- RusTender

- Question answer

- 44-FZ

- VAT in the contract

One of the most pressing issues when concluding a government contract is taking into account VAT in the cost of the contract for the performance of work, supply of goods or provision of services.

According to paragraph 4 of Art.

3 44-FZ, any legal entity or individual can become a participant in public auctions, incl. in the form of an individual entrepreneur. The law also does not establish restrictions on the form of taxation that the supplier uses. Organizations subject to special tax regimes can become participants in government orders, i.e. USNO, UTII, etc. VAT is a value added tax, which is included in the cost of goods, work or services sold and is paid to the state to the federal budget.

The standard tax rate is 20%, but there are also certain types of goods for which a tax rate of 10% and 0% is applied.

"VAT" - what is it?

VAT is a 20% tax (in most cases) on value added. It is levied on organizations operating under the general tax system (OSNO) and creating additional market value. Simply put, this is when organizations add an additional amount to the cost, and then part of this amount is returned to the budget. Organizations offer goods, perform work, provide services at a higher price than their cost.

From 2021, for general cases the rate is 20% (0% for international transport, 10% for the sale of food, newspapers, magazines, medical products, etc., this is stated in Article 164 of the Tax Code of the Russian Federation).

The difference between the cost of production and the price at which it is sold will be considered such a tax.

In our country, VAT has been applied since 01/01/1992. Initially, it was calculated in the manner approved by the law “On Value Added Tax”; since 2001, it has been subject to Chapter 21 of the Tax Code of Russia.

You can calculate VAT on the website https://www.ndscalc.ru/ using the online calculator. VAT calculation is a key accounting criterion for any organization working with OSNO. Beginning businessmen and managers do not understand enough the VAT allocation procedure. However, mistakes are unacceptable here; the fee may be very high. An online calculator will help you allocate and calculate value added tax without delving into mathematical complexities.

Return of goods: difference in accounting

The differences between a return and a buyback are also important for reflecting the transaction in accounting.

Regular return

When returning goods that have been accepted for registration, the buyer will make the following entries:

- Dt 76 (not 62!) Kt 41 - for the cost of return;

- Dt 76 Kt 68 - for the amount of VAT on the adjustment invoice.

The seller must reverse:

- revenue: Dt 62 Kt 90;

- cost: Dt 90 Kt 41;

- VAT: Dt 90 Kt 68.

Buyback

The buyer reflects the sale of goods:

- Dt 62 Kt 90 - for the redemption amount including VAT;

- Dt 90 Kt 41 - for the cost of returned goods;

- Dt 90 Kt 68 - for the amount of VAT.

The seller, accordingly, enters these goods into his account:

- Dt 41 Kt 60 - for the cost of return (redemption);

- Dt 19 Kt 60 - for the amount of VAT;

- Dt 68 Kt 19 - VAT deductible.

State contract with supplier using simplified tax system

The tax is applied in 2 stages:

- Formation of the initial (maximum) contract price (ICP).

- Contract price.

If we turn to Order of the Ministry of Economic Development No. 567 dated October 2, 2013, which defines the methods for forming the NMCC, we will see that the ministry does not give recommendations on the inclusion of VAT in the NMCC. But he reports that the cost must correspond to the conditions of the upcoming purchase. That is, if the subject of the order is included in the list of objects of taxation, the auction organizer must take into account this contribution to the NMCC (operations that are not recognized as an object of taxation are listed in Part 2 of Article 146 of the Tax Code of the Russian Federation).

In fact, when the customer specifies the NMCC, he must already take into account the value added tax.

If the contractor, for example, works using the “simplified tax system” (USN), then in the contract, in the price column, a dash is placed, or the wording “VAT is not subject to” is written.

According to the general rule, organizations and individual entrepreneurs operating under the simplified taxation system are not VAT payers. Therefore, when concluding a contract with a customer, they do not charge him VAT (they do not issue invoices).

In this case, the amount of value added tax, which is taken into account by the customer when determining the NMCC, will be an additional income of the procurement participant. This position is held by:

- The Federal Antimonopoly Service in its letter dated October 6, 2011 No. ATs/39173;

- The Ministry of Finance of the Russian Federation in a letter dated 02.02.2011 No. 03-07-07/02;

- Ministry of Economic Development of the Russian Federation in letters dated September 27, 2010 No. D22-1740, No. D22-1741;

- Federal Tax Service in letter No. SD-4-3/ [email protected] dated November 8, 2016.

