price of this or that enterprise? The clear answer to this question is determined by the cost of its fixed assets. The amount of assets is constantly changing for obvious reasons: machines wear out and become obsolete, new equipment is purchased. Accounting for these processes is reflected in the balance sheet items.

IV. Restoration of fixed assets

26. Restoration of a fixed asset object can be carried out through repair, modernization and reconstruction.

27. Costs for the restoration of fixed assets are reflected in the accounting records of the reporting period to which they relate. At the same time, the costs of modernization and reconstruction of a fixed asset object after their completion increase the initial cost of such an object if, as a result of modernization and reconstruction, the initially adopted standard performance indicators (useful life, power, quality of use, etc.) of the object are improved (increased) fixed assets. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

28. Point deleted. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

Tax reporting on time and without errors! We are giving access for 3 months to Kontur.Ektern!

Try it

NORMATIVE BASE

The procedure for assessing and revaluing fixed assets (FPE) is carried out in accordance with:

- Accounting Regulations “Accounting for Fixed Assets” (PBU 6/01), approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n (as amended on December 24, 2010; hereinafter referred to as PBU 6/01);

- Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n (as amended on December 24, 2010; hereinafter referred to as Guidelines).

PBU 6/01 provides for two methods of valuation ( revaluation ) of fixed assets:

- at historical cost , which generally means the amount of the organization’s actual costs for the acquisition, construction and production of fixed assets, with the exception of value added tax and other refundable taxes;

- at current ( replacement ) cost , that is, at the cost of reproduction of fixed assets. In fact, it shows how much money the organization would have to spend at the moment to replace existing worn-out fixed assets with the same, but new ones.

V. Disposal of fixed assets

29. The cost of an item of fixed assets that is being retired or is not capable of bringing economic benefits (income) to the organization in the future is subject to write-off from accounting. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

Disposal of an item of fixed assets occurs in the event of: sale; termination of use due to moral or physical wear and tear; liquidation in case of an accident, natural disaster and other emergency situation; transfers in the form of a contribution to the authorized (share) capital of another organization, a mutual fund; transfers under an agreement of exchange, gift; making contributions under a joint venture agreement; identifying shortages or damage to assets during their inventory; partial liquidation during reconstruction work; in other cases. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n

30. If a fixed asset is written off as a result of its sale, then the proceeds from the sale are accepted for accounting in the amount agreed upon by the parties in the agreement.

31. Income and expenses from writing off fixed assets from accounting are reflected in accounting in the reporting period to which they relate. Income and expenses from writing off fixed assets from accounting are subject to credit to the profit and loss account as other income and expenses. (as amended by Order of the Ministry of Finance of the Russian Federation dated September 18, 2006 N 116n)

Average annual cost

Of course, the ideal option would be a “real-time” economic analysis of key performance indicators. A manager, coming to work in the morning, would simply open the appropriate program and see how his management decisions affect capital productivity or profitability. Unfortunately, this is not possible for a number of reasons, including:

- a certain inertia of any economic system;

- multifactorial influence causing ambiguous results;

- high complexity of data collection and calculations.

Therefore, a comprehensive calculation of many parameters, including the cost of fixed assets, is carried out at a given rhythm, usually once a year. For greater efficiency, the figure is taken as the average for the reporting period.

The average annual cost of an operating system can be determined in at least three ways, depending on the required accuracy.

As the arithmetic mean

This is the simplest method that does not involve a “deep dive” into the subtleties, circumstances and chronology of events. To implement it, you just need to take two numbers reflecting the situation at the beginning and end of the year, add them and divide by two.

OSsr = (OSng + OSkg)/2

Where: OSsr – average annual cost of OS. OSng – the cost of the operating system at the beginning of January of the analyzed year. OSkg – the cost of fixed assets at the end of December of the analyzed year.

The method captivates with its simplicity, clarity and compliance with the concept of “average”. However, it also has a significant drawback.

For example, at the very end of last year, the company finally acquired an automatic line, which the general director had long dreamed of. This high-performance equipment was very expensive, but it promises amazing economic benefits. Of course, in the remaining time the equipment did not have time to generate much profit, but its cost was included in the OSkg figure (see formula). If the average annual cost obtained using the arithmetic mean formula is used to calculate the efficiency (profitability) of an investment, then the result, to put it mildly, may be disappointing.

Fortunately, such distortions can be avoided by using other methods.

Calculation based on the full book value of fixed assets

The formula used to calculate the average annual cost of fixed assets using this method takes into account the commissioning of assets to the nearest month, which provides quite acceptable accuracy.

Where: OSsr – average annual cost of OS. OSvv – the cost of assets put into operation. Т1 – number of months of operation of commissioned assets. OSvyv – the cost of decommissioned assets. Т2 – number of months without operation of withdrawn assets.

Using this formula, it is clear how long the new fixed assets have worked, and how long ago the old equipment stopped being used. Despite the complexity, this method is considered the most common.

Balance sheet method

Using this method, an accountant can get by with just the balance sheet lines without opening other reporting documents, which indicates its convenience. The formula looks like this:

Where: OSsr – average annual cost of OS. OSb – book value of fixed assets. OSvv – the cost of assets put into operation. Т1 – number of months of operation of commissioned assets. OSLIK – liquidation value of fixed assets. Т3 – number of months of operation of decommissioned assets.

