Statute of limitations for collecting insurance contributions to the pension fund

I was an individual entrepreneur, I haven’t worked for 8 years. Then I received a notification at work about a debt to the Pension Fund (the residential address has changed). I deregistered with the tax office and now the question is, will I have to pay the debt to the pension fund for all the years that I did not work or have statute of limitations?

Ivan, Nizhny Novgorod

Is there a statute of limitations for paying individual entrepreneur insurance premiums?

Good morning! My name is Tatyana, I opened an individual entrepreneur Tatarchuk, I submitted 0 reports and there was no activity. For 2012, a declaration of 0 was submitted and a contribution to the pension fund was paid. I should have closed the IP, but I held out for time. And I closed it in June 2013, and I was charged a contribution to the pension fund of about 19 thousand rubles.

Tatiana, Moscow

Is there a statute of limitations for paying individual entrepreneur insurance premiums?

Everything seems to be clear with the timing. Since they didn’t present it, they didn’t reveal it, everything should be fine. And there is a wonderful article. 45 212-FZ:1.

A person cannot be held accountable for committing an offense if three years have elapsed from the day it was committed or from the day after the end of the period during which the offense was committed and until the day the decision on bringing to responsibility is made (the statute of limitations). 2.

The statute of limitations for bringing to justice for committing an offense is suspended if the person held accountable actively opposed the on-site inspection, which became an insurmountable obstacle to its implementation and determination by the authorities monitoring the payment of insurance premiums of the amounts of insurance contributions payable to state extra-budgetary funds .

Now the functions of administering insurance premiums are carried out by the tax authorities. The Federal Tax Service can recover non-payment from the debtor, which consists of a combination of several deadlines.

- If a debt is detected, the inspectorate sends a demand to the debtor.

The period within which the demand will be sent depends on the amount of debt, the method of detecting the debt:

- The demand must be sent to the debtor within no more than 20 working days from the date of entry into force of the decision based on the results of the audit;

- The demand must be sent within 90 days (three months) from the date of detection of non-payment of contributions.

In this case, the body monitoring the payment of insurance premiums may apply to the court with a claim to recover from the payer of insurance premiums - an organization or individual entrepreneur - the amount of insurance premiums due for payment. An application may be filed with the court within six months after the expiration of the deadline for fulfilling the requirement to pay insurance premiums.

A deadline for filing an application missed for a valid reason may be reinstated by the court. Based on Part 3 of Art.

20 of Law N 212-FZ, a resolution on the collection of insurance premiums at the expense of the property of the payer of insurance premiums - an organization or an individual entrepreneur - is adopted within a year after the expiration of the deadline for fulfilling the requirement to pay insurance premiums, penalties and fines.

Part 2 of Art.

REI 07/17/2009 12:43

Once upon a time I was an individual entrepreneur without forming a legal entity. In 2003, he successfully closed his activities and seemed to have forgotten about it. But in May, a paper came from the Pension Fund demanding payment of a mandatory payment to the insurance and savings part for the entire 2002, as well as penalties and fines for 2003-2008. In response to my questions about this, the Pension Fund told me that they had an audit and this arrears surfaced. What should I do?

Cheerful gravedigger 07/17/2009 12:49quote:What to do? I don't think so. Kill them. They should, let them go to court. Were they registered? Was there really a debt? If not, look for payment slips. Send them a fax so that they don’t even bother you with letters.REI 07/17/2009 02:03

The fact is that I really didn’t pay for 2002, when I closed in 2003 I was told to pay for the current one, i.e. 2003. And now they suddenly remembered. There were more penalties than the payment itself. And they say that they will not go to court and let the debt accumulate and hang like a sword of Domocles with which I will not travel abroad, and perhaps there will be an action together with the traffic police in which my car can be taken away. These are the things.

Arkan 07/17/2009 09:44

Everything that the Pension Fund says about this is a deliberate lie. This is pressure on the psyche in the style of collection agencies in order to obtain uncollectible debts. The period for collecting a mandatory payment is: 1) after the expiration of the payment deadline (December 31 of the year for which payment is made) - 3 months to submit a claim;

2) after the expiration of the deadline for fulfilling the requirement - 6 months to go to court. That's it, there are no other deadlines. Consequently, the deadline for collecting payments for 2002 expired, at the latest, in October 2003. Travel abroad cannot be limited, just as it is impossible to carry out other enforcement actions (for example, seizure of a car by bailiffs), since this requires the initiation of enforcement proceedings on based on a court decision.

But its issuance is impossible due to what was said above about the deadlines. A similar question was asked not so long ago on the forum, in addition to the answer, he suggested notifying the Pension Fund by phone that you would inform the prosecutor’s office about the negligence of Pension Fund employees, which resulted in missing the deadline for collecting payments and, as a result, causing damage to the fund. You can also remind them about the unreliable certificate of no debt that they issued to the tax authorities when they were deregistered in 2003

REI 17-07-2009 12:01

Thanks for the answer. But I am still concerned that the debt exists and penalties will continue to accrue on it. This whole farm will grow like a snowball and crush me in old age. There is an idea to sue the Pension Fund of Russia, again guided by the statute of limitations. As they say, the best defense is an attack. And if the court decides in my favor, these arrears will be written off. Is there any point in suing?

Arkan 17-07-2009 12:35

There is no meaning, no reason. Currently, the Pension Fund of Russia does not violate your rights in any way, so there are no grounds for going to court, despite the fact that somewhere in the depths of the Pension Fund of Russia’s computer there is a fine ticking on your personal account. This personal account is an internal accounting register and does not affect your rights; by a court decision, nothing will be written off from it. There are many similar cases involving tax debts, and their outcome is the same.

REI 17-07-2009 17:33

Thank you for the consultation. But what is more important now, action or inaction? Thanks again.

Arkan 17-07-2009 23:53

Inaction, you have no grounds for active action and should not have them. The most extreme (but illegal) option is if the Pension Fund of the Russian Federation turns to the magistrate for the issuance of a court order for this debt.

