If your customer (principal) is a VAT payer and you, as an agent, act on your own behalf, then you must fulfill VAT obligations, even if you are on the simplified tax system.

When selling goods (works, services) of the principal, issue invoices to buyers, and when purchasing for the principal, reissue invoices from sellers to him. Register all these invoices in the accounting journal, which must be submitted to the tax office in electronic form. There is no need to pay VAT for the principal. He does it himself.

If you act on behalf of the principal, then you will not have VAT obligations. The principal himself draws up and registers invoices and pays VAT.

You don’t pay VAT on agency fees, since you are on the simplified tax system.

Documents for the buyer

The buyer must complete the same documents as in a regular transaction. For wholesale sales - an invoice, for retail sales - a cash register or sales receipt. When selling services, draw up a deed. If you are selling on your own behalf, please include your details in the documents. If you are acting in a transaction on behalf of the principal, indicate him in the documents.

In the documents, indicate the entire amount of the transaction, without separately highlighting the agency fee. After all, it makes no difference to the buyer whether he communicates with the seller directly or with his agent.

Why does an agency agreement attract the attention of tax authorities?

Let's compare the tax result in 2 cases (when making a transaction without the participation of an agent and with the participation of an agent using the simplified tax system):

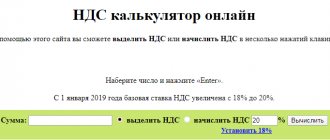

- The buyer purchases the goods at a price of 100 rubles, including VAT 18%, then sells it at a price of 200 rubles. with VAT to a third party. Input VAT: 100 / 1.18 × 0.18 = 15.25. According to paragraph 6 of Art. 52 of the Tax Code of the Russian Federation we discard 25 kopecks. Input VAT - 15 rubles. VAT on output: 200 / 1.18 × 0.18 = 30.50. According to paragraph 6 of Art. 52 of the Tax Code of the Russian Federation is rounded to the nearest ruble. VAT on output - 31 rubles. VAT payable: 31 – 15 = 16 rubles. Income tax: (200 – 100 – 16) × 0.28 = 23.53, rounded - 24 rubles. TOTAL taxes payable: 16 + 24 = 40 rubles.

- The buyer purchases the goods at a price of 100 rubles, including VAT 18%, then sells it at a price of 200 rubles. with VAT, paying the agent a fee of 50 rubles. VAT is the same, but the income tax changes, because expenses include payment for intermediary services (subclause 3, clause 1, article 264 of the Tax Code of the Russian Federation): (200 – 100 – 16 – 50) × 0.28 = 9 .52, rounded - 10 rubles. An agent using the simplified tax system pays 6% on 50 rubles, i.e. 50 × 0.06 = 3 rubles. TOTAL taxes payable: 16 + 10 = 26 rubles, and 3 rubles. at the agent.

Thus, the participation of an intermediary in a transaction leads to significant savings in income tax. The taxpayer’s task is to justify the receipt of tax benefits.

If the principal works with VAT, issue an invoice

If you are selling goods on your own behalf to a principal who works with VAT, you will have to issue invoices for buyers and report to the tax office. At the same time, you do not need to pay VAT itself.

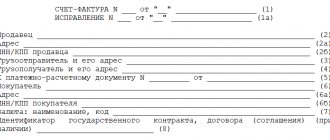

You issue an invoice for the client on your own behalf. In the seller's data you indicate your details, and in the buyer's data - the client's details. You give one copy of the invoice to the client, the second one you keep for yourself and send a copy of it to the principal. The principal will issue the same invoice on the same date, but in his own name, and give it to you. Both invoices must be recorded in the invoice journal. By the 20th day of the month following the quarter in which the invoices were issued, you must submit the tax journal in electronic form.

If you work on behalf of the principal, you won’t have to bother with VAT. You can, by proxy of the principal, issue an invoice on his behalf. Or the principal will do it himself. In this situation, you do not need to report to the tax office and pay VAT.

Acceptance of agent services: report, acceptance certificate

After the contract, the most important agency document is the report (Article 1008 of the Civil Code of the Russian Federation). The agent acts at the expense of the principal, and therefore is obliged to report both actual actions and expenses incurred. The preparation of this document and the possibility of classifying it as a primary accounting document are described in detail in the article at the link: Agent's report under an agency agreement - sample.

The report must disclose the content of the services, indicate natural measurements, prices and costs of services. It is accompanied by primary documents confirming the agent’s expenses. In the absence of specific content of the report, there is a high probability of refusal to recognize the actual nature of the expenses for the agent’s services, and in this case they will not reduce the tax base. As such an example, we can cite the resolution of the AS ZSO dated February 16, 2016 No. F04-28821/15 in case No. A70-2021/2015.

