Payment

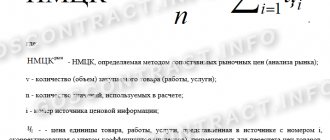

The comparable market price method involves establishing value based on prices for objects with similar

Legal center DVA M offers services for excluding buildings and premises from the list of taxable

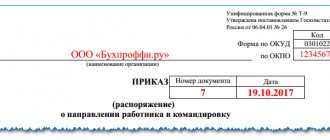

Performing work functions outside the main place of work is a fairly common occurrence. This kind

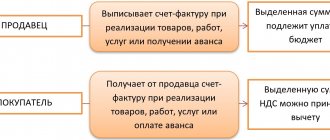

The functionality that an invoice has. An invoice (hereinafter we use the accepted abbreviation сч-ф) is the most important document that

Online stores are enterprises and organizations that trade via the Internet. Selling through online stores

prednalog.ru In practice, accounting for office supplies is not a very pleasant process in the work of accounting, since

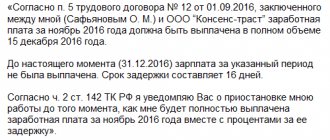

After opening a bank account, for convenience, you can submit an application to the organization for the transfer of wages

Business lawyer > Accounting > Accounting and reporting > Line 2350 of the Report

All enterprises operating as legal entities must pay property tax. This type

Home / Labor Law / Payment and benefits / Vacation payments Back Published: 05/06/2016