Excessive daily allowances are subject to insurance premiums - this is a requirement of the Tax Code, but how is it implemented in practice? In the article we will tell you what rules legislators have established for insurance premiums from daily allowances in 2021, and how to correctly set limits and make calculations.

When sending an employee on a business trip, the employer is obliged to compensate some of his expenses. Thus, the Labor Code establishes an exhaustive list of expenses that must be made at the expense of the employer. These include not only payment for travel and accommodation. Also, at the expense of the company, the seconded specialist must pay daily expenses (DS). Read more in the separate material “Payment of travel expenses in 2021.”

Before determining whether per diem is subject to insurance premiums, here are some key points to remember about business travel.

The employer is obliged to pay the posted employee:

- travel to and from your destination;

- accommodation (housing rental);

- expenses related to the performance of labor duties;

- costs that compensate for the inconveniences associated with living outside the place of residence, or CP.

Travel and accommodation costs are determined based on actual expenses incurred. Moreover, such expenses will have to be documented. That is, provide checks, tickets or receipts. With SR the situation is different. It is quite problematic to document such expenses. Therefore, it is necessary to set a limit for SR - a specific amount of money that will be given to the employee for one day of stay on a business trip.

Daily allowance for business trips in Russia and abroad

The amount of daily allowance is not limited by law (with the exception of employees of government agencies). Managers of private companies determine this parameter independently. The established value must be fixed in internal regulatory documents - for example, in a collective agreement.

We recommend that you take into account that clause 1 of Art. 217 of the Tax Code of the Russian Federation provides for maximum daily allowances that are not subject to personal income tax. Namely:

- up to 700 ₽ for each day of a business trip in Russia

- up to 2500 ₽ for each day of business trip in other countries

We also list the items of expenses that the organization is obliged to reimburse in case of a foreign business trip:

- visa and passport processing

- consular and airport fees

- entry or transit fees for vehicles

- registration of medical insurance policy

- other obligatory payments

Which travel expenses are subject to personal income tax?

Daily allowances are partially subject to personal income tax - they are exempt from tax only within the limits established by the Tax Code of the Russian Federation (clause 3 of Article 217 of the Tax Code of the Russian Federation).

If the manager decides to reimburse the posted employee for expenses in excess of the norm, then this difference is subject to personal income tax.

Clause 3 Art. 217 of the Tax Code of the Russian Federation establishes the following daily allowance rates:

- when a seconded employee is in the Russian Federation - 700 rubles. in a day;

- if a posted employee is located outside the territory of the Russian Federation—RUB 2,500. in a day.

Consequently, personal income tax on business trips will be calculated from the amount of 500 rubles. for each day you are on a business trip, i.e. from the difference between the daily allowance paid and the non-taxable rate established by law (1200 - 700 rubles).

Payment of daily allowances for days spent on the road

According to para. 3 hours 1 tbsp. 168 of the Labor Code of the Russian Federation, the employer compensates expenses for each of the following periods:

- for all weekdays on a business trip

- for weekends and public holidays

- for days on which the journey to the place of business trip and back fell in whole or in part, this also includes periods of forced stops

Let's say an employee went on a business trip on Sunday and returned the following Saturday. In this case, he is entitled to daily allowance for seven days - five weekdays and two weekends.

What travel expenses are not subject to personal income tax?

The Tax Code of the Russian Federation stipulates what is not included in the employee’s income subject to income tax. This includes, among other things, compensation by the employer for the following expenses (clause 3 of Article 217 of the Tax Code of the Russian Federation):

- the cost of travel to the place of performance of the official assignment (regardless of the place of departure for the business trip) and back, including the cost of services in luxury cars;

- commission for airport services;

- the cost of travel to the place of departure (train station, airport), destination or transfers;

- baggage transportation.

Compensation for these expenses is not subject to personal income tax if the expenses are documented. If such documents are missing, the compensation paid is exempt from personal income tax only within the established norms (clause 3 of Article 217 of the Tax Code of the Russian Federation).

In addition, the employee must be reimbursed for the costs of renting housing on a business trip (paragraph 3, part 1, article 168 of the Tax Code of the Russian Federation). If the employee submits supporting documents, then such expenses will be compensated in full and are not subject to personal income tax. In the absence of documents, income tax will not be imposed on the amount within the limits specified in paragraph. 10 clause 3 art. 217 Tax Code of the Russian Federation.

Daily allowance rates in 2021

To date, the procedure for calculating daily allowance remains unchanged compared to last year.

However, it is worth noting that a new concept has recently been introduced: resort fee. Now, employees who, in accordance with their job duties, are in the territory of the “resort” regions of the Russian Federation for more than a day, are paid additional compensation.

The fee is calculated using the following formula:

Number of days of stay, excluding the day of arrival

× amount of the resort fee

You can also read:

Tutu Business Travel is a convenient and transparent service for organizing business trips. More details

The vast majority of companies have business partners. They can be in our country or abroad.

To maintain strong business relationships and to develop their own business and production, enterprise managers send employees on business trips. The purposes of the trip can be different: concluding agreements and signing contracts, searching for new partners and providing various types of services.

When sending its employee on a trip, the organization is obliged to pay travel allowances in accordance with the legislation of the Russian Federation. When sending on a business trip, the company is obliged to pay travel and daily allowances to its employees.

Expert opinion

Korolev Dmitry Viktorovich

Lawyer with 10 years of experience. Specialization: family law. Extensive experience in document examination.

They are accrued for each day of a work trip. The daily allowance amounts are established and are not subject to taxation.

If the amount exceeds the preferential amount, then taxes must be assessed in the prescribed manner.

The hotel must have a category certificate

According to the Regulations on the Classification of Hotels, each of them must be assigned a category. Without a certificate of category it is prohibited to provide hotel services. Depending on the hotel room capacity, the ban comes into force:

- from July 1, 2021, if there are >50 numbers,

- from January 1, 2021, if numbers > 15,

- from January 1, 2012 – for all hotels.

Therefore, starting from July 1 of this year, hotels should be carefully checked before sending an employee on a business trip. When booking rooms, it is advisable to request a copy of the star award certificate. If the posted worker stayed in an uncertified hotel, disputes may arise with the tax authorities regarding written off housing expenses.

Amounts and procedure for calculating tax

At the legislative level, the amounts of travel allowances are established, which are exempt from taxation. Amounts have been determined for trips both within Russia and for work trips abroad.

Amount of daily allowance on which tax is not paid:

- 700 rubles per day for business trips within the country;

- 2500 rubles for foreign business trips.

If the daily allowance is higher than the specified amounts, then tax will be charged on the entire amount exceeding the reduced allowance. An amount exceeding the preferential amount is subject to personal income tax at a rate of 13%. In addition to personal income tax, insurance premiums must be paid on daily allowances in excess of the norm. If their size does not exceed 700 and 2500 rubles, then insurance premiums are not deducted.

When calculating income tax, an organization's accountant has the right to write off the daily allowance issued to an employee in full. According to the Tax Code of the Russian Federation, there is no need to standardize daily allowances. Their inclusion in the company’s expenses is carried out together with the approval of the expense report.

