The book of income and expenses is a document that will help confirm the receipt and expenditure of money during the year if the Federal Tax Service has questions for you during the audit.

Typically, the tax office needs KUDiR during desk audits, when the inspector requests information from banks about the movement of money in your current account. If it does not correspond to the declaration, the tax office will send you a request to provide an explanation.

All entrepreneurs and organizations on the simplified tax system, as well as entrepreneurs on OSNO, PSN and Unified Agricultural Tax are required to maintain KUDiR. You need to hand over the book only after the tax office has requested it. Those who do not do this within 10 days will have to pay a fine.

In this article we will tell you in detail what to do with KUDiR using a simplified taxation system and where to find the book in Elbe.

Maintaining a book of income and expenses under the simplified tax system: rules and responsibilities

In accordance with Art.

346.24 of the Tax Code of the Russian Federation, all taxpayers who have chosen the simplified tax system must keep records of income received and expenses incurred in order to determine the object of taxation. For this purpose, a tax register is opened annually: a book of income and expenses. The form of this register and the rules (procedure) for its completion were approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n (hereinafter referred to as the Procedure, Order No. 135n).

The book can be maintained in any way (filled out manually or on a computer), but in any case, its final copy must exist in paper form, have numbered sheets and be certified by the signature of the head of the legal entity or individual entrepreneur and a seal (if there is one).

The book does not need to be submitted to the Federal Tax Service along with the tax return, but during an audit it must be presented to the inspector within 10 days (clause 3 of Article 93 of the Tax Code of the Russian Federation).

If the book is not kept or there are significant violations when filling it out that lead to an underestimation of the taxable item, the violating taxpayer faces a fine. The maximum fine is 20% of the amount of the unified simplified tax system that has not been received into the treasury, the minimum is 40,000 rubles. (clause 3 of article 120 of the Tax Code of the Russian Federation).

If a violation of the tax accounting procedure does not lead to an understatement of tax, the fine for the taxpayer will be from 10,000 to 30,000 rubles (clauses 2 and 3 of Article 120 of the Tax Code of the Russian Federation). Failure to provide the book at the request of the inspectors will result in a fine of 200 rubles. (Article 126 of the Tax Code of the Russian Federation) plus 300–500 rubles. (Article 15.6 of the Administrative Code) in the form of an administrative penalty against the head of a legal entity.

Read more about liability for tax offenses committed in the article “Responsibility for tax offenses: grounds and amount of sanctions .

Species diversity of KUDiR and basic requirements for their management

The form of the document is determined by the applicable taxation system. In 2021, 4 types of it were approved for:

- simplified tax system;

- OSN;

- Unified Agricultural Sciences;

- PSN.

The first three reflect the income and expense operations of companies. In the fourth, patent system, only income received is taken into account. It is logical that in this case the form is called the “Income Accounting Book” (abbreviated as KUD). It has a simpler structure compared to KUDiR.

All of the above types have a number of general requirements:

- a new KUDiR is installed annually;

- entries are entered according to the dates they were made;

- each business operation on its own line;

- KUDiR is allowed to be maintained in handwriting, using computer programs and accounting services;

- in the finished document, all sheets are bound, including empty ones (the completed register is stitched together, its sheets are numbered);

A certification inscription is made on the last sheet of the KUDiR, which is confirmed by the visa of the authorized person and the stamp (if any)

- in the absence of activity, a zero KUDiR is formed;

- The register storage period is 4 years.

Previously, KUDiR had to be certified by tax authorities, and at the end of the year it had to be submitted to this department. Since 2013, this requirement has been abolished.

How to keep a book of income and expenses of an individual entrepreneur

The procedure for maintaining a book of income and expenses for individual entrepreneurs is no different from the general rules.

Entrepreneurs do not indicate in column 4 of Section I of the book income that is subject to personal income tax. This is directly stated in clause 2.4 of the Procedure approved by Order No. 135n.

In section IV of individual entrepreneurs on the simplified tax system, 6% without employees reflect the insurance premiums they transferred for themselves. Those who make payments to other individuals, in this column reflect both contributions transferred for themselves in a fixed amount, and similar payments paid for employees.

