Home / Labor Law / Payment and benefits / Vacation payments

Back

Published: 05/06/2016

Reading time: 6 min

0

1041

All cash payments transferred by the head of an organization or an individual entrepreneur to employees must be subject to personal income tax. Amounts paid to employees going on vacation are also considered income and, therefore, are subject to personal income tax.

The role of the employer in this situation is to collect personal income tax and transfer it to the state budget. This is done by the employer, not the tax agent! Difficulties arise in this situation because the payment of personal income tax on vacation pay does not have a sufficient legislative basis.

According to the Tax Code of the Russian Federation, the moment of receipt of income is the day of payment of vacation pay, or their transfer to the taxpayer’s bank account.

- How are personal income tax holiday payments reflected in accounting entries?

- When should the withheld tax be transferred to the budget? Vacation pay is paid in cash from cash proceeds

- Vacation pay is paid in cash from the taxpayer's current account

- Vacation pay is paid by bank transfer

When and how to pay personal income tax

There are vacation pay, and there is compensation for unused vacation. Both are subject to personal income tax. The tax rate is 13% for Russians and 30% for foreigners.

How to issue vacation pay

Vacation pay tax is calculated in the same way as salary tax:

Articles on the topic (click to view)

- Fine for late payment of vacation pay

- What to do with unused vacation

- What to do if your employer does not pay vacation pay

- How long after employment is vacation allowed?

- Is maternity leave taken into account when calculating pensions?

- Accounting for compensation for unused vacation

- Dismissal while on maternity leave

With this money Nikolai goes on vacation.

Personal income tax must be calculated and withheld on the day the employee receives the money. And you can transfer it to the tax office later:

- Tax on vacation pay can be paid immediately when the money is given to the employee or on any day before the end of the month. Vacation pay was issued on March 10, which means that personal income tax must be transferred by March 31;

- Tax on vacation compensation is paid on the day the employee received the money or at most the next day. On the same day if paid in cash at the cash desk, the next day if by transfer to a card.

There are penalties for delay - 20% of the tax. We advise you to transfer money to the tax office immediately so as not to forget.

Fixation of vacation pay in 2 personal income taxes

All tax amounts that must be withheld from an individual’s income are included in his personal personal income tax certificate 2. Vacation pay is taxable income and is recorded in the report according to the month of transfer to the employee.

An example of what a completed certificate looks like:

Take into account! Each employee has the right to apply to the employer for a certificate of income. The employer is obliged to provide the document within 3 days from the date of the person’s application. The rule applies to current and former employees.

You can order a certificate online through the taxpayer’s personal account on the website of the Federal Tax Service of Russia.

Fixation of compensation for unused vacation in 2 personal income taxes

Taxes on vacation pay received for unused rest days due to dismissal or refusal of additional days are recorded in certificate 2 of personal income tax under code 2013.

How to calculate insurance premiums

Employers pay insurance premiums for employees. They go toward free healthcare, pensions, and in case of work-related injuries.

How to save on employee contributions

The contribution amount is 30% of the salaries of all employees. Contributions are not withheld from wages as personal income tax; they are paid by the employer.

They are distributed like this:

- pension insurance - 22%;

- compulsory health insurance - 5.1%;

- social insurance - 2.9%.

In addition to these 30%, they also pay contributions in case of injuries and occupational diseases - from 0.2% to 8.5%.

This is important to know: Contract for the period of maternity leave: sample 2021

All contributions, except contributions for injuries, are transferred to the tax office. Injuries are listed in social insurance.

If an employee goes on vacation, insurance premiums are paid as usual - only vacation pay is added to the salary.

For each type of contribution you will have to fill out a separate payment form, so you will also have to count it separately. An approximate calculation is:

Salmon's accountant will enter these figures into the payment slips - one for each type of contribution.

UTII

If an organization pays UTII, the payment of vacation pay will not affect the calculation of tax in any way. UTII is calculated based on imputed income (clauses 1, 2, Article 346.29 of the Tax Code of the Russian Federation).

However, the amount of UTII can be reduced by the amount of contributions to pension (social, medical) insurance and contributions to insurance against accidents and occupational diseases, which are paid from vacation pay (clause 2 of Article 346.32 of the Tax Code of the Russian Federation). At the same time, observe the restriction: the total amount of the deduction should not exceed 50 percent of the UTII amount. This is stated in paragraph 2 of Article 346.32 of the Tax Code of the Russian Federation.