Calculation example: financial analyst Ivanov was on a business trip in Denmark from January 15 to 17. The head of the company set travel allowances to Denmark in the amount of 250 Danish kroner (DDK) per day. The daily allowance for business trips within the country in the company is 700 rubles.

While on a business trip, the employee is accrued the following daily allowances:

- for 2 days in Denmark – 500 CZK (250 DDK per day * 2 days);

- for 1 day of arrival in Russia – 700 rubles.

The Danish krone exchange rate on January 20 was equal to 8.42 rubles/kroner.

The accountant took into account the entire total amount of daily allowance when calculating income tax:

The amount of daily allowance for business trips abroad was calculated based on the exchange rate valid on the date of payment. When calculating the amount of personal income tax, the accountant did not take into account daily allowances, since their amount does not exceed the preferential amount, which is exempt from taxes.

Determining limits

So, the current legislation does not establish a maximum size of SR. However, officials have determined a certain limit, above which daily allowances in excess of the norm are subject to insurance premiums (2018).

Article 217 of the Tax Code establishes that excess daily allowances are subject to insurance contributions (2018). Also, personal income tax will have to be withheld from amounts exceeding the limit. The limits are set as follows:

- for trips within Russia - 700 rubles per day;

- for foreign business trips - 2500 rubles per day.

In other words, if an institution has established large values for this type of expense, then the amount exceeding the limit is subject to taxation (personal income tax and personal income tax). Please note that this limit only applies to taxation. The company has the right to establish a CP greater than specified in Art. 217 Tax Code of the Russian Federation.

Using a specific example, we will determine whether daily allowances are subject to personal income tax and insurance premiums.

Primerov Ivan Andreevich was sent to Moscow for 10 calendar days. 43,000 rubles were allocated for travel expenses, including:

- 5000 rub. - to pay for travel;

- 18,000 rub. — for rental housing (payment for a hotel room);

- 20,000 rub. - SR (2000 rubles per day, therefore, daily allowances over 700 rubles, insurance premiums will have to be charged).

Amounts allocated for travel and accommodation are not subject to taxes. But above-limit daily allowances are subject to insurance premiums. Let's do the calculation:

- We determine the amount of excess (2000 rubles – 700 rubles) × 10 days. = 13,000 rub.

- We calculate personal income tax: 13,000 × 13% = 1,690 rubles.

- We determine the amount of SV: 13,000 × 30.2% (OPS - 22%, compulsory medical insurance - 5.1%, VNIM - 2.9%, NS and PZ - 0.2%) = 3926 rubles.

Consequently, Examples will receive 41,310 (5000 + 18,000 + (20,000 – 1690)) rubles. And the company’s expenses will amount to 46,926 (43,000 + 3926) rubles.

Please note that one-day business trips and daily allowances (insurance contributions) are no exception. You will still have to withhold personal income tax on the excess and pay the contribution tax to the budget.

Taxation of daily allowances above the norm

In 2021, the amount of daily allowance, which is not taxed and from which insurance deductions are not made, has not changed. For business trips within the Russian Federation, this amount is 700 rubles per day. For work trips abroad, this amount is several times higher and amounts to 2,500 rubles.

But daily allowances in excess of the norm are subject to tax. Personal income tax on this amount will be paid on a general basis at a rate of 13%. Also, the company must make insurance deductions from the amount that exceeds the established preferential daily allowance.

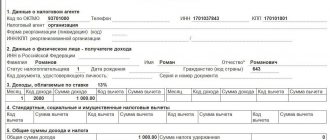

To display the amount of travel allowances in excess of the norm in form 6-NDFL, you need to know on what date they are accrued. The date of receipt of income for taxable daily allowances in excess of the norm is the last day of the month in which the manager approved the advance report.

The report is approved after the employee returns from a work trip.

Tax withholding from daily allowances that exceed the established amounts is made at the time of payment to the employee of wages from which personal income tax is withheld. But it is worth remembering that the tax withholding date cannot be earlier than the last day of the current month.

This is due to the fact that personal income tax cannot be withheld from the employee until he receives his salary. Based on this, it follows that the payment will be transferred to the tax office no later than the day following the day the personal income tax is withheld.

The daily allowance for 5 days of business trip was indicated in the amount:

This calculation was made as follows:

Tax will be withheld from this amount:

The employee received:

Reflection Examples

How to reflect excess daily allowance in 6-NDFL? Line 020 shows only the excess amount. The date when income was received in the form of daily payments is indicated in line 100. It is considered the last day of the month on which the manager approved the advance report. However, this is not necessarily the date the employee receives the payment, since he may return from a business trip before the deadline.

The employer must withhold tax immediately after the employee receives the income. According to the requirements of the Federal Tax Service, this cannot be done earlier. In practice, what happens is that tax is withheld on the day the employee’s salary was issued, and taxes are transferred the next day.

Insurance premiums

The concept of insurance premiums does not apply to daily allowances that correspond to the specified amounts. In order to avoid the emergence of any conflicts and uncertain situations, the organization must specify in a certain statutory document the principle by which daily allowances are calculated.

Insurance premiums are calculated on daily allowances exceeding the established standard. One-day business trips cannot fall under this category under any circumstances.

If you take a closer look at one-day business trips, you will find that opinions on them are very mixed.

Thus, the Social Insurance Fund believes that daily allowances should be paid in all cases. The opinion of the Supreme Arbitration Court is exactly the opposite. It is based on the fact that payments received by an employee during a business trip do not act as his additional income. They only compensate him for the inconvenience caused by the employer’s instructions.

Features of filling out the form

An example of filling out a report in Form 6-NDFL can be found on the website of the Federal Tax Service. It is sent there every reporting period, that is, quarter.

The calculation includes a title page and two sections. The first section is called “Generalized Indicators”, and the second section indicates the dates and amount of income received and tax withheld. The document must be completely filled out.

How to fill out the title page?

At the top of the first sheet is the individual taxpayer number and the company checkpoint. If the form is submitted to a separate department, then you need to indicate its checkpoint too. When filling out the line with the company’s TIN, the last two cells are usually crossed out. Individual entrepreneurs, notaries, and lawyers register only a personal TIN.

Sick leave in 6-NDFL is reflected along with all amounts that were allocated to the employee.

Read how salary is reflected in parts in 6-NDFL.

In the line called “Adjustment number” enter 000, if the primary calculation is submitted, if corrected, then the serial number of the corrections is indicated, for example, 001 or 002.

In the “Reporting period” line you need to enter the code:

| 21 | If the calculation is submitted for the first quarter. |

| 31 | If the calculation is submitted for half a year. |

| 33 | If the payment is due 9 months in advance. |

| 34 | If the calculation is submitted for a calendar year. |

In the column called “New period” the reporting year is indicated, for example, 2021. Next, you need to write the code of the tax service where the calculation is sent, on the appropriate date.

And then enter a special three-digit code, which changes depending on the location or registration:

| 120 | At the place of residence of the individual entrepreneur. |

| 125 | At the lawyer's place of residence. |

| 126 | At the notary's place of residence. |

| 212 | In the place where the Russian company is registered. |

| 213 | In the place where a large taxpayer is registered. |

| 220 | In the place where a separate division of a domestic company is located. |

| 320 | In the place where the entrepreneur operates on UTII. |

| 335 | In the place where a separate division of a foreign company is located. |

The short name of the organization, which is established by the constituent document, is indicated in the line “Tax Agent”; if it is not available, then the full name is written.

