Intangible assets include: scientific developments, trademarks, research costs, software, works of art, know-how, and so on.

1C 8.3 has full functionality for working with intangible assets. In this article, I want to consider step by step all the operations that can be performed in the program. These include receipt, acceptance for accounting, write-off and transfer (sale) of intangible assets.

Unlike fixed assets, such assets cannot be “touched” and placed in a warehouse.

Reasons for writing off intangible assets

According to clause 34 of the Regulations, the cost of a retiring asset or object that is no longer capable of generating economic benefits is subject to write-off in accounting. At the same time, the amount accumulated in the account is written off. 05 depreciation (when using this account). Possible reasons for disposal of intangible assets are:

- Completion of the established period of validity of exclusive rights to the asset.

- Transfer on the basis of alienation of the right to an object.

- Transfer of rights to an asset to other third parties, including due to collection or succession.

- The onset of obsolescence, leading to the impossibility of further use of the asset.

- The object's contribution to the authorized capital or mutual fund.

- Transfer of an asset under a gift/exchange agreement.

- Introducing intangible assets as a contribution to joint activities.

- Detection of the fact of shortage of an asset during inventory.

- Other circumstances.

Receipt of intangible assets in 1C 3.0

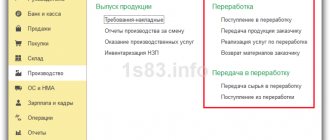

The first step for accounting for intangible assets is to create the document “Receipt of intangible assets”. Let's go to the "OS and intangible assets" menu, follow the link "Admission of intangible assets" to the list of admission documents:

To create a new document, you need to click the “Create” button (you can press the “Insert” key on your keyboard).

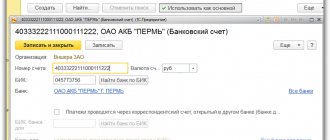

Let's move on to filling out the document. First, fill in the header details, namely the required fields – Organization, Counterparty and Counterparty Agreement. If the counterparty already has an agreement with the supplier and there is only one, the field will be filled in automatically when selecting the counterparty.

I would also recommend filling out the optional fields “Document No.” and its date. This is the number and date of the primary incoming document from the supplier. Sometimes this can be very useful to quickly find the source document.

Next we move on to the tabular part. By clicking the “Add” or “Insert” button on the keyboard, we add a new line. Selecting an intangible asset. It is worth noting that intangible asset cards are stored not in the usual “Nomenclature” directory, but in a special “Intangible Assets” directory. You can find it in the “Directory” menu, section “OS and intangible assets”.

Then enter the purchase amount of the intangible asset. If the organization is a VAT payer, indicate the VAT rate. In the header of the document you need to indicate whether VAT is included in the amount or should be added on top.

The details “Account” and “VAT Account”, if the program is configured correctly, will be assigned automatically in accordance with the settings.

At the bottom of the document, enter the number and date of the incoming invoice and click the “Register” button.

Filling out the document is complete. Click the “Proceed” button. Here's what I got:

After execution, 1C will generate the following transactions for intangible assets:

As you can see, upon receipt, an intangible asset goes to account 08.05 - “Acquisition of intangible assets.”

Documents for writing off intangible assets

The procedure for writing off intangible assets after the expiration of their useful life (USP) is accompanied by the preparation of primary documentation in accordance with Art. 9 of Law No. 402-FZ dated December 6, 2011. The forms can be approved by the head of the enterprise with the entry of all mandatory details, including the reason for disposal.

List of documents for write-off of an asset in connection with the end of the established SPI:

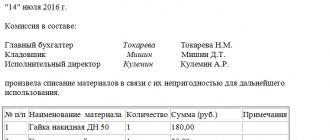

- The act and order for writing off intangible assets - the forms are signed by the head of the company; it is required to indicate the basis for writing off the object. In the case of a special commission, the act is signed by all participants, and the composition is pre-approved by the director of the enterprise.

- Intangible asset registration card - on the basis of the drawn up act, the corresponding entries on the write-off of the object are made in the registration card. Depreciation ceases from the month following the disposal period.

Documents required for write-off

To reflect the disposal of intangible assets, the following primary documents are required:

The organization develops the forms of both acts independently. A common mandatory requirement for them is to indicate the reason for disposal of the asset.

Read about the rules for completing forms INV-1a and INV-18 in the articles:

- “Unified form No. INV-1a - form and sample”;

- “Unified form No. INV-18 - form and sample.”