Approved by Order of the Ministry of Taxes and Taxes dated December 29, 2000 BG-3-07/466

Guidelines on the procedure for collecting debt from payers for insurance contributions to state social extra-budgetary funds, offset (refund) of overpayments of insurance contributions to these funds and the unified social tax (contribution)

These Guidelines have been prepared on the basis of Chapter 24 Unified social tax (contribution), Federal Law of August 5, 2000 N 117-FZ Tax Code of the Russian Federation. Part two, Federal Law of August 5, 2000 N 118-FZ 0 introducing part two of the Tax Code of the Russian Federation and introducing amendments to some legislative acts of the Russian Federation on taxes (hereinafter referred to as Federal Law N 118-FZ), orders of the Government of the Russian Federation dated October 16, 2000 N 1462-r and explain the procedure for collection by tax authorities of amounts of arrears, penalties and ? / fines on payments to state social extra-budgetary funds (Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation, State Employment Fund of the Russian Federation and funds compulsory health insurance) (hereinafter referred to as the Funds), as well as the procedure for crediting (returning) excess/unpaid amounts of insurance contributions to these funds and the unified social tax (contribution).

Collection of amounts of arrears, penalties and ?/traffic on payments

to state social extra-budgetary funds

In connection with the introduction into force of the unified social tax (contribution) on January 1, 2001 and the abolition of collection of insurance contributions to the Funds by tax authorities by the Federal Law of August 5, 2000 N 118-FZ entrusts control over the payment of the unified social tax (contribution), as well as, to the full extent provided for by the Tax Code of the Russian Federation (hereinafter referred to as the Code), the implementation of all tax control measures. The tax authorities are also responsible for collecting amounts of arrears, penalties and fines to the Funds that were formed on January 1, 2001, conducting checks on the correctness of calculation, completeness and timeliness of making insurance contributions to the Funds before January 1, 2001, as well as control over compliance with the conditions for granting deferments and installment plans for the payment of insurance premiums and accrued penalties, the procedure for restructuring debt on mandatory payments to the Funds, adopted before the entry into force of part two of the Code, and other tax control measures. The Code does not provide for the taxpayer to fulfill the obligation to pay tax in non-monetary form, and therefore the amounts of arrears, penalties and fines on insurance contributions to the Funds from January 1, 2001 are paid by payers of contributions only in cash. According to Article 10 of Federal Law No. 118-FZ, arrears in insurance contributions to the Funds and the corresponding penalties are paid in the manner in force before the entry into force of part two of the Code. According to Article 9 of Federal Law N 118-FZ, collection of arrears, penalties and fines on payments to the Funds, formed as of January 1, 2001, is carried out by the tax authorities of the Russian Federation in the manner established by the Code. In accordance with Article 30 of Federal Law N 118-FZ, established by the legislation in force before the entry into force of part two of the Code on specific types of compulsory social insurance, sanctions for offenses committed before the entry into force of part two of the Code are not collected after the introduction it comes into force if liability for similar offenses is not established by part one of the Code. In the event that part one of the Code establishes a more lenient liability for tax offenses than was established by the legislation on specific types of compulsory social insurance in force before the entry into force of part two of the Code, the liability established by part one of the Code is applied. Sanctions for non-compliance with legislation on specific types of compulsory social insurance, decisions on the collection of which were adopted, but the collection of which was not made before the entry into force of part two of the Code, after its entry into force can be collected in parts, not exceeding the maximum amount of tax sanctions provided for by part one of the Code for similar offences. In paragraph four of paragraph 1 of the order of the Government of the Russian Federation of October 16, 2000 N 1462-r, the Ministry of Labor of Russia and the Funds are instructed to ensure the safety of the primary accounting documents of insurance premium payers for five years and, if necessary, at the request of the tax authorities, if this is related to audits timeliness and correctness of payment of insurance contributions by payers to state social extra-budgetary funds, provide the tax authorities with the necessary information on specific taxpayers. According to Article 87 of the Code, a tax audit can only cover three calendar years of activity of the taxpayer immediately preceding the year of the audit. In 1998-2000, the payment of insurance premiums, the accrual of penalties and fines to the Funds was carried out in accordance with legislative and other legal acts in accordance with the appendix to these Guidelines. In this regard, during on-site tax audits of insurance premium payers, tax authorities should be guided by the legislation on the relevant type of social insurance in force during the audited period. In accordance with the procedure established by the Code, the tax authorities collect from payers the amounts of arrears, penalties and ?/traffic on insurance contributions to the Funds, both transferred to the tax authorities by the regional (territorial) bodies of the Funds according to the Reconciliation Acts of calculations of insurance premium payers (hereinafter referred to as the Reconciliation Acts), and and accrued based on the results of on-site tax audits. The tax authorities are entrusted with the obligation to ensure the collection of you?/the above amounts through coercive measures: by collecting debts from funds held in payers’ bank accounts, in the manner prescribed by Articles 46 and 48 of the Code, as well as by collecting debts from other property of payers in the manner provided for in Articles 47 and 48 of the Code. The specified procedure also applies to the amounts of payments to the Funds identified by tax authorities as a result of on-site tax audits, which were not paid by the payer of insurance premiums within the time limits specified in the request sent to him by the tax authority for payment of arrears on insurance premiums and penalties. According to Article 21 of Federal Law N 118-FZ, deferments (installments) for the payment of contributions provided before the introduction of part two of the Code by the Funds, as well as decisions on restructuring the amounts of debt on contributions and accrued penalties to the Funds accepted before the introduction of the effect of part two of the Code are applied in accordance with the conditions under which they were provided. From January 1, 2001, if a taxpayer (payer of fees) violates the conditions on the basis of which a deferment (installment plan) was granted for the payment of insurance contributions to the Funds, or the conditions for paying taxes, the Funds’ bodies, based on the submission of the tax authorities, make a decision to cancel the decision to grant a deferment (installment plan) within 5 days. The amount of debt is collected by the tax authorities in the manner prescribed by the Code. Collection of arrears and penalties on insurance premiums in relation to individuals is carried out in court. In relation to organizations, collection of arrears and penalties on insurance premiums is carried out in an indisputable manner. Fines from organizations and individuals are collected only in court.

