In this article we will look at how to fill out a payment order for fines. Let's look at common mistakes.

If an LLC or individual entrepreneur made mistakes as a result of which a tax, fee or contribution was not paid, or the accountant missed the deadline for sending funds to pay taxes, the company will soon receive a request from the Federal Tax Service to transfer the underpaid amounts. In addition, a fine and penalties will be assessed.

And here you will need the ability to competently fill out payment orders for the payment of fines, otherwise the tax inspectorate will be forced to take more stringent measures against the willful defaulter.

Payment order and its details

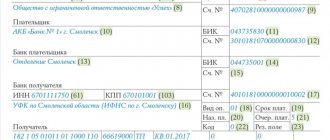

A payment order is a document whose purpose is to transfer funds from the sender's bank account to the recipient's account.

It is the most frequently circulated document in the financial sector. For budgetary institutions, the form of the document is approved by the Bank of Russia in the rules for transferring funds (Regulations of the Central Bank of the Russian Federation dated June 19, 2012 N 383-P). Payment order details must include all the necessary identifiers of the payer and recipient.

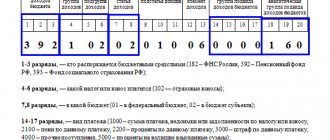

For transfers in favor of tax agents, funds or other budget payments, you must fill in fields numbered 106 and 107.

Fixed payments for individual entrepreneurs

According to subparagraph 2 of paragraph 1 of Article 419 and paragraph 1 of Article 430 of the Tax Code of the Russian Federation, an individual entrepreneur is obliged to pay contributions for compulsory health insurance and compulsory medical insurance. Individual entrepreneurs are not required to pay payments in case of temporary disability and maternity, but can do so on a voluntary basis.

The Tax Code clearly defines the amounts of transfers for compulsory medical insurance and compulsory health insurance. If a businessman’s income does not exceed 300,000 rubles, he will pay for the needs of the OPS:

- RUB 29,354 - in 2021;

- RUB 32,448 — in 2021

If the income exceeds 300,000 rubles, then in addition to the indicated amounts it is necessary to add 1% of the amount exceeding 300,000. The amount of deductions for mandatory pension insurance cannot exceed:

- RUB 234,832 — 2021;

- RUB 259,584 — 2021

As for fixed payments for compulsory medical insurance for individual entrepreneurs, they will be:

- 6884 rub. — 2021;

- 8426 rub. — 2021

What to write in field 106

These details contain information about the basis and tax period for which the payment is made.

Field 106 in the 2021 payment order is filled in with two characters and can take values from the list approved by the Central Bank.

So, to help you figure out how to correctly fill out field 106 (basis of payment) in a payment order, we have compiled a special table with explanations. It will help you understand the designations that can be indicated in the basis of payment 106; the decoding for 2021 is given in the left column.

| Props name | Payment basis 106: decryption of details |

| TP | Indicates payments for the current year for debts and accruals |

| ZD | Indicates that you yourself found an arrears or a payment error and, without waiting for the tax authorities, contributed the missing amount to the budget |

| BF | Set when the payer is an individual and funds are debited from his bank account |

| TR | It is necessary to put when the debt was discovered and presented for payment by the tax authority |

| RS | Denotes the repayment of a debt that can be paid in installments |

| FROM | Must be applied in case of repayment of debt that has been deferred |

| RT | Repayment of restructured debt |

| PB | Indicated in case of debt repayment by bankrupt organizations |

| ETC | Filled out when repaying a debt that has been suspended for collection |

| AP | Indicates that it is necessary to repay the debt after checking the organization and issuing an inspection report |

| AR | Placed in case of repayment of debt under a writ of execution |

| IN | Applicable for repayment of investment tax credit |

| TL | Used in bankruptcy cases where the debt is paid by a third party |

| ST | Indicated for repayment of current debt by bankrupt organizations |

Common mistakes

Error No. 1: In the payment order, a zero value was entered in the “Code” field, when the debt on penalties was repaid by the enterprise independently, without waiting for a request from the Federal Tax Service. The next time the tax office received a notice of payment of a fine, the accountant automatically entered “0” in the “Code” column.

Comment: When a company receives a document requesting the Federal Tax Service to pay penalties or fines, a unique accrual identifier specified in the request is entered in the “Code” field of the payment. And only if it is not specified there, you can leave a zero value.

Error No. 2: Indication by the organization that received a request from the tax service to pay penalties, the code “ZD” in the “Base of payment” field.

Comment: When an official request from the Federal Tax Service has already been received, the payment is considered to have been made not on a voluntary basis, but at the insistence of the tax inspectorate, therefore the code “TP” must be indicated in the “Base of payment” field.

