Accounting policy of the Unified Agricultural Tax

The Unified Agricultural Tax is a special tax regime, therefore, when starting a conversation about the accounting policy (AP) for merchants using the Unified Agricultural Tax, it is necessary to proceed from the general requirements of the Tax Code.

IMPORTANT! In accordance with Art. 313 of the Tax Code of the Russian Federation in its UP for tax purposes, the taxpayer establishes the rules for maintaining tax accounting when carrying out its activities.

In this case, the merchant will be required to:

- develop a management program before starting your work;

- approve the UP by order of the manager;

- apply consistently from period to period;

- adjust the management program in necessary cases (when legislation changes, when implementing new types of activities, etc.).

When forming a unitary enterprise and determining the rules of tax accounting, the special regime agricultural producer must take into account the requirements of Art. 346.5 Tax Code of the Russian Federation.

Clause 8 of this article formulates the main requirement for the form of tax accounting for agricultural merchants on the Unified Agricultural Tax. They are required to reflect the information necessary for calculating agricultural tax as follows:

- companies on the Unified Agricultural Tax - based on accounting data taking into account the requirements of Chapter. 26.1 Tax Code of the Russian Federation;

- Individual entrepreneur on Unified Agricultural Tax - in a special book for accounting income and expenses of individual entrepreneurs, approved by order of the Ministry of Finance of Russia dated December 11, 2006 No. 169n.

Thus, firms using unified agricultural tax must form two types of management systems:

- for accounting purposes;

- Tax UP.

They can be drawn up in the form of two separate documents approved by the manager or in the form of a single unitary enterprise, in which separate sections are allocated to the nuances of accounting and tax accounting.

For individual entrepreneurs on the Unified Agricultural Tax, reflecting income and expenses in a special book, the form and procedure for filling which are approved by law, the UE for accounting purposes is not needed - they are allowed not to carry out this type of accounting (clause 2 of article 6 of the law of December 6, 2011 No. 402- Federal Law on Accounting).

However, for the purposes of tax accounting for individual entrepreneurs, it is better to formalize it. For what? We'll tell you in the next section.

Read about drawing up accounting policies for the simplified tax system in this article.

Eskhn: organization of tax accounting -

E. Shatina, S. Kozmenkova magazine “Accounting in Agriculture” No. 3/2008

The use of a special regime in the form of payment of a single agricultural tax often raises questions among accountants. Our material will give answers to many of them, help to establish accounting in the organization and optimize the work of accounting workers.

Determining the accounting procedure

Let's start with the fact that organizations that have switched to a special tax regime in the form of paying the unified agricultural tax must maintain full accounting records. As for the accounting of indicators for calculating the tax base and the amount of the Unified Agricultural Tax, they are required to maintain it on the basis of accounting data.

However, unlike accounting, where all the rules are regulated, no special books or strict standards have been established for tax accounting. Therefore, agricultural organizations have the right to independently develop a tax accounting system.

We are creating an accounting system

When forming a tax accounting system (based on accounting), it is necessary to develop a methodological and organizational framework that will allow both types of accounting to be carried out most efficiently, with the least amount of time and money.

Accounting policies, rational document flow, selection of tax accounting registers, and the use of third-order accounting accounts will serve as a tool for accounting convergence.

In this work it is advisable:

– identify accounting objects for which accounting rules coincide with tax rules or differ slightly; – develop a procedure for using accounting data for tax accounting purposes (introduce additional sub-accounts); – identify those accounting objects for which the accounting rules are different, and develop forms of tax accounting registers; – develop forms of accounting certificates necessary for calculating the unified agricultural tax; – organize separate accounting of income and expenses associated with the sale (disposal) of fixed assets and intangible assets.

Grouping of income and expenses in accounting can be achieved using subaccounts and analytical accounts. Their data will allow you to exclude from the calculation of the tax base income and expenses that are not recognized for tax purposes.

The main primary tax accounting document will be an accounting certificate drawn up on the basis of primary accounting documents. It contains details that allow (if necessary) access to the original source. The organization of accounting for calculations for the unified agricultural tax can be presented in the form of a diagram. It is given in Appendix 1.

