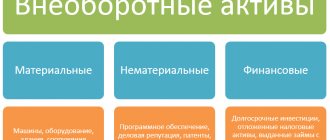

Almost any enterprise has property that is included in current assets and is necessary for carrying out current activities. However, if everything is clear with equipment and financial savings, then intangible assets raise more questions. They are not expressed in material form; they usually exist in the plane of legal rights. But, despite the fact that they do not have any physical expression, intangible assets are also the most important component of any company, reflect its liquidity and stability, and allow it to make a profit.

How to draw up an act of commissioning an intangible asset ?

What are intangible assets

Intangible assets are those objects that do not have a material embodiment, but at the same time generate profit and are used in production for more than one calendar year.

In general terms, intangible assets usually come down to copyrights, patent rights, know-how, breeding achievements, business reputation and other similar assets. In other words, intangible assets are objects of intellectual property that are directly used in production, but are not a tangible object that, roughly speaking, “can be touched.”

The absence of a material form is the key difference between intangible assets and fixed assets. Otherwise, from the point of view of use and accounting, these categories of assets are quite similar: they can be capitalized through purchase, independent creation or inclusion in the charter capital from the founder; they are depreciated, used for more than 12 months and are not intended solely for resale.

They are also shown differently on the balance sheet. There is a balance sheet line “Fixed assets”, there is a line “Intangible assets”. As for current accounting, entries related to intangible assets are posted to account 04 “Intangible assets”, as well as account 05 “Amortization of intangible assets”.

To recognize an object as an intangible asset, the ability to identify and separate it from other assets is important. For example, the professional qualities and skills of employees will not be considered intangible assets, since they are inseparable from the employee who possesses them.

For example, a bakery invented a new technology for producing pies and patented it. The equipment involved in the production process will be fixed assets, the products will be materials, the pies themselves will be finished products and goods, but the patented technology will be classified as intangible assets.

IFRS, Dipifr

This is a continuation of the article on the valuation of intangible assets. If intangible assets were acquired separately or created internally (as a result of R&D), then such assets are measured at cost. In this case, the issue of assessing intangible assets comes down to determining which expenses can be included in the cost of an intangible asset and which are expenses of the period. The first part of the article, which concerns the assessment of intangible assets in business combination transactions, was published earlier.

Valuation of intangible assets acquired separately

Let us once again recall the criteria for recognition of an intangible asset prescribed in IFRS 38.

- (a) it is probable that the entity will receive expected future economic benefits from the asset;

- (b) the cost of the asset can be measured reliably.

If a company buys an intangible asset (for example, a license), it does so because it expects to receive economic benefits from it in the future. Therefore, the first criterion for recognizing an intangible asset is automatically considered fulfilled. The cost of an asset at purchase can also be reliably estimated. The purchase price in one way or another reflects the magnitude of the expected economic benefits. This is especially true where the purchase consideration is in the form of cash.

Example 2: Customer Lists – Acquired and Internally Generated

On January 1, 2014, the Gamma company acquired the client list of another company for RUB 200,000. Gamma may sell this acquired customer list to third parties. Gamma's management believes that in 2014, additional costs of RUB 30,000 (salaries of responsible employees) were incurred to maintain and develop this acquired list of clients. In addition, Gamma has built up its list of loyal customers over the years of its activity.

How should two lists of customers be reported in the financial statements?

Solution

1) A company cannot recognize an intangible asset in relation to an internally generated customer list because IAS 38 expressly prohibits the recognition of internally generated intangible assets. The costs of building such a list of clients cannot be distinguished from the costs of developing the business as a whole.

2) The acquired customer list meets the definition of an intangible asset because it is separable (it can be sold to a third party). This intangible asset should be initially recognized in the amount of ₽ 200,000.

3) However, the additional ₽30,000 incurred to maintain and develop the acquired customer list should be recognized as an expense in determining profit or loss for the year. Subsequent costs for customer lists (whether obtained externally or generated internally) are always recognized in profit or loss. This is because such expenses cannot be distinguished from business development expenses in general and, therefore, do not meet the recognition criteria.

Paragraph 20, IAS 38 The nature of intangible assets is such that, in many cases, improvements or partial replacement of such assets will not occur. Accordingly, most subsequent costs are likely to provide the expected future economic benefits embodied in the existing intangible asset, but will not satisfy the definition of an intangible asset and the recognition criteria in this Standard. In addition, it is often difficult to attribute subsequent costs directly to a specific intangible asset rather than to the business as a whole.

