Procedure for paying VAT

According to the Tax Code of the Russian Federation, the deadlines for paying VAT in 2017-2018 are regulated by paragraph 1 of Article 174. According to it, payers must transfer the calculated tax after the tax period in three equal amounts no later than the 25th day of the three months that follow the corresponding tax period. Let us remind you that according to the law, the tax period for VAT is every quarter.

Companies are required to pay VAT every month in the amount of 1/3 of the amount of tax that must be paid to the budget at the end of the reporting quarter. The deadline is the 25th day of each month (clause 1 of Article 174 of the Tax Code of the Russian Federation).

The general tax rule also applies: if the VAT payment date falls on an official non-working holiday, then the VAT payment deadline is subject to shift any number of times during the year. You can wait until the next working day.

That is, the first payment of VAT for the 4th quarter of 2021 must occur no later than January 25, 2021.

As we have already said, the payment deadline may fall on a weekend. In this case, the tax can be transferred without penalty or interest on the next business day (clause 7, article 6.1 of the Tax Code of the Russian Federation). This situation will happen in February 2021 – the 25th falls on a Sunday. The last day to transfer the second VAT payment is February 26, 2018.

The deadline for paying the third installment of the tax is also postponed. March 25, 2018 is a Sunday, so the deadline for paying VAT for the 4th quarter of 2021 is March 26.

List of VAT rates, declaration, responsibility

Basic rates

For sales operations:

- food products (according to the list approved by paragraph 1, clause 2, article 164 of the Tax Code of the Russian Federation and by Decree of the Government of the Russian Federation of December 31, 2004 No. 908);

- goods for children (according to the list of clause 2, clause 2, article 164 of the Tax Code of the Russian Federation and Decree of the Government of the Russian Federation of December 31, 2004 No. 908);

- periodicals and book products related to education, science and culture (according to the list approved by Decree of the Government of the Russian Federation of January 23, 2003 No. 41);

- sales of medical goods (according to the list established by clause 4, clause 2, article 164 of the Tax Code of the Russian Federation and Decree of the Government of the Russian Federation of September 15, 2008 No. 688).

Settlement rates

10/110% (clause 4 of article 164 of the Tax Code of the Russian Federation)

18/118% (clause 4 of article 164 of the Tax Code of the Russian Federation)

Apply in the following cases:

- upon receipt of funds related to payment for goods (work, services) provided for in Art. 162 Tax Code of the Russian Federation;

- upon receipt of advances for the upcoming delivery of goods (works, services), transfer of property rights;

- when tax is withheld by tax agents;

- when selling property acquired externally and taken into account with tax;

- when selling agricultural products and their processed products in accordance with clause 4 of Art. 154 Tax Code of the Russian Federation;

- when selling cars that were purchased for resale from individuals;

- when transferring property rights in accordance with paragraphs 2 - 4 of Art. 155 Tax Code of the Russian Federation.

When selling the enterprise as a whole as a property complex.

When foreign organizations provide electronic services to individuals (not individual entrepreneurs), the amount of tax is calculated by foreign organizations as the percentage of the tax base corresponding to the estimated tax rate of 15.25% (clause 5 of Article 174.2 of the Tax Code of the Russian Federation).

Deadline and procedure for paying VAT

1. General procedure:

- in equal shares within three months following the expired tax period. The payment deadline is no later than the 25th of each month.

Early payment of tax is allowed.

2. Special procedure (clause 4 of article 174 of the Tax Code of the Russian Federation):

- when purchasing works or services from foreigners - simultaneously with the transfer of remuneration;

- persons who are not taxpayers or taxpayers exempt from VAT - no later than the 25th day of the month following the expired tax period.

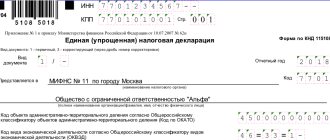

VAT declaration

The declaration is not submitted if the following conditions are simultaneously met:

- VAT evader;

- did not issue an invoice;

- not a VAT tax agent;

- does not issue/receive invoices as an intermediary.

A paper VAT return can only be submitted by tax agents who:

- do not carry out intermediary activities;

- are not VAT payers (or are exempt from fulfilling the duties of taxpayers under Article 145 of the Tax Code of the Russian Federation).

