Exclusive and non-exclusive rights

Computer programs are subject to copyright (Clause 1, Article 1259 of the Civil Code of the Russian Federation). Therefore, the procedure for reflecting the costs of creating a website in accounting depends on what rights the organization owns to it - exclusive or non-exclusive.

If an organization has exclusive rights to a website, developers do not have the right to create the same website for other persons. That is, the site is unique, and the organization becomes its sole owner.

If the organization has non-exclusive rights to the site, developers can create a similar site for other persons (clause 1 of Article 1297 and subclause 1 of clause 1 of Article 1236 of the Civil Code of the Russian Federation).

If the site is created on its own, then the exclusive rights to it may belong to the organization in the following cases:

- if the employment or other agreement with the employee involved in the development of the site does not provide for the retention of all exclusive rights to the site (Article 1261, paragraph 2 of Article 1295 of the Civil Code of the Russian Federation);

- if the author's order agreement with a third-party specialist does not stipulate that the exclusive rights to the site belong to the contractor (clauses 1 and 3 of Article 1296 of the Civil Code of the Russian Federation);

- if the contract or R&D agreement, which does not directly imply the creation of a website, stipulates that exclusive rights to the website belong to the customer organization (Clause 1 of Article 1297 of the Civil Code of the Russian Federation).

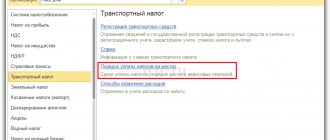

Depreciation

In tax accounting, the cost of creating a website worth over 100,000 rubles. write off through depreciation (clause 1 of article 256 of the Tax Code of the Russian Federation). On the procedure for writing off in tax accounting the costs of creating a website worth 100,000 rubles. and less, see What property is considered depreciable in tax accounting.

For more information on the rules for calculating depreciation on intangible assets, see the recommendations:

- How to determine the initial cost of an intangible asset in tax accounting;

- How to calculate depreciation of intangible assets using the straight-line method in tax accounting;

- How to calculate depreciation of intangible assets using the non-linear method in tax accounting.

Inclusion in the NMA

If all exclusive rights to the site belong to the organization (and not the developers), then it can be taken into account as part of intangible assets. In this case, other conditions listed in paragraph 3 of PBU 14/2007 must be observed. Namely:

- exclusive rights to the site are confirmed by documents (for example, an agreement with an employee involved in the development of the site; an official assignment for the creation of a site; an author's order agreement with a third-party specialist; an act of acceptance and transfer of the exclusive right, etc.);

- the organization does not plan to transfer (sell) exclusive rights to the site in the next 12 months;

- the site is used in the production of products (works, services) or for management needs;

- using the site may bring economic benefits (income);

- the period of use of the site exceeds 12 months;

- the initial cost of the site can be determined.

There are no cost restrictions for including a website among intangible assets in accounting. It is also not necessary to register exclusive rights to a website with Rospatent (Article 1262 of the Civil Code of the Russian Federation).

Expense recognition date

If an organization uses the accrual method, reduce the tax base as expenses arise for creating a website (clause 1 of Article 272 of the Tax Code of the Russian Federation). For example, take into account the cost of materials after they are written off from the warehouse, and the salaries of employees in the month of accrual. It is at this moment that expenses are recognized as economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

If the organization uses the cash method, reduce the tax base provided that the expenses incurred are paid (clause 3 of Article 273 of the Tax Code of the Russian Federation). For example, materials used to create a website must not only be written off, but also paid to the supplier (subclause 1, clause 3, article 273, clause 5, article 254 of the Tax Code of the Russian Federation).

Useful life

If an organization owns all exclusive rights to a website, then their validity period is not limited in time. Therefore, for accounting purposes, determine the period of use of the created website based on the period during which it is planned to use it for management needs, production of products (performance of work, provision of services) and other generation of income, but not longer than the period of activity of the organization. This is stated in paragraph 26 of PBU 14/2007. If it is impossible to determine the period of use of the site based on such parameters, then it is considered indefinite (such a program cannot be amortized) (clauses 25, 23 of PBU 14/2007). Subsequently, the organization must annually check whether the useful life of the site has changed significantly (clause 27 of PBU 14/2007). In addition, for objects with an indefinite useful life, it is necessary to check annually whether factors that interfere with determining their useful life have been excluded (paragraph 2 of clause 27 of PBU 14/2007).

The useful life of the site must be approved by order of the head of the organization.

Income tax: modernization

Situation: how to take into account the costs of upgrading a program (website) when calculating income tax? The program is accounted for as an intangible asset (the organization owns exclusive rights to the website).

Depending on the nature of the work being carried out, the costs of upgrading the website may be accounted for as a separate intangible asset or as the cost of updating programs.

This is explained as follows.

The site is a computer program (Article 1261 of the Civil Code of the Russian Federation). Upgrading a computer program should mean changing it. There are two types of modernization: adaptive and complete. With adaptive modernization, minor changes are made to a computer program to ensure its functionality. Complete modernization (modification) leads to the separation of the updated program into a separate object. This is stated in paragraphs 4.1, 4.5, 4.10 of GOST R ISO/IEC 14764-2002, adopted and put into effect by Resolution of the State Standard of Russia dated June 25, 2002 No. 248-st.

Thus, modification of the site, which involves changing its program code, leads to the emergence of a new object of copyright (subclause 9, paragraph 2, article 1270 of the Civil Code of the Russian Federation). That is, having modernized (reworked) the site, the organization created a new (derivative) work based on an existing one, namely a new site.

