The 4-FSS zero report is a document of the policyholder who did not conduct financial and economic activities in the billing period. The empty form is submitted to the territorial social insurance department within the same time frame as the completed one - before the 20th day of the month following the quarter in paper form and before the 25th day - in electronic form.

There are quite a lot of situations in which reporting data is missing. For example, an economic entity is at the stage of reorganization or liquidation and its activities have been suspended, the company’s current accounts have been seized, an individual entrepreneur has fallen ill and is not working. Another situation is when the company’s activities have not yet begun: the question arises whether it is necessary to submit a zero 4-FSS report in 2021 - yes, you will still have to submit a report to the Social Insurance Fund, even if the company does not have data to reflect in the reporting.

Significant fines are provided for late submission of reporting forms to the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund and other authorities. The absence of reporting data is not a valid reason; an administrative penalty will be imposed in any case.

What does the legislation say about zero 4-FSS?

Reporting to social security in Form 4-FSS is a calculation presented in tabular form, containing information:

- on insurance premiums for compulsory insurance against accidents at work and occupational diseases (ASP and OPD), accrued and paid in the reporting period (for injuries);

- expenses for payment of insurance coverage under NSP and PZ.

Zero calculation 4-FSS is a type of insurance reporting in the absence of reporting data. This situation arises if the company has suspended, ceased or is just planning to start operations.

The condition for the mandatory submission of such a calculation is contained in Art. 24 of the Law “On compulsory social insurance against accidents at work and occupational diseases” dated July 24, 1998 No. 125-FZ. This article speaks of the need for quarterly reporting on insurance premiums by all policyholders.

Find out who is taking the 4-FSS from this article.

Note! An individual entrepreneur without employees does not submit a zero to the Social Insurance Fund, since he is not an insurer.

There is no mention of zero form 4-FSS in the law. Nothing is said about this type of reporting in the FSS order No. 381 dated September 26, 2016, which describes the technology for filling out this reporting form.

However, this does not mean that the lack of reporting data relieves policyholders from submitting 4-FSS - everyone needs to report every reporting quarter. We will tell you how to do this in the following sections.

When it is not necessary to pass zero

Article 346.52 of the Tax Code of the Russian Federation regulates whether it is necessary to submit 4-FSS for individual entrepreneurs without employees - no, these individual entrepreneurs are not registered with the Social Insurance Fund as insurers. They do not pay wages and report on insurance premiums. The same rule applies to entrepreneurs who use the patent taxation system and UTII, even if they have employees.

Specialists of the Social Insurance Fund know whether it is necessary to submit a zero report to the Social Insurance Fund if there are no employees - no, all companies without employees should not report to the social insurance authorities, since they are not registered with the Fund and are not policyholders. Such legal entities and individual entrepreneurs do not bear responsibility for failure to pass the zero mark.

Mandatory zero sheets

Social insurance expects 4-FSS from policyholders in any case - whether they made payments in the reporting period in favor of individuals or not. If there is nothing to write down in the report, the employer will be required to submit a 4-FSS zero calculation completed according to special rules.

Its main difference from a regular (data-filled) calculation is the reduced volume of tables presented.

If in one of the quarters, for example, in the first, you had accruals for hired employees, but not in subsequent quarters, the report until the end of the year will not be zero, because some lines are filled with a cumulative total. ConsultantPlus experts explained the nuances of filling out each line of form 4-FSS. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

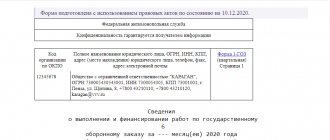

Calculation 4-FSS - 2021 is filled out on the form approved. by order of the FSS dated September 26, 2016 No. 381, as amended. from 06/07/2017. You can download it below.

The minimum set of sheets and tables of the report is defined in clause 2 of Appendix No. 2 to Order No. 381 - it includes:

- title page;

- 3 tables (1 - calculation of the base for calculating insurance premiums, 2 - calculation of injury premiums and 5 - results of assessing working conditions).