Submitted to the inspectorate at the place of registration of the organization.

A VAT return is not prepared for a separate division. Even if such an OP has a separate balance. VAT is paid centrally.

The deadline for submitting the declaration is no later than the 25th day of the month following the expired tax period - quarter. (Article 163, paragraph 5 of Article 174 of the Tax Code of the Russian Federation).

Updated (corrective) VAT return

If errors lead to an understatement of the tax base, an updated declaration must be submitted.

If errors did not lead to an understatement of the tax base, submitting an updated declaration is a right, not an obligation (clause 1 of Article 81 of the Tax Code of the Russian Federation) of the organization.

The updated declaration is submitted in the same form in which the original declaration was submitted. In this case, in the “Adjustment number” field on the title page of the updated declaration, you must indicate the number corresponding to the serial number of the updated declaration for the corresponding reporting period (starting from 1). The updated declaration must include not only the corrected data, but also all other indicators, including those that were initially correct (Letter of the Federal Tax Service dated June 25, 2015 No. GD-4-3/ [email protected] ).

An updated (corrective) tax return is submitted for the period the data of which is being updated.

Responsibility when filing an updated (corrective) VAT return

Liability is not provided if the updated declaration is submitted:

- Before the deadline for submitting the initial declaration expires, the declaration is considered submitted within the prescribed period (Clause 2 of Article 81 of the Tax Code of the Russian Federation).

- After the expiration of the deadline for submitting the initial declaration, but before the expiration of the tax payment deadline, provided that the updated declaration was filed before the moment when the organization learned about the discovery of errors by the tax authority or about the appointment of an on-site tax audit (clause 3 of Article 81 of the Tax Code of the Russian Federation).

- Submitted after the deadline for filing a return and paying tax has expired, subject to the following conditions:

- the updated declaration was filed before the organization learned about the discovery of errors by the tax authority or about the appointment of an on-site tax audit (clause 3 of Article 81 of the Tax Code of the Russian Federation);

- the organization paid the arrears and penalties until the submission of the updated declaration (clause 4 of article 81 of the Tax Code of the Russian Federation);

- Based on the results of an on-site tax audit, after which an updated declaration was submitted, no errors or distortions of information were found (clause 4 of Article 81 of the Tax Code of the Russian Federation).

| Types of bets | Bet size | Business transactions |

| 0% (clause 1 of article 164 of the Tax Code of the Russian Federation) | For sales operations:

| |

| 10% (clause 2 of article 164 of the Tax Code of the Russian Federation) | ||

| 18% | For all implementation operations not listed above. | |

| 15,25% (Article 158 of the Tax Code of the Russian Federation) | ||

| VAT is paid at the place of registration with the tax authorities (clause 2 of Article 174 of the Tax Code of the Russian Federation). |

VAT payment deadline for the 4th quarter of 2021 in the table

As a result, the VAT payment deadline for the 4th quarter of 2021 in the table looks like this:

| Payment | Deadline for transfer to the budget |

| First | January 25, 2021 |

| Second | February 26, 2021 (postponed from February 25) |

| Third | March 26, 2021 (rescheduled from March 25) |

Tax agents, as a general rule, pay VAT within the same deadlines as taxpayers, but in a separate payment. An exception is a tax agent who purchases work or services from a foreign person who is not registered with the tax authorities of the Russian Federation. He must transfer the withheld VAT to the budget simultaneously with payment for the work (services) of the foreigner (clause 4 of Article 174 of the Tax Code of the Russian Federation).

Tax transactions

Carrying out payment for goods and registering them, transferring taxes to the budget and other tax transactions - all this is reflected in accounting. To do this, use postings for specific transactions:

- payment for goods to the supplier: Dt 60 Kt 51;

- receipt of goods from the supplier: Dt 41 Kt 60, Dt 19 Kt 60;

- sales of goods: Dt 62 Kt 90, Dt 90 Kt 68;

- VAT deductible: Dt 68 Kt 19;

- entries for payment of VAT to the budget: Dt 68 Kt 51.

Postings when calculating penalties - Dt 91 Kt 68, fines - Dt 99 Kt 68.

