Fixed assets in budget accounting - 2020-2021: introductory information

In accordance with paragraph 21 of Order No. 157n, the concept of “budget accounting of fixed assets” applies only to certain government organizations.

For example, government institutions, government agencies, extra-budgetary funds. In addition to the unified chart of accounts, a special chart of accounts must be used in budget accounting (Order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n). The remaining government institutions, maintaining accounting and tax accounting of fixed assets in 2020-2021, in addition to the unified chart of accounts, use charts of accounts approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n or dated December 23, 2010 No. 183n (depending on the type of organization) and others regulations.

For example, FSBU “Fixed assets”, approved. by order of the Ministry of Finance of Russia dated December 31, 2016 No. 257. ConsultantPlus experts explained what institutions should take into account when applying this standard. Get trial demo access to the K+ system and study the review material for free.

Read about the regulatory documents governing accounting in budgetary structures here.

In this article we will refer to orders No. 157n and 162n as the basis for budget accounting. From the beginning of 2021, public sector organizations must be guided by the new federal standard “Fixed Assets”, approved. by order of the Ministry of Finance dated December 31, 2016 No. 257n (hereinafter referred to as the Standard). These documents reveal the general principles of accounting for fixed assets, as well as the logic of making transactions.

According to clause 8 of the Standard, in order to classify an asset as a fixed asset, the following criteria must be met:

- Property (with the exception of periodicals that make up the library collection of the subject of accounting) is classified as fixed assets regardless of its useful life.

- The accounting entity predicts the receipt of economic benefits or useful potential from the use of the asset.

- The initial cost of property as an accounting object can be reliably estimated.

If an asset does not meet at least one of the above criteria, it is recorded in off-balance sheet accounts. Information about such material assets is disclosed in the financial statements.

NOTE! Fixed assets do not include objects classified as inventories in accordance with clause 99 of Order No. 157n. For example, fishing gear, gas-powered saws, etc.

Each inventory item as a unit of accounting for fixed assets must be assigned a number. And an inventory card is created for each object.

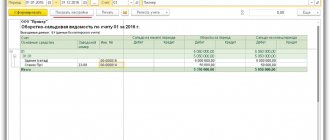

To account for fixed assets, a synthetic account 010100000 “Fixed Assets” is provided. The budget accounting account number consists of 26 digits, and only 18–26 digits are used in the accounting of the institution. Depending on the group and type of fixed assets, as well as the essence of their movement, the code in the 22–26 digits changes in the account number.

Below we consider the scheme for generating an accounting account number in a budgetary organization, and also decipher the category codes using an example. A detailed explanation of the categories can also be found in clause 21 of the instructions to the chart of accounts (order No. 157n), in the table of the budget accounting chart of accounts and in clause 2 of the instructions to it (order No. 162n).

| Account digit number | ||||

| 18 | 19-21 | 22 | 23 | 24-26 |

| Financial support | Accounting object | Accounting object group | Type of accounting object | Type of receipts, disposals of an accounting object |

| Example: account 110118310 “Increase in the value of other fixed assets - real estate of the institution” | ||||

| 1 | 101 | 1 | 8 | 310 |

| 1 - at the expense of the budget | 101—fixed assets | 1—real estate | 8 - other fixed assets | 310 - increase in OS cost |

Read about creating a working chart of accounts in a budget organization here .

Note that for budget accounting of fixed assets, according to Order No. 162n, only 2 types of financial support are possible: at the expense of the budget (code 1) and funds at temporary disposal (code 3).

Thus, government institutions, government agencies and other organizations falling under the jurisdiction of Order No. 162n cannot have their own non-budgetary income.

What information is included in the register of treasury objects: what is important to know

All treasury objects are subject to register registration. This information system contains not only their current list of names, but also comprehensive characteristics (evaluation, production, technical, legal, etc.). Thus, any register (RMS, RFS or RGS) can contain the following information for each object:

- register, cadastral No.;

- Name;

- grounds for inclusion in the register list;

- balance holder;

- its physical parameters (area, etc.);

- book value;

- depreciation data, etc. in accordance with legal requirements.

Thus, a treasury object can be included in the register or excluded from it, as well as make the required changes with additions to it, if there are legal grounds for this. For example, in the presence of an appropriate court decision, on the basis of a gift or exchange agreement, in accordance with a resolution of government authorities and for other reasons.

Accounting for fixed assets upon admission to budgetary institutions

OS are received by institutions at actual cost, which includes (clause 15 of the Standard):

- cost paid to the supplier;

- the cost of construction work when creating the facility;

- the cost of all costs required to create the OS;

- fare;

- amounts for related services;

- customs duties;

- as well as other costs associated with the purchase/creation of the OS.

NOTE! If the fixed asset will be used in budgetary activities, then the amount of input VAT is included in the initial cost.

