Those who are required to maintain accounting must prepare and submit financial statements. And these are all organizations, regardless of the taxation system applied (Part 1, Article 6, Part 2, Article 13 of the Law of December 6, 2011 No. 402-FZ).

This rule also applies to bar associations. There are no exceptions for such non-profit organizations (clause 2 of Article 22 of the Law of May 31, 2002 No. 63-FZ) in the legislation.

Under certain conditions, only individual entrepreneurs and structural divisions of foreign organizations are not required to prepare financial statements. This follows from Part 2 of Article 6 of the Law of December 6, 2011 No. 402-FZ.

How often to report

There are two types of reporting: annual and interim (parts 3, 4 of article 13 of the Law of December 6, 2011 No. 402-FZ).

All organizations that are required to maintain accounting must prepare and submit financial statements at least annually. The reporting period for annual financial statements (i.e., reporting year) is the calendar year - from January 1 to December 31 inclusive. An exception is cases when an organization is registered, reorganized or liquidated in the middle of the year. This is stated in parts 1, 4 of Article 15, parts 3–5 of Article 13 of the Law of December 6, 2011 No. 402-FZ.

It will be necessary to prepare reports more often, for example monthly or quarterly, only if this is directly stated in the law, constituent documents or in the decision of the owner of the organization (Part 4 of Article 13 of the Law of December 6, 2011 No. 402-FZ). Such interim reports are generated on an accrual basis from the beginning of the year.

Contents of the statement of changes in equity

This report is divided into sections.

- Section 1 “Capital” contains data such as the balances of the Authorized Capital, Reserve Capital, Additional Capital, and Reserve Fund.

- Section 2 “Reserves for future income” and section 3 “Evaluated reserves” contain data on reserves for vacations, doubtful debts, etc. formed at the beginning of the year.

- In section 4 “Change in capital” there is data on the amount of capital and its change.

Where to take it

Annual financial statements must be submitted:

- to the tax office;

- founders (participants, shareholders);

- to the territorial statistical office.

This procedure follows from part 2 of article 18 of the Law of December 6, 2011 No. 402-FZ and subparagraph 5 of paragraph 1 of article 23 of the Tax Code of the Russian Federation.

In addition, tour operator organizations that do not publish their reports as required by law must submit a copy of their annual financial statements to the Federal Tourism Agency. This obligation is established for them by paragraph 2 of the Procedure approved by order of the Federal Tourism Agency dated August 4, 2009 No. 175. This must be done after submitting the financial statements to the tax office (clause 4 of the Procedure approved by the order of the Federal Tourism Agency dated August 4, 2009 No. 175).

Submit interim (monthly, quarterly) reporting to the owners (founders, shareholders) upon their request (Part 4 of Article 13 of the Law of December 6, 2011 No. 402-FZ). There is no need to submit such reports to either the tax office or statistical authorities.

Situation: is it necessary to submit financial statements to the tax office at the location of a separate division of the organization?

No no need.

According to general rules, financial statements need to be submitted only at the location of the organization’s head office. That is, to the tax office in which it is registered. At the same time, reporting is generated for the entire organization as a whole, taking into account the performance indicators of all its divisions (branches, representative offices, etc.). This is provided for in paragraph 4 of PBU 4/99 and subparagraph 5 of paragraph 1 of Article 23 of the Tax Code of the Russian Federation.

An organization has the right, but is not obligated, to submit its financial statements to the inspectorate at the place of registration of its separate division. A similar opinion was expressed by representatives of the Russian Ministry of Finance in letters dated July 7, 2009 No. 03-02-07/1-345, dated March 8, 2008 No. 03-02-07/1-132.

Situation: do you need to submit your financial statements to other organizations or citizens upon their request?

Yes, it is necessary if it is expressly provided for by law.

Accounting data is not classified information. Therefore, the organization is obliged to ensure access to them for all interested users. These could be investors, creditors, banks, suppliers, buyers, etc. This is stated in paragraph 42 of PBU 4/99. But there are no strict deadlines and procedures within which reporting for this category of users must be provided in the legislation. The parties can agree on this themselves. By the way, such conditions are often specified in loan agreements with banks.

