Workwear is part of the employee's personal protective equipment (PPE). This is actually overalls, special-purpose shoes, various protective devices, for example, special glasses (Order No. 135n of the Ministry of Finance dated December 26, 2002, paragraph 7). Upon dismissal, the employee is obliged to hand over the protective clothing issued to him for use. The article discusses the nuances of this procedure, the actions of the employer, as well as problematic aspects of returning PPE to a resigning employee.

Purchasing workwear

First of all, you must reflect in the program the purchase of the workwear itself. To do this, go to the “Purchases” section and create a new document “Receipts (acts, invoices)”.

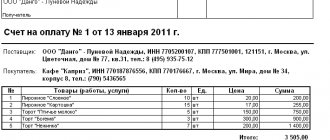

Fill out the header of the document, indicating the standard details of the supplier, your organization and where the purchased goods will be listed.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

In our case, the organization purchases rubber boots, a blue cotton robe and cotton gloves. As you can see, in the figure above, all item items have an accounting account of 10.10. 1C 8.3 filled it out automatically.

If this does not happen for you, go to the card of the corresponding item item and make sure that “Workwear” is set as the item type.

We will also check the rules for determining the accounting accounts for the rubber boots we buy. Her priority score is 10.10.

We will not fill out anything else in this document. Now you can carry it out and check the correctness of the formation of movements.

Justification for providing workers with PPE

Special clothing and personal protective equipment include: overalls, jackets, gloves, respirators, goggles, headphones, gas masks, etc. Article 221 of the Labor Code of the Russian Federation obliges heads of organizations to provide employees with uniforms and personal protective equipment free of charge if they work:

- in hazardous production (for example, in chemical production for the purpose of protection from the influence of harmful substances, etc.);

- if contamination is possible during work (uniforms are needed so as not to stain the employee’s personal clothing);

- if the employee’s work involves exposure to unusual temperatures (high or low).

Information about the name and number of units of protective clothing received by the organization is entered into the PPE logbook. It is also used to issue uniforms at the warehouse. Information about the protective clothing received by employees is entered into a personal record card for the issuance of personal protective equipment.

Workwear issuance card, sample

The form of this document is established by the annex to the intersectoral rules, approved. by order of the Ministry of Health and Social Development dated 07/01/09 No. 290n.

Personal card for issuing workwear, form

For all sectors of activity, there are established standards for the issuance of PPE, which employers should adhere to. They contain not only lists of personal protective equipment, but also the timing for which they should be provided to employees. The director of an enterprise, taking into account its specifics, can develop his own issuance standards, but without compromising the existing ones. Taking into account these rules, he must promptly change the worn-out uniforms of workers to new ones.

If for some reason an employee refuses to wear a uniform, this fact should be documented to relieve the employer of liability. Since for failure to provide a worker with special clothing, he may face a serious fine. It is prohibited to allow a person who has neglected safety rules to work.

Transfer into operation

After the fact of receipt of workwear was reflected in 1C 8.3, it began to be listed in the main warehouse as account 10.10. Now you can issue it directly to the organization’s employees. The document “Transfer of materials for operation” is used for this purpose. You can create it based on the workwear receipt we just created.

1C Accounting automatically filled in all possible fields, but suppose that we want to put into operation only 10 rubber boots. In the tabular part we indicate physical. person - Abramov Gennady Sergeevich. It is he who will now be credited with rubber boots.

Pay special attention to filling out the “Purpose of Use” column, which is marked in the image above. It contains an element of a special directory, which indicates the procedure for repaying the cost of special clothing and special equipment.

You can fill out this guide yourself. In our example, the linear method of paying off the cost was chosen. We are going to reflect expenses on account 25.

Assume that the useful life of the rubber boots in this example assignment will be 11 months. In accordance with the law, such workwear can be written off immediately if the period does not exceed 12 months.

After entering all the data, the document can be processed.

Accounting for workwear when dismissing employees

Quite often it happens that an employee quits (or moves to another department) and hands over the workwear before the depreciation period expires. Then you should create a document Return of materials from service. The tabular part can be automatically filled in according to the balances, and then only the names of the dismissed employees can be left.

The workwear will be returned to the account on 10.10, and the write-off of the cost as expenses will temporarily stop. Then it can be transferred to another employee according to the algorithm shown above.

It should be noted that the question of what to do with workwear if an employee quits and the residual value has not yet been written off is quite acute and does not have a single methodological solution. The situation above shows the simplest option. But sometimes workwear cannot be transferred to a new employee:

- For reasons of hygiene;

- Due to physical wear and tear;

- The overalls were custom-made for a specific employee.

