Taxes and fees

Marina Dmitrieva

Leading expert - professional accountant

Current as of March 7, 2020

The obligation to create a tax register for personal income tax is provided for in Art. 230 Tax Code of the Russian Federation. Read about why such a register is needed, what its form is and how to fill it out.

How to maintain tax registers for calculating personal income tax: general requirements for development

When developing a personal income tax register, it is necessary to take into account some requirements:

- Tax registers for personal income tax in 2021 must necessarily contain the following information:

- information to enable identification of an individual;

- sign of tax residence;

- types of income and deductions indicating the corresponding code;

- amounts and dates of payment of income;

- dates of tax withholding, its transfer to the budget and details of payment orders.

- The register is maintained throughout the year for each employee.

- The form and sample of the tax accounting register for personal income tax must be determined by the accounting policy.

- If, during a tax audit, tax accounting registers for personal income tax are not provided, the organization may be fined 10,000 rubles. in case the register was not maintained during the calendar year, and for 30,000 rubles if the register was not formalized for several years (Article 120 of the Tax Code of the Russian Federation).

If you have access to ConsultantPlus, check whether you have developed the personal income tax register correctly. If you do not have access to the legal system, get a trial demo access for free.

Mandatory details of the tax accounting register for personal income tax

An enterprise accountant must clearly understand how to maintain tax registers for calculating personal income tax. The main purpose of this list is to formulate the indicators necessary for promptly and accurately filling out a certificate of income for an individual, and therefore the following details and information should be reflected in the personal income tax register form:

- Basic information about the organization - tax agent:

- TIN, checkpoint;

- code of the Federal Tax Service with which the organization is registered;

- name of company.

- TIN;

- FULL NAME.;

- type and details of the identity document;

- Date of Birth;

- citizenship;

- address of residence in the Russian Federation;

- address in the country of residence.

- Taxpayer status (resident or non-resident).

Residents are recognized as individuals who stay in the Russian Federation for at least 183 calendar days over the next 12 consecutive months (Clause 2 of Article 207 of the Tax Code of the Russian Federation). The tax rate that will be applied to his income depends on the status of the person. For example, remuneration under an employment contract of a citizen of the Russian Federation is taxed at a rate of 13%, and the income of a non-resident individual under the same contract must be taxed at a rate of 30%, with the exception, for example, of the income of highly qualified non-resident specialists.

For more information about the correct determination of status, see the material “How to correctly determine the period required to give a citizen the status of a tax resident”.

Basic information

Personal income tax is a tax that ranks next after profit tax and VAT.

Therefore, it is worth understanding all the nuances of taxation. Let's consider who, when and how should calculate the amount of tax and pay it to the budget. Let's turn to the regulatory framework, which contains all the necessary data.

Tax Basics

Personal income tax is a tax on the income of an individual, which is a direct payment made by the population of the Russian Federation.

Payers of this tax are citizens of Russia and other persons who receive profit within Russian territory (foreigners and stateless persons).

Payers can be residents and non-residents. The rate used in income tax calculations will depend on your status.

It is possible to determine whether a person is a resident or non-resident by calculating the number of days of stay in the Russian Federation. If the total number for 12 months exceeds 183, the person is considered a resident (Article 207 of the Tax Code).

Object of taxation:

| Profit from a source located within the state or abroad | For residents |

| Profit from a source located within the Russian Federation | For non-residents (Articles 208, 209, 217 of the Tax Code of the Russian Federation) |

Article 217 also contains a list of types of profit that are not taxed. Personal income tax can be paid by individuals themselves or their tax agents.

An agent is a company, individual entrepreneur, notary, lawyer, or a separate division of a foreign enterprise operating within the Russian Federation from which profit is received.

Calculations of personal income tax are carried out by the tax agent on an accrual basis at the end of each month.

Tax base – receipt of profit in money or in kind, which may be reduced by a tax deduction provided for in Art. 218, 219, 219.1, 220, 221 NK.

Deductions are allowed only in cases where income is subject to personal income tax at a rate of 13%. In other situations, benefits of this type are not provided (Articles 210, 211, 212, 213, 214 of the Tax Code).

Let's list the possible rates (Articles 217, 214 of the Tax Code):

| 9% | When calculating amounts from dividend payments made to residents |

| 13% | The general rate used by residents, as well as foreign highly qualified specialists (regulatory document of Russia dated July 25, 2002 No. 115-FZ) |

| 15% | From dividends received by non-residents |

| 30% | When calculating the amount of tax by non-residents who received profit within the territory of Russia |

| 35% | When receiving a prize, gift, winnings, etc. |

Deadlines for transferring calculated taxes:

| For tax agent | No later than the day when funds are received from banks for payments to the employee; no later than the next day after payment is made to an individual |

| For persons who are not tax agents | On the 15th of July, October and January of the following year after the end of the tax period |

Payment is made to the territorial tax office where the company is registered, or where the payer himself lives (when transferring personal income tax for himself).