When to pay contributions from vacation pay

Contributions are calculated in the same month when vacation pay is issued. You can transfer contributions to tax and social security later - until the 15th of the next month. The same goes for vacation compensation.

Nikolai received vacation pay at the end of February, and went on vacation on March 8. Kirill’s employer calculates contributions for February and pays until March 15th.

There are holiday pay from which you do not need to pay insurance premiums:

- additional Chernobyl leave;

- leave for sanatorium treatment of an employee who has suffered an accident at work or an occupational illness.

Now let's move on to the payment.

Personal income tax when recalling an employee from vacation

There are often cases when an employee on vacation is called back to work. By law, recall from vacation must be formalized by order based on the employee’s consent. The order must reflect the use of the remainder of the employee’s vacation and notify him under signature or transfer the remainder of the vacation to the next year.

In such a situation, the amount of vacation pay paid is higher than expected, that is, it must be recalculated. For the days of vacation when the employee works, he will be paid a salary, and the employee’s excessively accrued vacation pay will be returned from his salary.

So, just like upon dismissal, personal income tax will be charged on vacation pay, which in most cases has already been listed and will need to be recalculated. In this case, the employee remains to work and the registration is offset as a result of recalculation. The tax agent issues a reversal of previously accrued vacation pay and personal income tax, and wages will be accrued for the days worked and personal income tax will be calculated .

What taxes are withheld from vacation pay?

In addition to the right to annual paid leave of standard duration, labor and social security legislation provides for other types of paid leave. Depending on the classification (purpose) of leave, the rules for assessing payments due to the employee with taxes and contributions also change:

Is the payment taxable?

Annual paid vacation

in connection with pregnancy and childbirth

in connection with adoption

Thus, we can clearly determine the general principle of taxation of vacation payments:

- If the vacation was paid by the employer, then the amount of vacation pay is subject to taxes.

- If the payment was made at the expense of the Social Insurance Fund, then payments for vacation are not subject to taxes.

Read more about the calculation and payment of insurance premiums from workers' vacation pay in this material.

Answers to common questions

Question No. 1 : Some organizations pay financial assistance in addition to vacation pay. Should it be considered income and personal income tax withheld from it?

Answer : According to Art. 217 of the Tax Code of the Russian Federation, any material assistance issued to employees is not subject to personal income tax when paying up to 4,000 rubles in total per year.

Question No. 2 : Is it necessary to charge personal income tax on vacation pay to non-residents?

Answer : Non-residents also receive income on which personal income tax must be withheld at 30%. The exception is citizens of the EAEU, refugees and non-residents - highly qualified specialists, whose personal income tax rate is 13%.

Rules for calculating and transferring income tax on vacation pay in 2021

The tax rate for personal income tax on vacation pay corresponds to Art. 224 of the Tax Code of the Russian Federation and amounts to:

- for residents of the Russian Federation - 13%;

- for non-residents - 30%.

Personal income tax is withheld from the amount of vacation pay on the day of payment. The deadline for tax remittance is set for the last day of the month in which the employee’s vacation was paid.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

This rule applies not only to vacations that fall within one month entirely. If an employee’s vacation is divided between two or more months, then income tax is still withheld and transferred in the month in which the employee’s payment falls.

Read more about the nuances of transferring personal income tax in our article “What is the procedure for paying personal income tax on vacation pay in 2019?”

Holiday pay accounting

Vacation pay is included in the remuneration system and is designated in accounting and tax accounting with the code 2012. Personal income tax must be transferred as payments are made during the month in which the employee received money for vacation.

Vacation pay is included in the calculation of the financial result for income tax.

Example

When transferring personal income tax to the budget, it is necessary to record the date of the transaction in order to correctly reflect it in the calculation of 6 personal income taxes. This document has 2 sections:

- first - amounts are recorded on an accrual basis from the beginning of the year;

- second – the amounts for the last quarter are recorded.

Dates are indicated on an accrual basis. For example, if accrual and payment were made in January, then in both sections 6 of personal income tax they will be indicated identically. It is easy to calculate the amounts due using special software.

Tax deduction from vacation pay

The use of tax deductions when calculating income tax on vacation pay is one of the most insidious aspects in the procedure for calculating the amounts due for payment.