Write-off of intangible assets - postings

The financial result from the disposal of intangible assets is generated by the organization's accountant on the account. 91 (clause 35 of the Regulations) as part of other income/expenses. All standard transactions should be reflected in the period when the income or expense was actually generated. In this case, the following transactions are made:

- D 05 K 04 – intangible assets are written off through accrued depreciation.

- D 91.2 K 05 – the residual value of intangible assets is written off as other expenses if the account. 05 was used.

- D 91.2 K 04 – the residual value of intangible assets is written off as other expenses if the account was not used. 05.

If the enterprise additionally incurred costs in connection with the disposal of the object, the following entry is made:

- D 91.2 K 60, 76, 10, 69, etc.

Accounting and postings

The financial result of the procedure for removing an intangible asset from the balance sheet is reflected in account 91. Transactions are recorded in accounting in the period in which income/expenses arise.

Typical correspondence is shown in the table.

| Operation | Debit | Credit |

| Intangible assets are written off through accumulated depreciation | 05 | 04 |

| The residual value is written off (account 05 was used) | 91/2 | 05 |

| The residual value of the object is written off (the 05-account was not used) | 91/2 | 04 |

| Additional costs of the enterprise for write-off are taken into account | 91/2 | 69,10,76,60,others |

Depreciation

If the 05-account was used to accumulate depreciation (accrual of depreciation), the amount of accumulated depreciation will be written off by correspondence of debit 05 with credit 04, and the residual value of the intangible asset, determined by 04-account, is transferred to other costs by correspondence of debit 91/2 with credit 04.

If the 05 account was not opened to accumulate depreciation, depreciation was written off directly from credit 04. In this case, the residual value is identified and transferred to other costs.

General audit department on the issue of writing off intangible assets for tax accounting purposes

Answer Article 1225 of the Civil Code of the Russian Federation establishes that the results of intellectual activity and equivalent means of individualization of legal entities, goods, works, services and enterprises that are granted legal protection (intellectual property) are, among other things, trademarks and service marks.

According to paragraph 1 of Article 1477 of the Civil Code of the Russian Federation, a trademark, that is, a designation used to individualize goods of legal entities or individual entrepreneurs, is recognized as an exclusive right, certified by a certificate for a trademark (Article 1481 of the Civil Code of the Russian Federation).

A trademark certificate certifies the priority of the trademark and the exclusive right to the trademark in relation to the goods specified in the certificate (clause 2 of Article 1481 of the Civil Code of the Russian Federation).

In accordance with paragraph 1 of Article 256 of the Tax Code of the Russian Federation, depreciable property for the purposes of this chapter is property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer (unless otherwise provided by this chapter), used by him to generate income and cost which are repaid by depreciation. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 40,000 rubles.

According to paragraph 3 of Article 257 of the Tax Code of the Russian Federation, intangible assets acquired and (or) created by the taxpayer are the results of intellectual activity and other objects of intellectual property (exclusive rights to them) used in the production of products (performance of work, provision of services) or for the management needs of the organization for a long time time (lasting over 12 months).

To recognize an intangible asset it is necessary

the presence of the ability to bring economic benefits (income) to the taxpayer, as well as

the presence of properly executed documents confirming the existence of the intangible asset itself and (or) the taxpayer’s exclusive right to the results of intellectual activity

(including patents, certificates, other documents of protection, assignment (acquisition) agreement ) patent, trademark).

Intangible assets, in particular, include the exclusive right to a trademark.

Thus, in order to recognize, for the purposes of Chapter 25 of the Tax Code of the Russian Federation, expenses for the acquisition (creation) of a trademark as an intangible asset, it is necessary to have documents confirming the taxpayer’s exclusive rights to this trademark.

As stated above, the exclusive right to a trademark is confirmed by a trademark certificate.

As follows from the question, the Organization was refused to register a trademark. Accordingly, it does not have documents of protection for the trademark confirming the exclusive right of the Organization.

In this regard, your organization has no grounds for recognizing the costs of developing a trademark as intangible assets.

In this regard, we will consider the possibility of recognizing incurred expenses for income tax purposes.

In accordance with paragraph 1 of Article 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses

carried out by the taxpayer.

Justified expenses mean economically justified expenses

, the valuation of which is expressed in monetary terms.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were incurred, and (or) documents indirectly confirming the expenses incurred. expenses (including customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

.

