Subtleties of reflecting individual payments in the DAM

— Natalya Vladimirovna, explain how to act in such a situation. On June 1, 2018, the organization entered into a GPA with an individual for the provision of services. The contract is valid until July 31, 2018.

The services were provided on July 27, 2018, on the same day a certificate of completion was signed and the amount of remuneration was accrued in accounting. And it was paid to the individual on August 1.

How to indicate this individual in lines 010 “Number of insured persons” and 020 “Number of individuals from whose payments insurance premiums were calculated” of subsections 1.1 (contributions for compulsory medical insurance) and 1.2 (contributions for compulsory medical insurance) of the calculation of contributions - only in July (in the month when the remuneration was accrued), only in August (when the remuneration was paid) or in all months when the contract was in force - in June and July?

— According to the Procedure for filling out the calculation of insurance premiums, payers in the corresponding lines and columns of the calculation reflect the amounts of payments and other remunerations specified in paragraphs. 1 and 2 tbsp. 420 Tax Code of the Russian Federation.

Remuneration under a civil contract is included in the base for calculating contributions to compulsory health insurance and compulsory medical insurance for the calendar month in which it is accrued. In this case it is July.

Thus, in subsections 1.1 (contributions to compulsory medical insurance) and 1.2 (contributions to compulsory medical insurance) of Appendix No. 1 to section 1 of the calculation, the individual with whom the GPA is concluded must be reflected in lines 010 and 020 in July. That is, you need to fill out column 3 (1 month out of 3 months of the reporting period).

In addition, the same individual must be indicated in lines 010 and 020 in column 2 “Total” (for the reporting quarter) and in column 1 “Total from the beginning of the billing period.”

— The accounting program transfers individuals with whom the GPA is concluded to Appendix No. 2 (contributions to VNiM) of the calculation as follows: it does not include them in line 010 “Number of insured persons.” And the remuneration to these persons is entered into lines 020 “Amount of payments and other remuneration calculated in favor of individuals” and 030 “Amount not subject to insurance contributions.”

Is that right? After all, on the basis of sub. 2 p. 3 art. 422 of the Tax Code of the Russian Federation, contributions to VNiM are not accrued for these payments.

- No, your program fills out the calculation incorrectly. The Federal Tax Service issued an official Letter on this topic in July. She explained that Appendix No. 2 to Section 1 calculates the amounts of contributions to VNiM based on the amounts of payments in favor of individuals who are insured persons in the compulsory social insurance system.

And persons with whom the GPA is concluded are not insured in case of temporary disability and in connection with maternity. And there are no premiums for this type of insurance.

Consequently, for individuals receiving remunerations under the GPA, the indicators in lines 010–070 of Appendix No. 2 to Section 1 of the calculation are not filled in. That is, neither the individuals themselves among the insured persons, nor the payments to them need to be reflected in Appendix No. 2 of the calculation.

In addition, the Federal Tax Service noted that section 3, where personalized information is indicated, must be filled out for individuals with whom the GPA is concluded. In this case, in subsection 3.1 on line 180, you must indicate the sign “2” - not insured in the compulsory social insurance system.

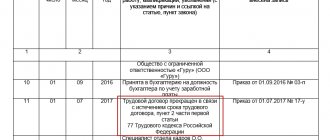

— In 2021, the individual entrepreneur had employees and he submitted contributions for them. In December 2021, employment contracts with all employees were terminated. The last time the individual entrepreneur submitted his calculations for 2017 to the inspectorate was January 25, 2021.

Now the Federal Tax Service has received a request to submit a calculation of contributions for the first quarter and half of 2021.

But the individual entrepreneur does not have to submit this calculation. What should I do?

— If the individual entrepreneur fired all employees at the end of 2021 (terminated all civil contracts) and did not enter into new employment or civil contracts in 2021, then he is not required to submit calculations for insurance premiums in the new year.

The obligation to submit calculations for insurance premiums arises only for payers making payments in favor of individuals.

