Home / Real estate / Land / Taxes

Back

Published: 04/01/2017

Reading time: 12 min

0

703

One of the reasons for citizens’ failure to fulfill their tax obligations is the insufficient level of organization of the tax authorities themselves, which do not always fulfill their obligations to timely send the relevant receipts to all payers.

Next, we will consider the most common reasons for not receiving a notice to pay land tax, as well as the necessary actions and possible consequences for the landowner.

- Legislative regulation

- Reasons for missing a receipt

- Authority to apply for receipt and payment methods

- Procedure for receiving a subpoena

- Liability for non-payment

Why haven't I received a receipt for payment of land tax?

Reasons why land tax is not received:

- The Federal Tax Service did not send a receipt. By law, notice must be delivered no later than 30 days before the payment deadline.

- The taxpayer belongs to the category of citizens who have benefits. The full list of beneficiaries can be found in Article 391 of the Tax Code.

- The payment amount is less than 100 rubles. The notification will not be sent until the payment amount exceeds 100 rubles.

- The inspectorate did not receive data on the land plot from Rosreestr. In the current year, the state duty for the previous year is paid. If the land is purchased this year, the receipt will arrive only next year.

- The citizen changed his place of residence and did not notify the inspectorate, so the tax was sent to the old address.

- The notification was lost in transit.

IMPORTANT! If a taxpayer is registered on the tax office website, the Federal Tax Service stops sending paper receipts. You can view them in your personal account and print them yourself.

Procedure for receiving a subpoena

After the payer becomes overdue for land tax, more fines and penalties begin to accumulate against him, which leads to an increase in his debt. Within three years after the debt arises, the tax authority has the right to file a lawsuit against the payer to collect this debt, including at the expense of his property, cash or non-cash funds.

After receiving a subpoena, the landowner first of all needs to establish whether the demands of the tax authority are legal and whether any violation has been committed on his part.

In particular, demands for recovery will be illegal in the following cases:

- the inspection did not send a notification to the payer or did so in violation of the deadlines;

- the landowner is exempt from paying tax under the benefit;

- the notification was sent to the old address, although the payer notified the inspectorate of the change of place of residence;

- the tax was calculated incorrectly, and the owner of the land paid only the amount that he calculated;

- the citizen is no longer the owner of the plot (for example, he sold it or donated it).

It is worth considering that this list of cases is not exhaustive or established by law. The final decision on whether the demands of the Federal Tax Service are legal or not is made only by the judicial authority.

In each of the listed cases, the payer will need to prepare the most complete package of documents that can be used as evidence of his case.

For example it could be:

- a notification letter with a dispatch date (if it is later than the established date);

- documents confirming that the payer belongs to a preferential category (pension certificate, certificate of a large family, certificate of disability, etc.);

- papers for the plot (including information about its cadastral value, if recalculation of the tax amount is required);

- a copy of the passport page with a registration mark;

- documents on the alienation of the plot (sale and purchase agreement, exchange, deed of gift, etc.).

All these documents will need to be submitted to the court, which will make the final decision on whether the payer’s actions were at fault or not. If he manages to prove that he is right, part or all of the accrued fines and penalties will be written off.

However, if there is a real debt, he will still have to pay it off.

What to do if the receipt has not arrived

If the payment deadline is approaching, and the land tax has not arrived either by mail or in your personal account, you need to contact the inspectorate to find out the reason.

The Federal Tax Service employee prints out the receipt that needs to be paid. But if there is no information about the plot, you need to provide a package of documents to enter information about the land into the tax service database.

On the website, through your personal account, it is possible to send a statement about the absence of a receipt or enter information about the land plot if it is not displayed. Applications are reviewed and responded to within the period established by law.

Land tax: subjects and objects of taxation, tax base, rates and benefits

Subjects of taxation

Taxpayers, on the basis of Art. 388 of the Tax Code of the Russian Federation, legal entities and individuals are recognized - owners of a land plot, as well as owners and users of land plots, in whose possession or use this land plot is indefinitely.

