Account 68 in accounting: calculations of taxes and fees

The Tax Code of the Russian Federation and the legislation of regions and municipalities provide for the obligation of an economic entity to calculate a number of mandatory payments to the relevant budgets.

With the help of tax registers, business entities determine the tax base for a specific tax and calculate the mandatory payment itself for a specified period of time. Tax accrual must also be shown in the accounting records.

For these purposes, account 68 is used according to the Chart of Accounts. This account records the occurrence of a tax liability in the form of a specific tax amount, and also reflects its transfer to the budget. Here the occurrence of underpayment or overpayment of a particular tax is determined.

The same account reflects the organization’s obligation as a tax agent, for example, for personal income tax, income tax or VAT.

Account 68 in the balance sheet is reflected in the fifth section as part of short-term debt, if it has a balance on the credit of the account, and in the second section as part of short-term receivables. Therefore, the location of the account balance determines whether it is active or passive.

Line by line it looks like this:

- On line 1230 as part of accounts receivable (if there is an overpayment of taxes);

- On line 1450 as part of other obligations when providing a deferment in the payment of taxes;

- On line 1520 as part of accounts payable for the amount of accrued taxes, payment for which has not yet occurred.

Attention! The same account can reflect the organization’s settlements with the budget regarding the accrual and payment of assigned fines and penalties to the budget for late payment of taxes.

Postings including VAT

Subaccount 68.02 is responsible for displaying information on the calculation and payment of VAT. It is calculated based on the documents provided - issued and accepted invoices. For example, the company Yunost bought goods from the company Sovest for a certain amount. The seller company issued an invoice to the client.

The wiring looks like this:

- D 19 Kt 60 – a record of accrued (input) VAT is recorded.

- D 68.02 Kt 19 – the required amount is written off.

If the company sells goods, then the wiring will be different:

D 90.03 Kt 68.02.

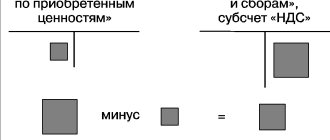

In such situations, the invoice is issued within a certain period. In the course of the enterprise’s activities, the amount of VAT on subaccount 68.02 is accumulated in debit for deduction, and in credit for payment. For the final calculation, it is necessary to find the difference between these two indicators - this will be the amount to be repaid for VAT obligations.

Account characteristics

The accounting chart of accounts establishes that account 68 is intended to summarize information on the implementation of settlements with the budget for various tax payments. The same regulatory act determines where, in an asset or liability, this account is included. It is considered active-passive.

An account can have two balances simultaneously, both on the debit side of the account and on the credit side:

- The debit balance of account 68 reflects the presence of overpayment of taxes at the beginning of the reporting period. The credit balance of this account determines the company's tax debt to the budget. Based on which balance, debit or credit, the following algorithm for determining the balance at the end of the period applies.

- If the opening balance is debit, the debit turnover on the debit should be added to it and the credit amounts on the account should be subtracted from it. If the result is positive, it is reflected as a debit balance in account 68 at the end of the month.

- If initially the balance at the beginning of the period was located on the credit account, then the turnover on the credit account 68 should be added to it and the debit turnover should be subtracted. If the result is greater than zero, then the balance is a credit balance and is located in the credit of the account. Otherwise, the balance will be reflected in the debit of the account.

You might be interested in:

Account 20 in accounting “main production”: what is it used for, characteristics, subaccounts, postings

Features and disadvantages of PBU 18/02

Unfortunately, PBU 18/02 does not consider the situation when permanent differences in income reflected in accounting exceed the “tax” ones (in practice, this option is possible). In this case, the identified amount, calculated as the product of the permanent difference (in terms of income) and the income tax rate, is not a permanent tax liability, but most likely a “permanent tax asset.” In accounting, it should be reflected by the following entry: Debit account 68 Credit account 99 subaccount “Permanent tax asset”.

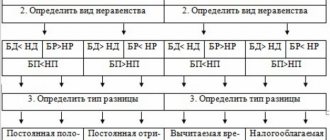

The difference between income and expenses, which forms profit (loss) in accounting in one reporting period, and taxable profit in another, in accordance with PBU 18/02 is called temporary.

