Performing work functions outside the main place of work is a fairly common occurrence. This type of activity is called business travel. The employer is obliged to comply with the legislation on business trips: correctly formalize the assignment of an employee to work in another area, maintain his average earnings, and also compensate for all related expenses.

Let's take a closer look at how this happens in practice and what pitfalls arise for the employer and the worker.

What is considered a business trip?

A business trip is a trip by a company employee to carry out an official assignment outside the permanent place of work. This definition is enshrined in the Labor Code of the Russian Federation. Sending is carried out on the basis of the order of the employer. If a citizen holds a position that requires him to constantly perform work duties while traveling, this will not be considered a business trip.

If a company sends an employee to perform a work assignment in another city or country, the action must be carried out in strict accordance with the procedure determined by the government of the Russian Federation. The specifics of going on a business trip and other nuances relating to it are enshrined in Resolution No. 749 of October 13, 2008.

For your information

If a citizen is sent to a structural unit of an organization that is located abroad or in another locality, this will also be considered a business trip.

If an employee is sent to another city to perform a work assignment, the following actions must be completed:

- Management issues a corresponding order.

- The citizen is provided with an advance.

- Upon returning from a trip, the employee fills out reporting documents.

The Labor Code establishes a wide range of guarantees and compensations. Payroll during the performance of an official assignment outside the main place of business is carried out on the basis of the average income of the employee.

Daily allowance for one-day business trips

If a business trip lasts only one day, then the employee is not entitled to daily allowance. This is directly stated in paragraph 11 of the Business Travel Regulations. But many organizations and entrepreneurs still pay daily allowances even for one-day business trips. Do I need to pay personal income tax and contributions on them?

The Russian Ministry of Finance believes that everything depends on the availability of supporting documents. If the employee has submitted them, then the payment for a one-day business trip, although it cannot be considered per diem, can be classified as another category of travel expenses. Namely, to other costs agreed with the employer. Then the payment in full is exempt from income tax and contributions (letter dated May 17, 2018 No. 03-15-06/33309; see “Personal income tax on daily allowances for a one-day business trip: the Ministry of Finance has changed its position”).

A similar conclusion was made in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 11, 2012 No. 4357/12 (see “SAC: payments in lieu of daily allowances for one-day business trips are not subject to personal income tax”).

Duration of business trip according to the Labor Code of the Russian Federation

A business trip according to the Labor Code of the Russian Federation must have a strict duration. In accordance with the definition enshrined in the regulatory legal act, a citizen goes on a business trip to carry out the order of the company’s management. When a certain event occurs, the business trip must end.

Explanations regarding the duration of the trip are enshrined in paragraph 4 of regulation No. 749. It states that the day of departure and return are included in the total travel period. If departure is made before 23:59, this day will be considered the moment of departure. If the departure time is indicated on boarding tickets as 00:00 or later, the departure date will be considered the next day.

The duration of the trip depends on the instructions of the management. It is obliged to draw up an appropriate order. It is issued in writing. The order states:

- the purpose for which the citizen is sent to another entity or country;

- duration of the work assignment;

- other nuances concerning the specifics of performing assigned tasks.

Additional information

The law allows you to adjust the period depending on emerging circumstances. If the employee completed the task before the date specified in the order, he has the right to return to his permanent place of work. Illness or unforeseen delays in travel may cause an extension of the deadline for completing a work assignment. This fact must be documented. An additional order is issued to record the changes.

Memo: what documents are needed for a business trip

All documents can be divided into basic ones, which must be completed unconditionally for each trip, and additional ones, which are drawn up at will. Additional documents are drawn up if their use is stipulated in the internal acts of the organization.

Basic documents

- A business trip order is the main document that contains all the basic information about the trip: dates, purposes, etc. For this, a standard T-9 form or company letterhead can be used;

- Advance report - with the help of this document, the employee confirms the expenses incurred during the trip. For it, the standard AO-1 form is used, in which supporting documents must be attached.