Error No. 3: Indication in the KBK payment order of the tax period in which the tax arrears arose and when penalties were accrued.

Comment: The BCC is indicated as current as of the date of actual repayment of the debt.

What to write in field 107

Field 107 in the payment order has 10 required characters. Eight of them are semantic, and two more characters are dividing points. For example, MS.06.2019.

According to the instructions of the Bank of Russia, the first two characters in detail 107 are filled in depending on the payment period and, accordingly, indicate it:

- MS - per month;

- KV - per quarter;

- PL - for half a year;

- GD - for a year.

The last 4 characters are filled in in accordance with the year for which payment is made.

In cases where the legislation provides for a specific tax payment date, field 107 in the payment slip should be filled out indicating this date, for example:

Payment period

This year, payment documents for the transfer of insurance premiums are processed within the same deadlines. Insurance payments must be transferred to legal entities before the 15th day of the month following the reporting month. If this day falls on a weekend or holiday, the payment date is postponed to the next business day. For example, in 2021, April 15 is Wednesday, therefore, there will be no postponements.

Other deadlines have been established for individual entrepreneurs:

- OPS from income up to 300,000 rubles. — until December 31, 2019;

- OPS for income above 300,000 rubles. - until July 1 of the year following the reporting year;

- Compulsory medical insurance - until December 31, 2019.

Rules for issuing a payment order to pay a fine

The main regulatory document defining the procedure for filling out payment slips is Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n (Appendix 2). Let's look at the main points.

- Detail 104 indicates the KBK (20-digit budget classification code), which can be found in Appendix 6 to Order No. 65n of the Ministry of Finance dated July 1, 2013 (you need to select codes that begin with 182). It should be noted that, according to paragraph. 7 p. 4 sec. II of the same order, for fines the income subtype code 3000 is used (14–17 digits of the code).

- for a fine related to income tax credited to the federal budget: 182 1 0100 110;

- fine related to income tax credited to the regional budget: 182 1 0100 110;

- fine related to personal income tax: 182 1 0100 110.

For the KBK for paying fines for all types of taxes, see the Ready-made solution from ConsultantPlus.

Remember that the BCC for arrears, penalties and fines for the same tax are different, which means you need to issue separate payments to pay them.

IMPORTANT! When composing or reproducing a payment order on paper, you can fill out the code on 2 or more lines.

You can download the payment order form on our website.

Regulatory regulation

Article 126 of the Tax Code of the Russian Federation provides for fines for failure to provide documents and information to the tax authority.

BOO. Tax sanctions are reflected in account 99.09 “Other profits and losses” (Instructions for using the Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n, clause 83 of the Accounting Regulations, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n, Letter of the Ministry of Finance of the Russian Federation dated February 15, 2006 N 07-05-06/31, Chart of Accounts 1C).

There are recommendations from the Ministry of Finance of the Russian Federation to reflect sanctions for violation of tax legislation as part of other expenses (Letter of the Ministry of Finance of the Russian Federation dated December 28, 2016 N 07-04-09/78875, clause 11 of PBU 10/99).

The organization should fix the way these expenses are reflected in its accounting policies.

WELL. The amounts of sanctions for violation of tax laws are not taken into account in expenses (clause 2 of article 270 of the Tax Code of the Russian Federation).

USN. Tax fines are also not taken into account when calculating tax, since they are not included in the closed list (Article 346.16 of the Tax Code of the Russian Federation).

How to issue a payment order to pay a fine on contributions

The option for filling out a payment form to pay a fine on contributions depends on who issued the sanctions:

- Federal Tax Service, due to late submission of reports;

- FSS for late payment of accident contributions.

Let's take a closer look.

If a taxpayer fails to submit reporting on contributions on time, he or she will be subject to sanctions in the amount of 5% of the amount of contributions for each month of delay, but not more than 30% of this amount and not less than 1 thousand rubles.

The algorithm for filling out a payment form for a fine is similar to the procedure established for tax fines, with the exception of the KBK. In 2019-2020, the following codes should be indicated:

for compulsory pension insurance

for social insurance due to illness or maternity

182 1 0210 160

182 1 0213 160

182 1 0210 160

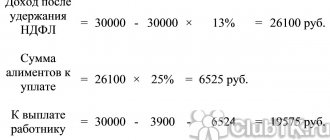

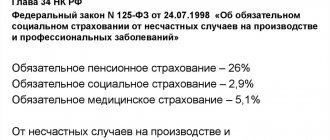

At the same time, the fine amounted to 1 thousand rubles. should be distributed among the KBK in proportion to the tariffs (letter of the Federal Tax Service dated 05.05.2017 No. PA-4-11/8641):

- to the Pension Fund of Russia 733.33 rubles. (22 / 30 * 1000);

- in FFOMS 170 rub. (5.1 / 30 * 1000);

- in the Social Insurance Fund 96.67 rubles. (2.9 / 30 * 1000).