The Tax Code does not provide for a change in the initial value of intangible assets in the event of its modernization (letter of the Ministry of Finance of Russia dated December 13, 2011 No. 03-03-06/1/819).

If the new site meets the requirements for intangible assets, then take it into account as part of the intangible assets in the amount of the modernization carried out (clause 3 of article 257 of the Tax Code of the Russian Federation). Write off the cost of a new intangible asset through depreciation (clause 1 of article 256 of the Tax Code of the Russian Federation).

If a new website (copyright object) does not meet the requirements for intangible assets, or changes are made to it solely for the purpose of its functioning (changing the structure within the existing program code, correcting defects, etc.), then such costs when calculating the tax on take into account the profit as other expenses associated with production and sales, taking into account the principle of uniformity (subclause 26, clause 1, article 264, clause 1, article 272 of the Tax Code of the Russian Federation). Similar clarifications are contained in letters of the Ministry of Finance of Russia dated November 6, 2012 No. 03-03-06/1/572, dated July 19, 2012 No. 03-03-06/1/346, dated October 31, 2011 No. 03- 03-06/1/704, dated September 29, 2011 No. 03-03-06/1/601.

Initial cost

In accounting, the site is accounted for as part of intangible assets at historical cost. It is equal to the sum of all website development costs, which include:

- expenses for services and work of third parties;

- salaries of employees directly involved in the development;

- contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases;

- expenses for maintaining fixed assets (other property) and intangible assets used to create a new asset, as well as depreciation amounts accrued on them;

- non-refundable taxes and fees;

- government, patent and other similar duties;

- customs duties and fees;

- other similar expenses.

This is stated in paragraphs 8 and 9 of PBU 14/2007.

The initial cost also includes the costs of developing (purchasing) the graphic design of the site (i.e., computer program). Despite the fact that the design of a website is the subject of copyright (paragraph 7, clause 1, article 1259 of the Civil Code of the Russian Federation), it cannot be taken into account as an independent object of intangible assets. This is explained by the fact that website design alone cannot bring economic benefits to the organization. And this is one of the main conditions for recognizing an object as part of intangible assets (subparagraph “a”, paragraph 3 of PBU 14/2007). In addition, the inventory object of intangible assets can be either one right or a set of rights to one object. Such rules are established by paragraphs 5 and 9 of PBU 14/2007.

Real costs of creating a website

Have you set the task of developing a website and want to know how much it will cost? Be prepared for the fact that the price range for these services is very wide. For seemingly the same amount of work, you can be asked to pay either 20 thousand rubles or one and a half million rubles.

A person who is far from the IT field does not understand why there is such a range in price tags. The explanations of managers who cleverly try to draw an analogy with the difference between the Zhiguli 2107 and the BMW 7 Series only make it worse: this does little to justify the costs of the website. Let's figure out what it really costs.

The first thing you need to understand is that any website development is first and foremost a business, therefore, its main task is to make a profit, and then everything else. Yes, there are a lot of people who are completely passionate about the idea of creating cool products. But, you see, these products turn out as such when the performer makes them in comfortable conditions. That is, he has good equipment, a suitable place to work, high-speed Internet and a lot of other little things, each of which costs money.

Let's say we need to develop a website that includes 14 standard pages. The main requirements for it are to be manufactured taking into account all the basic rules of search engine optimization and to have a convenient administration panel (to manage content). What kind of team will be required for this project (each participant has an average market salary):

- Project manager – 60,000 rubles.

- Programmer – 60,000 rubles.

- Graphic designer – 50,000 rubles.

- Sales manager – 45,000 rubles.

- SEO specialist - 45,000 rubles.

- Layout designer - 35,000 rubles.

- Content manager – 30,000 rubles.

Thus, to create and maintain a high-quality website, you need at least seven people. And how much time will each employee need to exercise his part of the powers:

- Project manager – 5 days.

- Programmer – 4 days.

- Graphic designer – 5 days.

- Sales manager – 3 days.

- SEO specialist – 1 day.

- Layout designer – 5 days.

- Content manager – 3 days.

Read other articles on the topic of running an online store

Step-by-step automation of an online store from scratch

Attracting visitors to the site: paid and free methods

Low conversion: 19 reasons and ways to eliminate them

Online store management: key details for success

How to maintain a customer base to increase company profits

The calculation is, of course, approximate, but it has a direct relationship to real life. In fact, each specialist may need much more time, taking into account all sorts of approvals and comments from the customer. Nevertheless, we will rely on the given figures in order to understand the approximate, and not the exact, amount of costs for the owner of a web studio to pay employees for the work on the website (we assume 21 working days per month):

- Project manager – 14,300 rubles.

- Programmer – 11,500 rubles.

- Graphic designer – 12,000 rubles.

- Sales manager – 6,500 rubles.

- SEO specialist - 2,200 rubles.

- Layout designer - 8,400 rubles.

- Content manager – 4,300 rubles.

That is, 59,200 rubles should be spent on salaries alone. Let's add to this the mandatory taxes and contributions to funds that the entrepreneur must pay from the earnings of his employees. Currently, the amount of these deductions is 30.2%. Let's add them to the previously calculated amount and get a new one - 77,100 rubles.

Further. Employees need a workplace in a bright room with good equipment and Internet access. Maintaining the office and depreciation costs for equipment is another 120,000 rubles per month. Taking into account the fact that specialists of one link can complete four projects in a month, and there are two links, the cost of the project increases by 15 thousand rubles. Accordingly, the cost will be 92,100 rubles.

It is difficult to find a company that does not purposefully attract customers. Some may only hope for free promotion, but most organizations rely on advertising. The average market cost of attracting a client who is interested in creating their own website is 2,500 rubles. In the best scenario, only half of the requests are processed. We add advertising expenses (5,000 rubles) to the cost of the site and get 97,100 rubles.