When receiving a request from the tax authority to submit a calculation, the entrepreneur must send an explanation to the Federal Tax Service indicating that all contracts have been terminated and payments to individuals are not being made.

— An employee of the organization resigned on June 30, and on August 1 he was hired again, but to a different position and with a different salary.

How to calculate the base for insurance premiums for this employee - taking into account payments accrued before his dismissal, or only payments made starting from August 1? Are previous accrued payments reset?

— Payers of insurance premiums determine the base for calculating contributions separately in relation to each individual from the beginning of the billing period at the end of each calendar month on an accrual basis. At the same time, the contribution base includes all payments accrued to the employee within the framework of the employment relationship from the beginning to the end of the billing period - the calendar year.

If an employee quit and was then rehired by the same organization during the year, then the base for calculating contributions for such an employee must include all payments that were accrued to him during the calendar year for the period of work in the organization as a whole.

Thus, since the employee did not change his employer during the year, payments accrued before his dismissal are not reset to zero, but are taken into account when calculating the base for insurance premiums.

— The organization combines the use of simplification and payment of UTII. She has the right to reduced rates for the activities of the fitness center (STS). A small bar was opened in the center premises, and this activity was transferred to UTII (catering activities). The share of income from the fitness center in total income (income from the fitness center and bar) is 80%.

Is it possible to calculate contributions at reduced rates from payments to all employees of the organization - both those employed in activities on the simplified tax system, and those employed in “imputed” activities?

— Reduced insurance premium rates can be applied by organizations on the simplified tax system whose main activity is, in particular, the activity of fitness centers. In this case, the type of activity is recognized as the main one if two conditions are met:

- income for the tax period does not exceed 79 million rubles;

- share of income in connection with the conduct of the type of activity named in subparagraph. 5 p. 1 art. 427 of the Tax Code of the Russian Federation, based on the results of the settlement (reporting) period, amounts to at least 70% of total income.

Moreover, the organization must include income from all types of activities in its total income, that is, income received from the activities of both the fitness center and the bar.

It turns out that reduced insurance premium rates are applied by the organization if the established criteria are met and the simplified taxation system is applied for the main type of economic activity - the fitness center.

Thus, an organization, combining the simplified tax system and UTII and observing the above conditions, has the right to apply reduced contribution rates in relation to payments to all employees, including those employed in activities transferred to the payment of UTII.

Work agreement. Example:

Since we start from the amount of remuneration that the contractor should actually receive, we will calculate the amount of remuneration for the contract (including personal income tax of 13%) as follows: 8,400 rubles. = 87%, Reward amount. according to the agreement = 100%.

Next, we calculate insurance premiums:

- The total amount of expenses that our future manager initially wanted to know =

Expert opinion

Ilyin Georgy Severinovich

Practicing lawyer with 6 years of experience. Specialization: criminal law. Law teacher.

We looked at a very simple example - without tax deductions, exceeding the limit on insurance premiums, without taking into account the duration of work and other conditions.

The goal was to give a rough idea to the future employer (customer) that in addition to paying remuneration, he will have to take care of taxes and insurance premiums and how to calculate them.

Please note:

- When calculating, you must apply the current rates of taxes and insurance premiums;

- In the contract, remuneration is indicated taking into account personal income tax;

- Insurance premiums are paid in rubles and kopecks.

That's all. Happiness to you and reasons for happiness! =)

Should an enterprise or individual entrepreneur pay taxes and fees for those with whom a civil law agreement has been concluded? What reports are submitted by enterprises using household labor? treaties? What should you pay attention to when filling them out? All these questions sooner or later arise for those who want to hire the right specialist without concluding an employment contract.

-0400400017: The condition of equality of the value of the amount of payments and other remunerations accrued is violated...

