What is considered travel expenses?

Workers often have to travel to other localities for work needs. Such trips (business trips) are provided for by law (Article 166 of the Labor Code of the Russian Federation) and require the completion of specific tasks. The concept of a business trip does not apply to hired workers whose type of activity involves constant work on the road (intercity transport drivers, conductors, etc.).

Art. 167 of the Labor Code of the Russian Federation guarantees the employee reimbursement by the employer for those expenses associated with a business trip.

According to labor legislation (Article 168 of the Labor Code of the Russian Federation), an employee sent on a business trip must pay:

- travel expenses to and from the business trip;

- expenses for renting residential premises, for example, payment for hotel accommodation;

- additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer.

Additional expenses include, for example, expenses for food in a cafe, travel on public transport in the locality where the employee was sent, and payment for taxi services. This also includes expenses for communication services. Particular attention should be paid to the agreement between the posted employee and the employer of entertainment expenses.

The law obliges an employee sent on a business trip to be given an advance from the cash register to pay expenses for the trip. It is important that all employee expenses will be paid by the accounting department based on the checks and receipts submitted by him.

Upon returning from a business trip, the employee draws up a report within three working days, according to which the employer will account for the expenses of the business trip employee. If an employee spent personal funds on justified and documented travel expenses, the accounting department will return this money to the person. And if not the entire amount of the travel advance issued from the cash desk is documented, then the employee returns the unspent balance to the cash office or this amount will be deducted from his next salary.

The amount of daily allowance for business trips is set by the employer independently. Obviously, such an amount must be economically justified.

There is no single standard for daily travel expenses that would be mandatory for all organizations in 2021. However, the law establishes the maximum amount of daily allowance, which for an employee will not be subject to personal income tax: for business trips within Russia 700 rubles per day, and for business trips abroad - 2,500 rubles.

Video: Travel expenses

Advance payment

A mandatory condition for sending on a business trip is the issuance of an advance payment.

This is indicated in paragraph 10 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as the Regulations). It is not specified when the advance payment must be made. But it is necessary to issue funds from the cash register for reporting on travel expenses before the employee leaves for a business trip. Transfer to a bank card is possible. It is not specified how to calculate the advance. In practice, daily allowances are calculated based on the duration of the business trip, as well as taking into account the approximate costs of travel and accommodation, if the employee pays for them independently.

If funds are issued in cash from the company's cash desk, then the posting when issuing an advance for travel expenses will be:

Dt71 Kt50

If a transfer is made to an employee’s card:

Dt71 Kt51

In the event that additional expenses have arisen, agreed upon with the employer, or the business trip has been extended, the employee must transfer funds, which follows from clause 10 of the Regulations, since the employee is not obliged to spend personal funds to carry out an official assignment.

In this case, the amount to be paid can be reflected in the order, indicating that this is an increase in the advance amount.

Which accounting accounts are used in postings when reflecting travel expenses?

According to the established procedure, before leaving on a business trip, an employee receives at the cash desk the amount to pay for travel expenses according to the expense order form No. KO-2 (). The employer's accountant prepares the document, and the employee signs for the receipt of funds.

The advance payment issued for travel expenses is documented in a cash receipt order

Non-cash payments by organizations with their employees are becoming increasingly widespread. This applies not only to salaries, but also to the transfer of accountable amounts, including travel allowances, to employee salary cards (letter of the Ministry of Finance of the Russian Federation, Treasury of the Russian Federation dated September 10, 2013 No. 02–03–10/37209 No. 42–7.4–05/5.2 –554).

It is wise to open a corporate bank card in the employee’s name, to which an advance can be credited for travel expenses. This is especially convenient for employees who often go on business trips.

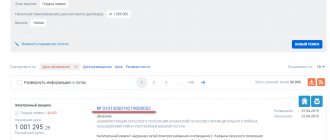

Returning from a business trip, an employee draws up and submits an advance report (Form No. AO-1). All expenses of the business traveler should be displayed on the reverse side of it. Daily allowances are reflected on a separate line. Other expenses (payment for a ticket, payment for a hotel room or rented accommodation, etc.) are reflected on the basis of the attached tickets, checks, receipts, properly executed. These documents must comply with the provisions of Art. 252 of the Tax Code of the Russian Federation. Otherwise, it will be impossible for the posted employee to confirm expenses. Although in special cases (for example, when a train ticket is lost), such compensation is made in practice according to a separate algorithm with the drawing up of acts and the attachment of certificates from the transport organization, which are justification for the costs.