Since a standard or social deduction is applied on a monthly basis, the fixed amount of such a deduction reduces the tax base only in the period in which the payment to the employee occurred. Here's an example:

Salary tax: (10,400.00 – 1,400.00) × 13% = RUB 1,170.00.

Total personal income tax: 1,170.00 + 2,723.50 = 3,893.50 rubles,

Of this amount, the first part of the tax (1,170.00 rubles) must be transferred - if the salary payment is due by the 10th day of the next month - by 06/11/2019 inclusive, and the second part - by 05/31/2019.

Reflection of money for vacation in the calculation of 6 personal income taxes

Vacation pay is not considered salary or other monetary remuneration for work.

The date of receipt of such income is considered the day on which the worker is paid such money in fact - transferred to a card or given through a cash register (letter of the Ministry of Finance of the Russian Federation No. 2187 dated January 26, 2015, Article 223 of the Tax Code of the Russian Federation). At the same time, personal income tax is withheld from vacation money. This is done before the end of a certain month by paying a specific amount of vacation pay (Article 226 of the Tax Code of the Russian Federation).

When preparing a unified calculation of 6-NDFL in Section 1 of this document, the accrued specific amount of vacation pay is combined with other monthly income. In Section 2, money for vacation is separated from salaries (clause 4.2 of Appendix No. 2 from Order of the Federal Tax Service of the Russian Federation No. 450 of October 14, 2015). In this situation, additional lines are allocated and then filled in separately for each payment.

Vacation benefits are paid regardless of the date of payroll. This money is reflected in separate specific lines of Section 2 of form 6-NDFL. This is done for reasons:

- due to a discrepancy between the specific date of accrual of annual vacation pay and monthly salary;

- when applying a separate procedure for transferring income tax amounts from money for vacation on one of these days - the 28th, 30th or 31st of the month.

Money for annual leave is paid along with the monthly salary. This is done when specific calendar days coincide or, in particular, when paying annual leave with the subsequent dismissal of an employee.

Letter of the Ministry of Finance dated January 26, 2015 No. 03-04-06/2187 “On determining the date of receipt of income in the form of vacation pay for personal income tax purposes”

Read also: Accounting for settlements with contractors

Example

Money for vacation and salary was transferred to the worker’s salary card on March 31. The date of transfer of this money and the day of personal income tax deduction coincided.

In this situation, a specific amount of tax from the monthly salary is paid on working Monday or another next day, and money for vacation is issued on March 31. Then, in the unified form 6-NDFL, the payment period for a certain amount of vacation pay and wages is indicated in separate specific lines of Section 2.

How to fill out a payment order

Payment of personal income tax on vacation pay is indicated in a separate payment order. This document is filled out according to the rules from the order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013 and on the form according to form 0401060. In field 101 indicate code 02. In field 104 the following BCC is written - 182 1 0100 110.

Attention! The specific KBK code is found in the service from the Glavbukh System - on the website www.1gl.ru/about/.

Field 106 indicates the type of payment, and field 107 indicates the period for which personal income tax is paid. For example, when transferring to the tax office a specific amount of tax on vacation money for January 2021, the following entry is made in field 107 - MS.01.2021.

Fields 109 and 108 are filled with zeros. Field 110 is left blank.

Sample of filling out a payment order

Form 0401060

Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation”

How and where are carryover vacation pay reflected and their amounts after recalculation?

The 6-NDFL calculation reflects all types of annual vacation pay, including those that transfer to another specific month. This is done this way:

- First, vacation pay and the specific amount of personal income tax are calculated. This is done in accordance with certain dates for accrual and payment of this money in fact;

- The amounts received are recorded in Section 1 of the calculation;

- They reflect the payment of money for vacation in Section 2. In this place, indicate the date of transfer of this money and the deadline for paying a specific amount of personal income tax on it.

Recalculation of annual vacation pay is performed in 2 situations:

- when you provide incorrect information. In this situation, an updated (additional) 6-NDFL report is drawn up, in which reliable information on money for vacation is entered;

- upon dismissal or recall from annual leave, as well as upon untimely transfer of specific amounts of vacation pay. Changes in the amount of such payments and the tax on them are entered into specific calculation lines for the month in which the recalculation is made.

Important! According to the letter of the Federal Tax Service of Russia No. 9248 dated May 24, 2021, the amount of carryover vacation pay is indicated in form 6-NDFL upon the fact of their payment, and not according to the period in which they are accrued.

