When making customs payments to the account of the treasury of the Russian state, there is a special classification code that is valid for Russian residents trading with foreign countries.

This scheme requires strict order when filling out payment details. The procedure for filling out and processing payment documents is set out in the regulations of the Central Bank of the Russian Federation and in the order of the Ministry of Finance of the Russian Federation. You can draw up a document one payment at a time indicating KBK 15311009000010000180. This budget classification code is deciphered as follows:

- Advance payment against future customs or other payments.

Payment of customs duties - old details for payment until 12/31/2018

.

FROM JANUARY 1, 2021 PAYMENTS ARE PAID USING NEW DETAILS. This page is intended for those companies that have not yet issued an ELS. If you already have ELS, then here you go

Details for filling out a payment form to customs:

recipient bank – Operations Department of the Bank of Russia, Moscow 701

BIC 044501002, account No. 40101810800000002901,

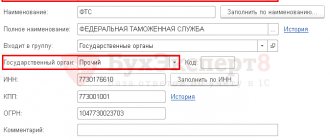

recipient – Interregional operational UFC (FTS of Russia),

KBK (column 104 in paragraph) - depending on the purpose of the payment (see below)

Column 107 must contain the customs code (see below)

All customs payments (duties, fees, VAT and excise taxes) are paid by bank transfer.

In the vast majority of cases, you need to make 2 payments: an advance payment and a fee. Advance payment is suitable for customs clearance fees, VAT and excise duty. The second, respectively, is for import duties. I talked about calculating the amount of customs duties here.

When making payments, it is IMPORTANT to fill out the payment order correctly! Very often, even experienced foreign trade participants make mistakes when filling out payment orders.

A sample of filling out an advance payment before 12/31/2018 (i.e. to pay fees and VAT) is presented below:

The values highlighted in yellow must be replaced with your own.

Undoubtedly, any accountant or manager will be able to independently fill out the recipient’s details, BUT what is worth paying attention to:

- Column 101 - here we enter your status as a participant in foreign trade activities. For legal entities it is 06, for individual entrepreneurs - 17.

- column 104 - KBK . For advance payments this is “ 15311009000010000180 ” (data outdated) New details at this link.

- column 105 - OKTMO - always 45328000

— Column 107 is for some reason the most difficult for everyone. Most often mistakes are made in it. In this column we indicate the customs code. This is not the code of the customs post, but the code of the customs office whose competence includes the post where you are being processed. This code consists of 8 digits. If you know the name of the customs office, the code can be found here. If column 101 is filled out incorrectly, as a rule, the client bank will not allow you to fill out this column.

— columns 106,108-110 are not filled in.

Sample of filling out a payment form for import duties (until 12/31/2018):

To pay the import duty, you only need to change the BCC and the purpose of payment.

All other columns remain the same. The BCC for the duty is “ 15311011010011000180 ” (data is outdated).

New details at this link. If you fill out the payment slip incorrectly, your money will go to the wrong place and you will not be able to release the cargo. If you do not fill out column 107, the money will hang on the FCS accounts as unidentified, and you will have to spend several working days to get it out of there. To transfer them, you need to apply to the FCS payment department. The application can be sent by fax to the phone number listed on the FCS website. If column 104 (KBK) is filled out incorrectly, you need to apply for a refund to the payments department of the customs office where the money was sent.

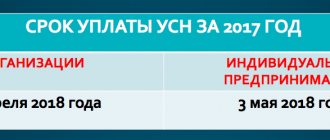

New KBK for payment of customs duties in 2021

Payment details and a sample of filling out payment orders can be found in this article.