When submitted to the accounting department, the advance report is signed by the traveler (accountable person), then the signature of the accountant who checked the report appears on the document. After this, the report is signed by the chief accountant and approved by the director.

If an employee returning from a business trip has not used part of the advance payment, he is obliged to return the remaining amount to the cashier. This amount may be deducted from the employee's next paycheck. If an employee on a business trip did not have enough advance payment for reasonable expenses and he spent his own money, the employer will reimburse him for such expenses.

To account for settlements on business trips, account 71 “Settlements with accountable persons” is used, where the debit reflects the amounts of the travel advance issued, and the credit reflects the expenses of the posted employee.

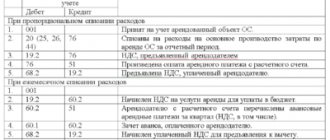

Table: entries for compensation of travel expenses

| Debit | Credit | Accounting transaction |

| 71 | 50 | Issued as a report for a business trip. |

| 71 | 51 | Travel allowances are listed on the salary card. |

| 55 | 51 | Transfer of advance payment to a special corporate card. |

| 71 | 55 | Reflection of the traveler's expenditure from a special card. |

| 50 | 71 | The unspent amounts of the travel advance were returned to the cash desk. |

| 70 | 71 | The unspent balance of the advance payment for the business trip is withheld from the salary. |

| 71 | 50 | The employee was given an amount equal to personal funds reasonably spent on a business trip. |

The employer may not consider certain expenses reflected in the advance report to be justified. These amounts are withheld from the employee's salary, or the employee independently reimburses the amount of unrecognized expenses.

Table: entries for amounts of unreasonable expenses

| 70 | 71 | Expenses not recognized by the employer are withheld from the posted worker’s salary. |

| 50 (51) | 71 | The employee reimbursed unreasonable expenses incurred on a business trip. |

In accounting, checking a traveler’s report begins with confirming the correctness of the daily allowance calculation. The daily amount of subsistence allowance is multiplied by the number of business trip days. These days always include the day of departure and the day of arrival. These dates are verified using the tickets attached to the report.

The time of departure and arrival of transport does not matter.

If the train departed on January 17 at 23:50, then January 17 should be considered the day of departure on a business trip with a daily allowance paid for that day (even if the employee was at work during the day). And also, the day of arrival from a business trip (with payment of daily allowance) will be considered the day on which the business traveler’s train arrived, for example, at 2 am.

The posted worker is paid for all days of travel

Daily allowances must also be paid for weekends and holidays that occur during a business trip, as well as for days en route. The payment of daily allowance is not affected by the inclusion of the cost of food in the ticket price (Letter of the Ministry of Finance dated March 2, 2017 No. 03–03–07/11901).

Expenses are charged to those accounting accounts that reflect the purpose of the employee’s work on a business trip.

If VAT is properly highlighted in the documents attached to the expense report (in invoices, on strict reporting forms), VAT on such documents is charged to account 19 and presented to the budget for deduction.

The cost of a travel document (airplane, bus or train ticket) is reimbursed by the employer. Typically, the choice of transport category is agreed upon by the traveling employee with management, since the cost of the ticket depends on the transport category.

The duration of the business trip is independently agreed upon by the employer and the employee and justified by an order from the manager, and a travel certificate has not been required since 2015 (Government Decree of December 29, 2014).

Table: entries for accounting expenses of a seconded employee

| Debit | Credit | Types of expenses |

| 20 (23, 25, 26, 29) | 71 | The main activity of the company is engaged in production (the balance sheet account depends on the type of activity of the traveler and the assignment for the business trip). |

| 44 | 71 | The main activity of a trading company. |

| 08 | 71 | The purpose of the business trip is the purchase and/or delivery of new fixed assets. |

| 10 | 71 | An employee is sent on a business trip to purchase materials, spare parts, etc. |

| 28 | 71 | Transportation of defective products or warranty repairs. |

| 19 | 71 | Allocation of VAT according to documents attached to the advance report. |

| 68.VAT | 19 | VAT is claimed for deduction. |

If the business traveler’s travel is paid directly by the employer, then the ticket must be received on account 50.3 “Cashier. Monetary documents".