The FAS letter dated October 6, 2011 No. ATs/39173 states:

From the text of the letter, we can conclude that organizations or individual entrepreneurs working under the simplified tax system are in a more advantageous position, in contrast to participants in the OSNO.

Let's figure it out in practice:

Let’s say 2 applications have been submitted to participate in the request for quotations. The first was submitted by a participant on the simplified tax system with a price of 110 thousand rubles, and the second by a participant on the OSNO with a price of 120 thousand rubles. including VAT.

The procedure was won by the participant who offered the most favorable conditions for the customer, i.e. participant on the simplified tax system with a contract price of 110 thousand rubles.

The second participant immediately included the VAT amount in his price offer. If it were not for VAT, its price would be 100 thousand rubles. and he would be the winner.

It should be noted that comparison of prices excluding VAT is popular among customers under 223-FZ.

In the Letter of the Ministry of Finance of the Russian Federation dated 02.02.2011 No. 03-07-07/02 we find the following opinion:

In Letters of the Ministry of Economic Development of the Russian Federation dated September 27, 2010 No. D22-1740, No. D22-1741 on this issue the following wording:

Federal Tax Service - letter No. SD-4-3/ [email protected] dated November 8, 2016:

Position of judicial practice:

However, the judges do not share the opinion of the above departments. So, for example, in the Resolution of the Supreme Court of the Russian Federation of August 18, 2014 No. A82-3316/2013, the Resolution of the Federal Antimonopoly Service of the Eastern Military District dated May 15, 2014 in case No. A29-6032/2012, the Resolution of the SZO Court of August 6, 2014 in the case No. A21-9158/2013, Resolution of the FAS SZO dated 02.20.2014 in case No. A21-2287/2013, Resolution of the FAS SZO dated 09.25.2013 in case No. A67-294/2013, the court sided with the customer, who paid the contractor for the obligations in the amount of the contract value minus VAT.

In the Decision of the Arbitration Court of the Krasnodar Territory in Case No. A32-32818/2015, the court also ruled in favor of the customer, who in the draft contract indicated the amount offered by the winner of the electronic auction, including VAT, despite the fact that the winner was on the simplified tax system.

Here is a screenshot of a snippet from this solution:

The same decision was made in the Decision of the Arbitration Court of the Kurgan Region in case No. A34-6052/2015.

It should be noted that there are examples when a decision was made in favor of the executor who is on the simplified tax system. An example of this is the Resolution of the Federal Antimonopoly Service No. F03-3381/2013 of August 13, 2013.

When the seller does not pay VAT

If the organization operates without VAT

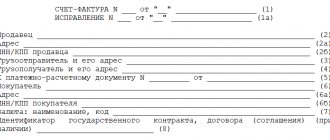

, delivering, for example, goods, then she prepares all the shipping papers without indicating VAT in them. Such documents include an invoice, invoice, invoice and cooperation agreement. In places intended for entering the amounts of this tax, either a dash is placed or “excluding VAT” is written.

There is an opinion that one of the listed documents must indicate the reason for VAT exemption. Note that this is hardly advisable in primary documents, since there are strict filling standards for them. But in the contract you can make a reference to the reason. However, no one will punish the seller if the basis is not reflected.

It is noteworthy that some categories of companies must record “excluding VAT” in strictly defined places. This is an identification mark for the tax office that these companies are exempt either under Art. 145 of the Tax Code of the Russian Federation (in connection with the volume of revenue), or under Art. 145.1, which provides such a right for participants in Skolkovo.

Companies that use special tax regimes in their activities (simplified taxation, imputation, patent or unified agricultural tax) are not required to pay VAT. Nor should they issue a document such as an invoice. This right is given to them by the norms contained in paragraph 3 of Art. 169 of the Tax Code of the Russian Federation. However, they also have the right to issue this document under one condition - they must comply with all the rules of execution contained in paragraph 5 of Art. 168 Tax Code of the Russian Federation.

