Important information about 71 accounts: characteristics, postings, examples

71 accounts reflect settlements with employees for amounts issued on account.

The article contains characteristics of 71 accounts in accounting, postings, examples, free sample documents. Guest, you have free access to a chat with an expert accountant. Order a call back to connect or call: 8 (toll-free within the Russian Federation).

The following documents will help you easily reflect settlements with accountable persons:

Convenient accounting of settlements with accountable persons can be maintained in the BukhSoft program. To watch the program, simply click on the button below:

Try the program

Accounting account 71 is an active-passive account, which is called “Settlements with accountable persons” and is used to reflect settlements with individuals for amounts issued for reporting. Any employee, including a foreign citizen, manager, etc., can receive accountable funds from the employer. In addition, an individual who has entered into a GP agreement with them - contractor, executor - can receive funds on account from a company or entrepreneur.

Account usage example

Let's look at a specific example of mutual settlements with employees for amounts issued on account. We use account 71 - accountable persons.

At Khlopushka LLC there was a need to purchase spare parts to repair a machine. Cash in the amount of 25,000 rubles. issued for reporting to O. Sakharov. Immediately after the purchase, an advance report was submitted in the amount of 20,130 rubles, including VAT.

Check whether you correctly reflect mutual settlements with accountable persons in your accounting using the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The general director presented a report, which included cash receipts from the restaurant. It was a dinner with a potential client, that is, entertainment expenses in the amount of 5,400 rubles.

The following transactions should be reflected in accounting:

- Dt 71 Kt 50 - 25,000 rub. — issued for reporting based on an employee’s application;

- Dt 10 Kt 71 - 16,755 rub. — materials purchased by the accountant are capitalized;

- Dt 19 Kt 71 — 3355 rub. — VAT is allocated on purchased materials;

- Dt 50 Kt 71 - 4,870 rub. — the unspent balance of funds is returned to the cash desk;

- Dt 44 Kt 71 - 5,400 rub. — entertainment expenses are reflected according to the receipts provided, the estimate of the event, and certificates of the event.

Account 71 in accounting

Upon the issuance of a cash accountable amount or transfer of non-cash funds, account 71 in accounting is debited while simultaneously reflecting the same amount on the credit of the accounts on which cash amounts are recorded. These can be accounts 50 “Cash”, 51 “Currency accounts” or 52 “Currency accounts”.

The debit of account 71 shows the debt of the reporting individual (employee, contractor, performer) to the employer or customer.

An entry on the debit of account 71 is possible only if the primary document is drawn up. When cash is issued, a cash order is drawn up, and when the amount is transferred non-cash, a bank statement can serve as a primary source.

Upon spending the accountable amount, an individual draws up a mandatory document. An advance report serves as such a document. The employer or customer determines the form of the report independently. As a rule, standard form No. AO-1 is used. It is presented in the window below and can be downloaded.

At will, the employer can modify the standard form of the advance report and supplement it with any details. There is only one requirement for the document - it must have all the mandatory “primary” details specified in the accounting law. In addition, an individual must attach documents to the advance report that confirm the fact of the expenditure, its targeted nature and its amount.

Upon approval by the manager of the advance report with the documents attached to it, account 71 in the accounting records is credited while simultaneously reflecting the cost of purchased property, services or work in the debit of the corresponding accounting accounts. If the accountable amount was not enough, then there is an overspending.

Credit 71 of the account shows the debt of the employer or customer to the reporting individual.

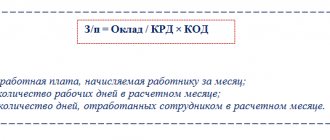

The procedure for calculating and accounting for deductions from wages

— D 70 K 71 – accountable amounts that were not returned in a timely manner were withheld from wage accruals;

- D 70 K 73 - amounts for material damage caused were withheld from wage accruals.

To account for the amounts of taxes withheld from citizens in favor of the state budget, account 68 “Settlements with the budget” is used. This account is passive. The account balance reflects the amount of debt the enterprise owes to the budget, debit turnover - the amounts transferred to the budget to repay the debt; loan turnover - the amount of taxes withheld from the wages of workers and employees.