Thus, the necessary conditions for recognizing expenses for the purpose of calculating income tax are:

— economic feasibility;

- focus on generating income;

— availability of documentary evidence.

Economic feasibility and focus on generating income.

First of all, we note that the concepts of economic feasibility and focus on generating income are not clearly defined. The criteria for classifying expenses as justified and aimed at generating income are subjective in nature and are assessed based on the specific circumstances of the case. In connection with this, disputes often arise with the tax authorities on this issue.

The Constitutional Court in its Determinations dated December 16, 2008 No. 1072-O-O, dated June 4, 2007 No. 320-O-P and dated June 4, 2007 No. 366-O-P explained the main points related to the interpretation of the concepts of justification and economic justification and application norms of Article 252 of the Tax Code of the Russian Federation:

1. Expenses are justified and economically justified if they were incurred to carry out activities aimed at generating income. In this case, only the purpose and direction of such activity matters, and not its result.

(paragraph 7, 8 paragraph 2 of Definition No. 1072-O-O, paragraph 3, 4 paragraph 3 of Definition No. 320-O-P, paragraph 3, 4 paragraph 3 of Definition No. 366-O-P).

2. The economic justification of expenses cannot be assessed based on their feasibility, rationality, efficiency or the result obtained (paragraph 9, paragraph 2 of Definition No. 1072-O-O, paragraph 5, paragraph 3 of Definition No. 320-O-P, paragraph 5 clause 3 of Definition No. 366-O-P).

Only the taxpayer alone has the right to evaluate the expediency, rationality, and efficiency of financial and economic activities

. Thus, based on the principle of freedom of entrepreneurial activity, the courts are not called upon to check the economic feasibility of business decisions made by the taxpayer (paragraphs 9, 10 paragraph 2 of Definition No. 1072-О-О, paragraphs 5, 6 paragraph 3 of Definition No. 320- O-P, paragraph 5, 6 clause 3 of Definition No. 366-O-P, Determination of the Supreme Arbitration Court of the Russian Federation dated August 12, 2008 No. 9783/08).

4. All expenses incurred by the organization are initially assumed to be justified. It is the tax authorities who must prove their groundlessness (paragraph 11, 13 paragraph 2 of Definition No. 1072-O-O, paragraph 7, 9 paragraph 3 of Definition No. 320-O-P, paragraph 7, 9 paragraph 3 of Definition No. 366-O-P).

In addition, according to the regulatory authorities, the focus on generating income arises in the case when expenses are directly related to activities aimed at generating income, while this circumstance does not mean that the Organization should actually receive income - Letters of the Ministry of Finance of the Russian Federation dated 05.09. 12 No. 03-03-06/4/96, dated 12/19/11 No. 03-03-06/1/833, dated 08/25/10 No. 03-03-06/1/565, dated 04/21/10 No. 03-03 -06/1/279, dated 07.17.08 No. 03-03-06/1/414, Federal Tax Service of the Russian Federation for Moscow dated 10.19.10 No. 16-15/ [email protected]

.

From the foregoing, we can conclude that, until the opposite is proven by the tax authorities, expenses are recognized as economically justified. Moreover, since the taxpayer has the right to assess the expediency, rationality, and effectiveness of expenses solely based on the risks of his business activities, such assessments by the tax authorities cannot be the basis for recognizing expenses as unreasonable.

The focus on generating income is evidenced by the direct connection of expenses with the entrepreneurial activities of the organization. The fact that there is no economic benefit in connection with the amount of expenses incurred cannot be a basis for refusing to recognize such expenses.

In the case under consideration, the Organization incurred costs for the development of a trademark. In our opinion, if the trademark was supposed to be used in the activities of the Organization, then the costs of its development, despite the fact that it was not registered, are economically justified expenses, since they are aimed at attracting attention both to the Organization itself and to its products

.

Therefore, they can be taken into account for income tax purposes.

It should be noted that the latest official clarifications on the issue under consideration were given by the Department of Tax Administration of the Russian Federation in letter No. 26-12/55328 dated November 14, 2002. In the said letter from the Department of Tax Administration of the Russian Federation, Fr.

It is also worth noting Resolution No. KA-A40/9241-08 dated 01.10.08, in which the FAS Moscow District, taking the side of the taxpayer, recognized the costs of developing a trademark, the registration of which was refused, as corresponding to Article 252 of the Tax Code of the Russian Federation.