How to fill out section 1?

The first section is usually filled in with a cumulative total. If there are several tax rates, then they are all indicated in separate sections.

Lines 060-090 should be filled in only once:

| Line 010 | The tax rate is indicated. |

| 020 | The amount of employee income during the reporting year is reflected. |

| 025 | Additional bonus income is allocated. |

| 030 | The total amount of all deductions made from all employees is shown; taxable income is reduced by exactly this amount. The line is also filled in for the entire period. |

| 040 | The amount of calculated tax during the year is reflected; To do this, it is necessary to add up the personal income tax indicators that were withheld from the income of employees. |

| 045 | It is filled out in the same way, but only dividends are taken into account. |

| 050 | Advance payments are recorded, offset against the income tax of foreign citizens who work under a patent. |

| 060 | The number of employees who received wages during the reporting period is indicated. |

| 070 | The amount of tax withheld is indicated. |

The amount in lines 040 and 070 may not match. This situation may arise if the employee’s income was indicated and tax was calculated on him, but the actual payment was not made. The Federal Tax Service decided that line 070 will only include the tax that was withheld at the time of reporting.

| Line 080 | The calculated personal income tax amount is indicated. |

| 090 | The amount of tax that was refunded under Article 231 of the Tax Code of the Russian Federation is indicated. Article 231. Procedure for collection and refund of tax |

How to fill out section 2?

This section describes only those actions that were carried out during the last three months of the reporting period:

| Line 100 | The dates of actual receipt of wages are indicated. |

| 110 | The dates when the tax was withheld are indicated. |

| 120 | The date when the tax should be transferred is written, usually the next business day after receiving wages. |

| 130 | The amount of income received as of the date indicated in line 100 is displayed. |

| 140 | The amount withheld at the time of date is indicated in line 110. |

Non-taxable expenses

When sending an employee on a business trip, the management of the enterprise is obliged to reimburse him for all expenses for accommodation, travel and daily allowances. Also, for each day of a business trip, the employee must be paid an average salary.

Travel expenses to the place of business trip are paid to the employee in full. Personal income tax is not withheld from this amount. These costs include travel by any type of transport to your destination, as well as travel by taxi or public transport to the station or airport.

Tax on these expenses will not be withheld if these expenses are documented. If there are no supporting documents, then the tax will be withheld in full from the entire amount that was spent on travel to the destination and back. Tickets can be provided as proof of travel costs.

If for some reason they have not been preserved, then you can request a certificate from the carrier, which will indicate the direction, type of transport and cost of travel.

Expenses for renting residential premises are not fully taxed. Personal income tax is not withheld only if the employee has supporting documents. They could be a receipt for a hotel room or an apartment rental agreement.

If the employee does not have documentary evidence, then the tax-free amount is 700 rubles per day when traveling on business in Russia. If the work trip is abroad, then this amount should not exceed 2,500 rubles. If living expenses exceed the specified amounts, then personal income tax is paid on the amount in excess of the norm.

general information

In accordance with the provisions of Art. 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee at the direction of his employer to perform an official task outside his place of permanent work for a specific period.

Place of permanent work is the legal or actual address of the company (division) where the employee performs his duties in accordance with the employment contract.

Here are the basic rules for paying daily allowance:

- The company pays the employee per diem for each day of travel, incl. weekends and holidays, travel time and temporary stops.

- Daily allowances are issued until departure on a business trip. The employee must receive travel allowances in advance, otherwise he has the right not to go on a business trip. The accountant issues money to the employee, making a debit entry to account 71.

- When a business trip involves a trip to a nearby area, and the employee intends to return home every day after the end of the working day, per diem is not paid .

- Per diem is paid even if an employee gets sick on a business trip, which is confirmed by sick leave. In addition to the daily allowance, the sick person will be paid a disability benefit.

The specifics of employees going on business trips are established by the Regulation “On the Peculiarities of Departing on Business Trips”, approved by Decree of the Government of the Russian Federation on October 13, 2008 No. 749.

As for business trips for 1 day , for a long time there were different opinions about whether it is necessary to pay daily allowances, as well as how to pay taxes and insurance premiums on them.

Now we recommend that internal regulations provide for the payment of these expenses, moving away from the concept of “per diem” . In this case, the accountant can include payment of these costs in income tax expenses - according to clarifications of the Ministry of Finance of Russia dated May 26, 2014 No. 03-03-06/1/24916.

If there is a documentary justification for the expenses incurred, there is no need to impose insurance premiums on payments for one-day business trips (letters of the Ministry of Finance dated May 17, 2018 No. 03-15-06/33309, dated October 2, 2017 No. 03-15-06/63950, determinations of the Armed Forces of the Russian Federation dated August 11. 2017 No. 310-KG17-10343, dated January 26, 2015 No. 310-KG14-7400).

One-day business trips are practically no different from ordinary ones, so it is also important to document them correctly. Payment for such business trips due to the lack of daily allowances has its own characteristics , characteristic only for business trips for one day.

Changes in daily allowances above tax standards in 2021

In 2021, a reform was carried out on insurance premiums in relation to daily allowances in excess of the norm. Recent innovations oblige enterprises to pay taxes on the income of their employees along with insurance premiums in case of exceeding the limits on the amount of daily allowances that are withheld by law.

Changes in the field of taxation were made in accordance with the fact that from the beginning of 2021 the Federal Tax Service is responsible for insurance payments. The only exception is if you are injured. All insurance transfers according to the new rules are made to the tax service, and not to the Social Insurance Fund.

The latest tax changes in 2021 establish that daily allowances in excess of the norm must be correctly processed both when traveling on business in the Russian Federation and in other countries. Everything must be done in strict accordance with the Tax Code of the Russian Federation.

In 2021, adjustments were made to Article 422; they are dedicated to daily allowances in excess of taxation standards in 2021. They also need to pay personal tax. However, in addition to these tax contributions, companies are required to make payments to the Social Insurance Fund. The exception is payments that are related to employee injuries.

The Federal Tax Service does not establish the amount of standards for payments per day. In other words, each company can independently determine them for the time spent on a business trip.

The tax office sets limits on the amount of refunds that are not subject to taxation. If the limit is exceeded, the organization must pay compensation for personal income tax on daily allowances in excess of the tax rate in 2021. The company will also have to pay contributions for health insurance and the Pension Fund.

A significant number of enterprises set their own amounts of travel allowances, which exceed the standards defined by law. As a result, they are ready to make insurance payments.

Are they taxable?

The amount of daily allowance paid to a seconded specialist is determined by the employer.

When determining this amount, he takes into account several factors - the duration of the work trip, the method of departure, expenses spent on rented housing, etc.

The Tax Code of the Russian Federation establishes a limit for travel expenses that are not subject to insurance contributions. In accordance with Article 422 of the regulatory document, these are the following indicators:

- 700 rubles – if the business trip location is located on the territory of the Russian Federation;

- 2500 rubles – if the business trip location is located outside the Russian Federation.