2.5. Accounting for contributions to social protection funds and their use

The rights of citizens to various types of social protection (material support for illness, old age, disability, etc.) are enshrined in the Constitution of the Russian Federation. In accordance with the Labor Code and regulatory documents of the Ministry of Finance of the Russian Federation and the Ministry of Labor of the Russian Federation, social protection funds are created without deductions from employees’ wages. Currently, the following social protection funds have been created in the Russian Federation: a pension fund, a social insurance fund, a compulsory health insurance fund and an employment fund.

Contributions to these funds are mandatory for all enterprises, institutions and organizations that are legal entities.

The procedure for the formation and use of contributions to the Pension Fund of the Russian Federation.

Insurance contributions to the organization's pension fund are charged on all types of payments accrued to workers, as well as accrued to individuals under civil contracts, the subject of which is the performance of work and provision of services, and under copyright contracts.

Payers of contributions to the Pension Fund are:

— enterprises, organizations and institutions, regardless of their form of ownership, carrying out business or other activities on the territory of Russia;

— farms and tribal and family communities engaged in traditional economic sectors;

- citizens, including foreigners, who use hired labor in their private households and act as employers;

— citizens, including foreigners, registered as entrepreneurs and carrying out their activities without forming a legal entity;

- citizens working under direct contracts with foreign enterprises that do not have permanent representative offices in Russia and are registered as entrepreneurs without forming a legal entity.

If a citizen is employed, then contributions for him are obliged to be calculated and paid by the employer.

Public organizations of disabled people and pensioners, as well as enterprises, associations and institutions owned by them, created to implement the statutory goals of public organizations, are exempt from paying contributions to the Pension Fund. The exemption must be confirmed by a decision of the manager of the Pension Fund branch at the payer’s location.

Contributions to the Pension Fund of the Russian Federation are charged by payers for all types of remuneration for work in cash or in kind for all reasons that are included in the calculation of pensions.

Currently, contributions amount to 28% of the taxable base and are included in production costs (distribution costs).

Contributions are calculated before deduction of all taxes and withholdings, that is, from the accrued amount. When accruing debt on contributions to the Pension Fund from taxable wages, the following entry is made in the accounting:

For April 2004:

D 20.1.1 K 69-2 - 2819.04 rubles.

D 20.1.2 K 69-2 - 5790.40 rub.

D 25.1 K 69.2 – 2310.84 rub.

D 96.1 K 69.2 – 2664.09 rub.

Insurance premiums for payments included in the cost (costs) are also included in the cost and are accrued from the same sources as the payments themselves.

Transfers of contributions to the Pension Fund of the Russian Federation are made only through non-cash payments and are reflected in the accounting records as follows:

Dt 69-2 Kt 51 15881.6 rubles.

Quarterly, before the 30th day of the month following the reporting quarter, the payer’s accounting department compiles and submits to the Pension Fund of the Russian Federation branch at the location of the enterprise a “Settlement sheet for insurance contributions to the Pension Fund of the Russian Federation.”

The basis for drawing up the “Payment Sheet” is the data from the general ledger and primary accounting.

Go to page: 3

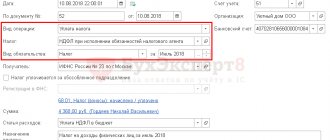

Procedure for carrying out accountable transactions

An accountable person is an employee who has received funds to use for the business needs of the enterprise.

The basis for issuing funds against the report is an application filled out by the employee and approved by the signature of the manager. The application records the amount and purpose of the funds (purchase of materials, payment to suppliers, etc.). The form of application for the issuance of accountable amounts is not established by law; the document is drawn up in any form.

Upon completion of a business transaction, the employee submits to the accounting department an advance report and documents confirming the expenses incurred by him (receipts, invoices, certificates of work performed, invoices, etc.). These documents are the basis for recording business expenses in accounting.

If the amount of funds previously received by an employee exceeds his actual expenses, then the amount of the difference is deposited by the employee at the cash desk. In case of overspending and its documentary confirmation, the amount of excess expenses is reimbursed to the employee through the cash desk or in non-cash form.

It should be emphasized that an employee who has not reported on previously received amounts cannot be given funds to carry out new business operations. Whether the funds were issued in cash or to a bank card in this case does not matter.

