From July 1, 2021, Russian citizens can apply for sick leave electronically in their FSS personal account. You can get it for pregnancy and childbirth, as well as for temporary disability. Every month the number of medical institutions that issue electronic sick notes is growing. If employees belong to such clinics, then accountants can connect to the new program and start working in their personal account.

Filling out and registering an electronic sick leave certificate is very simple. Let's look at how the system works, how to get sick leave, and also how you can check the certificate of incapacity for work in your personal FSS account.

Introductory information

Let us remind you that changes in legislation that made it possible to receive sick leave certificates electronically came into force in July 2021 (Federal Law dated 01.05.17 No. 86-FZ).

And at the end of 2017, by-laws were adopted regulating the procedure for issuing electronic certificates of incapacity for work (ELN), as well as the Rules for electronic interaction between Social Insurance Fund bodies, employers and medical organizations (approved by Decree of the Government of the Russian Federation of December 16, 2017 No. 1567; hereinafter referred to as Decree No. 1567 ). It took some time to “test” the system for the formation of electronic sick leave, and at the end of 2021 - beginning of 2021, the FSS began an active information campaign aimed at introducing electronic sick leave into business practice.

What is an electronic certificate of incapacity for work?

As you know, sick leave benefits are calculated on the basis of a certificate of temporary incapacity for work, which is issued to a sick employee by a medical organization. According to Article 13 of Federal Law No. 255-FZ dated December 29, 2006 (as amended in force on July 1, 2017), a medical institution can generate sick leave both in the form of a paper document and in electronic form without duplicating it on paper.

Calculate your salary and benefits for free in the web service

ENL is a full-fledged document that has the same legal force as a traditional paper sick leave. At the same time, the technology for issuing an electronic certificate of incapacity for work does not provide for either printing it out for transmission by the employee to the employer, or sending it directly from the medical organization to the employer via TKS. All interaction between a sick employee, a medical institution and an employer takes place with the participation of the Social Insurance Fund through an information system specially created for this purpose, which is called the “Unified Integrated Information System “Social Insurance””. In this system, ELNs are formed and stored at all stages of working with them.

IMPORTANT. All medical organizations, both public and private, have the right to create sick leave certificates electronically using the Social Insurance Unified Information System. Consequently, ELN can be issued not only by clinics or hospitals to which employees apply as part of compulsory medical insurance, but by medical organizations (including private ones) with which the employer has entered into VHI agreements in favor of its employees.

How to check sick leave for an employee

To check the sick leave, the employee himself uses the same web interface https://cabinets.fss.ru. But in this case, the interested person selects the “Insured Account” option.

By that time, a person, as in the case of an employer, must have a profile on State Services. At the same time, it is not necessary to issue a qualified digital signature from a certification center. You just need to go through the identity verification procedure at an authorized center for registration on State Services. The most accessible of them are Russian Post branches, city MFCs, Rostelecom offices, SberbankOnline. Their services are free.

The functionality of the “Insured Person’s Account” allows, in particular:

- review certificates of incapacity for work issued to the employee;

- print these sheets;

- view data on accrued and paid sick leave;

- print out calculation certificates.

If necessary, the user can:

- view and clarify information about yourself;

- view and clarify contact information.

And this is only a small part of the functions available to the insured person.

As for viewing the data on the sick leave, they are given in full and correspond to the data that is reflected in the regular sick leave. To find the required certificate, a person, like an employer or a doctor at a medical institution, can use special filters for various details of a certificate of incapacity for work.

Let's now consider how to check the authenticity of a sick leave certificate in regular paper form.

Conditions for switching to ELN

Based on Article 13 of Law No. 255-FZ, a sick leave certificate is issued electronically to a sick employee only with his written consent. Moreover, if the employee gave such consent, and it later turned out that his employer does not yet work with the ELN, the right to benefits will remain. As explained by specialists from the Federal Social Insurance Fund of Russia, in this case, the medical organization, at the request of the employee, must cancel the ETN and issue him a sick leave certificate on paper (letter dated 08/11/17 No. 02-09-11/22-05-13462).

ATTENTION. For employers, the transition to ENL is also voluntary. No liability has been established for those who do not gain access to the Social Insurance Unified Information System and will not be able to work with the new format of sick leave. Likewise, no “bonuses” are provided (exemption from inspections, faster reimbursement of expenses, etc.) for those who connect to the electronic sick leave system.

