Why do you need a spare parts write-off act?

Enterprises that use cars regularly record transactions that reflect the turnover of spare parts for them. In this case, it is assumed that the following basic operations with these materials are recorded:

- Posting.

- Moving from one division of the company to another.

- Write-off for repair.

Each case uses its own supporting documents. If we talk about the 3rd operation, then as a corresponding document, many companies use an independently developed form of an act of writing off spare parts for a car, the main feature of which is the justification for the need to replace the corresponding spare part.

This act can be used as an alternative to such unified forms as an invoice (drawn up according to the M-15 form) or a demand invoice (drawn up according to the M-11 form), which do not always meet the specifics of the movement of spare parts accepted in the organization when writing off for repairs.

M-11 and M-15 are unified forms reflecting the release of goods and materials from the warehouse (clause 100 of the Methodological Instructions, approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n). At the same time, the act of writing off for repairs can formalize the transfer of inventory items not only from the warehouse, but also between divisions of the company.

Read about forms M-11 and M-15 in the articles:

Accounting for material assets

Inventories are assets used as raw materials in the production of products, performance of work, provision of services, for resale, as well as for the needs of the organization. It is also acceptable to use the term “inventory assets”.

Accounting for inventories in accounting is regulated by the Guidelines for accounting of inventories (approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n) and (approved by Order of the Ministry of Finance of Russia dated June 9, 2001 No. 44n).

If the need arises and there are sufficient grounds, the organization can write off inventory items. Reasons for writing off material assets (clause 90-132 of Order of the Ministry of Finance of the Russian Federation No. 119n):

- release of materials into production;

- sale of materials by the organization to individuals and legal entities;

- write-off of materials that have become unusable after expiration of storage periods;

- write-off of obsolete equipment;

- write-off when shortages, theft or damage are identified, including due to accidents, fires, and natural disasters.

Documentation of these operations is carried out through accounting documents, including the act of writing off the inventories. An organization can develop the form independently or use a unified one approved for public sector organizations (No. 0504230 according to Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n).

Act on write-off of spare parts: document structure

The act, based on the requirements of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, must include:

- information about the enterprise (name, address);

- title of the document, date of its preparation, number;

- information about the structural unit of the company that writes off spare parts;

- information about the structural unit of the company that receives spare parts (for example, a repair shop);

- information about the types of spare parts being written off and their item numbers;

- data on the quantity and cost of written off spare parts;

- information about the accounts used to record the write-off of spare parts in accordance with clause 93 of Methodological Instructions No. 119n.

The document can be signed:

- a representative of the department from which spare parts are written off;

- repair shop employee.

Also, the chief accountant of the organization can put his signature on the document, confirming the correctness of the act.

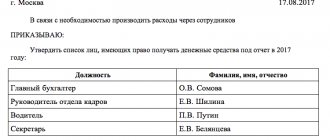

The form of the act on the write-off of spare parts is entered into the document flow by order of the head of the company.

To learn about what a document for writing off materials for production may look like, read the material “Writ-off certificate - sample for 2017.”

Decor

The act can be printed or written by hand. Specialized forms of the organization and regular A4 paper are used. The main thing is that the information contained in the installation certificate meets the requirements for official documents and contains the necessary data in full.

Corrections to official documents are not encouraged. That's great rarity. If an error was identified before signing, the act is reprinted or rewritten. If the error was discovered after the manager’s approval and the act was entered into the appropriate registers, then corrections will have to be made according to the general requirements.

It is necessary to cross out incorrect information with one line (so that it remains readable), and write the correct information above it (or next to it). At the same time, the correction is marked with the inscription “Corrected”, the date and signatures of all persons who signed the original version.

Features of the act for writing off car spare parts in Russia

During operation, the property gradually wears out. Cars that periodically require repairs are no exception. How are car parts written off in Russia, what are the features of drawing up the corresponding act?

The main business transactions relating to vehicles include the receipt, movement and disposal of spare parts.

Each of these facts must be documented. This is especially important when writing off parts. What are the features of the act for writing off automobile parts in Russia?

Automotive parts that are unusable should be scrapped. But the essence of the procedure is not so clear.

First of all, there must be confirmation of the validity of the write-off. In addition, there may be situations where spare parts are deregistered but not retired.

For example, if an organization has the necessary parts, they can be used for repairs, which requires them to be written off as a separate object.

If a faulty spare part that is not suitable for restoration is written off, a defective statement is issued. The document is drawn up by a specially created commission with the participation of a mechanic.

Based on the statement, an application for the purchase of a new spare part is submitted. The application must be approved by the chief accountant and the head of the organization.

Next, the necessary spare parts are purchased and taken into account. The purchased spare part, in accordance with the mechanic’s memo, is transferred to replace the faulty part.