Typical transactions for 71 accounts

C is used to reflect transactions with accountable persons. When issuing funds, amounts are posted according to Dt 71, when expenses are allocated - according to Kt 71.

The issuance of funds to an employee can be made either in cash or in non-cash form:

| Dt | CT | Description | Document |

| 71 | 50 | Funds were issued in cash through the cash register | Account cash warrant |

| 71 | 51 | Funds were transferred to a bank card | Payment order |

| 71 | 55 | Funds were issued from special bank accounts | Bank statement |

| 71 | 52 | Funds in foreign currency were transferred to a bank card | Bank statement |

| 71 | 50.3 | Travel documents were issued to an employee who is going on a business trip | Account cash warrant |

If the amount of funds issued has not been fully spent, the balance may be returned:

| Dt | CT | Description | Document |

| 50 | 71 | Refund by employee in cash through the cash register | Receipt cash order |

| 52 | 71 | Transferring the balance of funds to a special bank account | Bank statement |

| 55 | 71 | Crediting the balance of funds in foreign currency | Bank statement |

Transactions with accountable persons can be reflected using production accounts:

| Dt | CT | Description | Document |

| 20 | 71 | Reflection of accountable amounts as part of the main production expenses | Advance report, supporting documents |

| 23 | 71 | Reflection of accountable amounts as part of auxiliary production expenses | Advance report, supporting documents |

| 28 | 71 | Reflection of accountable amounts as part of the costs of correcting defects | Advance report, supporting documents |

| 29 | 71 | Reflection of accountable amounts as part of the expenses of service production | Advance report, supporting documents |

At retail trade enterprises, sales expenses may be incurred through an accountable person:

| Dt | CT | Description | Document |

| 44 | 71 | Reflection of sales expenses incurred through an accountable entity | Advance report |

Goods and materials purchased by an accountable person are reflected in accounting by the following entries:

| Dt | CT | Description | Document |

| 10 | 71 | Materials purchased by the accountable person have been received | Advance report |

| 41 | 71 | Goods purchased by the accountable person have been received | Advance report |

Example of accounting entries for 71 accounts

To the employee of Consul LLC Petrenko S.P. funds were issued for the report in non-cash form in the amount of 2,500 rubles. to purchase paper. In fact, Petrenko S.P. spent 2840 rubles, VAT 433 rubles, which was confirmed by an advance report and a sales receipt. Overexpenditure in the amount of 340 rubles. Petrenko was credited to his bank card.

The following entries were made in the accounting of Consul LLC:

| Dt | CT | Description | Sum | Document |

| 71 | 51 | To the bank account of Petrenko S.P. funds credited for household needs | 2500 rub. | Payment order |

| 10 | 71 | The paper purchased by Petrenko arrived (RUB 2,840 - RUB 433) | 2407 rub. | Advance report, sales receipt |

| 19 | 71 | VAT amount reflected | 433 rub. | Advance report, sales receipt |

| 91.02.1 | 19 | VAT is included in expenses | 433 rub. | Advance report, sales receipt |

| 71 | 51 | To the bank account of Petrenko S.P. the amount of overspending is credited | 340 rub. | Payment order |

Account 71 in accounting is a separate accounting account designed to reflect the amounts issued to the company's employees. Let's understand the features of its application, designate the wiring and the rules for their preparation. ConsultantPlus FREE for 3 days Get access

Typical accounting entries

Let's look at how, in typical situations, accounting entries are made for reporting for dummies.

Purchasing materials through reporting

| Debit | Credit | Name of the situation |

| 71 | 50/1 | Money issued, report from the cash register |

| 71 | Materials were purchased for accountable amounts | |

| 19 | 71 | Accepted for VAT accounting on purchased materials |

| 10 | Purchased materials were released into production | |

| 50/1 | 71 | The person handed over the unspent balance of the accountable amount to the cashier |

| 71 | 50/1 | The accountable person was issued an overexpenditure on the accountable amounts from the cash register |

Travel expenses

| Debit | Credit | Name of the situation |

| 71 | 50/1 | Money was issued according to the cash register for a business trip |

| 20 | 71 | Expenses for purchasing travel tickets have been written off |

| 19 | 71 | Accepted for VAT accounting on purchased tickets |

| 44 | 71 | Hotel expenses and daily allowances written off |

| 19 | 71 | Accepted for VAT accounting for hotel stays |

| 50/1 | 71 | The accountable person returned the remaining funds to the cash desk |

What to show on account 71

Order of the Ministry of Finance of the Russian Federation No. 94n approved that account 71 “Settlements with accountable persons” is intended to reflect transactions for the issuance and return of accountable amounts.