The specifics of the actions of a buyer who has received documents with the entry “excluding VAT” are as follows:

- He must take into account the received transaction objects at the cost indicated in the documents handed over to him. There is no VAT in this cost, and accordingly, it does not need to be taken into account separately, much less reimbursed.

- When transferring money to a supplier, the payment document must contain the entry “Excluding tax (VAT).”

Government contract with an individual

Guided by the provisions of clause 2, part 13, article 34 of 44-FZ, mandatory conditions are introduced into the text of the contract: on reducing the amount payable by the customer to a legal entity or individual, including one registered as an individual entrepreneur, by the amount of taxes, fees and other obligatory payments in budgets of the budget system of the Russian Federation related to payment for the contract , if, according to the legislation of the Russian Federation on taxes and fees, such taxes, fees and other obligatory payments are subject to payment to the budgets of the budget system of the Russian Federation by the customer.

If a contract is signed with an individual, the text must reflect the condition that the amount payable to the individual be reduced by the amount of tax payments (personal income tax - 13%) associated with the payment of obligations.

Thus, the customer pays the individual an amount reduced by the amount of tax payments. The tax amount is transferred by the customer to the appropriate budget in fulfillment of the duty of a tax agent when paying remuneration to an individual (Article 226 of the Tax Code of the Russian Federation).

We are talking specifically about the amount of payments to an individual, and not about a reduction in the contract price.

Let's summarize the above:

- procurement is carried out on a basis common to all participants, regardless of the tax regime;

- when paying for work, the customer is obliged to be guided by the price offered by the winner and specified in the contract;

- the terms of the contract are not affected by the “special regime” applied by the winning bidder;

- The customer does not have the right to make changes to the contract price without agreement with the contractor.

The judges did not reach a consensus on this issue. Some of them share our point of view and make decisions in favor of suppliers on a “simplified” basis, others take the customer’s side.

When the buyer does not pay VAT

Let's consider the case when the selling company uses VAT, and the buyer works without this tax. It is clear that the documents received by the buyer will indicate the amount of tax included in the final purchase amount. But the invoice itself is allowed not to be drawn up for the buyer if there is a written agreement of the parties. Such permission is contained in sub. 1 clause 3 art. 169 of the Tax Code of the Russian Federation.

However, the seller must still prepare an invoice according to all the rules and enter it into the sales book. If this is not done, the tax authorities consider this as an understatement of the tax base and apply appropriate sanctions.

If the organization operates without VAT

and acts as a buyer, then the tax indicated separately in the documents of the selling company can be taken into account:

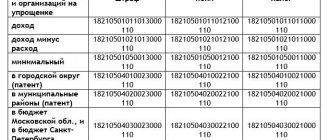

- Fully and at a time when reflecting the cost of received objects in accounting. This method is available to those companies that fall under the provisions of Art. 145 and 145.1 of the Tax Code of the Russian Federation, as well as companies using UTII in their activities. In this case, the features specified in paragraph 7 of Art. 346.26 Tax Code of the Russian Federation.

- In a special order, when accounting for VAT depends on the type of expenses to which this tax is attributed and whether it has been paid. If all conditions are met, the purchasing company has the right to include it in costs and reduce the tax base. This method is available to some organizations that use regimes such as the simplified tax system and unified agricultural tax, which is stipulated by the norms contained in subclause. 8 paragraph 2 art. 346.5 ch. 26.1 Tax Code of the Russian Federation and sub. 8 clause 1 art. 346.16 ch. 26.2 Tax Code of the Russian Federation.

Features when documenting a transaction are as follows:

- Firstly, in the payment documents, where the basis for the payment is given, when transferring funds, the purchasing company must indicate the allocated VAT included in the total payment amount.

- Secondly, the selling company, having received an advance from a non-payer of this tax, has the right to issue an invoice only for itself, if the transaction partner who does not pay VAT does not require such a document.

Similar articles

- Formulas for calculating the cost of goods without VAT

- How to correctly fill out an invoice without VAT?

- The procedure for calculating and paying VAT when switching from the simplified tax system to the OSNO

- Who is the VAT payer and who does not have to pay it?