To start working with the new system, you need to perform a number of actions. First, it is necessary to conclude an agreement on information interaction with the regional office of the FSS.

Secondly, you need to purchase an enhanced qualified electronic signature (if you don’t already have one). You also need to install a special program on the computers of employees working with electronic signatures to verify electronic signatures and protect information.

Receive an enhanced qualified electronic signature certificate in an hour

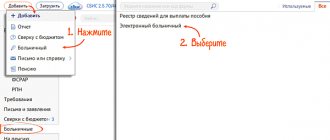

Finally, thirdly, it is necessary to select the software with which the organization will work with ENL. Currently, there are three options for such software (subparagraph “a” of paragraph 10 of the Rules, approved by Resolution No. 1567). Thus, you can use software provided by the state: the policyholder’s personal account on the Social Insurance Fund website with access through the state portal, available on the Fund’s website.

You can also use special accounting services that have the ability to work with electronic sick leave. For example, all actions necessary to work with ENL can be performed in the system for preparing and sending reports “Kontur.Extern”.

Work with electronic sick leave and submit all related reporting through Kontur.Extern

Next, you need to inform all employees that the organization has switched to working with ENL. In particular, it should be explained to employees that they can now demand that medical institutions issue sick leave in electronic form, which will undoubtedly save them time.

Employee actions

Let's consider the receipt of sick leave by employees of enterprises.

Receipt

It is useful for an employee to know how to apply for electronic sick leave. This can be done in a medical facility. An employee receiving a certificate of incapacity for work has the right to choose a carrier. Before choosing an electronic form, it is recommended to check at work whether ENL support is implemented there. If yes, then the employee only needs to notify him of his decision during an appointment with a doctor and give consent to the processing of personal data. The sheet does not need to be certified; it will be assigned an individual code, which the employee can report to his company. Knowing the code, the company will be able to track the status of sick leave and calculate benefits.

Whether or not to use electronic sick leave is a matter for the employer. As of 2021, the use of electronic sick leave is a company right, not an obligation.

How to extend an electronic sick leave certificate

Extension of an electronic sick leave follows the same procedure as the extension of a regular one. After passing the initial examination, the doctor fills out the patient’s electronic disability form and transmits the unique sheet code to the latter. On a second visit, if the patient does not improve, the doctor may extend sick leave by 3 days. The total time spent on sick leave should not exceed 15 days, otherwise a medical commission will be assembled. Only it can prolong the disability.

The only difficulty in extending sick leave is changing the place of treatment. If a patient was treated in one institution and moves to another, he should notify the FSS, which will cancel the current sheet and issue a new one indicating the new medical institution. The days spent on sick leave will remain the same.

Checking sick leave online

An employee can use the service of the Social Insurance Fund of the Russian Federation to obtain information about his electronic sick leave. To use the service, an employee will need an account on State Services and its confirmation. The most accessible confirmation methods are post offices and MFCs. On the service in the “Insured Person’s Account” you can track online how the sickness benefit is being accrued, or find out its amount.

If the employer does not accept electronic sick leave

For an employee who has received a virtual illness certificate from a doctor, but is unable to obtain a certificate from the employer, it is legal to replace the virtual form with a paper one. To do this, the employee should contact the doctor who issued the electronic sick leave. The attending physician will give the patient a paper sheet, making a note on it about duplication. After filling out, indicating the number and period of illness, a paper sick leave form is given to the patient. The electronic duplicate of the sheet is destroyed.

New technologies in the administrative part of healthcare are necessary. Innovations simplify the lives of patients and relieve doctors from paperwork. Unfortunately, the electronic sick leave service has not yet been implemented everywhere. Lack of funding and poor level of computer technology knowledge among ordinary registry employees slows down the implementation of the service.

How to get ELN

Let's consider what steps a sick employee must take in order to receive an electronic sick leave certificate. As already mentioned, such a certificate of incapacity for work is issued only upon a written application from the employee. This means that you need to inform your attending physician about your desire to receive an ELN and receive the appropriate application form from him. The employee must also inform the medical institution about SNILS.