The remoteness of the travel region plays a key role.

A trip to another country requires higher expenses, so the limit of the amount not subject to insurance premiums is much higher than in the case of trips within Russia.

If the daily allowance paid for a business trip abroad is accrued in a foreign currency, to determine the need/no need to pay insurance premiums, it is necessary to convert the currency into Russian ruble according to the exchange rate valid at the time of transfer.

If an employee’s travel expenses, compensated to him by the management of the enterprise, exceed the specified levels, they are subject to insurance premiums according to the standard scheme.

The amounts of money received are equal to the full income of a working citizen.

Particular attention should be paid to one-day business trips.

Often, employers neglect this point and do not complete proper documentation when the business trip lasts only 1 day.

In order for insurance premiums not to be deducted from the daily allowance, the expenses spent by the employee must be documented as travel expenses.

How to calculate deductions from overpayment?

Expert opinion

Ilyin Georgy Severinovich

Practicing lawyer with 6 years of experience. Specialization: criminal law. Law teacher.

Daily allowances, the amount of which exceeds the maximum limit established by the Tax Code of the Russian Federation, are subject to insurance contributions. This rule is regulated by Article 422 of the relevant Code.

Despite the fact that contributions are calculated only from the excess amount, the primary documentation reflects the full amount of daily allowance.

In the future, the amount established at the legislative level (700 rubles or 2500 rubles, depending on the specific case), is indicated in the section of payments not subject to insurance deductions.

To calculate the amount subject to contributions, the number of days during which the worker was on a work trip is calculated. After this, the daily allowance received during this time is calculated.

Next is the difference between this amount and the amount established by the Tax Code of the Russian Federation. The resulting figure is subject to contributions.

Accrual example

To better understand this topic, you need to familiarize yourself with the example. It is assumed that the employee was sent on a business trip to the city of Voronezh.

The duration of the trip was 5 working days.

The amount of daily allowance he received in the end was 5,000 rubles. The business trip region is located on the territory of the Russian Federation, therefore, it is not subject to RUB 3,500. (700 rub. x 5 days = 3500 rub.).

Insurance premiums will be deducted from the excess amount:

5000 rub. – 3500 rub. = 1500 rub.

Exactly from the amount of 1500 rubles. responsible accounting specialists will withhold interest for deductions to funds.

Features of payment of insurance premiums

Expert opinion

Korolev Dmitry Viktorovich

Lawyer with 10 years of experience. Specialization: family law. Extensive experience in document examination.

In 2021, a mandatory requirement to charge taxes on excess daily payments was introduced. Article 424 of the Tax Code of the Russian Federation determines the terms of payment and the procedure for calculating compensation to employees.

When an employee receives daily allowance in excess of the norm, an advance report is approved. This means that reimbursements from the employer for business trip expenses that exceed the limits are attributed to the insurance of payments for the same calendar month in which the employee’s advance report is approved.

When the daily allowance is within the amount established by law, there is no need to make insurance contributions on it. Compliance with the legal requirements for calculating travel allowances will allow you to avoid claims against the company from the Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund.

Insurance deductions are made from the employee's additional expenses for his residence in a foreign area, which exceeded the standards. This condition applies to business trips lasting more than 24 hours.

The concept of “per diem”

In situations where a company employee goes on a business trip in Russia or abroad, the employer undertakes to pay him a certain monetary remuneration, which is calculated per day - these are the so-called daily allowances. At the same time, there are only 3 main situations in which the employer is obliged to pay per diem.

To study the issue more accurately, let’s look at how the law interprets business trips. A business trip is a business trip, the terms and conditions of which are determined by the employer. In this case, the place where the work will be carried out must be remote from the established one.

Per diems are not part of the housing payment when working remotely and are taken into account as additional expenses for the employee’s daily needs. As a rule, the further away the remote work location is, the greater the amount the employer pays.

Inclusion in RSV-1

All organizations, including individual entrepreneurs, need to send personal data and certificates in the RSV-1 form to the Pension Fund. It is a report that contains information regarding accrued or made insurance transfers. It contains a large amount of information; it must be sent to the FFOMS and the Pension Fund of the Russian Federation.

Line 201 in clause 2.1 reflects the amount of payments and compensations that do not require transfers for compulsory pension insurance.

All individual entrepreneurs and company managers should know the information from the RSV-1 form certificate.

Accounting procedure

Calculation of personal income tax involves standardizing the amount of daily payments. Taxes are charged on the following amounts:

- a day of stay on a work trip across Russia (700 rubles);

- trip to another country (2500 rubles).

Personal income tax is withheld in cases where the amount of compensation exceeds the specified standards.If a company reimburses an employee for per diem in excess of the norm, his income is subject to taxes. It is recognized regarding the last day of the month on which the advance report is approved, which is sent by the employee returning from a business trip.

Personal income tax is payable after the following payments are made to the employee; this requirement also applies to salary. Payment must be made on the first business day following the listed payments to the official. This procedure is regulated by the Tax Code of the Russian Federation, Article 226.

Daily allowances, the amount of which exceeds the standards, are paid to the employee in accordance with current legislation. In addition to such payments, the company must compensate the official for a number of expenses associated with the work trip:

- payment for accommodation in another locality;

- transportation costs (the general director of the organization determines its type);

- expenses for additional personal needs.

Compensation for other expenses is made to the official with his daily allowance, which is provided by the company management. The amount may be increased by appropriate decision of the company’s management.When sending an employee on a trip to perform work duties, the company is obliged to reimburse expenses for the entire time spent on a business trip. These include costs associated with travel and accommodation, as well as other expenses. They can be:

- registration of a foreign passport and visa;

- use of lounge services at airports and train stations;

- Internet and cellular communications;

- currency exchange commission.

While on a work trip, the employee does not incur financial losses. The company must cover all the official's expenses that arise during the trip when paying the very first salary. The state levies certain taxes on these and other payments. - Travel expenses

- Daily expenses

- Per diem above normal

- Documentation of daily allowances

- Taxation and insurance premiums on daily allowances in excess of the norm

- Accounting for daily allowances in excess of the norm: an example

List of travel expenses

In any organization in the Russian Federation, it is rare to find an employee who has not gone on a business trip at least once in his life. All expenses that the employee incurs for travel, accommodation and daily expenses within the established limits must be reimbursed by the enterprise.

In this article, we classify travel expenses and indicate what documents are required to reimburse an employee. We will also take a closer look at daily allowances in excess of the norm: what is their documentation, taxation, and insurance premiums.

Recommendations and answers to pressing questions

Let's consider a number of frequently asked questions that often arise both among company employees and financiers. These questions relate to payments of daily allowance and excess daily allowance, as well as their features:

- When assessing daily income tax with personal income tax, it is recommended to act according to the following algorithm. First, an advance report is received from the employee, then the amount subject to tax is calculated, then personal income tax is calculated and, finally, personal income tax is withheld from the salary.

- To ensure that problems do not arise within the company, as well as during its interaction with organizations such as the Pension Fund or the Social Insurance Fund, it is recommended that the rules for calculating daily allowances and insurance premiums be established in local documents. It is best to fix the rules in a collective labor agreement.