The FSS also has the right to impose penalties for late submission of Form 4-FSS (5% of the amount of contributions, but not less than 1 thousand rubles and no more than 30%) or for violating the procedure for submitting the form (200 rubles).

The procedure for filling out a payment form is slightly different from that established for tax fines:

- Fields 106 – 109 are not filled in;

- KBK — 393 1 0200 160

For information on how to fill out a payment order to pay a fine to the Pension Fund, see the Ready-made solution from ConsultantPlus.

New BCC for fines from 01/01/2020

In accordance with the order of the Ministry of Finance dated November 29, 2019 No. 207n KBK 18211603010016000140, from 2021, in particular, the following budget codes for fines will be replaced:

- 182 1 1601 140 - for violation of the procedure for registration with the tax authority (Article 116 of the Tax Code of the Russian Federation);

- 182 1 1602 140 - for failure to submit a tax return, calculation of the financial result of an investment partnership, calculation of insurance premiums (Article 119 of the Tax Code of the Russian Federation);

- 182 1 1603 140 - for violation of the established method of submitting a tax return, calculation (Article 119.1 of the Tax Code of the Russian Federation);

- 182 1 1604 140 - for submitting to the tax authority by the managing partner responsible for maintaining tax accounting, a calculation of the financial result of an investment partnership containing false information (Article 119.2 of the Tax Code of the Russian Federation);

- 182 1 1605 140 - for gross violation of the rules for accounting for income and expenses and objects of taxation, the basis for calculating insurance premiums (Article 120 of the Tax Code of the Russian Federation);

- 182 1 1606 140 - for failure to comply with the procedure for possession, use and (or) disposal of property that has been seized or in respect of which the tax authority has taken interim measures in the form of a pledge (Article 125 of the Tax Code of the Russian Federation);

- 182 1 1607 140 - for failure to provide the tax authority with information necessary to carry out tax control (Article 126 of the Tax Code of the Russian Federation);

- 182 1 1608 140 - for the submission by a tax agent to the tax authority of documents containing false information (Article 126.1 of the Tax Code of the Russian Federation);

- 182 1 1609 140 - for failure to appear or evasion of appearing without good reason as a witness, unlawful refusal of a witness to testify, as well as giving knowingly false testimony (Article 128 of the Tax Code of the Russian Federation);

- 182 1 1610 140 - for refusal of an expert, translator or specialist to participate in a tax audit, giving a knowingly false conclusion or making a knowingly false translation (Article 129 of the Tax Code of the Russian Federation);

- 182 1 1611 140 - for unlawful failure to report information to the tax authority (Article 129.1 of the Tax Code of the Russian Federation);

- 182 1 1613 140 - for unlawful failure to provide a notification of controlled transactions, provision of false information in a notification of controlled transactions (Article 129.4 of the Tax Code of the Russian Federation);

- 182 1 1614 140 - for unlawful failure to submit a notice of a CFC, a notice of participation in foreign organizations, provision of false information in a notice of a CFC, a notice of participation in foreign organizations (Article 129.6 of the Tax Code of the Russian Federation), etc.

Results

The rules for filling out payment order details for paying fines are listed in Appendix 2 to Order No. 107n of the Ministry of Finance of the Russian Federation. The payment for the fine must be filled out correctly, otherwise the bank may not accept it. And in case of errors in the details that are significant for crediting the payment, the Federal Tax Service may classify it as unclear.

If you doubt the correctness of filling out the details of the payment order, then remember that the Tax Code of the Russian Federation in paragraph 6 of Art. 32 obligated the tax authorities to provide all the necessary information to fill out orders for the purpose of paying taxes, fees, penalties and fines. Therefore, you can request all the necessary information from your tax office.

How to avoid paying too much

When processing a claim, it is important to know about the peculiarity of indicating amounts in the “Arrears” field. If the amount is marked with an asterisk, then you do not need to pay it - this information is for reference only.

When you create a payment order in Externa, you will never include an amount with an asterisk in it by mistake. This amount will be in the general list, but you cannot select it to generate a payment order.

Errors in personal income tax payment orders

Please fill out the payment order details very carefully. If you make a mistake on them, your tax will be considered unpaid. Accordingly, you will have to re-transmit the tax amount to the budget and pay penalties for personal income tax (if you discover the error after the end of the established payment period).

But this does not mean that the amounts paid will be lost. But sometimes legal entities and individual entrepreneurs with staff as a safety net have to re-transmit the required amount in order to avoid a settlement with the Federal Tax Service.

The most important details include (clause 4, clause 4, article 45 of the Tax Code of the Russian Federation):

- Federal Treasury account number;

- name of the recipient's bank.