Forced collection of debts from organizations

a) collection orders (instructions) According to Article 46 of the Code, in case of non-payment or incomplete payment of tax on time, the obligation to pay is compulsorily fulfilled by foreclosure on the taxpayer’s funds in bank accounts. The provisions of Article 46 of the Code also apply when collecting penalties for late payment of tax. Forced collection of debt on insurance premiums from funds in bank accounts of organizations is carried out by sending to the bank in which the payer's accounts are opened a collection order (instruction) to write off and transfer to the appropriate budgets of the Funds the necessary funds from the payer's accounts. For amounts of debt from previous years transferred by the Funds on the basis of Reconciliation Certificates, within the limits of amounts for which enforcement measures were not applied by the Funds, demands for payment are made. The decision on collection is made after the expiration of the period established for the fulfillment of the obligation to pay insurance premiums, but no later than 60 days after the expiration of the deadline for fulfilling the requirement to pay insurance premiums. A decision on collection made after the expiration of the specified period is considered invalid and cannot be executed. In this case, the tax authority may apply to the court with a claim to recover from the payer the amount of insurance premiums due for payment. The decision on collection is brought to the attention of the payer no later than 5 days after the decision on the collection of the necessary funds is made. When tax authorities issue collection orders for the forced collection of debts from previous years within the limits of the amounts for which the Funds have provided information on unfulfilled collection orders returned to the Funds, prior issuance of payment demands to the taxpayer is not required. If during on-site tax audits the tax authorities establish facts of violation by payers of the legislation on the payment of insurance contributions to the Funds, then the tax authorities will send demands for payment of additional accrued payments in the manner prescribed by the Code. The payment request issued to the payer in accordance with the decision of the tax authority based on the results of the tax audit must be sent to him within ten days from the date of the relevant decision. According to the Order of the Ministry of Finance of the Russian Federation dated January 14, 2001 N Zn, communicated to the Departments of the Ministry of Taxes of Russia for the constituent entities of the Russian Federation by letter dated January 16, 2001 N FS-6-09 / [email protected] , taxpayers submit payment orders to the bank for the transfer of arrears, penalties and ?/traffic charges, formed?/them as of January 1, 2001, separately for each Fund, to the personal accounts of the federal treasury bodies of the Ministry of Finance of Russia (hereinafter referred to as the federal treasury bodies), opened in banks on balance sheet account 40101 Income distributed by the federal treasury bodies between the levels of the budget system of the Russian Federation. The federal treasury authorities keep track of incoming/named amounts using the following classification codes for budget revenues of the Russian Federation:

1400305 Debt from previous years for the payment of insurance premiums, penalties and fines to the State Employment Fund of the Russian Federation, as well as funds from the Employment Fund returned by organizations in accordance with previously concluded agreements (agreements); 1400310 Debt on insurance premiums, penalties and ?/traffic charges credited to the Pension Fund of the Russian Federation; 1400311 Debt on insurance contributions, penalties and ?/traffic charges credited to the Social Insurance Fund of the Russian Federation; 1400312 Debt on insurance premiums, penalties and ?/traffic charges credited to the Federal Compulsory Medical Insurance Fund; 1400313 Debt on insurance premiums, penalties and fees credited to territorial compulsory health insurance funds.

Funds received to personal accounts according to code 1400305 of the classification of budget revenues of the Russian Federation are transferred by the federal treasury authorities to accounts for recording federal budget revenues. In accordance with the Directive of the Central Bank of the Russian Federation dated January 5, 2001 N 898-U and the Ministry of Finance of the Russian Federation dated January 15, 2001 N 5n 0, the procedure for banks to work with settlement documents for the transfer (collection) of funds to state social extra-budgetary funds in connection with the introduction from January 1, 2001 of the unified social tax (contribution) (brought to the Offices of the Ministry of Taxation of Russia for the constituent entities of the Russian Federation by letter of the Ministry of Taxation of Russia dated January 17, 2001 N FS-6-07 / [email protected] ) unfulfilled payment orders of contribution payers and collection orders of the Funds will be re-registered by banks using new details. Collection of debt on insurance premiums can be made from ruble settlement (current) and (or) foreign currency accounts of payers, with the exception of loan and budget accounts. According to Article 46 of the Code, payments to the Funds are not collected from the payer’s deposit account if the deposit agreement has not expired. If there is such an agreement, the tax authority has the right to give the bank an instruction (instruction) to transfer, upon expiration of the deposit agreement, funds from the deposit account to the payer's settlement (current) account, if by this time the order (instruction) of the tax authority sent to this bank has not been executed. authority to transfer taxes.

b) foreclosure on other property of the payer The procedure for foreclosure of tax at the expense of other property of a taxpayer-organization is determined by Article 47 of the Code. It should be borne in mind that Article 47 of the Code does not contain restrictions on the time limits for the tax authority to make a decision on the collection of a tax (fee) at the expense of other property of the payer. The execution of the tax authority’s decision on the collection of a tax or fee is entrusted to bailiffs, to whom it is sent within three days after the relevant decision is made. The obligation to pay insurance premiums is considered fulfilled from the moment the payer’s property is sold and the debt is repaid from the proceeds. The provisions provided for in Article 47 of the Code also apply when collecting penalties for late payment of insurance premiums.

Forced collection of debt from individuals

Collection by tax authorities of debt on insurance contributions to the Funds (arrears, penalties, ?/traffic) from individuals is carried out in court (Articles 48, 114 of the Code). The tax authority must, within one month after the expiration of the deadline for fulfilling the requirement to pay insurance premiums, apply to the arbitration court (in relation to the property of an individual entrepreneur) or to a court of general jurisdiction (in relation to the property of an individual who does not have the status individual entrepreneur) with a statement of claim for the collection of debt on insurance premiums at the expense of the property of these persons. If the tax authority's claim for collection of debt on insurance premiums is satisfied at the expense of the property of the payer - an individual, collection is carried out by bailiffs in accordance with Federal Law 0b Enforcement Proceedings. According to Article 31 of the Code, tax authorities have the right to bring claims to the courts of general jurisdiction or arbitration courts for the liquidation of an organization of any organizational and legal form on the grounds established by the legislation of the Russian Federation. Article 6 of the Federal Law of January 8, 1998 No. 6-FZ 0 on insolvency (bankruptcy) establishes that the tax authorities have the right to apply to the arbitration court to declare the debtor bankrupt in connection with failure to fulfill the obligation to make mandatory payments. Thus, the tax authorities can exercise the right to compulsorily collect debt on insurance premiums from debtors (organizations and individuals) by applying to the arbitration court with an application to declare the debtor bankrupt due to his failure to fulfill his obligation to pay insurance premiums to the Funds.