Table: transactions for payment of travel documents

| Debit | Credit | Operation |

| 76 | 51 | Payment for the ticket by the employer. |

| 50.3 | 76 | The ticket has been posted. |

| 71 | 50.3 | The ticket was issued to the traveling employee. |

| 20, 23, 25, 26, 29 (44) | 71 | According to the advance report, the expense for the ticket is written off. |

| 19 | 76 | VAT has been deducted from the ticket price. |

| 68.VAT | 19 | VAT on the ticket price is deductible. |

Write-off of accountable amounts

After receiving the expense report, the accountant writes off the spent and confirmed amounts. For this purpose, the credit of account 71 is used, which corresponds with the corresponding accounts. Postings are made:

- Dt 10/15 Kt71 - receipt of materials purchased by the accountable person;

- Dt 41 Kt71 - receipt of goods purchased by an employee;

- Dt 20/23 Kt71 - write-off of business trip expenses into the cost of production;

- Dt 44 Kt 71 - writing off business trip expenses as sales expenses.

If an employee spends less money than he was given, he is obliged to return the rest. The return is processed by posting Dt50 Kt71. If an employee refuses to return the unspent amount within the prescribed period, then, by decision of the manager, it can be collected from the salary of the accountable person. This is reflected in accounting as follows:

- Dt 94 Kt 71 - unrefunded amount written off;

- Dt 73 Kt 94 - reflects the employee’s debt to the organization;

- Dt 70 Kt 73 - reflects the deduction of unreturned money from the salary.

Author of the article: Mikhail Kobrin

The cloud service Kontur.Accounting will help you easily account for advances issued and write off accountable amounts. Keep records in the system, pay salaries, pay taxes, send reports via the Internet. The service generates taxes and reports itself based on accounting data. Use the program for free for a month.

Tax accounting of travel expenses

Russian tax legislation does not classify amounts received from the employer for business trip expenses as the income of the posted employee, therefore such amounts are not included in the tax base for personal income tax and insurance premiums (clause 2 of Article 422 of the Tax Code of the Russian Federation and clause 3 of Article 217 Tax Code of the Russian Federation).

These non-taxable amounts include documented travel expenses from the company's location to the point of the business trip and back, as well as all reasonable expenses associated with this travel (boarding passes, airport services, baggage fees).

Non-taxable amounts also include expenses in the locality where the employee was sent. This includes hotel checks and checks for payment for communication services.

Daily allowances are also not taxed, but there is a non-taxable maximum: 700 rubles per day in the Russian Federation and 2,500 rubles for a business trip outside the Russian Federation. This restriction applies to both personal income tax and insurance premiums (clause 2 of article 422 of the Tax Code of the Russian Federation). An exception to this limitation of daily allowances is social insurance contributions “for injuries” - for them the entire amount of daily allowance established in the organization is considered non-taxable (Letter of the Social Insurance Fund of November 17, 2011 No. 14-03-11/08-13985).

Similar to the daily allowance, personal income tax is applied to payments for renting residential premises in the case where documents are not submitted (no more than 700 rubles per day in the Russian Federation and no more than 2,500 rubles abroad). The entire amount is not subject to insurance premiums.

As part of expenses for calculating income tax, actual travel expenses are taken into account in full (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation), including daily allowances. These costs should be classified as general expenses.

The exception is payment for service in a restaurant, additional service in a hotel room, etc. Such expenses are either not recognized by the employer and are paid from the personal funds of the business traveler, or (upon agreement with the employer) are written off as company expenses, but are subject to income tax.

The general basis for accepting VAT for deduction is the presence of an invoice. For travel expenses, you can accept other documents with a designated VAT amount, for example, railway tickets (clause 1 of Article 172 of the Tax Code of the Russian Federation).