This is the letter I wrote to the circuit after the report was submitted. Maybe this will help you: Good afternoon, technical support! For several days you and I have been trying to figure out why RSV-1 is not being accepted by me. They couldn't help me in any way. I think that I am not the only one with this problem. The notification comes with an error: - 0000000002: The declaration (calculation) contains errors and is not accepted for processing - NO_RASCHSV_3339_3339_331101969601_20180131_F7B0E384-49FA-40B3-AB65-2FB9812C60E4: - 0400400018 : The condition of equality of the value of the base for calculating insurance premiums for the payer of insurance premiums to the total amount for the insured is violated persons - 0400400018: Pr.1.1 line 001 (adjusted tariff) = 1 Amount for group 3 (line 050 - line 051) pr.1.1 = 83962.61 Amount line 220 (1 month op) = 109357.50 difference = - 25394.89 - 0400400018: Ex.1.1 line 001 (adjusted tariff) = 1 Amount for group 4 (line 050 - line 051) ex.1.1 = 80599.45 Amount line 220 (2nd month op) = 97599.45 difference = - 17000.00 - 0400400018: Ex.1.1 line 001 (adjusted tariff) = 1 Amount for group 5 (line 050 - line 051) ex.1.1 = 83891.30 Amount line 220 (3rd month op) = 108282.60 difference = - 24391.30 - 0400400018: Ex.1.1 line 001 (adjusted tariff) = 1 Amount for group 2 (line 050 - line 051) ex.1.1 = 248453.36 Amount line 220 (1,2,3 month op) = 315239.55 difference = -66786.19 So, I’m writing to you, maybe this will also help someone. I began to calculate the logic of the program that accepts reports from the tax office and realized that all employees throughout the year should be under their serial numbers, and in the next adjustments these numbers should always match. I entered all the employee numbers as they were submitted in the 1st quarter, made 1 adjustment in each employee’s card and immediately went through the report. I did the same in all quarters, that is, I adjusted all serial numbers during the year, and all reports were accepted. I am writing this to you because your specialists, working with me, did not pay attention to this and also could not understand what was wrong in the report. That’s why I ask you to bring to their attention that this happens, so that they would pay attention to it. Maybe it will help someone else submit this unfortunate report.

Calculation of insurance premiums. There are no payments for GPC.

- In subsection 3.1 section. 3, the personal data of the individual who is the recipient of the income is indicated: Full name, Taxpayer Identification Number, SNILS, etc. (clauses 22.8 - 22.19 of the Procedure for filling out the calculation of insurance premiums)…

In subsection 3.2 section. 3 indicates information about the amounts of payments calculated in favor of an individual, as well as information about accrued insurance premiums for compulsory health insurance (clauses 22.20 - 22.36 of the Procedure for filling out calculations for insurance premiums).

For persons who did not receive payments for the last three months of the reporting (calculation) period, subsection 3.2 section. 3 does not need to be filled out (clause 22.2 of the Procedure for filling out the calculation of insurance premiums). Ready-made solution: How to fill out and submit the form for calculating insurance premiums to the tax authority (ConsultantPlus, 2018) {ConsultantPlus}

- Question: How to fill out the calculation of insurance premiums if the dates of concluding a contract and payment of remuneration fall on different reporting periods?

Answer: When calculating insurance premiums for reporting periods in which no payments were made, section should be completed. 3 regarding general information and subsection 3.1. Subsection 3.2 section. 3 must be completed based on the results of the reporting period in which payments under the agreement will be made. An individual must also be included in the number of insured persons (subsections 1.1, 1.2 of Appendix 1 to Section 1 of the calculation of insurance premiums)... {Question: How to fill out the calculation of insurance premiums if the dates of concluding a contract and payment of remuneration fall on different reporting periods ? (Expert Consultation, 2018) {ConsultantPlus}}

- ... According to clause 22.2 of the Procedure in personalized information about insured persons, which does not contain data on the amount of payments and other remunerations accrued in favor of an individual for the last three months of the reporting (settlement) period, subsection 3.2 section. 3 is not filled in.