Letter of the Federal Tax Service dated May 24, 2021 No. BS-4-11/9248 “On the issue of filling out form 6-NDFL”

An example of form 6 personal income tax

Below is an example of how to correctly fill out the 6-NDFL calculation with vacation pay.

At Titan LLC, 2 workers were paid the following money for annual leave:

- August 15 - 17 thousand rubles. At the same time, personal income tax was charged in the amount of 2,210 rubles;

- August 22 - 23 thousand rubles. In this situation, income tax is 2990 rubles.

In 9 months paid 2 million rubles. salaries, applied deductions of 50 thousand rubles. Also, during this period, personal income tax was charged in the amount of 253,500 rubles, and withheld 230,500 rubles. tax

In this situation, in Section 1 of the unified form 6-NDFL, 2 workers entered vacation payments and the above salaries on line 020 (2 million rubles + 23 thousand rubles + 17 thousand rubles = 2 million 40 thousand rubles .).

Read also: Benefits and compensation for harmful working conditions

The amount of a certain accrued personal income tax was indicated on line 040 (2,990 rubles + 2,210 rubles + 253,500 rubles = 258,700 rubles), and the amount of such tax withheld was indicated on line 070 (2,990 rubles + 2,210 rubles. + 230,050 rub.) = 235,700 rub.).

In Section 2 of the report, the corresponding entries were made in the lines below:

- pp. 100, 130 - indicated the date of payment of annual vacation pay to workers (08/15/2016), and their amount (RUB 17,000);

- pp. 110, 140 - entered information about the day of withholding of accrued income tax (08/15/2016) and its amount (2210 rubles);

- page 120 - indicated the date of transfer of a certain amount of tax to the INFS (08/31/2016).

In the same way, fill out the lines for the second accrued specific personal income tax amount:

- pp. 100, 130 - indicated the date of payment of vacation money to the second employee (08/22/2016) and their amount (23,000 rubles);

- pp. 110, 140 - date of withholding (08/22/2016) and the amount of personal income tax (RUB 2990);

- page 120 - date of personal income tax payment (08/31/2016).

Attention! If the unified form 6-NDFL is correctly completed, the specific amount of vacation pay along with the monthly salary is prescribed in Section 1. In Section 2 of this document, vacation payments are separated from other various incomes.

Results

An employee's vacation, paid for by the employer, is subject to personal income tax and contributions in the same way as wages. Only the tax payment deadline changes. The main thing is to correctly determine the month in which personal income tax is withheld and transferred. Then the rules for calculating and applying tax deductions are quite logical.

Each employee is entitled to annual paid leave (Article 114 of the Labor Code of the Russian Federation).

No later than 3 days before its start, the employee must be paid vacation pay (Article 136 of the Labor Code of the Russian Federation).

Insurance premiums are charged on vacation pay (including “for injuries”), since vacation pay is recognized as an object of taxation and is not included in the list of non-taxable payments (Part 1 of Art.

7, art. 9 of the Law of July 24, 2009 N 212-FZ, paragraph.

1 tbsp. 20.1, art.

This is important to know: Leave before maternity leave: how much is required in 2021

20.2 of the Law of July 24, 1998 N 125-FZ).

Rules for calculating personal income tax.

The personal income tax rate is regulated by Article 224 of the Tax Code. Residents of the Russian Federation pay 13% of income.

Accordingly, vacation pay is equal to income. 13% is subtracted from the full amount and sent to the tax office no later than the last day of the month.

For non-residents of the Russian Federation, the tax is higher, it is 30% of income. The transfer rules remain unchanged. Only the amount of payments differs.

Is compensation for unused vacation subject to contributions?

If an employee who has unused vacation days leaves an organization, he may be paid compensation for them (Article 127 of the Labor Code of the Russian Federation). Insurance premiums for compensation upon dismissal are calculated in the general manner as from the payment transferred to the employee within the framework of the labor relationship (Part 1, Article 7, subparagraph “d”, paragraph 2, part 1, Article 9 of the Law of July 24, 2009 N 212- Federal Law, paragraph 1, 2 article 20.1, paragraph 2 paragraph 1 article 20.2 of the Law of July 24, 1998 N 125-FZ).

Each employee can exercise their right to vacation once a year, that is, after working for 11 months. This vacation is paid.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The employer is obliged to calculate and pay vacation pay to employees. This compensation serves as financial support for the employee during the period of absence from work.