What is a subreport? This is a certain amount of money from the organization that is transferred to the employee for specific purposes. Moreover, the purpose of expenses and the reporting period are strictly limited. After the allotted time has passed, the subordinate must provide a report on the expenses incurred. In simple words, money is given in advance, but with the condition that the employee provides a report - this is the essence of reporting.

For example, the company secretary was given 100 rubles from the cash register to buy an envelope and send a letter. When the reporting employee sends the letter, he will be given a receipt or check at the post office. It is these payment documents that the secretary will attach to the report, which will confirm the fact that the funds were spent on purpose.

For what purposes can a report be issued:

- Advance on travel expenses. This is relevant when an employee is sent on a business trip. Travel allowances include payment for accommodation and travel, daily allowances and other expenses en route.

- Expenses for the business needs of the company. Money can be issued for any purpose, from buying a light bulb for a utility room to building materials for major repairs.

- Settlements with counterparties. For example, the issuance of money is subject to payment for the services of third-party organizations. The operation is used less and less often, since non-cash payments are much more convenient.

- Other goals fixed by the decision of the company management. The director has the right to order the issuance of a report for any purpose. For example, for the purchase of equipment, exclusive rights, software products, etc.

IMPORTANT! Loans and advances to employees cannot be reflected in account 71. For this purpose, a separate account is provided in accounting - 73. Some companies, wanting to simplify accounting and evade taxes, issue short-term loans to employees through 71 accounts. This is a violation.

Characteristics of account 71 - settlements with accountable persons

What does the instructions for using the chart of accounts tell us about account 71 for settlements with accountable persons?

This account is intended to collect information about settlements with employees. Accountable amounts not returned on time are written off as shortfalls. Detailed accounting on account 71 - settlements with accountable persons - is maintained for each employee individually.

Let's look at typical transactions for this account:

| Dt | Account name | CT | Contents of operation |

| 71 | 50, 51 | Issuing funds to an employee through a cash register or to a corporate or personal card | |

| 07, 10, 15, 20, 41, 44, etc. | Account for accounting expenses (materials, costs, sales expenses - depending on the documents provided and the type of purchase) | 71 “Accountable Persons” | The costs incurred by the accountables were posted to the appropriate accounts (goods or materials were purchased or a service was purchased) |

| 19 | Input VAT | VAT is allocated from expenses incurred by the employee | |

| 70,73 | Settlements with personnel for wages or other payments | The amount not returned on time is written off as salary or other settlements with the employee. | |

| 94 | Shortages from loss of valuables | The unreturned amount of funds is written off as a deficiency | |

| 50,51 | Current account, cash register | The remaining funds are returned to the company's cash desk |

Rules for issuing money report

The organization is obliged to independently develop and approve the procedure for settlements with accountable persons. For example, by identifying uniform provisions in the annex to the accounting policies. The company calculates limits and standards on an individual basis.

Key requirements for conducting settlements with accountable persons:

- Money can only be given to an employee of the company. That is, accountable persons (account 71 is used only in this case) must be determined by a separate order of the manager.

- Funds can be transferred in cash from the cash register or by bank transfer. Which method will be used in settlements with accountable persons should be specified in the accounting policy.

- The maximum amount to be issued for reporting can be fixed by a separate order of management.

- It is recommended to approve the limits on travel expenses in the subsistence report separately.

- The deadline for submitting a report on accountable money is also fixed in the regulations or in the accounting policy.

- All settlements with accountable persons (account 71) must be documented. To do this, checks, invoices, tickets, receipts and other documentation are attached to the report.