Recommendations for the procurement participant

- Carefully study the procurement documentation before participating in the procedure for payment. If you do not find the wording “Without VAT”, then take the opportunity to send the customer a request for clarification, ask to clarify this point and add the necessary wording.

Important point! If the purchase is carried out with the customer’s own money, and not from the budget, and this is stated in the documentation, then the customer’s requirement to conclude a contract with VAT is legal. The judiciary is of this opinion.

- If the purchase has already taken place and you have received a draft contract with VAT from the customer, send him a protocol of disagreements with a request to indicate the price “Without VAT”, because you work for the simplified tax system.

- If the contract is signed with VAT, do not send an invoice to the customer.

- In the application, immediately indicate that you are on a “simplified” tax and are not VAT payers. Additionally, you can submit, along with the application, a Notification of the transition to the simplified tax system (form No. 26.2-1) with a mark from the tax office.

- If the customer organized the procedure at his own expense and indicated the price including VAT, then think carefully about the profitability of such work. In most cases, such conditions will be unprofitable for simplifiers.

If the supplier has not paid the tax, the deduction is at risk

The biggest problem taxpayers may face is non-payment of tax by the supplier. When resolving such disputes, the courts indicate: no transfer to the budget - no deduction of VAT (resolutions of the Federal Antimonopoly Service of the Ural District dated 02/05/09 No. Ф09-7440/08-С2 and the North Caucasus District dated 03/09/10 No. А63-13200/2006-С4). The Code gives the buyer the right to reimburse from the budget the tax paid by the supplier. If the supplier has not fulfilled its obligations, the source for the deduction has not been generated. In this case, the only source for VAT reimbursement remains the federal budget. This contradicts the legal nature of VAT as an indirect tax. However, an opposite view of this problem is also found in judicial practice. For example, in the decisions of the Federal Antimonopoly Service of the Northwestern district dated 05.13.04 No. A26-7051/03–214 and the Central district dated 04.27.04 No. A54-4312I03-C4, the judges decided that the buyer should not be responsible for the dishonesty of suppliers. The responsibility here lies with the tax authorities and the suppliers themselves. A bona fide taxpayer cannot be denied tax reimbursement from the budget.

VAT in 223-FZ

223-FZ does not provide clear instructions for determining the NMCC and concluding a contract. Article 4 only states that the notice must contain information about the NMCC and the procedure for its formation (with or without the costs of paying duties, taxes and other obligatory payments). The procurement regulations should regulate the comparison of price offers of potential contractors working with different tax regimes.

Opinions on this issue are again divided:

- The Decision of the St. Petersburg OFAS Russia dated August 12, 2015 on complaint No. T02-405/15, the Decision of the Khabarovsk OFAS Russia dated September 30, 2014 No. 157 states that VAT must be taken into account when evaluating proposals , otherwise the principle of equality is violated and cost-effective spending of the budget.

- In the Resolution of the Federal Antimonopoly Service of the East Siberian District dated May 15, 2015 No. F02-1709/2015 in case No. A33-10428/2014, the Ruling of the Supreme Court of the Russian Federation dated April 11, 2017 in case No. 304-KG16-17592, A27-24989 /2015, on the contrary, it is reported that valuation excluding VAT does not create unequal conditions for participation .

There is no consensus on calculating the cost of a contract concluded with a contractor under a special regime. A reduction in the price of a contract for the VAT rate with the winner is almost always recognized as unlawful, however, in practice, the reduction if the contractor applied the simplified system to the contract was recognized as legal (decision of the Chelyabinsk OFAS dated November 3, 2016 on complaint No. 77-03-18.1/2016).

Due to the fact that departments do not have a clear position on this issue, certain risks arise for the parties. Therefore, the Procurement Regulations are the only tool for resolving disputes; all requirements must be specifically identified in it.

When is an in-depth check needed?

Let's start with checking potential counterparties.

