A manager is an employee who has rights and responsibilities. The General Director does not just carry out organizational work, he is the legal representative of the LLC, has the right to sign and is responsible for all areas of activity.

The labor relationship between the company and its director must be properly formalized in compliance with all labor law standards.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

It's fast and free !

Is a contract necessary if he is a founder?

Labor relations between the director and the company are regulated by laws and the Charter of the company. In general, the conclusion of an employment agreement is mandatory . and this seems obvious. However, when the sole founder and director are the same person, legal confusion arises as the person cannot employ himself.

The study of arbitration practice and analysis of existing legal provisions allowed us to give a reasoned answer.

The Labor Code contains a separate chapter 43 with provisions on the labor of managers. There are rules governing hiring and firing procedures, working hours, responsibilities and rights. However, all these rules do not apply to directors who are sole founders, as stated in Article 273.

Having studied this issue, lawyers from the Ministry of Health and Social Development came to the conclusion that despite the absurdity of the situation, a citizen cannot remain socially unprotected. Official labor relations are a guarantee of compulsory medical and pension insurance. In written explanations they confirm that a written contract must be concluded.

Banal logic can put an end to the dispute between the two departments.

- Firstly, the general director enters into an agreement not with the founder, but with the company, that is, formally, the employer and the employee are different entities.

- Secondly, labor law norms will not be violated if the general provisions of the Code, rather than the specific Chapter 43 of the Labor Code, are used to regulate labor relations.

- Thirdly, all significant or specific legal issues can be written down in the Charter and followed.

Logical contradiction

The position of Rostrud is dubious, because in fact there can be no talk of any coincidence of the parties. After all, the contract is signed by the employer - the general director as a representative of the LLC, and on the other hand - by an individual (employee). The provisions of the Labor Code themselves do not mean that in such cases labor relations do not arise. On the contrary, from the content of Articles 11, 273 of the Labor Code, it follows that if a person appointed to the position of general director of a company is its employee, then the relationship between them is regulated by labor law.

The position of Rostrud is also questioned by the courts. The absence, in the department’s opinion, of labor relations allows, for example, the Social Insurance Fund to refuse reimbursement of expenses for compulsory social insurance. Thus, the dispute resolved by the Resolution of the Ninth Arbitration Court of Appeal dated May 26, 2010 No. 09AP-10226/2010-AK in case No. A40-13990/10-154-41 seems interesting. The arbitrators declared illegal the refusal of the Social Insurance Fund to reimburse the Company for the costs of maternity benefits to the general director, the only participant. At the same time, the court rejected the Fund’s argument with reference to Article 273 of the Labor Code that the only participant in the company cannot be an employee of this company, as untenable and based on an erroneous interpretation of the law. The court in this case indicated that the general director is an employee by virtue of Articles 255 and 256 of the Labor Code of the Russian Federation and has the right to maternity leave with the payment of state social insurance benefits in the amount established by law.

Who signs this agreement

The contract is concluded after the general meeting of owners approves the proposed candidacy of the future director and confirms its decision with signatures in the minutes. In most cases, its appointment coincides with the beginning of the state registration procedure.

The tax authority carrying out registration works with a specific representative - the executive body of the company - its director. The employment contract is submitted to the inspectorate along with a full package of documents for registration, since the position of a manager, by definition, should not be empty.

In addition to the position of director, the minutes of the meeting of founders confirm the responsible member of the company who, on behalf of the meeting, will sign a contract with him:

- If there is only one founder, then he also signs.

- If the shares of the participants in the authorized capital are the same, then the responsible member is elected by voting.

- If the amounts of contributions differ, then the agreement is signed by the one who contributed the majority, but another participant can be elected by voting.

All the features of hiring a general director are shown in the following video:

Specifics

When determining the work schedule of the general director, as a rule, an irregular day is established. As for the period during which the agreement is valid, in this case they are usually guided by the Charter of the organization. Its provisions may stipulate that the general director is elected for a specific term. This could be 3, 5 years or another period. If there is such a clause in the Charter, the contract must indicate that it is urgent.

For how long is it usually concluded?

The Labor Code of the Russian Federation and the Law “On Limited Liability Companies” do not contain a direct indication of what the agreement with the director should be - fixed-term or unlimited. The maximum possible duration of the agreement with the director is determined by the participants of the company and is prescribed in the Charter.

If the owners deem it necessary, they may not limit the director’s tenure at all or change it on a case-by-case basis by issuing a Resolution of the meeting of participants. There is no need to make any changes to the Charter. When drawing up a contract, it may indicate a shorter period of validity than was provided in advance. A document is considered to be of unlimited duration unless the contrary is stated in any administrative or constituent document.

