Returnable (reusable) packaging is used in circulation many times and must be returned to the supplier, unless the contract provides for other conditions. The contract may also provide for the collection of a deposit by the supplier from the buyer as a guarantee of the return of the container within a specified period and in an undamaged condition.

Containers are accepted on the basis of invoices or other accompanying documents. If the actual quantity of containers and its quality characteristics do not correspond to the documents, then the discrepancies are documented in a document.

Rice. 1. Container movement

What is container

Containers are the main element of the packaging complex for goods, designed to preserve commercial quality during movement, storage and sale of products.

REFERENCE! The Italian word tara comes from the Arabic tarha, meaning “something thrown away.”

The terms “container” and “packaging” do not duplicate each other, despite the fact that the Guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, call containers “outer packaging.” GOST 17527-2003 “Packaging: terms and definitions” directly calls not to consider them synonymous.

How can a supplier take into account returnable and returnable deposit packaging when applying FAS 5/2019?

According to legislative clarifications, containers differ from packaging in that without containers, products in principle cannot be sold, while packaging only facilitates this process and makes it more convenient.

FOR EXAMPLE. The washing machine can theoretically be delivered to the store and to the consumer without any additional work with it. However, since it is expensive, and the appearance of the product may be damaged during transportation, the body and its elements are protected with a cardboard box, foam pads, and plastic film. All this is packaging.

Lemonade cannot be sold without some kind of container in which it is placed when bottling. A plastic or glass bottle will be a container, and a film in which 6 bottles or a box are packed at once will be a package.

How can a buyer take into account returnable and returnable deposit packaging when applying FSB 5/2019?

Container classification

Containers are divided into types for several reasons:

- Application in the production process:

- containers that are used in the technological process itself;

- containers for warehouse storage;

- container for placing goods sold in it.

- According to the material of manufacture:

- metal;

- cardboard;

- glass;

- polyethylene;

- plastic;

- ceramic;

- fabric, etc.

- By form:

- bottles;

- boxes;

- barrels;

- boxes;

- banks;

- packages;

- canisters;

- flasks;

- tubes;

- bags, etc.

- By purpose:

- consumer – the one in which the product reaches the final buyer (can be individual or group);

- production - containers used for storing raw materials and product elements, as well as for moving them within production;

- transport – to facilitate transportation and storage (can be small or large);

- special (preservative) - to ensure the safety of products.

- By frequency of use:

- one-time;

- multi-turn (return);

- special - is part of the product itself, equipment for it.

IMPORTANT! When they talk about the type of container, they most often mean its shape, and when they talk about the type of container, then the material.

Features of the concept of returnable packaging

Returnable (reusable) packaging is a mandatory element of packaging, the availability of which is guaranteed by the supply agreement. It can be returned to the manufacturer undamaged and reused without compromising the quality of the product packaging. Examples of returnable packaging include glass jars and bottles, fabric bags, boxes, containers, etc.

According to Art. 481 of the Civil Code of the Russian Federation, for some types of goods delivery in containers is mandatory. Violation of this clause may become the basis for recognizing the product as being of low quality, which may cause claims from the buyer or even the return of the product.

The container is recognized as returnable in the text of the purchase and sale agreement (clause 3 of Article 254 of the Tax Code of the Russian Federation). This means that it must be returned to the supplier in its original condition, unless the parties agree otherwise (Article 517 of the Civil Code of the Russian Federation). The seller takes a deposit from the buyer for returnable packaging, and after delivery it returns the deposit.

No price? Come at market price

If the cost of reusable non-returnable packaging is included in the cost of the property received in it and is not indicated in the receipt documents, and you intend to use this container in the future (for example, sell separately from the received goods), then the cost of the container must be separated from the cost of the acquired property and clause 3 Art. 254 Tax Code of the Russian Federation. In this case, the container is accounted for at market value, and the acquired property is taken into account at its cost reduced by the cost of the container.

You determine the market value of the container yourself on the date it was accepted for accounting. A guideline can be suppliers' prices for a similar type of container (you can get information on prices from the Internet) para. 2 clause 9 PBU 5/01. You record the market value in a report drawn up by the inventory commission and attach supporting documents to it. Here is an example of filling out such an act.

Nuances of accounting for returnable packaging

Possible accounting difficulties are caused by the special status of returnable packaging: despite the fact that it is delivered to the buyer along with the goods, the ownership of it remains with the seller. An important point that determines accounting is the classification of reusable containers into different types of assets:

- material and production inventories;

- fixed assets.

Accounting for returnable packaging as stock

It is possible to register returnable containers as inventories in accounting if their useful life does not exceed 1 year or one operating cycle (if it exceeds 12 months).

To reflect transactions with such containers, the following are used:

- account 22 “Low value and wearable items”;

- subaccount 10.4 “Containers and packaging materials” - for warehouse and in-production storage and movement;

- subaccount 284 “Containers for goods” - mainly used by trading enterprises.

Accounting for returnable packaging as a main means of production

If the period of use of the container is greater than 12 months, and the cost is included in the limit established for the fixed assets, it falls under the definition of a fixed asset and should be recorded in the corresponding account 115 “Non-current assets”. Like all fixed assets, it is subject to depreciation and subsequent write-off.

Accounting for containers at the supplier

The supplier gives the container along with the goods, retaining ownership of it. In the receipt documents, a separate line is allocated to account for the cost of purchasing such containers; it is not added to the cost of other inventories, but is calculated at net realizable value. When it arrives with the goods, it will have a separate line on the delivery note or invoice.