- Not only insurance premiums, but also personal income tax are not charged on the established daily allowance rates. This feature must be taken into account by accountants when working.

To legally work with daily payments in favor of employees, it is necessary to carefully monitor the updating of the current legislative framework, as well as monitor the company’s local documents and their content. At the same time, it is recommended to sometimes consult professional tax employees about documentation, who will help resolve existing shortcomings and avoid problems with various inspections.

When an employee is sent on a business trip, the employer guarantees not only the preservation of his job and average earnings, but also reimbursement of expenses associated with the business trip, which include daily allowances. Per diem can be defined as the employer's financing of additional daily expenses of an employee associated with temporary residence in another location.

According to the Tax Code, personal income tax is not withheld from daily allowances if they are paid within the limits established by Article 217 of the Tax Code of the Russian Federation. And according to what standards should daily allowances be subject to insurance premiums? To understand this issue, we should consider the current provisions of the law, as well as the upcoming changes in the new year.

When daily allowances in excess of the norm are subject to insurance contributions, what are these norms for employers, and also what new is expected in 2017 in connection with the entry into force of new provisions of tax legislation regarding the taxation of daily allowances for business trips in Russia and abroad - about all this in our article.

Travel expenses

This is a list of employee expenses during a trip related to business needs. The company is obliged to reimburse these expenses to the employee within the established limit, if he, in turn, provided a list of correctly executed documents, that is, timely and correctly reported for the business trip.

List of travel expenses

Below we provide a list of expenses that can be reimbursed by the company during a business trip:

- employee living expenses. The limit of funds within which an employee can rent housing. Set by the enterprise before the employee’s departure;

- travel expenses;

- food for the traveling employee;

- daily expenses;

- other expenses that were agreed upon with the management of the company.

Daily expenses

At the time of approval of a business trip, at the stage of its establishment, the employee must be provided with a local document issued by the enterprise for review. Such documents are both the regulations on business trips and the annex to the employment or collective agreement.

This document is published at the discretion of the organization itself. It indicates all the aspects and nuances of the trip, and also indicates the norms or limits of the amounts within which the seconded employee has the right to make expenses related to accommodation and travel.

Let's look at an example. Ivanov I.I. was sent from Moscow to Berlin. The business trip period is from 06/12/2020 to 06/15/2020.

On 06/12/2020 at 22:23 the employee departs from Moscow and on 06/13/2020 at 02:38 he arrives at Berlin airport. The employee departs back on 06/15/2020 at 15:47 and arrives in Moscow at 19:54 on the same day. Calculation of daily allowance for a business trip is as follows:

On June 12, 2020, the daily allowance will be 700 rubles, since the employee was in Moscow that day.

Accounting for excess daily allowances. Example

Four schemes from the Federal Tax Service for avoiding paying VAT, but I missed the code!!! I also missed it in some databases. I didn’t notice it right away, I didn’t expect it like this... Accountants are complaining that 1C incorrectly puts the tariff code in the RSV simplified tax system, 01 - Japanese policeman! And the year in section 3 was 2021, but I noticed it there, but missed the code!!! Accountants are complaining that 1C incorrectly puts the tariff code in the RSV id157773611, there will be a deduction for the online cash register: new details from the tax authorities Trout, you wrote: Handed over on April 20, 43 tax office, Moscow. There is a receipt and notified...

Moscow tax officials ignore the movable property tax exemption introduced by Moscow law. Those who have nothing to hide do not suffer. All drug addicts are on Telegram About the money for accountants Nad.K, you wrote: tinka10_03, this is a check about the financing of terrorism. Let the employee in...

Per diem above normal

Daily allowances in excess of the established norm are the amount of daily allowances exceeding the amount specified in the Labor Code of the Russian Federation, regardless of the amount of daily allowances established at the enterprise and stated in the official documents of the enterprise itself. Thus, for such amounts, the company pays personal income tax and insurance premiums to the posted employee.

Such amounts are the direct income received by an employee of the enterprise.

Documentation of daily allowances

The final calculation of the daily allowance is made by the accountant or the head of the enterprise after the employee returns from a business trip, upon provision of an advance report and a list of documents that are drawn up by the company when the employee is sent on a business trip and after his arrival. Such documents are:

- order to send an employee on a business trip. This document must specify the purpose of the business trip and the period for which the employee is sent. Information about the duration is needed to calculate the amount of daily allowance, and information about the purpose of the business trip is needed to confirm the production nature of the trip;

- memo, if necessary. Compiled by the posted employee after returning from the trip. It is drawn up in the absence of documents for accommodation or travel, in order to confirm the whereabouts of the employee at the time of the business trip, also in the event of a delay or postponement of the employee’s departure for technical reasons, etc. This document is drawn up at the request of the enterprise management;

- document regulating business trips outside of a regular employee. Information about the reimbursement of funds must be specified in the civil contract at the time of its conclusion or amended to it after the need to send the employee on a business trip.

There is no need to provide documents confirming expenses associated with the amount of daily allowance, that is, checks and receipts to the employer.

Taxation and insurance premiums on daily allowances in excess of the norm

As stated above, daily allowance amounts that are not recognized as income of the posted employee. And for which taxes are not calculated, they amount to 700 rubles and 2,500 rubles, paid as part of a business trip in Russia and abroad, respectively. Taxes are calculated on amounts exceeding these norms established by law:

- Personal income tax, personal income tax. Equal to 13%. Deducted from the amount exceeding the daily allowance norm. The deduction must be made in the month of approval of the employee's advance report;

- income tax. An employee's travel expenses can be included in the tax base within the amounts specified in the local document of the enterprise. These expenses can be taken into account if the seconded employee provides all primary documents that confirm these expenses. Such documents are checks and receipts for accommodation, checks or travel documents, checks for fees or consular payments, receipts for payment for services for issuing visas, passports, invitations, etc.;

- Insurance premiums. Accrued for the entire amount in excess of the daily allowance. These amounts are accrued at the time of approval of the advance report provided by the posted employee. For social insurance the percentage is 2.9%;

- Insurance premiums. For pension insurance it is 22%;

- Insurance premiums. For compulsory health insurance it is 5.1%.

Insurance premiums for injuries in the amount of daily allowance are not calculated.

If an enterprise does not transfer contributions to insurance funds or does not withhold personal income tax from a posted employee, it will receive a fine in the amount of 20% of the amount of funds not transferred plus the mandatory transfer of the necessary amounts to the funds and deduction of funds from the employee’s salary.

If an employee returned from a business trip abroad, the daily allowance was given to him in foreign currency, calculated at the exchange rate on the day the application for advance was submitted. To calculate daily allowance, personal income tax and insurance contributions, amounts are recalculated at the rate on the day the employee reports an advance report.

Accounting for daily allowances in excess of the norm: an example

We will reflect these amounts in Accounting.

The amount of insurance premiums for compulsory health insurance, calculated on daily allowances in excess of the norm (6,000 rubles - 2,800 rubles) * 5.1%

Features of “travel” taxation

Any company in the course of its activities may be faced with the need to send employees on a business trip or official trip.

