Institutions and organizations provide financial assistance to employees, former employees, as well as members of their families on various grounds. At the same time, it is important to document such payments, as well as their taxation. We will talk about the features of these payments in the article.

According to Art. 144 of the Labor Code of the Russian Federation, wage systems (including tariff wage systems) for employees of state and municipal institutions are established:

- in federal government institutions - collective agreements, agreements, local regulations in accordance with federal laws and other regulatory legal acts of the Russian Federation;

- in state institutions of the constituent entities of the Russian Federation - collective agreements, agreements, local regulations in accordance with federal laws and other regulatory legal acts of the Russian Federation, laws and other regulatory legal acts of the constituent entities of the Russian Federation;

- in municipal institutions - collective agreements, agreements, local regulations in accordance with federal laws and other regulatory legal acts of the Russian Federation, laws and other regulatory legal acts of constituent entities of the Russian Federation and regulatory legal acts of local governments.

The Government of the Russian Federation can establish basic salaries (basic official salaries), basic wage rates for professional qualification groups. At the same time, remuneration systems are established taking into account, in particular, the approximate provisions on the remuneration of employees of institutions by type of economic activity, approved by federal government bodies and institutions - the main managers of federal budget funds (clause “e” of clause 2 of Government Decree of the Russian Federation N 583 ).

From the above rules it follows that if there is financial opportunity, the institution has the right to prescribe in a local regulatory act the payment of financial assistance for one reason or another and issue it to employees. However, remember that material assistance is a social service provided to employees to support them and improve their standard of living (GOST R 52495-2005 “Social services to the population. Terms and definitions”, approved by Order of Rostekhregulirovaniya dated December 30, 2005 N 532-st). In this case, material assistance can be provided in the form of cash, food, sanitation and hygiene products, child care products, clothing, shoes and other essential items, fuel, as well as special vehicles, technical means for the rehabilitation of disabled people and people in need in outside care. As practice shows, most often material assistance is provided in the form of cash.

Main aspects of payment of financial assistance

Financial assistance is provided when employees encounter special circumstances. It is a non-production payment, does not depend on the performance of the institution and is not related to the individual results of employees. Accordingly, it is not stimulating or compensatory in nature and is not considered an element of remuneration. Its main goal is to create the necessary material conditions to solve the problems that the employee has encountered. In addition, financial assistance cannot be regular and is paid at the request of the employee, most often in connection with:

- with treatment;

— with the death of an employee’s family member;

- with the death of the employee himself;

- with damage caused by any emergency;

- with marriage;

- with the birth of a child.

Let us clarify that the amount of financial assistance is established by the management of the institution and is determined depending on each specific situation and the financial capabilities of the institution. In this case, the procedure for providing financial assistance must be regulated by a local act of the institution, a collective or labor agreement.

In addition, many institutions, when providing annual leave to employees, pay financial assistance, which they are guaranteed along with other payments. Such a payment, in its essence, will be a one-time payment, and it must be provided for in the local regulatory act of the institution. In this case, the specified payment is an element of remuneration, since it is related to the employee’s performance of a labor function. That is, a lump sum payment made when granting annual leave cannot be recognized as financial assistance, and therefore is taken into account in labor costs when calculating income tax. A similar opinion is presented in letters of the Ministry of Finance of the Russian Federation dated 09/03/2012 N 03-03-06/1/461 and the Federal Tax Service of the Russian Federation dated 06/26/2012 N ED-4-3/ [email protected] , as well as in the Resolution of the Federal Antimonopoly Service dated 03/05/2012 N Ф03-379/2012.

If financial assistance is an element of remuneration and is provided to an employee for annual leave, then the basis for its payment are:

— employee’s application for leave;

— an order from the head of the institution to provide the employee with leave and pay financial assistance in the established amount.

Let's define the terms

Issues of incentives, bonuses for employees, as well as various financial assistance are found everywhere and sometimes are not at all simple. The Labor Code will help you deal with them.

The concept of “remuneration for labor” (Article 129 of the Labor Code) includes not only wages, but also compensation, incentive payments, bonuses and other types of incentives. The payment system is regulated by the employment contract, in accordance with the law, and the type of remuneration practiced by the employer.

The amounts of established salaries (tariff rates), compensation and incentive bonuses, and the procedure for bonuses are contained in the collective agreement and other local documents.

In addition, the employer has the opportunity to reward conscientious employees by issuing an unscheduled bonus, declaring gratitude, awarding a certificate or gift.