Those whose land plots are leased or for temporary free use do not need to pay land tax.

Objects of taxation

Taxed according to Art. 389 of the Tax Code, land plots located within the boundaries of the constituent entities of the Russian Federation and municipalities.

Not subject to tax, acc. with the laws of the Russian Federation, land plots:

- Removed from circulation.

- Limited in circulation: occupied by objects of cultural heritage, including world heritage, historical, cultural, archaeological monuments, museum-reserves;

- Land plots where state water resources are located.

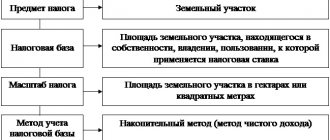

Tax base and its definition

The tax base (TB) for land tax is the KS - the cadastral value of the taxable object, established at the beginning of the tax period (TP), that is, the first of January (Article 391 of the Tax Code of the Russian Federation).

- For new land plots formed during the NP, the tax base is considered to be the KS at the time of registration of the land plot in the Unified State Register.

- If the land plot occupies the territories of different municipalities, then the tax base of each share of the land plot is calculated: the cadastral value of the entire land plot must be multiplied by the ratio of the area of the share to the total area of the land plot.

- The tax base for each share is also determined separately if several persons have common shared ownership, or if each share of the property has its own tax rate.

When changes in cadastral value are taken into account

Changes in the CS during the tax period are taken into account:

- when correcting errors made when calculating the KS;

- by decision of a court or commission considering disputes regarding cadastral value;

- if the change in the CS was the result of transferring the memory from one category to another.

In other cases, changes in cadastral property throughout the entire tax period are not taken into account to determine the national security.

- Taxpayers, legal entities (organizations), independently determine the CS according to the information from the Unified State Register of Real Estate.

- The tax base for individuals is determined by the tax authorities based on information received from the Unified State Register of Real Estate.

Tax, reporting period and tax rates

The tax period is equal to the calendar year (Article 393 of the Tax Code).

Reporting periods: first, second and third quarters. Reporting periods may not be established by decision of the authorities.

Tax rates are set in accordance with Art. 394 NK of the following size:

0.3% of KS:

- Land plots on agricultural lands or in settlement areas intended for agricultural production;

- Land plot for private household plots (personal subsidiary plot), SNT (gardening non-profit partnership), ONT (gardening non-profit partnership), livestock;

- Housing facilities and occupied by housing and communal services facilities;

- land plots used for defense and security purposes in the border and customs zones.

1.5% - all other memories.

Tax benefits

Based on Art. 391 of the Tax Code, a tax deduction in the amount of a cadastral stipulation of 600 m2 of land plot area is provided in accordance with clause 5 of Art. 391, to the following persons:

- heroes of the USSR and the Russian Federation;

- disabled people of the first and second groups;

- disabled children, as well as people with disabilities since childhood;

- veterans and disabled people of WWII and combat operations;

- persons covered by social protection programs who suffered as a result of disasters at the Chernobyl Nuclear Power Plant and Mayak Production Association;

- persons who worked in high-risk units, participating in testing atomic weapons and eliminating the consequences of nuclear accidents at military facilities;

- persons who became disabled or suffered from radiation sickness as a result of testing nuclear weapons (installations) or spacecraft and equipment;

- pensioners and persons who have reached retirement age and are on lifelong support.

A tax deduction can be applied only to one of the plots owned, in perpetual possession or use by the taxpayer. The tax authorities must be notified of the selected site no later than November 1 of the calendar tax year.

If the tax deduction exceeds the tax base, then it is considered equal to zero.