Offset (refund) of surplus/unpaid (collected) amounts of insurance premiums

and unified social tax (contribution)

The procedure for offset or return of surplus/unpaid amount of tax, fee, and penalties is determined by Article 78 of the Code. According to paragraph 5 of Article 78 of the Code, at the request of the taxpayer and upon the decision of the tax authority, the amount of the outflow/unpaid tax may be used to fulfill obligations to pay taxes or fees, to pay penalties, to pay off arrears, if this amount is sent to the same budget (extra-budgetary fund) to which the surplus/unpaid amount of tax is sent. With the introduction of the unified social tax (contribution), it is envisaged to separate the shares of this tax paid by taxpayers in separate payment orders for each Fund and credited to the personal accounts of the federal treasury authorities opened in banks on the balance sheet account 40101 Income distributed by the federal treasury authorities between the levels of the budget system of the Russian Federation . According to Article 9 of Federal Law N 118-FZ, the amounts of over/unpaid insurance contributions to the Funds as of January 1, 2001 are subject to offset against the payment of the unified social tax (contribution) or refund in the manner established by the Code. Thus, if there are over/unpaid amounts for insurance contributions to any Fund as of January 1, 2001, then by decision of the tax authority, adopted on the basis of a written application from the taxpayer, these amounts can be offset against upcoming payments of that share of the single social tax (contribution) that is subject to credit to this Fund. Overpayment of insurance premiums, formed as of January 1, 2001 as a result of payment of these contributions in the form of non-monetary payments (payment in kind, bills, etc.), is also counted towards the payment of the single social tax (contribution) to the relevant Fund . Offsetting the amounts of insurance premiums or the share of the unified social tax (contribution), allocated/not paid (collected) to one Fund, towards the repayment of debt on insurance contributions or the share of the unified social tax (contribution), formed?/them in another Fund, not produced. By Order of the Government of the Russian Federation dated October 16, 2000 N 1462-r, the Ministry of Labor of Russia was instructed to reconcile with payers the amounts of insurance contributions to the State Employment Fund of the Russian Federation by December 28, 2000 and, upon establishing the facts of over/unpaid (collected) amounts, to carry out until January 16, 2001, their return from existing balances in the accounts of the State Employment Fund of the Russian Federation. “Based on the foregoing, the offset of excess/unpaid (collected) amounts of insurance contributions to the State Employment Fund of the Russian Federation against upcoming payments for the unified social tax (contribution) or other taxes received by the federal budget is not made. Also, these amounts are not subject to refund from funds from the unified social tax (contribution) or from the federal budget. The procedure for returning excess/uncollected tax, as well as penalties, is determined by Article 79 of the Code. Refunds of excess/unpaid (collected) amounts of insurance premiums and unified social tax (contribution) are carried out by the federal treasury body based on the conclusions of the tax authorities in the following order:

— for insurance premiums Refunds are made from a personal account opened by the federal treasury body for the transfer of funds received from January 16, 2001 to pay off debts on insurance premiums, penalties and fines to the budget of that Fund (with the exception of the State Employment Fund population of the Russian Federation), for which the payer incurred an overpayment. Any unpaid amounts of insurance premiums are subject to refund within the limits of funds balances at the beginning of the day and daily receipts of funds to your/named personal account of the relevant Fund. Refunds to the payer of amounts of insurance premiums over/not paid in the manner of non-cash payments (payment in kind, bills, etc.) are not made, but only offset against the payment of the single social tax (contribution).

— for the unified social tax The refund is made from a personal account opened by the federal treasury body for the transfer of the unified social tax (contribution) to the budget of the Fund for which the payer has overpaid. Tax amounts not paid (collected) are also subject to refund within the limits of funds balances at the beginning of the day and daily receipts of funds to your/named personal account of the relevant Fund.

When collecting debt on insurance contributions to the Funds, tax authorities should also be guided by: - letter of the Ministry of Taxes of Russia of October 3, 2000 N BG-6-12/774 0b notifying taxpayers of the introduction of a unified social tax from January 1, 2001; — letter of the Ministry of Taxes and Taxes of Russia dated October 20, 2000 N BG-6-07/814, Ministry of Labor of Russia dated October 18, 2000 N 214-AP, Pension Fund of the Russian Federation dated October 18, 2000 N KA-16-27/9192, Social Fund Insurance of the Russian Federation dated October 18, 2000 N 02-08/06-2134P, Federal Compulsory Medical Insurance Fund dated October 18, 2000 N 4875/20-2/i on the forms of Registers and Consolidated Registers of data transfer and Certificates of reconciliation of calculations of insurance premium payers with funds, as well as Methodological guidelines on the procedure for organizing the transfer by state extra-budgetary social funds to the tax authorities of information about payers of insurance contributions; — letter of the Ministry of Taxes of Russia dated October 26, 2000 N 09-03-13/4269, bringing to the attention of the departments of the Ministry of Taxes of Russia for the constituent entities of the Russian Federation the order of the Ministry of Finance of the Russian Federation dated October 23, 2000 N 93n 0 introducing additions to the Instructions on the procedure for applying the budget classification of the Russian Federation Federations that have introduced budget classification codes for accounting for income from the payment of the unified social tax (contribution), as well as for accounting for payments received to pay off the debt of previous years for the payment of insurance contributions to state social extra-budgetary funds; — letter of the Ministry of Taxes and Taxes of Russia dated October 31, 2000 N BG-6-07/836 0b organization of work on the introduction of a single social tax (contribution); — by letter of the Ministry of Taxes and Taxes of Russia dated November 13, 2000 N FS-6-09/868 0 measures to ensure accounting for the unified social tax (contribution); - by letter of the Ministry of Taxes of Russia dated January 16, 2001 N FS-6-09/24, bringing to the attention of the Departments of the Ministry of Taxes of Russia for the constituent entities of the Russian Federation the order of the Ministry of Finance of the Russian Federation dated January 14, 2001 N Zn 0b approving the Rules for crediting contributions paid as part of the unified social tax ( contribution) to the accounts of the federal treasury bodies of the Ministry of Finance of the Russian Federation, and the transfer of these funds to the budgets of state social extra-budgetary funds, as well as for crediting arrears, penalties and ?/traffic on insurance contributions to state social extra-budgetary funds (including the State Employment Fund population of the Russian Federation), formed?/them on January 1, 2001, to these accounts and transfers of these funds to the budgets of state social extra-budgetary funds and the federal budget; - by letter of the Ministry of Taxes of Russia dated January 17, 2001 N FS-6-07/35, conveying to the Directorates of the Ministry of Taxes of Russia for the constituent entities of the Russian Federation the instructions of the Central Bank of the Russian Federation dated January 5, 2001 N 898-U and the Ministry of Finance of the Russian Federation dated January 15, 2001 N 5n 0 the procedure for banks to process settlement documents for the transfer (collection) of funds to state social extra-budgetary funds in connection with the introduction of a single social tax (contribution) from January 1, 2001.