KBK for payment of VAT for the 4th quarter of 2017

KBK for payment of VAT (except import) – 182 1 0300 110.

KBK for payment of penalties for VAT (except for import) – 182 1 03 01000 01 2100 110.

When importing, VAT is paid in a special manner (to another BCC and at other times).

Below is a table with all BCCs for VAT:

| VAT | |||

| from sales in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

Read also

27.09.2016

When and to what budget to pay VAT

VAT is a federal tax, so it must be paid to the federal budget. VAT is the most popular tax for the state and provides up to 40% of all tax revenues.

Taxpayers pay VAT to the budget when selling value-added goods.

Read more in the material “Who is the VAT payer?”.

Payment of VAT is provided for legal entities and individual entrepreneurs under the general taxation regime (GST), as well as persons who are exempt from paying VAT or apply special taxation regimes (USN, UTII, Unified Agricultural Tax, PSN), but have issued an invoice to the buyer with the allocated amount VAT.

VAT administration is carried out by tax authorities and customs services (when importing goods from countries outside the EAEU).

The following articles will help you prepare a payment order for tax payment:

- “Where to pay VAT and how and where to find the correct details for payment?”;

- “Details for paying VAT in the payment slip in 2016-2017: how to fill out?”;

- “Payment order for VAT in 2021 - sample”.

Filing VAT reports through the Taxpayer PRO PC

The second and most convenient option is to use a special program that will generate a tax return automatically. The accountant will not need to spend a lot of time installing system components or familiarizing himself with complex cumbersome instructions. All certificates will be compiled in a few clicks.

You can find the current document form and submit VAT reports electronically through the Taxpayer PRO PC or the online.nalogypro.ru service. With their help, users are protected from errors when generating reporting information.

The VAT return is filled out on the basis of downloaded databases about the organization’s activities. After preparing the report, the system conducts expert testing. The accountant can familiarize himself with the error log and eliminate any inaccuracies as soon as possible.

The form is checked using the control algorithms in force in the Federal Tax Service, which exclude any unreliable data that has not been identified. Declarations are sent via the Internet. The documentation is first endorsed using an electronic digital signature.

Advantages

The “Taxpayer PRO” program will help you download, systematize and store confidential information on financial transactions, keep proper records of the economic details of an enterprise of any size, its branches and separate divisions. Among the obvious advantages:

- Urgent execution of all specified operations. The system demonstrates high performance. Creating databases and sending reports takes place in a few clicks.

- Wide functionality that allows you to maintain accounting, tax and personnel records in one system.

- Regular updating of databases in accordance with the latest changes in domestic legislation that have come into force.

- Convenient and intuitive interface, detailed instructions for using the program.

- Opportunity to get advice on how to use the system from experienced operators.

KBC for VAT deductions in 2021

• goods, works, services sold within the borders of the Russian Federation: - for tax: 18210301000011000110; — for penalties: 18210301000012100110; — for fines: 18210301000013000110;

• goods supplied from Belarus and Kazakhstan: - for tax: 18210401000011000110; — for penalties: 18210401000012100110; — for fines: 18210401000013000110;

• goods reshipped from other countries to the Russian Federation (administrator - FCS): - for tax: 15310401000011000110; — for penalties: 15310401000012100110; — for fines: 15310401000013000110.

From 2021, new BCCs are valid for payment orders for insurance premiums, penalties and interest on them. Payments for insurance premiums are now sent to the Federal Tax Service.

Submitting documents through the Federal Tax Service website

You can submit VAT electronically through a specialized service developed by the Federal Tax Service. The declaration is generated and sent on the official website of the fiscal authority. It is available to every individual entrepreneur and company that has received a personal electronic digital signature and can meet a number of technical requirements.

The downside is that you need to study the instructions yourself. Users will need to install the software. Files created in third-party programs are uploaded to the tax office service. All these operations take the accountant a lot of time.