For example, if in January an organization entered into a contract with an individual, and the payment of remuneration will be made in July, then for the reporting periods - the first quarter and half of the year for persons with whom contract contracts were concluded in January 2021, subsection 3.2 section. 3, the policyholder does not need to fill out, and for the reporting period - 9 months, in which the remuneration will be paid, this subsection must be filled out... {Question: How to fill out the calculation of insurance premiums if the dates of concluding a contract and payment of remuneration fall on different reporting periods? (Expert Consultation, 2018) {ConsultantPlus}}

- ... As is known, insured persons under compulsory health insurance are persons working under an employment contract or under a civil contract, the subject of which is the performance of work and the provision of services <3>. Accordingly, after an employee quits, he is no longer an insured person for the employer. So, the Ministry of Finance clarified in the fall that if in the current reporting period no payments were accrued to employees dismissed in previous reporting periods, then for such employees subsection 3.2 of section 3 of the calculation of contributions is not filled out <4>.

But then the question arises: does subsection 3.1 (where the personal data of an individual is recorded) for all reporting periods following the period of dismissal (until the end of the calendar year) need to be filled out even in the absence of payments in favor of the former employee? But what sign then should be indicated on lines 160, 170, 180: “1”, meaning that the former employee is still an insured person for all types of insurance? Or “2”, since in fact, due to the lack of labor relations, he is not one <5>?

In addition, in October, the Federal Tax Service issued a Letter that literally says the following: “... in cases of failure to include in the calculation of insurance premiums for the reporting (calculation) period, employees who resigned in the previous reporting period and who did not receive payments in the reporting (calculation) period must be submitted in tax authority at the place of registration, an updated calculation of insurance premiums for the reporting (settlement) period, indicating in section 3 the calculations of all insured persons in whose favor payments and other remunerations were accrued in the reporting (settlement) period, including those dismissed in the previous reporting period" <6>.

To clarify the situation, we turned to a specialist from the Federal Tax Service with a question: is it necessary to fill out section 3 for former employees who were not accrued payments after dismissal? For example, if an employee quit in March 2021, is it necessary to fill out section 3 for him and submit it as part of the calculation of contributions for half a year, for 9 months, for 2021?

Reflection of former employees in section 3 of the calculation of insurance premiums

Elena Viktorovna Savostina, 3rd class adviser to the State Civil Service of the Russian Federation

— If the employee quit in March 2021, then section 3 must be filled out for him and submitted as part of the calculation of insurance premiums for the first quarter of 2021. It must reflect all payments accrued to the employee in January, February and March.

If, after dismissal, the employee received payments in April, then Section 3 must be filled out for him and presented as part of the calculation of contributions for the first half of 2021. And all payments accrued to the employee in April should be reflected in it. If the payer of contributions has not done this, he must submit an updated calculation of contributions for the reporting (calculation) period in which payments were made. This is exactly what is said in the Letter of the Federal Tax Service of Russia dated October 4, 2017 N GD-4-11/ [email protected]

If, after dismissal, no payments were accrued to the employee until the end of the year, then Section 3 does not need to be filled out for him for subsequent reporting periods. In relation to the conditions of the example under consideration, for an employee who quit in March, it is not necessary to fill out Section 3 and submit it as part of the calculation for half a year, for 9 months, for 2017. This is confirmed by the Control ratios for checking the calculation of contributions. After all, the number of insured workers under compulsory health insurance for the reporting quarter, reflected in column 2 of subsection 1.1 of Appendix No. 1 to section 1 of the calculation, must be equal to the number of workers for whom sections 3 are presented and for whom attribute “1” is indicated in subsection 3.1 on line 160 ( insured in the OPS system) <7>...

———————————

<3> Clause 1 of Art. 7 of the Law of December 15, 2001 N 167-FZ.

<4> Letters of the Ministry of Finance of Russia dated October 20, 2017 N 03-15-05/68646, dated September 21, 2017 N 03-15-06/61030.

<5> Clause 1 part 1 art. 2 of the Law of December 29, 2006 N 255-FZ; clause 1 art. 7 of the Law of December 15, 2001 N 167-FZ; clause 1 art. 10 of the Law of November 29, 2010 N 326-FZ.