Maximum duration

If you carefully read the Labor Code of the Russian Federation, there are no provisions in it regarding the maximum period of a business trip. In accordance with established standards, the period of a citizen’s stay on a trip is determined by the employer. In this case, the company must comply with the following requirements:

- draw up a written order that reflects the purpose of sending the citizen to another locality or country, as well as the approximate time frame for completing the official task;

- have a concluded agreement with the employee sent on the trip. If a person is not officially employed, he has the right to refuse to complete the assigned task.

- The employee's main duties should not be of a traveling nature.

Please note:

If the requirements are not met, it will not be possible to send a specialist to work in another city or country. It must be borne in mind that the trip cannot continue indefinitely. The deadline for its completion is the fulfillment of the employer’s instructions. In another situation, sending a specialist to another locality may be regarded as a transfer to another company. The rule is enshrined in Article 72.1 of the Labor Code of the Russian Federation.

Is it possible to combine a vacation with a business trip?

The law defines that annual paid leave is a period during which an employee is completely relieved from performing his duties. And if the employer needs to process a business trip during the period when the employee is on vacation, he must be recalled from vacation.

When performing this procedure, it must be taken into account that according to the Labor Code there are types of employees who are absolutely prohibited from being recalled. In addition, the employee must sign a written consent to the recall.

If it becomes necessary to recall an employee to go on a trip, you must do the following:

- Issue an order that will recall the employee from vacation;

- On the order, the employee must give written consent by checking the words “I do not object” in the column.

- Issue an order to go on a business trip.

- Provide daily allowances and other funds to cover expenses.

You also need to take into account that recall from vacation requires mandatory amendments to the vacation schedule. Therefore, it is important to immediately discuss with the employee at what time he will take the remaining unused days. If he wishes to go on annual leave immediately upon returning from a trip, this will need to be arranged again.

Attention!

Another important point that should not be forgotten is the recalculation of vacation pay. This can be omitted if the employee wants to take rest days immediately upon return, and these days are included in the current month. Otherwise, the excess amount will need to be returned to the cashier, or counted against daily allowance or future vacation pay.

Sending an employee on a business trip under the Labor Code of the Russian Federation

If you plan to send an employee on a business trip, you must complete a number of mandatory actions. The standard procedure is as follows:

- The employer approves the schedule.

- In accordance with the document, an order is issued. It records the date of departure for the trip and the purpose of the action. Additionally, a service assignment is issued. The result of the journey should be the completion of the assigned task.

- On the day specified in the order, the employee leaves the enterprise and goes to the specified destination. The day of departure is considered the day the business trip begins. The citizen is first given an advance to pay expenses. A note is placed on the time sheet indicating that the employee has been sent to perform a work assignment.

- A person carries out activities in a new place. When the work is completed, there is a return to the company.

- The employee submits a report on the work done. It may contain information about the completion of a work assignment or a negative result of the trip. In the latter situation, you will need to indicate the reasons.

- Upon returning to the main place of work, the citizen is obliged to submit payment documents confirming the intended use of the allocated funds.

Documenting

A local internal document recommended for enterprises and entrepreneurs by leading editors and auditors is the developed “Regulations on Business Travel”. In the document, it is important to specify the amount of daily allowance, document flow, how many days before the trip travel allowances are issued in part of the advance. Formally, an advance for the purchase of transport tickets can be issued immediately after the order is created.

Starting from 01/08/2015, a travel certificate, a job assignment and a business trip report are optional documents. The trip is regulated by the manager’s order and the advance report, which requires close attention and clarity when processing.

Business trip order

Documentation of a business trip begins with the execution of an order from the head of the enterprise, including:

- Full name and position of the employee;

- purpose of the trip;

- travel duration;

- locality;

- problems that need to be solved.

- An employer violates an employment contract: what should an employee do, how to sue

Based on the order, accounting considers travel days by number, issues daily allowances for them and pays the estimated costs of purchasing transport documents.

If a delay is necessary, the manager creates an additional order to extend the duration of the trip.

Advance report

Reflection of expenses in accounting, payment for a business trip and final payment to the accountable person are made on the basis of an advance report, which is submitted to the accounting department within 3 working days after arrival. Attached to the report are the accompanying documents:

- transport tickets;

- invoices, checks and receipts;

- commission fees;

- fee for obtaining documentation;

- currency exchange costs;

- luggage transportation and payment for luggage storage;

- residence documents;

- a copy of the international passport with border crossing marks;

- waybills when traveling by road and receipts from gas stations.