Excerpts from the Appendix

to the Methodological Instructions on the procedure for collecting debts of payers on insurance contributions to state social extra-budgetary funds, offset (refund) of overpayments of insurance contributions to these funds and the unified social tax (contribution)

LIST of legislative and other legal acts, in accordance with which insurance premiums were paid to the Funds in 1998-2000:

//

for the Social Insurance Fund of the Russian Federation (FSS RF):

- Federal Law of April 30, 1999 N 83-FZ 0 budget of the Social Insurance Fund of the Russian Federation for 1999; — Federal Law of July 14, 1999 N 164-FZ 0 budget of the Social Insurance Fund of the Russian Federation for 1998; — Federal Law of July 16, 1999 N 165-FZ “On the Basics of Compulsory Social Insurance”; — Federal Law of January 2, 2000 N 24-FZ 0 budget of the Social Insurance Fund of the Russian Federation for 2000; — Decree of the Government of the Russian Federation of February 12, 1994 N 101 0 to the Social Insurance Fund of the Russian Federation; — Resolution of the Social Insurance Fund of the Russian Federation dated June 3, 1999 N 22 0b changing the amount of penalties accrued for arrears on payments to the Social Insurance Fund of the Russian Federation; — Resolution of the Social Insurance Fund of the Russian Federation dated January 10, 2000 N 1 0 on the accrual of penalties for arrears of payments to the Fund and the application of liability measures to policyholders and banks for violating the procedure for paying insurance premiums; — Resolution of the Social Insurance Fund of the Russian Federation dated January 10, 2000 N 2 0 on the procedure for providing deferments (installment plans) for the repayment of debt amounts on mandatory transfers to the Social Insurance Fund of the Russian Federation in 2000; — methodological recommendations for tax authorities to conduct documentary checks on the completeness and correctness of payment of insurance contributions to the Social Insurance Fund of the Russian Federation and compulsory medical insurance funds (attachment to the letter of the State Tax Service of Russia dated December 27, 1999 N ШС-6-07/ [email protected] ); — letter of the Social Insurance Fund of the Russian Federation dated February 24, 1999 N 02-10/05-920 “On the tariffs of insurance contributions to the Social Insurance Fund of the Russian Federation”; — letter of the Social Insurance Fund of the Russian Federation dated November 24, 1999 N 02-10/05-6150 (explains the procedure for applying part one of the Code); — letter of the Social Insurance Fund of the Russian Federation dated April 6, 2000 N 02-18/05-2322 (review of the practice of applying social insurance legislation in terms of the appointment and payment of benefits, as well as on the issues of calculating penalties and applying liability measures in accordance with part first Tax Code of the Russian Federation). //

How long after closing can individual entrepreneurs calculate the debt?

It may have happened to you that receipts for payment of transport tax (TN), the payment of which you had forgotten out of forgetfulness, suddenly stopped arriving due to unknown circumstances. It’s as if the tax office simply forgot about you! In reality, everything is not quite like that. Like any mandatory payment, there is a statute of limitations for transport tax. From what moment does it begin and what conditions must be met is the topic of this article.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call:

- 7 ext. 987 (Moscow and region)

- 7 ext. 133 (St. Petersburg and region)

- 8 ext. 652 (Regions)

It's fast and free!

The statute of limitations for payment of transport tax for individuals is the period after which the fiscal authority, having discovered the fact of non-payment of the fee, will no longer be able to sue you to recover the overdue amount and penalties.

Let's figure out what date this period begins. An individual must pay the TN for the past year before December 1 of the current year; after February 1, a legal entity must pay the difference between the amount of the fee accrued for the year and the amount of quarterly advance payments. The availability of advance payments and the final dates for payment of the fee for legal entities are determined by the laws of the constituent entities of the Federation, but the deadline for submitting a declaration is 1 working day of February of the new year.

The day after the deadline for payment, the amount of unpaid tax is considered arrears, and is subject to 1/300 of the Central Bank rate for each day of delay. It is from this day that the limitation period begins to count.

The differences between the liability of individuals and legal entities are that for organizations it begins from the moment of delay; The obligation of individuals to pay tax on a vehicle begins from the moment a notification is sent to it from the fiscal authority. Thus, if a private individual was not notified of the need to pay, then he does not become liable for non-payment of these payments. However, here one should not confuse the failure to send a notification and its failure to receive it.

Another notable difference between legal entities and individuals in the context of payment is the possibility of amnesty on transport tax for individuals. The last official amnesty was announced by order of the Federal Tax Service of the Russian Federation No. ММВ-7-8/923 dated December 14, 2011. This one-time action affected only individuals and established the procedure for writing off debts on tax payments as of January 2009.

So is there a statute of limitations for transport tax for individuals? Yes - as for any debt, but there is also a list of responsibilities of the fiscal authority, the implementation of which is necessary during the procedure for claiming tax payments from citizens or organizations.

First of all, if a fact of non-payment is revealed, the Federal Tax Service must send a demand within 90 days indicating the amount of the arrears and the penalty for it. Receipt of the request must be confirmed by the signature of the person to whom it was delivered (legal entities) or, if sent by mail (to an individual), it is automatically considered received after 6 days.

The payer has 8 days to fulfill the terms of the claim, repay the debt and penalties. In the case of an organization, the fiscal authority, after this period, has the right to write off payments from its personal account.