Full tax exemption

Exempt from land tax, according to Art. 395 of the Tax Code of the Russian Federation, the following organizations and individuals in relation to land plots on which objects related to their professional, statutory or other activities are located:

- Penal system (institutions of the penal system);

- organizations serving roads of national importance;

- public all-Russian org. disabled people: in relation to areas where production or sale of goods is carried out (except for excisable ones), while the number of disabled workers must be at least 50% of the total number of employees, and at least 25% of the total must be spent on remuneration for disabled people payment fund;

- in relation to storage facilities used by organizations of disabled people for treatment and health, educational, cultural, sports, information purposes, recreation, rehabilitation and social adaptation;

Tax benefits in relation to shipbuilding organizations, residents of SEZs and SEZs are terminated in the event of their division or merger of land plots in relation to newly formed land plots as a result of the reorganization.

Is it possible to pay without a receipt?

There are two ways to pay tax without a receipt.

In online banking, the payment is made using the TIN number. To do this, in the column about choice. But you won’t be able to find and pay the current tax, only the debt.

The Federal Tax Service website contains information about taxes. In order to pay off the debt, you must:

- Click on the “Individuals” column.

- Click on the item “Payment of taxes and insurance contributions for individuals.”

- Enter the document index in the special field.

- Select a payment type and enter the amount.

- Add the site address, phone number and other owner details.

The taxpayer can print out the receipt and pay it at the bank or directly on the Federal Tax Service website.

Authority to apply for receipt and payment methods

In a situation where the payment deadline is already coming to an end and there is still no notification,

The payer must take care of obtaining a receipt independently.

You must apply for this to the Federal Tax Service division whose jurisdiction falls territorially at the site it owns. Also, in some cases, it is possible to contact the inspectorate located at the payer’s place of residence.

As a rule, a separate unit or inspectors are responsible for land tax in this body, who will be able to calculate it.

Perhaps the employee already has this data (for example, if the notification was sent and lost in transit), so all he has to do is print out the receipt and give it to the payer. In any case, this operation will not take much time.

Another option is to obtain data through the payer’s personal account on the Federal Tax Service website (registration is required for this). Provided that the Federal Tax Service has data on the taxable object and the tax has been calculated, the user will be able to generate the data necessary for payment.

If the object of taxation is not listed in the database, the payer must provide a certain package of documents to the inspectorate during the application. In particular, you will need title papers for the plot and a cadastral passport (extract from the Unified State Register).

Of course, if the owner has all the necessary information (tax rate, cadastral value of the plot, payment details), he can calculate and pay the tax himself.

However, an error in calculations can lead to underpayment of tax, which will subsequently result in financial sanctions for him. Therefore, it is better to get a receipt from the inspection staff.

After receiving the receipt, the landowner will be able to pay it in one of the following ways:

- through a banking institution;

- online using Internet banking;

- through a payment terminal;

- using the service “State;

- online using electronic money.

The law allows the use of any of these methods, but it should be taken into account that each of them has a certain period for crediting funds. Therefore, payment should be made at least a few days before the deadline for paying the tax.

Making changes to the cadastral passport of a land plot is possible only with the participation of a cadastral engineer. How is the fee for an easement set? Find out about this by reading our article.

In some cases, it is allowed to use a land plot without giving it ownership. Read more about this here.

The legislative framework

Settlement lands are prescribed in the Land Code of the Russian Federation.

In this document, a whole section is dedicated to them - 15. like this:

- Art. 83 - defines the very concept of “settlement land” and the order to which their definitions and zoning are subject.

- Article 84 - gives characteristics regarding the establishment of the boundaries of such a settlement. And how it should be established, who installs and determines it.

- Art. 85 - describes the composition of these lands and territorial zoning, rules and regulations for urban planning.

- Article 86 - determines the composition of natural zones, their boundaries and rules of use.

Purchase and rental

To acquire land, you must first study what the purpose of the territory is and what type of buildings are allowed to be built on it.

What you should pay attention to when purchasing a plot:

- Inconsistency between the data set out in the contract and the real state of affairs. The land may not be intended for the construction of a building, as is the case with private household plot land. Or the land plot is part of a green fund, where the territory can only be rented, but not purchased. Individual housing construction land is best suited for such cases.