Application of regional coefficients

In accordance with Art. 315-317 of the Labor Code of the Russian Federation for persons working in the regions of the Far North and equivalent areas, the use of regional coefficients and percentage increases in wages, the amount of which is established by the Government of the Russian Federation, is provided. Let us note that similar norms exist in Art. 10 and 11 of the Law of the Russian Federation of February 19, 1993 N 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas.” However, the acts provided for by the above norms have not been issued, and therefore previously published legal acts of federal government bodies of the Russian Federation or government bodies of the former USSR that do not contradict the Labor Code of the Russian Federation (Part 1 of Article 423 of the Labor Code of the Russian Federation) are applied. Accordingly, one should be guided by the Explanation approved by Resolution of the Ministry of Labor of the Russian Federation No. 49.

According to clause 1 of the Explanation, percentage bonuses for persons working in the regions of the Far North, equivalent areas, in the southern regions of Eastern Siberia, the Far East, and coefficients (regional, for work in high mountain areas, for work in desert and waterless areas) established to the wages of persons working in areas with unfavorable natural and climatic conditions are accrued on actual earnings, including remuneration for long service, paid monthly, quarterly or in a lump sum.

In addition, according to paragraph 19 of the Instruction on the procedure for providing social guarantees and compensation to persons working in the regions of the Far North and in areas equated to the regions of the Far North, in accordance with current regulations, approved by Order of the Ministry of Labor of the RSFSR dated November 22, 1990 N 2, The salary for which bonuses are calculated does not include payments based on wage coefficients, average earnings, one-time remuneration for length of service, remuneration based on the results of work for the year, financial assistance, as well as payments that are of a one-time incentive nature and are not conditional. wage system.

Since material assistance cannot be recognized as actual earnings, it is not possible to assign a regional coefficient to it.

Financial assistance and alimony obligations

The list of types of wages and other income from which alimony for minor children is withheld is approved by Decree of the Government of the Russian Federation of July 18, 1996 N 841. According to paragraphs. "l" clause 2 of this List, alimony is withheld from amounts of financial assistance, except for one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, extra-budgetary funds, at the expense of foreign states, Russian, foreign and interstate organizations, other sources in connection with a natural disaster or other emergency circumstances, a terrorist act, the death of a family member, as well as in the form of humanitarian assistance and for assistance in identifying, preventing, suppressing and solving terrorist acts and other crimes. That is, alimony should be withheld from amounts of financial assistance.

Taxation of financial assistance

Personal income tax withheld from the amount of financial assistance exceeding 4,000 rubles should be reflected by posting:

DEBIT 70 (76) CREDIT 68, subaccount “Personal Tax Payments”

— personal income tax is withheld from the amount of financial assistance.

When calculating contributions for insurance against industrial accidents and occupational diseases on the amount of financial assistance, make an entry:

DEBIT 91-2 CREDIT 69-1-2

— premiums are charged for insurance against industrial accidents and occupational diseases.

Amounts of financial assistance exceeding 4,000 rubles are subject to insurance contributions.

Accrue contributions using the following transactions:

DEBIT 91-2 CREDIT 69-1-1 (69-2, 69-3)

— contributions for compulsory social insurance, compulsory health insurance and compulsory health insurance have been calculated.

Financial assistance and average earnings

Let us remind you that average earnings are calculated to pay vacation pay, compensation for unused vacation, as well as to calculate temporary disability benefits, maternity benefits, and monthly child care benefits. In this case, the average earnings for paying vacation pay and compensation for unused vacation are calculated in accordance with Art. 139 of the Labor Code of the Russian Federation and Procedure No. 922, and for calculating benefits - in accordance with Federal Law No. 255-FZ and Regulation No. 375.

So, according to Art. 14 of Federal Law N 255-FZ, clause 2 of Regulation N 375, benefits for temporary disability, maternity benefits, monthly child care benefits are calculated based on the average earnings of the insured person, calculated for the two calendar years preceding the year of the onset of temporary disability, maternity leave, child care leave, including during work (service, other activities) with another policyholder (other policyholders). At the same time, the average earnings, on the basis of which these types of benefits are calculated, include all types of payments and other remuneration in favor of the insured person, for which insurance contributions to the Social Insurance Fund are calculated in accordance with Federal Law N 212-FZ.

Let us clarify that by virtue of clause 3, part 1, art. 9 of Federal Law No. 212-FZ are not subject to insurance premiums for the amounts of one-time financial assistance provided by insurance premium payers:

- to individuals in connection with a natural disaster or other emergency circumstance in order to compensate for material damage caused to them or harm to their health, as well as to individuals who suffered from terrorist acts on the territory of the Russian Federation;

- to an employee in connection with the death of a member (members) of his family;

- to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child, paid during the first year after birth (adoption), but not more than 50,000 rubles. for each child.

Financial assistance paid not on the grounds mentioned above is subject to insurance contributions if it exceeds 4,000 rubles. per employee for the billing period (clause 11, part 1, article 9 of Federal Law N 212-FZ).