In addition, in cases provided for by law, the organization is obliged to publish annual financial statements in the media. For example, if an organization openly places bonds or other equity securities (clause 2 of Article 92 of the Law of December 26, 1995 No. 208-FZ, clause 2 of Article 49 of the Law of February 8, 1998 No. 14-FZ).

Situation: is it necessary to submit annual financial statements to the tax office if the organization did not conduct business during the reporting period?

Yes need.

The organization is obliged to submit financial statements at the end of each reporting year (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). The legislation does not provide exceptions for periods in which there was no activity.

Situation: is it necessary to submit financial statements on the activities of a simple partnership to the tax office? The organization is a participant in a simple partnership and conducts its general affairs.

No no need.

After all, the obligation to submit financial statements is provided only for economic entities (Part 2 of Article 13 of the Law of December 6, 2011 No. 402-FZ). And among these are commercial and non-profit organizations (Part 1 of Article 2 of the Law of December 6, 2011 No. 402-FZ). Participants in a simple partnership agreement do not form a new organization (clause 1 of Article 1041 of the Civil Code of the Russian Federation). That is, this association is not an economic entity. Therefore, there is no requirement to submit reports on the activities of a simple partnership to the inspectorate.

How do the indicators of joint activities get to the tax office? Participants in a simple partnership can entrust accounting of the common property of the partners to one of the participating organizations (clause 2 of Article 1043 of the Civil Code of the Russian Federation, clause 12 of PBU 20/03). Such an organization reflects data on joint activities in a separate balance sheet (clauses 17, 18, 19 PBU 20/03). This balance, as well as other information about general affairs necessary for the generation of reporting, tax and other documentation, is communicated to all users, primarily to comrades. The procedure and deadlines for this are initially established in the joint activity agreement. In this case, the period cannot be later than 30 days after the end of the quarter and 90 days after the end of the year (clause 20 of PBU 20/03).

In turn, each of the participants, based on information received from a partner conducting common business, reflects the necessary information about joint activities in its financial statements. The list of such information and the procedure for their reflection is given in paragraph 16 of PBU 20/03. In addition, in the Explanations to the Balance Sheet and the Statement of Financial Results, each of the partners must reflect information about participation in joint activities. In particular, information about the share of participation (contribution) in joint activities, the share in jointly incurred expenses (income received), etc. This is stated in paragraph 2 of paragraph 16, paragraphs 22 and 23 of PBU 20/03.

When the agreement on joint activity ceases to be valid, the partner conducting common affairs draws up a liquidation balance sheet. In this case, the property due to each partner as a result of the division is taken into account as repayment of his contribution to the joint activity. This is stated in paragraph 21 of PBU 20/03 and paragraph 2 of Article 1050 of the Civil Code of the Russian Federation. Such a report, as well as a separate balance sheet, does not need to be submitted to the inspection (Clause 1, Article 48 of the Civil Code of the Russian Federation).

There is no requirement to draw up an interim liquidation balance sheet when terminating the activities of a simple partnership. This report should be prepared only by legal entities (organizations) (Article 17 of the Law of December 6, 2011 No. 402-FZ).

There is no need to inform the tax inspectorate about the liquidation of a simple partnership, again for the reason that such an association is not recognized as a participant in tax legal relations (Article 9 of the Tax Code of the Russian Federation, paragraph 1 of Article 1041 of the Civil Code of the Russian Federation). Each participant will reflect information about the closure of a simple partnership in his Explanations to the Balance Sheet and the Statement of Financial Results. Data will appear in reports for the period in which the joint venture agreement expired. This conclusion follows from the provisions of paragraphs 27 PBU 4/99, 22 PBU 20/03.

An example of how to reflect the liquidation of a simple partnership in accounting

Alpha LLC and Proizvodstvennaya LLC entered into an agreement on joint activities. “Alpha” was appointed as a comrade in charge of general affairs. Cash deposits in the total amount of RUB 3,000,000. The partnership participants contributed equally.

Due to the expiration of the contract, the joint activity is terminated, while the remaining property and funds are distributed in proportion to the value of the partners’ contributions to the common cause.