- The territory may be under arrest, or ownership of it has been acquired by the state.

- The papers may contain discrepancies in the description, parameters, and dimensions of the site.

- A purchase and sale agreement cannot be drawn up without notifying family members or guardianship authorities if the plot belongs to a person under the age of majority.

List of required documents for purchasing a plot:

- Civil passport or identity document of a proxy.

- A legal entity is required to provide a registration document.

- Cadastral passport (without this document the transaction will be invalid).

- A document confirming the owner's rights to the site.

- Refusal in writing from a constituent entity of the Russian Federation to purchase land.

Problems with the cadastral value of land

The standard tax base for land tax is determined for each specific land plot as its cadastral value as of January 1 of the year that is the tax period (clause 1 of Article 391 of the Tax Code of the Russian Federation). Revaluation of the cadastral value of land is carried out every 5 years.

READ ON THE TOPIC:

How to legally register the rights to a country house or an unfinished house, starting from 2021.

If the land plot is allocated during the tax period, then the taxable base in this tax period will be determined as its cadastral value on the date of entering the data, which serves as the basis for determining the cadastral value such land in the Unified State Register of Real Estate (USRN).

The law specifies that changes in cadastral value made during the year will not be taken into account in this tax period, as well as in previous ones. Previously, this possibility existed in two cases.

Firstly, when an error is discovered, the correction of which entails a change in the cadastral value. In such situations, recalculation was performed starting from the moment when erroneous data was used for calculations.

Secondly, when the value of the cadastral value was changed by a decision of the commission for resolving disputes about the results of determining the cadastral value or by a court decision. The recalculation was carried out starting from the tax period in which the taxpayer submitted an application for revision of this parameter, but not earlier than the date of entering information on the cadastral value into the Unified State Register of Real Estate, which became the subject of challenge

The cadastral value of the plot also changes when the type of permitted use of the land plot changes or it is transferred from one category of land to another.

However, these points are not specified in the amended version of the Tax Code of the Russian Federation. Accordingly, in all the cases described above, the general scheme will be applied, when the edited data will be applied already in the period following the period when the correction occurred. The same opinion on this issue was expressed by the Constitutional Court in Ruling No. 212-O dated 02/09/2017, without taking into account how this situation affected the taxpayer’s position. The Ministry of Finance gave a similar explanation in Letter dated April 14, 2017 No. 03-05-04-02/22593.

However, this procedure applies only to changes in cadastral value relating to the period up to 2021 inclusive.

Legislators took into account the current situation and corrected it. But the provision is that if a change in the value of the cadastral value occurred due to a change in the type of permitted use of the land plot and (or) its transfer from one category of land to another, and only then will it be taken into account when determining the tax base from the date of entering the necessary information into the Unified State Register of Real Estate, will come into force only on 01/01/2018.

How to calculate land tax: formula and examples

To calculate land tax based on cadastral value, a single formula is used (Article 396 of the Tax Code):

ZN = NB × D × NS × K, where

- NB - tax base, determined based on the cadastral value of land plots;

- D - size of the share, with shared ownership;

- NS - tax rate;

- K is the coefficient of time of ownership of the plot (in this case, the full month will be taken as the one in which the right arose before the 15th day or was terminated after the 15th day. And the month in which the right arose after the 15th day or was terminated before the 15th day is not taken into account at all).

Important! Article 52 of the Tax Code of the Russian Federation establishes that the tax is calculated to the nearest whole number, applying the rounding rule.

Example 1. Calculation of land tax for 12 months

Owned by Sokolenko Yu.V. There is a plot of land in the Leningrad region, Priozersk. Its cadastral value is 867,459 rubles.

Calculation of land tax:

The tax rate for this piece of land is 0.3.

ZN = 867,459 × 0.3% = 2602 rubles.