At the same time, accounting for expenses incurred for income tax purposes, as well as settlements with employees regarding personal income tax, have certain features. Taxation is affected by the nature of the work, length of travel and other factors. An interview with Sergei Viktorovich Razgulin, active state adviser of the Russian Federation 3rd class, is devoted to accounting and documenting travel expenses. 02/12/2016

Sergey Viktorovich, what trips of the organization’s personnel can be regarded as business trips?

A business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. A business trip is recognized, for example, as a trip by an employee of the parent organization to its separate division (representative office, branch) located in another locality.

At the same time, the period of stay of an employee on a business trip is not limited by the legislation of the Russian Federation. However, if it lasts for quite a long time, the tax authorities have the right to re-qualify the nature of the organization’s activities and recognize the place of business trip as the actual place of work of the employee with corresponding changes in the taxation regime.

What are the “tax” differences between a business trip and a business trip?

Work that is carried out on the road or has a traveling nature does not apply to business trips. However, labor legislation provides for the employer’s obligation to reimburse staff for expenses associated with business trips when performing such work (Article 168.1 of the Labor Code of the Russian Federation). Accordingly, these expenses can be fully taken into account when calculating the income tax base.

For the purposes of calculating personal income tax, payments aimed at compensation, including daily allowances, are not standardized. That is, they are exempt from this tax in actual amounts (letter of the Ministry of Finance of Russia dated 06/07/2011 No. 03-04-06/6-131).

A work trip of a remote worker to the location of his employer is a business trip. The costs for it can be taken into account when calculating the income tax base as part of other expenses associated with production and sales (letter of the Ministry of Finance of Russia dated 08.08.2013 No. 03-03-06/1/31945).

The legislation does not provide for the registration of a business trip for an individual working in an organization under a civil contract, therefore payment for travel, accommodation and other expenses of such a person does not apply to travel allowances. As a general rule, these payments are recognized as income of an individual. If the listed expenses were incurred directly by an individual, he has the right to claim a professional tax deduction for them if there are supporting documents (clause 2 of Article 221 of the Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated April 29, 2013 No. 03-04-07/15155).

But I note that for the purposes of personal income tax, the rules on business trips are applied to the trips of persons who are under the authority or administrative subordination of an organization or who are members of its management bodies and who arrive (depart) to participate in a meeting of management bodies (clause 3 of Article 217 of the Tax Code of the Russian Federation) . Reimbursement amounts are not subject to personal income tax. For income tax purposes, no similar rules have been established. Moreover, there is a direct ban on taking into account payments to members of the board of directors in expenses (clause 48.8 of article 270 of the Tax Code of the Russian Federation).

What expenses can be classified as travel expenses?

According to Article 168 of the Labor Code, the list of expenses reimbursed in connection with a business trip is open. These may include any expenses incurred by the employee with the permission or knowledge of the employer. In many ways, the same approach to the list of expenses can be used to guide the calculation of income tax and personal income tax.

According to the Tax Code, business trip expenses are included (clause 3 of Article 217, subclause 12 of clause 1 of Article 264 of the Tax Code of the Russian Federation):

- daily allowance;

— travel expenses to the destination and back;

— fees for airport services, commission fees;

— expenses for travel to the airport or train station at the places of departure, destination or transfers, for luggage transportation;

- expenses for renting residential premises;

— payment for communication services;

— expenses for obtaining and registering a service foreign passport, obtaining visas;

— expenses associated with the exchange of cash or a check at a bank for cash foreign currency.

For the purposes of both personal income tax and income tax, travel expenses can be recognized provided that they:

- actually produced;

- documented;

- are targeted.

Is reimbursement to employees of business travel expenses limited in absolute terms for the purpose of calculating personal income tax?

Actually standardized, that is, containing a limit above which payments are included in the income of an individual, are daily allowances. In the absence of documentary evidence, compensation for one-day business trips and expenses for renting living quarters are also regulated.

Since 2008, an employee’s income, not subject to personal income tax, includes daily allowance of no more than 700 rubles for each day of a business trip in the Russian Federation and no more than 2,500 rubles for each day of a business trip abroad (clause 3 of Article 217 of the Tax Code of the Russian Federation).

Exactly the same amounts are exempt from taxation on payments for rental housing if the employee fails to provide documents confirming payment for housing during a business trip.

When can you take into account daily allowances for a one-day business trip in the organization’s expenses for the purposes of calculating income tax and not take them into account in the employee’s income for the purposes of calculating personal income tax?

When traveling on business to an area from where the employee, based on transport conditions and the nature of the work performed, has the opportunity to return daily to his place of permanent residence, daily allowances are not paid. However, the organization must reimburse the individual for expenses incurred with its permission or knowledge. Such payments are exempt from personal income tax without documentary confirmation in the amounts established for daily allowances (clause 3 of article 217 of the Tax Code of the Russian Federation). This conclusion was made by the Supreme Arbitration Court of the Russian Federation (post. of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 11, 2012 No. 4357/12). Accordingly, during one-day business trips, the organization may not take into account in the employee’s income for the purposes of calculating personal income tax only the amount that does not exceed the established limits. Otherwise, there is a risk of a dispute with the tax authorities.

As for income tax, expenses for reimbursement of expenses incurred on a one-day business trip are taken into account when calculating the tax base as part of other expenses associated with production and sales (subclause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation; letter from the Ministry of Finance of Russia dated 05/21/2013 No. 03-03-06/1/18005).

How will taxation be affected by specifying in a collective agreement or local act of an organization an amount of daily allowance greater than that established by law?

The amount over 700 rubles for daily allowance for business trips within Russia and 2,500 rubles for foreign business trips will be subject to personal income tax.

In terms of income tax, the entire amount of daily allowance, the amount of which is established in a collective agreement or local regulation, can be taken into account as expenses when calculating the tax base.

I note that when determining the amount of daily allowance, you should take into account the Regulations on business trips (approved by the resolution of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as the Regulations on business trips)). Thus, when an employee travels from the territory of the Russian Federation, the date of crossing the state border is included in the days for which daily allowances are paid in foreign currency. When traveling to the territory of the Russian Federation, the date of crossing the state border is included in the days for which daily allowances are paid in rubles (clause 18 of the Regulations on Business Travel).

What are the differences in the procedure for determining the amount of income exempt from personal income tax in the case when an organization pays an employee daily allowance in foreign currency before leaving on a business trip, and in the case when the payment of daily allowance is made as compensation after returning?

In the case of payment of daily allowance to an employee before being sent on a business trip, the amount of tax-exempt amounts is calculated based on the exchange rate of the relevant currency to the ruble, established by the Central Bank of the Russian Federation on the date of receipt of income. According to the clarifications of the Ministry of Finance of Russia (letter of the Ministry of Finance of Russia dated January 14, 2013 No. 03-04-06/4-5), the date of receipt of income is the date of approval of the employee’s advance report.

Calculation and withholding of personal income tax is carried out on the nearest date of payment of funds to the employee.

If the payment of daily allowances is made as compensation after the employee returns and the advance report is approved, then the exchange rate established by the Central Bank of the Russian Federation on the date of their payment is applied (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

However, from January 1, 2021, the date of receipt of income when calculating personal income tax will be considered the last day of the month in which the advance report was approved after the employee’s return from a business trip (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation, as amended by Federal Law dated May 2, 2015 No. 113-FZ).