Stock containers are recorded on account 41 “Containers under goods and empty,” and special containers are recorded on account 01 as fixed assets.

Accounting for containers from the buyer

The safety of returnable packaging and its return can be guaranteed by the text of the contract; in this case, no deposit is required, but sanctions for damage or loss of packaging are stipulated. This procedure will have to be taken into account in off-balance sheet account 002 “Inventory and materials accepted for safekeeping.”

The buyer who has paid a deposit for returnable packaging undertakes to return it to the seller in undamaged condition, after which he will receive the deposit amount back. This procedure is subject to accounting on balance sheet accounts 10 “Container” (if the goods arrived for your own use) and 41 “Container under the goods” (if resale is planned).

Example of posting dynamics of returnable packaging

Uchkuduk LLC entered into 2 agreements:

- Agreement for the supply of lemonade for its subsequent resale to the consumer. Lemonade in glass bottles is in plastic boxes of 6 pieces. The boxes are multi-return containers, for non-return of which there is a fine of 5,000 rubles. – reimbursement of the cost of boxes.

- Agreement for the supply of drinking water for employees of Uchkuduk LLC. Water cans are provided by the supplier on a returnable basis with a deposit of RUB 2,000.

Postings regarding containers under Contract 1, made by Uchkuduk LLC (buyer):

- debit 002 “Inventory and materials accepted for safekeeping” – 5,000 rubles. – plastic boxes in which lemonade is supplied are accepted;

- credit 002 – 5,000 rub. – plastic boxes are returned to the supplier.

Postings regarding containers under Contract 1, made by Zhazhda LLC (seller):

- debit 62 “Settlements with buyers and customers”, credit 41 “Container” - 5,000 rubles. – plastic boxes containing bottles of lemonade were handed over;

- debit 41 “Containers”, credit 62 “Settlements with buyers and customers” – 5,000 rubles. – plastic boxes were returned by the buyer.

Postings regarding containers under Contract 2, made by Uchkuduk LLC (buyer):

- debit 76 “Settlements with various debtors and creditors”, credit 51 “Settlement accounts” - 2,000 rubles. – a deposit has been paid for drinking water cans;

- debit 10 “Container”, credit 76 “Settlements with various debtors and creditors” - 2,000 rubles. – received canisters of drinking water;

- debit 76 “Settlements with various debtors and creditors”, credit 10 “Container” - 2,000 rubles - drinking water cans were returned to the supplier;

- debit 51 “Current accounts”, credit 76 “Settlements with various debtors and creditors” - 2,000 rubles. – deposit amount received for water canisters.

Postings regarding containers under Contract 2, made by Zhazhda LLC (seller):

- debit 51 “Current accounts”, credit 62 “Settlements with buyers and customers” – 2,000 rubles. – a deposit was accepted for drinking water cans;

- debit 62 “Settlements with buyers and customers”, credit 41 “Container” - 2,000 rubles. – canisters of drinking water were handed over to the buyer;

- debit 41 “Container”, credit 62 “Settlements with buyers and customers” – 2,000 rubles – drinking water cans were returned;

- debit 62 “Settlements with buyers and customers”, credit 51 “Settlement accounts” - 2,000 rubles. – the deposit amount for water canisters has been returned.

Results

The condition for the return and deposit payment of containers fixed in the contract will allow the supplier to avoid the tax burden in the form of VAT paid upon the sale of containers.

The buyer's condition for the return and payment of packaging is taken into account when reflecting movements on packaging in accounting accounts. Failure to return packaging, upon recognition of this fact by the supplier and reimbursement of its cost by the buyer, is considered a sale of packaging subject to VAT. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Returnable packaging from a tax perspective

Tax Code of the Russian Federation in paragraph 7 of Art. 154 regulates taxation in transactions with returnable packaging:

- When paying a deposit for the packaging, this amount is not included in the VAT calculation base.

- If the reusable packaging is not returned, it is considered that it was purchased for a deposit price, and this operation is already subject to VAT (after the expiration of the return period and receipt/sending of a corresponding notification from the former owner of the container).

- A supplier who has not received his container back must allocate VAT from its cost, include the remaining amount in the tax base, and send an invoice to the buyer who has become the owner of the container for the allocated VAT.

- If the buyer keeps the container for himself, then VAT will need to be written off as “other income,” and if he resells it, it will need to be deducted.

NOTE! All documents regarding reusable packaging that has not been returned lose their validity, and instead, documentary evidence of the purchase and sale of packaging, subject to the usual taxes for this transaction, becomes relevant.

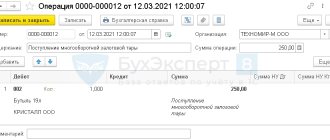

Transfer of advance payment and deposit amount to the supplier

Complete the transfer of funds to the water supplier by debiting from the current account transaction type Payment to the supplier (Bank and cash desk - Bank statements).

Break the payment into 2 lines:

- reflect the advance payment for water in the usual manner;

- on the line with the amount of the deposit for the packaging, indicate: Expense item - item with the type Other payments for current operations ;

- Debt repayment - Do not repay ;

- Settlement account - 76.05 “Settlements with other suppliers and contractors.”

Postings

After returning the container to the supplier and receiving the deposit amount from him, issue a Receipt to the bank account :

- Type of operation - Other receipt ;

- Settlement account — 76.05;

- Income item with the type Other receipts from current operations .