After this, the old spare part can be written off. The write-off is documented by a defective statement and an inventory write-off act.

When car repairs are carried out by a third party, spare parts can be written off on the basis of an invoice for the release of materials to the third party in the M-15 form.

In this case, an acceptance certificate is additionally drawn up in a unified form.

When repairing on your own, the transfer of the part is carried out on the basis of a demand invoice, and the act can be drawn up in any form.

What it is

The act is the primary document confirming the fact of the transaction. Thus, the act of writing off car spare parts certifies the fact of writing off certain values from the organization’s accounting records.

Based on the provisions of Federal Law No. 402. the obligation to use unified forms of primary documentation is excluded.

Since 2013, organizations have the right to develop their own forms of documents, guided by standard templates. In this case, the document must contain mandatory details that allow it to be recognized as primary.

The structure of the act for writing off car spare parts is as follows:

Owner information

Name of organization, details, legal address

Write-off of purchased spare parts

Without prior posting of such

As for the act of writing off spare parts for a car itself, the validity of the document is recognized only if the basic requirements are met. Such as the availability of mandatory details and accuracy of data.

That is, all write-off parts must be identified in as much detail as possible in order to eliminate the possibility of erroneous write-off of other objects. The same applies to the cost of write-off spare parts.

The amount spent on purchasing the required part is written off, and not the residual value of the worn-out part. Disposal of spare parts requires compliance with certain preliminary procedures.

Thus, an act for writing off spare parts can be drawn up only after the process of identifying defects and establishing the scope of work is completed. And initially a proper order from the leader is necessary.

Formation of an order for a vehicle

To generate an order for a vehicle, a technical report is initially required on the failure of the vehicle due to physical wear and tear of parts.

The conclusion states that it is necessary to restore a certain unit through partial replacement of parts, or it is necessary to replace it due to the impossibility of repair.

Based on the technical report, the head of the organization issues an order to carry out repairs in accordance with the technical report.

At the same time, an order is issued to create a special commission that will determine the need to repair vehicles. If the need for repair work is confirmed, a defective statement is drawn up.

It indicates which parts need replacement. Based on the defective list, the necessary spare parts are purchased, which are then transferred upon request-invoice.

Upon completion of the repair, a materials write-off act is drawn up. In the event that there are spare parts suitable for use, they are received on the basis of a commission report. When spare parts are not subject to further use, a disposal report is drawn up.

Filling out form OS-4a

A separate write-off procedure is provided in cases where car repairs are deemed inappropriate. For example, the physical wear and tear of the asset is too great, and the depreciation value has already been written off.

In this situation, the vehicle is written off completely. For write-off, a standard form is used, approved by the State Statistics Committee of the Russian Federation in Resolution No. 71a of October 30, 1997.

An act is drawn up in form OS-4a in two copies. The first is sent to the accounting department along with a document confirming the deregistration of the car with the traffic police.

Another copy is retained by the responsible person and becomes the basis for depositing the valuables and materials remaining as a result of write-off.

When filling out form OS-4a:

Write-off costs and value of valuables

Those remaining after dismantling the car are displayed in the section “Certificate of costs associated with the write-off of vehicles and the receipt of material assets from their write-off”

The eighth column displays

The amount of accrued depreciation on a car at the time of its disposal

In the section “The following main parts and assemblies are subject to capitalization”

Displays the quantity, item numbers and cost of material assets remaining after write-off

From the first to the fourth columns

The amount of all expenses for writing off the car is displayed

In columns five to nine

Data is recorded on expenses associated with the write-off and values received after the write-off

Act OS-4a is signed by all members of the commission and the chief accountant. After this, the document is approved by the head of the organization.

Sample act for writing off tires

At this time, there are no approved standards regarding the write-off of spare parts and consumables, including tires used during the operation of vehicles.

The standard tire mileage is determined by the manufacturer. Guided by this information, the head of the enterprise can independently approve the mileage standards for car tires.

It is also permissible to base the approval on existing operating experience. In any case, operating mileage standards must be justified, economically justified and documented.

Find out what reasons there may be for writing off furniture in a write-off act from the article: write-off act.

Read how to draw up a sample defect report for equipment here.

About the form of a defective act in the construction of the Russian Federation, see here.

Tires are written off according to the standard scheme. But at the same time, you need to take into account the nuance that scrapped tires must be handed over for recycling.

A sample act for writing off tires looks like this:

- The title is “Act for writing off tires.”

- Document number, approving organization.

- Composition of the commission indicating the order of appointment.

- The fact that the tires were declared unfit for use.

- The name of the organization or department that operated the vehicle.

- Car data.

- Data on tires indicating the actual mileage and standard tire mileage.

