The world does not stand still and the developers of the 1C: Accounting 8 program also do not lag behind and try to make our work easier with each release.

In the 1C: Accounting program (starting from release 3.0.42) to account for the receipt of leased property from the lessee

subaccount 01.K has been added to the Chart of Accounts, Adjustment of the value of leased property, the purpose for documents is changed:

Receipt of leasing

,

Acceptance of fixed assets for accounting

, and the long-awaited document

Redemption of leased items

.

When preparing the article, information posted in the 1C:ITS Information System was used.

What is account 01

Account 01 01 in 2021 refers to assets reflecting fixed assets, their movement and cost. The account is considered non-current.

The concept of fixed assets

Account 01 identifies fixed assets as tangible assets owned by the organization. They are used in economic activities. Their cost is transferred to the cost of manufactured goods or products.

Fixed assets include:

- roads and all transport;

- tools, work equipment;

- breeding stock;

- power machines;

- production equipment;

- structures and buildings owned by the organization;

- all types of transmission networks, these include heating networks and electrical networks.

Included in the account are fixed assets that are capital investments in leased assets and leased land plots. They are non-current assets and take part in production activities not as a means, but as a direct object.

For an object to be recognized as a fixed asset, the following conditions must be met:

- It is used in the production activities of the enterprise.

- There are promising economic benefits.

- The object is not intended for resale.

If the cost of a fixed asset is less than 40,000 rubles, it can be immediately written off as an expense.

Acceptance of the leased object into the operating system

Previously

Acceptance of a leased asset for accounting as an object of fixed assets is carried out using the document Acceptance for accounting of fixed assets

, to which the operation

Under a leasing agreement

, which allows you to specify the lessor and the method of reflecting the costs of leasing payments in tax accounting.

Now

When choosing the method of receipt Under a leasing agreement

additionally required fields are displayed:

- Counterparty and Agreement on the Non-current asset

- Method for reflecting expenses for leasing payments on the Tax Accounting

.

It is important to remember

that in the NU, in the method of reflecting expenses for leasing payments, the type of Cost Items

Other Expenses must be indicated.

Account functions 01

Account zero one in accounting has a number of functions.

Formation of the cost of fixed assets

Initially, the price of the OS is taken into account as the initial price. Expenses for the acquisition of intangible assets include:

- amounts paid to the seller;

- delivery costs;

- expenses for advisory and information services;

- payment for services to intermediaries;

- customs duties when importing OS;

- expenses for contractors' services.

Customs duties as expenses on account 01

A number of costs remain unchanged. For example, amounts for general business expenses. Purchase costs are initially reflected on account 08. After they are fully formed, they are transferred to account 01.

Important! This is done only at the moment when the property is fully equipped and suitable for use. Therefore, if a company purchased a kettle, it should immediately be reflected in the balance of account 01, even if it was in the warehouse all this time.

Depreciation of fixed assets

Depreciation of fixed assets in accounting means the transfer of their value to the cost of manufactured products. This is done gradually.

Depreciation process

There are categories of objects that are not subject to depreciation. These include:

- plots of land;

- livestock;

- environmental management facilities;

- external landscaping;

- road and forestry;

- residential properties that are not classified as non-industrial.

If the repair process took more than a year, and the objects were mothballed for a period of more than three months, then depreciation is no longer calculated.

On the balance sheet of the accounting department, residual funds are reflected at their residual value. This means that the first value minus the accumulated depreciation percentage is reported. Non-depreciated property must be accounted for on the balance sheet at its original cost.

According to the plan, depreciation begins the next day from the date of commissioning. The termination of accrual according to the approved standard occurs after the complete write-off of the cost.

From the moment the book value of a fixed asset becomes zero or receives a negative value, it ceases to be reflected in the balance sheet.

Other possible uses

Account 01 allows you to organize analytical accounting of funds. In this case, each object will be assigned an inventory number. If one object has several parts that have different service lives, in such a situation each part will be counted as separate.