<6> Letter of the Federal Tax Service of Russia dated 10/04/2017 N GD-4-11/ [email protected]

<7> Letter of the Federal Tax Service of Russia dated June 30, 2017 N BS-4-11/ [email protected] (clause 1.308). {Article: To be or not to be fired in section 3 of the calculation of contributions? (Sharonova E.A.) (“General Ledger”, 2021, N 24) {ConsultantPlus}}

>Calculation of contributions for the GPA: how to fill out

Features of a civil contract

A civil contract (CLA) is concluded for the duration of the execution of the agreed amount of work or provision of services. Its parties are the customer and the performer.

Legal relations that arise within the framework of such an agreement are regulated by the provisions on the work contract and on the provision of paid services, in accordance with Chapter. 37, 38, 39 Civil Code of the Russian Federation.

By concluding such an agreement, the contractor undertakes to perform a certain amount of work or provide services according to the customer’s instructions using his own materials and his own funds. However, cases are allowed when the customer supplies the contractor with his own materials and provides him with his equipment.

In this case, they talk about a contract with the customer's dependency. Upon completion of the work or full provision of services, the parties to the contract draw up an act on the completion of work or provision of services, in accordance with which the contractor is paid a remuneration.

Household contract workers do not obey the work schedule in force in the company and the orders of its management.

They are not included in the staff and do not bear disciplinary liability and cannot be sent on business trips. But, boss.

Contractors bear full financial responsibility in accordance with the concluded agreement, while the liability of an ordinary employee is limited by the norms of the Labor Code of the Russian Federation.

How to fill out a report on insurance premiums in 2021

IMPORTANT! Labor relations with an employee are regulated by the Labor Code of the Russian Federation, and civil relations with an individual are regulated by civil law.

To avoid possible problems, the following features must be observed in the terms of the contract: 4.

Unlike an employment agreement, such an agreement, regardless of its subject, status of the parties and special conditions, always has a finite period of validity and is of a one-time nature.

One of the most important advantages of formalizing relations with an individual in a civil law manner is the possibility of reducing the amount of accrued insurance premiums, and sometimes the complete absence of the need to accrue them.

To understand which payments are subject to contributions and which are not, it is necessary to clearly define the subject of the agreement and its compliance with one of the categories listed in Art.

Procedure for filling out calculations for insurance premiums (2019)

In 2021, the list of those who must form and submit calculations for fear.

insurance Lines (from 051 to 054) that relate to payments have been completely removed:

- For foreigners;

- Citizens on the patent system;

- Employees of pharmacies and pharmaceutical companies;

- Ship crews.

Also, the following columns will be added to this application:

Online magazine for accountants

Today, regional branches of the Pension Fund insist on the following. Freelance workers are included in the SZV-M report, even if in the reporting month:

- Accordingly, insurance premiums were not charged on him.

- they were not paid any remuneration under a civil law contract;

That is, in order to understand whether or not to include a specific insured person in SZV-M, you must proceed from the following: Thus, even when in the reporting month you did not pay remuneration under a civil law agreement and did not accrue contributions to it, in the form SZV-M of such a person still needs to be included.

- the performers were paid remuneration;

- contributions are calculated on the amount of remuneration.

Zero calculation for insurance contributions to the tax office

Note! If the company ignores the requirements of stat. 431 of the Tax Code, namely clause 7, and will not report on the ERSVR; she faces sanctions under the provisions of clause.

Subsection 1.1 to Appendix 1 section. 1 – on this sheet the calculation of SV for OPS is performed.

Subsection 1.2 to Appendix 1 section.

1 – on this page the calculation of SV for compulsory health insurance is carried out.

Appendix 2 section. 1 – this application is used to display calculated data on SV on the OSS. Sec.

The calculation of insurance premiums (hereinafter referred to as the calculation) for the first half of 2018 must be submitted to the Federal Tax Service no later than July 31. In this regard, we will clarify an important question: how to fill out the payment form if a civil law agreement has been concluded with an employee?

