Payment

What is meant by a corrected invoice? In Ch. 21 of the Tax Code of the Russian Federation the term “corrected invoice”, so

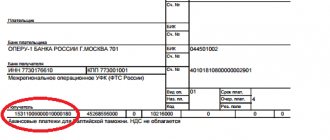

When making customs payments to the account of the treasury of the Russian state, there is a special classification code,

Form 7-injuries is an annual report on accidents and occupational diseases that occurred at the enterprise.

Dividends are part of the profit of a commercial organization that is distributed among its participants. If

Exclusive and non-exclusive rights Computer programs are the subject of copyright (clause 1 of Article 1259

Important information about 71 accounts: characteristics, postings, examples 71 accounts reflect settlements with employees for

The accounting policy (AP) is a “particularly important” document that collects aggregate information about

The world does not stand still and the developers of the 1C: Accounting 8 program are also not lagging behind

The statute of limitations for collecting insurance contributions to the pension fund was an individual entrepreneur, 8 years is no longer

How to reflect deferred income on the balance sheet? Organizations, without exception, keep accounting records. From