The following balances are listed on a separate balance sheet of the joint activity:

- 600,000 rub. (according to the debit of account 10 “Materials”, line “Inventories” of the Balance Sheet);

- RUB 2,400,000 (according to the debit of account 51 “Current accounts”, line “Cash” of the Balance Sheet);

- 3,000,000 rub. (according to the credit of account 80 “Deposits of partners”, line “Authorized capital (share capital, authorized capital, contributions of partners)” of the Balance Sheet).

In accounting (on a separate balance sheet), Alfa reflected property distribution operations as follows:

Debit 80 Credit 51 – 1,200,000 rub. – part of the unused funds was returned to Alpha;

Debit 80 Credit 10 – 300,000 rub. – some of the unused materials were returned to Alpha;

Debit 80 Credit 51 – 1,200,000 rub. – part of the unused funds was returned to the “Master”;

Debit 80 Credit 10 – 300,000 rub. – some of the unused materials were returned to the “Master”.

After carrying out these operations on all accounts, zero balances are formed on the balance sheet of the joint activity. Thus, all settlements under the simple partnership agreement are completed.

In the liquidation balance sheet of a simple partnership at the end of the reporting period, the lines “Inventories”, “Cash” and “Authorized capital (share capital, authorized capital, contributions of partners)” reflect zeros.

Accounting and methods of its regulation

Accounting statements are a set of data about the economic activities of an organization and its financial status. This data is provided for a certain period, called the reporting period, and consists of systematized tables, organized according to legally defined and uniform forms in accordance with Federal laws. Reporting links and integrates all information about the organization and is the final stage of accounting.

Keeping records is the responsibility of a professional accountant

A reporting period is a certain time period that includes all business transactions that occurred during this period and are reflected by an economic entity in accounting and financial statements. The main reporting period is a year, and the additional ones are a month and a quarter (three months). The calendar reporting period is the period beginning on January 1 of the new year and ending on December 31 of the same year. Thus, it is considered to fully describe all transactions for the current year.

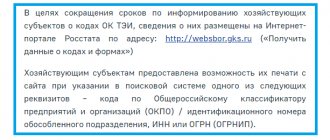

All accounting data is open information, so society must provide access to it to all interested people: creditors, investors, banks, tax authorities, buyers. This is stated in Accounting Regulations 4/99. However, there are no strict deadlines or frames within which documents must be submitted. The parties agree on this independently by registering agreements with banks, etc.

There are the following types of accounting:

- Statistics. Performed for statistical authorities. If you do not provide it on time, you may receive a fine.

- Control. Compiled for company management to monitor its management, improve operational efficiency and increase profits.

- As systematized data on business transactions and property status.

When to take it

Annual reports must be submitted to the tax office no later than three months after the end of the reporting year (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). At the same time, a mandatory copy of the annual reporting must be submitted to the statistics department (Part 2 of Article 18 of the Law of December 6, 2011 No. 402-FZ). That is, as a general rule, annual financial statements must be submitted no later than March 31 of the year following the reporting year. For example, financial statements for 2021 must be submitted no later than March 31, 2021.

If the deadline for submitting reports falls on a non-working (weekend) day, submit it on the first working day following it (clause 47 of PBU 4/99).

There are no deadlines for submitting interim reports in the Law of December 6, 2011 No. 402-FZ. That is, there is no need to submit financial statements to the tax office during the year.

For organizations created after September 30, the first reporting year is the period from the date of their registration to December 31 of the following year (Part 3 of Article 15 of the Law of December 6, 2011 No. 402-FZ). For the first time, such organizations must submit financial statements based on the results of the next year. For example, an organization was created on October 15, 2015; it must submit financial statements for the first reporting year by March 31, 2021 inclusive. The report will cover the period from October 15, 2015 to December 31, 2021.

Organizations registered before September 30 submit annual reports on a general basis. In the annual reporting, include performance indicators from the date of establishment of the organization to December 31 of the current year. This procedure follows from Part 3 of Article 15 of the Law of December 6, 2011 No. 402-FZ.

For liquidated organizations, the last reporting year is the period from January 1 to the date of making an entry about liquidation in the Unified State Register of Legal Entities (Article 17 of the Law of December 6, 2011 No. 402-FZ). Therefore, reports must be submitted within three months from this date. For example, an entry on the liquidation of an organization was made in the Unified State Register of Legal Entities on October 27, 2021, prepare financial statements as of October 26, 2016, the reporting period is from January 1 to October 26, 2016.