From January 1, 2021, the Federal Customs Service recommends paying customs duties indicating the new BCC:

| Name of payment type | KBK |

| Advance payments towards future customs and other payments | 153 1 1000 110 |

| Customs duties | |

| VAT | |

| Excise taxes | |

| Export customs duties | |

| Aggregate customs payment for individuals | |

| Cash deposit to secure payment of customs and other payments | |

| Import duties | 153 1 1000 110 |

| Import customs duties (penalties and interest) | 153 1 1000 110 |

| Special, anti-dumping and countervailing duties | 153 1 1000 110 |

| Special, anti-dumping and countervailing duties (penalties and interest) | 153 1 1000 110 |

| Provisional special, provisional anti-dumping and provisional countervailing duties | 153 1 1000 110 |

| Provisional special, provisional anti-dumping and provisional countervailing duties (penalties and interest) | 153 1 1000 110 |

| Recycling fee for wheeled vehicles (chassis) and trailers for them, except those imported from the territory of the Republic of Belarus | 153 1 1200 120 |

| Recycling fee for wheeled vehicles (chassis) and trailers for them, except for those imported from the territory of the Republic of Belarus (penalties) | 153 1 1210 120 |

| Recycling fee for wheeled vehicles (chassis) and trailers for them imported from the territory of the Republic of Belarus | 153 1 1200 120 |

| Recycling fee for wheeled vehicles (chassis) and trailers for them imported from the territory of the Republic of Belarus (penalties) | 153 1 1210 120 |

| Recycling fee for self-propelled vehicles and trailers for them, except for those imported from the territory of the Republic of Belarus | 153 1 1200 120 |

| Recycling fee for self-propelled vehicles and trailers for them imported from the territory of the Republic of Belarus | 153 1 1200 120 |

| State duty for making preliminary decisions on the classification of goods according to the unified Commodity Nomenclature of Foreign Economic Activity of the Customs Union | 153 1 0800 110 |

| State duty for issuing excise stamps for labeling alcoholic beverages | 153 1 0800 110 |

| Other income from compensation of federal budget expenses | 153 1 1300 130 |

| Funds paid by importers to customs authorities for the issuance of excise stamps | 153 1 1500 140 |

Source: Order of the Ministry of Finance of Russia dated June 8, 2021 No. 132n “On the procedure for the formation and application of budget classification codes of the Russian Federation, their structure and principles of purpose”

If you did not find the answer to your question in this material, then write to [email protected ] and I will update the article soon.

You may be interested in the following: 1) Sample of filling out the clause 2) We calculate customs payments 3) How to calculate the customs value? 4) Classifiers and other useful information on the content and completion of the declaration

If you find an error, please select a piece of text and press Ctrl+Enter.

KBK for VAT for tax agents

An organization and individual entrepreneur are considered tax agents for VAT when:

- purchase products, services, work from a foreign company that is not registered with the Federal Tax Service of the Russian Federation, and sell them in the Russian Federation;

- rent property that is owned by the state or municipality, and also acquire government property;

- by court decision, sell property, as well as ownerless, confiscated or purchased property;

- act as intermediaries for a foreign company not registered in the Russian Federation.

In all of the above cases, the tax agent is obliged to withhold VAT from the amounts it owes to the counterparty and transfer the tax to the budget. Companies that apply special tax regimes are not exempt from this obligation.

In the payment order, tax agents indicate the same BCC as legal entities - tax payers. In this case, in field 101 of the payment slip, you must indicate that the tax is transferred by a tax agent (code “02”).

What's happened?

The Federal Customs Service of Russia issued Order No. 480 dated March 31, 2017, which approved the List of compliance of the classifier of types of taxes, fees and other payments, the collection of which is entrusted to the customs authorities, with budget classification codes. This list is necessary to determine the correct BCCs for the names of types of payments used in the territory of the Eurasian Economic Union. Payers must use the list when transferring funds to the budget system of the Russian Federation in 2021.

How to fill out a payment order for VAT payment according to the new rules?

So that you can know for sure that you have fulfilled your obligation to calculate and pay VAT, we will tell you how to correctly fill out a payment order to transfer tax to the budget.

DO NOT MISS! From 01/01/2021, there have been changes in the details of the payment order for the payment of taxes. There will be a transition period until 05/01/2021 (that is, payments can be made according to the old rules). And from 05/01/2021 only new rules need to be applied.