There are no later clarifications or courts on this issue. However, taking into account the above explanations, as well as the court ruling, we do not exclude claims from the tax authority in the event that the expenses in question are recognized for income tax purposes.

Is the taxpayer obliged to restore the amount of previously deducted input VAT if the costs of creating a trademark that was not subsequently registered are written off?

Amounts of VAT on purchased goods (works, services) are accepted for deduction if the following conditions are simultaneously met:

- the amount of tax must be presented, as evidenced by the corresponding invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation);

- goods (work, services), as well as property rights, acquired for the implementation of transactions subject to VAT (subclause 1 of clause 2 of Article 171 of the Tax Code of the Russian Federation);

— goods (work, services) are accepted for accounting on the basis of the relevant primary documents (clause 1 of Article 172 of the Tax Code of the Russian Federation).

If the specified conditions are met, the taxpayer has the right to accept the VAT presented to him as a deduction.

Cases, as well as the procedure for VAT recovery, are established by Article 170 of the Tax Code of the Russian Federation.

The list of situations when VAT previously accepted for deduction is subject to restoration is closed and does not contain such grounds for VAT restoration as refusal to register the results of intellectual activity, or non-compliance of expenses with the requirements of Article 252 of the Tax Code of the Russian Federation.

Taking into account the above, in our opinion, the Organization is not obliged to restore VAT previously legally accepted for deduction on the costs of developing a trademark that was subsequently not registered

.

It should be noted that at the moment there are no clarifications, as well as arbitration practice on the issue of VAT restoration on the cost of acquired works (services) due to the fact that these works (services) were used to develop an object of intellectual activity, which was subsequently not recognized NMA. In this regard, we cannot completely eliminate the risk of claims from the tax authority, whose opinion may be based on the fact that the object being created, in principle, was not used in the activities of the Organization. there were no conditions for deduction.

Can an organization write off intangible assets due to the impossibility of their further use before the expiration of their useful life, with the costs of their write-off (including the amount of underaccrued depreciation) included in non-operating expenses for income tax purposes?

Since we do not have other information, when answering we will proceed from the fact that depreciation on intangible assets was calculated using the straight-line method.

As stated above, for income tax purposes, an object is recognized as an intangible asset if the taxpayer has properly executed documents confirming the existence of an intangible asset or an exclusive right.

As follows from the question, in the case under consideration, these documents have ceased to be valid. In this regard, in our opinion, the Organization has no grounds for further qualification of the object as intangible assets. Consequently, intangible assets for industrial designs are subject to write-off.

For profit tax purposes, in our opinion, the residual value of written off intangible assets can be taken into account as part of non-operating expenses

.

Thus, in accordance with subparagraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, non-operating expenses include expenses for writing off intangible assets, including the amount of depreciation underaccrued in accordance with the established useful life.

A similar opinion was expressed in the letter of the Ministry of Finance of the Russian Federation dated 05.08.11 No. 03-03-06/1/454:

“In accordance with paragraph 3 of Art. 257 of the Code, for the purpose of taxing the profits of organizations, intangible assets are recognized as acquired and (or) created by the taxpayer results of intellectual activity and other objects of intellectual property (exclusive rights to them), used in the production of products (performance of work, provision of services) or for the management needs of the organization during for a long time (lasting over 12 months).

Clause 2 of Art. 258 of the Code provides that the determination of the useful life of an object of intangible assets is made based on the validity period of the patent, certificate and (or) other restrictions on the terms of use of intellectual property objects in accordance with the legislation of the Russian Federation or the applicable legislation of a foreign state, as well as based on the useful life use of intangible assets stipulated by relevant agreements. For intangible assets for which it is impossible to determine the useful life of the intangible asset, depreciation rates are established based on a useful life of 10 years (but not more than the period of activity of the taxpayer).

Taking into account the above, exclusive rights to trademarks and television commercials that meet the criteria established by clause 3 of Art. 257 of the Code are recognized as an intangible asset.

Moreover, in cases where, on the date of putting an intangible asset into operation, it is impossible to determine the validity period of exclusive rights based on a contract or civil legislation of the Russian Federation, the useful life is determined to be 10 years.

Taking into account the above, for profit tax purposes, the useful life of these intangible assets is set equal to 10 years.

An organization may sell an intangible asset before the end of its useful life, or an object of intellectual property may be declared unsuitable for further use and written off.