Nuances of the agreement

The agreement with the manager is drawn up according to the rules common to all such documents. However, given the high degree of responsibility, it would be wiser not to get away with general wording or references to other documents, but to spell out all job functions and responsibilities in as much detail as possible.

The position of director involves a wide range of responsibilities, long working hours and frequent business travel.

Managers are one of the categories of employees for whom an individual work schedule can be established, and overtime or, conversely, additional rest periods are allowed.

Due to the flexibility of legal norms regarding the position of director, the main defining document becomes the Charter of the company. All nuances and specific responsibilities must be contained in the Charter, references to it must be present in the text of the agreement.

Main sections of the document

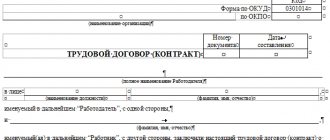

A typical contract outline contains the following sections:

- Names and registration addresses of the parties.

- Subject of the agreement.

- Detailed description of responsibilities.

- Detailed description of rights.

- Operating mode.

- Responsibility of participants in labor relations.

- Remuneration and guarantees.

- Procedure for extension and termination of the contract.

- Settlement of disputes.

- Details and signatures of the employer and employee.

Here you can download this document for free

You will find a sample power of attorney for the right to sign for the general director in this article.

What the job description of the general director of an LLC includes - see here.

How to extend it?

An extension or prolongation is needed if the agreement is of a fixed-term nature and has expired. The extension procedure is formulated in the text of the document itself. The following options are possible:

- Automatic renewal - if the parties intend to continue working, they simply continue to perform their duties. There is no need to draw up additional agreements.

- An additional agreement to the contract is drawn up if automatic renewal is not provided. Such a document must be drawn up in advance, usually a month before the end of the contract.

- Re-conclusion of the document – used when the terms of cooperation change significantly.

The method of extension must be specified in the Charter and duplicated in the text of the employment agreement.

Still have questions? Find out how to solve exactly your problem - call right now:

Validity

According to the validity period, the document can be of two types:

- unlimited - in this case, the document does not contain provisions regarding the duration of its validity, it can be terminated only if there are serious grounds (specified in legislative acts or in the agreement itself);

- urgent - has a specific validity period, after which it can be terminated or extended. In the case under consideration, the document most often concluded of this urgent type, with a set time limit for validity.

Often the validity period is determined by agreement of the parties or on the basis of data specified in the internal documents of the enterprise (in the charter).

For some enterprises, the maximum period is established by law (Article 58 of the Labor Code of the Russian Federation). For example, the chairman of an agricultural cooperative can hold this position for a maximum of 5 years , after which the agreement must be renewed.

The document must indicate whether it has a specific validity period, the duration of this period, as well as the grounds for establishing it.

After the agreement expires, it can be extended if both parties do not object to this.

What to do if the founder-manager wants to enter into an employment contract with himself?

The main reasons why a founder may be interested in concluding an employment contract with his organization are the following:

- social guarantees - the opportunity to go on vacation, sick leave, maternity leave;

- pension insurance experience - work experience as a director is included in the total length of service for calculating a pension;

- the opportunity to receive income from the business in the form of a monthly salary, and not once a quarter in the form of dividends (and even then, if there is profit).

Since 2015, the tax rate on dividends for individuals has increased from 9% to 13% and is equal to what is withheld from an employee’s salary in the form of personal income tax, so there is no longer any economic sense in receiving profit from a business in the form of dividends. As for the organization’s expenses for insurance premiums from the director’s salary, they amount to a significant amount - 30% of the accruals. According to current legislation, insurance premiums are credited to the personal account of the insured person, but it is difficult to say whether the entire amount of contributions will be returned in the form of a pension.

Responsibilities of the director as an employer: reporting

Being an employer for himself, the founder of a business company will have to submit to state authorities the reporting required by law:

- information on the average number of employees;

- confirmation of the type of activity;

- report on Form 4-FSS (regarding contributions for injuries);

- report in the form of the Unified calculation of insurance premiums;

- report in form SZV-M

- report in the form SZV-STAZH;

- reporting on forms 2-NDFL and 6-NDFL.

Please note that many of these reporting forms are constantly updated.

You can learn more about the use of one of the employer’s key reporting forms, the Unified Calculation, in the article “Unified Calculation of Insurance Contributions - Form” .

What to do if the founder-manager does not want to enter into an employment contract?