Expert commentary

“We have a responsibility to make our customers happy in any way possible!”

Alexey Molchanov, founder of the international IT company Envybox

The current situation in the country and the world is gaining more and more momentum every day.

Today, every entrepreneur asks the question: “What will happen to my business now?”

If you succumb to general panic and “freeze” the company’s activities, then this will not lead to anything good. If you see that a crisis is inevitable and the company’s income is already beginning to decline, do not suspend your activities. Do not under any circumstances reduce your advertising costs or stop promoting (unless, of course, you are closed due to Government Decree).

Direct maximum efforts and attention to promoting your company and increasing the flow of new clients.

In order for you to have an understanding of how to behave during a crisis, I will share with you useful tools that helped us not only overcome the crisis, but also emerge victorious from it.

Below you can use simple and accessible tools for any company to attract a stable flow of new customers or return existing ones. And also, as a bonus, get free use of our services

to increase requests from the site within 7 days and a 30% discount on their connection. We wish you good luck, new clients and big sales!

There are still some factors that do not have a significant impact on the cost; they, let’s say, are included in the company’s profit. It’s not surprising that the company we work with also strives to make a profit. Let's say that our founders are modest and receive 25% from the project.

As a result, the hypothetical expenses for the official website amount to a round sum - 125,000 rubles. We will assume that we have taken into account everything, even such a controversial issue as the tax burden - like true optimists, we believe that this financial part is taken into account in the company’s profit.

What we ended up with is the cost of a typical commercial website (which can be promoted based on thematic queries), and not a super complex project or online store.

Our next step is to consider market offers at prices. Let's analyze seven cost ranges: let's see how many players are represented in each. We only have the capital market in view, since the above cost calculation is based on Moscow salaries and rental costs.

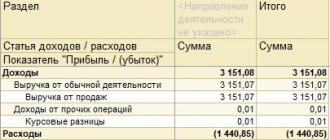

| Price range, thousand rubles. | Number of studios, pcs. | Share of studios, % |

| No more than 50 | 294 | 15 |

| 50–100 | 421 | 21 |

| 100–200 | 444 | 22 |

| 200–300 | 306 | 15 |

| 300–500 | 273 | 14 |

| 500–700 | 161 | 8 |

| From 700 and above | 102 | 9 |

Based on the above data, we can conclude that when forming their pricing policy, most studios proceeded from the same input as we did. Let's take a closer look at each price range and products developed within the specified framework.

• No more than 50,000 rubles

This segment can be considered the most dangerous; it is home to studios that hire freelancers or use outsourcing to create websites. Reputation is not very important for such companies; they are not very upset about quarrels and parting with clients. This is a common practice in this segment, to which performing companies have long come to terms and adapted.

Of course, you can’t paint everyone with the same brush: a normal website can be made within this range. But still, for those who order web development for the first time, it is advisable to look for a different path.

The client must be prepared for the fact that they will try to save as much as possible. And design, and communication, and technical execution - everything will be in an economical version. And the website customer, as a rule, wants politeness in communication, an individual approach, and fresh ideas.

Top 6 useful articles for managers:

- How to brainstorm among employees

- Stages of the sales funnel

- Pareto's Law in business and life

- What is traffic and how to calculate it

- Sales Conversion: 19 Reasons for Low Conversion

- Call back on the website

• 50,000–100,000 rubles

Young and very promising digital teams have firmly taken their positions in this sector. Here you are more likely to get a quality product with a fairly high level of service. True, you shouldn’t expect any stunning features: the admin panel will be standard (developed using free SMS), and developers most likely will not remember that the site does not end at the web interface.

There will be various kinds of difficulties here, but they are all solvable. Thus, a promising team usually promotes the customer for additional services (and expenses) on the site. In addition, there will most likely be no personal communication, only by phone. Dumping companies do not spend money on an office - don’t expect a cozy meeting room with tea and buns.

High website conversion

What non-trivial techniques will help you do this?

More details

Customers who have not previously dealt with web development and want to create a website in this segment are advised to choose a contractor very carefully. Check out the applicants' portfolios, study the commercial proposal and presentation of the studio's services, and hold personal meetings with the developers. In this price range, the customer himself is expected to actively participate in the project, and this requires self-confidence.

• 100,000–200,000 rubles

A segment for those who are used to looking at things realistically. The optimal level of customer service and product quality can be said to be guaranteed here. In this price range, performers approach their work as high-class professionals, and not as free artists. Therefore, here they think not in categories such as “rich”, “beautiful”, “gradient” and “flowers”, but in “convenience”, “efficiency”, “trends”, “quality”.

It must be said right away that lovers of special effects and painting who want to reflect their picture of the world on the site will not find understanding among performers in this category. It’s better for them to turn to those who create websites at a price of 700 thousand rubles with cool tuning and an exclusive design concept. Customers who need a quick payback web resource at a fair price will also find satisfaction here.

• 200,000–300,000 rubles

This niche has been occupied by companies with extensive experience and constant cash flow. And although they were never able to open new horizons, they do not suffer because of it. The stable profit they receive allows them to feel quite confident in the market. There are no complaints about the quality of the product they produce.

• 500,000–700,000 rubles

We are entering the borders of the most hungry zone (especially against the backdrop of the economic crisis). In the price segment with such high website costs, contractors of government orders and other projects that are not focused on efficiency settled down.