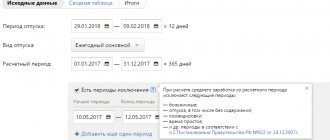

Vacation pay is calculated based on 3 factors:

- duration of vacation;

- the employee's average daily earnings;

- billing period.

The key role is played by the employee’s income received in the billing period. When calculating, not only salary is taken into account, but also bonuses, allowances, etc.

Vacation pay is paid 3 days before going on vacation. Violation of this norm may become the basis for filing a complaint with the labor inspectorate against the employer’s actions.

Before paying vacation pay, personal income tax is withheld from them in accordance with the rules of the Tax Code of the Russian Federation.

Income tax

Consider the amounts of vacation pay as part of labor costs (clause 7 of Article 255 of the Tax Code of the Russian Federation).

The write-off of expenses for rolling leave and the insurance premiums accrued from them in tax accounting depends on the method of accounting for income and expenses that the organization uses.

When using the cash method, include vacation pay in expenses at the time of actual payment to the employee (subclause 1, clause 3, article 273 of the Tax Code of the Russian Federation). Contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases will also reduce tax profit at the time of their payment (subclause 3, clause 3, article 273 of the Tax Code of the Russian Federation).

Situation: how to take into account vacation pay when calculating income tax if vacation days fall in different reporting (tax) periods? The organization uses the accrual method.

Include the amount of vacation pay in expenses in proportion to the vacation days falling on each period.

It is explained like this. Vacation pay refers to labor costs (Clause 7, Article 255 of the Tax Code of the Russian Federation). And such payments are the same salary, only paid in advance. This means that a general principle applies to vacation pay: they are recognized as expenses in the reporting (tax) period to which they relate, regardless of the time of actual payment (clause 1 of Article 272 of the Tax Code of the Russian Federation).

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated June 9, 2014 No. 03-03-RZ/27643, dated January 9, 2014 No. 03-03-06/1/42, dated July 23, 2012 No. 03-03 -06/1/356.

For example, an organization has a profit tax reporting period of the first quarter, half a year and nine months. If vacation falls in September and October, then vacation pay must be distributed. The amount of vacation pay relating to September is included in expenses for nine months. The portion of vacation pay attributable to vacation days falling in October is included in expenses for the year. If the vacation falls entirely within one quarter, then there is no need to distribute vacation pay. An exception is organizations that report income taxes on a monthly basis. They must share the costs of the vacation carried over to the next month in any case.

Advice: there are arguments that allow organizations to take vacation pay into account when calculating income tax at a time in the month of accrual, regardless of whether the vacation falls on one or more reporting (tax) periods. They are as follows.

The entire amount of vacation pay must be paid to the employee no later than three days before the start of the vacation (Part 9 of Article 136 of the Labor Code of the Russian Federation). From which we can conclude that vacation pay is accrued and paid to the employee at a time, regardless of whether his vacation falls on one or more reporting (tax) periods. It turns out that in tax accounting the amount of vacation pay should be taken into account as expenses during the accrual period in full (clause 4 of Article 272 of the Tax Code of the Russian Federation). There is no need to distribute this amount in proportion to vacation days. This point of view is also confirmed by arbitration practice (see, for example, decisions of the Federal Antimonopoly Service of the West Siberian District dated November 7, 2012 No. A27-14271/2011, dated December 1, 2008 No. F04-7507/2008(16957-A46-15 ), dated January 23, 2008 No. F04-222/2008(688-A27-37), Moscow District dated June 24, 2009 No. KA-A40/4219-09, Volga District dated November 14, 2008 No. A55- 4199/2008).

Similar conclusions are contained in the letter of the Federal Tax Service of Russia dated March 6, 2015 No. 7-3-04/ [email protected]

Situation: how to take into account contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases accrued on transferable leave when calculating income tax? The organization uses the accrual method.

Contributions for compulsory pension (social, medical) insurance accrued on the amount of vacation pay do not need to be distributed over different months.

They must be accrued in the same month as vacation pay (part 3 of article 15 of the Law of July 24, 2009 No. 212-FZ), and written off as expenses on the date of accrual (subparagraph 1 of paragraph 7 of article 272 of the Tax Code of the Russian Federation , letters of the Ministry of Finance of Russia dated June 9, 2014 No. 03-03-RZ/27643, dated April 13, 2010 No. 03-03-06/1/255).

The procedure for writing off contributions for insurance against accidents and occupational diseases has its own characteristics.