Let's consider the opposite situation - when the founder assumes management functions, but does not want to enter into an employment contract. Most often, such reluctance arises at the start of a business, when the LLC is not yet properly operating, there is no profit, and the founder agrees with this state of affairs.

He is ready to invest a year or even more in the development of his business, and the existence of an employment contract with him as a manager obliges the organization to pay a salary not lower than the regional minimum plus insurance premiums. In addition, quarterly HR reporting for employees (even with one director) is quite complex, and without the involvement of specialists it will not be easy to submit.

Since we have just refuted the arguments of the Ministry of Finance and Rostrud that it is impossible to conclude an employment contract in this case, we will not refer to the above letters. Then on what basis can a founder manage his organization if an employment contract is not concluded?

This is where civil law comes into force. The provisions of Article 53 of the Civil Code of the Russian Federation, Articles 32,33, 40 of the Law “On LLC” indicate that the director is the sole executive body of the company and carries out the current management of the LLC’s activities.

The sole founder receives his managerial powers from the moment when he, by his decision, assumes the functions of the sole executive body. In this case, management activities are carried out without concluding any contract, including an employment contract.

Order of the sole founder to assume the duties of the General Director ()

By the way, indirectly, the fact that the managerial powers of the executive body is not the same as the labor duties of the director is evidenced by the fact that a director working on the basis of an employment contract is not deprived of his managerial functions while on vacation. A director on vacation still has the right to sign documents on behalf of the company within his competence and perform other functions assigned to him by law and the charter. It should be noted, however, that in such a situation there is a risk of disputes with the tax authorities, so the safest thing to do would be to recall the director working under an employment contract from vacation to sign documents.

Thus, the only founder who wants to manage his organization himself has the right to either conclude an employment contract or do without it . Rostrud cannot oblige him to conclude an employment contract with himself, because his official position contradicts this.

Features of the contract

An employment contract is a document that represents an agreement between an employer and an employee. In accordance with this document, the former undertakes to provide the latter with tasks related and conditioned by the corresponding professional function. The employer also provides the employee with appropriate working conditions provided for in industry legislation or other legal acts that contain labor standards, collective agreements, and local documents.

The employer’s responsibilities, according to the contract, include, among other things, setting the salary, its timely payment in full with all allowances and other charges. The employee, in turn, must perform the work personally assigned to him within the framework of the agreement, comply with the rules of discipline in force at the enterprise, and follow the job description. The agreement establishes the responsibility of both parties for violations of the conditions, disciplinary measures, and the procedure for dismissal from the enterprise. In addition, an integral part of the contracts is an indication of the possibility of resolving conflicts according to the rules established by law, including the right to contact trade unions and inspectorates.

Employment contract with the director, if he is the founder

The general director (or simply director, president, manager) is a person who is entrusted with the functions of the sole executive authority in the management of the company. A person from among the founders or employees of the enterprise, as well as an outsider, can be appointed to this position.

If an organization has several founders, then the general director is elected on the basis of a general meeting. But what to do in situations where the company has only one founder?

In accordance with the Labor Code of the Russian Federation, enterprises are required to draw up employment contracts with all employees. Therefore, this document must be present when accepting the position of director of the company, even in cases where he is the sole owner.

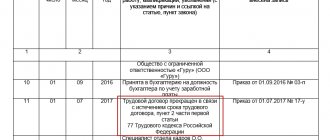

Registration for the position of director occurs on the basis of a decision made by the sole founder. All documents are drawn up as for an ordinary employee, only there is no hiring order; instead, the decision of the founder is mentioned everywhere. Accordingly, an entry in the work book will also be made only on the basis of this decision.

an employment contract with the general director, if he is the founder, can be found at the bottom of the article.

We also offer an employment contract with the general director in this article.

Powers of the General Director

The manager is obliged to exercise control over all processes, including production and economic activities of the organization in which he holds the position of general director.

Responsibilities of the director as an employer: reporting

An employee holding the position of General Director is assigned the following responsibilities:

- control of accounting affairs;

- providing the enterprise with professional employees;

- protecting the interests of the organization during legal proceedings;

- organization of interaction between all divisions and departments of the enterprise;

- providing the staff with the necessary property to carry out professional activities in accordance with the organization’s charter;

- monitoring the fulfillment of obligations to partners, banks and creditor companies;

- ratification of production, job responsibilities and powers of employees;

- fulfillment of obligations specified in regulatory documents to the board of directors;

- control of measures to protect property from harmful external and internal factors;

- provision of full reporting on the functioning of the enterprise to authorized bodies.