Moreover, if income and expenses increase the tax on accounting profit in the reporting period (i.e., the amount of accounting profit in the reporting period is less than the amount of tax profit by the amount of the indicated income and expenses), but reduce it in subsequent periods, then they are called deductible temporary vestries . If such income and expenses reduce the tax on accounting profit in the reporting period, but increase it in subsequent periods, then they are called taxable temporary vestries.

PBU 18/02 requires that taxable and deductible differences be taken into account separately in the analytical accounting of the corresponding asset and liability account in the assessment of which the deductible or taxable temporary difference arose. To generate information in the accounting system about income and expenses that lead to the formation of temporary differences, we consider it appropriate to organize their separate accounting in second-order subaccounts, highlighting income and expenses that have a different accounting or recognition procedure for tax purposes.

Deferred tax asset (DTA) is understood as that part of the income tax by which the tax on accounting profit of the reporting period increases and the income tax payable in subsequent reporting periods decreases.

Deferred tax liability (DTL) is understood as that part of the income tax by which the tax on accounting profit of the reporting period is reduced and the income tax payable in subsequent reporting periods is increased.

The amount of the deferred tax asset and deferred tax liability is determined by multiplying the deductible and taxable temporary differences by the income tax rate.

In a manufacturing enterprise, a simplified scheme for calculating permanent and temporary differences can be represented as formulas:

Z = Mater. + Salary pl. + Report

Subaccounts

Since the purpose of account 68 is to keep records of all transactions in a business entity related to the calculation and payment of taxes, then subaccounts to it should be opened for each type of such mandatory payments.

For example:

- 68/1 — Calculations for personal income tax;

- 68/2 — VAT calculations;

- 68/3 — Calculations for excise taxes;

- 68/4 - income tax calculations;

- 68/6 - calculations for land tax;

- 68/7 — calculations for transport tax;

- 68/8 - calculations for property tax;

- 68/10 - other payments to the budget;

- 68/11 - calculations for UTII;

- 68/12 - calculations for the single tax simplified tax system.

Attention! An organization has the right to open sub-accounts for itself only for those taxes that it actually pays. Therefore, the given list can be both expanded and shortened.

In addition to taxes, a business entity may be assessed fines and penalties. They can be accounted for in separate accounts within tax subaccounts, or you can open another subaccount 68/PENI, within which such payments can already be taken into account in terms of taxes.

What does debit 68 credit 68 mean?

In VAT accounting, there are situations when the amount of incoming VAT is greater than that accrued upon sale. This happens, for example, when a company purchased more raw materials than it sold products. Or a large OS was purchased. Or the company built a new workshop on its own. Another situation with compensation arises for companies involved in exports.

More information about the VAT refund mechanism itself can be found in the article “What is the procedure and features of the “input” VAT refund?”

If you receive a VAT refund at the end of the quarter, then the tax authorities can offset the amount of the refund against existing arrears, penalties, and fines not only for VAT, but also for other federal taxes - on the basis of clause 4 of Art. 176 of the Tax Code of the Russian Federation, wiring Dt 68 Kt 68.

If the taxpayer decides to receive a VAT refund to the current account, then when money is received from the budget, the accountant must make the following entry in the accounting:

Dt 51 Kt 68 - the amount of VAT to be refunded was returned to the current account.

Posting debit 68 to credit 68 means offsetting the overpayment (reimbursement) for one tax against the company's payments for other taxes.

The same posting should be made if the taxpayer transferred funds into a single tax payment. And the tax authorities independently distributed taxes among personal accounts. See here for details.

Example

LLC "Sdoba" in the first quarter of 20XX acquired a production line for the production of confectionery products worth 5 million rubles, including VAT of 833,333.33 rubles. In addition, during the quarter I bought raw materials, paid for utilities and workshop rent - in total, the deduction for the first quarter of 20XX amounted to 1 million rubles. In the first quarter of 20XX, she sold products worth 2,360,000 rubles, including 393,333.33 rubles. VAT. The difference between accrued VAT and input VAT was:

RUB 393,333.33 – 1,000,000 rub. = –606,666.67 rub.