Since 01/01/2017, railway services for the transportation of passengers are taxed at a VAT rate of 0% (clause 9.3, clause 1, article 164 of the Tax Code of the Russian Federation), therefore, payment for the use of bedding can be deducted for VAT.

If on the ticket VAT is allocated as one amount for the fee for the use of bedding and for food services, VAT cannot be deducted (Letter of the Ministry of Finance dated October 6, 2016 No. 03–07–11/58108). This amount will be reflected in the company's expenses, not subject to income tax.

Video: Confirmation of travel expenses

Advance on wages. who is entitled to it and the terms of issue (calculation example)

The agreement between the parties will be terminated because neither party has fulfilled its obligations. But in order to guarantee the fulfillment of agreements, a deposit is used. It is these funds that are paid subject to an agreement between the parties.

Such an agreement is not drawn up when paying an advance. In addition, the deposit must be returned in double amount. The choice of the form of prepayment is made by the enterprise based on its financial capabilities and desires. The deposit has other features - it must be returned in double amount.

Therefore, it is not as popular as an advance payment. In addition, tax and other contributions are not deducted from the salary advance. For example, personal income tax is withheld directly from the income itself, after the advance payment has been calculated. But there are also situations when the employer, without obvious reasons, decides to pay wages ahead of the approved date. The law does not prohibit the payment of wages earlier than the approved date; only delays in payment are a violation. Despite the fact that there are no obvious prohibitions, there are certain pitfalls related precisely to the fact that wages must be paid every half month and the date itself must be fixed. Naturally, no one in any organization will change the employment contract and internal documentation due to a delay in the payment of wages or advance payments, and formally this is already a violation. But the risk of falling under administrative liability is small, since the rights of the organization’s personnel to pay wages are not violated.

> Travel expenses

* * *

Thus, when analyzing the nature of the employee’s debt for travel funds issued to him, it turns out that the debt cannot be included in his income for the purpose of assessing personal income tax and insurance contributions at any time.

Of course, officials have a different opinion on this matter. Tax authorities may also report it during an audit. That is, if the employer has not received the specified amounts from the employee, he must take certain actions indicating his intention to repay the indicated debt. This will confirm that this amount will not remain at the employee’s disposal forever and, accordingly, should not be subject to personal income tax and insurance contributions.

Accountant of Crimea, No. 4, 2021

Menu

The advance amount also includes daily allowance.

- A seconded employee goes to his destination, completes a production task and returns back.

- Within three days after returning, the employee draws up an advance report, to which he attaches documents confirming the expenses (checks, receipts, invoices, etc.).

- The economic services of the enterprise check the advance report, after which it is approved by the head of the organization.

The amount of daily allowance is controlled by the dates of arrival and departure on travel documents. - The final payment is made for the advance payment issued and the funds actually spent.

Business trip abroad

An advance for a business trip abroad can be issued in rubles or foreign currency. In order to receive cash currency, an organization can:

– withdraw money from your foreign currency account;

– buy currency from a servicing bank;

– give the employee money to buy currency at the bank.

An advance can also be issued non-cash by issuing a plastic bank card to the employee.

Situation: is it possible to issue an advance from the cashier for a foreign business trip in foreign currency?

There is no clear answer to this question in the legislation.

Currency legislation allows payments in foreign currency related to business trips abroad (Clause 9, Part 1, Article 9 of Law No. 173-FZ of December 10, 2003). However, nowhere does it say that payments in foreign currency can be made through the cash register. Moreover, Part 2 of Article 14 of the Law of December 10, 2003 No. 173-FZ states that resident organizations can make payments in foreign currency only through bank accounts. Therefore, when checking, services that control currency transactions (for example, Rosfinnadzor) may qualify the issuance of a foreign currency advance from the cash register as a violation of currency legislation (Part 1 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation).

The Bank of Russia, in letter dated July 30, 2007 No. 36-3/1381, expressed the opinion that issuing a foreign currency advance for foreign business trips from the cash desk does not contradict currency legislation (clause 9, part 1, article 9 of the Law of December 10, 2003 No. 173-FZ). However, in letter dated August 31, 2007 No. 12-1-5/1970, the Bank of Russia expressed the opposite point of view. Since transactions with currency must be carried out through bank accounts, issuing cash currency as an advance for a business trip does not comply with the law (Part.