For more information about the payment period, please click on the link "

It often turns out that taxpayers receive notifications from the tax office about tax arrears for periods long past. Are such demands legal and is there a statute of limitations for paying transport tax?

Are there any restrictions due to which the tax office loses the opportunity to claim the debt through the courts?

The statute of limitations for transport taxation, according to the Ministry of Finance, has not yet been regulated at the legislative level, but the provisions of the Tax Code clearly state that a tax offense has a statute of limitations of 3 years.

clause 1 art. 113 Tax Code of the Russian Federation. states: “A person cannot be held accountable for committing a tax offense if 3 years have elapsed from the day it was committed or from the next day after the end of the tax period during which this offense was committed until the decision to bring it to justice is made.”

If the payer does not pay the tax, then the fiscal authorities have the right to demand forced collection. Then the tax debt is withheld in accordance with the same Tax Code. That is, the actual existence of debt serves as the basis for its forced collection.

Never pay off old tax debts if you doubt their existence. It is necessary to wait for clarification and confirmation of the situation, after which you can act.

But at the same time, the Federal Tax Service can appeal to the courts regarding the issue of payments no earlier than six months after the expiration date for tax payment. Moreover, in this case, the taxpayer must receive a tax demand for payment within 3 months from the date of discovery of the debt.

The general rules state that the tax is paid before December 1 at the place where the vehicle is actually located. The basis for payment is a notification sent by the Federal Tax Service by mail 30 days before the due date of payment. Calculations at the tax office are made according to the traffic police data, and the amount is determined based on the results of the taxation period, which is prescribed in the Tax Code of the Russian Federation.

By law, if the tax office requires that payments be made for a period exceeding the 3-year statute of limitations, then the taxpayer has every right to refuse payment through legal proceedings.

Transport tax is considered by law as a financial measure of a regional nature, therefore this payment replenishes the regional and local budget, but not the all-Russian one. Tax authorities are responsible for calculating transport tax; legal entities independently carry out calculations for payment of tax contributions.

my son was an individual entrepreneur, he has not worked for 5 years, yesterday they blocked the card without any enforcement, it seems that the pension tax was not fully paid, do they have the right to do this?

Natalya, Barnaul

Is there a statute of limitations for paying individual entrepreneur insurance premiums?

Statute of limitations for identifying arrears in insurance premiums. does it exist?

As a general rule, the limitation period begins from the day when the person learned or should have learned about the violation of his right and who is the proper defendant in the claim for the protection of this right (Clause 1 of Article 200 of the Civil Code of the Russian Federation). The limitation period is interrupted if the debtor takes actions indicating recognition of the debt.

Statute of limitations for the return or offset of insurance premiums An application for offset or return of amounts of overpaid insurance premiums must be submitted to the Pension Fund of Russia office within three years from the date of payment of these contributions (clause 13 of Article 26 of the Federal Law of July 24, 2009 No. 212-FZ ).In relation to the payment of insurance premiums, this fact is the signing of a reconciliation report with the Pension Fund.

When the document is endorsed, the “countdown” starts again. To extend the statute of limitations, the parties must attach to the claim a petition indicating valid reasons for missing the deadline. For example, an individual entrepreneur may refer to a long-term illness, stay in prison, departure abroad, etc.

Percentage of contribution to the pension fund In what time frame can an overpayment from the budget be returned? According to the text of Art. 26 212-FZ, the statute of limitations for returning amounts of contributions to the Pension Fund is three years from the moment the surplus was transferred. In practice, entrepreneurs and firms often find out about the existence of an overpayment later, during reconciliations with the Fund.

However, how interesting the approach is formulated, including by judicial practice. For example, the Appeal ruling of the Rostov Regional Court dated September 24, 2015 in case No. 33-14791/2015 {amp}amp;#171;{amp}amp;#8230; Law No. 212-FZ also does not establish a general statute of limitations for identifying arrears on insurance contributions.

Article 45 of Law N 212-FZ establishes only the statute of limitations for bringing to responsibility for committing an offense, that is, arrears on insurance premiums and penalties on them do not affect{amp}amp;#8230;{amp}amp;#187; Or, Appeal ruling of the Supreme Court of the Chuvash Republic dated 07/08/2015 in case No. 33-2949/2015 {amp}amp;#171;{amp}amp;#8230;

In good faith, the judge cannot issue a court order under these circumstances, but in reality it is possible. In this case, upon receipt of a copy of the court order (which the magistrate is obliged to send to you by registered mail with notification to the registration address), you must submit written objections to the order to the judge within 10 days after receipt.

There is no particular need to justify it, “I don’t agree with the order, please cancel it,” and that’s enough. If there are objections, the judge will certainly cancel the court order, and the Pension Fund of Russia has absolutely nothing to gain from the claim.

REI 18-07-2009 12:31

Thank you very much. I consider the question settled.

Home{amp}amp;#9650;{amp}amp;#9660;

Accrual of penalties after the pre-trial period

Preventive is the period of time provided by law to perform a specific action necessary to preserve a person’s rights or protect interests. The purpose of this period also differs from the limitation period, including for penalties to the tax authorities. After all, if the latter is over, the right itself does not go away and continues to exist, but a person cannot exercise it with the help of coercive instruments. When the pretrial period ends, the right no longer exists. In most situations, it should not be increased or interrupted.

Statute of limitations for collection of non-payment of insurance contributions to the Pension Fund

The deadline for paying insurance premiums in 2017-2018 is an issue that does not lose its relevance, especially in light of the change in the administrator of most contributions since 2017. Accordingly, changes have occurred in the reporting of contributions and in the preparation of bills for their payment. Are there any changes in the deadlines for paying contributions, what are these deadlines in general? We'll look into it in the article.

Deadlines for transferring insurance premiums in 2017-2018

Statute of limitations for insurance premiums from 2021

The terms of insurance contributions for compulsory medical, pension and social insurance in case of maternity and disability for companies making payments to employees are shown in Art. 431 Tax Code of the Russian Federation. In accordance with paragraph 3 of this article, contributions calculated for one month must be transferred by the 15th day of the next month.

: Rules for filling out a sick leave certificate by a medical institution and a sample

The rules for calculating insurance premiums against industrial accidents and occupational diseases are reflected in the Law “On Social Insurance” dated July 24, 1998 No. 125-FZ. In accordance with it, the amounts calculated according to the insurance tariff must also be transferred to the Social Insurance Fund no later than the 15th day of the subsequent calendar month. Insurance premiums are calculated and paid in rubles and kopecks.