An organization offering to develop a website according to the parameters of a given cost range will certainly invite the customer for a conversation over a cup of tea or coffee in a pleasant, friendly office environment. The responsible manager will serve the client to the fullest extent, and you can enter the director’s office at any time.

• 700,000 rubles and above

This seems to be not a price segment, but another planet - such high price tags don’t immediately fit into the mind, right? Nevertheless, an Internet resource with such a cost is not a fiction. One large retail brand actually ordered a three-page website for 900,000 rubles from a fashion agency.

The customer needed this to promote one of the events (it was also imposed by advertisers). The agency named the amount at random, and the customer agreed without hesitation. But this is not the most interesting thing: at that time the agency had neither a professional web designer nor a competent developer.

What solution did the PR people find? They ordered the production of a website from a company that operates in an adequate price sector, and kept the difference for themselves.

Accounting

The costs of creating a website, which will be included in intangible assets, must first be taken into account in account 08 “Investments in non-current assets”. The Chart of Accounts does not provide a special subaccount for these expenses, so create one yourself. A subaccount, for example, could be called “Creation of Intangible Assets.”

Debit 08 subaccount “Creation of intangible assets” Credit 60 (10, 68, 69, 70, 76...)

– the costs of creating a website, which will be included in intangible assets, are taken into account.

After fulfilling all the conditions for recognizing the site as part of intangible assets, create a card for it in form No. NMA-1 and make the following entry:

Debit 04 Credit 08 subaccount “Creation of intangible assets”

– the site is taken into account as part of intangible assets.

Write off the cost of the site included in intangible assets through depreciation (clause 23 of PBU 14/2007).

If the conditions for including the site among intangible assets are not met (for example, the useful life of the site is less than 12 months), reflect the costs of its development on account 97 “Deferred expenses” (clause 18 of PBU 10/99 and Instructions for the chart of accounts (count 97)). Do the following wiring:

Debit 97 Credit 60 (10, 68, 69, 70, 76…)

– the costs of creating the website are taken into account.

After you start using the site, the costs of its development, taken into account as deferred expenses, are subject to write-off. The organization establishes the procedure for writing off expenses relating to several reporting periods independently (letter of the Ministry of Finance of Russia dated January 12, 2012 No. 07-02-06/5). For example, the costs of creating a website can be written off evenly over a period approved by order of the head of the organization. Fix the chosen option for writing off deferred expenses in the accounting policy for accounting purposes (clauses 7 and 8 of PBU 1/2008).

In accounting, write off the costs of creating a website using the following entries:

Debit 26 (44) Credit 97

– the costs of creating the website were written off.

A website helps an organization express itself: to present the most complete information about the goods it sells, the work it performs or the services it provides. For example, it is impossible to imagine online commerce without a website that will contain information about goods and services, contact information, directions and names of managers.

You can create a website yourself or order it from third parties. Accounting and tax accounting for the costs of creating a website has a number of features that are associated with obtaining exclusive or non-exclusive rights, taking into account such objects as hosting, domain name, etc. In this article we will look at questions that will help an accountant account for website expenses correctly.

According to the definition given in the Information Law, a website on the Internet is a collection of computer programs and other information contained in a system, access to which is provided via the Internet using domain names and (or) network addresses. In addition to semantic content, the site has several components: software (serves to manage data and ensures the functioning of the site) and visual-graphic (determines the design of the site, its design and the way information is presented on it).

Domain name is a symbol designation intended for addressing sites on the Internet in order to provide access to information posted on the Internet.

The domain name needs to be registered. In Russia, the administrator of national top-level domains .RU and .РФ is the coordination center of the national Internet domain (abbreviated name - Coordination Center of RU/РФ domains). It functions as a national registry. Re-registration of a domain name is carried out, as a rule, annually and provides the organization with the opportunity to retain the specific name of its website on the Internet.

Hosting is services provided on a regular basis for placing an organization’s website on a provider’s server that is constantly connected to the Internet.

Website promotion is an advertising method based on increasing the website’s position in search engine results for thematic queries. Promotion generally refers to the placement on the Internet of links to a website, keywords (targeted queries) in various search engines, placement of banners and videos on other sites. As part of the provision of website promotion services, in particular, websites can be modified, contextual advertising campaigns can be carried out, including advertising in other media and on news portals, viral marketing, mailings, creating mobile versions of websites, etc. The goal of promotion is to achieve the appearance of the site (links to the site) on the first lines of search results conducted by search engine users.

Thus, accounting should be kept for the following areas of costs for creating a website:

- works (services) to create a website;

- costs for registering a website domain name;

- fees for using the website domain name;

- hosting services;

- website promotion costs.

First stage. Setting permissions for the website

In accounting, the procedure for accounting for the costs of creating a website depends on whether the organization recognizes it as an intangible asset (intangible asset) or not.

If an organization has acquired exclusive rights to a website or its individual parts that can independently generate income, then in accounting they should be taken into account as part of intangible assets when fulfilling the requirements of clause 3 of PBU 14/2007 (approved by Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n ), in particular if the object is intended to be used for a period exceeding 12 months and is capable of bringing economic benefits to the organization.

The first option is quite rare. An intangible asset must have all the features listed in paragraph 3 of PBU 14/2007:

- Exclusive rights to the site belong to your organization, not the developers. Their transfer is confirmed by the alienation agreement.

- The useful life of the site exceeds 12 months. In practice, sites are often completely redesigned or closed in the first year. Therefore, this condition is not always met.

- The website brings economic benefits to the organization. In IFRS, only those sites through which sales occur are classified as intangible assets (SIC 32 “Intangible assets - costs of a website.”

The rules for accounting for a site also depend on the source of its creation.

The organization develops the website independently.