A person working on a GPA basis is insured only in the health and pension insurance systems.

To automatically generate the correct report, in the BukhSoft: Salaries and Personnel program you need to indicate that the employee works according to the GAP.

Calculation of insurance premiums 2021: example of filling out

Current as of: January 22, 2021

You can find the current form for calculating insurance premiums for 2021 on the website of the ConsultantPlus reference and legal system. You can start making calculations from the title page.

On it, in the “Calculation (reporting) period (code)” field, you will need to indicate “34”, which corresponds to the billing period - the calendar year, and in the adjacent field the year itself - 2021 (clause 3.6, 3.

7 Procedure for filling out the calculation, Appendix No. 3 to the Procedure for filling out the calculation).

On our website you can see a sample of filling out the calculation of insurance premiums, by analogy with which you can fill out the calculation submitted in 2021. As stated above, until a new form of Calculation of insurance premiums is approved or changes are made to it, for the 1st quarter of 2019 and subsequent periods

Zero report on insurance premiums in 2021 (procedure and sample of completion)

The obligation to submit calculations for insurance premiums is assigned to:

- Organizations (including foreign companies operating in Russia), as well as separate divisions of organizations;

- Entrepreneurs who make payments to individuals.

In this case, the calculation is presented regardless of the status of the insured persons to whom the above-mentioned persons pay remuneration, that is:

- Employees with whom employment contracts have been concluded;

- General Director (sole founder);

- An individual with whom a civil contract has been concluded, for example, a contract, a contract for the provision of services.

Calculation example

Payment will be made based on the results of the provision of services. There are no advance payments. There are no contributions for injuries under the terms of the agreement.

The institution pays insurance coverage at generally established rates.

Let's calculate what fees and taxes for civil partnership with an individual the organization will have to pay:

Contributions such as VNiM, NS and PZ are not charged.

The article is devoted to taxes and contributions under the GPC agreement in 2021. It describes in detail what exactly needs to be paid, in what volume, and who exactly should do it.

If you need a specific specialist to do a certain job for you, you can hire him. And for this it is not always necessary to conclude an employment contract. In some cases, a civil law agreement will be optimal. It is also called a GPC agreement.

This agreement differs from an employment agreement in that the parties to it are not the employer and the employee. It is regulated by the Civil Code of the Russian Federation (Article 420), and not by the Labor Code of the Russian Federation. The essence of the contract comes down to the performance by one person of a second volume of work or the provision of specific services for a monetary reward.

In this regard, the question arises: are taxes paid under a civil partnership agreement? Yes, there are no exceptions in this regard in the legislation. Therefore, the relevant issues need to be dealt with.

Is it necessary to include workers under the civil law in the calculation of insurance premiums?

– Constitutional law – Should employees be included in the calculation of insurance premiums under the civil law?

You can distinguish many cases. What are the rules for setting insurance premiums? We will try to answer this question in the article. Who to show in SZV-M Today, regional branches of the Pension Fund of Russia insist on the following. Freelance workers are included in the SZV-M report, even if in the reporting month:

- they were not paid any remuneration under a civil law contract;

- Accordingly, insurance premiums were not charged on him.

That is, in order to understand whether or not to include a specific insured person in the SZV-M, it is necessary to proceed from the following: Principles for setting employee insurance premiums There is no doubt about the contributions paid from the employment contract - each employee must have a mandatory retirement, disability, illness, accident and health insurance from the date of commencement of work.

Filling out calculations for insurance premiums if a GPC agreement has been concluded with an employee

GPC (lines 010, 020, 030). They are listed in Appendix 2 of the ZKBU. And on the VLSI website, in the instructions for filling it out, it is highlighted that contractual agreements are not included in Appendix 2. So should they get there or not? Answer: According to the procedure for filling out the DAM (approved by the Order of the Federal Tax Service of Russia dated 10.10.