That is, a tax was generated for reimbursement from the budget. And for income tax in the first quarter of 20XX, Sdoba LLC received a tax payable in the amount of 500 thousand rubles. The company submitted an application with a request to offset the budget debt in the form of a VAT refund against the payment of income tax for the first quarter of 20XX. The tax authority agreed on the offset of taxes among themselves.

From October 1, 2021, it is possible to offset the amounts of overpaid/withheld taxes without restrictions on their levels.

ConsultantPlus experts explained in detail how organizations can offset tax overpayments. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Then, by posting between the subaccounts of account 68, the accountant can redistribute the overpayment of VAT towards the payment of income tax. The accountant of “Sdoba” will make the following entry:

Dt 68 subaccount “Income Tax” Kt 68 “Calculations for VAT” - for 500,000 rubles: VAT is credited for reimbursement for the first quarter of 20XX against the payment of income tax.

The company still has 140 thousand rubles left. overpayment of VAT, which can be offset by posting Dt 68 Kt 68 against taxes in the second quarter of 20XX.

In what other cases can a company make an accounting entry Dt 68 Kt 68? In case of offset of overpayment between any taxes for which the Tax Code of the Russian Federation allows offset. And also when overpaying one tax is offset against penalties, arrears or fines.

Example

discovered in April 20XX an overpayment of personal income tax transferred for employees in the amount of 11,235 rubles. And for income tax, an arrears of 7,000 rubles were revealed. The company submitted an application to the Federal Tax Service with a request to offset the arrears against the overpayment. The tax office allowed the offset. The accountant made the accounting entry Dt 68 Kt 68 as follows :

Dt 68 subaccount “Calculations for income tax” Kt 68 subaccount “Calculations for personal income tax” - in the amount of 7,000 rubles: overpayment for personal income tax is offset against arrears for income tax.

The company asked to offset the balance of the overpayment against the fine for incomplete payment of the tax amount; the tax authorities agreed on the offset. Then the posting of Dt 68 Kt 68 should be detailed with the following subaccount:

Dt 68 subaccount “Calculations for income tax” Kt 68 “Calculations for personal income tax” - in the amount of 4,235 rubles: overpayment of personal income tax is offset against the fine for incomplete payment of tax.

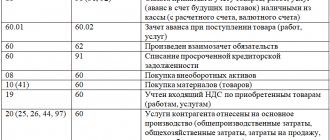

Corresponds with accounts

Account 68 can enter into transactions with the specified accounts.

From the debit of account 68 to the credit of accounts:

- Account 19 - when deducting VAT on previously acquired inventory items;

- Account 50 - such an entry can reflect the payment of various benefits to employees at the expense of the budget;

- Account 51 - when reflecting the payment of tax to the budget from the current account;

- Account 52 – when paying taxes to the budget from a foreign currency account. Considering the fact that such correspondence is directly stated in the chart of accounts, which is established by 94-N, it most likely will not occur in life, since payments to the budget must be made in rubles.

- Account 55 - when paying taxes to the budget from special bank accounts;

- Account 66 - if the repayment of tax obligations is carried out using short-term loan funds, while they themselves are transferred to the budget directly, without intermediate crediting to the organization’s account.

- Account 67 - if the repayment of tax obligations is carried out using long-term loan funds, while they themselves are transferred to the budget directly, without intermediate crediting to the organization’s account.