In accounting, the initial (actual) cost of the site will be the cost of remunerating the organization’s employees, as well as the amount of insurance premiums accrued from the salaries of employees participating in the creation of intangible assets.

In accordance with paragraphs 3, 4 of the Accounting Regulations “Accounting for Intangible Assets” (PBU 14/2007), approved by Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n, a website created on its own is an intangible asset (IMA), since all the conditions for accepting this object for accounting as intangible assets are met.

Intangible assets are accepted for accounting at the actual (initial) cost determined as of the date of its acceptance for accounting. The actual (initial) cost of intangible assets in this case is recognized as the amount of costs for its creation and provision of conditions for using this asset for the planned purposes (clauses 6, 7, 9 of PBU 14/2007). In this case, the initial cost of the website includes costs directly related to the creation of the website itself, that is, labor costs, insurance premiums and depreciation of the operating system.

The site is developed by a third-party organization and it transfers exclusive rights to it.

The initial cost of intangible assets will be the amount of costs for developing the site under an agreement with the developer organization. Also included in the initial cost of intangible assets are other expenses directly related to the acquisition and creation of an intangible asset and providing conditions for using the asset for the intended purposes (clauses 8 and 9 of PBU 14/2007). For example, the cost of the initial registration of a domain name should be taken into account in the cost of intangible assets. After all, a website cannot function without a domain name. The exclusive right to a website from the moment of its creation by a specialized company belongs to the organization (customer), unless otherwise provided by the contract (Clause 1 of Article 1296 of the Civil Code of the Russian Federation).

Please note that registration of the exclusive right to a website is not mandatory (as follows from paragraph 1 of Article 1232, paragraph 4 of Article 1259 of the Civil Code of the Russian Federation). At the same time, in relation to computer programs and databases, registration is possible, carried out at the request of the copyright holder (clause 1 of Article 1262 of the Civil Code of the Russian Federation).

Let's complicate the task. The site is presented as a collection of several objects: design, database, graphics, program code, etc. For accounting purposes, we will present the site as two parts: a program and a graphic solution. Exclusive rights to one part (for example, a program) may remain with the developer, but the right to the graphic solution must pass to the customer. In this case, the accountant will not be able to show the intangible asset, since the exclusive rights to the intangible asset do not belong to the customer organization in full.

Thus, the accountant considers two options for organizing website accounting:

- reflect the website as an intangible asset. If, along with the website, the customer organization acquired exclusive rights to it, this can be shown as intangible assets in both accounting and tax accounting, subject to the fulfillment of certain conditions;

- write off website costs as expenses. If the developer owns the rights, then the customer does not have the right to reflect the asset, and he can only create costs.

If advertising information is posted on the website, then these costs are taken into account as advertising expenses (clause 28, clause 1, article 264 of the Tax Code of the Russian Federation).

To establish exclusive rights to the site, it is necessary to conclude an appropriate agreement. It is better if the right is indicated in the title of the agreement. “Agreement for the alienation of the exclusive right to a work” shows that the website is owned by the customer organization. “A license agreement granting the right to use a work” indicates that the owner is the developer.

Don't forget to study the text of the contract. If there is no information about the transfer of rights, then by default the customer owns the rights, which directly follows from paragraph 1 of Article 1296 of the Civil Code.

Let us add that the customer who has received the rights to the new site is not required to officially register it. According to paragraph 1 of Article 1262 of the Civil Code of the Russian Federation, during the period of validity of the exclusive right to a computer program or database, the copyright holder may, at his own request, register such a program or such a database with the federal executive body for intellectual property. Consequently, the possibility of reflecting an intangible asset does not depend on the presence (or absence) of the corresponding paper from the registering authority.

Second phase. Determining the cost of the site

The initial cost of a site includes all costs associated with its creation and bringing it to a state in which it is suitable for use. That is, this includes software development on the server, design and testing with debugging, excluding VAT.

If an organization decides to account for a website as intangible assets, then for accounting and tax accounting purposes the costs of creating the site are the costs of creating intangible assets (Letters of the Ministry of Finance dated 07/19/2012 N 03-03-06/1/346, dated 07/28/2009 N 03-11 -06/2/136). It also states that if the cost of acquiring rights to use computer programs does not exceed 40,000 rubles, then the costs of purchasing such rights are taken into account in other costs associated with production and sales.

These costs, as well as the costs of updating the website and prolonging the registration (re-registration) of a domain name, are taken into account in the same way as the costs of creating (purchasing) and updating a computer program for which the organization has the exclusive right (Letter of the Federal Tax Service for Moscow dated January 17, 2007 N 20-12/004121). The cost of website promotion services is non-standardized advertising expenses, which are taken into account:

- in the case of OSN - on the date of signing the act on the provision of services (Letter of the Ministry of Finance dated 08.08.2012 N 03-03-06/1/390);

- under the simplified tax system - after signing the act on the provision of services and their payment (Letter of the Ministry of Finance dated December 16, 2011 N 03-11-11/317).

How to account for domain registration costs? There are two opinions:

The costs of domain registration and hosting services do not relate to the creation of a website, but are periodic expenses necessary for its functioning. Therefore, these expenses may not be included in the initial cost of intangible assets, but taken into account as part of general business expenses (Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n). Guided by the requirement of rational accounting and taking into account the insignificance of the costs of registering a domain, the organization has the right to take them into account as part of general business expenses of the current period without prior reflection in account 97 “Future expenses” (clause 6 of the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n). Costs for hosting services are recognized as general business expenses on a monthly basis in accordance with the counterparty's acts on the provision of services. As for hosting services, we are talking about a fee for renting space on the provider’s server where the site will be physically located. Such costs are always taken into account as other costs on the basis of Art. 264 of the Tax Code (for example, paragraph 49, paragraph 1).