Sample employment contract with the founding director

The employment contract concluded with the founding director must contain all the points regulated by the Labor Code:

- Full name and full details of the identity card (passport) of the future director (including registration and residence address);

- address, tax identification number and full name of the organization;

- functions and responsibilities assigned to the director;

- information about who will sign the contract on the part of the company and on what basis;

- date of entry into office;

- date and city of signing the contract;

- the amount of payment for the work (rate, salary, is there an allowance, incentives, bonuses, etc.);

- social insurance conditions;

- rights and responsibilities of the parties.

An employment contract concluded with the general director and the sole founder of the company as one person has 2 features:

- the term of acceptance for the position is not written in it, since the contract is of unlimited duration;

- signed by one person for both the employee and the employer.

After signing the employment agreement, all other standard procedures follow - a personal file is opened. The employment contract is registered in the journal, as well as the work book is drawn up (if it is missing, a new one is created).

If the sole founder, acting as the head of the company, decides not to enter into an employment agreement with himself, then he may face a number of negative consequences:

- lack of social benefits, wages, the right to receive annual paid leave, as well as maternity payments at the expense of the Federal Social Insurance Fund of Russia;

- When auditing a company, tax authorities may request a documented explanation for the payment of the general director. This document is precisely the employment agreement. In addition, they have the right to remove wages from an expense item for tax purposes;

- length of service does not count.

Thus, in order to avoid any problems or disputes with the tax authorities, concluding an employment contract with the manager, who at the same time is the founder of the company, is advisable. In addition, this work is far from complicated and is carried out according to a standard procedure with a few exceptions.

Registration of the contract

Employment contract with the director, if he is the only founder, sample - download.

The correct procedure for concluding an employment contract with the sole founder

Employment contract with the sole founder

A new-born small enterprise is often so small that the entrepreneur himself, as they say, is a Swede, a reaper, and a player of the pipe. And if we are talking about organizing an LLC - a limited liability company, then in most cases the founder of the company becomes its director, taking over the management of the company.

The director is a full-fledged employee of the enterprise, and it seems that all the norms of the Labor Code should apply to him. However, not everything is so simple here, especially if there is only one founder. Then the question arises: an employment contract with a single founder - to be or not to be? The answer to this question determines whether the director (who is also the sole founder) will be paid a salary and whether it will be subject to taxes.

Who is the director?

Let's look at the procedure for appointing a director from a legal point of view. An LLC can be established by several persons or by one – Art. 88 Civil Code of the Russian Federation. The highest governing body of the company is the general meeting of participants. If there is only one participant, then he alone can make decisions.

Director (CEO) is the sole executive body of the LLC. This director must be elected by the general meeting of participants. It turns out that if there is only one founder, then he alone makes the decision to elect a director. The director can be either one of the participants in the company or a third party (Article 91 of the Civil Code and Article 40 of the Federal Law “On LLC”).

Employers in labor relations are guided by labor law standards. To formalize labor relations between the employer and the employee, an employment contract is concluded - Article 16 of the Labor Code. According to Art. 56, 59, 275 of the Labor Code an employment contract is also concluded with the manager. If a third party is appointed director, then no problems arise; an employment contract is concluded with such employee-director, as well as with other employees.

Poles of opinion

A different situation arises if the LLC has one founder, and he will also act as director. Is it possible in such a situation to conclude an employment contract with the sole founder? There have been debates on this topic for many years and there is still no clear and unambiguous answer. There are two opposing approaches:

— a regular employment contract is concluded with the director. This is a contract “with yourself”. In this case, the director receives a salary, from which personal income tax is withheld at a rate of 13% and insurance premiums are charged.

- the director works without an employment contract - this is the official position of the Ministry of Finance, the Federal Tax Service, and the Ministry of Health and Social Development.

No employment contract!

For many years now, the official position of officials on the issue of whether to conclude an employment contract with a single founder has been this: there is no need to conclude an employment contract. The Ministry of Health and Social Development expressed its point of view in a letter dated August 18, 2009 No. 22-2-3199. And even earlier, Rostrud adhered to this position (letter dated December 28, 2006 No. 2262-6-1). And the letter of the Ministry of Finance dated 09/07/2009 No. 03-04-07-02/13 states that if an employment contract is not concluded, then wages are not paid and insurance premiums are not charged.

What is this point of view based on? Chapter 43 of the Labor Code establishes labor rules for heads of organizations, namely, the procedure for concluding an employment contract, its termination, guarantees, and liability. However, in Art. 273 of the Labor Code states that the norms of this chapter do not apply to those managers who are the only founders.

