The concept of labor function

When hiring a new employee, the employer enters into an employment contract with him. According to Art. The Labor Code of the Russian Federation must reflect the conditions of admission in the document, including:

- position according to the staffing table;

- profession (specialty) and qualifications;

- specific type of work assigned to the employee.

This is exactly how the concept of labor function is revealed in the Code. In fact, this is a description of the responsibilities assigned to the employee, a certain range of tasks outlined by the employment contract and local company documents (staffing schedule, job descriptions).

How to correctly draw up an employment contract for remote work

Lawyer and expert in the field of labor law Alexander Yuzhalin will help us correctly spell out the mandatory terms of an employment contract in accordance with the requirements of the law and taking into account changes associated with the COVID-19 epidemic.

An employment contract has always been and remains, perhaps, the main document in regulating labor relations. It is especially important for both the employee and the employer, since it is in the employment contract that all the agreements that were reached during hiring and which now need to be fulfilled by the employee and the employer are recorded in writing. And for an employer, an employment contract is also important because, in accordance with current legislation, the most serious liability is provided for violations related to the execution of an employment contract (compared to other violations of the execution of personnel documentation).

The Labor Code of the Russian Federation provides for uniform requirements for drawing up an employment contract with the majority of employees (these requirements are contained in the mandatory form of the employment contract, as well as in the mandatory conditions that must be included in the employment contract). However, you need to be especially careful with certain categories of workers, including remote workers, since the law provides for special conditions in relation to them.

Features of the procedure for concluding an employment contract with a remote worker

As a general rule, in accordance with Article 67 of the Labor Code of the Russian Federation, an employment contract is always concluded in writing. However, there is a special feature for remote workers. In accordance with Part 1 of Article 312.2 of the Labor Code of the Russian Federation, an employment contract for remote work can be concluded by exchanging electronic documents. However, in this case, the employer, no later than three calendar days from the date of conclusion of this employment contract, is obliged to send the remote worker by registered mail with notification a duly executed copy of this employment contract on paper. In other words: in the end, the employment contract must still be drawn up in classic paper form and sent to the employee by registered mail.

Contents of an employment contract with a remote worker

As noted above, the requirements for the content of an employment contract with any employee are established by the Labor Code, namely Article 57. However, in relation to a remote worker, special attention must be paid to some terms of the employment contract, since they will differ from the standard terms of the contract.

Article 57 of the Labor Code of the Russian Federation divides the employment contract into three parts:

1) information about the place and time of concluding the employment contract; 2) information about the parties to the employment contract (employee and employer); 3) mandatory terms of the employment contract.

Next, let's look at each of these parts in more detail.

Place and time (date) of concluding a contract on remote work

The location of the employer is indicated as the place of concluding the employment contract (regardless of the location of the employee or the place where the employee plans to carry out his activities). This requirement is established by Article 312.2 of the Labor Code of the Russian Federation.

As the date of conclusion of the employment contract, it is necessary to indicate the date when the parties signed the employment contract.

Information about the parties to the employment contract

Mandatory information about the employee is the last name, first name and (if available) patronymic, as well as details of the identity document. Please note: other information about the employee can be included in the employment contract only if there is consent to the processing of personal data. Without such consent, it is not recommended to add additional information to the employment contract!

Mandatory information about the employer is:

• name of the organization according to the charter; • last name, first name and (if any) patronymic of the person who acts on behalf of the employer; • the basis document, according to which the person representing the employer has the right to sign an employment contract; • taxpayer identification number (TIN).

At the employer’s discretion, it is permissible to include other information about the employer in the employment contract without any restrictions.

Mandatory terms of an employment contract with a remote worker

1. Place of work.

The Labor Code of the Russian Federation does not disclose the content of the concept “place of work”. In the theory of labor law, a place of work is understood as a specific organization located in a certain area (settlement), its representative office, branch, or other separate structural unit.

Considering the fact that the specific place of work of a remote worker cannot be determined in the form of the territorial location of the facility, it is permissible to indicate in the employment contract the condition that the employee is hired in ... (name of organization), and also indicate that “the employee’s place of work is determined by him at your own discretion."

2. Labor function

(work according to the position in accordance with the staffing table, profession, specialty indicating qualifications; specific type of work assigned to the employee).

When concluding an employment contract, the employee agrees with the employer on the specific work that will be performed. The text of the contract indicates the name of the position in accordance with the staffing table for which the employee is hired, or the name of the profession/specialty indicating qualifications, as well as the specific type of work entrusted to the employee. Together they characterize the employee’s labor function, which is determined by the parties to the employment contract.