These are mandatory sheets for 4-FSS. The remaining calculation tables (1.1, 3 and 4) may not be filled out - this is indicated in clause 2 of the Procedure for registration of 4-FSS, approved. by order No. 381 (Appendix No. 2). Therefore, you can create a zero calculation without them.

We will talk about the specifics of filling out the cells of the zero calculation tables in the next section.

Procedure and deadlines for submitting the document

The deadlines for submitting reports vary depending on the option used for submission:

- electronic format until the 25th day of the month following the reporting period;

- paper version until the 20th in the same order.

At the same time, according to the regulations, the electronic format is mandatory for use by enterprises and entrepreneurs whose average number of employees has reached or exceeded 25 people. Other participants in the economic market have a choice between electronic and paper format.

Responsibility

Federal Law No. 125 outlines a list of sanctions for failure to submit a document. According to this document, penalties can be of different sizes, since the fine for delay in calculation is based on the number of days of delay and the amount indicated in the report.

In the case of zero reporting, the penalties are minimal - 1,000 rubles.

In addition, liability also arises for an incorrectly applied reporting format, for example, if paper was used when the document should be in electronic form, a fine of an additional 200 rubles.

At the same time, according to Art. 15.33 of the Administrative Code for officials an additional penalty in the amount of 300 - 500 rubles.

Important: blocking the debtor’s accounts in this case is unacceptable, since the report is not a tax return, to which similar sanctions can be applied on the basis of Art. 76 Tax Code of the Russian Federation.

How to prepare a report if there is no data - zeros, dashes or empty cells?

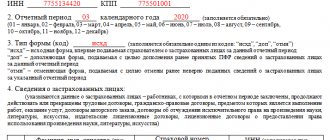

To correctly fill out the zero calculation in Form 4-FSS, use the algorithm set out in Appendix No. 2 to Order No. 381:

| Clause of Appendix No. 2 to Order No. 381 | Decoding |

| 2 | Dashes are added to table cells if there is no reporting indicator. |

| 5.8 | When filling out the “TIN” field in the 2 initial cells (zone of 12 cells), enter zeros (00) if the TIN consists of 10 characters. How to find out the FSS registration number by TIN in a couple of minutes, see the material |

| 5.10 | In the 1st and 2nd cells of the field “OGRN (OGRNIP) of the legal entity, enter zeros (their OGRN consists of 13 characters with a 15-digit zone to be filled in) |

In addition, individual calculation cells are not filled in at all - neither with zeros nor dashes. For example:

- the field “Cessation of activity” located on the title page - according to clause 5.6 of Appendix No. 2 to Order No. 381, code “L” is entered in this field (if the company or individual entrepreneur is liquidated in the reporting period) or it is not filled in at all;

- field “Budgetary organization” - only state employees work with it (clause 5.12 of Appendix No. 2 to Order No. 381), and in the reporting of other companies and individual entrepreneurs it remains blank.

From these features of the calculation filling technique, the following conclusion can be drawn:

- zeros are entered only in the 1st and 2nd cells of the “TIN” and “OGRN” fields if the value indicated in them consists of 10 or 13 characters, respectively;

- In the cells of the form tables, if there is no data, dashes are inserted;

- individual cells for a specific purpose are left unfilled.

If you generate several different reports in parallel at once, read the next section to protect yourself from errors.

Technology of filling out calculations - how not to make a mistake?

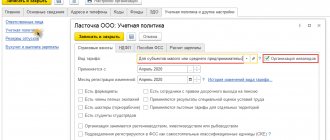

The above method of filling out the fields is typical only for 4-FSS. When preparing, for example, the calculation of contributions, a different scheme is used (clause 2.20 of Appendix No. 2 to the Federal Tax Service order No. ММВ-7-11/ [email protected] dated ):

- 12 acquaintances of the “TIN” field of a single calculation for insurance premiums must be filled out from the first cells, and with a 10-digit TIN, dashes are entered in the last 2 cells (for example, 8970652349—);

- missing indicators (quantitative and total) are filled with zeros; in other cases, empty cells are crossed out.