Example 2. Calculation of land tax for one and ten months

Citizen K. bought and registered ownership of a plot of land for gardening on March 13, 2021 in the Moscow region. Then the months of ownership will be taken from March to December, that is, 10 months. The cadastral value of the plot is 1,244,000 rubles.

Calculation of land tax:

The tax rate for the region is 0.3.

Plot ownership coefficient: K = 10 /12 = 0.8333

ZN = 1,244,000 × 0.3% × 0.8333 = 3110 rubles.

Citizen F. sold a plot of land on February 10, 2021 for 385,000 rubles. Since the alienation transaction occurred before the 15th day of the month, it will not participate in the calculation of the tax due. Therefore, only 1 month (January) can be taken into account.

Tax calculation:

Tax rate - 0.3. Plot ownership coefficient: K = 1 /12 = 0.083

ZN = 385,000 × 0.3% × 0.083 = 96 rubles.

Land tax calculator

The correctness of land tax calculations can be checked on the official website of the Federal Tax Service. Among the electronic services there is a very convenient online land tax calculator.

The result of your calculation may not always coincide with the opinion of the tax office. This situation may arise when an error is made or benefits are not taken into account. To restore justice, you must contact the Federal Tax Service with an application drawn up in two copies. Be sure to attach documents to your application that will make your position clear.

The tax authority is obliged to review the application and documents and make a decision to refuse or change the tax amount. The refusal must be reasoned and issued in writing. If you persist in your position, go to court.

Composition and purpose of settlement lands

The composition of settlement lands may include the following territorial zones and have their own purpose:

- Residential - intended for development of residential buildings, as well as cultural and social buildings. Such buildings can be individual and one-story, have a medium and large number of floors, as strictly ordered by type. So have a mixed character.

- Public - they are built up with objects intended for public use.

- Business - administrations, business centers and everything related to the conduct of both business and control over the city are often located here.

- Production - contain industrial and warehouse facilities.

- Engineering - consists of units and enterprises for the operation of these systems.

- Transport - all road and railway facilities are located here. River, sea, air and similar plans.

- Recreational - intended for recreation of citizens, and consists of parks. Forests, squares, ponds and lakes.

- Farmland is used for its intended purpose - for agricultural work.

- Special - this can be a protected ancient tree, or a special object for government purposes.

- Military - these lands are reassigned for military units and their infrastructure facilities, training grounds and the like.

- Others include all zones that are not included in this list.

Possible when. The above-mentioned site and the buildings on it do not comply with the regulations for the construction of a settlement on it: the lack of availability of their type of use as permitted by the regulations, discrepancy in the size of the site. Those that are established in the town planning regulations.

How do general rules and local specifics relate?

The rules for calculating and paying land tax are enshrined in Chapter 31 of the Tax Code. The provisions of this chapter are the same for all municipalities of the Russian Federation, but local authorities have the right to establish some features within the framework of general rules.

Thus, the municipality can approve its own tax rates, but these rates should not exceed the maximum values set out in the Tax Code. In addition, for organizations, a municipal entity has the right to set its own deadline for paying taxes and advance payments, provided that the last date for transferring money is not earlier than the one specified in the Tax Code of the Russian Federation. For individuals, the tax payment deadline is fixed directly in the Tax Code. Finally, local authorities can introduce their own land tax benefits, as well as establish or not establish reporting periods within the tax period.

Legal regulation

Legal regulation is also described in Articles 83, 84, 85 and 86 of the Land Code of the Russian Federation:

- Additional changes in cities of federal significance: Moscow, St. Petersburg and Sevastopol, are carried out by the laws of these subjects.

- Also, according to the laws of land use and development, plots that are owned by private, legal entities or leased can be purchased or seized in favor of the state.

- The territories through which the border passes must be provided as property to private, legal entities or leased.