We prepare accounting statements

Data from accounting certificates prepared at each accounting site can be used to prepare almost any tax calculation. Let's look at an example of the procedure for accounting for sales income accepted for calculating the Unified Agricultural Tax.

We invite you to familiarize yourself with the Unified Agricultural Tax (USAT) in 2021 - Kontur.Extern - SKB Kontur

Let's consider another situation.

According to the rules of paragraph 4 of Article 346.5 of the Tax Code of the Russian Federation, when selling fixed assets before the expiration of three years from the date of accounting for the costs of their acquisition, the taxpayer must recalculate the tax base, pay an additional amount of tax and penalties. When selling a fixed asset with a useful life of more than 15 years, recalculation is done if less than 10 years have passed. This recalculation is not shown in the example.

We create a consolidated tax register

Based on accounting statements, data on sales accounting accounts (accounts 90 and 91), as well as cash accounts, settlements, etc., a consolidated tax register is formed to record income from sales accepted for the calculation of the Unified Agricultural Tax. Its form is shown in Appendix 3.

In this register, income is allocated in accordance with the specifics of production in the context of revenue from the sale of agricultural products, primary processed products and other income. In addition, in the tax register it is advisable to show income by source of income.

Thus, non-operating income may include, for example, income from equity participation in other organizations, from property received free of charge, in the form of written off accounts payable...

Using the same principle, you can build cost accounting. The accounting policy must be accompanied by forms of accounting statements and calculations that will be used in accounting.

In conclusion, we note that the proposed version of the system for accounting for settlements under the Unified Agricultural Tax is of a recommendatory nature. It can be used to analyze the data used in accounting records, which will increase the comparability of accounting and tax information.

Accounting policy of individual entrepreneurs on the Unified Agricultural Tax

At first glance, the requirement to register a UE for an entrepreneur on the Unified Agricultural Tax seems redundant for the reason that Ch. 26.1, dedicated to the issues of Unified Agricultural Tax, does not provide for a multivariate methods and methods of accounting for income and expenses, and the legislation does not require rewriting the norms of the Tax Code of the Russian Federation one to one in the UE.

However, in reality everything is not quite like that. The point is that Art. 313 of the Tax Code of the Russian Federation provides that tax accounting data must be confirmed by:

- primary accounting documents;

- analytical tax accounting registers;

- tax base calculations.

This means that individual entrepreneurs in their UP must provide for the following important aspects:

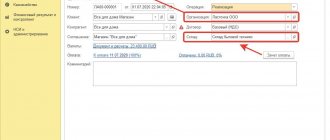

- forms of primary documents used for registration of business transactions;

- document flow algorithms and procedures for processing accounting information;

- other important decisions for tax accounting purposes.

Since individual entrepreneurs on the Unified Agricultural Tax have the right to keep records of their income and expenses both on paper and electronically, the chosen method must also be fixed in the UE.

If you have access to ConsultantPlus, check whether you have correctly drawn up the accounting policy for individual entrepreneurs on the Unified Agricultural Tax. If you don't have access, get a free trial of online legal access.

In addition, any businessman is interested in the safety of his property, therefore the management program should reflect the issues of conducting an inventory of property and liabilities, as well as aspects of internal control over the accounting process.

Another important nuance that requires indispensable reflection in the UP is the detail of such an accounting procedure as separate accounting - if the individual entrepreneur combines the Unified Agricultural Tax with another taxation regime.

IMPORTANT! Based on paragraph 1 of Art. 346. 1 of the Tax Code of the Russian Federation, taxpayers applying the Unified Agricultural Tax have the right to combine this special regime with other (provided for by the Tax Code of the Russian Federation) taxation regimes.

And the combination of modes means the need to maintain separate records, the regulations of which are not described in the legislation. It must be developed independently and reflected in the UE.

IMPORTANT! The main requirement for the method of separate accounting used by a businessman is the possibility of unambiguously attributing certain indicators to different types of business activities (letter of the Ministry of Finance of Russia dated November 30, 2011 No. 03-11-11/296).