Thus, only rarely are subsequent costs—costs incurred after the initial recognition of an acquired intangible asset or the completion of self-creation of an intangible asset—recognized as part of the asset's carrying amount. All subsequent costs for trademarks, title data, publishing rights, customer lists and similar items (whether acquired or self-generated) are always recognized in profit or loss as incurred. This is due to the fact that such costs cannot be distinguished from the costs of business development as a whole.

In this example, the value of the acquired intangible asset is equal to its purchase price. But in addition to the purchase price and the cost of purchased intangible assets, direct costs related to preparing the asset for use are included.

clause 27, IFRS 38 The cost of intangible assets upon acquisition is equal to:

purchase price + import duties + non-refundable taxes - trade discounts - refundable taxes + DIRECT costs of preparing the asset for use.

clause 28, IFRS 38 Examples of direct costs that are included in the cost of an intangible asset:

- (a) employee benefit costs that are directly related to bringing the asset into working condition;

- (b) professional costs directly related to bringing the asset into working order; And

- (c) the cost of verifying that the asset is operating properly.

EXAMPLE 3: Purchasing software for production equipment

On January 1, 2011, the company purchased a software package for manufacturing equipment for the amount of ₽600,000, including refundable purchase taxes of ₽50,000. The purchase was financed with a loan of RUB 600,000 at 10% per annum. The loan is secured by the purchased software license.

In January 2011, the company incurred costs to customize the software to make it more suitable for the equipment used by the company: • Salaries of employees involved in customizing the software - ₽ 70,000 • Depreciation of fixed assets used for customization - ₽ 15,000

In January 2011, the company's production staff completed a training course in using the new software. The cost of an external expert instructor was RUB 17,000.

In February 2011, the company's production team reviewed the software and the information technology team made some changes necessary for the software to function properly. During the testing phase, the following costs were incurred: • Materials - ₽ 21,000 • Salaries of production team employees - ₽ 31,000 • Depreciation of fixed assets when they were used for modification - ₽ 5,000 In addition, as a result of the sale of goods received during the testing phase, the company gained ₽ 3,000.

The new software was ready for use on March 1, 2011. However, due to low initial orders, the company incurred a loss of ₽23,000 on the software during March.

What is the cost of intangible assets (software) upon initial recognition?

Solution

Reimbursable taxes must be subtracted from the purchase price. A purchase loan is a financial liability; interest on it will be written off as expenses for the period. But since the asset was prepared for its intended use within two months, interest on the loan for January-February is included in the initial cost of the asset (IFRS 23): RUB 600,000 x 10% x 2/12 = RUB 10,000.

Software setup and testing are direct costs related to preparing the asset for its intended use and are therefore included in the cost of the asset. Employee training is written off as period costs, since it is not directly related to preparing the asset for use (this is personnel training).

| Description | Sum | A comment |

| Purchase price | 550,000 | Purchase price less refundable purchase taxes |

| Setup costs | 85,000 | Salary 120,000 and depreciation 15,000 |

| Testing costs | 57,000 | Materials 21,000, salary 31,000, depreciation 5,000 |

| Training costs | 0 | Period costs |

| Product at testing stage | 0 | Income of the period |

| Loan interest | 10,000 | According to IFRS 23 |

| Total | 702,000 |

The initial loss of ₽ 23,000 is written off to the income statement. Software as an intangible asset will be amortized from March 1, 2011. Until March 1, all costs for preparing, setting up and testing intangible assets will be collected as part of a separate asset (in Russian accounting on account 08).

Clause 29, IFRS 38 Examples of costs not included in the cost of an intangible asset are:

- (a) costs associated with the introduction of new products or services (including costs of advertising and promotional activities);

- (b) costs associated with conducting business in a new location or with a new category of clients (including costs of personnel training); And

- (c) administrative and other general overhead costs.

- (d) costs incurred while an asset capable of being used as intended by management has not yet been brought into service; And

- (e) initial operating losses, for example, those incurred during the period when demand for the results produced by the asset was generated.

EXAMPLE 4. Valuation of intangible assets acquired partially in exchange for another asset

On January 1, 2015, the company received landing rights at the local airport in exchange for 9,000 liters of aviation fuel and RUB 100,000 in cash. Aviation fuel costs ₽50 per liter.

Landing rights received (an intangible asset acquired in an exchange transaction) should be measured at RUB 550,000 (their fair value) on initial recognition. The fair value of landing rights is determined based on the fair value of aviation fuel RUB 450,000 (ie 9,000 liters × RUB 50 per liter) plus cash of RUB 100,000.

EXAMPLE 5. Exchange of intangible assets

Alpha and Beta companies produce chemicals in different countries (jurisdictions). On January 1, 2015, Alpha and Beta expanded their product lines and granted each other the right to manufacture each other's patented products in their respective home jurisdictions. The fair value of both the asset received and the asset given up cannot be measured reliably. The carrying amount of the patented rights granted by Alpha and Beta was RUB 10,000 and RUB 20,000, respectively.

