Personal income tax upon dismissal of an employee is a mandatory operation; the payment is calculated and carried out by the employer. In this article we will look at how to correctly calculate personal income tax for a tax agent upon dismissal, when to pay tax to the budget, and how to reflect it in reporting.

The employer is the tax agent for the income taxes of its employees. That is, he is obliged to calculate the amount to be paid, withhold it from the employee’s income and transfer it to the budget in a timely manner. We will tell you what are the features of paying personal income tax upon dismissal.

When is tax time

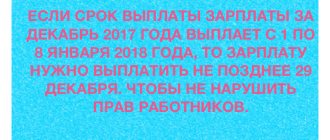

In any organization, certain dates are assigned each month when employees receive salaries. Usually, money is given to employees on the following dates - the 5th or 10th.

The Tax Code of the Russian Federation establishes the deadline for transferring income tax to the budget. Thus, personal income tax from wages, in accordance with current regulations, must be received by the treasury no later than the next day after the payment of remuneration for labor. This period is set quite clearly and does not depend on the method of payment of salaries. The following situations are possible:

- The organization transfers the salaries of its employees to bank cards. This means that personal income tax must be paid no later than the next day. The same procedure is relevant in the case of issuing money in person after first withdrawing it from a bank account.

- Salaries are paid from the cash register (daily earnings). The tax must be transferred to the treasury before the end of the next day.

These rules are enshrined in paragraph 6 of Article 226 of the Tax Code of the Russian Federation. They are valid from 2021.

An enterprise accountant may have a question: when to pay personal income tax when dismissing an employee in 2021? After all, the previous rules do not apply if an employee leaves the company on a day other than the day the remuneration is issued. What to do in this case?

EXAMPLE

All employees receive their salary on the 5th of every month. One of the employees left the company on May 29.

When should he be paid? What about personal income tax upon dismissal in this case? Will the employee have to wait until June 5 or will the money be paid earlier? To resolve these issues, you must be guided by the letter of the Ministry of Finance No. 03-04-06/4831 dated February 21, 2013. More on this later.

What is personal income tax

What the abbreviation personal income tax stands for is something that employers and the average person who pay tax contributions to the state treasury must know. The former keep employees on staff and act as a tax agent from the state, the latter receive official wages at the place of employment.

Personal income tax means personal income tax. This direct tax brings the lion's share of funds to the country's budget, being in third place in terms of efficiency in attracting them. From the name it is clear that income received by individuals is subject to this tax. They are income tax payers.

Deductions are usually taken from people's wages paid out at the workplace, but according to the law, income can also include:

- rental property fees;

- funds received as a result of the sale of property;

- winning a cash prize in any lottery, etc.

A person must give a portion of the income inflow to the state. Depending on the status of the citizen and the situation in which funds are received, tax rates for withdrawal of fees will differ.

Thus, a tax deduction is usually taken from wages in the amount of 13%, from a cash prize won in the lottery , as much as 35% is deducted, etc.

A person does not make deductions from wages on his own. This is what the company does - the place of work. This deduction is made only if the person is officially employed and receives so-called white wages. There is no tax deducted for black workers and, as a rule, it is higher, while there is no official employment, and the person does not accumulate work experience, which will be useful for employment in another place of work and, upon reaching a certain age, for receiving a pension.

If the employer is responsible for deducting taxes to the state treasury, you are deprived of the annoying and inappropriate need to independently run around credit institutions, filling out certificates and receipts, defend long streams of people in front of the cash registers and submit declaration forms to the tax service of the Russian Federation every 12 months.

The accounting department of the company where you are employed does this for you.

If, in addition to wages, there was other income, for example, the tenant paid the money or you sold the home and received money, then you are a tax agent for yourself and must declare income by submitting reports to the inspectorate to which you belong according to your place of residence. Then, receive a receipt and use it to independently transfer funds to the country’s budget, using the services of credit institutions.

If reporting documents are not submitted to the tax office on time or are not provided at all, payers are subject to penalties in the form. At the same time, having paid a fine and not submitted a declaration, after a while you will receive another one and pay even more.

Penalty for late submission of a declaration to the tax authorities

Didn't manage to submit your declaration on time? In our article you will learn what consequences result from failure to submit reports on time. Learn more about the statute of limitations for tax offenses and how to reduce the amount of the fine.

General rule

In 2021, the situation with personal income tax deductions is as follows. Based on Article 226 of the Tax Code of the Russian Federation, the employer is obliged to transfer personal income tax upon dismissal no later than the day following the payment of wages. At the same time, they do not take into account the methods used by the employer to transfer wages to employees. Even in the case of a non-cash transfer to a plastic card, the period is the same.

We also invite you to read the article: “Dismissal “without working two weeks”: possible or not.”

RULE

In 2021, transfer personal income tax from payments upon dismissal no later than the next day after payment to the employee (clause 6 of article 226 of the Tax Code of the Russian Federation).

Let's sum it up

Salaries, some types of severance pay, as well as compensation upon dismissal are subject to personal income tax in the general manner. Tax deductions are applied in accordance with the Tax Code of the Russian Federation. There are no exceptions for dismissal payments.

The deadline for paying personal income tax upon dismissal is the day following the day of transfer of final settlement payments, that is, the day following the date of termination of the employment agreement. If this date falls on a weekend or holiday, then complete the calculation on the first working day (clauses 6-7 of Article 6.1 of the Tax Code of the Russian Federation).