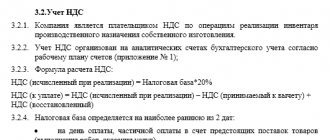

The most popular questions and answers to them regarding tax accounting according to the Unified Tax Code for LLCs

Question: Hello, our peasant farming has switched to the Unified Agricultural Tax. In addition to the production and sale of agricultural products, we are engaged in passenger transportation, since we have to deliver employees to their workplace, and the rest of the time the minibus is idle.

We also included all income received from this activity in accruals under the Unified Agricultural Tax, paid the tax and submitted the declaration on time. Now we have had a tax audit and, based on its results, a significant fine was assessed for incorrect calculation of tax and violations in record keeping, obliging us to transfer passenger road transportation to UTII.

We suggest you familiarize yourself with whether debts for utilities are transferred to the new owner

Tell me, is such a requirement legal and can we challenge the penalties in court?

Answer: Hello. Your situation is a typical example of a violation of current tax laws. First of all, we need to start with the fact that Chapter 26.

1 of the Tax Code of the Russian Federation states that income for calculating the tax on the Unified Agricultural Tax is funds received from the sale of agricultural products. Income from passenger transportation is not such and is subject to another type of taxation - UTII.

After the start of the provision of such services, you were required to submit an application to the Federal Tax Service to transfer this activity to UTII, and after that begin to submit the corresponding declaration to the inspectorate.

In your case, all receipts were indicated as income under the Unified Agricultural Tax, which means, firstly, there was an overpayment of the unified agricultural tax and an underpayment of the UTII, and secondly, for failure to submit a declaration under the “imputed tax”, an appropriate fine would be imposed on the enterprises.

In turn, the distribution of expenses when combining UTII and Unified Agricultural Tax occurs on the basis of the provisions of Art. 346.6 and 346.18 of the Tax Code of the Russian Federation, which states that costs are calculated in proportion to the revenue shares for each regime.

In other words, the fine imposed is absolutely legal, and you are unlikely to be able to challenge the decision in court.

Accounting policy of the company on the Unified Agricultural Tax

Firms using the Unified Agricultural Tax (as opposed to individual entrepreneurs) are required to keep accounting records, so they need to reflect all the nuances of their accounting and tax accounting in the UE.

They can form a “tax” UP taking into account the recommendations described in the previous section.

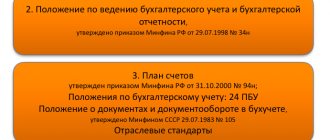

IMPORTANT! The rules for the formation of “accounting” accounting policies are defined in PBU 1/2008 “Accounting policies of organizations”, approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n.

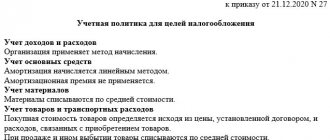

PBU 1/2008 requires firms to include the following aspects in the management program:

- working chart of accounts;

- forms of primary documents;

- regulations and frequency of inventory taking;

- document flow schedule;

- other decisions necessary for organizing accounting.

The “accounting” UP should reflect various accounting issues related to the specifics of the company’s activities.

For example, if its employees go on business trips, the following can be written in the UP:

- organizational regulations for the “travel” procedure;

- daily allowance amount;

- a list of reporting documents upon return from a business trip;

- other “travel” nuances.

In its UP, a company needs not only to reflect accounting nuances, but also to detail reporting features. In particular, if a company uses simplified reporting forms, which is allowed for small businesses, information about the reporting forms used must be reflected in the CP.

Document management system

The agricultural organization must approve a document management system that coordinates the following issues:

- the procedure for creating primary accounting documents;

- control of the correct completion of forms of primary accounting documents;

- the procedure and timing for the transfer of primary accounting documents to the accounting department;

- procedure for transferring documents to the archive.

At the same time, the accounting policy can provide that the document flow schedule is drawn up either as an annex to the accounting policy, or as a separate independent document. The work on drawing up such a schedule is organized by the chief accountant. The schedule is approved by order of the head of the organization.