The receipt of fixed assets is reflected in the synthetic account 0010600000 “Investments in non-financial assets”, which contains 3 grouping accounts:

- 0010611000 - for real estate;

- 0010631000 - for movable;

- 0010641000 - for accounting for financial lease objects.

In the accounting of fixed assets, to reflect receipts, separate analytical accounts are allocated, in 24–26 digits of which code 310 is used for each type of fixed assets (see the chart of accounts approved by Order No. 162n). This code indicates an increase in the cost of the OS.

The main entries for accounting for fixed assets upon receipt are shown in the table below. Other transactions can be found in paragraphs. 7, 31, 33, 34 instructions to the chart of accounts (order No. 162n).

| Wiring | Description of posting in fixed asset accounting |

| Dt 010600000 “Investments in non-financial assets” (010611310, 010631310, 010641310) Kt 020800000 “Settlements with accountable persons” (020831660, 020832660), 030200000 “Settlements for accepted obligations” (030231730, 030232730) | Purchasing an OS |

| Dt 010600000 “Investments in non-financial assets” (010611310, 010631310) Kt 030200000 “Settlements for accepted obligations”, 020800000 “Settlements with accountable persons”, 010400000 “Depreciation”, 030300000 “Settlements for payments to budgets”, 010500000 “Inventories” | Creating an OS object yourself |

| Dt 010100000 “Fixed assets” (010111310, 010112310, 010113310) Kt 010611310 “Increasing investments in fixed assets - real estate of the institution” | Commissioning of the constructed building |

| Dt 010100000 “Fixed assets” (010111310–010113310, 010115310, 010118310, 010131310–010138310) Kt 010611310 “Increase in investments in fixed assets - real estate of the institution”, 010631310 “Increase in investments in fixed assets - other movable property of the institution” | Commissioning of purchased, manufactured household goods. OS way |

| Dt 010100000 “Fixed assets” (010111310–010113310, 010115310, 010118310, 010131310–010138310) Kt 030404310 “Internal settlements for the acquisition of fixed assets” | The OS object was received from another budget institution that has the same budget resource manager |

| Dt 010100000 “Fixed assets” (010111310–010113310, 010115310, 010118310, 010131310–010138310) Kt 040110180 “Other income” | The OS object was received from another budgetary institution that has a different manager of budget resources at the same level, from organizations, individuals. |

| Dt 010100000 “Fixed assets” (010111310–010113310, 010115310, 010118310, 010131310–010138310) Kt 040110100 “Income of an economic entity” (040110151, 040110152, 040110153) | Other gratuitous receipts of fixed assets |

| Dt 010140000 “Fixed assets - leased items” (010141310–010148310) Kt 010641310 “Increasing investments in fixed assets - leased items” | Acceptance for registration in 2016–2018. OS leased |

For information on how the accounting policy of a budgetary institution is formed, read the material “An example of an accounting policy in a budgetary institution (nuances).”

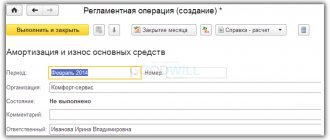

Depreciation of fixed assets

Government institutions charge depreciation of fixed assets linearly over their service life. There is also a rule of monthly accruals in the amount of 1/12 of the annual amount. Depreciation charges begin to be reflected in the month following the month the facility is put into operation.

Read about the practical application of the linear method in the article “Linear method of calculating depreciation of fixed assets (example, formula)” .

The useful life is determined based on:

- the expected period of receipt of economic benefits;

- recommendations contained in the manufacturer's documents;

- warranty period for use of the object;

- other methods described in clause 35 of the Standard

Depreciation is reflected in the synthetic account 010400000 “Depreciation”.

To record entries for depreciation charges, analytical accounts ending in 410 are used, which are used in the following transaction: Dt 040120271 “Depreciation costs of fixed assets and intangible assets”, 010900000 “Costs of manufacturing finished products, performing work, services” (010960271, 010970271 , 010980271, 010990271) Kt 010400000 “Depreciation” (010411410–010413410, 010415410, 010418410, 010431410–010438410).

To account for fixed assets leased: Dt 040120271 “Depreciation costs of fixed assets and intangible assets” Kt 010440000 “Depreciation of leased items” (010441410–010448410).

In paragraphs 19, 20 instructions to the chart of accounts (order No. 162n) consider special cases of reflecting depreciation, for example, for fixed assets received free of charge.

Displaying depreciation of treasury property: when it is charged and when it is not

As for depreciation of NFA, it should be displayed in the form of amounts that were accrued by the previous owner. Reason: clause 94 of Instruction No. 157n. Standard account is used for these purposes. 0 104 50 000 “Depreciation of treasury property.” All operations that are associated with it are recorded in a special journal for the movement and disposal of NFA.

| Account for depreciation of real estate property | Account for shock absorption property | Account for depreciation on |

| 0 104 51 000 | 0 104 58 000 | 0 104 59 000 |

There are no special conditions for accounting. The only caveat. From the day the fixed assets are included in the treasury, depreciation is not charged on them, and, consequently, they are not accounted for. 0 104 50 000 are not produced.

