Payment

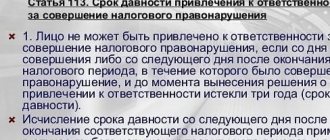

What we are talking about In tax law, there is a limitation period for bringing to liability

Cash collection involves the movement by employees of a special service of money and documentary values, such as

What rules should “simplified people” keep accounting records by? How to simplify management with minimal losses

Civil legislation makes it possible to use someone else’s property both on a paid basis (lease agreement) and

Excise taxes and VAT are one of the key concepts for economists dealing with the peculiarities of

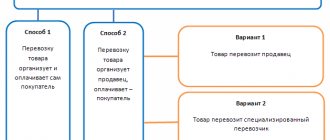

Methods for reimbursement of transportation costs under a supply agreement The supply agreement may provide for several options

The key resource of any manufacturing company is fixed assets, the analysis of which traditionally includes an assessment

Home / Taxes / What is VAT and when does it increase to 20 percent?

Legal topics are very complex, but in this article we will try to answer the question “To

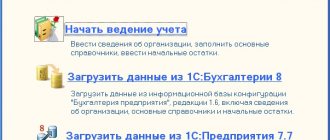

If you are not familiar with the first two parts, then you can find and familiarize yourself with them