The terms of remuneration are stipulated in the employment contract without fail. If they are not in the document, an additional salary agreement is concluded with the employee, which becomes an integral part of the contract (Article of the Labor Code of the Russian Federation). The contract must contain information on the size of the tariff rate or salary, and on the procedure for paying allowances, bonuses, additional payments, and various monetary incentives (if they are provided for by law or local regulations of the enterprise). Incorrect wording may result in claims from the labor inspectorate and administrative fines.

SALARY AMOUNT IS A MANDATORY CONDITION OF THE EMPLOYMENT CONTRACT

The terms of remuneration are among the mandatory conditions of the employment contract (paragraph 5, part 2, article 57 of the Labor Code of the Russian Federation). Labor legislation includes the following conditions:

• tariff rate or salary (official salary) of the employee;

• additional payments;

• allowances;

• incentive payments.

According to Part 1 of Art. 135 of the Labor Code of the Russian Federation, wages for a specific employee are established by an employment contract in accordance with the wage systems in force for a given employer. That is, it is of great importance what kind of remuneration system is applied to the employee (for example, time-based or piece-rate), whether additional payments, allowances, bonuses, etc. are established, as well as working conditions.

At the same time, remuneration systems are developed based on the requirements of labor legislation. That is, the wages of each employee must take into account the criteria established in the legislation, including working conditions[1].

As a rule, employers include in an employment contract with an employee a special section dedicated to the terms of remuneration for this employee (for example, “Wages”).

Terms of transfer and date of payment of wages

Employers transfer salaries to their employees in installments not on their own initiative, but in accordance with labor legislation. Art. 136 of the Labor Code of the Russian Federation states that salaries must be transferred at least every half month . Even if the parties can agree to pay the entire amount once a month, and sign an agreement on this, it will still be considered illegal.

The days when employees are paid their salaries must be contained in the following documents:

- in internal labor regulations;

- in a collective agreement;

- in the TD of each employee (what else should be contained in the TD?).

The Labor Code of the Russian Federation establishes restrictions on the minimum number of payments per month , but the employer is not deprived of the right to make transfers more than 2 times.

Prepaid expense

An advance is not a specific amount, but an employee’s salary for the period of time actually worked in the first half of the month. It is calculated on the basis of the established salary, as well as various additional payments, the amount of which does not depend on the results of the month worked.

The specific date when the advance must be paid is not established by law. The employer chooses a specific date and indicates it in internal regulations, the collective agreement and TD.

According to Art. 136 of the Labor Code of the Russian Federation, wages must be paid at least every half month, that is, approximately 15 calendar days must pass between the advance and wages. In addition, it should be borne in mind that the payment date must be set as a specific number, and not a time period .

If the due date falls on a weekend or holiday, payments are made the day before.

TIME-TIME WAGE SYSTEM

If the employee has only a tariff rate or official salary (salary), their specific amount in numerical terms (for example, 100 rubles per hour or 50,000 rubles per month). Such explanations are given by Rostrud[2].

The wording may be as follows:

3.1. For the performance of labor duties provided for in this employment contract, the Employee is set a salary of 50,000 (Fifty thousand) rubles per month.

3.1. For the performance of labor duties provided for in this employment contract, the Employee is set an hourly tariff rate of 100 (One Hundred) rubles per hour.

In this case, the employment contract cannot use the wording “Payment according to the staffing table” or “The employee’s official salary is established in accordance with the staffing table.” If the employer does not indicate a specific salary amount, this will violate the requirements of paragraph 5 of Part 2 of Art. 57 Labor Code of the Russian Federation.

Thus, referring to the staffing table instead of indicating the specific amount of the employee’s salary is a violation of the requirements of labor legislation, for which the employer may be brought to administrative liability under Part 1 of Art. 5.27 of the Code of the Russian Federation on Administrative Offenses (CAO RF).

Therefore, when paying time-based labor, the employment contract must indicate the specific amount of the tariff rate or official salary of the employee, as well as additional payments, allowances and incentive payments.

Holds

Deductions from an employee’s salary are funds that are due to him for the period of time worked, but will not be paid, and will be used to ensure the requirements put forward to the employee in accordance with the law.

Monies may be charged on such grounds:

- withholding tax payments (Article 226 of the Tax Code of the Russian Federation);

- maintenance of convicts (Article 107 of the Criminal Executive Code of the Russian Federation);

- payment of alimony (Article 109 of the Family Code of the Russian Federation);

- other cases in accordance with the Law of October 2, 2007 No. 229-FZ.

The TD indicates the salary accrued to the employee . To document the deduction of funds from an employee’s earnings, the employer must issue an appropriate order.

PIECE WAGE SYSTEM

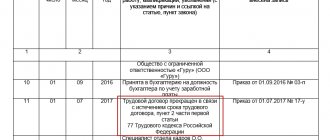

If, in accordance with the employer’s current remuneration system for the employee, a piece-rate remuneration system is established, the corresponding condition must be included in the employment contract.

At the same time, labor legislation does not oblige the employer to indicate in the employment contract the specific amount of piece rates or labor standards provided for in Art. 160 Labor Code of the Russian Federation.