General requirements of KUDiR for all tax regimes

Every year a new document is opened.

At the end of the year, it is printed, stapled, the pages are numbered, the total number of pages is certified by the signature of the individual entrepreneur.

All information is recorded in chronological order based on primary documents and only after payment (cash method).

For transactions with settlements through a cash register, it is allowed to fill out the Book at the end of the working day using the Z-report.

KUDiR and primary documents on the basis of which records are made must be stored for 4 years.

If there is no activity, a “zero” KUDiR is printed and stitched.

For individual entrepreneurs on OSNO

For individual entrepreneurs on the simplified tax system

For individual entrepreneurs on PSN

How to keep a book of income and expenses in electronic format

Most official portals with regulatory documents offer to download a file in MS Excel format for maintaining the register in electronic form. When you download it, an electronic document opens in the form of a formatted appendix to order No. 135n.

Due to the fact that the procedure for maintaining a book in electronic and paper formats is the same, there should not be any particular difficulties with its design on a computer. If an error made when registering a transaction was discovered before the book was printed on paper, it can be easily corrected. If an error was discovered when the register was printed, the correction is made on the basis of clause 1.6 of the Procedure (certified by the manager’s signature and seal (if any) with the date of the correction).

The register, which was kept in electronic format during the year, must be printed at the end of the tax period. Its sheets are numbered, stitched and sealed with the signature of the head - a legal entity or individual entrepreneur - and a seal (if any).

Sending the book to the Federal Tax Service in electronic format with a digital signature is not provided for by the specified Procedure.

Is it possible to change the method of maintaining KUDiR (from electronic to paper or vice versa) during the year? The Ministry of Finance of the Russian Federation answered this question. Get trial online access to K+ for free and proceed to the explanations of the officials.

Instructions for filling

There are the following basic rules for reflecting information in KUDiR:

- Every year a new book needs to be created.

- Information in the book must be recorded in a chronological manner, using primary documentation. Such forms can be checks, payment orders, cash registers, etc.

- When entering income, you must remember that account replenishment and transfers to the authorized capital are not considered income for determining tax, therefore they should not be entered in the book.

- The book can be prepared both on paper and in electronic format. If it is compiled electronically, it must be printed at the end of the year.

- KUDiR in paper format must be stapled, numbered and sealed with the signatures of responsible persons. If the company provides for the existence of a seal, its imprint must be present on the book.

- If the KUDiR section does not contain data, it also needs to be printed and stapled in a common package.

- When a company has no income and expenses, the register still needs to be printed with zero indicators.

- Accounting for expenses and income is carried out in rubles.

You might be interested in:

Unified simplified tax return: sample completion in [year]

How to fill out sections of the income and expense ledger

Each business transaction performed by a taxpayer using the simplified tax system during the tax period, which has an impact on the formation of the tax base, must be registered in the book. Entries are made in chronological order. Based on the results of each quarter and at the end of the year, results are compiled.

ConsultantPlus experts provided a detailed commentary on filling out the book of income and expenses, including samples of completion. Get trial online access to K+ for free and proceed to recommendations.

Column 4 of Section I reflects income, the list of which is contained in Art. 249–250 Tax Code of the Russian Federation. Accordingly, the operations listed in Art. 251 of the Tax Code of the Russian Federation, as well as those that are subject to income tax for legal entities or personal income tax for individual entrepreneurs. Income received in kind is reflected at the market price of the received property.

Taxpayers who have chosen the accounting object “income minus expenses” enter their expenses in column 5 of the same section (their list is specified in Article 346.16 of the Tax Code of the Russian Federation). “Simplified people” who pay tax on the object “income” indicate in this column their expenses incurred as part of the implementation of budget unemployment programs, as well as expenses that were made from funds subsidized for the development of entrepreneurship.

Section II, concerning fixed assets, is filled out by simplifiers who have chosen “income minus expenses” as the object of taxation. Section III is also completed by taxpayers working with the “income minus expenses” object, if they have losses based on the results of previous years that can be taken into account when calculating the tax for the current year.

Section IV is filled out by taxpayers who calculate the single tax on the “income” object. All insurance premiums paid are recorded here, which have an impact on reducing the amount of accrued tax.