The acceptance certificate for the services provided by the agent, if there is a detailed report, can be drawn up in a simple form.

Agency agreements: how an agent pays taxes on the sale of goods and services of the principal

An agent is an intermediary between the seller and the buyer who helps them complete the transaction. For example, you are a courier and deliver goods from online stores to customers. Or you take a product from a supplier and sell it in your store, receiving a commission for it. In these situations, money received from buyers passes through you and is not your income.

[motivationNew(30 days free of charge', subcaption: 'for new business', href: '/?utm_source=enq227'>)=The service will calculate taxes and prepare reports for individual entrepreneurs, LLCs and employees. You can do it even if you don't know anything about accounting.]

Agent on the simplified tax system: income and expenses

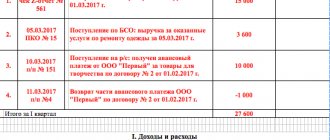

Funds received by the agent for the execution of the contract are not recognized as his income (clause 1.1 of Article 346.15, clause 9 of clause 1 of Article 251 of the Tax Code of the Russian Federation). Only his remuneration will be taken into account in the simplified person’s income. The timing of recognition of this fee will depend on the terms of the agency agreement. If the remuneration is transferred to the agent as part of the amounts for the execution of the contract, then the agent must independently allocate the amount of his remuneration and reflect this income in KUDiR. If the remuneration is paid by the principal separately, then the simplifying agent will reflect it in the income at the time of receipt of the remuneration, and not the amount transferred to him for the execution of the contract.

Documents for the buyer

The buyer must complete the same documents as in a regular transaction. For wholesale sales - an invoice, for retail sales - a cash register or sales receipt. When selling services, draw up a deed. If you are selling on your own behalf, please include your details in the documents. If you are acting in a transaction on behalf of the principal, indicate him in the documents.

In the documents, indicate the entire amount of the transaction, without separately highlighting the agency fee. After all, it makes no difference to the buyer whether he communicates with the seller directly or with his agent.

Principal on the simplified tax system: income and expenses

Amounts transferred by the principal to the agent for the execution of the contract are not taken into account in the principal’s expenses until the services are provided by the agent. After all, the simplified tax system takes into account not just payments, but costs after their actual payment (clause 2 of article 346.17 of the Tax Code of the Russian Federation). The amounts of payments returned by the agent are not taken into account in the principal's income. How the amounts sent to the agent for the execution of the contract will be taken into account in the future will depend on the subject of the contract. If the agent purchased goods for the simplified principal with the object “income minus expenses,” then the latter will take them into account in expenses as they are sold (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation). If fixed assets were purchased, then expenses will be recognized until the end of the current year (clause 3 of Article 346.16 of the Tax Code of the Russian Federation). The situation is different with the agency fee transferred by the principal to the agent as part of the principal amount for the execution of the agency agreement: it will be recognized as the principal’s expenses in accordance with the terms of its accrual under the agreement - as a rule, on the basis of the agent’s report, where this fee will be indicated (clause 24 Clause 1 of Article 346.16 of the Tax Code of the Russian Federation). If the remuneration is paid to the agent later, separately from the main amount transferred for the execution of the agency agreement, then it will also be recognized in the expenses of the simplifier only after payment.

Results

If a simplifier purchases (sells) goods or other property through an agent, he needs to thoroughly think through all the terms of the agency agreement, as well as organize timely and correct reflection in the KUDiR of information related to the execution of the agreement.

Are you an agent or use their services? How are transactions carried out, how are invoices issued and is VAT allocated?

APPLICATIONS AND CALLS ARE ACCEPTED ROUND THE CLOCK AND WITHOUT WEEKENDS.

It's fast and FREE!

Let's consider the features of interaction between an agent on the simplified tax system and a principal on the general taxation system.

No matter how well you understand the legislation regarding your tax regime, you will not be able to insure yourself against the occurrence of questions and difficulties.

Often, ambiguities arise during the execution of an agency agreement. Let's figure out how agents on the simplified tax system and principals on the OSNO should interact (this is a common situation).

Let's consider the most common questions related to intermediary transactions

How can an intermediary (commission agent, agent, attorney) take into account the income received for fulfilling the instructions of the customer (principal, principal, principal)?

It must be taken into account as part of income from the provision (sale) of services (clause 1 of Article 346.15, clause 1 of Article 249 of the Tax Code of the Russian Federation).