A domain name (site name) is an integral part of the site, without which it cannot function. Note that the organization can include the costs of initial domain registration and hosting services for the first month in the initial cost of the site if the organization decided to reflect it as intangible assets. Those. these will be expenses that provide conditions for using the website, based on clause 8 of PBU 14/2007. Accordingly, the fee for the initial registration of the name is included in the initial cost of the intangible asset. The costs of domain name re-registration are subsequently reflected as other expenses.

In the future, the costs of re-registering a domain name (in fact, for extending the registration period) must be included in other expenses. Since re-registration is done for 1 year, it is safer to write off the costs of it during this period. However, when the amount of such costs is insignificant (for example, less than 700 rubles or 1000 rubles), we recommend taking it into account as expenses at a time.

Third stage. Determining the useful life (USL) of a website

If a website is considered as an intangible asset.

As a rule, the SPI of the website is not specified in the documents. Therefore, the organization has the right to install it independently and secure it, for example, by order of the manager. If the site is recognized as an intangible asset, this period will be needed to calculate depreciation.

The period of use of a website can be set, for example, based on the expected period of updating its graphics and design. Let us recall that the SPI for intangible assets in accounting is checked annually by the organization for the need to clarify it. In the event of a significant change in the duration of the period during which the organization expects to use intangible assets, its useful life is subject to clarification. The adjustments that arise in connection with this are reflected in accounting and financial statements as changes in estimated values (clause 27 of PBU 14/2007).

The useful life of a website in both accounting and tax accounting is determined by the organization independently, but in tax accounting it cannot be less than 24 months (clause 2 of article 258 of the Tax Code of the Russian Federation, clause 26 of PBU 14/2007).

Expenses are recognized in the reporting (tax) period in which these expenses arise based on the terms of the transactions. If the transaction does not contain such conditions and the connection between income and expenses cannot be clearly defined or is determined indirectly, the expenses are distributed by the taxpayer independently. Thus, if the terms of the agreement for the acquisition of non-exclusive rights cannot determine the period of use of the computer program, the taxpayer using the accrual method distributes the expenses incurred taking into account the principle of even recognition of income and expenses. A similar procedure applies to the costs of subsequent modification of the corresponding computer program.

If the site is not classified as an intangible asset, and its cost is written off as an expense, a self-approved useful life may be useful for writing off future expenses.

Stage four: take the site into account in accounting

Let’s assume that all conditions are met and the site is classified as an intangible asset. In this case, all amounts that make up the value of the asset should be reflected in the debit of account 08, subaccount “acquisition of intangible assets.” Then, at the time of commissioning (that is, when posted on the Internet), the cost of the site must be written off as a debit to account 04.

Depreciation should begin in the month following the date of publication on the Internet. In accounting, it is permissible to choose any of three methods: linear, declining balance, or write-off of value in proportion to the volume of products (work) (clause 28 of PBU 14/2007 “Accounting for intangible assets”). Most organizations, in order to bring tax accounting closer to accounting, approve the same methods of depreciation of intangible assets.

The organization's expenses aimed at promoting the site are of an advertising nature, therefore, when calculating income tax, they are taken into account as part of advertising expenses (subclause 28, clause 1, clause 4, article 264 of the Tax Code of the Russian Federation). In this case, it does not matter how the costs of developing the site itself were taken into account: as other expenses or as the creation of an intangible asset, since the initial cost of an intangible asset after its acceptance for accounting does not change. The financial department adheres to a similar position (letter of the Ministry of Finance of Russia dated 08/08/2012 No. 03-03-06/1/390).

A website, the exclusive rights to which belong to the organization, simultaneously meeting all the criteria provided for in clause 3 of the Accounting Regulations “Accounting for Intangible Assets” (PBU 14/2007), approved by Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n, is accepted for registration as an object of intangible assets (clause 4 of PBU 14/2007).

Intangible assets are accepted for accounting at the actual (initial) cost equal to the amount calculated in monetary terms, equal to the amount of payment in cash and other forms or the amount of accounts payable paid or accrued by the organization upon acquisition, creation of the asset and provision of conditions for using the asset for the planned purposes (clauses 6, 7 PBU 14/2007).

05/20/2015 The online store "Net" LLC was opened. The creation of the website was transferred to a third party. As a result of creating the website, the following costs were incurred: material costs, programmer's wages, calculation of contributions from the payroll, depreciation of fixed assets used in creating the site. The manager set the service life of the website at 15 years. The online store has non-exclusive rights to the website.

09/20/2015 The online store "Net" LLC has been opened. The online store does not have a programmer on staff. The creation of the website was transferred to a third party. As a result of creating the website, the following costs were incurred: material costs, programmer's wages, calculation of contributions from the payroll, depreciation of fixed assets used in creating the site. The manager set the service life of the website at 20 years. The online store has non-exclusive rights to the website.