Since 2021, the book of income and expenses has been supplemented with Section V, in which taxpayers who have chosen “income” as the object of taxation reflect the amounts of trade duty paid, which affect the amount of tax payable to the budget.

For more information about the differences in the procedure for filling out the book, depending on the chosen object of taxation, read the material “The procedure for filling out KUDiR under the simplified tax system, income minus expenses .

You can download the current book of expenses and income form for 2020-2021 on our website.

If you use the tax object “income”, then see the sample KUDiR for 2021 in ConsultantPlus. If you have “income minus expenses,” then the sample for 2021 is at this link. It's free.

And if you need the previous version of the register (for 2013-2017), then this is it:

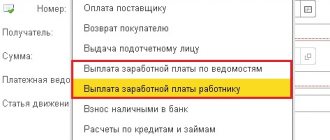

How to record expenses

There is no general rule here: expenses for materials, fixed assets, goods for resale, employee salaries, etc. are reflected differently.

Expenses for materials or services in KUDiR

For example, expenses for the purchase of materials for subsequent use may be recognized on the date these materials are written off in production, provided that the goods are paid for.

You have 3 events:

- Debiting from the current account and payment order;

- Receipt of materials and delivery note;

- Write-off of materials and accounting certificate or act of write-off of materials for production.

In general, write-off should occur according to event 3, but after 1 and 2. In practice, materials are often written off immediately as they were received, that is, events 2 and 3 coincide in date. The primary document in this case will be the delivery note.

This means that you will make the following entry in the Book:

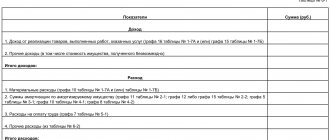

Income and expenses

| Registration | Sum | |||

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| 1 | 15.11.2020 Consignment note No. 189 | Receipt of goods from Antares LLC | 40000 | |

Services are reflected in a similar way - upon completion in the amount of paid services. The supporting document will be the act of provision of services in the presence of a payment order for their payment.

Expenses for goods for resale

They differ from materials costs in that event 3 will be the shipment to the final buyer. Date and document - according to the sales invoice or according to the retail sales report, or according to the inventory report.

Expenses for fixed assets

As we said above, the cost of fixed assets is written off in equal parts quarterly throughout the year. Date—the last day of the last month of the quarter. Document - invoice or certificate of acceptance and transfer of fixed assets, commissioning certificate, payment orders for payment.

Everyone does it differently: some list documents separated by commas, others (especially with automated maintenance) indicate the document on the receipt of the operating system. The main thing is that the remaining documents are available in case of a tax audit.

Input VAT

Input VAT in KUDiR can be reflected as a separate line or included in the value of assets. The order of reflection depends on what the simplifier bought:

- VAT on materials, works and services - input VAT is reflected in a separate line at the time of recognition of purchase expenses;

- VAT on goods for resale - input VAT is reflected in a separate line as goods are sold;

- VAT on fixed assets and intangible assets - acquired fixed assets are reflected in column 6 of section 2 of KUDiR at the original cost, which includes VAT.

How to check the book of income and expenses in 1C

There is an opportunity to check the correctness of the book of income and expenses in the 1C: Accounting program. For this purpose, a special function “Book Filling Assistant” is provided. With its help, an accountant can run routine operations and analyze the results.

When you download the special service built into the program, you can view all accepted and non-accepted expenses. The most common mistake is the program’s failure to provide documents confirming payment of expenses incurred. And in the absence of payment, expenses cannot be taken into account (Article 346.17 of the Tax Code of the Russian Federation). You can correct the error by group re-posting all documents for the tax period.

Read about all the nuances of using this accounting program by simplifiers in the article “Using “1C Accounting” under the simplified tax system .

Income from barter transactions

Income received from barter transactions should be reflected in the book of income and expenses at the moment when the counterparty fulfilled its obligations to the organization under the barter (commodity exchange) agreement. That is, when the counterparty transferred the relevant goods (other property) to the organization. This follows from paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation.