During reorganization, the last reporting year is the period from January 1 of the year in which the state registration of the last of the legal entities that emerged was carried out until the date of such registration (Part 1 of Article 16 of the Law of December 6, 2011 No. 402-FZ). An exception to this rule is reorganization in the form of merger. In this case, the last reporting year is the period from January 1 to the date of making an entry in the Unified State Register of Legal Entities on the termination of the activities of the affiliated organization. This is stated in Part 2 of Article 16 of the Law of December 6, 2011 No. 402-FZ.

When should a reorganized organization submit its latest financial statements? This must be done no later than three months from the day that precedes the date of state registration of the last of the legal entities that emerged (the date of entry into the Unified State Register of Legal Entities on the termination of the activities of the affiliated legal entity). After all, it is on this date that the latest accounting (financial) statements must be prepared. This conclusion follows from Part 3 of Article 16 and Part 2 of Article 18 of the Law of December 6, 2011 No. 402-FZ.

For organizations that were formed as a result of reorganization, special rules apply. Other (compared to the creation of an organization) requirements have been established. A legal entity created as a result of a reorganization must always prepare and submit financial statements as of December 31 of the year in which the reorganization took place. This must be done even if the state registration of a newly created legal entity as a result of reorganization occurred in the period from October 1 to December 31. These rules are enshrined in Part 5 of Article 16 of the Law of December 6, 2011 No. 402-FZ. And such reporting must be submitted within the usual time frame - no later than three months after the end of the reporting year.

There are no specific deadlines for tour operator organizations within which they must submit copies of their financial statements to the Federal Agency for Tourism specifically. However, paragraph 4 of the Procedure, approved by order of the Federal Tourism Agency dated August 4, 2009 No. 175, states that these documents must be submitted along with information on financial security for the new term. And such papers are submitted no later than three months before the expiration of the current financial security (paragraph 4, article 17.3 of the Law of November 24, 1996 No. 132-FZ). This means that financial statements must be submitted within the same period.

What is a financial statement used for and who prepares it?

When the reporting period in any organization ends, all legal entities and individual entrepreneurs (IP) must submit annual financial statements. It is necessary for internal work, as well as for external specialists who will evaluate the activities of an enterprise or individual entrepreneur.

Organization or enterprise data

The preparatory part of drawing up this document consists of the following steps:

- the correctness of the recording of correspondence on accounting transactions for the previous year is checked;

- all erroneous entries that were identified during the inventory period are corrected;

- if the reporting needs to reflect transactions that were identified in the new year, then accountants make notes and carry out all events according to the documents;

- after checking all the data, taxes for the reporting period are calculated;

- the last step is to make accounting entries for the calculation of taxes and reform the balance sheet of the company or enterprise.

Chief accountant - responsible person

Annual reports are prepared by the chief accountant . The accountants who are subordinate to him must provide all the necessary figures for the reporting period for their area.

This document is the final document in the accounting process. This helps to trace the unity of all available indicators in primary papers and accounting registers.

What happens if you don’t submit your reports on time?

If financial statements are not submitted to the Federal Tax Service of Russia on time, the inspectorate may fine the organization under Article 126 of the Tax Code of the Russian Federation. The fine is 200 rubles. for each document included in the reporting that tax inspectors received late.

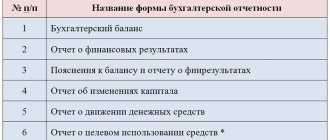

When determining the amount of the fine, inspectors are guided by the full list of documents that a specific organization must submit (letter of the Federal Tax Service of Russia dated November 16, 2012 No. AS-4-2/19309, Ministry of Finance of Russia dated May 23, 2013 No. 03-02-07/2 /18285). For example, as part of the financial statements for 2015, the organization must submit the following forms: Balance sheet (see filling out the balance sheet), Statement of financial results, Statement of changes in capital, Statement of cash flows (see ODDS for the procedure for filling out), explanations in tabular and text forms. If an organization fails to submit its financial statements on time, the fine will be 1,000 rubles. (200 rub. × 5).