The Fund recovers underpayment from the business entity:

- Within three months from the moment the arrears are identified, the Pension Fund sends a demand to the business entity to repay it and pay the “accumulated” penalties.

- Within a 10-day period from the date of receipt of the request, a commercial structure has the right to voluntarily repay the debt by making a payment from its current account.

- If the company or individual entrepreneur ignores the requirement, the Fund has two months to independently recover funds from the policyholder’s accounts.

- If this fails, the Fund must go to court within a six-month period.

Underpayment of contributions from an individual entrepreneur is not recovered in two situations: declaring an individual bankrupt in court or his death, from a company - only if bankruptcy proceedings are completed and there are no funds from the sale of property.

Attention

But the fact of an overpayment can be revealed later, for example, after a reconciliation with the Pension Fund of the Russian Federation, when the overpayment will be confirmed by a Certificate of the status of settlements for insurance premiums, penalties and fines, or even an Act of joint reconciliation of settlements, signed by both parties. Do these documents interrupt the deadline for applying for a credit or refund of the overpayment?

Thus, within 3 years from the date of payment, the policyholder can submit an application for a refund or offset of insurance premiums to the Pension Fund of the Russian Federation, and after this period, go to court, citing the fact that the statute of limitations has not yet expired.

Statute of limitations for collection of non-payment of insurance contributions to the Pension Fund

Federal Law No. 212-FZ dated July 24, 2009 establishes the following procedure for the collection of insurance premiums by the Pension Fund of the Russian Federation:

- In case of failure to pay insurance premiums on time, the Pension Fund of Russia branch sends the policyholder a demand for payment of arrears on insurance premiums, penalties and fines. This must be done in the general case within 3 months from the date of discovery of the arrears (clause 3 of article 19, clause 2 of article 22 of the Federal Law of July 24, 2009 No. 212-FZ);

- within 10 calendar days from the date of receipt of the demand (unless a longer period is specified in it), the policyholder must fulfill the demand (clause 5 of Article 22 of the Federal Law of July 24, 2009 No. 212-FZ);

- 2 months after the end of the payment period specified in the request, the Pension Fund is given to try to collect funds from the insured’s accounts in a pre-trial manner on the basis of a decision on collection (clause 5 of Article 19 of the Federal Law of July 24, 2009 No. 212-FZ);

- no later than 6 months after the expiration of the deadline for fulfilling the requirement to pay insurance premiums, the PFR branch may apply to the court with an application for the collection of insurance premiums (clause 5.5 of Article 19 of the Federal Law of July 24, 2009 No. 212-FZ).

Attention

Procedure for collecting arrears

This process is regulated by Law 212-FZ:

- Article 19 – forced repayment of debt with the debtor’s funds;

- Article 20 – repayment of debt with the debtor’s property, if there are not enough funds in the accounts;

- Article 21 – repayment of debt with property for an individual without forming an individual entrepreneur.

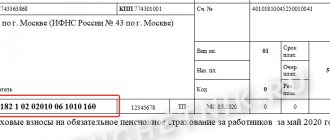

If arrears are detected, the payer is sent a written notice in the form of a requirement in the established form:

- 4-PFR - for debts on medical and pension contributions (approved by Resolution of the PFR No. 1p dated 01/11/16);

- 5-FSS – for debts on social contributions (approved by FSS Order No. 2 of 01/11/16).

Insurance premiums from 2021 - changes

From 2021, insurance premiums will again be paid to the Federal Tax Service and will come under the jurisdiction of the Federal Tax Service. Why do I say "again"? Because before everything was like this, then control over contributions was transferred to the Pension Fund, which, in my opinion, only worsened the situation, giving rise to many misunderstandings.

The innovations were adopted in the summer, but will come into force on January 1, 2021. At the same time, mandatory contributions will remain contributions and will not become taxable. Insurance premiums for injury insurance remain the responsibility of the Social Insurance Fund.

The law regulating the payment of insurance premiums is Chapter 34 of the Tax Code, which clearly states the calculation procedure, tariffs, base and much more for the payment of contributions.

If you analyze this chapter of the code, you can understand that the norms from Federal Law 212, which loses force on January 1, 2021, were copied into it. As you can see, the calculation and procedure for paying contributions PRACTICALLY does not change - only the controlling body changes. I indicated practically - since some points have changed, you can study them in more detail on your own, I will not compare.

The Pension Fund of Russia will transfer all data on arrears to the Federal Tax Service (until February 2021), but will now not be able to collect the debt, nor will it be able to recalculate.

As stated in the letter from the Federal Tax Service, the Pension Fund can “take measures to collect arrears” until the data is transferred to the tax authority (clause 3.3.1. and clause 6.6.3).

The same letter indicates other deadlines, actions related to the transfer of powers and the responsible body - I recommend looking at it. Also on January 19, 2021, the Federal Tax Service published a memo for contribution payers, which provides answers to many questions.

The foundation talks about this on its website.

But, as usually happens, while the Federal Tax Service and the Pension Fund of the Russian Federation exchange data, the payer will suffer, since part of the data on the payment of contributions will most likely be LOST, therefore we DO NOT throw away documents confirming the payment of contributions, certificates, etc. for previous periods, but carefully store them. I recommend signing a reconciliation report on payment of contributions with the Pension Fund of Russia to avoid further disputes.

Debt in contributions (if any) AFTER 01/01/2017 should be paid to the Federal Tax Service, and not to the Pension Fund - otherwise there is a risk that the payment will simply be lost. As for the return of overpaid contributions, you need to contact the Pension Fund or the Social Insurance Fund; the decision on the return of contributions for the period until 2021 will be made by these bodies. The decision will be sent to the tax authority, and the amount of overpayment will be paid from the treasury.

Lawyers' answers (2)

For the collection of arrears of insurance premiums, a three-year statute of limitations applies. If the Pension Fund of Russia transfers the case to court, you need to declare its omission.

Civil Code of the Russian Federation Article 196. General limitation period (as amended by Federal Law dated 05/07/2013 N 100-FZ) (see text in the previous edition) Positions of higher courts under Art. 196 Civil Code of the Russian Federation

Good afternoon The 3-year limitation period does not apply to contributions to the Pension Fund.