VAT return for taxpayers: checkpoints

Line 060 of section 2 + line 110 of section 3 + lines 05 and 080 of section 4 + lines 050 and 130 of section 6 = line 260 + line 270 of section 9

Section 3 line 190 + Section 4 Section 5 lines 080 and 090 + Section 6 lines 060, 090 and 150 = Section 8 line

We recommend the online course “VAT for Practitioners”: the training program takes into account all changes in VAT and provides examples of filling out a declaration.

| Calculated and restored VAT |

| VAT deductions |

Features of the procedure for calculating and paying VAT

In recent years, some changes have been made to the tax calculation procedure. Most of the updates affected clause 3 of Art. 170, pp. 1, 6 tbsp. 172 of the Tax Code of the Russian Federation.

In addition, the updated Art. 169 allows for non-issuance of invoices by sellers who are not VAT payers or are exempt from paying it. However, it is better to stipulate this fact in the supply contract. All this has a positive effect on the procedure for paying VAT , since it reduces labor costs for completing additional documentation.

In addition, it has become possible to refund taxes on documents received after the tax period. In such a case, operations related to the calculation and payment of VAT are carried out in the period when it was actually taken into account. Moreover, the time period available for performing these actions is limited to 3 years.

PLEASE NOTE: A rather important point from the point of view of the tax department when calculating VAT is incorrectly executed documents. In most cases, they are the basis for denial of the right to benefits, the occurrence of arrears, and the application of punishment. Therefore, the correct execution of all VAT documentation should be one of the main tasks of the company’s accounting services.

VAT calculation and payment terms

VAT is one of the types of taxes that is transferred by business entities to the federal budget. As a rule, the procedure for calculating VAT does not present any particular difficulties - when selling certain goods or services, an organization or individual entrepreneur who is a VAT payer increases the final cost of goods and services by the VAT rate, and the input tax is reimbursed from the budget.

The procedure and deadlines for paying value added tax are defined in Art. 174 of the Tax Code of the Russian Federation. Payment is made within three months after the end of the reporting quarter, and the amount of tax deducted is divided into three equal parts. If the payment deadline falls on a weekend, the payment date is postponed to the next working day. Since 2008, partial payment of VAT has helped ease the burden on taxpayers.

Payment deadlines in 2021 are made in accordance with the information given in the table below:

Get 267 video lessons on 1C for free:

Please note that you should pay special attention when filling out the VAT payment details. The main thing is to avoid making any mistakes when filling out the treasury accounts into which the funds will be received:

When filling out a declaration and paying VAT, you need to pay attention to the KBK codes, that is, they stand out:

- special codes for transactions when goods or services are sold on the territory of the Russian Federation;

- when import VAT is applied when working with Belarus or Kazakhstan;

- as well as the BCC separately for all other countries.

KBK table for VAT in 2021:

Who maintains the books of purchases and sales, as well as the journal of received and issued invoices:

- VAT payer: maintains books of purchases and sales.

- The payer is at the same time a developer, an intermediary acting on his own behalf, a forwarder who receives remuneration only for organizing transportation: he maintains books of purchases and sales and a journal of received and issued invoices.

- VAT evader: Does not keep books of purchases and sales.

- The defaulter is at the same time a developer, an intermediary acting on his own behalf, a forwarder who receives remuneration only for organizing transportation: he keeps a log of received and issued invoices.

Who should keep the sales book:

- VAT payers, incl. exempted from the obligations of payers under Art. 145 of the Tax Code of the Russian Federation.

- VAT tax agents, incl. simplifiers and imputators.

The sales book records documents on the basis of which VAT is calculated for payment to the budget.

Who should keep the purchase book:

All taxpayers are responsible, except those who:

- received exemption from the duties of a VAT payer.

- conducts only VAT-free transactions (including transactions for the sale of goods (works, services), the place of sale of which is not recognized as the territory of the Russian Federation).

Who should keep an invoice journal:

A log of received and issued invoices should be kept only by those organizations that act on their own behalf as intermediaries in the interests of other persons and re-issue invoices to them. These intermediaries include:

- commission agent (agent) who buys goods (work, services) from VAT payers for the principal (principal);

- commission agent (agent) who sells goods (work, services) of the principal (principal) - the VAT payer;

- a developer who reissues invoices to investors for goods (works, services) purchased from third parties;

- a forwarder who reissues invoices to the client for works (services) purchased from third parties.