There are also situations when, after the dismissal of an employee, accounting workers discovered that he had not handed over his workwear. The residual value has not been written off and remains on the balance sheet. What to do in such cases?

There is no single answer to the question of how such situations will affect the calculation of taxes (VAT, profit, personal income tax and insurance contributions). It is clear that the position of the tax authorities and the Ministry of Finance is aimed at increasing the tax burden on the enterprise. At the same time, judicial practice often speaks in favor of organizations that did not add additional taxes, from their point of view. Let's consider some options for action, without insisting that they are the only correct ones. The chief accountant of an enterprise must develop a strategy for action in such a situation and consolidate it in the accounting policy.

Let’s assume that the following situation arises in terms of amounts at the time of the employee’s dismissal:

| Dt | CT | Sum | Operation |

| 10.10 | 60 | 1 800 | The cost of the protective suit was capitalized |

| 19 | 60 | 324 | VAT credited |

| 68 | 19 | 324 | VAT is accepted for deduction |

| 10.11 | 10.10 | 1 800 | The suit was put into operation, wear period is 18 months |

| 20 | 10.11 | 1 000 | Depreciation of workwear was accrued for 10 months |

| 10.11 | 800 | Residual cost of workwear upon dismissal of an employee |

Below are a few examples of an employee’s actions and options for an accountant’s reaction to them:

| Dt | CT | Sum | Operation |

| 1. The employee handed over the workwear to the warehouse, but it cannot be issued again. The Inventory Commission generated a write-off act due to wear and tear. | |||

| 94 | 10.11 | 800 | The residual value of workwear has been written off |

| 91.2 | 94 | 800 | The cost of written-off workwear is included in non-operating expenses |

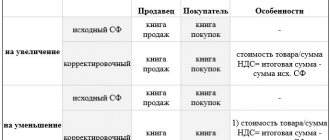

| 2. If the accountant in Example 1 decides that the costs written off to account 91.2 are not accepted for calculating income tax, and VAT must be restored additionally, then there will be more entries. In terms of profit, the constant difference is 160 rubles (800 rubles x 20%). Regarding VAT, theoretically there are two options: calculate the tax amount proportionally, as with separate accounting, and restore VAT in the amount of 144 rubles. (800 rub. x 18%). At the same time, it may be necessary to act with an eye to the provisions of the tax code, which states that VAT should be restored in proportion to the book value on fixed assets, but we have materials. Therefore, we need to decide for ourselves whether VAT should be restored in full from the amount of 324 rubles? | |||

| 99 | 68 | 160 | Permanent income tax difference |

| 19 | 68 | 144 (? 324) | VAT restored |

| 91.2 | 19 | 144 (? 324) | VAT is written off to non-operating expenses |

| 3. The employee did not hand over his work clothes; he has not yet received the final payment upon dismissal. The accountant decided to calculate the residual value of the clothes from wages. | |||

| 94 | 10.11 | 800 | The residual value of workwear has been written off |

| 73 | 94 | 800 | The cost of workwear has been transferred to payments to employees |

| 70 | 73 | 800 | The cost of workwear was repaid through salary accrual |

| It should be noted that if Example 3 is slightly changed, and the employee has already received a payment, then the cost of workwear can only be recovered through the court, because This is a kind of theft of company property. Here it is worth comparing the cost of the shortage and legal costs. | |||

| 4. The employee compensates the company for the residual cost of the workwear and keeps it for himself. He must do this voluntarily, submitting an application with a request to make a deduction from his salary. | |||

| 73 | 10.11 | 800 | The overalls were handed over to the employee |

| 70 | 73 | 800 | Debt is taken into account when calculating wages |

| 5. Example 4 causes heated debate between enterprises and tax authorities about whether VAT should be charged on the residual value of workwear when it is transferred to an employee. The regulatory authorities say that it is necessary, because... there is a transfer of ownership - this is a sale and VAT arises. The courts are inclined to believe that this situation is a reimbursement of costs, and VAT does not arise. If you reflect the transfer of workwear as a sale, then the following postings are possible: | |||

| 73 | 91.1 | 944 (800 + 144) | Non-operating income from the sale of workwear |

| 91.2 | 10.11 | 800 | The residual cost of workwear is taken into account in expenses |

| 91.2 | 68 | 144 | VAT |

| 70 | 73 | 944 | The employee's debt is taken into account when calculating wages |