At its core, this method is similar to the method of calculating using the full accounting value, but requires less labor.

The concept of the initial cost of an object

Initially, you should define the concept of fixed assets, which are tools of labor, production property, or intended for the provision of services with a cost of over 40,000 rubles. Such assets are not intended for sale, but are used for a long time to obtain economic benefit.

The initial cost is all those costs that actually occurred at the time of purchasing the OS before the start of its use. To highlight the initial cost, it is necessary to summarize all these costs up to the moment the property is brought into operational condition.

Important! Assets for which the initial cost is determined to be 40 thousand rubles or less can be received as inventory, and then immediately written off without depreciation.

Expenses for companies associated with the acquisition of operating systems can be taken into account as expenses only if there is documentation. Without documents, accounting entries are not made, and tax expenses are not accepted as a reduction in the tax base.

When fixed assets are received, the composition of costs differs somewhat depending on the option of their receipt.

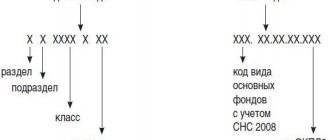

Useful life and depreciation groups

According to the Tax Code of the Russian Federation, the useful life is the period during which the fixed asset serves to fulfill the taxpayer’s goals. Despite the difference in wording, in essence this definition coincides with that in accounting.

The useful life is set by the company itself on the date when the OS is put into operation. However, you cannot be completely independent when setting a deadline. Taxpayers must adhere to the classification approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1. In it, all fixed assets are distributed into ten depreciation groups, and for each group a lower and upper limit on the useful life is specified. For example, computer technology is classified in the second group with a useful life of 2 to 3 years inclusive.

For tax accounting purposes, the organization is required to adhere to this classification. Derogation from it is possible only if the main means is not mentioned in the classification. Then the useful life must be determined based on the technical conditions and recommendations of the manufacturer.

After reconstruction, modernization and technical re-equipment, the useful life can be increased. But even the extended period must fit within the framework established for the depreciation group to which the object originally belonged.

If a company receives a used OS (including during reorganization or as a contribution to the authorized capital), the accountant should request a certificate from the previous owner. The certificate must indicate what useful life was established by the previous owner and how long he operated the object. The new owner must take this information into account when calculating depreciation. A used fixed asset must be included in the same depreciation group to which it belonged to the previous owner.

Results

Account 01 in accounting is used to accumulate data on the initial cost of property. Fixed assets are assets that meet 5 main requirements:

- the value of assets must be more than 40,000 rubles;

- service life - longer than 12 months;

- the asset is not intended for resale;

- the asset is used in production, commercial or management activities;

- The use of the asset allows the enterprise to obtain economic benefits.

The procedure for forming the initial value of enterprises entitled to a simplified form of accounting may differ from the procedure used by ordinary enterprises.

Fixed assets must be classified in accounting according to depreciation groups.

Starting from 2021, a new procedure for such classification is being introduced, therefore, by the end of 2016, all enterprises are required to switch to the classification established by Decree No. 640 dated July 7, 2016. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

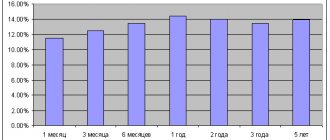

What is bonus depreciation

Each organization has the right to apply the so-called depreciation premium to all fixed assets, except those received free of charge. The bonus allows you to immediately write off part of the money spent on the purchase or construction of an object as current expenses. The maximum premium amount is determined as a percentage of the original cost and depends on the depreciation group (we will discuss these groups in detail below). For fixed assets belonging to the third to seventh depreciation groups, the premium cannot exceed 30%, for all other groups - 10%.

Also, a depreciation bonus can be applied to the costs of completion, additional equipment, reconstruction, modernization, technical re-equipment and partial liquidation. The maximum size here is determined in the same way as in the case of the acquisition or construction of a fixed asset.

If, before the expiration of five years from the date of commissioning, the company sells the fixed asset to a related party, the depreciation bonus must be restored, that is, included in taxable income. In this case, the financial result from the sale should be reduced by the amount of the depreciation bonus. In a situation where an object is sold to a person who is not interdependent, the depreciation bonus is not restored and does not reduce the financial result.

We would like to add that the use of bonus depreciation can be waived. In this case, all costs associated with the fixed asset will be included in its initial cost.

In accounting, bonus depreciation is not provided.

Get a sample accounting policy for a small LLC Get it for free

How to accept an OS object for accounting

The fixed asset is accepted for accounting at its original cost minus the depreciation bonus (if the company used it). So, if the initial cost of the object is 200,000 rubles. (excluding VAT), and the depreciation premium is 20,000 rubles, then the fixed asset is taken into account at a cost equal to 180,000 rubles. (200,000 - 20,000).

When registering a fixed asset for tax purposes, no special actions need to be taken. In essence, registration means that the accountant has determined the useful life of the asset, included the object in one or another depreciation group, and began to calculate depreciation.