When should a fired person be paid?

If an employee has expressed a desire to leave the organization and has written a corresponding statement addressed to the manager, then all due amounts must be paid to him on the day of dismissal. In particular, this applies to:

- remuneration for the number of days worked;

- bonus payments;

- debts to the employee.

The salary issued on the day of dismissal must consist of all amounts due to the employee. That is, the organization must pay the employee in full and have no debts to him. This rule is enshrined in the Labor Code of the Russian Federation (Article 140).

Failure to comply with this procedure for making the final salary payment in the event of an employee's departure may result in liability for the employer. Among other things, delays in wages can even result in criminal punishment for the company’s management.

If the employee did not come to the employer on the day of dismissal to receive the payments due and his work book, then he will have to be paid a salary later. This must be done on the day the employee reports.

The Labor Code also establishes the possibility of making the payment of the last salary not on the day the employee arrives, but on the next day after that. You can push back the deadlines if the accountant needs to recalculate the amounts due (for example, if an employee gets sick, the final payment amount changes, since it is calculated taking into account the number of sick days). An additional day in this case will allow the calculations to be made in a new way, after which the money will be issued to the resigning employee.

Everything is now clear regarding payment of wages in the event of dismissal. But how is personal income tax paid upon dismissal in 2021 on a day that does not coincide with the salary?

For more information about this, see the article: “What are the deadlines for paying salaries upon dismissal.”

Sample payment order

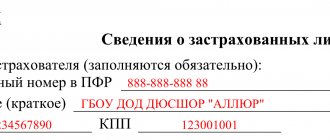

According to Art. 226 of the Tax Code of the Russian Federation, personal income tax is withheld by the employer and sent to the place of registration of the tax agent.

Consequently, the payment order reflects the details of the Federal Tax Service to which the company or individual entrepreneur is included.

In the personal income tax payment order, the following points must be taken into account:

- The name of the document on the basis of which the tax calculation was made.

- Order number.

- Field 101 displays the payer status. This is a two-digit number, which is approved by Order No. 106 n.

- Date of document creation.

- Field 6 indicates the payment amount.

- In field 7 the amount is displayed in words.

- The payer registers the TIN.

- Legal entities are prescribed checkpoints.

- Data on the taxpayer's and recipient's banks is recorded.

- Regarding the recipient, the TIN, KPP, addressee and account number are registered.

- In field 18 the type of operation is indicated, “01” Payment order.”

- Sequence of payment.

- If there is a seal, it must be affixed.

- The number of personal signatures should not exceed two.

The payment for the penalty is drawn up in four copies - one each for the bank and the taxpayer, two for government agencies.

The payment order for the penalty is similar to the payment order for the payment of the main tax. The date of the document is indicated in field 109 of the document.

This information must be filled in when paying tax based on the declaration. In this case, it is necessary to take into account the specifics of the taxation regime used.

Thus, employees who work under a simplified regime, subjects report for six months. For example, when sending an advance payment using the simplified tax system for the second quarter, you must enter “0” as the date, and not the exact time.

When the tax amount is sent based on the declaration, the date of its submission is indicated in the document. In field 21 of the payment order, the order of payment is indicated.

This detail is mandatory and if it is missing, the banking organization may refuse to accept the payment order.

Indication of the priority is necessary to establish the order of crediting money in the event of a shortage of funds in the taxpayer’s account. The order of payment depends on the voluntariness of payment or payment upon request.

Requirements regarding the queue of payment are prescribed in Art. 855 of the Civil Code of the Russian Federation. So, when a taxpayer sends tax on a voluntary basis, the order of payment will be fifth.

If the payment was made at the request of the tax service, then the payment is made in third place.

When to transfer taxes from a fired person?

In the absence of force majeure circumstances, the employee receives his salary on the day of his dismissal. If he came for the work book later than the established deadline, then the salary is paid no later than the next day. But what should an accountant do with taxes? When does he need to deduct personal income tax when dismissing any of his employees in 2021?

To understand this situation, you need to carefully study the mentioned letter from the Russian Ministry of Finance. It provides key clarifications regarding timing.

Difficulties arise from the fact that employees most often quit without working for a month. In this case, the employer must pay income on the day of dismissal, which is enshrined in paragraph 2 of Article 223 of the Tax Code of the Russian Federation. But personal income tax on dismissal payments by agreement of the parties (and any other reasons) should be transferred maximum the next day after the day the last salary was issued. This is also the last day of work.

Transfer deadlines

In order not to violate the law and transfer personal income tax to the budget on time, you need to be guided by the deadlines shown in the table:

| The procedure for issuing salaries | On what day should personal income tax be transferred? |

| To an employee’s bank plastic card (according to the salary project) | At the same time when the salary is transferred to the card or the next day |

| In hand cash, previously withdrawn from the organization’s bank account | At the same time when funds are withdrawn from the account or on the next day |

| In hand from the cash register or from the proceeds received during the day | At the time of payment or the next day |

The letter from the Ministry of Finance explains that the established deadlines for transferring taxes to the treasury apply not only to the wages themselves, but also to all other money due to the employee.

It turns out that along with the salary tax, personal income tax must be deducted from benefits and compensation for unspent vacation. If such payments are made simultaneously, the tax from them must also be transferred to the budget together.

Read also

26.04.2018