If the vacation is transferable (that is, it begins in one month and ends in another), then in accounting, unlike tax accounting, there is no need to distribute vacation pay (and contributions accrued on them) by month.

For the procedure for recording vacation pay for rolling leave in accounting, see How to reflect the accrual and payment of vacation pay in accounting.

An example of how to take into account expenses for rolling leave. The organization is not a small enterprise and applies a general taxation system. Income and expenses are determined using the accrual method

Alpha LLC pays income tax monthly based on the actual profit received. A reserve for future expenses for vacations is not created in tax accounting.

The rate for insurance premiums against accidents and occupational diseases is 3 percent. In tax accounting, the accountant takes these contributions into account during the period of their accrual.

In June 2021, manager A.S. Kondratiev was given basic paid leave. Duration of vacation - 28 calendar days - from June 16 to July 13, 2021 inclusive.

For the billing period (from June 1, 2015 to May 31, 2021 inclusive), Kondratyev received a salary in the amount of 183,260 rubles. The billing period has been fully worked out.

Kondratiev’s average daily earnings were: 183,260 rubles. : 12 months : 29.3 days/month = 521.22 rub./day.

The accountant accrued vacation pay in the amount of: 521.22 rubles/day. × 28 days = 14,594.16 rub.,

including:

- for June: 521.22 rubles/day. × 15 days = 7818.30 rub.;

- for July: 521.22 rubles/day. × 13 days = 6775.86 rub.

Kondratiev has no rights to deductions for personal income tax. Vacation pay was paid to the employee in June.

In June, Alpha's accountant made the following entries:

Debit 96 subaccount “Estimated obligation to pay for vacations” Credit 70 – 14,594.16 rubles. – vacation pay was accrued to the employee for June–July;

Debit 96 subaccount “Estimated obligation to pay for vacations” Credit 69 subaccount “Settlements with the Pension Fund” – 3210.72 rubles. (RUB 14,594.16 × 22%) – pension contributions accrued;

Debit 96 subaccount “Estimated obligation to pay for vacations” Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” - 423.23 rubles. (RUB 14,594.16 × 2.9%) – social insurance contributions have been accrued;

Debit 96 subaccount “Estimated obligation to pay for vacations” Credit 69 subaccount “Settlements with the Federal Compulsory Medical Insurance Fund” – 744.30 rubles. (RUB 14,594.16 × 5.1%) – contributions for health insurance to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 96 subaccount “Estimated obligation to pay for vacations” Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 437.82 rubles. (RUB 14,594.16 × 3%) – contributions for insurance against accidents and occupational diseases are calculated from the amount of vacation pay;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1897 rubles. (RUB 14,594.16 × 13%) – personal income tax withheld;

Debit 70 Credit 51 – 12,697.16 rub. (RUB 14,594.16 – RUB 1,897) – vacation pay is transferred to the employee’s bank card.

In June, the accountant took into account when taxing profits:

- vacation pay for June - 7818.30 rubles;

- the entire amount of accrued insurance premiums - 4816.07 rubles. (RUB 3,210.72 + RUB 423.23 + RUB 744.30 + RUB 437.82).

The amount of vacation pay for July (RUB 6,775.86) was taken into account when calculating income tax in July.

An example of how to take into account expenses for rolling leave. The organization is a small enterprise and applies a general taxation system. Income and expenses are determined using the accrual method

Alpha LLC pays income tax monthly based on the actual profit received.

The rate for insurance premiums against accidents and occupational diseases is 3 percent. In tax accounting, the accountant takes these contributions into account during the period of their accrual.

The organization does not create a reserve for vacation pay in accounting and taxation.

In June 2021, manager A.S. Kondratiev was given basic paid leave. Duration of vacation - 28 calendar days - from June 16 to July 13, 2021 inclusive.

For the billing period (from June 1, 2015 to May 31, 2021 inclusive), Kondratyev received a salary in the amount of 183,260 rubles. The billing period has been fully worked out.

Kondratiev’s average daily earnings were: 183,260 rubles. : 12 months : 29.3 days/month = 521.22 rub./day.

The accountant accrued vacation pay in the amount of: 521.22 rubles/day. × 28 days = 14,594.16 rub.,

including:

- for June: 521.22 rubles/day. × 15 days = 7818.30 rub.;

- for July: 521.22 rubles/day. × 13 days = 6775.86 rub.