For a sample zero-sum calculation for insurance premiums, please follow the link.

Do not confuse these technical features of the design of different reporting forms, otherwise problems may arise with the timely acceptance of the 4-FSS calculation by social insurance specialists. They may not accept the calculation on formal grounds - due to non-compliance with the procedure established by law for filling it out.

How much the policyholder will have to pay if, due to a technical or other error, the calculation is not submitted on time, find out here.

Where can I get the information for Table 5?

Always fill out this table, regardless of whether the indicators are in the other calculation tables or not. It is devoted to the results of a special assessment of working conditions (SOUT) and mandatory medical examinations performed at the beginning of the year.

Please put dashes in all cells if you have registered as an insured this year. Other companies and individual entrepreneurs need to collect information:

- from the personnel service - about the number of jobs (this information is needed for column 3), the number of employees required to undergo medical examinations (column 7) and those who have already passed them (column 8);

- from the SOUT report - on the number of certified workplaces, including those classified as harmful and dangerous working conditions (columns 4–6).

What the law on SOUTH refers to as hazardous working conditions is described here.

For all the details on filling out this table, see our material “4-FSS - Table 5: how to fill out in 2021.”

Example

Let’s say Romashka LLC was registered on September 1 of the current year. As of October 1, activities had not begun. Of the employees, there is only a director on staff, no payments were made, and no contributions were accrued for injuries. The insurance rate applies without surcharges and discounts - 2.3%. A special assessment of working conditions will be carried out at the end of the year.

So, the organization was registered in the third quarter, which means that at the end of it it is necessary to submit 4-FSS. Since there is no activity, a zero calculation is submitted. The full form 4-FSS for Romashka LLC is available.

Sample 4-FSS with an example for a novice policyholder

Let's consider the scheme for filling out the 4-FSS 2021 for a company created in the 3rd quarter.

Example

Initial data:

- Stroika Plus LLC was registered in August 2021.

- At the end of the 4th quarter, activities had not yet begun, staff had not been recruited, payments had not been made, insurance premiums had not been paid.

- Only the director is on staff.

- The injury contribution rate is 2.3% (without discounts or surcharges).

- The SOUT is scheduled for September 2021.

Despite the lack of activity, in October 2021 the company will be required to submit its first calculation to social insurance in Form 4-FSS. It will be null because there is no data to fill:

- table 1—no injury payments were accrued;

- table 2 - Stroika Plus LLC did not conduct mutual settlements with the Social Insurance Fund;

- table 5—there is no information about the results of special assessment tests and mandatory medical examinations.

How to complete a zero calculation, see the sample of filling out 4-FSS, the latest edition of 2021.

How to fill out table 1 in the zero report

Table 1 of Form 4-FSS reflects information about the base for calculating contributions. In it, the payer of contributions will put dashes in all lines, except for those related to the amount of the insurance tariff (discounts and allowances for it), that is, except for lines 5 to 9. There are never dashes here.

The insurance rate is set by the FSS for each payer of contributions based on the main code according to OKVED (clauses 3 and 8 of the Rules approved by Decree of the Government of Russia dated December 1, 2005 No. 713). At the same time, every year a legal entity must confirm its main type of economic activity (Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55). Read more about the OKVED confirmation procedure here. In case of failure to submit such confirmation, the tariff is increased to the maximum possible for those OKVEDs that are reflected in the extract from the Unified State Register of Legal Entities. Individual entrepreneurs do not need to confirm anything - they simply look at the main OKVED.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Thus, until the OKVED code of the contribution payer does not change, the tariff (discounts and surcharges) is invariably reproduced in lines 5−9 of the table in question in the zero (and regular too) report.