2016 N ММВ-7-11/): “on line 030 of Appendix No. 2, the corresponding columns reflect the amounts of payments and other remunerations that are not subject to insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity in accordance with Article 422 Code, ..." Amounts under GPC agreements are not included in the base for calculating insurance premiums in terms of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity in accordance with paragraphs. 2 p. 3 art. 422 of the Tax Code of the Russian Federation.

GPD in calculation of insurance premiums

Attention Payments will automatically go to Appendix 2 in lines 010, 020, 030. In section 3 you need to indicate the attribute of the insured person (1 – insured, 2 – not). In subsection 3.1 for employees working under the GPA, we put 1 in lines 160 and 170, and 2 in line 180.

Both civil law and employment contracts can be concluded with the same employee. Then in the “type of contract” field you select labor, and it is not necessary to add GPA. This employee will be included in line 010. In 020 all accruals for him will be displayed, and in 030 only non-taxable payments. In subsection 3.

1 for such employees in lines 160, 170, 180 we put 1. In this case, there is no need to take into account the fact that the person also performs work according to the GPA.

Insurance premiums for civil liability in 2017-2018

Important Moreover, on a new form, which was approved by order of the Russian Tax Service dated October 10, 2021 No. ММВ-7-11/551. When filling out a new report, you must use the same approach as discussed above.

That is, individuals included in SZV-M, with whom civil contracts have been concluded, but for which there have not yet been payments (for example, upon completion of work), must be correlated with Section 3 of the new calculation of insurance premiums (see below).

Individuals included in SZV-M, with whom civil contracts have been concluded, but for which there have been no payments, must be correlated with Section 3 of the new calculation of insurance premiums.

How to fill out a report on insurance premiums in 2021

Good news In the Bukhsoft Online service, until August 1, 2021, we have opened access to the formation of the DAM absolutely free of charge! We wish you pleasant work and successful reporting! For 2016, the Pension Fund continues to accept and verify final reports on insurance premiums.

At the same time, its employees may draw attention to some inconsistencies in the reports of SZV-M and RSV-1. Let's talk about the most likely situation that many companies and individual entrepreneurs with staff have already encountered.

This results in financial consequences to the payer in the form of abandonment of such person with outstanding dues along with payment of late payment interest. Mrs. Wanda is 53 years old and works under an employment contract. The employer calculates the employee's income as follows.

Social insurance contributions from total income in the amount of. Basis for calculating the health premium. After all, section 3 of the calculation is filled out for all insured persons for the last three months of the billing (reporting) period

What taxes and fees do you need to pay?

So, you have figured out that in this case you cannot get rid of taxes. Now you need to understand what exactly to pay. That is, you need to understand what taxes the GPC is subject to in 2021. We are talking about the following:

- Personal income tax (personal income tax) – 13% of income if we are talking about an individual. An individual also has the right to use standard tax deductions, but they will only apply to the period during which such an agreement was in effect;

- insurance premiums - only contributions to the Compulsory Medical Insurance Fund and the Pension Fund will be mandatory. Everything else is determined by the text of the contract. Insurance premiums are as follows:

- to the Pension Fund or the Pension Fund – 22%;

- in the Compulsory Medical Insurance Fund – health insurance, the rate will be 5.1%.

Please note that if the customer has the right to apply reduced rates, then he has the right to use it in the described case. That is, this right also applies to payments under GPC.

Also, when deciding what taxes and contributions to pay under the GPC agreement, you need to take into account the Social Insurance Fund or social insurance. And this has its moments.

Thus, contributions are not made for disability or maternity benefits. But there may well be premiums for insurance against injury or occupational disease if they are provided for in the text of the agreement.

Calculation of insurance premiums for GPD

There are rules regarding the amount of the deduction - there is a limit to the accrued amount of remuneration, and if expenses are within its boundaries, they are not required to be confirmed with documents:

- for writing music for theater and films, creating design and decorative graphics, as well as sculptures - 40%;

- for the creation of industrial designs, inventions - 30% of the contractor’s revenue for the first two years of using the results of his work;

- for the creation of photographs, artistic, audiovisual, architectural works - 25%;

- for scientific developments, writing literary works - 20%.