- List of tire defects.

- The commission's conclusion regarding further use (completely unsuitable, handing over for disposal).

- Signatures of all commission members.

Is a vehicle inspection report required?

A car inspection report is required at the very initial stage, when a technical report on the condition of the car is being prepared. The act justifies the need for vehicle repairs and subsequent write-off of spare parts.

An inspection report is also drawn up upon completion of the repair to detect possible remaining faults.

The structure of the vehicle inspection report includes:

- mandatory details;

- composition of the commission;

- vehicle identification information;

- owner's name;

- technical condition parameters;

- signatures of responsible persons.

general information

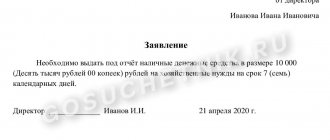

The act confirms the fact of the economic life of the company. Based on the act of writing off spare parts, spare parts installed in the car during repairs are written off from the balance sheet. Such paper is necessary to prove to them in case of claims from the inspection authorities that the funds were spent lawfully.

A commission may be convened to draw up the document. This can also be done by one responsible employee, since the act will still be approved by the manager. The details of the write-off operation and the composition of the commission, if one is planned, must be specified in the organization’s accounting policies.

Before the write-off procedure, follow the following procedure:

- the responsible person writes a memo addressed to the head of the department or company about the need to repair the vehicle;

- authorized employees - members of the commission - draw up a defect report based on the results of the inspection or fill out a defect sheet, where they certify that repairs are necessary with the replacement of certain parts;

- the manager issues an order to carry out repairs and further write-off of parts;

- prepare repair estimates, carry out repairs using spare parts from the warehouse, or the necessary equipment is purchased, registered and used in work;

- After repairs, used spare parts are written off.

Thus, spare parts need to be capitalized, their movement between divisions of the company recorded, then written off for car repairs.

For write-off, you can use unified forms M-15 or M-11, however, they do not accurately reflect the essence of this fact of economic life.

Certificate of write-off of auto parts

Name I APPROVED the organization _____________________ _________________________________ (position) ___________ _____________________ (signature) (signature transcript) “___” _____________ 20__

ACT N __________

for write-off of auto parts

from "___" ______________ 20___

A commission consisting of: chairman _________________________________________________ (position, full name) members of the commission _________________________________________________ (position, full name) ________________________________________________, (position, full name) appointed by order (instruction) No. ______ dated _____________ , confirms the write-off of the following spare parts spent on the repair of vehicles during the period from ________ to _______: —————————————————————————————- ¦ N ¦Name¦ Unit¦Quantity-¦Price¦Amount¦ Number ¦ For repair of which unit ¦Number and date¦ ¦p/p¦auto parts¦meas.¦ in ¦rub.¦ rub.¦vehicle¦vehicle ¦ defective ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦spare parts wasted¦ statements ¦ +—+————+—-+—-+—-+——+———-+————————+ ————+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+————+—-+—-+—-+——+———-+————————+— ———+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+————+—-+—-+—-+——+———-+————————+—— ——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+————+—-+—-+—-+——+———-+————————+——— —+ ¦ ¦ Total¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —-+————+—-+—-+—-+——+———-+————————+——— —- Total number ________________________ units, total write-off amount (in words) _________________________________________ rub. (in words) After replacing spare parts, scrap metal was registered at the price of procurement organizations: —————————————————————————— ¦ N ¦ Name ¦Unit. unit ¦ Quantity ¦ Price ¦ Cost ¦ ¦p/p¦ auto parts ¦ ¦ ¦ rub. ¦ rub. ¦ +—+———————+———+———-+———+——————-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+——————— +———+———-+———+——————-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —-+———————+———+———-+— ——+——————— Scrap (scrap) was delivered to the warehouse for repair (destruction) according to invoice N ___ (cross out what is unnecessary) dated “___” ___________ 20__. The organization drew up an act of acceptance and delivery of the car from repair in one copy. The act was signed by members of the commission and the organization’s mechanic. A note about the repair was made in the vehicle's inventory card. Chairman _______________ ________________ _____________________ (position) (signature) (signature transcript) Members of the commission: _______________ ________________ _____________________ (position) (signature) (signature transcript) _______________ ________________ _____________________ (position) (signature) (signature transcript)

Add-ons

Since there is no generally accepted form, for greater efficiency and convenience, the heads of organizations (perhaps at the suggestion of clerks, accountants, personnel officers or other employees) change the standard form of the document, supplementing it with the following points of the main part:

- Links to acts according to which material assets are accepted for installation.

- If a legal entity or individual entrepreneur used the services of other organizations, then the manufacturer, supplier, shipper, carrier, as well as the direct installation organization carrying out work on connecting structural elements may be designated.