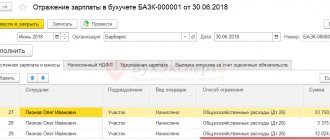

After the report is checked by the accountant and approved by the manager, the overexpenditure of funds is returned to the enterprise's cash desk, and the debt is paid to the employee. If the business trip is a moving one, in which month the expenses should be accrued and reflected in accounting is evidenced by the date of approval of the report, which forms the accounting entries.

Payment

The specifics of payment for business trips are reflected in Article 167 of the Labor Code of the Russian Federation. It states that employees are paid based on their average daily earnings. Cash is accrued for each day of absence from work. To calculate the average daily income, the calendar year that precedes the period of departure of the trip is taken into account.

If a person has been working for a company for less than a year, income for the period worked is taken into account when determining average earnings. This calculation scheme is used even if a citizen works for a company for only a few days. When determining average daily earnings, the following are not taken into account:

- Holiday to care for the child;

- disability benefits;

- payments for downtime days;

- other monetary payments that the employee received without working.

Additional information

To determine the average daily earnings, an authorized employee sums up all income for the period and divides it by the number of days during which the citizen performed work. The total value is multiplied by the period during which the person will be on a business trip. This amount of money will be provided to the employee for the trip. If the resulting amount is less than the usual daily income, the company has the right to pay the employee additionally. The fact of providing additional funds is recorded by local acts. If the resulting amount exceeds the usual daily income, the calculation of travel allowances is based on this indicator.

Calculation of travel allowances

Funds issued on account to an employee during business trips abroad can be either in Russian rubles or in the currency of the country where the employee is sent. After arrival, recalculation is made at the National Bank rate. There are also a number of nuances when traveling for different periods.

One day business trip

Since the minimum duration of a business trip is not established by law, the employer has the right to send an employee to another locality for one day. If the connection with economic activity is confirmed, such a trip is recognized as a business trip with payment for travel.

The nuances compared to the usual ones are that for a one-day business trip, daily allowances within Russia are not provided, and for an overseas trip - no more than 50% of the amounts established by local documents.

Formally, it turns out that the company cannot pay compensation without being subject to personal income tax and social contributions. The recommendation is to create a clause in internal documents that explains the employee’s lack of economic benefit, thereby avoiding personal income tax. Indirect confirmation in support of this position is the letter of the Ministry of Finance of the Russian Federation dated March 1, 2013 No. 03-04-07/6189.

Business trip exceeding daily allowance

An enterprise, by means of an internal administrative document, has the right to standardize the amount of daily allowance, both downward and upward. The specific amount is fixed in the employment contract with the employee and can be differentiated among employees.

For example, an employee left for a business trip on 10/05/2018 at 23.15, and arrived on 10/14/2018 at 00.45, the daily allowance according to the internal regulations is 900 rubles. Then:

- The number of days is 10, since 05.10 and 14.10 are included in the calculation.

- Daily allowance exceeding the limit: (900-700)*10=2000 rubles;

- Personal income tax: 2000*0.13=260 rubles.

In addition to personal income tax, it is necessary to accrue taxes on daily allowances in excess of the limit to social funds except for injuries, and not include them in expenses that form taxable profit.

To fully calculate travel allowances, you need to add documented expenses associated with financial and economic activities.

Rotating business trip

In practice, situations often arise when an employee goes on a business trip in one month and returns in another reporting period. If the trip goes to the next month, how to pay for the business trip, when and in what amount should it be included in expenses? Are there any restrictions on paying an advance? – questions that arise for accountants.

Example

For example, a production worker left on September 28, 2018 for a neighboring locality, and arrived on October 3, 2018 according to the order. He presented a transport ticket dated September 28 for departure in the amount of 1,500 rubles excluding VAT and dated October 3 for entry in the amount of 1,400 rubles, and a hotel bill for the amount of 5,000 rubles. On September 27, 2018, he was given an advance in the amount of 6,000 rubles in cash. The daily allowance is 500 rubles according to the employment contract. The report was submitted on October 4, 2018.