Accounting for fixed assets on account 01

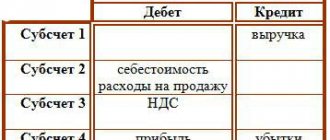

Examples of postings depend on the situation. And since accounting for fixed assets is quite complex and voluminous, we will give just a few individual examples. This issue is discussed in detail in online lessons and in the video course. Here are some typical wiring:

- Dt 01.01 - Kt 000 Operation to enter the initial balances of fixed assets. There is a separate article about the 000 account.

- Dt 01.01 - Kt 08.04.1 Acceptance of fixed assets for accounting.

- Dt 91.02 - Kt 01.09 Operation on disposal of fixed assets, in particular sale.

Please note that all transactions that use 01 or its subaccounts are part of fairly complex documents. The examples of postings shown above are only a small part of the postings of a real document. In reality, all transactions are generated when posting documents and records in various registers, a lot is created.

If you already have your own experience with fixed assets in general and account 01 in particular, be sure to share it in the comments. This will help other novice accountants better understand fixed asset accounting and its practical application in the 1C: Accounting program.

What subaccounts are there in account 01

Sub-accounts are opened for account 01:

- 01-1 - this includes all means of primary activity, with the exception of livestock, perennial plantings, plots of land and environmental management facilities. This subaccount takes into account the availability and movement of funds from the main type of activity, which is established by the constituent documents.

- 01-2 - Other production operating systems. This takes into account the movement of funds from other productions and industries that are not related to the main activities of the organization.

- 01-3 - non-production OS. This subaccount records the movement and safety of funds aimed at servicing the social activities of the enterprise, housing and communal services, and consumer services for citizens.

- 01-4 is a subaccount that takes into account working and productive livestock.

- 01-5 - this includes all perennial plantings, including forest strips. Plantings accepted for use are recorded by type and year of planting. The object in this case will be the landing area. Maintenance costs are included in the cost of production obtained from these plantings. Depreciation is not charged for young plantings that have not been put into operation.

- 01-6 - subaccount takes into account the movement of plots of land, water and forest lands, minerals that are transferred to the enterprise for operation. Depreciation is not charged on these items.

- 01-7 - non-inventory objects - this will include movements of capital investments aimed at using land, water and forest resources.

- 01-8 - all household supplies, tools and equipment whose useful life is more than a year.

- 01-9 - these are objects received on lease, rent or credit. Account 001 is also used when a leasing agreement is concluded, but only if the fixed assets will be registered with the organization. Accounting is maintained for each object separately. Adjustments to the value of the leased property will be reflected through account 01k.

- 01-10 - this subaccount takes into account other objects not previously specified.

- 01-11 - the account reflects the disposal of fixed assets.

For analytical accounting, account card 01 is used. It is distributed by location, groups and individual objects.

Leasing concept

Analytical accounting should provide all the necessary data on the availability and movement of funds in Russia and abroad. If fixed assets contain precious metals, then their mass must be indicated on the cards.

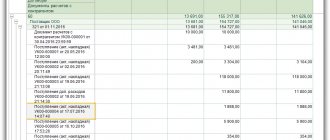

Negative amounts on the account card that are NOT an error

There is another reason why your account card may show you negative balances opposite some documents. This is due to an elementary flaw in the document processing process.

Let's say we have two documents going one after the other:

- Issuing an advance to the supplier;

- Delivery document;

The first document generates the posting Dt60.02/Kt (50 or 51), and the second accrues the debt for the supply and offsets the advance payment. So, the account card 60.01 will have the following:

A negative balance is formed due to the fact that in the receipt document, the entry for offsetting the issued advance is made FIRST. And only then the DEBT to the supplier is accrued. And if so, then we get a (temporarily!) negative balance. Reason: incorrect posting sequence.

However, this is not your mistake, this is just how the mechanism for processing documents in this case works. It is logical for this wiring to be last in the list, and not first, as shown in the screenshot below:

However, in all versions of 1C: Accounting, the entry for offsetting the advance is the first one. At the same time, Express Check does NOT consider this an error and there is no need to manually rearrange the entries. True, there have been versions of the program in which a similar case is recognized as a 1C error, which is reported by the Express check, but this is a flaw of the 1C programmers, and not a problem with your accounting!

For example, you can manually move the advance payment to the end of the list of transactions, then save the document and update the account card: the problem will disappear. This does not mean that you need to manually edit all documents. Leave everything as it is!