The resulting trademarks (intangible assets acquired in an exchange transaction) must be measured at initial recognition at ₽10,000 and ₽20,000 respectively by Alpha and Beta (ie they are measured at the carrying amount of the asset transferred in the exchange transaction).

Valuation of an intangible asset when it is created within the company

To assess whether an independently created intangible asset meets the recognition criteria, an enterprise divides the process of creating the asset into two stages:

- (a) stage of research;

- (b) development stage.

Expenses incurred during the research stage are written off as period expenses. IFRS 38 allows expenses at the development stage to be capitalized on the balance sheet as an asset. This asset is not depreciated because it is not yet ready for use (08 account). If a company cannot separate the research stage from the development stage, then all costs are written off to the income statement.

The research stage includes research conducted with the prospect of obtaining new scientific or technical knowledge: new materials, devices, products, processes, services, etc. The development phase involves the application of research results to produce new or significantly improved materials, devices, products, processes, systems or services before commercial production or use. This stage includes the design, manufacture and testing of prototypes, pilot plants, prototypes, etc.

Capitalization of costs is limited to the fulfillment of six conditions, i.e. This is the exception rather than the rule. The Dipifr exam always indicates whether these conditions are met or not. But in real life, reading accounting documents, determining the moment when the development stage began is not so easy. For a correct interpretation, it is necessary to talk with the company’s engineering specialists who know the details of the projects. It happens that in Russian accounting some expenses are capitalized and then written off because the project brought a negative result. When transforming from RAS to IFRS, such costs should not be capitalized initially. Perhaps a good indicator of the transition of a project to the development stage is the fact that a prototype of a future product has been manufactured based on new materials, formulas, etc.

Not only is the capitalization of R&D costs tightly constrained, but the amount of capitalized costs must be tested for impairment at each reporting date. Any excess of the cost of such an asset over its recoverable amount must be written off as an impairment loss in profit or loss.

Note to Dipifr students - such a combined task according to the standards of IFRS 38 “Intangible Assets” and IFRS 36 “Impairment of Assets” may well appear on the exam.

Example 6. Valuation of intangible assets obtained as a result of an R&D project

In 2015, a detergent manufacturer spent the following amounts during a project to find a new chemical formula that would allow the company to gain a competitive advantage by improving the performance of its products.

• ₽ 200,000 - experiments with chemicals to discover improved cleaning compounds • ₽ 30,000 - evaluation of the suitability of various compounds - safety for people • ₽ 15,000 - payment for registering a patent for the most effective chemical compound • ₽ 73,000 - development and testing of experimental prototypes after September 1 • ₽ 20,000 – advertising a new product

On 1 September 2015, the company was able to demonstrate the commercial viability and technical feasibility of the project (paragraph 57 of IAS 38). Cost savings from the new manufacturing process are expected to be at least ₽50,000 annually for a minimum of 5 years after production of the improved formula product begins.

What is the cost of the intangible upon initial recognition?

The following amounts will be recognized as a development asset after 1 September 2015:

| Description | Sum | A comment |

| Patent | 15,000 | Payment for patent registration |

| Testing | 73,000 | Expenses after September 1, 2015 |

| Total | 88,000 |

The following will be written off to the company's profit/loss for the year ended December 31, 2015:

₽ 200,000 + 30,000 = 230,000 - expenses for research work ₽ 20,000 - for advertising a new product.

Total expenses ₽ 250,000

At the reporting date, an entity must test for impairment a recognized asset that is not yet available for use. If the recognized amount of an asset exceeds its recoverable amount, an impairment loss must be recognized. In this case, there is no impairment loss, since even the undiscounted flows from cost savings (₽50,000 x 5 years = ₽250,000) exceed the cost capitalized on the balance sheet (₽88,000).

Conditions for recognition of intangible assets at the development stage:

Clause 57, IFRS 38 Intangible assets created within a company can only be recognized at the moment when the company can demonstrate:

- (1) The technical feasibility of completing the creation of the intangible asset so that it can be used or sold.

- (2) Intent to complete the creation of the intangible asset and use or sell it.

- (3) Ability to use or sell intangible assets.

- (4) How the intangible asset will create probable future economic benefits. Among other things, the company may demonstrate that there is a market for the product of the intangible asset, or the intangible asset itself, or, if the asset is intended to be used internally, may demonstrate the utility of the intangible asset.

- (5) Availability of sufficient technical, financial and other resources to complete the development, use or sale of intangible assets.