In addition, for late submission of financial statements at the request of the tax inspectorate, the court may impose a fine in the amount of 300 to 500 rubles from the responsible employee (for example, the head of an organization). (Part 1 of Article 23.1, Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

In each specific case, the perpetrator of the offense is identified individually. In this case, the courts proceed from the fact that the manager is responsible for organizing accounting, and the chief accountant is responsible for its correct maintenance and timely preparation of reports (clause 24 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18). Therefore, the chief accountant (an accountant with the rights of the chief) is usually recognized as a violator. And the head of an organization may be found guilty in the following cases:

- the organization did not have a chief accountant at all (resolution of the Supreme Court of the Russian Federation dated June 9, 2005 No. 77-ad06-2);

- accounting was carried out by a specialized organization, and it also compiled reporting (clause 26 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18);

- the reason for the violation was a written order from the manager, with which the chief accountant did not agree (clause 25 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18).

If you fail to submit financial statements to Rosstat on time or submit them incompletely, an administrative fine will be charged.

An official of an organization faces a fine of 300 to 500 rubles. (to the manager). The organization itself can be fined from 3,000 to 5,000 rubles.

Such sanctions are provided for in Article 19.7 of the Code of the Russian Federation on Administrative Offenses (letter of Rosstat dated February 16, 2016 No. 13-13-2/28-SMI).

Similar separate fines will apply for late submission of an audit report to Rosstat.

Results

- Annual financial statements are prepared by the chief accountant. This document is necessary for work within the company and for users who are involved in assessing the activities of the enterprise.

- The principles for drawing up the annual form are the correctness of the format and the reliability of all the numbers provided.

- The annual report includes a balance sheet of the enterprise, a document with reflected profits and losses, and others.

- The legal regulation of this document is carried out by certain documents.

Rules for filling and signing

Prepare financial statements in Russian (clause 15 of PBU 4/99). Report numerical data in thousands or millions of rubles (without decimal places). Indicate financial reporting indicators that have a negative value (for example, the amount of uncovered loss) in parentheses. In the same order, reflect the data that needs to be subtracted from other indicators. For example, the cost of goods sold, products, works, services in the Financial Results Report. This follows from the provisions of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Accounting statements are considered prepared after they are signed on paper by the head of the organization (Part 8 of Article 13 of the Law of December 6, 2011 No. 402-FZ). If accounting is carried out by a specialized organization, then the financial statements must be signed by the heads of both organizations, that is, the one that provides accounting services (clause 17 of PBU 4/99).

The signature of the chief accountant on reports submitted to Rosstat is not required. This follows from Article 18 of the Law of December 6, 2011 No. 402-FZ. Rosstat came to this conclusion in letter dated April 7, 2021 No. 532/OG.

The signature of the chief accountant is not required in the accounting reports submitted to the Federal Tax Service. This is not provided for by current legislation.

Situation: who, instead of the head of the organization, can sign the financial statements? The organization has its own accounting department.

This can be done by any employee authorized by the head of the organization.

The manager can delegate part of his powers (including the right to sign financial statements) to other employees. For example, to your deputy, financial or commercial director. To do this you need:

- issue an order appointing someone responsible for signing the financial statements;

- issue the employee a power of attorney for the right to sign financial statements (subclause 2, clause 3, article 40 of the Law of February 8, 1998 No. 14-FZ, article 69 of the Law of December 26, 1995 No. 208-FZ, clause 5 of Art. 185 of the Civil Code of the Russian Federation).

If such documents are drawn up correctly, then the signature of an authorized employee on the financial statements is equal to the signature of the head of the organization.

The manager can transfer the right to sign to another individually, without coordinating this with the founders, board of directors or shareholders. Provided, of course, that a different procedure is not provided for by the organization’s constituent documents.

An important detail: a power of attorney is required - one order appointing someone responsible for signing the statements is not enough. The legislation does not provide that anyone other than the manager (general director, president, etc.) has the right to act on behalf of the organization and represent its interests without a power of attorney.

Such conclusions are confirmed by letters of the Ministry of Finance of Russia dated September 25, 2012 No. 03-02-07/1-227, Federal Tax Service of Russia dated June 26, 2013 No. ED-4-3/11569.

Situation: is it possible to put a facsimile signature of the head of the organization on financial reporting forms?

No you can not.