By crediting the account, it enters into correspondence with the debit of the following accounts:

- Account 08 - when allocating the listed fees, customs duties, and non-refundable taxes to the initial cost of capital investments;

- Account 10 – when allocating the listed fees, customs duties, and non-refundable taxes to the original cost of materials;

- Account 11 – when allocating the listed fees, customs duties, and non-refundable taxes to the initial cost of animals and young animals;

- Account 15 – when allocating the listed fees, customs duties, and non-refundable taxes to the initial cost of materials, provided that the Accounting Policy provides for accounting for the purchase of materials through account 15;

- Account 20 - when attributing the listed fees, customs duties, and non-refundable taxes to the costs of production of the main products;

- Account 23 - when attributing the listed fees, customs duties, and non-refundable taxes to the costs of auxiliary production;

- Account 26 – when attributing the listed fees, customs duties, and non-refundable taxes to general corporate expenses;

- Account 29 – when attributing the listed fees, customs duties, and non-refundable taxes to the costs of auxiliary production and farms;

- Account 41 – when allocating the listed fees, customs duties, and non-refundable taxes to the original cost of goods purchased for resale;

- Account 44 - when attributed to costs associated with the sale of finished products, listed fees, customs duties, non-refundable taxes;

- Account 51 - when returning from the budget to the current account in excess of the transferred amounts of taxes and other payments;

- Account 52 – when returning from the budget to a foreign currency account in excess of the transferred amounts of taxes and other payments. Despite the fact that such correspondence is directly spelled out in the chart of accounts, which is established by 94-N, it most likely will not occur in life, since payments to the budget must be made in rubles.

- Account 55 - when returning excessively transferred amounts of taxes and other payments to a special account;

- Account 70 - when reflecting the withholding of personal income tax from employees’ salaries;

- Account 75 - when reflecting the withholding of personal income tax from dividends accrued to the organization's employees;

- Account 90 - when calculating taxes related to the sale of products (VAT, excise taxes, duties, etc.)

- Account 91 - when calculating taxes related to the sale of other property (VAT, excise taxes, duties, etc.)

- Account 98 - when reflecting taxes related to transactions of a future period;

- Account 99 - when reflecting the accrual of income tax, as well as tax sanctions (fines, penalties).

You might be interested in:

Account 70 in accounting: what is it used for, characteristics, subaccounts, examples of postings

What does the debit of account 68 show?

The debit reflects information on transferring taxes to the budget or reducing tax liabilities in another way, for example, by deducting VAT. Thus, the debit accumulates the VAT amounts written off from account 19. The debit of account 68 shows (or rather, the final balance) that there is an overpayment of taxes. Let us dwell on the typical entries in the debit of account 68 in accordance with the chart of accounts approved by order of the Ministry of Finance dated October 31 .2000 No. 94n:

- Dt 68 Kt (51, 52, 55) - repayment of taxes in cash;

- Dt 68 Kt - acceptance of VAT for deduction;

- Dt 68 Kt () - tax debt has been repaid through short-term (long-term) loans, for example, a budget payment has been made through an overdraft.

Examples of wiring for dummies

Let's consider situations regarding the calculation and payment of various taxes

simplified tax system

| Debit | Credit | Type of transaction |

| 99 | 68/USN | An advance payment (tax) has been calculated according to the simplified tax system |

| 68/USN | 51 | Advance payment (tax) has been paid |

Personal income tax

| Debit | Credit | Type of transaction |

| 70 | 68/NDFL | Payroll tax withheld |

| 73 | 68/NDFL | Deduction made from financial assistance |

| 75 | 68/NDFL | Deductions were made from employee dividends |

| 84 | 68/NDFL | A withholding was made from dividends of a third party |

| 68/NDFL | 51 | Personal income tax transferred to the budget |

VAT on sales of goods

| Debit | Credit | Type of transaction |

| 41 | 60 | Purchased goods for resale |

| 19 | 60 | Incoming VAT reflected |

| 68/VAT | 19 | VAT credited |

| 62 | 90/1 | Product sold to buyer |

| 90/2 | 41 | Cost of goods sold written off |

| 90/3 | 68/VAT | VAT tax charged on the sale of goods |

| 68/VAT | 51 | Tax paid to the budget |

VAT on advance received

| Debit | Credit | Type of transaction |

| 51 | 62/AB | Advance received for goods |

| 76/VAT | 68/VAT | VAT is reflected on the prepayment received |

| 62 | 90/1 | Sales of goods reflected |

| 90/3 | 68/VAT | VAT charged on sales |

| 68/VAT | 76/VAT | VAT has been deducted from the advance payment |

Typical wiring

The main transactions for this account are presented in the table:

| Account Dt | Kt account | Wiring Description | A document base |

| 68 | 19 | Amounts of taxes actually transferred to the budget + VAT | Payment order |

| 68 | 50/51,52,55 | Payment of tax debts in cash or through a bank | Payment order |

| 70/75 | 68 | Personal income tax withheld from the income of employees or founders | Payslip |

| Based on settlement amounts for contributions to budgets | |||

| 99 | 68 | Income tax is reflected | Help-calculation |

| 70 | 68 | We reflect the amount of accrued personal income tax | Payslip |

| 90 | 68 | We reflect VAT, excise taxes, indirect taxes | Accounting information |

| 91 | 68 | We reflect financial results (operating expenses) | Certificate of calculation/Acceptance and transfer certificate |

Example 1. Postings to subaccount 68.01 “NDFL”

Let’s say that at the end of the month, at Osen LLC, an accountant assessed personal income tax on employee salaries in the amount of 107,256 rubles. Dividends were also paid to the founders, the tax amount was 65,123 rubles.

Postings for calculating personal income tax on account 68:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 70 | 68.01 | 107 256 | Personal income tax accrued on salary | Payslip |

| 75.02 | 68.01 | 65 123 | Personal income tax accrued on dividends | Tax card for personal income tax, accounting certificate |

| 68.01 | 51 | 107 256 | Personal income tax on wages transferred to the budget | Payment order |

| 68.01 | 51 | 65 123 | Personal income tax on dividends transferred to the budget | Payment order |

Example 2. Postings to subaccount 68.02 “VAT”

At Leto LLC based on the results of the 2nd quarter (core activities):

- VAT was charged in the amount of RUB 78,958;

- VAT accepted for deduction (advance) in the previous quarter in the amount of RUB 36,695 was restored;

- VAT on the sale of fixed assets amounted to RUB 7,959.

The accountant of Leto LLC reflected the accrual of VAT with the following entries:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 90.03 | 68.02 | 78 958 | VAT charged (sales) | Accounting information |

| 76 advance | 68.02 | 36 695 | VAT restored | Sales book |

| 91.02 | 68.02 | 7 959 | VAT charged (VAT) | Certificate of acceptance and transfer |

| 68.02 | 51 | 123 612 | The tax is transferred to the budget | Payment order |

Example 3. Postings to subaccount 68.04 “Income Tax”

To account for income tax calculations with the budget, subaccount 68.04.01 is used, and for tax calculations, a balance-free subaccount 68.04.02 is used, which is closed on account 68.04.01 at the end of the period.

Income tax is calculated on an accrual basis, taking into account advances of the reporting periods: quarter, 06 and 09 months and based on the results of the tax period - calendar year.

Let’s say that at the end of the reporting period, quarter, Vesna LLC made a profit, the tax on which amounted to 310,000 rubles. and was transferred to the budget.

The accountant of Vesna LLC generated the following entries for subaccount 68.04 “Income Tax”:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 99 | 68.04.02 | 310 000 | The amount of income tax accrued | Help-calculation |

| 68.04.01 | 51 | 310 000 | The tax amount is transferred to the budget | Payment order |

We prepare transcripts for accounts 68 and 99 in order to fill out the report without errors

During the reporting period, the company developed discrepancies between accounting and tax profits. Let's figure out how to fill out a profit and loss statement in such a situation, taking into account the requirements of PBU 18/02 and reporting users

In order to avoid mistakes when generating a profit and loss statement, it is convenient to make a breakdown of the turnover on accounts 68 “Calculations for taxes and fees” (sub-account “Income Tax”) and 99 “Profits and Losses” on a separate sheet. Let's consider four situations.

1 In the accounting and tax accounting of the company, a profit was made.

2 In accounting - loss, in tax accounting - profit.

3 In accounting - profit, in tax accounting - loss.

4 A loss was incurred in accounting and tax accounting.

IT IS CLEAR THAT...

„.net profit in the income statement (line 2400) is the balance of account 99 “Profits and losses”.