Situation: when to reflect income from barter transactions in the ledger of income and expenses? Property from the counterparty was received in one month, the organization’s property was transferred in another

Income from barter transactions should be reflected in the book of income and expenses after the ownership of the received property has transferred to the organization.

This is explained by the fact that property obtained not under the right of ownership is not income of the organization (Article 41 of the Tax Code of the Russian Federation).

Paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation states that the date of receipt of income is the moment of receipt of property. From the provisions of this paragraph, we can conclude that income from barter transactions is reflected in the book of income and expenses on the day when the organization receives property from the counterparty.

However, with barter, the parties to the contract receive ownership of the exchanged property at the same time, after fulfilling their obligations to each other.

You can deviate from this rule if the contract specifies a special procedure for transferring ownership. If there are no special clauses in this regard, all received property belongs to the counterparty until the organization transfers its property to him. This is stated in Article 570 of the Civil Code of the Russian Federation.

The above rules also apply to autonomous institutions, since property acquired by the institution under an agreement (other reasons) enters the operational management of the institution in the manner established for the acquisition of property rights (clause 2 of Article 299, Article 570 of the Civil Code of the Russian Federation).

Methodologically, this position seems more justified. However, there are no official explanations from regulatory agencies on this matter.

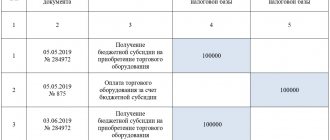

Book of income and expenses: example of filling out in special situations

An example of filling out a book of income and expenses will help you avoid mistakes in its design. This is especially true in situations where some non-standard operation arises.

Example:

The taxpayer transferred the advance payment to the supplier using the simplified tax system, but he did not ship the goods to him, and in the end he returned the advance payment. In this situation, an entry in column 5 cannot be made when transferring the advance, since this type of expense is not specified in Art. 346.16 Tax Code of the Russian Federation. This means that the returned advance is not shown in column 4 “Income”. This is stated in the letter of the Ministry of Finance of Russia dated December 12, 2008 No. 03-11-04/2/195.

If the taxpayer receives an advance payment, this amount is reflected in income, since simplifiers are required to use the cash method. But when returning the advance payment, it is necessary to reverse the entry made earlier for the amount of the advance payment returned to the buyer.

A sample of filling out the book of income and expenses for 2019-2020 can be found on our website.

And this is a sample of filling out a book of income and expenses for periods up to 2018:

Is an individual entrepreneur required to conduct KUDiR on the simplified tax system?

Carrying out activities in the format of an entrepreneur involves carrying out accounting in a simplified format. This rule simplifies a lot when using the simplified tax system. However, the requirement of the law is that an individual entrepreneur must keep records of income and tax expenses in a special register, which is this book.

An entrepreneur cannot refuse to use it. Based on it, a declaration under the simplified tax system is drawn up. Here the individual entrepreneur must record all transactions that affect the determination of the single tax according to the simplified tax system. A book on accounting for income and expenses is needed both when working only on income, and when reducing them by expenses incurred.

It can be completed in any way available to the entrepreneur. This could be making entries in a journal of the same name on paper. An individual entrepreneur can also keep a book in electronic format. At the same time, he must print it out either at the end of the quarter or the tax period.

There is currently no need to submit it to the tax office. This is done upon receipt of a corresponding request from the Federal Tax Service.

Results

Do not neglect filling out the book of income and expenses, because filling out this register is not difficult, and the consequences of its absence can be quite noticeable. and samples from our article and check yourself when filling out.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n

- Code of Administrative Offenses of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it necessary to stitch KUDiR

The procedure for filling out KUDiR establishes that this document must be stapled. First, all sheets of the document must be numbered in page order, without any omissions or corrections.

The instructions do not specify exactly where the firmware should be done. Therefore, the accountant can do this either in the middle of the sheet or in the upper left corner.

The ends of the thread used for stitching are not cut. On the back of the last page, you need to paste a small piece of paper on top of them, on which the line “Numbered and laced ... sheets” is written. Next, you need to indicate your full name. and sign. The inscription is confirmed by the seal of the company or entrepreneur, if used.

Attention! Stapling or gluing sheets together is prohibited.