Therefore, in an employment contract with an employee, whose earnings will depend on the number of units of product produced (work performed), it is necessary to indicate that wages are piecework. You must also provide a link to the employer’s local regulations establishing:

• piece rates, time standards, production standards;

• the procedure for recording production output and the volume of work performed (for example, regulations on remuneration of employees or an order from the employer).

The employee must be familiarized with the specified local regulatory act against signature.

The wording in the employment contract may be as follows:

3.1. The worker is established with a direct piece-rate wage system and is paid for the amount of product he produces. Piece rates, time standards, production standards, as well as the procedure for recording production output and the volume of work performed are established by the Regulations on the remuneration of employees of Specialist LLC.

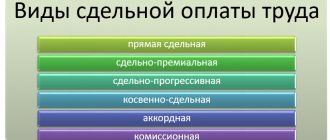

It is also necessary to take into account that there are several types of piecework wages:

• direct piecework;

• piecework-bonus;

• piecework-progressive;

• indirect piecework.

Document form

Any TD must be concluded in writing and certified by the signatures of the head of the employing organization and the employee himself. The law does not provide for the oral conclusion of such a contract. The standard form of TD is legally provided only for micro-enterprises (approved by Decree of the Government of the Russian Federation of August 27, 2021 No. 858), however, if desired, all other employers can use it. This template is convenient because it already provides for all the current norms of the Labor Code of the Russian Federation and other legislative acts, so this is a successful example of an employment contract. Piecework payment (2017) in its section on salaries must be prescribed by the organization itself. In a TD that an organization has developed independently, this section may look something like this:

ADDITIONAL PAYMENTS, ALLOWANCES, BONUSES

Norm of paragraph 5, part 2, art. 57 of the Labor Code of the Russian Federation allows you not to indicate in the employment contract the specific amounts of additional payments, allowances and bonuses.

If the employer has established additional payments, allowances and incentive (incentive) payments (including bonuses), then you can indicate their types and amounts:

a) directly in the employment contract;

b) in the form of a reference to the local regulatory act of the employer (for example, regulations on remuneration of employees, regulations on bonuses for employees) or the collective agreement by which they are established. Employees must be familiarized with the specified documents against signature (paragraph 10, part 2, article 22, part 3, article 68 of the Labor Code of the Russian Federation).

The fact that in this case it is possible to use reference norms in an employment contract is confirmed in its explanations by Rostrud2.

Extract from the letter of Rostrud dated March 22, 2012 No. 428-6-1 2. […] The specific amount of the tariff rate or official salary is indicated directly in the employment contract. As for additional payments, allowances and incentive payments due to an employee, they can be directly indicated in the employment contract or it can make a reference to the relevant local regulation or collective agreement, which provides the grounds and conditions for their payment. In the latter case, the employee must be familiarized with the content of local regulations and the collective agreement against signature.

The wording may be as follows:

3.1. For the performance of labor duties provided for in this employment contract, the Employee is paid a salary that includes: 3.1.1. Official salary in the amount of 50,000 (Fifty thousand) rubles per month. 3.1.2. Quarterly and annual bonuses that are accrued and paid to the Employee in the manner and on the terms established by the Regulations on bonus payments to employees of New Technologies LLC.

3.1. For the performance of labor duties provided for in this employment contract, the Employee is paid a salary that includes: 3.1.1. Official salary in the amount of 30,000 (Thirty thousand) rubles per month. 3.1.2. Personal bonus for high qualifications in the amount of 10,000 (Ten thousand) rubles per month.

Please note that in an employment contract with an employee who will work in the Far North or equivalent areas[3], you must indicate the regional coefficient and percentage increase in wages. If the employer violates this rule and does not include such conditions in the employment contract, the employee will still be able to demand their payment. This position is confirmed by judicial practice[4].

Remuneration in kind

In some cases, employers resort to paying wages in kind . As a rule, this happens when the company experiences a cash shortage, but there is a large amount of unsold products.

The part of the salary paid in kind should not exceed 20% of the total earnings.

Payments in kind can only be made under these conditions:

- The TD or collective agreement indicates the possibility of making payments in kind, indicating the amount, which should not exceed 20% of the total salary.

- The employer must receive a written statement from the employee indicating his consent to receive non-cash earnings.

What does the salary depend on?

An official salary is a fixed amount of money that an employee receives for performing his immediate job responsibilities. It does not include any type of payment - neither incentive, nor social, nor compensation.

The salary of any employee depends on many factors, including:

- workload;

- education according to the profile of the work performed;

- qualifications;

- experience in this position.

The amount of remuneration for working personnel is established based on the salary scheme that is used in a single enterprise or in an entire industry.

If an enterprise is financed from the budget of one of the levels, then it must adhere to the industry salary scheme. If the enterprise operates exclusively at its own expense, then it is obliged to approve the staffing table, in which the nomenclature of official salaries must be specified.

Advantages for the employer

- a working hour is always the same period of time, and the working day can change its duration, so it is more convenient to operate with a clock;

- rates per hour of employment will help more accurately regulate the amount of payment due in cases where the employee was absent for a certain time;

- it is more convenient to calculate remuneration for part-time part-time workers, as well as those for whom a flexible work schedule is applied;

- financial savings, since only time spent working is paid;

- an additional incentive for employees to use their working time effectively.