Here the judges noted that the Federal Tax Service often substitutes concepts. Instead of establishing the fact that an organization exercised prudence when choosing a counterparty, tax authorities identify flaws in the efficiency and rationality of business decisions made by the taxpayer. This is exactly how, in the opinion of the high court, the claims of the tax authorities should be qualified that the taxpayer, when concluding a transaction, did not request information about the warehouses, transport, and employees of the counterparty, but limited himself to only checking the information according to the Unified State Register of Legal Entities and verifying the passport data of the manager. Check the counterparty for the accuracy of information in the Unified State Register of Legal Entities and signs of a shell company

Such a substitution, according to the RF Armed Forces, is unacceptable. Indeed, when choosing a counterparty, you need to evaluate not only the terms of the transaction and their commercial attractiveness, but also the business reputation, solvency of the partner, as well as the risk of non-fulfillment of obligations. That is why the buyer can check whether the counterparty has the necessary resources (production capacity, technological equipment, qualified personnel) and relevant experience. However, the depth of such checks, as noted by the Judicial Panel, depends on the specific contract. You cannot apply the same approach when checking a counterparty for a one-time minor transaction (for example, the purchase of inventories) and when choosing a party to a contract in a large or long-term contract. For example, in the case of purchasing an expensive asset or concluding a long-term contract involving regular deliveries or the performance of a significant amount of work.

In practice, this conclusion of the RF Armed Forces means the following: if a small transaction is concluded, it is enough to make sure that the counterparty is registered in the prescribed manner, can be contacted at the address specified in the Unified State Register of Legal Entities, and an authorized person acts on his behalf.

Receive a fresh extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs with the signature of the Federal Tax Service Send an application

In-depth checks, which involve an analysis of the capacity of the counterparty, licenses and permits, the history of its relationships with other counterparties, etc., are required when carrying out significant (large or long-term) transactions. An exception is a situation when the terms of the contract planned for conclusion deviate significantly from the market level, or a counterparty who does not have experience in executing similar transactions offers its services. In these cases, according to the RF Armed Forces, an in-depth check of the counterparty should also be carried out.

Recommendations to the customer on 223-FZ

Based on the previous paragraph of this article, the customer can be given 3 simple tips for evaluating proposals from potential contractors. Compliance with them will help avoid some controversial issues in the future.

- Decide on the approach to evaluating applications from future suppliers, which one is most convenient for you and optimal, taking into account current practice: take into account VAT or not when comparing applications.

- Write down your clear requirements in the procurement regulations and procurement documentation.

- Compare price offers strictly in accordance with the terms of the documentation.

Why is the tax regime of a party to a transaction important?

For a buyer applying the general taxation system (OSNO), it is essential whether the supplier applies the same regime or the simplified taxation system (simplified taxation system).

Under the general regime, each participant in the chain of movement of goods, from raw materials to finished products, as required by law, adds VAT to the price. When calculating the tax to be paid, the seller, a participant in the chain of movement of goods, does not pay the entire 18% of the tax, but only 18% of his markup. The tax he paid to his supplier as part of the price of that product can be deducted from the total tax amount.

What happens if the supplier uses the simplified tax system or another special regime? The buyer is required to charge 18% VAT on the resale of goods, but he cannot receive a deduction. Therefore, I am forced to either increase the markup, losing competitiveness in the market, or incur losses.

So, the main difference for the buyer on OSNO is between 2 suppliers using different modes:

- when purchasing from a supplier who pays the simplified tax system, the buyer does not have the opportunity to claim VAT for deduction;

- When purchasing from a supplier on OSNO, the buyer can save by deducting the paid VAT.

You can learn more about the difference between the 2 modes from the article on our website OSNO or simplified tax system - which is more profitable.

In practice, attempts are being made to overcome the problems of the situation “buyer on OSNO - seller on simplified tax system”. Let's look at what this leads to.

The supplier works with VAT and the buyer without how to make a return

In this case, an invoice is not issued. Accounting certificate 91 62 8 850 The loss of 2021 is reflected in the amount that must be returned to the buyer (15 pcs.) (March 2019) RUB 70,800.

: 120pcs. × 15pcs. = 8,850 rub. Accounting certificate 41 91 7 500 Other income was accrued in the amount of the actual cost of the returned goods (15 pcs.) (March 2019) 60,000 rub. If the goods were released without providing an invoice, that is, by using a cash register system, then the seller is obliged to return the money to the buyer by entering data into the purchase book, namely cash register details. In addition, the seller is obliged to register the receipt of the returned goods.

It is worth considering that even if the goods were returned by a VAT non-payer, the seller does not lose the right to deduct VAT.