That is, the amounts of financial assistance listed in clause 3, part 1, art. 9 of Federal Law N 212-FZ, as well as those not exceeding 4,000 rubles, are not taken into account when calculating average earnings for the purpose of calculating temporary disability benefits, maternity benefits, and monthly child care benefits. Other financial assistance in an amount exceeding RUB 4,000. per employee per calendar year, is included in the employee’s average earnings for calculating benefits.

When calculating average earnings for vacation pay and compensation for unused vacation, all types of payments provided for by the remuneration system used in the institution are taken into account, regardless of their source (Article 139 of the Labor Code of the Russian Federation and clause 2 of Order No. 922). By virtue of clause 3 of Order No. 922, when calculating average earnings in this case, social payments and other payments not related to wages, in particular, financial assistance, payment for the cost of food, travel, training, utilities, and recreation are not taken into account.

What does the law say?

According to the law, the concept of material assistance includes any transfer of both money and medicines, food, clothing or shoes, transport and other material resources to people in need. This is the interpretation of the National Standard of the Russian Federation (GOST R 52495-2005) in terms of social services.

This applies primarily to persons affected by terrorist attacks or natural disasters. But there is no clear interpretation in the legislation of providing it to ordinary workers. In general, this definition includes damage to health (not through the fault of the enterprise), financial troubles on a particularly large scale and, as mentioned above, a significant event, for example, the birth of a child.

We remind you that the law, even in these cases, does not oblige the employer to provide assistance to the employee, i.e. this is an absolutely voluntary matter.

Documenting

The procedure for paying financial assistance must be enshrined in a local regulatory act: a collective agreement, Regulations on remuneration, Regulations on payment of financial assistance (a sample is given below), or others.

Regulations on the payment of financial assistance to employees of the Federal State Budgetary Institution "Novorossiysk Research Institute of Traumatology and Orthopedics" of the Ministry of Health and Social Development of the Russian Federation

1. General Provisions

1.1. This Regulation provides for the payment of financial assistance to employees of the Federal State Budgetary Institution “Novorossiysk Research Institute of Traumatology and Orthopedics” of the Ministry of Health and Social Development of the Russian Federation (hereinafter referred to as the Institution).

1.2. Financial assistance can be provided one time or several times during the calendar year.

2. Directions and amount of financial assistance

2.1. For the purpose of social protection of employees of the Institution and non-working pensioners of the Institution, they may be provided with financial assistance from funds coming from the federal budget (if there are savings in the wage fund), as well as from funds coming from extra-budgetary sources (from income-generating activities, directed by the Institution to pay employees).

2.2. An employee is considered to be an employee hired under an employment contract.

2.3. Financial assistance for partial reimbursement of costs in connection with expensive treatment of an employee is:

- for the purchase of expensive medicines and other medicinal products and equipment - up to 20,000 rubles;

— for treatment, prosthetics and dental implantation, harvesting and replanting of a dental bone block — up to 150,000 rubles;

— for inpatient treatment, including sanatorium-resort treatment — up to 50,000 rubles;

— for surgical operations for vital indications — up to 50,000 rubles.

In exceptional cases, by decision of the director, an employee may be provided with financial assistance in large amounts.

In this area, financial assistance is provided upon provision of relevant documents from the medical institution.

2.4. If an employee suffers material damage as a result of emergency circumstances (burglary, apartment flooding, etc.), assistance is paid in the amount of up to 50,000 rubles.

The fact of a natural disaster, theft and the amount of damage must be confirmed by relevant documents.

2.5. Financial assistance in connection with death:

- employee (working or dismissed) - up to 30,000 rubles;

- close relatives (Article 2 of the RF IC) - from 10,000 rubles. up to 30,000 rub.

2.6. Financial assistance to women on maternity leave aged 1.5 to 2 years - in the amount of 20,000 rubles. at one time. Financial assistance is provided subject to the employee’s application before the child turns two years old.

2.7. Financial assistance to an employee upon dismissal due to retirement, including illness and disability:

- with work experience in the Institution from 1 to 5 years - in the amount of the official salary;

- with work experience in the Institution from 5 to 10 years - in the amount of two official salaries;

- with more than 10 years of experience in the Institution - in the amount of four official salaries.

2.8. Financial assistance in connection with the birth of a child - in the amount of 50,000 rubles.

2.9. Financial assistance in connection with marriage - in the amount of 10,000 rubles.

2.10. Financial assistance to an employee in connection with an anniversary (40, 45, 50, 55, 60 years, then by decision of the director) - in the amount of 10,000 rubles.