Kondratiev has no rights to deductions for personal income tax. Vacation pay was paid to the employee in June.

In June, Alpha's accountant made the following entries:

Debit 26 Credit 70 – 14,594.16 rub. – vacation pay was accrued to the employee for June–July;

Debit 26 Credit 69 subaccount “Settlements with the Pension Fund” – 3210.72 rubles. (RUB 14,594.16 × 22%) – pension contributions accrued;

Debit 26 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 423.23 rubles. (RUB 14,594.16 × 2.9%) – social insurance contributions have been accrued;

Debit 26 Credit 69 subaccount “Settlements with FFOMS” – 744.30 rubles. (RUB 14,594.16 × 5.1%) – contributions for health insurance to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 26 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 437.82 rubles. (RUB 14,594.16 × 3%) – contributions for insurance against accidents and occupational diseases are calculated from the amount of vacation pay;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1897 rubles. (RUB 14,594.16 × 13%) – personal income tax withheld;

Debit 70 Credit 51 – 12,697.16 rub. (RUB 14,594.16 – RUB 1,897) – vacation pay is transferred to the employee’s bank card.

In June, the accountant took into account when taxing profits:

- vacation pay for June - 7818.30 rubles;

- the entire amount of accrued insurance premiums - 4816.07 rubles. (RUB 3,210.72 + RUB 423.23 + RUB 744.30 + RUB 437.82).

The amount of vacation pay for July (RUB 6,775.86) is taken into account when calculating income tax in July.

What do you need to know?

Many employers do not know for sure whether vacation pay is subject to personal income tax. This payment is not a salary or bonus, but is nevertheless subject to taxation.

This fact is connected with the fact that vacation pay is a citizen’s income. And in accordance with the Tax Code of the Russian Federation, income tax is calculated on all types of income of a citizen, with the exception of cases established by law. Vacation pay is no such exception.

This payment can be presented to the employee in the form of cash or in non-cash form by transfer to a bank account or card.

Before the funds are transferred, personal income tax is collected from them. The employer acts as a tax agent and is obliged to take appropriate actions to accrue, withhold and transfer funds to the treasury.

Money is transferred to the budget on the day vacation pay is paid or at the time of transfer to the employee’s account. There is no need to do these operations in advance.

Objects of taxation

The object of personal income tax is income received by an individual. The employee receives vacation pay before going on vacation. They are the ones who will act as the object.

Vacation pay is calculated using the formula: duration of vacation (in days) * average daily income of the employee.

The resulting amount is then multiplied by 13%.

This is the exact amount of tax that will be collected from the employee.

By the way, the employee himself does not need to take any action. All operations are carried out by the employer-tax agent. He will also be responsible for the correctness of calculations and timely transfer of funds to the budget.

Personal income tax payments for excessively granted leave

In a situation where an employee has received the required vacation, but quits and on the date of dismissal the vacation has not been fully worked out, the employer has the right to withhold from the employee’s salary that part of the vacation pay that was previously paid.

Also in this same situation, personal income tax has already been calculated and withheld in accordance with the law. If, upon dismissal, an employee’s amount of severance payments is reduced by the amount of vacation taken in excess, then the personal income tax withheld and transferred from vacation pay is overpaid. Therefore, the personal income tax amounts must be adjusted, since when the vacation pay amounts are returned, they will not be the taxpayer’s income, and the tax agent will have an overpayment of personal income tax. This overpayment amount can be returned to the tax agent on the basis of a corresponding application to the Federal Tax Service at the place of registration of the organization. Having received the return, the organization transfers it to its former employee.

Payment procedure

Personal income tax is collected only from that part of the funds that the employee actually receives. This rule is relevant when an employee does not take a full vacation.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

When several employees within one enterprise go on vacation, the payment is transferred to the treasury in total for all of them at once.

This is important to know: Report on rescheduling a serviceman’s leave

And as we mentioned earlier, now employers can transfer funds to the treasury not on the day the vacation pay is issued, but until the end of the month in which the employee is granted vacation.

If vacation pay is not paid, what should I do? Read here.

How is vacation pay calculated correctly? Details in this article.

When will money be transferred for vacation in 2021?

According to Art. 136 of the Labor Code of the Russian Federation, vacation pay is paid a maximum of 3 days before the start of annual leave.

Example

The merchandiser of Lenta LLC went on vacation on August 20. The accountant of this company set the deadline for payment of money for vacation - August 17, 18 and 19.