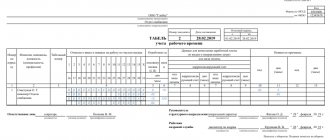

The accounting entries are shown in the table:

| date | Dt | CT | Sum | Operation |

| 27.09.2018 | 71 | 50 | 6000 rub. | An advance was issued for a business trip |

| 04.10.2018 | 20 | 71 | 500*6+1500+1400+5000=10900 rub. | Advance report approved |

| 04.10.2018 | 71 | 50 | 10900-6000=4900 rub. | Final calculation made |

Cancellation of a business trip

The Labor Code allows some categories of citizens to refuse to go on a business trip. According to the Labor Code of the Russian Federation, the employer is obliged to request written confirmation of consent to travel from the following employees:

- women raising children under 3 years of age;

- persons who are guardians of minor children;

- workers who raise children under 5 years of age without the help of a spouse;

- citizens whose family has a disabled child or a relative suffering from a serious illness and in need of care.

IMPORTANT

If an employer draws up an order without obtaining the consent of the above categories of citizens, this will be a direct violation of the norms of the Labor Code of the Russian Federation.

Is it possible to refuse

Business travel is part of the company’s technological process. An employee is sent to perform this type of work by order of the employer. Unreasonable refusal to travel may be regarded as a violation of labor discipline with ensuing disciplinary consequences.

But here it is worth highlighting some nuances. In particular, at the legislative level, a list of persons who are prohibited from being sent on long trips outside the main workplace has been established. This:

- minor workers (under 18 years of age);

- pregnant women (who have officially notified their employer of their situation and provided the appropriate medical document);

- disabled people (1st and 2nd disability groups);

- apprentices (employed at the enterprise under an apprenticeship agreement).

In addition, there is a category of persons who can be sent on business only with their consent. This included:

- mothers whose babies are under 3 years old;

- single parents with minor children;

- raising disabled children;

- caring for a sick relative based on a medical certificate;

- guardians of minors.

Among the valid reasons for refusing business trips for other workers are the following:

- Disease. This could be being on sick leave, or some kind of chronic disease associated with traveling to another area, or being in harmful or dangerous conditions.

- Accident.

- Family circumstances. This category includes a wedding, a funeral, the need to eliminate domestic problems (a broken water pipe in the house).

Remember, groundless refusal to travel is fraught with disciplinary action. Therefore, it is necessary to have a valid reason why you cannot leave your main workplace.

Business trip on a day off

A person may be sent to another city to complete a task for a long period of time. Often the period of being away from a permanent workplace falls on weekends. The law does not oblige employees to carry out work activities during the required rest period. A citizen has the right to use a day off in accordance with the standard schedule.

However, working on weekends is also not prohibited by the Labor Code. As compensation, time off or a change in wages will be provided. Payment for days off worked is doubled. The fact of carrying out labor activity during the period of required rest must be documented. The citizen will have to provide supporting documents to the organization’s accounting department. Information about work on weekends is entered into the work report sheet. Additionally, the fact is reflected in the order.

What does the labor law guarantee?

By sending a colleague on a business trip, the company guarantees that he will retain his position and salary. During the business trip, the employee is paid an average salary.

An employee sent on a business trip will be paid for travel to the destination, compensated for accommodation and will be reimbursed for all expenses for living away from home (daily allowance), as well as other expenses permitted by management (communication services, for example). During the entire period of business trip and travel time (and forced delays), the employee retains his average earnings according to the schedule established at his permanent place of work. Going to work on weekends and holidays during a business trip is paid according to law.

Payment for business trips on weekends under the Labor Code of the Russian Federation

Attention:

If a person is forced to work on weekends, the company is obliged to provide double pay for this period.

The rule also applies during a business trip. It is recorded in Article 139 of the Labor Code of the Russian Federation. If the day off falls on the day of arrival or departure from a business trip, the employee also has the right to qualify for increased pay.