| 6. When reflecting the transfer of workwear as a sale, not everything is clear with the price issue. Previously, we looked at examples in which residual value was taken into account for sales purposes. But what if it is necessary to sell based on market prices, and it is necessary to make some kind of markup? Let’s say right away that when selling workwear with a markup and VAT, you will be freed from claims from inspectors, but whether this is beneficial for the enterprise and employees is a question. Let’s say the cost of clothing without VAT is equal to 1,000 rubles, then the postings will be as follows: | |||

| 73 | 91.1 | 1 180 (1 000 + 180) | Non-operating income from the sale of workwear |

| 91.2 | 10.11 | 1 000 | The residual cost of workwear is taken into account in expenses |

| 91.2 | 68 | 180 | VAT |

| 70 | 73 | 1 180 | The employee's debt is taken into account when calculating wages |

We have considered a far from complete list of questions that an accountant may have when handing over workwear to employees. For example, it is possible to formalize such an operation as a gratuitous transfer. VAT then still arises, and the employee will most likely have to pay personal income tax on material benefits at a rate of 35%.

Seeing the range of issues related to the residual cost of protective equipment when dismissing employees, it becomes clear the approach of gradually writing off as expenses even those workwear that have a service life of less than a year, especially in conditions of high staff turnover.

It is clear that it is impossible to show the entire range of 1C user actions in one article with so many options; a book or qualified assistance from a consultant is needed here. Understanding the complexity of the choice, we can propose to decide on a plan of action in such situations and record the found algorithm in the accounting policy. That is, having previously compiled a list of transactions and amounts that should ultimately be received, contact 1C consultants to reflect this situation in the 1C: Accounting program.

Disposal of workwear

Based on the transfer of materials into operation, this workwear can be written off.

The document was filled out automatically, and all we had to do was change the number of rubber boots to be written off.

After posting the document in the postings, you can verify that all boots in the amount of 10 pieces were written off from the account MTs.02.

Return from service

Sometimes in practice there are cases when workwear needs to be returned from use. There can be many reasons for this phenomenon, for example, dismissal, sick leave, business trip or transfer of an employee.

A document for the return of their use can be created based on the transfer of materials into operation.

In this case, just like in the previous example, you just need to indicate the quantity. The image below shows an example of the return of one pair of wellington boots.

After posting the document, we see that one pair worth 150 rubles has been written off from account MTs.02. The boots accounting account has changed from 10.11.1 (in service) to 10.10 (in warehouse).

Common mistakes

Error: The accountant wrote off damaged workwear without deducting its cost from the employee’s salary.

Comment: If the workwear is worn out naturally, its cost is not deducted from the employee’s salary. If an employee damages or loses clothing, its cost must be compensated at the expense of the subordinate.

Error: The accountant did not withhold personal income tax from the cost of workwear, which the dismissed employee did not return to the company.

Comment: The workwear left behind is the employee’s income, and therefore personal income tax is withheld from its value, plus its value is indicated in the income certificate 2-NDFL.

Repayment of cost

We will add one more item to the previously introduced transfer of workwear - “Blue cotton robe” in the amount of 5 pieces. In the purpose of using the robe, we indicate that its useful life will be 18 months, that is, a year and a half.

Repayment of the cost of the robe will be made at the close of the month. In our example, all documents were posted from September 2021. In this regard, the operation we need to pay off the cost of the robe will be carried out at the close of October 2017. A similar scheme is used for depreciation of fixed assets.

Let's consider the transactions created by the operation of repaying the cost of workwear and special equipment in October 2021. As shown in the figure below, a write-off was made for the robe in the amount of 97.22 rubles. This amount will be used to repay the value of this position within 18 months.

In accordance with the specified data in the intended use, the calculation turned out as follows:

- 5 (number of bathrobes) * 350 (price of one bathrobe) / 18 (useful life) = 97.22 rubles.

* * *

Workwear is the property of the employer. Consequently, upon dismissal, the employee is obliged to return the special clothing received to him. Otherwise, the employer has the right to recover from the employee its cost minus depreciation. According to Rostrud, without the consent of the employee, amounts cannot be withheld from his salary to reimburse the cost of workwear. If the employee does not agree to reimburse the cost of the workwear that was not returned to him, the issue should be resolved in court.

[1] Rules for financial support of preventive measures to reduce occupational injuries and occupational diseases of workers and sanatorium and resort treatment of workers engaged in work with harmful and (or) dangerous production factors, approved. By Order of the Ministry of Labor of the Russian Federation dated December 10, 2012 No. 580n (valid as amended on October 31, 2017).

Remuneration: accounting and taxation, No. 8, 2018