- Only the laws of the constituent entities of the Russian Federation can change the territorial border. As for cities of federal significance: Moscow, St. Petersburg and Sevastopol, changes in the boundaries of these cities are carried out by federal legislation through agreement with local authorities of the city and region.

- Territorial boundaries for administrative zones are established only by the government of the Russian Federation. Individuals and legal entities do not lose the right to own property in the form of land and real estate after their inclusion in the settlement.

- Urban planning regulations must be taken into account by all land owners or tenants without exception. Persons who own or lease plots of land are required to use them for their intended purpose in accordance with the zone in which they reside and the regulations established for this zone.

- The size of territories and legal norms can be changed in suburban areas only by constituent entities of the Russian Federation. The exception is the suburban areas of Moscow, St. Petersburg and Sevastopol, they change in accordance with federal laws.

- Zones occupied by forests of the first category may come under the control of the suburban zone based on a decision of the Government of the Russian Federation.

New declaration form is in effect

The innovation in land tax for legal entities from 2021 concerns the submission of a declaration for the period 2021 in a new form and format. They, as well as the procedure for filling them out, are now fixed by order of the Federal Tax Service dated May 10, 2021 No. ММВ-7-21/347.

The table below lists the main adjustments that have occurred in the land tax return form for legal entities since 2021:

| Declaration section | New declaration form | The previous form of the declaration (approved by order of the Federal Tax Service dated October 28, 2011 No. ММВ-7-11/696) |

| Title page | Removed the field for OKVED codes | There was a field for the OKVED code |

| Section 2 | Line 050 was supplemented with the indicator “Standard price of land” (filled out for plots in Crimea and Sevastopol) | Line 050 provides only the indicator “Cadastral value of a land plot” (it is not possible to indicate the standard price of land) |

The total number of lines is 25. The following lines are missing:

| Total number of lines – 28 |

You can check the correctness of filling out the land declaration in 2018 using special control ratios for it. They are confirmed by letter of the Federal Tax Service of Russia dated July 13, 2021 No. BS-4-21/13656.

Also see “What will change in 2021: taxes, insurance premiums, reporting, accounting and a new fee.”

Read also

26.12.2017

Tax rate

Each municipality approves its own land tax rates, subject to the restrictions established by the Tax Code. It names the maximum values for various categories of land. Thus, for agricultural plots, plots occupied by housing stock and plots intended for personal subsidiary and dacha farming, gardening, vegetable farming and livestock farming, the maximum permissible rate is 0.3%. For all other lands the maximum rate is 1.5%.

In addition, local authorities have the right to differentiate rates depending on the categories of land and the permitted use of the site. You can find out what rates and benefits have been introduced in your area by contacting your tax office.

Who should calculate the tax amount?

After purchasing land or acquiring it in another way , land real estate is registered in the local branch of the State Real Estate Cadastre (GKN). The registrar, when registering an object for cadastral registration after a property transaction, transmits information to the local branch of the Federal Tax Service (FTS).

Based on the information received from the State Tax Committee, authorized persons from among the specialists of the settlement department of the Federal Tax Service independently calculate the tax amount payable. Only citizens receive this benefit; this service is not provided to enterprises and organizations.

After the tax has been calculated , a postal item containing notification of the calculated amount and the timing of payment is sent to the home address of the landowner who has taken possession of the plot. The notice specifies the amount to be paid and payment details.

From what age?

The notification is addressed to a person who responsibly manages the site, who has reached the age of majority and is fully capable. If the owner has not reached the age of 18, the responsibility for paying taxes lies with his parents - the child’s legal representatives, or his guardians.

At the discretion of the representatives, it is permissible to submit an application to delegate tax responsibility to a person who has reached 14 years of age. Such an application is submitted to the head of the local branch of the Federal Tax Service. It states a request to charge tax to the direct owner of the land plot who has not reached the age of eighteen and expresses consent to the transfer of tax liability.

If a minor payer is late in payments, claims from the Federal Tax Service will be directed towards the applicant representing his property interests.