Required Documentation

Tax agents and individual individuals must submit a declaration drawn up in Form 3-NDFL.

Citizens must submit this type of reporting in two cases:

- when there is a need to independently calculate and transfer personal income tax amounts to government agencies (when receiving income from the sale of property, winnings, as well as in relation to income from which tax was not withheld by the agent);

- if you wish, receive tax deductions, that is, reimburse part of the tax paid from the budget.

The declaration must be submitted by the end of April next year after the end of the tax period. Forms may be filled out electronically or by hand.

In addition to the declaration, it is necessary to prepare the following certificates:

- 2-NDFL - a form that reflects the income of a specific employee that was received during the tax period. If such a report is not submitted in a timely manner, the person will pay a fine under Art. 126 NK. In case of violation of the filing procedure or distortion of information in the document, the rules described in Art. 15.6 Code of Administrative Offences. The obligation to prepare 2-personal income tax must be fulfilled by the tax agent who transfers the amount of earnings or other funds to the employee.

- If a citizen wishes to receive a child deduction, it is worth submitting a corresponding application (Letter dated September 5, 2012 No. 03-04-05/8-1064).

- Application for refund of overpaid tax (if necessary).

- Tax register is a document that reflects the income of the personal income tax payer, the amount of taxes withheld from him, and the deductions provided.

Normative base

According to Art. 230 clause 1 para. 1 of the Tax Code, tax agents must maintain a tax register to carry out personal income tax calculations.

The income that a citizen who is not a tax agent received when selling property or property rights is also indicated.

The same applies to individual entrepreneurs (Article 226, paragraph 2, Article 227, Article 228 of the Tax Code). The same is stated in the document of the Ministry of Finance dated December 29, 2010 No. 03-04-06/6-321.

If a company does not keep records of an employee’s income using a tax register, a representative of the authorized body will issue a fine of 1 thousand rubles.

In cases where violations have been recorded for several years in a row, the fine may be 30 thousand.

If violations lead to an underestimation of the tax base, the amount of the fine will be calculated as 20% of the underpaid personal income tax, but not less than 40 thousand (Article 120 of the Tax Code of Russia). Officials will be fined 300-500 rubles.

Frequency of preparation of the tax accounting register for personal income tax

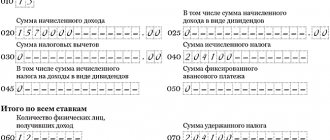

A special place in the form of the tax accounting register for personal income tax is occupied by data on income on which tax is calculated. They are formed in the document by types and deductions with the assignment of the corresponding code.

When assigning a code, you must refer to the order of the Federal Tax Service of Russia “On approval of codes for types of income and deductions” dated September 10, 2015 No. ММВ-7-11 / [email protected] , where each type of income is assigned a corresponding code. For example, when indicating a salary, code 2,000 is used, and if a deduction is provided for the first child under 18 years of age, code 126 is indicated.

A separate register is maintained for each employee. It indicates all payments made, even if the tax percentage rate differs (from 13 to 35%). But they are all reflected separately, for example in different sections of the document. A similar system is used in 2-NDFL certificates, in which each rate has its own section.

The frequency of the personal income tax register is established by the taxpayer. As a rule, a personal income tax register for an employee is opened every year so that income to which a 13% rate is applied, as well as tax deductions, are reflected in it both monthly and on an accrual basis from the beginning of the year. Income to which other rates apply is sufficient to indicate only monthly.

Income that is not subject to personal income tax may not be included (for example, maternity benefits).

Income, the amount of which is limited when calculating personal income tax, must be indicated in the register to monitor compliance with such a limit. One of such income is material assistance, which will not be subject to personal income tax until its amount reaches RUB 4,000.00. per year (clause 28 of article 217 of the Tax Code of the Russian Federation).

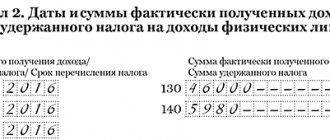

What day is considered the date of payment of income and what is the deadline for paying personal income tax?

The last day of the month for which the salary was accrued is recognized as the actual date of its receipt (Article 223 of the Tax Code of the Russian Federation). If the employment relationship is completed on a day that is not the last in a given month, then the date of receipt of salary will be the last day of going to work.

