Payment

The Tax Code of the Russian Federation obliges all individual entrepreneurs to make contributions for their insurance. Fixed payments

Key characteristic All tax obligations are classified into three large groups: federal, regional and local

The concept of special tax regimes is spelled out in Art. Tax Code of the Russian Federation. They provide a special procedure for determining

According to the Investigative Committee of Russia, in the first six months of 2021, 3,062

Legal entities and individual entrepreneurs using the simplified tax system, as a general rule, are not recognized as VAT payers (for

I am currently engaged in the supply of building materials and saw a little occupied niche - cargo transportation with VAT.

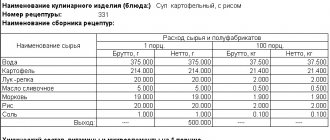

Features of accounting in public catering Almost every public catering enterprise simultaneously uses three business processes. Production

Returnable (reusable) packaging is used in circulation many times and must be returned to the supplier if

The duration of the trip is not regulated; it is determined by the entrepreneur himself. It is most practical to write it out on one

Sales of goods (works, services) on the territory of Russia are recognized as subject to VAT (subclause 1, paragraph.