Errors in other details are not critical, because the money will still go to the budget. The error can be corrected by clarifying the payment (Clause 7, Article 45 of the Tax Code of the Russian Federation).

Drawing up a protocol for a company car

It is undeniable that a legal entity, i.e. – an organization cannot drive a car that belongs to it. However, in case of recording a violation of an accident with a company car, traffic police inspectors, as a general rule, draw up a report specifically for the legal entity, regardless of who was driving it at the time of the offense.

In such a situation, the actions of the inspectors are lawful, because they draw up a protocol based on the provisions of paragraph 1 of Art. 2.6.1 of the Code of Administrative Offenses of the Russian Federation, which establishes that in the event of an administrative offense in the field of traffic rules (including the use of official vehicles), the owner of the vehicle is held accountable.

How to pay through Sberbank online

One of the most convenient ways to pay off debts to the Federal Antimonopoly Service, so as not to miss the deadline for paying an administrative fine. Here everything is done literally on the go, and you don’t need to delve into details for a long time to understand the algorithm. And then you will be able to make payments without hesitation. Be sure to double-check all entered data: whether everything is written correctly, whether numbers are missing.

To make a payment using this method, you need to:

- have a Sberbank plastic card;

- install the Sberbank Online application on your smartphone or go to the bank’s website;

- have a receipt in hand;

- Instead of a ticket, a copy of the punishment protocol will do.

Once you are sure that you have all this, you can begin to pay the administrative fine. There are several ways here. Let's look at one of them step by step.

Step 1. Register or log into your personal account.

Step 2. Find in the menu in the gray field at the very bottom of the screen the item called “Payments”.

Step 3. Oh.

Step 4. Find the fine that needs to be paid off.

Step 5. Fill in all the necessary details using the prompts.

Step 6. Now it’s time to check your data entry.

Step 7. If everything is correct, it’s time to pay the fine and complete the transaction.

There is a simpler method, especially for those who always have their documents at hand. They can do it differently: you can find your fine using your personal tax identification number. For this method you will need:

- log in;

- go to the “Payments” section;

- at the top of the screen in the gray search field, enter your TIN;

- Unpaid fines that were issued to you will appear, then, in the same way as in the previous instructions, fill out the fields and make payment.

Additionally, Sberbank Online provides the opportunity to pay a fine through “Government Services”. This is done like this:

- after authorization, go to the “Payments” section;

- then select the item “Staff Police, taxes, duties, budget payments”;

- then you will see a list, and the first line will be the “Public Services” item. Choose it;

- you will be given a choice: you will be asked to enter the receipt number for an administrative fine or check for fines using the government services portal.

Paying fines through the app takes 5 minutes and is free. That is, no commission is charged.

The concept of penalties and reasons for their formation

The very concept of a penalty is a certain type of fine for untimely fulfillment of obligations established by law. From Latin and translated as “punishment.” This is the amount of a certain tax that the taxpayer is deprived of. A penalty is established if a number of violations are identified:

- Missing a payment during a certain period.

- Errors in the details being filled out.

- Ensuring the fulfillment of property obligations.

The penalty interest itself is calculated at a certain rate, and can also be assigned for each overdue day. Specifically, the VAT penalty implies compensation in monetary terms.

In any business activity, errors arise that can be made by the organization’s accountant, or violations in the course of the enterprise’s activities.

Late payment of declarations, receipts, and advance payments is already a reason for charging late fees and penalties.

How to pay through the State Services website

Government services also do not charge any fees for paying a fine online.

Step 1. Registration on the site. You will need to prepare your passport, SNILS, remember your email address and contact phone number.

Step 2. If you have already registered on the site, you just need to log into your personal account.

Step 3. At the top of the screen, find the “Payment” button, click on it, and then click on the “Pay by receipt number” button. You can do this: on the right side of the screen, find the “Payment by receipt” button, it is located in the blue field.

Step 4. In the empty field, enter the number from the fine receipt, if necessary, fill in all the necessary fields (the system provides hints automatically, you cannot miss anything).

Step 5. Pay your administrative fine.

To pay fines, you can use a bank card or electronic wallet.

You can pay the receipt through “State Services” by logging not into the website or application, but through Sberbank Online. This doesn’t make much sense if you have both applications installed, but paying through Sberbank will be somewhat easier.

Reducing penalties

Sometimes situations arise when the taxpayer is unable to pay the tax and penalties on it. Judicial practice shows that it is impossible to change or remove penalties, since this type of tax is not a tax charge. Tax authorities can write off “bad” debts, but the taxpayer will have to pay penalties in any case. It is possible to highlight which articles of offenses are exempt from liability:

- Committing a tax offense.

- Inability to pay due to bankruptcy.