When reflecting vacation pay amounts, you must follow the instructions of the letter of the Ministry of Finance of the Russian Federation dated 06.06.2012 No. 03-04-08/08-139: the date of receipt will be the day of payment. It is advisable to use this approach when indicating the date of payment of benefits for sick leave. Transfer personal income tax to the budget from vacation and sick leave benefits in accordance with clause 6 of Art. 226 of the Tax Code of the Russian Federation should be no later than the last day of the month in which these payments were made.

On the issue of determining the date of income in the form of vacation pay, see the material.

Labor legislation obliges employees to pay wages at least every half month (Article 136 of the Labor Code of the Russian Federation). But, despite the advance received, the employee does not generate income, and the obligation to the budget is formed on the last day of the month, so the date of transfer of the advance does not need to be reflected.

See here for details.

In paragraph 6 of Art. 226 of the Tax Code of the Russian Federation states that the organization is obliged to transfer the withheld personal income tax no later than the next day after the date of repayment of the debt to employees.

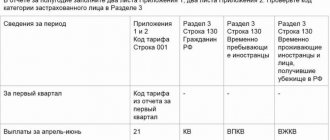

According to the new regulations of the Federal Tax Service, bonuses should be divided into labor and one-time bonuses. The date of receipt of income will be different for each, therefore, the deadline for transferring personal income tax is set separately.

Read about the nuances here.

Possible errors in interpayment documents using the example of 1C 8.2 ZUP 2.5

As for the 1C ZUP 2.5 program, in the current release the date of the document, for example, “Vacation”, does not in any way affect the calculation of withheld personal income tax. For example, let’s take a vacation accrual with a planned payment date of 01/28/2016 and change the document date to 01/30/2016. After that, we will repost the Salary Payment Sheet. Let's see the movement according to the Registers.

The program 1C ZUP 2.5 personal income tax withheld saw and registered it. Therefore, document dates are not so important here.

But such a mechanism, when the program tries to withhold everything accrued as of the end of the month, which is used in the 1C 8.2 ZUP 2.5 program, has its drawbacks and leads to other problems, which we will consider in the next question, when we talk about personal income tax withheld.

Give your rating to this article: (

3 ratings, average: 4.67 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Personal income tax register form: where is 2020, sample and example of how to fill it out

Taking into account the requirements described in this article, it is recommended to create your own sample of filling out the tax accounting register for personal income tax. It should reflect all the information necessary for the correct calculation of personal income tax for a specific employee.

We recommend the personal income tax register for 2021 at the following link.

This document is taken as a basis and then used not only for the 2-NDFL certificate, but also for calculating 6-NDFL.

In addition to the form itself, taxpayers can register the personal income tax tax register for 2021 on our website. It was created for the calculation of 6-NDFL and gives an idea of the rules for filling out the document. You can download it from this link.

ConsultantPlus experts explained how a tax agent should reflect a professional deduction in the personal income tax register. Get trial access to the system and upgrade to the Ready Solution for free.

Frequently asked questions

If the legislation contains a lot of information about the declaration and other documentation, then many questions arise when creating a tax accounting register.

For example, it is not clear whether to submit such a report or not, whether to print it or leave it on electronic media, and who should sign such forms. Let's look into these nuances.

Do I need to print the document?

There are no rules in the legislation regarding the storage of a tax accounting register. This means that such documentation can be saved according to the general rules with the rest of the financial statements.

But, nevertheless, it is recommended to print out such forms and staple them into a book. This is necessary for the convenience of conducting your own checks and reconciliation with accounting.

Find out whether personal income tax is collected from a foreign citizen on a work patent in 2021 from the article: personal income tax from foreigners.

Is personal income tax taken from sick leave in 2021?

What are the transactions when calculating personal income tax?

Although the register is an internal document of the organization, tax accounting is conducted on its basis. The forms will not need to be taken anywhere - they must remain at the enterprise.

But representatives of authorized structures can request registers when conducting desk audits.

Who signs the tax register?

The certificate must be signed by the head of the company or another official who has such right in accordance with internal documentation (director’s orders, etc.).

Registers can sign:

- chief accountants;

- deputy chief accountants;

- accountants who are responsible for conducting payroll calculations.

When creating tax accounting registers, tax agents should be guided by general recommendations.

But employers retain the right to draw up their own form and enter data in accordance with their own designs.

The main thing is that you must have a document so that you can present it if necessary.

Previous article: Personal income tax upon dismissal Next article: Fine for non-payment of personal income tax

Results

Thus, the main tasks in developing a tax register for personal income tax in 2021 are to fully reflect reliable information and group indicators to obtain analytical data. A sample personal income tax register developed by our specialists for 2020 can serve as a guide for the enterprise.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.