After the doctor “closes” the sick leave, the medical organization will generate an electronic certificate of incapacity for work in the Unified IIS “Sotsstrakh”, and fill out its part in it (clause 3 and subclause “b” of clause 10 of the Rules, approved by Resolution No. 1567) . Next, the employee will receive a special coupon from the doctor, where the ELN number will be indicated. There is no need to collect additional signatures from medical workers or affix the medical institution’s seal to the sick leave form.

IMPORTANT. A coupon issued to an employee with an ELN number is not a strict reporting document. There is no need to give it to the employer - just give the sick leave number indicated on the coupon. As reported on the FSS website, this can be done in any way, including by telephone or via email. The coupon, where this number is indicated, is not a mandatory document for calculating and paying for sick leave. The employer should neither require it from the employee nor wait for the employee to provide it.

If an employee loses a ticket, he will need to take the following actions. First, register on the government services website, and then go to your personal account on the FSS website, where he can see the number of his electronic sick leave.

Can this be done without the participation of an employee?

To obtain a certificate of incapacity for work (in any form), a sick employee must personally appear at a medical institution .

Only there can they issue an ELN, which means personal presence is necessary.

The employer will also not have access to sick leave without a unique ELN code, known only to the employee.

However, you can transfer the code remotely:

- via SMS;

- telephone call;

- by mail.

Instructions for working with ENL for employers

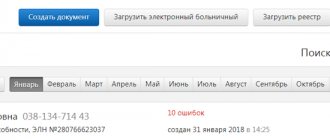

As soon as the employee has received information about the electronic sick leave number, the employer must begin taking the actions necessary to pay for it. First, using the selected software, you need to find this sick leave in the Social Insurance Unified Insurance Database. The search is carried out using the number provided by the employee and his SNILS.

After the electronic sick leave certificate has been found, it must be requested from the FSS database. In the received ENL, you need to fill in all the columns of the section “To be filled out by the employer” (subclause “c” of paragraph 11 of the Rules, approved by Resolution No. 1567). In their content, these columns are no different from the columns of a similar section of the paper version of the certificate of incapacity for work.

The completed document must be saved and certified with an electronic signature. After this, the data will automatically go to the Social Insurance Fund, and the employer will be able to pay benefits. This algorithm is valid in regions that have not yet switched to direct payments from the Social Insurance Fund as part of a pilot project (see “38 more regions will join the Social Insurance Fund pilot project for payment of benefits”).

Create electronic registers and submit them to the Social Insurance Fund via the Internet

From the message on the FSS website it follows that it is not necessary to print out the electronic tax record or create a copy of it on the employee’s computer or the organization’s server. Likewise, there is no need to store any information for each specific electronic sick leave.

The ELN benefit must be assigned within 10 calendar days from the day the employee presented his number (Clause 1, Article 15 of Law No. 255-FZ). The procedure for paying for electronic sick leave in those regions where the Social Insurance Fund has not yet assumed this responsibility is no different from paying for a traditional paper certificate of incapacity for work. The employer calculates the amount of the benefit and indicates it in the appropriate columns of the section of the certificate of incapacity for work that he fills out. The ELN benefit, as well as the paper sick leave benefit, must be paid along with the next salary (Clause 1, Article 15 of Law No. 255-FZ).

At the stage of benefit payment

Step 6. Submit information to the Social Insurance Fund for payment or reimbursement of benefits

The completed sick leave will instantly be sent to the Social Insurance Fund office at the insured person’s place of work. The Social Insurance Fund will take this information into account when calculating and checking benefits.

Further, the scenarios for calculating and paying benefits differ in different regions of Russia. Some regions are participating in the FSS pilot project “Direct Payments”, all of them are listed in Decree of the Government of the Russian Federation dated April 21, 2011 No. 294. In these regions, benefits are paid by the FSS directly to the employee. In other regions, benefits are calculated and paid to the employee by the employer. Let's consider scenarios for an accountant's work in both cases.

Credit system

Figure 1. Procedure for paying disability benefits under the offset system of insurance contributions.

With the credit scheme:

- Calculate the benefit and pay it to the employee with the nearest salary.

- The amount of expenses incurred to pay benefits can either be offset against social insurance contributions or reimbursed to the Social Insurance Fund. To receive a refund, you must go to the Social Insurance Fund office and provide an application or a certificate of calculation.

Direct payments

Figure 2. Procedure for paying disability benefits in the regions where the Direct Payments pilot project operates.