Interaction with other accounts in accounting

01 accounting account is allocated according to the plan for accounting for fixed assets. There they must be used at their original cost. The budget account is active. This will mean that all receipts are recorded as a debit, and the decrease, the new value of the value, is taken into account as a credit.

Postings

In the debit budget, account 1 interacts with the credit of the following accounts:

- 03 - reflection of the return of fixed assets from income (for example, this may be a return from a creditor);

- 08 - receipt of funds, then increase in their price due to reconstruction, re-equipment;

- 76 - crediting fixed assets from other debtors (cases when no modification is required);

- 79 — on-farm calculations;

- 83 - price increase based on revaluation.

The loan interaction is carried out with the following accounts:

- 02 - reflection of the disposal of funds;

- 11 — transfer of animals to the main herd;

- 99 — write-off as a result of an emergency;

- 83 - price decrease as a result of revaluation, decrease in profit.

Postings

The receipt of fixed assets to the account of the enterprise, the arrival of the object on the balance sheet could be carried out in different ways. This can be either a purchase, a gift agreement, or a contribution to the authorized capital.

Carrying out an inventory

As soon as an enterprise purchases a fixed asset, all the costs it incurred for the acquisition and preparation for operation are entered into account 08. Subsequently, the entire amount is transferred to account 01. This is where accounting is carried out. These postings control the receipt of all fixed assets in accounting.

An enterprise may become the owner of an object in connection with capital construction. In this case, the initial price will include payment for the work of contractors and all costs for materials and construction.

Modernization

The main feature of the modernization procedure is that in the process of its implementation, the original characteristics of the objects are adjusted. As a result, the period of use and cost change. In order to properly record expenses, it is recommended to open a sub-account on account 08. All expenses that were necessary for the modernization will be collected here. The procedure is carried out in several types.

Sale

Revenue after the sale must be indicated in the reporting documents in the amount specified in the contract. This also includes all losses that went towards depreciation. All transactions must be reflected in account 91.

Liquidation

The procedure for liquidating an object is carried out if its use for the enterprise has become economically unprofitable. The fixed asset is subject to write-off. In the future, they have the right to disassemble it in order to use the resulting materials for other purposes.

Revaluation

The revaluation operation is not mandatory for the organization. But there are cases when this necessity is determined by local acts. In such a situation, the revaluation procedure will need to be carried out on the last day of the year. There are two types of revaluation possible. This can be a markdown or revaluation.

Unaccounted assets based on inventory results

All business entities are required to regularly conduct an inventory of the property on their balance sheet. This is necessary to ensure authenticity. If the inspection reveals objects that are not registered, they must be included in it in the same month. The cost will be indicated based on the current market price for similar properties.

OS shortage based on inventory results

Based on the results of the inventory, a shortage may occur. In such a situation, the company employee is responsible for the damage. If it is not determined, then it is written off as a loss. The amount is determined based on the actual residual value.

Account 01 in accounting plays an important role for the correct accounting of objects on the balance sheet of an organization, enterprise, and related to the main ones. Interaction between accounts helps to correctly track changes in their value during operation.

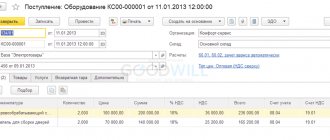

Receipt of leased object

Accounting for the receipt of leased property is carried out using the document Receipt for leasing

(Section of fixed assets and intangible assets - Receipt of leasing).

Previously

This document was intended to reflect the transactions of receipt of leased property; the document indicates the initial cost of the leased property in accounting and tax accounting. When posting a document, if the cost in accounting and accounting records differs, entries were automatically generated to reflect temporary differences.

Now

Document Acceptance of leasing

is also intended to reflect transactions of receipt of leased items, but now it indicates the initial cost of received leased items only according to accounting. That is, the total amount of lease payments is indicated, taking into account the redemption price for the period of validity of the contract.

When posting a document, the following transactions are generated

It is important to remember about VAT

At the time of receipt of the leased asset, VAT is reflected on account 76.07.9. No entries are generated for VAT accounting registers. At this stage, you can neither deduct nor include VAT in the price, since it is conditional

There are no VAT or invoices for it.