Note:

if, in accordance with the Labor Code of the Russian Federation or other federal laws, the performance of work in certain positions, professions, specialties is associated with the provision of compensation and benefits or the presence of restrictions, then the names of these positions, professions or specialties and the qualification requirements for them must correspond to the names and requirements specified in qualification reference books approved in the manner established by the Government of the Russian Federation, or corresponding to the provisions of professional standards.

Unfortunately, the legislation of the Russian Federation does not contain a single document that would define all guarantees, compensation or restrictions established for certain positions or professions. Accordingly, to determine the presence or absence of such features for a particular position, the employer needs to analyze all regulatory legal acts that may contain the information of interest. It is advisable to carry out this work together with the legal department of the organization.

Please also note that the labor function refers not only to the name of the position, but also to the specific type of work assigned to the employee. That is, each employment contract must specify the employee’s job responsibilities, which can be specified both in the text of the employment contract and in the job description, which will be an integral annex to the employment contract (if the employment contract at its conclusion for some reason information about job responsibilities was not included).

Placing a condition on a specific type of work entrusted to an employee outside the scope of the employment contract (for example, in a job description, which has the status of, for example, a local regulatory act) will be a violation of labor legislation.

In order to reserve the right, if necessary, to make changes to the employee’s job description, it will need to be drawn up separately from the employment contract. But at the same time, the employment contract itself, in any case, must contain a condition on the specific type of work entrusted to the employee.

To resolve this issue, you can use the following option: you prescribe a brief labor function (generalized function) in the employment contract, and you take all the specifics of what the employee must perform within the framework of such a generalized function outside the scope of the employment contract, formalizing this condition, for example, job description.

In this case, if the change in the job description does not entail a change in the terms of the employment contract, the employer has the right to do this unilaterally, without asking for the employee’s consent. Please note that otherwise the job function specified in the contract can be changed only with the consent of the employee.

3. Start date

regulated by Article 61 of the Labor Code of the Russian Federation. And in the case when a fixed-term employment contract is concluded, it is also important to indicate the period of its validity and the circumstances (reasons) that served as the basis for concluding a fixed-term employment contract in accordance with the Labor Code of the Russian Federation or other federal law (the grounds for concluding a fixed-term employment contract are defined in Article 59 Labor Code of the Russian Federation).

An employment contract comes into force from the day it is signed by the employee and the employer, unless otherwise provided by law or the employment contract, or from the day the employee is actually admitted to work with the knowledge or on behalf of the employer or his representative. Thus, the start date of work may coincide with the day the employment contract is concluded, or the parties may agree that the employee will begin work on a different date specified in the employment contract.

4. Terms of remuneration (including the size of the tariff rate or official salary of the employee, additional payments, allowances and incentive payments).

The main requirement is to indicate the amount of salary, hourly rate or piece rates, depending on the remuneration system used in the organization. It is recommended to list the remaining types of payments (compensation, incentives, incentives) (but it is permissible to do this without indicating specific amounts with reference to the local regulatory act of the employer establishing these payments, including the procedure, amount, criteria and conditions for their receipt).

Important point!

Article 136 of the Labor Code of the Russian Federation provides for the employer’s obligation to pay wages to the employee at least every six months and on the day established by the internal labor regulations, collective agreement or employment contract.

Thus, the condition on specific days for payment of wages must be contained in both the internal labor regulations and in the labor or collective agreement. In other words, the dates of payment of wages may not be specified in the employment contract only if these dates are determined by the collective agreement.

5. Working hours and rest hours (if for a given employee it differs from the general rules in force for a given employer)

In accordance with Article 312.4 of the Labor Code of the Russian Federation, unless otherwise provided by the employment contract on remote work, the working hours and rest periods of a remote worker are established by him at his own discretion.

Thus, if the working hours are not specified in the employment contract with a remote worker, this means that he has the right to determine the working hours at his own discretion

(which in a large number of cases will not protect the interests of the employer). Therefore, it is recommended that the employment contract reflect a condition on the employee’s working hours - either with reference to the internal labor regulations (if the employee’s working hours do not differ from those prescribed in the PVTR), or in the employment contract itself, all elements of the established working hours are specified.

Advice!

When describing the working time regime, check that the regime includes all the mandatory elements named in Article 100 of the Labor Code of the Russian Federation.

6. Conditions that determine, if necessary, the nature of the work (mobile, traveling, on the road, other nature of work).

Remote work in itself is already a type of work, therefore, in the employment contract itself, it is necessary to indicate the condition that the contract is an “employment contract for remote work.” And if it is expected that the employee will travel on business during working hours, the employment contract should indicate that “the traveling nature of the work is established for the employee.”

7. Conditions on compulsory social insurance of the employee in accordance with the Labor Code of the Russian Federation and other federal laws.

The employment contract must duplicate the employee’s right to compulsory social insurance specified in the law.