Payment will be provided only if there is documented evidence of work activity during the required rest period. If the employer finds out that the employee will be forced to work during the day off, this fact must be reflected in the order in advance. In addition to basic information, the document must contain the reasons that led to the need to complete the task at an inappropriate time.

Additional Information

It must be taken into account that increased pay is provided only for the period of time actually worked. If a citizen rested on a day off while on a business trip, he does not have the right to claim an increase in the amount of payment for the business trip.

How to arrange a business trip for an employee in 2019: instructions for an accountant

Step 1. Create a business trip order

In order to make a business trip order, you can use standard forms T-9, T-9a, or do it on company letterhead in a free style.

Previously, an official assignment was used to draw up an order, which was indicated as the basis. Now, in that column, data about the manager’s order, memo is recorded, or this field remains empty.

The employee for whom the order was drawn up gets acquainted with it and signs it.

Attention!

If you use your own transport for a business trip, then this must be included in the existing order, or an additional order must be issued.

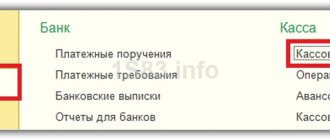

Step 2. Issue money for reporting

When going on a business trip, the employee must receive funds from the cashier to pay for tickets, rental housing and other expenses, as well as daily allowance for each day of the trip.

The amount within which these expenses are paid must be established in a local act.

The basis for an employee to receive funds is a business trip order. Also, the employee himself can draw up a memo for the expected amount of expenses, but it must be signed by the manager.

When traveling within the country, funds in rubles can be issued from the cash register or transferred to a bank card.

Attention!

If a business trip abroad is required, then the daily allowance for the days when the employee will be in Russia is issued in rubles, and for the days of stay on the territory of a foreign state - in its currency.

See more details - Daily allowances for business trips abroad in 2021, norms and accounting.

Step 3. Create a travel document (if necessary)

If this step is specified in local regulations, then when a business trip is processed, you need to draw up a travel certificate. Depending on which form is used in the company, it may also include a report on the work performed, calculation of daily allowances, and travel assignments for the employee.

The need to compile a log of those departing on a business trip has also been abolished. Firms can continue to use it at their discretion. But first they need to secure the form of the magazine.

Typically, the log includes the following information:

- Personal information about the employee;

- The name of the company to which he is leaving;

- Name of the locality;

- Departure and arrival dates;

- A note indicating receipt of the report by the accounting department.

Attention!

The travel certificate has space for affixing stamps from the receiving party. But their presence is now not mandatory in the document, since the document is not mandatory.

Step 4. Complete and submit an advance report

Within three days from the fact of returning from the trip, the employee needs to write and submit to the accounting department an advance report on the AO-1 form. If this is indicated in the internal acts of the company, then along with the advance report it is also necessary to draw up and submit a report on the work done.

This is drawn up in any form, on a form that was created in the company, or for the report, column 12 is used in the official assignment form for a business trip T-10a, if it was created when the business trip was processed.

Documents are attached to the advance payment, with the help of which the employee can confirm the expenses incurred, they include:

- Documents used to rent accommodation for a trip - a hotel bill, a receipt that contains the number of days of stay and the cost per day, or a rental agreement for a private house or apartment.

- Documents that can be used to confirm travel to and from a business trip - tickets, boarding passes, checks, receipts for receiving a bed, etc.

- Documents confirming the hire of a taxi - checks, tickets, forms.

- An official note with a breakdown of expenses if the employee used personal transport - waybills, receipts from gas stations, etc.

- An official note when the employee cannot provide documents confirming accommodation or travel;

- Documents confirming other expenses (for example, a receipt for communication services).

Attention!

When submitting the expense report to the accounting department, the accountant makes a mark on the tear-off spine and hands it to the employee. This is necessary to confirm that the employee has submitted documents to the accounting department.

Step 5. Return unused amounts to the cashier (if any remain)

If, upon returning from a trip, an employee has money left over, he must return it to the cashier within 3 days from the date of his preparation of the advance report. A cash receipt order is provided for this operation.