Let's start filling out the payment order from top to bottom. Some data, for example, the name of the taxpayer, his tax identification number, checkpoint, as well as bank details, the accounting program will insert into the document independently. We focus on those details that are specific to tax payments in general and specifically for VAT.

Field 101, which indicates the status of the payer, can take the value 01 - if the payer is a legal entity, 09 - if an individual entrepreneur pays (for individual entrepreneurs, the TIN is required).

NOTE! If you pay VAT when importing imported goods, then field 101 should contain the value 06. If you act as a tax agent for VAT, then code 02 should be entered.

The amount of tax payable is rounded to the nearest ruble (Clause 6, Article 52 of the Tax Code of the Russian Federation). The details of the payee, that is, the Federal Tax Service Inspectorate to which the company belongs, can be obtained on the inspection website or clarified by calling the Federal Tax Service Inspectorate hotline.

The type of transaction for any payment orders is 01. The order of payment for VAT is 5.

The UIN in field 22 is 0. From now on, the payment type (field 110) no longer needs to be filled in: banks will accept a payment slip with an empty field value, as required by the Federal Tax Service.

BCC for VAT for payment of the tax itself is 182 1 0300 110 (goods or services are sold in the Russian Federation), BCC for payment of VAT on imports depends on the importing country (182 1 0400 110 for goods from Belarus and Kazakhstan, for other countries - 153 1 04 0100001 1000 110).

Field "Base of payment" - TP, payment of the current period. Next, you need to indicate the tax period - the quarter for which the tax is transferred. In the “Document number” field you need to put 0, and in the “Document date” field - the date of signing the tax return.

OKTMO in a payment order consists of 8 or 11 characters; its meaning can be clarified in the Federal Tax Service or on the Internet. It is mandatory to indicate it.

We recommend indicating the purpose of the payment as follows: “1/3 of VAT for the _ quarter of 20__ by the payment deadline “___”________20___.”

Please note: the tax can be transferred in parts, or in one amount at once. On what this depends, read the article “In what cases is it possible to pay VAT in 1/3 (shares)?” .

ConsultantPlus experts have prepared a sample payment order for VAT transfer. Get trial access to the system for free and proceed to the sample and comments on filling it out.

When transferring VAT penalties, it matters whether the defaulter repays the debt on his own or at the request of the Federal Tax Service. In the first case, in the payment order in the “basis of payment” field, you need to put the PO, and in the purpose of the payment, the UIN must be set to 0.

If the tax authorities demanded that penalties be paid, then you need to enter the UIN number specified in the request in field 22 “Code”, and if it is not in the request, then 0.

See also: “Do I need a UIN on a fine payment?” .

The basis of payment in this case is TR. Payment deadline - the deadline for repaying the debt to the budget in accordance with the requirements of the inspectors. The “Document number” field is the request number, “Document date” is the request date.

See a sample payment slip for payment of VAT penalties in the ConsultantPlus system. Get access to K+ for free and download the sample along with comments on how to fill it out.

The payment order for the transfer of the VAT fine is filled out in the same way.

Results

The BCC for VAT did not change in 2020-2021: the codes themselves depend on whether the goods were sold in the Russian Federation or imported from abroad, as well as on the type of payment: current payment, fine or penalty. An error in indicating the KBK is not critical for the company, but it is better to check our article when indicating the KBK, so as not to worry about whether the payment was received to the budget on time, and not to argue with the tax authorities.

You can read about the BCC for other taxes in our articles:

- “Deciphering the KBK in 2020-2021 - 18210102010011000110, etc.”;

- “KBK for payment of personal income tax on dividends in 2020”;

- “CBC for land tax in 2019-2020 for legal entities”;

- “KBK for insurance premiums for 2021 - 2021 - table”;

- "KBK for payment of UTII in 2021 - 2021 for individual entrepreneurs."

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.