Reverse balance sheet for account 68

On debit, data on actual transfers of the organization is collected. In addition, VAT amounts presented by suppliers and accepted for deduction (from Kt19) and credited advances from buyers (from Kt76AV) are transferred to Debit account 68.

Attention! Balances on account 68 must coincide with the settlement certificate for mutual settlements ordered from the Federal Tax Service.

Calculations for each tax are analyzed separately, therefore, separate sub-accounts 68 accounts are opened in accounting:

68.01 – mutual settlements with the budget as a tax agent are taken into account when transferring personal income tax from employee salaries;

68.04 – data on advance payments and annual tax calculation on the profit received by the company is displayed here. The payment is distributed between the federal and regional budgets.

Something to keep in mind! Organizations operating in accordance with PBU 18/02 must open an additional sub-account to reflect information on the calculation of advance payments.

68.07 – display of information about transport tax;

68.08 – property taxes;

68.09 – tax payments on advertising

68.10 – other types of taxes and fees

68.11 – UTII (for business entities who have chosen this form of taxation);

68.12 – simplified tax system (for business entities who have chosen this form of taxation);

68.13 – information on trading fees

68.22 – this sub-account records information on possible VAT refunds on exports if it is necessary to obtain additional permission from regulatory authorities (the sub-account is active)

68.32 – data on VAT transfers if the company acts as a tax agent (passive subaccount)

How to calculate income tax in 1C

+ Am. + Other + PR + Write-off of RBP

S RP (account) = (GP n – GP k) book. + (WIP n – WIP k) book. + Z inc. + Z indirect. + PR + A book. + RBP equal

S RP (cash) = (GP n – GP k)cash. + (WIP n – WIP k)cash. + Z inc. + Z indirect. + And cash. + RBP units

S RP (cash) - S RP (accounting) = D GP cash. — DGP book. + DWIP cash. – DNZP book. - ETC. + And cash. - And boom. + RBP units — RBP equal.

Unlike the balance sheet, Form No. 2 is based not on accounting account balances, but on the basis of turnover. Therefore, Form No. 2 reflects not the balances of accounts 09 “Deferred tax assets” and 77 “Deferred tax liabilities”, but the results of the turnover of these accounts for the reporting period.

The income statement reflects the difference between accrued and written off deferred tax assets and liabilities. Namely: the line “Deferred tax assets” shows the difference between the debit turnover of account 09 and the credit turnover on this account for the reporting period, and the line “Deferred tax liabilities” shows the difference between the credit and debit turnover on account 77.

In Form No. 2 there are no brackets in the line “Deferred tax liabilities”. The fact is that the indicators of the lines “Deferred tax assets” and “Deferred tax liabilities” in form No. 2 in certain cases can change their sign.

Once accrued, deferred tax assets increase profit (reduce loss) before tax. Deferred tax liabilities, on the contrary, reduce the amount of profit or increase the loss. When deferred tax assets or liabilities are settled, the reverse process occurs. The write-off of deferred tax assets occurs at the expense of profits (that is, profits decrease), and the settlement of deferred tax liabilities leads to an increase in the organization's profits.

The indicator of deferred tax assets is reflected in Form No. 2 as a positive value if the debit turnover on account 09 (the amount of accrued tax assets) for the reporting period was greater than the credit turnover (the amount of repaid tax assets). If the credit turnover on account 09 is greater than the debit turnover (that is, more deferred tax assets have been repaid than accrued), then the difference between the turnovers is reflected with a minus sign. A negative deferred tax asset will appear on the income statement.

The opposite situation occurs with deferred tax liabilities. If the credit turnover of account 77 is greater than the debit turnover of this account, this means that during the past period more tax liabilities were accrued than were repaid. Then in form No. 2, in the line “Deferred tax liabilities”, an indicator with a minus sign will be reflected, which will reduce profit (increase loss) before tax. But if during the reporting period the organization repaid more deferred tax liabilities than accrued (that is, the debit turnover on account 77 exceeds the credit one), then in the profit and loss statement the indicator of the line “Deferred tax liabilities” will change its sign from minus to plus.