- (6) The ability to reliably estimate the costs associated with an intangible asset during its development.

I hope these simple examples will help you understand the theory set out in international standards, which is quite boring to read without examples.

Other articles:

Intangible assets: what they include in accounting, examples, accounting according to IFRS 38

IFRS 36 Impairment of Assets in Plain English (Part 1)

IFRS IFRS 15: examples of accounting for contract modifications

EPS indicator - calculation formula. Basic earnings per share

Go back to main page

Do not apply to intangible assets

- R&D that did not produce a positive result, was not completed or was not formalized in the prescribed manner;

- things in which the results of intellectual activity and equivalent means of individualization are expressed (for example, CDs with programs recorded on them);

- financial investments;

- expenses associated with the formation of a legal entity (organizational expenses);

- intellectual and business qualities of the organization’s personnel, their qualifications and ability to work.

Reflection of intangible assets in accounting and financial statements

Intangible assets are recorded on account 04 “Intangible assets”, amortized and reflected in the balance sheet at their residual (book) value as part of non-current assets on line 1110 “Intangible assets”.

A breakdown of the information on intangible assets is given in tables 1.1 – 1.5 of the Explanations to the balance sheet and financial results statement (Appendix No. 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n).

Write-off of obsolete intangible assets

In accordance with PBU 14/07, intangible assets that are not capable of generating income are subject to write-off. Income and expenses on the disposal of intangible assets are taken into account in other income and expenses in account 91. In tax accounting (accounting for determining income tax), the residual value of intangible assets (under-marketed) reduces the income tax.

Let's look at an example:

Know-how (intangible assets) initial cost is 500,000 rubles, the amount of accumulated depreciation is 300,000 rubles. Due to the fact that this intangible asset no longer generates income, it was decided to write off the intangible asset due to obsolescence.

Solution:

- Debit 05 Credit 04-300,000 rubles - Accumulated depreciation is written off.

- Debit 91-2 Credit 04- 200,000 rubles. (500,000-300,000). The residual value of intangible assets has been written off.

- Debit 99 Credit 91-9-200,000 rubles - At the end of the reporting period, the LOSS is written off to the financial result.

Let's break it down according to the charts of accounts (airplanes):

Comments: The residual value in the amount of 200,000 rubles in tax accounting reduces taxable profit. (In accordance with the tax code art. 265 p1. p. 8)

Reasons for the occurrence of intangible assets

Intangible assets arise on certain grounds. Their presence must be documented. This is especially important when accounting for intangible assets. You can confirm the grounds for obtaining rights with the following documentation:

- Patents.

- Agreements for the transfer of rights.

- Purchase and sale agreements.

- Licenses for the right to operate.

- Agreements on the transfer of rights to inventions and know-how.

Intangible assets can be either created by the enterprise itself or acquired. In the first case, you need to obtain a patent. For example, a company made an invention in the manufacturing industry and is actively using it. However, the discovery will not be included until a patent is granted. Another example: an organization uses the invention of another person. To obtain rights to it, you need to draw up an agreement for the transfer of an intangible asset.

The discovery may belong to the employees of the enterprise. In this case, an agreement on the execution of R&D is concluded with employees. The mere fact that an employee invented something does not mean that the discovery belongs to the enterprise.

How long do they serve?

To write off the cost of an intangible asset, you need to determine its useful life. This is the duration of the exclusive rights or the period during which the company plans to receive income from the asset. For some intangible assets, the service life is determined by the number of products that the company plans to produce with its help.

The company annually inspects assets with an indefinite life. If something has changed and the period can be determined, then depreciation begins to be charged on the asset*.

Valuation of intangible assets

The principles for valuing intangible assets were invented by economist Leonard Nakamura, working in the United States. He proposed three main criteria for assessment:

- Estimated financial result. That is, you need to calculate how much profit the acquired or developed asset will bring.

- Costs associated with the creation or acquisition of intangible assets.

- Increase in operating profit due to the introduction of intangible assets.

IMPORTANT! The cost is determined based on the price of the item at the time of its receipt. Typically, the primary cost can be determined based on the concluded contract for the transfer of rights. They can be transferred to the company free of charge. In this case, the assessment is carried out based on the market value of similar objects.

The basis for the assessment may be the totality of costs associated with obtaining the asset. The list of expenses may include:

- amount paid to the seller;

- payment for intermediary services;

- receiving advice related to the acquisition of an asset;

- customs duties.

It will be more difficult to evaluate assets that were created by the enterprise itself. The price will include the following expenses:

- developer salaries;

- social Security contributions;

- material costs for carrying out development activities.