In favor of this position, the norm of Article 420 of the Civil Code is also often cited, according to which an agreement is recognized as an agreement of two or more persons to establish, change or terminate civil rights and obligations. And clause 3 of Art. 182 of the Civil Code – prohibition of transactions by a representative on behalf of the represented person in relation to himself personally.

If the company decides not to enter into an employment contract with the founding director, then the only document confirming his powers is the founder’s decision to assume the duties of the sole executive body. The charter sets out all the powers of the founder.

Why then does a director work who does not receive a salary? It’s not an idea, you have to think. He has the right to receive dividends from net profits. Dividends are taxed at a rate of 9% (clause 4 of Article 224 of the Tax Code of the Russian Federation). These payments are not taken into account when taxing profits (they are not included in costs) and insurance premiums are not charged on them.

Risks in the absence of an employment contract

The absence of an employment contract can give rise to a number of problems, including:

1. Banks in most cases require an employment contract with the director when opening a current account.

2. An organization can be fined by inspectors from the tax service, who do not always adhere to the official position of the Ministry of Finance. The director manages the company and works in it. The absence of an employment contract with an employee leads to fines (Article 5.27 of the Administrative Code).

3. A director without an employment contract is disadvantageous for the Federal Tax Service and funds, because receives less from the budget (personal income tax at a rate of 9% instead of 19%) and funds (insurance premiums are not charged).

4. An organization that has no net profit has no right to pay dividends. Work hard, director, thank you!

5. The absence of an employment contract with the director is a direct path to the lack of social benefits at the expense of the Social Insurance Fund. This deprivation is especially noticeable for female directors.

Thus, the arguments in favor of this point of view are very dubious, and the position itself is quite absurd. Yes, the provisions of ch. 43 do not apply to directors who are the sole founders. But is it explicitly stated somewhere that it is prohibited to enter into an employment contract with the director - the sole founder? There is no such prohibition!

Unreasonableness of application of Civil Code norms

According to experts, one cannot be guided by the provisions of the Civil Code in this matter. This is due, for example, to the fact that the Civil Code does not regulate relations between entities engaged in commercial activities or transactions with their participation. Entrepreneurship is a relatively independent activity. It is carried out at your own risk and is aimed at acquiring profit from the use of property, sale of goods, performance of work, etc. by persons registered in accordance with the procedure established by law.

Labor law regulates working relationships and other activities directly related to them. The activity of a manager as a public worker falls within the scope of regulation of the Labor Code, but not to commercial activity. Entrepreneurship in this case is carried out by the entire company as a whole, but not by its boss personally. In this regard, the application of Art. 182 of the Civil Code to labor relations is unreasonable. In addition, this provision does not change the procedure in accordance with which an employment contract is concluded. The general director of an OJSC and another organization should be included in the staff in accordance with the requirements of the Labor Code. In particular, this is carried out by issuing an appropriate order and concluding an agreement.

Employment contract with the director of the LLC

Currently, limited liability companies are one of the most common forms of business organization in Russia. This is primarily due to the significant advantages of this form over individual entrepreneurship (read more here). Therefore, quite often there are such societies that are organized by a single participant, who at the same time also performs the functions of a director. Registration of labor relations in such cases often raises questions.

The requirements given in this article for drawing up an employment contract with the director of an LLC can be applied not only to situations where there is only one participant in the company, but also to any situations of concluding employment agreements between the LLC and a newly appointed director.

Is it necessary to conclude an employment contract with the director of an LLC?

The first question that arises in a situation where the founder is also the chief executive officer of the company is whether there is a need to draw up an employment contract with the director of the LLC. Here it is very important to understand the mechanism for appointing a director and its functionality.

The director of the LLC is appointed based on the decision of the participant (if there is only one) or on the basis of the decision of several participants at their general meeting. The procedure for recruiting and appointing the head of the company must be reflected in the Charter of the LLC. But in any case, the issue of choosing a manager is decided by the LLC participants (this decision is signed either by the sole participant or by the person presiding at meetings of its participants).

So, the sole founder decides that he will be the head of the company organized by himself. In this situation, from the date of this decision, executive functions are transferred to the director, and he assumes the corresponding rights to enter into employment contracts with hired employees. Therefore, from the point of view of the correct execution of such activities, of course, it would be fair to conclude an employment contract between the director and the LLC in order to clearly define his functions and ensure payments in his favor for social funds (pension, social insurance).

In this sense, it does not matter at all whether the director of the LLC is also a member of the company or not - he performs labor functions and the employment contract must be drawn up.