- In addition to the name of the part (structural element or other material assets for installation), the passport number or marking, brand, date of receipt or manufacture are entered.

Procedure for documenting defects

In the case of companies with a small staff, there is often no particular need to develop, prescribe and approve a procedure for checking equipment and drawing up a defective list, since such situations arise quite rarely.

However, in the case of large companies, equipment quality monitoring is carried out only according to pre-drafted and approved regulations. In general, the order is as follows:

- The management of the company or a specific branch issues an appropriate order to conduct a scheduled or unscheduled inspection.

- This order reflects the authorized persons who will be part of the inspection commission: at least 2 employees . It usually includes not only representatives of technical services (engineers, technicians, quality controllers), but also accounting departments.

- Direct quality control is carried out, a defective statement is drawn up on a pre-prepared form, signatures are placed, after which the document is handed over to authorized persons.

NOTE. The verification procedure using a defective list should not be confused with technical expertise. Planned quality control is, as a rule, only a visual inspection of external surfaces, mechanisms, and connections of parts. At the same time, examination involves a more in-depth analysis of the mechanism using special equipment for testing.

What should be included in the defective statement?

Considering that the purpose of the defective statement is to confirm the presence of defects in a fixed asset item and justify the need for its repair, the relevant information should be indicated in the defective statement. Thus, the statement, in particular, reflects the following information:

- name of the fixed asset item and its inventory number;

- types of identified defects, their characteristics;

- the volume of proposed repair work and its cost (if possible).

The defective statement is usually prepared by a commission. This commission can be created specifically to identify defects in fixed assets. Or the commission that was appointed to conduct an inventory of fixed assets can deal with these issues.

Inspection of fixed assets for defects can be carried out either on a scheduled basis (for example, quarterly) or on the basis of a separate order of the manager. In the latter case, this occurs, say, when a defect was identified by a person responsible for a particular item of fixed assets or using it in work, and such an employee initiated a quality check of the fixed asset. In this case, a link to the manager’s order is usually given in the defective statement. If necessary, sketches, photographs of defects, and other information are attached to the defective list.

Spare parts were obtained during dismantling or disassembling of operating systems being decommissioned

In accounting, spare parts can appear on the balance sheet not only as a result of their purchase specifically for their intended purpose (to repair a vehicle), but also as a result of dismantling. For example , after an accident, spare parts suitable for use or subject to scrapping are identified. Such business transactions in accounting are reflected in the debit of account 10, subaccount 10-5 (for spare parts suitable for use), 10-6 “Other materials” (for spare parts that cannot be used as such in this organization (scrap metal, waste materials)), and to the credit of account 91 “Other income and expenses”, subaccount 91-1 “Other income” (clause 79 of the Instructions for accounting for inventories, Instructions for using the Chart of Accounts).

Clause 9 of PBU 5/01 establishes that the actual cost of spare parts remaining from the disposal of vehicles is determined based on their current market value as of the date of acceptance for accounting. For the purposes of PBU 5/01, current market value means the amount of money that can be received as a result of the sale of these assets. By the way, such spare parts are available on the date the vehicle is written off. For convenience, most accountants use the same cost of spare parts in accounting as in tax accounting.

Example 2 . As a result of the disposal of the vehicle by the transport company, spare parts suitable for use were credited to the organization's balance sheet at a price of 3,600 rubles. (the cost is determined by the conclusion of the commission).

The following entry will be made in the accounting records of the transport company:

Number of copies

The installation act is a “safety cushion” for organizations that install and install various types of equipment, structures, etc. Therefore, the act is usually drawn up in at least two copies. One is needed for the customer, the other for the installation contractor.

If the customer goes to court, the contractor can always prove through an act that the work was at least carried out.

Even if an organization installed material assets on its own, this document must appear in the financial statements to calculate remuneration for the employee who carried out the installation. It is also needed to write off acquired material requirements, followed by adding their value to the total value of equipment or other property of the organization.

Defect sheet: sample 2021

Articles on the topic

If you discover a breakdown of equipment or a device, you will need a defective statement - download a sample of its completion and a form relevant in 2019 in this material.

Companies should regularly check and inspect equipment and devices in the facility. Not only productivity, but also employee safety depends on this.

To conduct an inspection, a commission must be formed. Its composition is independently approved. But the team should include not only accountants, but also specialists who understand the specifics and technical characteristics of the equipment. Otherwise, it will be impossible to determine what exactly caused the breakdown, as well as whether the equipment can be repaired.

If you are conducting a routine inspection, then it is not at all necessary to carefully inspect and check the serviceability of the equipment. Typically, a detailed inspection is carried out when it is already known for certain that the equipment is faulty. In these cases, the commission draws up a statement.