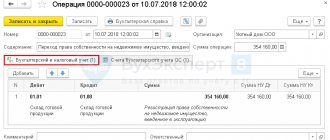

At LLC Net, accounting entries were made for the creation of:

DEBIT 08 subaccount “Purchase of intangible assets” CREDIT 60

— 45570 rub. – payment for the work of third-party programmers is included in the costs of creating a website;

DEBIT 08 subaccount “Purchase of intangible assets” CREDIT 02

— 750 rub. – depreciation was accrued on fixed assets used to create the website;

DEBIT 08 subaccount “Purchase of intangible assets” CREDIT 10

— 2000 rub. – reflects the amount of material costs incurred during the creation of the website;

DEBIT 08 subaccount “Purchase of intangible assets” CREDIT 60

— 580 rub. – expenses for the initial registration of a domain name are taken into account;

DEBIT 19 subaccount “VAT on acquired intangible assets” CREDIT 60

— 104 rub. – VAT is included in the cost of the initial registration of a domain name;

DEBIT 97 CREDIT 08 subaccount “Purchase of intangible assets”

-48900 rub. (RUB 35,000 + RUB 10,570 + RUB 750 + RUB 2,000 + RUB 580) – expenses for creating a website are reflected (the exclusive right does not belong to the organization)

DEBIT 90 CREDIT 97

-204 rub. (RUB 48,900/20 years/12 months) — expenses for creating a website within the period established by order of the head of the organization (in a share for the entire period of use) are taken into account as part of expenses for ordinary activities.

After creating a website and registering it, you must enter into an agreement for hosting services with the provider: a separate server or space on it will be created for the organization, on which all files are available 24/7.

In accounting, such hosting costs are classified as other costs for ordinary activities.

Expenses for hosting services are generated monthly and written off to the organization's distribution costs.

However, it would be more reasonable to use the following option. In accordance with Article 2 of the Federal Law of July 18, 1995 N 108-FZ “On Advertising” (as amended on July 21, 2005), advertising is information about an individual or legal entity distributed in any form, by any means, goods, ideas and undertakings, which is intended for an indefinite number of persons and is designed to generate or maintain interest in these individuals, legal entities, goods, ideas and undertakings and facilitate the sale of goods, ideas and undertakings.

The costs of creating and maintaining a website can definitely be classified as advertising costs, since the purpose of such activities is to influence an indefinite circle of consumers and disseminate information about the organization. These expenses will not be advertising only when the site being created does not serve to disseminate information about the organization, but is, for example, a news feed for news agencies.

The organization's expenses associated with updating and maintaining information posted on the site should also be considered as advertising expenses. These costs can be compared with regular advertising in newspapers or other media. The organization must also charge advertising tax on these expenses.

However, there are other costs associated with creating and maintaining a website. Such expenses may include, for example:

- registration and annual maintenance of a domain name in the “.ru” zone;

- creation and content of a website, the design of which is developed using the customer’s corporate style;

- registration of a website in search engines.

In accounting, a web site is reflected in the same way as any other software. Either as part of intangible assets, or on account 97 “Deferred expenses”.

05/20/2015 The online store “Net” LLC has been opened. The online store does not have a programmer on staff. The creation of the website has been outsourced to a third party. As a result of creating the website, the following costs were incurred: material costs, programmer's wages, calculation of contributions from the payroll, depreciation of fixed assets used in creating the site. The manager set the lifespan of the website to be 20 years. The online store has non-exclusive rights to the website.

In LLC "Net" accounting entries were made for the creation of:

At LLC Net, accounting entries were made for the creation of:

DEBIT 08 subaccount “Purchase of intangible assets” CREDIT 60

— 45570 rub. – payment for the work of third-party programmers is included in the costs of creating a website;

DEBIT 08 subaccount “Purchase of intangible assets” CREDIT 02

— 750 rub. – depreciation was accrued on fixed assets used to create the website;

DEBIT 08 subaccount “Purchase of intangible assets” CREDIT 10

— 2000 rub. – reflects the amount of material costs incurred during the creation of the website;

DEBIT 08 subaccount “Purchase of intangible assets” CREDIT 60

— 580 rub. – expenses for the initial registration of a domain name are taken into account;

DEBIT 19 subaccount “VAT on acquired intangible assets” CREDIT 60

— 104 rub. – VAT is included in the cost of the initial registration of a domain name;

DEBIT 97 CREDIT 08 subaccount “Purchase of intangible assets”

-48900 rub. (RUB 35,000 + RUB 10,570 + RUB 750 + RUB 2,000 + RUB 580) – expenses for creating a website are reflected (the exclusive right does not belong to the organization)

DEBIT 90 CREDIT 97

-272 rub. (RUB 48,900/15 years/12 months) — expenses for creating a website within the period established by order of the head of the organization (in a share for the entire period of use) are taken into account as part of expenses for ordinary activities.

After creating a website and registering it, you must enter into an agreement for hosting services with the provider: a separate server or space on it will be created for the organization, on which all files are available 24/7.

In accounting, such hosting costs are classified as other costs for ordinary activities.

Expenses for hosting services are generated monthly and written off to the organization's distribution costs.

Websites differ from each other not only in appearance, but also in their service, i.e. availability of functionality (for example, ease of navigation, search, viewing products, payment methods, etc.). Accounting for modern accounting objects requires a competent approach to such issues.

Accounting: domain name registration

Situation: how to reflect in accounting the costs of registering a website domain name?

The answer to this question depends on whether the site is accounted for as an intangible asset or not.

The website domain name is not an object of intellectual property (the result of intellectual activity). Therefore, the domain name is not taken into account as a separate intangible asset. This follows from paragraph 3 of PBU 14/2007. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated March 26, 2002 No. 16-00-14/107.

However, without a domain name, the site cannot function. Therefore, if the site is included in intangible assets, the costs of the initial registration of the domain name should be included in its initial cost:

Debit 08 subaccount “Creation of intangible assets” Credit 60 (76)

– the costs of the initial registration of the site’s domain name are taken into account.

This procedure follows from paragraph 9 of PBU 14/2007.

If the website is not an intangible asset, take into account the costs of registering a domain name as follows (depending on the period for which the domain name is registered):

- deferred expenses;

- current expenses.