Article 47 of Law 212 Federal Law provides for the imposition of a fine in case of non-payment of the insurance premium. A fine is a measure of liability and the conditions for its collection are subject to the statute of limitations of 3 years (Article 45 of the law). That is, the fine can only be collected for unpaid contributions for the last 3 years. Moreover, the period is not financial, but is counted from the date of the decision. Article 45 of Federal Law 212 provides for a statute of limitations for applying penalties for non-payment of insurance premiums. But arrears, and this is what your unpaid contribution will be called, is not a measure of liability, it is an insurance premium payable to the budget of the Russian Federation. The amount of the contribution is not subject to the provisions of Article 45 and the limitation period. In addition, Art. 25 of the law provides for the payment of penalties in the amount of unpaid insurance premiums. Paragraph 2 of this article states that penalties are paid regardless of the application of liability measures (fine). That is, the penalty is also not a measure of liability and its calculation is also not subject to the statute of limitations. Article 113 of the Tax Code of the Russian Federation, which talks about the 3-year limitation period for bringing to liability, does not apply to relations regarding the payment of contributions to the Pension Fund, because the body controlling the payment of contributions is not the Federal Tax Service, but the Pension Fund (Article 3 of Law No. 212). Also, these legal relations are not subject to the general statute of limitations established in the Civil Code of the Russian Federation (Article 21 of Law No. 212), because payment of contributions is not a civil legal relationship based on the free will of the parties. Thus, you will have to pay. At the same time, it is necessary to clearly examine the volume and period of accruals. Therefore, I recommend that you contact a qualified and experienced lawyer in this area.

Question about calculating the limitation period for insurance contributions to the Pension Fund and the Social Insurance Fund

This is true if interest under a loan (credit) agreement is accrued before the principal debt is due for repayment and is paid after that. In this situation, the limitation period for a claim for payment of interest does not depend on the limitation period for a claim for repayment of the principal debt.

As you know, since 2015, only those visa-free foreigners temporarily staying in the Russian Federation who have a special patent issued by the migration service can be legally employed.

According to the applicant, the entrepreneur did not pay insurance premiums for compulsory pension insurance in the form of a fixed payment for 2004, and therefore the defendant incurred a debt to pay insurance premiums for compulsory pension insurance for 2004 in the amount of 1,800 rubles. of which 1200 rubles. — for the insurance part of the pension, 600 rubles. - for the funded part of the pension.

Was registered with the tax office. The Pension Fund does not. As soon as I registered with the Pension Fund, everything started pouring in - penalties and contributions. I paid off all my debts in 3 years. They began to charge me with debts for 2002-2009! This is still about 35,000. This is already too much. Even in judicial practice, they charge for 3 years. Are the FIUs right?

Sergey, as far as I understand from your question, you have been registered as an individual entrepreneur since 2002.

The Pension Fund of the Russian Federation may apply to the arbitration court to collect from the policyholder arrears of insurance premiums for compulsory pension insurance at the end of both reporting and billing periods, depending on the time of issuing the corresponding demand for payment of this arrears.

In the case submitted to the Presidium of the Supreme Arbitration Court of the Russian Federation, the fund’s demand was dated 21.

A very common situation is when a person registers as an individual entrepreneur, works for some time, then realizes that the business has not taken off, gives up his entrepreneurial activity, and forgets to close the individual entrepreneur. And, of course, he doesn’t pay contributions to the Pension Fund, naively believing that “since I don’t conduct any business, I don’t have to pay.” And here I am obliged!

- 1 How is the limitation period calculated?

- 2 Within what time frame can an overpayment from the budget be returned?

- 3 Limitation period for withholding underpayment from a company or individual entrepreneur

How is the limitation period calculated? The concept of limitation of actions is discussed in Art. 195 of the Civil Code of the Russian Federation.

It states that this is the period when an individual or legal entity has the right to apply to the court for protection of violated interests. In Art. 196 of the Civil Code of the Russian Federation states that, in general, the statute of limitations is three years from the date when the business entity learned or should have learned about the violation of its own rights and realized who would be the defendant in its claim.

If the applicant missed the deadline, the court will refuse to consider his case. The progress of the limitation period is stopped if the parties take actions that clearly indicate the acknowledgment of the debt.

Recently, new provisions have been introduced in the Tax Code, in accordance with which the rules for calculating and paying insurance premiums are regulated, including also corresponding payments to the Social Insurance Fund for mandatory payments in case of temporary disability or maternity. This also applies to payments for the provision of administration services by tax authorities.

In particular, it is worth noting the fact that the Tax Code now has a special chapter No. 34, which talks about:

- object and base for insurance premiums paid;

- amounts that cannot be subject to insurance premiums;

- all tariffs, including those that have been reduced;

- a uniform form and deadlines for submitting reports;

- procedure and timing of payment of insurance premiums.

In addition, the possibility was also introduced of offsetting those costs that were incurred by payers of insurance premiums in order to pay insurance coverage in accordance with current legislation against the payment of further contributions. It is worth noting the fact that the validity of this rule is limited to December 31, 2018, and after this point its further fate is currently unknown.

At the same time, it is worth noting the fact that employees of the Social Insurance Fund are now involved in administering the costs that are allocated by companies for the payment of insurance coverage, and verification of the costs of paying this coverage, which are declared by policyholders in the calculation of insurance premiums, is carried out by the territorial bodies of the Social Insurance Fund in the order which is established by Federal Law No. 125-FZ on the basis of the information that comes to the fund from the tax service.

The Social Insurance Fund has a wide range of powers. In particular, the Social Insurance Fund is responsible for payments for sick leave, industrial emergencies, birth certificates, and maintenance of persons with disabilities.

Clause 9 of Article 18 of Federal Law No. 212 “On Insurance Contributions” states that the Social Insurance Fund can initiate reconciliation of settlements with the payer. This procedure is carried out on the basis of the rules established by the same law - Federal Law No. 212. It is carried out on the initiative of both the body itself and the payer.

The frequency of the event can be any. Reconciliation can be initiated on any date. However, the procedure is usually carried out every quarter. In particular, it is planned after sending the report in Form 4-FSS.