This means that, regardless of the moment of payment of funds, the recalculation of the income (expenses) of the posted worker, expressed in foreign currency, will be made on the last day of the month in which the advance report is approved. Depending on fluctuations in the exchange rate of foreign currency on the date of its actual payment and on the date of recognition of the fact of receipt of income, the amount of the payment exempt from tax may change significantly.

Could a company have difficulties taking into account travel expenses if an employee goes to a business trip before a weekend, and the start of the business trip is considered to be the next working day?

No, there won't be any difficulties. When an employee leaves for a business trip on the eve of a weekend or leaves a business trip after a weekend, expenses are taken into account in calculating the income tax base in the generally established manner (clause 2 of the letter of the Federal Tax Service of Russia dated August 20, 2014 No. SA-4-3 / [email protected ] ).

Please note that in order to include other expenses in the income tax base as travel expenses that fall on the days before the start or after the end of a business trip, it is necessary to change its terms by order of the employer.

In terms of personal income tax, a dispute with the tax authorities may be caused by a situation where an employee spends a vacation at the place of a business trip before it begins or after it ends. They can consider payment for travel as income received by an individual in kind (letter of the Ministry of Finance of Russia dated 05.08.2008 No. 03-04-06-01/246).

Does tax legislation provide for restrictions on the choice of mode of transport, its comfort class and other travel characteristics when an employee goes on a business trip?

As a general rule, the procedure and amount of compensation to employees of commercial organizations for expenses related to business trips are determined by a collective agreement or local regulations.

If the specified documents do not contain special norms, then the expenses may include the cost of travel in any class, including the use of a luxury lounge (letter of the Ministry of Finance of Russia dated 03/05/2014 No. 03-03-10/9545). At the same time, payment by the employer of the cost of travel, for example, in luxury cars with the cost of services provided in such cars included in it, is exempt from personal income tax (letter of the Ministry of Finance of Russia dated July 2, 2015 No. 03-04-06/38183).

It is possible that restrictions, in particular on the use of business class, are established by the organization for all or some categories of employees. However, even in this case, if there is a decision by the employer to reimburse the employee for business trip expenses in actual amounts exceeding those specified in the local regulatory act, as well as documentary evidence of such expenses, the amounts of payments are not subject to personal income tax (letter of the Ministry of Finance of Russia dated December 30, 2011 No. 03-04 -06/6-364).

On a business trip, an employee has the right to use the services of road transport, including taxis, for production purposes (letters of the Ministry of Finance of Russia dated July 11, 2012 No. 03-03-07/33, dated September 28, 2011 No. 03-04-06/6-241). Since transport services are provided in the interests of the employer, their payment is reimbursed to the employee along with other travel expenses and is not subject to personal income tax.

To confirm the costs of paying for a taxi, the employee must have a cash receipt or a receipt in the form of a strict reporting form. The document must contain the mandatory details that are specified in Appendix No. 5 to the Rules for the Transportation of Passengers (approved by the resolution of the Government of the Russian Federation dated February 14, 2009 No. 112 (hereinafter referred to as the Rules for the Transportation of Passengers)).

If travel to the place of business trip was carried out on official or personal transport, the employee, in order to confirm expenses, must draw up a memo with the attachment of waybills, cash receipts for the purchase of fuel and lubricants and other supporting documents.

Does an organization have the right to compensate an employee’s expenses for food on a business trip? Is such compensation subject to personal income tax?

Among the independent types of travel expenses, compensation for meals as a payment exempt from personal income tax is not provided (clause 3 of Article 217 of the Tax Code of the Russian Federation). However, the provision of meals as part of another service is stipulated, for example, by the Rules for the Transportation of Passengers. Therefore, if it is impossible to separately purchase the specified service, income subject to personal income tax does not arise.

A similar approach should be applied to the common practice in most hotels of including breakfast in the room rate. At the same time, in order to avoid tax risks, the company must have a hotel account in which no additional services are allocated.

Please note that the hotel bill may include the cost of an employee visiting the pool, sauna and other similar facilities. Compensation by the employer for these expenses does not reduce the income tax base (Article 270 of the Tax Code of the Russian Federation) and forms the income of an individual subject to personal income tax (Article 211 of the Tax Code of the Russian Federation).

When a posted employee participates in entertainment events (lunch, dinner), income is generated that is not subject to personal income tax (letter of the Ministry of Finance of Russia dated December 11, 2012 No. 03-04-06/4-348).

The need for an employee to participate in a representative event in the interests of the organization can be proven by a report on its conduct, from which it follows that there is a direct connection between the subject of negotiations within the framework of which the event is held and the official responsibilities provided for in the employment agreement (contract) with the employee.

What documents are required to recognize travel expenses?

The advance report is the primary document. On its basis, a business transaction in the form of travel expenses is taken into account - accrual of debt to the employee for the amount of expenses incurred or writing off the accountable amount from the employee (letter of the Ministry of Finance of Russia dated September 14, 2009 No. 03-03-05/169).

The date of recognition of travel expenses is the date of approval of the advance report (subclause 5, clause 7, article 272 of the Tax Code of the Russian Federation).

To approve the expense report, in turn, primary documents are required about the expenses incurred by the employee: invoices, receipts, cash receipts, waybills.

Submission of checks and receipts confirming the employee's expenditure of daily allowance is not required (letter of the Ministry of Finance of Russia dated November 11, 2011 No. 03-03-06/1/741).

Please note that the procedure for issuing travel documents has undergone changes.

From January 8, 2015, the number of registration forms was reduced due to the cancellation of the travel certificate, the official assignment for sending on a business trip and the report on its implementation (Regulation of the Government of the Russian Federation dated December 29, 2014 No. 1595).

In addition, since August 8, 2015, the procedure for keeping logs of employees leaving on business trips from the sending organization and arriving at the organization to which they are sent is not actually applied (approved by order of the Ministry of Health and Social Development of Russia dated September 11, 2009 No. 739n (clause 8 of the Regulations on business trips, on the basis of which the order was issued, was declared invalid)).

Despite the fact that the travel certificate in form No. T-10 (approved by the State Statistics Committee of Russia dated January 5, 2004 No. 1) has been cancelled, you can continue to use this form provided that the receiving party fills it out. Issuing travel certificates can help confirm the duration of a business trip.

In the new conditions, what documents should be used to confirm the duration of a business trip?

The duration of the business trip is indicated in the employer’s written decision (order, manager’s order) to send the employee on a business trip.

Retains the validity and procedure for recording employees sent on business trips in the work time sheet (form No. T-13) (approved by the State Statistics Committee of Russia dated January 5, 2004 No. 1).

The fact of being at the place of business trip at the specified time can be confirmed, in particular:

travel documents indicating the dates of arrival and departure from the destination;

waybill, route sheet when traveling on a business trip on official or personal transport (including a vehicle driven by an employee by proxy). (These documents reflect the transport route. In this case, information about sending an employee on a business trip on official or personal transport must be contained in the decision on the business trip);

an employee memo, which must contain the mandatory details of the primary document (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ).