An employee of the accounting department counted 3 calendar days without taking into account the start dates of vacation and the day of transfer of funds. As a result, this money was transferred to the merchandiser’s card on August 16.

Video about tax issues

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Vacation pay taxes: when and how to pay, transfer deadlines.

All employers are required to make tax deductions in our country. It does not matter whether the employee works officially, with information entered in the work book, or under a contract. Any work must be paid, and any payment must be subject to income tax. Let's consider how taxes are calculated on vacation pay, and within what time frame they must be transferred.

Should vacation benefits be taxed?

Tax legislation regulates the rules for transferring all payments, including vacation benefits. Are vacation pay taxable?

Yes, this money, like wages, must be taxed. The employer acts as an agent who must transfer funds to the budget. In particular, an accountant.

There are different types of vacations.

Annual leave

Annual leave, according to Art. 114 of the Labor Code of the Russian Federation must be paid in full by the employer. It is necessary to make deductions from it: personal income tax and insurance premiums.

Income tax is charged on holiday pay.

Extraordinary leave.

There are situations when an employee requires additional paid leave. These circumstances are described in articles: 116, 117, 118, 119 of the Labor Code of the Russian Federation.

The employer is obliged to provide leave if there are grounds for doing so.

Contributions to the budget are made without fail, and they do not differ from those payments that are due in the case of payment of regular annual leave benefits.

Leave for the duration of the session.

For those who work and at the same time improve their skills, receive higher education, leave is provided.

Parental leave.

An exception to the rule is parental leave. The state exempts the Social Insurance Fund from taxes on this type of payment.

Parental leave benefits are not taxed.

The law provides for three types of parental leave:

- Maternity leave is regulated by Art. 255 Labor Code of the Russian Federation.

- From birth to three years, a woman has the right to take legal leave, in accordance with Article 256. At the request of the employee and the consent of management, leave can be extended.

- Couples who have adopted a child also have the right to vacation benefits: Art. 257 Labor Code of the Russian Federation. The situation here is no different from the birth of a child. The state supports families who decide to adopt and provides them with equal conditions.

Child care is not paid by the employer, payments are calculated through the accounting department at work, but the Social Insurance Fund pays.

Whatever the parental leave, you are not required to pay taxes on it.

General rules for issuing vacation pay

What is vacation pay: from the point of view of accounting and tax accounting, this is income that is paid to an employee by the employer. Legal relations take place between the employee and the employer, since vacation and vacation pay are established by labor legislation.

Note! Vacation pay is a payment provided for by the Labor Code of the Russian Federation and is part of the social guarantees of every employee who gets a job under an employment contract.

Vacation pay is not considered salary or other remuneration for work; it is precisely payment for the period of compulsory leave.

In accordance with Article 115 of the Labor Code of the Russian Federation, each employee is provided with at least 28 days of paid rest during one calendar year, of which 14 days must be consecutive, and the rest can be divided by an individual at his own discretion.

In some industries, paid leave lasts more than 28 days, for example, in hazardous industries, in the civil service, etc.

Important! Working without vacation for 2 years in a row is illegal, even if the employee voluntarily refused to take the vacation.

Now about calculating payments:

- calculation is made in accordance with the Regulations on Average Earnings, drawn up by Decree of the Government of Russia No. 922 of December 24, 2007, and Article 139 of the Labor Code of the Russian Federation;

- calculation basis - average daily earnings; it is multiplied by the number of vacation days, this is the payment;

- the daily average earnings itself takes into account payments for the period, divided by 12 months and multiplied by 29.3; coefficient 29.3 is the average number of days in a month;

- The period for average earnings is usually considered to be 12 months preceding the month the individual goes on vacation;

- payments for calculation include all main payments from the wage system; This does not include sick leave benefits, travel allowances, various social or non-work related payments (financial assistance, etc.).

Take into account! Vacation pay must be transferred to the employee 3 calendar days before the vacation itself. For example, if you go on vacation on Friday, then the money should arrive no later than Monday.

Before payment, the employer withholds personal income tax from vacation pay. There are no situations in the legislation when income tax is not taken from vacation pay: payment for vacation is the direct income of an individual, is not included in the list of exceptions from Article 217 of the Tax Code of the Russian Federation, and has its own code established by the Federal Tax Service of Russia.

Important! Vacation pay is subject to income tax and insurance contributions in the general manner.