In accordance with paragraphs. 8 clause 1 art. 265 of the Code, expenses for the liquidation of fixed assets being decommissioned, for the write-off of intangible assets, including the amount of depreciation underaccrued in accordance with the established useful life, as well as expenses for the liquidation of unfinished construction projects and other property, the installation of which has not been completed (costs of dismantling, dismantling , removal of disassembled property), subsoil protection and other similar work are included in non-operating expenses not related to production and sales.

Expenses in the form of amounts of depreciation underaccrued in accordance with the established useful life are included in non-operating expenses not related to production and sales only for depreciable property items for which depreciation is calculated using the straight-line method. Objects of depreciable property for which depreciation is calculated using the non-linear method are taken out of service in the manner established by clause 13 of Art. 259.2 of the Code.

Thus, if exclusive rights to trademarks and television commercials are recognized in accordance with the provisions of Art. Art. 256 and 258 of the Code with amortizable intangible assets and the taxpayer in its accounting policy uses the linear method of calculating depreciation, then expenses in the form of amounts of depreciation under-accrued in accordance with the established useful life are included in non-operating expenses in accordance with paragraphs. 8 clause 1 art. 265 Code

».

Is it legal to include in expenses for tax purposes the amount of depreciation accrued in the period from 2012 to the current date?

As follows from the question, the patent expired in 2012. However, the intangible asset was not written off and until now depreciation continued to accrue on the intangible asset.

From the information provided, we can conclude that due to the fact that in 2012 the residual value of intangible assets was not written off, for the tax period of 2012, as a result of an error, the taxable base for income tax was overestimated.

In subsequent periods (2013-2015), mistakes made led to an understatement of the tax base, since expenses included depreciation on an object that should no longer be taken into account.

These errors led to the following tax consequences:

— overstatement of the amount of income tax for 2012;

— understatement of the amount of income tax for 2013-2015.

Taking into account the above, we will consider the procedure for correcting mistakes.

In accordance with paragraph 1 of Article 54 of the Tax Code of the Russian Federation, if errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods, in the current tax (reporting) period, the tax base and tax amount are recalculated for the period in which they were made. specified errors (distortions).

If it is impossible to determine the period of errors (distortions), the tax base and tax amount are recalculated for the tax (reporting) period in which the errors (distortions) were identified. The taxpayer has the right to recalculate the tax base and the amount of tax for the tax (reporting) period in which errors (distortions) relating to previous tax (reporting) periods were identified, also in cases where the errors (distortions) led to excessive payment of tax .

At the same time, according to paragraph 1 of Article 81 of the Tax Code of the Russian Federation, if a taxpayer discovers in the tax return submitted by him to the tax authority the fact of non-reflection or incomplete reflection of information, as well as errors leading to an understatement of the amount of tax payable, the taxpayer is obliged to make the necessary changes to the tax return and submit to the tax authority an updated tax return in the manner prescribed by this article.

If a taxpayer discovers inaccurate information in the tax return submitted to the tax authority, as well as errors that do not lead to an understatement of the amount of tax payable, the taxpayer has the right to make the necessary changes to the tax return and submit an updated tax return to the tax authority in the manner prescribed by Article 81 Tax Code of the Russian Federation.

Thus, if the error made by the taxpayer did not lead to an understatement of income tax, it can either be corrected in the current period, or corrected in the period in which it was made by filing an updated return

. If an error results in an understatement of tax, an amended tax return must be filed.

In the case under consideration, in our opinion, the mistake made did not generally lead to an understatement of the tax, since the amount of accrued depreciation (for the period 2012-2015) does not exceed the residual value of the intangible asset, which should have been written off in 2012. That is, expenses in the form of depreciation, in our opinion, can be considered as parts of the residual value of intangible assets, written off over several tax periods.

Taking into account the above, in our opinion, the Organization has the right to write off the remaining part of the residual value of intangible assets in the current period, without making corrections to past periods

.

I would also like to draw your attention to the fact that, in the opinion of the Ministry of Finance of the Russian Federation, if at the end of the tax periods in which an error was made there was a loss, then the norm of paragraph 3 of paragraph 1 of Article 54 of the Tax Code of the Russian Federation cannot be applied, since in fact such an error did not result in excessive payment of income tax. In this case, you should recalculate the tax base for the period in which the error was made and submit an updated declaration[1].

Accordingly, if in any of the periods of 2012-2013. According to tax accounting data, the organization incurred a loss; there is a possibility that the tax authorities will require the provision of an updated tax return for the corresponding period.