When determining the duration of a business trip based on travel tickets, you should take into account the time required to travel to the station, pier or airport, if they are located outside the populated area.

In the absence of travel documents, the duration of the business trip can be confirmed by a document on rental housing, which indicates the period of residence at the place of business trip, including a hotel receipt (letter of the Ministry of Finance of Russia dated August 16, 2011 No. 03-03-06/3/7).

But what if there are no documents about travel and rental housing?

To establish the actual length of stay at the place of business trip, and thereby to calculate the daily allowance, a document can be used that contains a mark from the receiving party about the employee’s arrival and departure (for example, a travel certificate). For the purpose of obtaining the appropriate mark, this document can be sent to the receiving organization and received back from it by mail.

This option is provided in the List of documents confirming the actual length of stay of a federal civil servant on a business trip in the absence of travel documents (tickets) (approved by order of the Ministry of Finance of Russia dated March 10, 2015 No. 33n).

Since August 8, 2015, rules on the possibility of using this method of confirming the duration of a business trip have been included in the Regulations on Business Travel (Regulation of the Government of the Russian Federation dated July 29, 2015 No. 771).

Despite the fact that the new version of paragraph 7 of the Business Travel Regulations contains the sequence of using documents, it seems that in practice the duration of a business trip will be confirmed by a set of available documents: travel documents, documents on the rental of living quarters, written confirmation of the receiving party about the arrival and departure of the posted worker.

And in conclusion, let's look at the taxation procedure in the case where an organization sent its employee to a separate unit (representative office, branch) located outside the place of his permanent work, to participate in corporate events, sports competitions, concerts or professional skills competitions and paid him all expenses incurred in travel expenses?

In my opinion, in this situation, disputes are possible with the tax authorities, who will consider that the employee is participating in non-production activities and his trip is not related to the performance of work duties. Accounting for expenses incurred in the income tax base conflicts with the provisions of Articles 252 and 270 of the Tax Code.

In this case, payment or reimbursement by the organization of expenses may be the employee’s income and subject to personal income tax (letter of the Ministry of Finance of Russia dated August 14, 2013 No. 03-04-06/33039).

This approach concerns sending an employee on a business trip not only to a separate unit, but also to another organization (to another person, including a foreign one).

Current accounting

Post:

Comments

Daily allowances in excess of the norm are subject to insurance premiums

Thus, from 2021, daily allowances in excess of these standards should be subject to contributions, regardless of whether the excess amounts are prescribed in local regulations or not. As a general rule, the date of payments is determined as the day they are accrued (clause

1 tbsp. 424 of the Tax Code of the Russian Federation).

The date the employee receives income in the form of excess daily allowance is the day the advance report is approved. This means that daily allowances that exceed the norm are included in the base for calculating insurance premiums in the calendar month in which the employee’s advance report is approved.

Please note that daily allowances are not subject to insurance premiums for injuries (Clause 2, Article 20.2 of Federal Law No. 125-FZ of July 24, 1998).

In this case, the amount of daily allowance does not matter. In 2021, a reform was carried out on insurance premiums in relation to daily allowances in excess of the norm.

Recent innovations oblige businesses to pay taxes on income

How to determine the amount of daily allowance when making payments in foreign currency

How are insurance premiums calculated on daily allowances in 2021 for foreign business trips? Some enterprises for such trips may pay amounts in foreign currency rather than Russian rubles. To determine on what amount taxes need to be calculated, you will first need to recalculate payments. On what date are calculations performed?

Regarding the features of converting amounts from foreign currency into rubles, there are no nuances in the chapters. 34 is not provided.

This means that calculations are performed at the time the daily allowance is accrued in favor of the business traveler. The basis for an accountant to be able to calculate payments in the accounting of an enterprise is an advance report.

The approval of this document is carried out by the head of the organization.

Daily allowances - 2021 in terms of taxes

The procedure and amount of reimbursement of expenses related to business trips are established in the collective agreement or local regulations of the company.

Since 2021, the Federal Tax Service of Russia has been administering the procedure for calculating and paying insurance premiums to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund of Russia (with the exception of contributions for injuries).

In this regard, the Tax Code has been supplemented with a new chapter 34 “Insurance premiums”. It sets out the rules for calculating and paying contributions.

Thus, it has been established that daily allowances in the amount of:

- no more than 700 rubles for each day of a business trip in the Russian Federation;

- no more than 2,500 rubles for each day of being on a business trip abroad (clause 3 of article 217, clause 2 of article 422 of the Tax Code of the Russian Federation).

Until 2021, daily allowances were not subject to insurance premiums within the limits established by the company itself in its local regulations. So

What expenses are reimbursed to a posted worker?

There are often cases when employers are forced to send their employees outside the location of the organization to resolve official issues. Trips for a certain period of time, on a specific official assignment from a manager, to another locality or abroad are called business trips.

Before the start of a business trip, the employer must:

- establish the amount and procedure for paying travel expenses to an employee;

- prepare the documents necessary to send an employee on a business trip.

In accordance with the Labor Code of the Russian Federation, the employee is reimbursed for the following business trip expenses:

- for travel;

- rental of residential premises;

- additional living expenses (per diem);

- other expenses for the performance of official tasks (with the permission of the manager).

As a rule, an organization develops internal documents or a collective agreement that defines the procedure and amount of reimbursement for these expenses.

The procedure for reimbursement of business trip expenses to employees of various federal government bodies, institutions and funds, as well as municipal institutions is determined by regulatory legal acts of the government of the Russian Federation, local governments, and state authorities of the constituent entities of the Russian Federation (Part 2 of Article 168 of the Labor Code of the Russian Federation).

Excess daily allowance: insurance premiums and taxation

At the same time, the daily allowance standards remained at the same level (clause 2 of Article 422 of the Tax Code of the Russian Federation):

- for business trips in Russia – up to 700 rubles;

- for foreign business trips – up to 2.5 thousand rubles.

Thus, daily allowances in 2021 are subject to insurance premiums if these values are exceeded. According to the law, daily allowances are additional costs in connection with staying in a place other than your permanent residence (see.

168 of the Labor Code of the Russian Federation). As can be seen, legislators have equated the daily allowance standards that have long been in force in relation to income tax. Therefore, from the specified norm of the head of the Tax Code of the Russian Federation on insurance premiums, a direct reference is given to the third paragraph of Article 217 of the Tax Code of the Russian Federation. Also see “Rules for excess daily allowances.” In 2021, insurance premiums must continue to be charged on payments under employment agreements and civil contracts.

Let's sum it up

So, we have identified the following important points:

- The CP limit is set by the organization independently.

- The norms must be enshrined in the order.

- If the CP per day exceeds 700 rubles. for trips around Russia and 2500 rubles. per day for business trips abroad, then amounts exceeding the daily allowance for business trips are subject to insurance contributions.

- All travel expenses should be included in reporting, namely in the DAM.

Please note that if a company does not include travel expenses in the DAM report, then tax authorities do not have the right to issue a fine. However, this only applies to non-taxable amounts. It should also be noted that if the company has not included non-taxable business trips in the DAM, then it is advisable to provide an adjusting report. But if the adjustment is not provided, then the tax authorities cannot fine the company, since the tax base is not underestimated.