What features of accounting for a merchant’s property on the Unified Agricultural Tax should be reflected in the accounting policy?

The use of the Unified Agricultural Tax is characterized by strict regulation of income and expenses taken into account when calculating agricultural tax. This also applies to accounting subtleties in relation to property used in agricultural activities.

However, even in such strict conditions, certain issues remain that require independent resolution (including reflection in the CP) on the part of the merchant using the Unified Agricultural Tax.

Let us consider, for example, the nuances of how the algorithm for accounting for the cost of land plots is reflected in the UE. The actions of a businessman when purchasing land are regulated by clause 4.1 of Art. 346.5 of the Tax Code of the Russian Federation and provide for taking into account the cost of land in expenses:

- after actual payment of “land” rights;

- if there is a documented fact of filing documents for state registration of the specified right;

- evenly over a certain period (at least 7 years).

The legislator has established a minimum time limit of 7 years, and taking this into account, the agricultural producer prescribes his time period in the UP. It can be equal to either the minimum allowed or any time period exceeding this limit (8, 9, 10 or more years).

In addition to land plots, the UE may reflect the specifics of establishing the useful life of the fixed assets and intangible assets of an agricultural businessman.

This is relevant for the following agricultural producers on the Unified Agricultural Tax:

- switched to the Unified Agricultural Tax from a different tax regime;

- having fixed assets and intangible assets with residual value at the time of transfer.

Since the write-off of the specified property cannot be carried out at a time, but depends on the useful life of fixed assets and intangible assets, it is necessary to establish in the CP the procedure for its determination - if such information is not available in the generally applicable classification (approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1).

For a general mechanism for registering an UE, see the material “How to draw up an organization’s accounting policy (2021)?”.

Forms of primary accounting documents

The next stage is approval of primary documents. For agricultural enterprises, this section is very relevant, because farms engaged in the production of agricultural products use a huge number of forms of primary documentation. The management’s task is to create a list of documents in relation to a specific enterprise.

Note. Specialized forms of primary accounting documentation were approved by the Ministry of Agriculture of Russia by Order No. 750 of May 16, 2003.

If you need to draw up a document for which a unified form is not provided, then when creating it you need to remember that its mandatory components are: name of the document, date of preparation, name of the organization, content of the business transaction, names of positions, signatures of the persons responsible for the business transaction and the correctness of its design.

For example , such a document can be called an act on the output of products of own production in crop production. There is no standard form for it, but its presence is an important component of the production and accounting processes. This means that its form must be developed in accordance with all accounting rules.

Results

Firms and individual entrepreneurs using the unified agricultural tax system, when drawing up accounting policies, must proceed from the basic requirements of the Tax Code of the Russian Federation and PBU 1/2008.

The main purpose of the accounting policy for merchants on the Unified Agricultural Tax is to consolidate the accounting methods used that allow reliably forming the tax base for agricultural tax and calculating it.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting policy in 2021

When drawing up an accounting policy for the next year, the company must take into account the following points:

- in connection with the abolition of UTII, it is necessary to decide which taxation system will be used for accounting; if the choice falls on the simplified tax system, then before the end of 2021 you must notify the tax office of your decision (see in more detail Which regime to switch to after UTII?)

- from next year, more companies will be able to apply for the use of the simplified tax system due to an increase in the maximum values of mandatory limits

- for SMEs in 2021, reduced rates on insurance premiums will be applied for wages above the minimum wage, which also affect the size of the reserve for vacation pay

- from next year it is allowed to adhere to the requirements of the Federal Standard “Fixed Assets” instead of PBU6/01

- IT companies can apply a reduced rate on insurance premiums and income tax (see more details Income Tax. Changes for 2021)

- The form of the waybill has changed, the accounting policy must reflect the method of registration: paper or electronic

Document approval deadlines

When a company has been registered, it needs, according to PBU 1, to draw up and approve its accounting policy no later than 90 days. That is, it can be entered immediately along with registration, or you can consider all the points more carefully and approve it no later than three months. Moreover, it begins to operate from the moment the organization is registered.