What contracts do not apply to the calculation of contributions There are also contracts of a civil law nature for which insurance premiums are not charged.

Insurance premiums under GPC contracts in 2021.

Sample of filling out a GPC agreement in 2021 Sample of writing an acceptance certificate of work under a GPC agreement in 2021 Based on the specified documents, as well as in the absence of mutual claims between the customer and the contractor, payment is made for the work performed.

Those performers who have the right to a deduction must write an application and submit documents confirming this right (for example, a business trip).

Important If the GPC agreement stipulates the possibility of paying for work in advance, then insurance premiums will be withheld at an earlier date of payment, i.e. at the time the advance payment is accrued. Accounting for insurance premiums GPA Insurance premiums are accounted for using an account.

69, the credit of which shows the accrual of insurance premiums, and the debit shows their payment. A separate subaccount is added to it for each type of insurance.

Civil contract in 2021: what taxes and contributions are imposed

If expenses for accommodation and travel are paid by the organization, then such expenses are displayed as KOSGU 222 and 226. For the correct use of codes, a table of correspondence between KOSGU and KVR codes 2021 is used.

Calculation of GPA insurance premiums according to the standard formula Remuneration minus payments from the Pension Fund of the Russian Federation, compulsory medical insurance, and personal income tax is paid to the contractor only after he has completed all types of work and handed it over to the customer.

Calculation of insurance premiums

The form and procedure for filling out (hereinafter referred to as the Procedure) for calculating insurance premiums were approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ Appendix No. 2 to Section 1 calculates contributions for compulsory social insurance in case of disability and in connection with maternity .

In this case, payments that are subject to insurance premiums are reflected on line 020 of Appendix No. 2 (clause 11.4 of the Procedure), and payments exempt from taxation by insurance premiums are reflected on line 030 of Appendix No. 2 (clause 11.5 of the Procedure). According to clause

1 tbsp. 420 of the Tax Code of the Russian Federation, the object of taxation with insurance premiums is payments and other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance.

Calculation of insurance premiums 2021

Attention The concept of a civil law contract (GPC) Labor relations with employees employed on the basis of an employment contract are regulated by the Labor Code, and relations under a civil law contract are regulated by the Civil Code.

In the matter of paying insurance premiums under a GPC agreement, it is important that when signing such a contract, any hints of its similarity with a standard employment contract are excluded, since in judicial practice there have been cases when a GPC agreement was recognized as an employment contract, and subsequently the company was forced to pay additional insurance premiums and pay penalty for late payment. To avoid any difficulties, the terms of the agreement must include the following points:

- The subject of the contract must include work, services or the transfer of rights to property, but not the performance of official functions.

Status of the contractor who has entered into a GPC agreement Deductions from GPA payments Private entrepreneur Pays income tax and mandatory contributions (compulsory medical insurance, Pension Fund) on his own Individual personal income tax and insurance premiums (PFR, Compulsory Medical Insurance), except for payments for occupational diseases and industrial accidents, the customer pays for the individual ( tax agent) Calculation of payments for insurance against industrial accidents and occupational diseases is possible if this is provided for by the terms of the GPC agreement.

When it is impossible to conclude a GPC agreement

It is not always illegal to enter into such a contract. Officials provided specific conditions. If the employer violates them, the labor inspectorate will impose a substantial fine. A budgetary institution does not have the right to conclude a PPPC if:

- The position in which the contract worker works is provided for in the staffing table of the government agency.

- The internal labor regulations apply to the mercenary. For example, such an employee works during working hours that are established for core personnel.

- Work is carried out in a specially created workplace. For example, a doctor in a medical facility.

If at least one of the conditions is met, then enter into an employment contract. There are no exceptions. In 2021, taxes and contributions under the GPC agreement will be collected without fail.