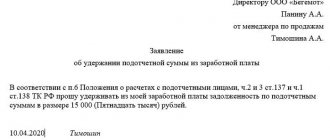

According to the law, the employer has the right to withhold this amount from the employee’s salary, but only if a month has not yet passed since the end of the period for voluntary return. When a month has passed, it is possible to make a deduction only by drawing up a court decision.

You might be interested in:

An employee took a taxi on a business trip - is it possible to deduct these expenses?

The employee may also voluntarily agree to have the debt deducted from their salary. To do this, he needs to write a statement. Based on this document, a retention order is created. It must be remembered that the amount of funds withheld cannot exceed 20% of the salary accrued for that month.

Step 6. Compensate for overspending by the employee (if necessary)

A situation may arise that during a trip an employee spent more money than he was given. In this case, you must first check his expense report. If the expenses were justified, then they are subject to compensation by issuing funds from the cash register according to an expense cash order.

To determine the validity of the overspending, it is necessary to examine:

- Whether the costs were incurred for urgent reasons;

- Are there documents for these costs, and are they drawn up correctly;

- Correct writing of the expense report.

Attention!

Excess amounts must be issued within three days from the date of submission of the report. Otherwise, the employee has the right to go to court to recover from the employer not only these amounts, but also interest for their use.

If the organization is unable to repay the entire amount, it is advisable to draw up a repayment schedule, which must be signed by both parties.

Nuances

There are a number of additional nuances that employees and employers should remember. Often employees feel that they are sent on trips too often. However, the Labor Code does not impose restrictions on the number of business trips. In this case, the length of the working day must be respected and days off must be provided.

Foreign employees may also be sent on travel, but provided that they have permission to carry out activities in the territory in which the official task will be performed. If there is no patent, the duration of the trip cannot exceed 10 days. If the employee is highly qualified, he has the right to work without permission for 1 month. For representatives of creative professions, the restriction is lifted.

Comments Showing 0 of 0

The nuances of business trips and who should not be sent

Quite often, when sending employees on a business trip, nuances arise that can be difficult to understand.

So, for example, the question arises of how an employee’s business trip is paid for. According to the current rules, if an employee is sent on a business trip, he retains his average daily earnings.

In addition, there are cases when an employee working part-time is sent on a business trip. In this case, the procedure for business trips and payment of expenses is carried out on the same basis as for other employees of the organization. If an employee is sent on a business trip from both workplaces, then the average salary is maintained for all positions occupied. If the decision to travel was made by only one employer, then at the second place of work you will have to take free or paid leave.

There are cases when an employee who is a foreign citizen is sent on a trip. Such employees can only work in the territory of the subject of the Russian Federation where they received a patent.

Foreign employees can be sent on business trips to other constituent entities of the Russian Federation for a maximum period of up to 40 days during each year.

As for business trips abroad, in this case there are no such restrictions.

It is also possible that a posted employee is fired due to the fact that, for example, he did not start completing the task in a timely manner or interrupted his official trip. To fire an employee who has been sent on a business trip for a long period of time, you must first recall him. At the same time, the employer must receive clarification regarding the current situation, as well as return the remaining advance funds.

No one is immune from death that may occur during a business trip. According to Article 184 of the Labor Code, all costs associated with determining the cause of death of an employee can be taken into account as expenses, due to which the tax base can be reduced.

As for the question of who is prohibited from being sent on a business trip, in accordance with current labor legislation, these can only be full-time employees with whom a contract has been concluded.

However, there are some limitations to this rule. Thus, it is prohibited to send on a business trip:

- women bearing a child;

- minor employees;

- employees with whom a student contract has been signed.

Question No. 2: are the constant trips of a freight forwarder a business trip?

Answer: no, not a business trip.

This conclusion follows from Article 166 of the Labor Code. It states that business trips of employees whose permanent work involves traveling (couriers, direct sales employees, plumbers, electricians providing services to the public), or who are on the road (drivers, conductors, pilots, machinists, forwarders) are not recognized as business trips .

Accordingly, such employees do not need to issue a travel certificate for each trip and pay daily allowances. This rule works even if the trip is to another city and for several days (for example, in the case of freight forwarders).