Further, depreciation on an object that is already included in the state treasury (or the treasury of a municipality) is calculated and accrued at a time by its owner precisely for the period of its stay in this composition. For calculations and accruals, data on the value of the object (initial, residual, other) are used, which are available in the corresponding register (RGS, RMS). In this case, the period of stay of the property in the treasury must be taken into account.

The noted norms are applied in the general case, unless otherwise established by the adopted legal act on budget accounting.

Accounting for disposal of fixed assets

To account for fixed assets upon their disposal, separate analytical accounts of the “Fixed Assets” account are also used, ending with 410 and indicating a decrease in the value of the corresponding fixed assets.

For a selection of practical recommendations for writing off certain types of fixed assets in the accounting of public sector employees, see the analytical review from ConsultantPlus experts. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure. And in this publication you will find a sample order for writing off fixed assets in a budget institution.

The main entries for accounting for fixed assets upon disposal are shown in the table below. Other transactions can be found in clause 10 of the instructions for the chart of accounts (order No. 162n).

| Wiring | Description of posting in fixed asset accounting |

| Dt 040120271 “Costs for depreciation of fixed assets and intangible assets”, 010634340 “Increase in investments in inventories - other movable property of the institution”, 010900000 “Costs for the manufacture of finished products, performance of work, services” (010960271, 010970271, 010980271, 010 990271) Kt 010100000 “Fixed assets” (010134410, 010135410, 010136410, 010138410) | Commissioning of an OS costing no more than 3,000 rubles. |

| Dt 030404310 “Internal settlements for the acquisition of fixed assets”, 040120200 “Expenses of an economic entity” (040120241, 040120242, 040120251, 040120252, 040120253) Kt 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010131410–010138410) | Free transfer of an object or transfer to trust management |

| Dt 010400000 “Depreciation” (010411410–010413410, 010415410, 010418410, 010431410–010438410) Kt 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010131410–010138410) Dt 040110172 “Income from operations with assets” Kt 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010131410–010138410) | OS sales |

Example 2. Postings when transferring a car to the treasury (government body)

The treasury of one of the constituent entities of the Russian Federation (state authority) received a car. Its book price is, say, 500,000 rubles. rub., and the accrued depreciation until the moment of receipt and inclusion in the treasury is RUR 300,000. rub. Accounting displays transactions for the acceptance and depreciation of a car with the following entries:

- Acceptance of a vehicle into the treasury of a constituent entity of the Russian Federation (500 thousand rubles): DT 1,108 52,310 CT 1,401 10,151.

- Depreciation accrued until the vehicle was added to the treasury (300 thousand rubles): DT 1,401 10,151 CT 1,104 58,410.

So, the depreciation of a car is shown until the day it is added to the treasury of a given entity. It should also be taken into account that the necessary records on the receipt of acquired (or created) property objects into the treasury, as well as their surpluses discovered during the inventory, etc., should be enshrined in the regulatory legal act regarding treasury accounting.

Results

Budgetary accounting of fixed assets has a complex structure of accounts and their coding.

However, the instructions listed in the article contain detailed explanations and lists of possible entries that can help the accountant. Maintaining budgetary accounting of fixed assets is strictly regulated. All movements of fixed assets must be documented in primary documents and reflected in accounting by accounting entries. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Which OKOF to use

Based on OKOF, the accountant determines the useful life of the object and calculates monthly depreciation. In 2017, the Russian Ministry of Finance seriously changed the structure of the classifier (letter dated December 27, 2016 No. 02-07-08/78243); the department removed some positions altogether or replaced them with generalizing concepts. The type of coding of fixed assets has also changed. The previous code consisted of 9 digits of the form XX ХХХХХХХ, for example:

11 0000000 Buildings (except residential):

- 11 0001000 Buildings, except residential, not included in other groups

- 11 4521000 Buildings of fuel and energy, metallurgical, chemical and petrochemical enterprises

The new codes have a different structure - ХХХ.ХХ.ХХ.ХХ.ХХХ. For comparison, here is the classification of some buildings according to the new OKOF:

Fifth group (property with a useful life from 7 to 10 years inclusive)

| Building | ||

| Buildings (except residential) | Prefabricated and movable buildings | |

| Dwellings | ||

| General purpose residential buildings | Frame-reed and other lightweight dwellings | |

The new OKOF applies only to buildings, structures and premises that were put into operation and registered after January 1, 2021. There is no need to revise the groups of previously received property; the previous classification remains for them.