For direct payments:

- Use your accounting program to calculate the average earnings for the benefit.

- If the benefit for the first three days must be paid by the employer, calculate and include this part in the next salary.

- Prepare the register electronically (if you send data via the Internet) or fill out an application to the Social Insurance Fund on behalf of the employee (if you contact the Social Insurance Fund in person).

- Send the register to the FSS portal or take the application in person to the FSS office.

- Make sure that the employee receives the benefit: the Social Insurance Fund will pay it by bank or postal transfer.

Read more about the pilot project “Direct Payments”.

Report for employees through Kontur.Extern. Loading data into RSV from SZV-M. Importing data from 2-NDFL 5.06. Zero RSV in no time. Free for 3 months.

Register

Pros and cons of electronic sick leave

For policyholders, the transition to electronic insurance has undoubted advantages. These include:

- complete protection against payment for fake sick leave. The authenticity of the ELN is checked by the FSS at the stage of issuing the document by the medical institution. This means that the employer, when requesting an electronic sick leave using the number provided by the employee, receives a document for payment that has already been verified and approved by the Fund;

- no need to store sick leave certificates and present them during inspections. All information about ELN is always at the disposal of the FSS, which can check it without the participation of the organization. This means that you will not have to present electronic sick leave certificates during inspections. This is confirmed on the FSS website.

There are also conveniences for workers who issue electronic sick leaves. They can receive the appropriate payment faster, since in order to assign a benefit, they do not need to give the original document to the employer, but only need to provide its number. In addition, the electronic form of sick leave makes it impossible to lose or damage it. Finally, in the ENL there simply cannot be errors in indicating information about the employer, since the medical institution takes all the information from the Social Insurance Fund database.

As for the disadvantages of switching to a new system, perhaps the most significant of them at the moment is the lack of regulation of the procedure for correcting errors made by the employer when filling out his part of the electronic tax record. FSS specialists note that changes are not made to the electronic sick leave certificate itself, and all corrections are reflected “on paper” and stored by the employer. At the same time, software tools for working with electronic sick leave allow for correction of information in the electronic sick leave, including after the benefit has already been paid.

REFERENCE. The rules for making changes to the ENL are contained in the draft order of the Ministry of Health of Russia “On approval of the Procedure for generating certificates of incapacity for work in the form of an electronic document.” It provides for the possibility of re-sending a corrected electronic sick leave to the Social Insurance Unified Insurance System. In this case, the reason for the correction and the justification for the changes made must be indicated. All documents must be certified with the employer’s digital signature (clause 52 of the draft order).

Also, difficulties when working with electronic devices may arise due to technical failures in the functioning of the corresponding electronic systems. This leads to the inability to receive an electronic sick leave by number, fill it out or send it, etc. Judging by the information posted on the FSS website, errors in the operation of systems are quickly eliminated.

Practical conclusions

Let's summarize. The transition to working with electronic certificates of incapacity for work has positive aspects both for the employer (the risks of receiving fake sick leave are eliminated, as well as loss of documents during storage), and for employees (they can receive benefits faster). The disadvantages of working with ENL are currently associated with the technical side of the issue and the lack of sufficient regulation of some procedural issues. To eliminate these problems, new regulatory documents are being developed, the technical base is being improved and finalized.

In any case, today every employer has the right to decide on the issue of switching to ENL independently. If an organization does not want to use electronic sick leave, it can continue to assign benefits solely on the basis of paper certificates of incapacity for work. Current legislation does not oblige employers to provide work with electronic sick leave certificates, and does not establish any liability for those policyholders who have not connected to the Social Insurance Unified Insurance System.

Peculiarities of the procedure for calculating benefits on the basis of ELN

Features in the processing of ELN are due to the possibility of electronic processing. There are a lot of ways to process ENL: through the Foundation’s personal accounts, through the government services website, using accounting programs participating in the implementation of the ENL implementation project. It simplifies the receipt of sick leave, the calculation of payments, and the transfer of the ELN register to the FSS gateway.

The discovery of an electronic tax record in the FSS service already indicates the authenticity of the issued sheet and is subject to calculation.

To effectively process electronic sick leave, train your team, show them actions that reduce labor costs - then the speed and accuracy of working with electronic sick leave will increase.