Money is issued based on a written application from the employee or by order of management. The recipient is required to sign the cash receipt order if funds are issued in cash from the cash register. When making purchases or while on a business trip, the reporting employee must keep all receipts and checks in order to account for the advance received. Upon returning from a trip or upon completion of the purchase, the subordinate draws up an advance report. Supporting documents are attached to the report. The deadline for drawing up a report on accountable money is 3 days.

Accountable amounts: to whom, why

In the life of any organization, situations arise when paying in cash is preferable to paying a bill through a bank, or when an employee goes on a business trip, or there is a need to arrange a cultural program for an important client.

All these situations lead to the appearance of amounts issued to company employees for certain needs with the subsequent provision of a report on expenses. That is, accountable money is those funds of the company that are spent by employees in accordance with designated goals. For control, account 71 is used - settlements with accountable persons are accumulated there. How funds are issued against the report:

- The employee writes a statement addressed to the director. The director endorses this application.

- The employer issues a corresponding order.

ATTENTION! As of November 30, 2020, the rules for issuing reports have been simplified. Now, in the application for the issuance of accountable money, it is not necessary to indicate the amount of the advance and the period for which the accountable amounts are issued. The organization sets the deadline independently. Employers were also allowed to issue one order for several cash payments to one or more employees. In this case, you need to indicate the name, amount and period for which the money is issued for each employee.

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free.

What to do if an employee has not returned the money received from the cash register, read our material “Repaying the debt on account upon dismissal.”

- Within the number of days established by the employer after the business trip, the employee submits an advance report with documents attached. If these were business or other expenses, the advance report must be submitted within the same number of days after the end of the period for which they were issued. This period is not established by regulation, so it must be approved by a local act to strengthen control over costs.

IMPORTANT! The requirement to submit an advance report within three days was excluded by the Bank of Russia’s directive No. 5587-U dated October 5, 2020.

You can read more about deadlines in the article “Is there a maximum deadline for issuing money for reporting?”

Sometimes the opposite situation arises: the employee did not receive money from the cash register, but had to spend it on the needs of the enterprise.

What to do in this case, read our article.

Next, the accountant processes the received documents and posts them through the account for settlements with accountable persons , i.e. account 71.

Debit and credit of account 71: what to reflect

| What we reflect on the debit of account 71 | What do we indicate in the credit of accounting account 71 |

| 71 debit account is the amount that was provided to the company employee in advance for specific expenses. That is, this is the money that the employee received as an account. For example, a cashier dispenses cash from a cash register. The balance of account 50 “Cash” decreases - the turnover to the credit account is reflected. 50. And at the same time the debit turnover on the account is reflected. 71 - the employee received accountable funds. Before the subordinate provides an advance report, he will be credited with an advance - a debit balance on the account. 71. Or a debit balance is formed if the employee reported less than the amount received in advance. The remainder should be returned to the organization's cash desk. | In the credit of the account we reflect the expenses of the accountable person, supported by documents. That is, the employee submitted an advance report, and the manager checked and approved it. Then the accountant accepts the transactions for accounting and accrues expenses according to the report. The expenditure of funds is reflected in the credit of accounting account 71. At the same time, the debit balance of the account decreases. The result of the operation may be the loan balance if the reporting employee spent his money on company expenses. The company must repay this debt. That is, pay the amount of the credit balance to the accountable person. |

Accounting entries for account 71

Let's look at how to correctly make transactions for 71 accounts. Here are typical transactions and correspondence of accounts. Let us indicate which documents to draw up during the operation.

| Operation | Debit | Credit | Foundation documents |

| Money issued in cash report | A cashier's report and an expense order were drawn up | ||

| Funds are credited to the bank card account | Bank statement, payment order for transfer | ||

| Funds are credited to the report on the organization’s corporate card | Bank statement from special company accounts | ||

| The purchase of fixed assets is reflected in the advance report | Certificate of acceptance of works and services | ||

| Materials and raw materials purchased by the accountable person were capitalized | Invoices, sales receipts, transportation documents, acceptance certificate | ||

| The amount of expenses according to the advance report for production and economic needs is reflected | 20, 26, 44 | Advance report, invoices | |

| Return to the cash desk of funds unspent by the accountable person | Cashier's report, receipt order | ||

| Debt accrued for amounts not returned on time by the accountable person | Advance report |

Now let's look at examples of posting entries for various situations.