The original cost can only change when revalued or depreciated. For example, an organization bought a patent, the market value of which jumped. However, later there was a sharp decline. The value of the asset indicated in the accounting documents should be brought into line with its actual value.

Where do they come from

Intangible assets are purchased, created on their own, received as a gift or as a share in the authorized capital. The options differ in the way the initial cost is calculated.

When purchasing, the initial cost includes all actual expenses for acquiring the asset:

- the cost of exclusive rights under an agreement with the copyright holder;

- the cost of consultations required to purchase the asset;

- non-refundable taxes, government and patent fees;

- customs duties and fees;

- remuneration to the intermediary through whom the asset was purchased.

VAT is not included in the price. But if you are on the simplified tax system, input VAT is included in the cost of the purchased property*.

When created, the initial cost is the sum of all costs for its development and registration: costs of materials, labor, insurance premiums, electricity, third-party services, patent fees.

The rest is quite simple.

If the intangible asset was donated , the initial cost is taken at the market value or determined by an expert. The services of an appraiser in this case are not intangible assets, but management expenses.

If the intangible asset is received as a share in the authorized capital , the initial cost is determined by the board of founders. For example, students started a startup. Some invested in money, some in real estate, and some with their unique streaming video compression algorithm. They determine how much this algorithm costs themselves, based on the amount of contributions from others.

Rules for accounting for intangible assets

The unit of measurement of intangible assets is an inventory object. This term refers to the totality of all rights associated with the purchase of one asset. An object may include rights to a collection of objects.

Objects are recorded in account 04 “Intangible assets”. The accounting must indicate their original cost. The situation is somewhat more complicated with depreciation. In relation to some assets, it cannot be reflected on account 05 “Depreciation of assets”. Accruals are indicated in the credit column of account 4 “Intangible assets”. The receipt of objects into the enterprise is reflected in the debit of account 04. The correspondence will be account 08 “Investments in non-current assets”.

Documenting

For each intangible asset object, the enterprise draws up a proper protocol, and also creates a special accounting card, which reliably indicates all the characteristics of the object, its significant features, valuation, useful life period, and depreciation rates.

The same document, by the way, records any changes in the accounting status for an intangible asset, that is, the facts of its appearance (acquisition, creation), modification, sale, transfer, disposal, write-off.

Any movements of intangible assets at the enterprise are documented with appropriate primary documents that clearly reflect the essence of the procedures performed.

Each operation with an intangible asset must have a basis confirmed by a title document.

The fact of write-off (disposal) of a specific intangible asset is documented at the enterprise by drawing up a write-off act. In addition, the relevant information is indicated in the registration card of the decommissioned (retired) object.

Depreciation

There are two methods used to calculate depreciation:

- Linear. The linear method takes into account depreciation rates determined on the basis of the period of use of the object.

EXAMPLE. The company acquired assets in the amount of 12,000 rubles. The period of use is 4 years. To calculate annual deductions, you need to divide the amount by the terms. Get 3,000 rubles. This amount can be divided by 12. This will determine the monthly deductions.

- Declining balance. Deductions are calculated based on the residual value at the beginning of the reporting period.

EXAMPLE. Assets were purchased for the amount of 10,000 rubles. To determine the annual rate, you need to divide 10,000 rubles by 100%. It will be 10%. The annual depreciation amount will be 1,000 rubles (10,000 times 10%). The residual value will be 9,000 rubles (10,000 – 1,000).

Intangible assets, despite the lack of physical form, must be correctly reflected in accounting. To do this, you need to know the signs of intangible assets and the rules for calculating depreciation charges.

How are they depreciated?

Amortization is the gradual transfer of the value of an intangible asset to the cost of products or services.

Depreciation is charged for each intangible asset on a monthly basis, starting from the next month after commissioning. We bought the rights to the logo in May, started using it in June, and depreciation will begin in July.

When an asset is completely depreciated or is written off from the balance sheet as unnecessary, depreciation stops on the 1st day of the next month. They were written off in May, June is the last month of depreciation of the asset.

If the useful life of an intangible asset cannot be determined, depreciation is not charged on it.

The method of calculating depreciation is chosen based on the planned income from the use of an intangible asset. There are three methods of depreciation:

Linear is the simplest. Assumes equal accrual over the useful life. This method is also used when it is impossible to calculate the income from the use of an asset or this calculation is unreliable.

Declining balance - a smooth decrease in the original cost along a flat curve. The method was borrowed from IFRS and does not work well in our context. We have no concept of depreciable or salvage value.

Write-off of cost is proportional to the volume of production - when you need to link expenses to a specific activity or product.

The chosen method is fixed in the accounting policy.