Conditions that must be included in an employment contract with a remote worker

1. On the procedure and timing of providing equipment, software and hardware, information security tools and other means necessary for the performance of one’s duties under an employment contract for remote work.

2. On the procedure and terms of payment of compensation for the use by a remote worker of equipment owned or leased by him, software and hardware, information security tools and other means (if the employee uses equipment that the employer did not provide to him).

3. On the procedure and timing for remote workers to submit reports on work performed. When specifying this condition, we recommend determining in what period (daily, once every few days, etc.), to whom (indicating the position and email address) and in what form the employee is obliged to provide a report on the work done. If an organization has a local regulatory act that describes the issues of interaction between an employer and a remote worker, it is permissible to indicate a link to this document in the employment contract without specifying specifics in the employment contract itself (if such a local act exists, this option is the most acceptable).

Note! Unlike a standard employment contract, an employment contract for remote work does not specify working conditions at the workplace.

This is due to the fact that in relation to remote workers, a special assessment of working conditions in the workplace is not carried out.

The parties to the employment contract, in addition to the necessary conditions, may establish additional conditions. They can be very diverse within the limits permitted by current legislation.

Additional (optional) terms of the employment contract, established by law

1) On clarification of the place of work (indicating the structural unit).

If you indicate a structural unit as a condition of the employment contract, then if you need to change it, you will be faced with a situation that will be equal to a transfer, according to Article 72.1 of the Labor Code of the Russian Federation. If the structural unit is not specified in the employment contract, a change in the structural unit under Article 72.1 of the Labor Code of the Russian Federation will constitute a transfer and written consent will not be required from the employee.

2) About the test. The absence of a probationary clause in the employment contract means that the employee was hired without a trial.

3) On non-disclosure of secrets protected by law (state, official, commercial and other).

4) On the employee’s obligation to work after training for at least the period established by the contract, if the training was carried out at the expense of the employer.

5) On the types and conditions of additional employee insurance.

6) On improving the social and living conditions of the employee and his family members.

7) On clarification, in relation to the working conditions of a given employee, of the rights and obligations of the employee and the employer established by labor legislation and other regulatory legal acts containing labor law norms.

On additional non-state pension provision for employees.

On additional non-state pension provision for employees.

The employment contract may also provide for other additional conditions that do not worsen the employee’s position in comparison with the situation established by the current law, collective agreement or local regulations of the employer.

Our column with materials from HR experts is updated weekly. In order not to miss the most important things, subscribe to our Telegram channel.

How to fill out the type of assigned work in SZV-TD

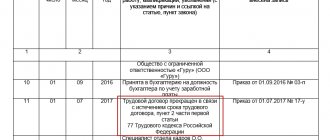

Information about the job function and place of work (the department to which the employee is attached) is reflected in column 4 of the form.

Requirements for entry in column 4 of the SZV-TD form (clause 2.5.4 of the Rules for filling):

- the title of the position is taken from the employer’s staffing table;

- qualifications are indicated;

- if the profession involves providing benefits to the employee (or there are restrictions on it) - the name is given in strict accordance with the qualification directory, job register or professional standard;

- when establishing a second (and subsequent) specialty, profession, qualification for an employee, ranks, classes or other qualification categories are also indicated.

In the SZV-TD, in the column “type of assigned work,” the employer enters the full name of job duties and specific types of work performed, when the company does not have a staffing table (or the position is not available due to the specifics of the work) or in the event of a significant difference in the professional functions of this employee from others employees in the same position.

As an example, let’s take the position of an accountant: let’s say the company included 2 accountant positions in the staffing table, one of which is “materials accountant”, and the second is “payroll accountant”. In this case, the specific type of work is accounting for materials and calculating wages, which is reflected in the SZV-TD. The sample “type of assigned work” will show you how to correctly enter the information:

New reporting to the Pension Fund

On January 1, 2020, the introduction of electronic work books began in Russia.

Innovations have added more work to personnel officers. Now all employers are required to submit information about personnel changes that have occurred at the enterprise to the Pension Fund of the Russian Federation. In 2021, messages must be sent every month by the 15th day of the month following the reporting month. From 2021, the frequency of data reporting will change. Messages about the dismissal or hiring of an employee will have to be sent no later than the day following this event. For other cases, the procedure in force in 2021 remains the same.

To inform the Pension Fund of Russia, a new form has been developed - SZV-TD (approved by Resolution of the Board of the Pension Fund of December 25, 2019 No. 730p).

Our article will help you fill out the SZV-TD form without errors. There you can also find a report and samples of how to fill it out in various situations.

In the SZV-TD form, the type of work assigned is indicated in the tabular part of the form, intended to inform about the employee’s work activities. Let us examine in more detail what and in what cases should be written down in the appropriate columns of the reports.