2.11. Financial assistance for specific social needs:

- in case of difficult financial situation of the employee - from 10,000 rubles. up to 30,000 rubles;

— for urgent needs (once per calendar year) — up to 10,000 rubles;

- for social needs in addition to the amount of annual basic paid leave - up to 30,000 rubles;

— for preparing schoolchildren for first grade — 5,000 rubles.

2.12. An employee has the right to receive financial assistance on all the grounds provided above, no more than once a year for each of them.

3. Procedure for obtaining financial assistance

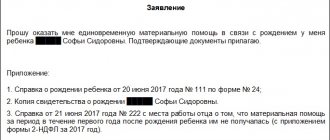

3.1. To receive financial assistance, a personal application from the employee (his close relative) or a pensioner is drawn up in the name of the director, indicating the reasons for paying financial assistance and attaching documents confirming the right to receive it.

3.2. When paying financial assistance in connection with the death of close relatives, the employee himself (working or dismissed) must submit a copy of the death certificate to the accounting department.

In such cases, financial assistance is issued:

- employee (in case of death of close relatives);

- close relatives of the employee (in the event of the death of the employee himself - working or dismissed) upon presentation of copies of documents confirming family ties (birth certificates, marriage certificates, etc.).

3.3. Payment of financial assistance is formalized by the accounting department with an expense order and issued from the cash desk or transferred to the current account specified in the submitted application.

3.4. Amounts of financial assistance are not taken into account as expenses recognized when calculating income tax.

3.5. This Regulation comes into force on January 9, 2013.

Director Sinyakov /Sinyakov V.A./

As we have already indicated, the employee must submit an application in any form addressed to the employer, attaching copies of the relevant supporting documents.

Let us present the main reasons for the allocation of financial assistance in the table and indicate what documents they must be confirmed with.

| Reasons for paying financial assistance | Supporting documents |

| In connection with emergency situations (theft, fire, flooded apartment, etc.) | Documents confirming the fact of an emergency situation, issued by the relevant organization |

| For surgery, expensive treatment, prosthetics, expensive medications | — contract for treatment, surgery; — doctor’s certificate; — documents confirming actual payment (payment documents, invoices, invoices, receipts, other necessary documents issued in the name of the applicant, and receipts for the purchase of medicines); - personalized recipes. If necessary, you can also request certificates from relevant institutions, organizations, documents (referral, epicrisis, etc.) indicating the medical institution, confirming the need for paid expensive medical care for vital indications |

| Due to the difficult financial situation, which is justified, in particular, by the following: - lives alone (one); - has a disability; — one (one) is raising children and has no income other than a salary; - the large family; — husband (wife) is temporarily unemployed; and so on. | — certificate of disability; — single mother’s certificate; — copies of the child’s birth certificate; and so on. |

| On the occasion of the death of close relatives (mother, father, wife, husband, children) | — a copy of the death certificate; — a copy of the marriage certificate (for husband, wife); - copy of birth certificate (for children) |

| To organize an employee's funeral | If there are relatives: — a copy of the death certificate; — a copy of the marriage certificate (for husband, wife); — a copy of the birth certificate (for children). If there are no close relatives: — a copy of the death certificate; — receipts and checks confirming funeral expenses; - a petition from the trade union for the allocation of funds indicating who is trusted to receive the money |

| In connection with the wedding | Copy of marriage certificate |

| In connection with the birth of a child | Copy of the child's birth certificate |

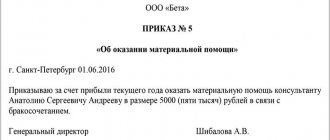

When considering an application submitted by an employee, the employer puts its resolution on the payment or non-payment of financial assistance. If the manager approves the payment of financial assistance, an order is issued, which must contain the required details: Full name. the person receiving financial assistance, its amount and source of payment, as well as the basis. Let us remind you that there is no unified form for such an order, so it is issued in a free form approved by the institution.

Here is a sample order for the payment of financial assistance in connection with expensive treatment.

FSBI Novorossiysk Research Institute

Traumatology and Orthopedics" Ministry of Health and Social Development of the Russian Federation

| Novorossiysk | 15.01.2013 |

Be specific

In the regulations on financial assistance to an organization, all the circumstances of its payment must be specified as precisely as possible; vague formulations such as “for the purpose of social protection” are unacceptable. Otherwise, the tax service will suspect management of trying to understate the size of the tax base.

In a large enterprise, the procedure for paying it in branches must strictly correspond to the same as in the central office. Liberties in the interpretation of the main order are unacceptable.

An order for payment of assistance is issued when the manager, after reading the employee’s application and checking the documents, agrees. What else should you know?

The order for the enterprise must include the exact amount and payment period, as well as the full name of the recipient of assistance, the basis and a link to the regulatory document regulating the system of financial assistance in the organization.

It is also necessary to indicate sources (for example, from profit - current or previous years).