However, the accounting policy includes a section on taxes. The Tax Code of the Russian Federation requires that accounting policies for taxation be approved no later than the end of the first tax period. At the same time, its rules will apply to the company’s activities from the moment of registration.

Accounting policies are drawn up for an indefinite period. When forming it, the principle of consistency in the application of existing rules applies. That is, having chosen accounting methods and methods once, it is advisable to use them in the future. Changes in them must be justified and aimed at optimizing activities.

Attention! Changes can be made by appropriate order of management or by approving a new accounting policy.

In what case is it compiled?

Subjects must formulate accounting policies in cases where they maintain accounting records. Therefore, it is composed of all legal entities, regardless of their form of ownership. The only exceptions are credit organizations, representative offices and branches of foreign companies.

Many people mistakenly think that if an organization applies a simplified or other preferential tax system, then it should not draw up an accounting policy.

Actually this is not true. It is in the accounting policy that the moment is fixed in accordance with which the accounting of the enterprise is built according to a simplified scheme. If this does not happen, then the organization will not be able to use simplified accounting.

As a rule, the formation of accounting policies occurs immediately after the creation of a company. It is compiled by the chief accountant and approved by the director of the company. Then, at the end of each year, adjustments are made to it if necessary, and it is re-approved for the new year.

A separate big question is whether it is necessary for individual entrepreneurs to have an accounting policy. Indeed, according to the regulations, only organizations should develop and use this document. However, the Tax Code says that the taxpayer, regardless of the form, must develop an accounting tax policy.

Attention! It should be used only by those entrepreneurs who use OSNO or simplified tax system. Those who are in a special regime (UTII, Unified Agricultural Tax, patent) do not need to develop it, provided that they do not combine several modes.

But they do not need to develop and apply accounting policies for accounting, since according to the law they may not conduct accounting at all.

Accounting in agriculture.

Just click the button below. Example sample account. Sample accounting policy of Osno LLC 2021

Agricultural enterprise policy, accounting policy, agricultural enterprise accounting policy. We will provide you with a sample document. You will be redirected to our file sharing service. This accounting policy has been prepared in accordance with the order of the Ministry of Finance of Russia of October 2008 106n approving the accounting regulations of the organization's accounting policy. The importance of the document as an order to the accounting policy of the enterprise. Law topic accounting policy example of an enterprise. Appendix to order 30. The thesis examines the following concepts of the category accounting policy, tax accounting policy, accounting for fixed assets, depreciation of fixed assets, accounting for tax purposes. Accounting policy of the organization

Inventory procedure

For agricultural organizations, the section of the accounting policy that establishes the procedure for conducting inventories is one of the most important.

For example, it is possible to write off the natural loss of agricultural products during storage only after taking inventory of goods based on appropriate calculations. Let us note that, based on the experience of audits, many agricultural enterprises write off natural loss without conducting inventories. And this is unacceptable. And during tax audits, officials recognize such expenses as unfounded. Inventory refers to the methods of accounting, and the procedure for its implementation is one of the annexes to the accounting policy.

If reporting is prepared according to IFRS rules

A number of organizations are required to keep records and prepare consolidated financial statements in accordance with IFRS. These, in particular, include all companies whose securities are admitted to trading on stock exchanges and (or) other organizers of trading on the securities market. Also, financial statements according to IFRS rules can be prepared by companies that do not create groups (clause 1, article 1, clause 5, article 2 of the Federal Law of July 27, 2010 No. 208-FZ).

In the updated version of clause 7 of PBU 1/2008, a rule has appeared according to which such organizations in their accounting policies have the right to take into account not only FAS, but also IFRS. And if any accounting method established by the federal standard is contrary to the requirements of IFRS, this method need not be applied. But at the same time, the company must describe this method, disclose the relevant IFRS requirement and explain how it will be violated when adopting the Russian method of accounting (new clause 20.1 of PBU 1/2008).