If the employee has no income, there is no taxable base.

The Resolution of the Federal Antimonopoly Service dated 01.04.2013 in case No. A55-15647/2012 states that funds issued by an organization to an accountable person form the debt of an individual to the organization even if they are not spent on the purposes for which they were issued, or not completely used up, must be returned.

Consequently, these funds are not an economic benefit for an individual and do not relate to his income (see also the Ruling of the Supreme Court of the Russian Federation of April 21, 2016 No. 306-KG16-3205 in case No. A65-2127/2015). The employer must take measures to return these funds, including going to court. It is assumed that these funds cannot remain with the employee, which means that he will not be able to use them in his own interests.

Let us recall that until January 1, 2017, insurance premiums were calculated and paid not by the tax service, but by the control bodies of extra-budgetary funds. In this regard, the opinion expressed in paragraph 5 of the appendix to the Letter of the Federal Insurance Service of the Russian Federation dated April 14, 2015 No. 02‑09‑11/06-5250 is interesting.

The control body judged approximately the same as the judges in the FAS Resolution PO No. A55-15647/2012. He indicated that on the basis of Art. 137 of the Labor Code of the Russian Federation, funds issued on account, for which the employee did not submit an advance report in a timely manner, are recognized as his debt to the organization and can be deducted from the employee’s salary. The employer has the right to decide to withhold from wages within a month from the date of expiration of the period established for the return of the advance, repayment of debt or incorrectly calculated payments, and provided that the employee does not dispute the grounds and amount of the withholding.

If the employer withheld the above funds from the employee’s salary on the basis of Art. 137 of the Labor Code of the Russian Federation, the object of taxation with insurance premiums does not arise.

And only if the employer decides not to withhold the mentioned amounts, they are considered as payments in favor of employees within the framework of the employment relationship and will be subject to insurance contributions in the generally established manner.

Moreover, if the employee submits an advance report with supporting documents (with copies of sales receipts for the purchase of goods, works (services), invoices, invoices) in the case where the organization has already accrued insurance premiums for the mentioned amount of payments, the organization has the right to recalculate the base for accrual insurance premiums and amounts of accrued and paid contributions.

If a corporate bank card is issued in rubles

When issuing a corporate bank card to an employee in rubles, the procedure for recording expenses and settlements with the accountable person is similar to the procedure used when issuing an advance in rubles. Travel expenses are recognized on the date of approval of the advance report at the conversion rate on the date of the transaction, that is, on the date of purchase of currency by the employee or on the date of debiting funds from the corporate bank card.

If an employee received an advance in rubles (from the cash register in cash, by transferring funds to a personal bank card or by making a transaction with an organization’s corporate card), then he should report on foreign currency expenses on a foreign business trip only with a ruble advance report. In the document Advance report

ruble amounts will have to be calculated manually, guided by the explanations of the Russian Ministry of Finance given above.

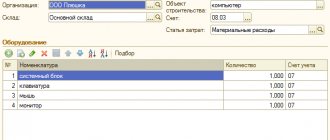

1C:ITS

In the Directory of Business Operations. 1C: Accounting 8” section “Instructions for accounting in 1C programs”, see in more detail: about paying with a corporate card for goods (work, services); on settlements with accountable persons, including when sent on a business trip abroad.

From the editor.

1C experts spoke about settlements with accountable persons in “1C: Accounting 8” edition 3.0 on July 30, 2020 at a lecture in 1C: Lecture Hall.

The video is available on the 1C:ITS website on the 1C:Lecture .

We pay daily allowances before departure on a business trip

However, previously, accountants used a travel certificate to confirm and accrue such payments. The document indicated the dates of departure for the trip and return from it (arrival date). But in January 2015 the form was canceled. Now the employee’s departure and return dates must be confirmed on the basis of tickets, residential rental agreements or fuel receipts. It’s a complicated method, which is why many organizations continue to issue travel certificates to their employees.