In the same order, take into account the costs of subsequent domain name registration.

The period for which a domain name is registered is chosen by the organization independently. If this period exceeds one month, then reflect the costs of registering a domain name as deferred expenses:

Debit 97 Credit 60 (76)

– the costs of subsequent registration of the site’s domain name are taken into account.

If a domain name is registered for a period not exceeding a month, then consider registration costs as part of the organization’s operating expenses:

Debit 26 (44) Credit 60 (76)

– expenses for subsequent domain name registration are written off.

Costs for registering a domain name included in deferred expenses are subject to write-off. The organization establishes the procedure for their write-off independently. For example, an organization may write off such expenses in equal installments over the period for which the domain name is registered. Write off costs accounted for as deferred expenses by posting the following entries:

Debit 26 (44) Credit 97

– expenses for subsequent domain name registration are written off.

This procedure for accounting for expenses for subsequent registration of a domain name follows from the Instructions for the chart of accounts (account 97) and paragraph 18 of PBU 10/99.

Basic costs for the website

The main ones include costs, without which no site will work. We are talking about buying or renting a domain name, as well as hosting costs. Let's look at them in more detail.

1. Domain name

You can acquire it in two ways: buy or rent, paying an annual fee.

To buy a domain name, you will have to fork out some money - this pleasure is not cheap (from several thousand rubles to several hundred thousand). But the advantage in this case is that by purchasing a domain name, the owner owns it forever and gets rid of the need to pay additional fees later. Another plus: a purchased domain name can be sold at any time, and if it is popular, it can be very profitable.

An alternative option is to rent a domain name. Considering the affordable prices, this will not be at all expensive for the budget. For example, for registering and renting a domain name in the “.ru” and “.рф” zones (suitable for most Russian-language sites) you will have to pay about 185 rubles per year.

For comparison: the most expensive zone for registering a domain name is “.ag” with an annual rental cost of 8,500 rubles.

2. Hosting costs

The range of prices for hosting is quite large; server performance, availability of disk space and provider rules play a role in their formation.

The minimum cost of hosting, which must be taken into account in the costs of the site, is 59 rubles per month.

If you pay for hosting for a year at once, you can get a good discount, for example, pay not 708 rubles, but 588 rubles. In addition, paying an annual hosting fee provides other benefits - the ability to register a domain name for free or renew the lease of an existing one.

3. Postage expenses

You may find hosting providers that charge extra for registering mailboxes. But why turn to them when there are a lot of free email services and providers that register mailboxes for free?

4. Costs for a virtual (VDS) or dedicated server

Those who do not want to deal with hosting can consider renting a VDS server. It will cost more, but the possibilities here are much wider.

The minimum monthly rent for a VDS server is 300 rubles, the maximum is determined by providers at 3110 rubles per month. For a dedicated server you will have to pay even more - monthly 3,500–16,100 rubles (depending on its characteristics).

So, it’s time to calculate what the cost of maintaining the site will be for the main items.

We focus on the minimum values (we do not consider dedicated or VDS servers, we do not need them):

- domain name – 185 rubles per year;

- hosting – 99 rubles monthly or 948 rubles per year (economical option for the first time – 59 rubles per month or 588 rubles per year);

- mailboxes – free of charge (0 rubles per year).

Using simple calculations, we get 1,133 rubles (773 rubles for the economy option) - this is the amount that the maintenance of the site will cost.

Accounting: payment for hosting services

The costs of paying for hosting services in accounting are classified as expenses for ordinary activities (clause 5 of PBU 10/99). As a rule, after concluding a hosting agreement, the organization transfers a monthly fee to the provider for services, and at the end of the month the provider provides the organization with an act (report) on the provision of hosting services.

When reflecting the services provided in accounting, make the following entry:

Debit 26 (44) Credit 60 (76)

– hosting services are taken into account (based on the provider’s act (report) on the provision of services).

VAT

The creation of a website does not apply to construction and installation work performed by an organization for its own consumption. Therefore, there is no need to pay VAT on the costs of creating a website on your own. This follows from subparagraph 3 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation.

Input VAT on costs associated with creating a website should be deducted at the time they are reflected in accounting (for example, on account 08 - for works and services, on account 10 - for materials, on account 97 - as part of deferred expenses) (p 2 Article 171, paragraph 1 Article 172 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 11, 2009 No. 03-07-11/295). Along with this, other conditions required for deduction must be met.

If an organization carries out both taxable and non-VAT-taxable operations and plans to use the site in both types of activities, distribute the input tax on the cost of materials (work, services) (clause 4 of Article 170 of the Tax Code of the Russian Federation).

OSNO and UTII

If an organization uses a website in activities on the general taxation system and in activities on UTII, then the costs of its creation must be distributed (clause 9 of Article 274 and clause 7 of Article 346.26 of the Tax Code of the Russian Federation). This is due to the fact that when calculating income tax, expenses related to activities on UTII cannot be taken into account. This situation is possible if, for example, the site simultaneously advertises goods that are sold both retail and wholesale. If an organization uses a website for only one type of activity, the costs of its creation do not need to be distributed.

For more information on how to distribute expenses related to both tax regimes, see How to take into account expenses for income tax when combining OSNO with UTII.

If the contractor for the creation of the site (supplier of the materials necessary to create the site) has issued an invoice, then the amount of VAT allocated in the invoice must also be distributed. For more information about this, see How to deduct input VAT when separately accounting for taxable and non-taxable transactions. The amount of VAT that cannot be deducted should be added to the share of expenses for the organization’s activities subject to UTII (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).