Special modes

Tax according to the simplified tax system. In the fourth quarter, payers of this tax must pay an advance payment for 9 months. This had to be done no later than October 25th. The final calculation of the tax paid in connection with the application of the simplified system will be carried out next year. The nearest deadlines for paying tax according to the simplified tax system:

- for the organization - April 2, 2021 (postponement due to the weekend from March 31);

- for individual entrepreneurs - April 30, 2021.

Read the article on how to prepare a Declaration under the simplified tax system with the taxable object “Income” for 2021

UTII. The tax period for UTII is a quarter. So next time it will be paid based on the results of the fourth quarter. This must be done no later than January 25, 2021.

Unified Agricultural Sciences. The tax is paid once every six months. The next payment is due in 2021 - it must be made before April 2. The deadline is postponed from March 31 due to holidays.

Payment of VAT by certain categories of payers

The above rules are not applicable to all value added tax payers:

- Persons engaged in economic activities and applying special tax regimes and who are obligated to pay VAT must pay immediately only in certain cases, without spreading the payment over three months.

- Tax agents who work with foreign legal entities, as well as those purchasing goods and services from them, must pay VAT when transferring funds to the supplier. The bank, along with information for payment for the goods, must receive information and a payment order for the amount of VAT regarding the amount of payment.

If a business entity does not pay VAT on time or does not submit a return on time, this may entail penalties. The minimum possible amount of such a fine is 1,000 rubles, and the maximum is up to 30% of the amount of tax that was calculated according to the declaration.

So, if the declaration was submitted untimely, but the VAT itself was credited on time, then the organization or individual entrepreneur may face a fine of 1,000 rubles. If a partial payment of tax was made, the amount of the fine will be calculated based on 5% of the difference between the amount of tax paid and accrued.

Finally, we note that VAT taxpayers must submit tax returns in any case, even if there were no business transactions during the tax period.

Add a comment Cancel reply

You must be logged in to post a comment.

General taxation system

The main taxes that distinguish OSN from other tax regimes are VAT and income tax. Let's consider when they need to be paid.

Income tax

This tax is paid in advance payments once a quarter or month. In this case, the control date is the 28th. With the quarterly option, the advance payment for the fourth quarter had to be paid by October 28. Given that this day fell on a weekend, the deadline was moved to October 30. If monthly payment is applied, the tax must be transferred to the budget by the 28th of each month. That is, in the fourth quarter there are still two dates left on which the transfer must be made - November 28 and December 28.

VAT

VAT is usually paid at the end of the quarter in three equal installments. They are carried out no later than the 25th day of each month of the next quarter. If a company or individual entrepreneur uses just such a payment scheme, then in the current quarter the accountant only has to pay 2/3 of the VAT for the third quarter. Payments, accordingly, must be made no later than November 25 and December 25.

It is also not prohibited to pay VAT in one amount without division. In this case, the payment is transferred before the 25th day of the month following the end of the quarter. That is, for the third quarter it was necessary to pay VAT by October 25. And for IV it must be paid in a single amount until January 25, 2021.

Do not forget that in some cases the deadline for paying VAT is not the 25th. So, if operations are related to imports from EAEU countries, then you need to focus on the 20th. For example, if you plan to import goods in December of the current year and immediately register them, then you will need to pay VAT no later than January 22 of the next year. This takes into account the fact that January 20 falls on a day off. In this case, the tax must be paid in a single amount, without breaking it into parts.

Imports from other countries mean that VAT is paid immediately. This is done together with the payment of other customs duties. The same procedure, that is, immediate payment of VAT, applies in the case of purchasing goods and services from a foreign organization that does not have a representative office in Russia. Simultaneously with the payment to the foreign counterparty, the subject must submit a payment order to the bank to pay VAT. Without this, the bank will not carry out the operation.

Sometimes it is impossible to divide the VAT payment into three parts for operations not related to imports. This procedure applies to VAT non-payers who issue an invoice despite the fact that they are not obliged to do so. So if you, for example, apply the simplified tax system and issue an invoice in the fourth quarter of 2021 with the allocated amount of VAT, then you will have to pay the tax indicated in it until January 25, 2021 in a single amount.