Facsimiles can be used only in cases provided for by law (clause 2 of Article 160 of the Civil Code of the Russian Federation). But the accounting law does not directly allow the use of a facsimile signature. But it says that the manager must sign the financial statements personally, on paper (Part 8 of Article 13 of the Law of December 6, 2011 No. 402-FZ).

PBU and IFRS

PBU and IFRS are accounting standards. What is the difference?

PBU is an abbreviation for “Accounting Regulations”. These are Russian accounting standards that regulate the accounting of assets, liabilities or events of economic activity. PBUs are internal documents of Russia, they are adopted by the Ministry of Finance of the Russian Federation and are valid for commercial non-banking organizations (for banks and credit organizations, the provisions adopted by the Central Bank of the Russian Federation are used).

Today there are 24 PBUs in force, all of them are mandatory for use when preparing financial statements and maintaining accounting registers.

IFRS is an abbreviation for International Financial Reporting Standards. These standards are adopted by the International Accounting Standards Board (IASB), located in the UK.

IFRS is mandatory for use in some European countries, as well as for almost all European companies whose securities are traded on the stock exchange.

In Russia there is a program for reforming accounting in accordance with IFRS. By Order of the Ministry of Finance of Russia dated November 25, 2011 No. 160n, 63 documents were put into effect in our country: the IFRS standards themselves and explanations to them.

Approval of annual reports

The annual financial statements must be approved (Part 9, Article 13 of the Law of December 6, 2011 No. 402-FZ). The decision on this is made by the general meeting of shareholders (participants) (subparagraph 11, paragraph 1, article 48 of the Law of December 26, 1995 No. 208-FZ, subparagraph 6, paragraph 2, article 33 of the Law of February 8, 1998, No. 14 -FZ). Such a decision must be formalized in the minutes of the general meeting (Article 63 of the Law of December 26, 1995 No. 208-FZ, paragraph 6 of Article 37 of the Law of February 8, 1998 No. 14-FZ).

There are no mandatory requirements for the minutes of the meeting of LLC participants in the legislation. But there are details that must be provided. This is the number and date of the minutes, place and date of the meeting, agenda items, signatures of the founders. The minutes of the general meeting of shareholders differ from the minutes of an LLC in that they are drawn up in duplicate and have mandatory details. These signs are listed in paragraph 2 of Article 63 of the Law of December 26, 1995 No. 208-FZ.

An example of how to draw up minutes of a general meeting of LLC participants. Approval of annual financial statements

The charter of Torgovaya LLC stipulates that annual financial statements are approved no later than March 20 of the following year. At the general meeting of participants, which took place on March 19, 2021, the financial statements were approved. The decision was made unanimously. The minutes of the general meeting of participants are compiled as follows.

Attention: the current legislation does not provide for liability for the fact that the annual financial statements are not approved. But a fine is possible for failure to submit such reports to shareholders for approval.

Administrative liability in this case is established by Part 2 of Article 15.23.1 of the Code of the Russian Federation on Administrative Offences. This provision provides for punishment, in particular, for failure to provide or violation of the deadline for providing mandatory information (materials) in preparation for the general meeting of shareholders. Such materials also include the organization’s annual financial statements (Part 3 of Article 52 of the Law of December 26, 1995 No. 208-FZ).

The fine will be:

- for an organization – from 500,000 to 700,000 rubles;

- for officials – from 20,000 to 30,000 rubles. or disqualification for up to one year.

Situation: is it possible to submit to the tax office annual financial statements that were not approved at the general meeting of participants (shareholders)? The deadline for filing reports expires before the date for which the general meeting is scheduled.

Yes, you can.

As a general rule, accounting (financial) statements are considered prepared after a paper copy is signed by the head of the organization (Part 8, Article 13 of Law No. 402-FZ of December 6, 2011).

But indeed, the period during which the annual financial statements must be submitted to the tax office does not coincide with the period during which they must be approved by the general meeting of the organization’s founders. Thus, the annual reporting of an LLC must be approved no earlier than two, but no later than four months after the end of the reporting year (paragraph 2 of Article 34 of the Law of February 8, 1998 No. 14-FZ). And in a joint-stock company - no earlier than two, but no later than six months after the end of the reporting year (paragraph 3, paragraph 1, article 47 of the Law of December 26, 1995 No. 208-FZ).