Is the taxpayer obliged to restore the amount of previously deducted input VAT in the event of writing off intangible assets before the expiration of their useful life?

As stated above, paragraph 3 of Article 170 of the Tax Code of the Russian Federation defines cases in which tax amounts accepted for deduction by the taxpayer, including for intangible assets, are subject to restoration. At the same time, the legislation on taxes and fees does not contain rules obliging the taxpayer, when writing off the residual value of intangible assets, to restore the amounts of VAT previously legally accepted for deduction. Accordingly, in our opinion, the Organization has no obligation to restore VAT when writing off intangible assets

.

There are no official clarifications on the issue under consideration. At the same time, it should be noted the clarifications that were made regarding the write-off of fixed assets before the end of the depreciation period, since, in our opinion, the situation with the write-off of the residual value of fixed assets is similar to the situation with the write-off of intangible assets.

Thus, in its letter dated March 18, 2011 No. 03-07-11/61, the Ministry of Finance of the Russian Federation indicated:

“According to paragraphs. 1 item 2 art. 171 ch. 21 “Value Added Tax” of the Tax Code of the Russian Federation (hereinafter referred to as the Code), tax amounts presented to the taxpayer when purchasing goods (work, services) in the territory of the Russian Federation used to carry out transactions recognized as objects of taxation by value added tax are subject to deductions.

Based on paragraphs 2 and 3 of Art. 170 of the Code, the value added tax is subject to restoration in cases where the purchased goods (work, services), including fixed assets, are not used for operations for the sale of goods (work, services) subject to value added tax.

Thus, tax amounts on fixed assets liquidated due to an accident before the end of the depreciation period, including the remainder of which are accounted for as scrap ferrous and non-ferrous metals, are subject to restoration in the generally established manner

. In this case, the tax amounts subject to restoration are calculated based on the residual (book) value without taking into account revaluation.”

A similar opinion was expressed in letters of the Ministry of Finance of the Russian Federation dated 03/18/11 No. 03-07-11/61, dated 01/29/09 No. 03-07-11/22, dated 02/07/08 No. 03-03-06/1/86.

At the same time, the courts take the opposite point of view on this issue and point out that Article 170 of the Tax Code of the Russian Federation does not contain provisions according to which the taxpayer is obliged to restore VAT upon disposal of fixed assets in the under-depreciated part (for example, Resolution of the Federal Antimonopoly Service of the Moscow District dated March 23, 2012 No. A40 -51601/11-129-222, dated 06/20/11 No. KA-A40/5832-11, FAS North Caucasus District dated 11/23/12 in case No. A32-36919/2011, FAS North Caucasus District dated 09/22/11 case No. A32-22742/2009, FAS of the North Caucasus District dated 04/13/11 in case No. A32-20112/2010, FAS Central District dated 03/10/10 in case No. A35-8336\08-C8).

Taking into account the above, we do not exclude possible claims from the tax authority regarding unrecovered VAT on the residual value of the written-off intangible asset. At the same time, given the lack of arbitration practice and official clarifications on the issue under consideration, this risk, in our opinion, is minimal. At the same time, taking into account the established arbitration practice, in the event of a dispute, the Organization, in our opinion, will most likely be able to defend its opinion in court.

Board of Tax Consultants, August 24, 2015

[1] Letters of the Ministry of Finance of the Russian Federation dated 05/07/10 No. 03-02-07/1-225, dated 04/23/10 No. 03-02-07/1-188.

Answers to the most interesting questions on our telegram channel knk_audit

Back to section

Intangible assets are not subject to exclusion from depreciable property

Chapter 25 of the Tax Code of the Russian Federation establishes a list of depreciable property that is not subject to depreciation, as well as a list of what is excluded from depreciable property.

The list of depreciable property that is not subject to depreciation is defined in clause 2 of Art. 256 Tax Code of the Russian Federation. The specified list includes acquired rights to the results of intellectual activity and other objects of intellectual property, if, under the agreement for the acquisition of these rights, payment must be made in periodic payments during the term of this agreement (clause 8, paragraph 2, article 256 of the Tax Code of the Russian Federation).

As for the list of depreciable property excluded from this property, it is enshrined in clause 3 of Art. 256 of the Tax Code of the Russian Federation and contains only OS under certain circumstances. In this regard, intangible assets are not subject to exclusion from depreciable property (see Letter of the Ministry of Finance of Russia dated August 12, 2019 No. 03-03-06/1/60597).