The annual financial statements must be submitted to the tax inspectorate no later than three months after the end of the reporting year (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). This deadline cannot be moved - the law does not provide for this. And for late submission of reports, the organization, its manager and (or) chief accountant may be fined.

So it turns out that annual financial statements must be submitted to the tax office, even if they did not have time to approve them at the general meeting.

Accounting statements of banks and credit organizations

The accounting statements of banks and credit institutions are special. It is regulated by the regulatory documents of the Bank of Russia. The fundamental documents are the “Regulations on the rules of accounting in credit institutions located on the territory of the Russian Federation” (approved by the Bank of Russia on July 16, 2012 No. 385-P) and the Bank of Russia Directive dated September 4, 2013 No. 3054-U “On the procedure for drawing up credit organizations annual accounting (financial) statements.” Attention!

New reporting forms for banks were established by Bank of Russia Directive No. 4212-U dated November 24, 2016, which canceled the previously effective Bank of Russia Directive No. 2332-U dated November 12, 2009.

New reporting forms include:

- 0409120 “Data on the risk of information for calculating the amount of participation of foreign capital in the total authorized capital of credit institutions licensed to carry out banking operations”;

- 0409702 “Information on unexecuted transactions”, developed for the purpose of maintaining statistics and operational monitoring of systemic risks of the financial system associated with the non-execution of certain types of transactions in financial markets.

The requirements for the formation of indicators of reporting forms and the procedure for their submission to the Bank of Russia are also clarified.

Annual reporting of banks is compiled based on the results of the calendar year. It is subject to mandatory audit. The auditor's report is submitted along with the annual report to the Bank of Russia.

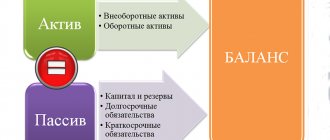

Balance sheet: asset

The numbers in line 1110 are calculated by subtracting from the debit balance of account 04 the corresponding value for the credit of account 05.

In order to determine the value for item 1150, the corresponding indicator for the credit of account 02 should be subtracted from the balance on the debit of account 01.

Line 1170 records the balance on the debit of account 58.

Point 1100 records the sum of the above figures.

In line 1210 it is necessary to record the amount of the balance on the debit of accounts 10 and 43.

In paragraph 1220, the figures for the debit of the balance of account 19 should be reflected.

In order to calculate the numbers for line 1250, you need to sum up the debit balances of two accounts - 50 and 51.

Point 1200 records the total for the above indicators.

In turn, in line 1600 it is necessary to reflect the sum of the values for points 1100 and 1200. As for the remaining lines, which include line 1360, in this case you can put dashes in them.

The above items form a balance sheet asset. Our next task is to consider the structure of the passive. If an auditing agency or other interested party analyzes the composition of the financial statements, then both parts of the document will have equal significance for it.

Financial reporting requirements

All requirements for accounting financial statements are listed in PBU 4/99. They are aimed at ensuring that accountants prepare reports that will provide complete and reliable information about the organization to all users. There are six main requirements:

- Credibility . Financial statements should contain only truthful information and help users learn about the real financial position of the organization, its financial results and cash flows. To ensure reliability, organizations annually conduct an inventory of assets and liabilities.

- Usefulness . All information in the reporting should be useful. The usefulness category includes relevance, timeliness, reliability and comparability. That is, there should be no errors in the reporting; it should satisfy the needs of users, help make management decisions and track the dynamics of indicators.

- Completeness . Reporting must be compiled and transmitted to users in its entirety, and all points that require clarification must be accompanied by additional data.

- Materiality . All indicators, non-disclosure of which may lead to incorrect management decisions, must be reflected in the reporting.

- Neutrality . The information in the reporting should satisfy the interests of all user groups. Information that influences decisions and evaluations of users in the way intended by the compiler cannot be considered neutral.

- Subsequence . The organization must adhere to the applicable content and forms of reporting consistently from one reporting period to another.

You also need to comply with the registration requirements: prepare reports in Russian, in the currency of the Russian Federation, comply with reporting periods and affix the signature of the manager, chief accountant or other person responsible for preparing the reports.