Collection of funds consists of the movement by employees of a special service of money and documentary values, such as bills of exchange, payment and settlement documents, from the cash desk of clients of a banking structure to transfer to the bank for subsequent posting of money and valuables to the accounts of organizations.

Collection services are in demand in the work of an enterprise or individual entrepreneur whose activities require the periodic delivery of cash or the movement of valuables.

How to deposit cash at the bank through collection ?

What is it and what is it for?

Cash collection is a complex concept that means a set of interrelated measures for the physical movement of cash between individual business entities (organizations), their structural (separate) divisions and servicing banks.

Transportation of cash is carried out by authorized collectors - specialists with the necessary professional training.

The actions of all participants in this procedure - cashiers, collectors, bank employees - are subject to the established procedure regulated by Directive of the Central Bank of the Russian Federation No. 3210.

As a rule, collectors are contacted for the following reason - ensuring the safety of cash during its transportation.

Cash collection is a guarantee of its safety and protection from external attacks.

In fact, the transportation of cash by armed cash collectors is the priority and safest way to physically move it from the cash desk of the enterprise to the servicing bank.

The cash collection procedure allows you to successfully solve the following tasks:

- Physical movement (transportation) of cash proceeds of a commercial enterprise from a retail outlet to a servicing bank.

- Delivery of the required amount of cash from a financial institution to the cash desk of a business entity for the next payment of salaries to its employees.

- Transportation of cash between separate structural divisions (branches) of a particular bank.

- Regular replenishment of ATMs with the required amount of paper bills with the generation of a report on the current state of cash counters.

- Periodic withdrawal of cash proceeds from payment terminals that accept cash.

- Safe transportation of material assets and documentation.

The cash collection service, which implies the subsequent crediting of transferred funds to a bank account, is provided legally in the following ways:

- Directly through bank tellers.

- With the help of a collection service authorized to transport cash. These may be collection departments at servicing financial institutions, as well as private security structures that have the legal right to accompany the transportation of cash.

- Through the RosInkas service, a collection agency that has a special permit from the Central Bank of the Russian Federation.

- Through the federal postal system.

- Directly through automatic safes.

Is it mandatory for an LLC?

Current legislation - regulatory documentation of the Central Bank of the Russian Federation - provides for a requirement to limit the cash balance of business entities.

We are talking about setting a limit on the total amount of cash remaining in the organization's cash desk at the end of each operating day.

This condition applies to all business entities carrying out incoming and outgoing transactions with cash, except for individual entrepreneurs and organizations related to small enterprises.

It should be noted that business entities that fall under the exceptions have the right to limit the cash balance, but not the obligation.

If an individual entrepreneur/small enterprise nevertheless decides to exercise this right, compliance with the established standard (limit) will be mandatory. Read about the limit for small businesses here.

Exceeding the limit cash - exceeding the established limit - is subject to withdrawal from the cash desk of a business entity and mandatory transfer to the servicing bank with its subsequent crediting to the organization's current account.

Cash collection is considered the safest method of physically moving cash from a business's cash desk to a servicing financial institution.

If we are talking about significant amounts, it is recommended to use the services of professional cash collectors who guarantee the safety of the money being moved.

Business entities are allowed to accumulate and retain excess cash in excess of the limit only on paydays and holidays/weekends.

Violation of these rules results in the imposition of penalties on the perpetrators. The fine for officials ranges from 4,000 to 5,000 rubles, for organizations (enterprises) – from 40,000 to 50,000 rubles.

Collection

Related publications

Organizations are not allowed to accumulate excess cash on hand. An exception is days of payment of salaries and stipends (clause 2 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). Cash can be deposited at the bank's operating cash desk in order to be credited to the company's current account in two ways: independently through the organization's cashier, or by entering into an agreement with the bank's collection service, and then the money will be collected and transferred to the organization's account by an employee of this service - the collector.

How collection is carried out, as well as how the delivery of money to the collector is recorded in an accounting entry - this is what our article is about.

Rules and procedures for cash in an enterprise

There are generally binding legal norms that clearly regulate the procedure for cash collection in an organization.

These rules, as mentioned earlier, must be strictly observed by all participants in this process - the cashier of the enterprise transferring cash, and the collector delivering the transferred money to the bank.

In addition, collection rules may be regulated by a signed agreement on the provision of collection services, which, for example, provides for the frequency of transfer of funds and other specific conditions.

The cash collection procedure itself involves the sequential performance of the following actions by its participants:

- The transferred cash is prepared by the cashier of the business entity for dispatch. At this stage, a thorough counting and packaging of funds are carried out, which are then placed in bags. A set of necessary documents is prepared in several copies. The completed papers are also placed in collection bags with money. This stage ends with the sealing of bags to be handed over to collectors.

- Cash packed in bags is handed over to the collector. This action is performed by the cashier of the transferring organization in a special room. The auditor, financial controller, chief accountant, and head of the organization have the right to control this procedure. The cashier checks the identity and papers of the collector, enters information into the appearance card, provides a sample of the seal, and gives the bag with money and documentation to the collector. The collector verifies his identity, presents the necessary papers to the cashier and returns empty bags, accepts bags with money, checks the serviceability of seals, verifies document data, signs and dates the receipt, and puts a stamp.

- Transportation (physical movement, transportation) of transferred funds directly to the servicing bank. This procedure is carried out by an authorized collector along a route developed and approved in advance.

- Delivery and acceptance of bags with cash at a financial institution. The collector transfers the bags of money to the servicing bank, which duly accepts these funds. The acceptance procedure is carried out according to established rules. If it is completed successfully, the collector’s full financial responsibility for the transferred money ceases.

- The transferred cash is accepted and received by a bank employee who checks the bags, the integrity of the seals, and the correctness of the information in the accompanying papers.

Documenting

In order to correctly transfer cash to the collector for transportation to the bank, the cashier draws up the following documentation:

- The accompanying statement in three copies (one - in the bag, the second - to the cashier, the third - to the collector);

- a register of completed transactions (placed in a bag), the amount of which must correspond to the amount of the statement;

- money bag invoice;

- receipt for money bag.

The collector verifies his identity, presents a power of attorney, and gives the cashier an appearance card to fill out.

The cashier enters the necessary information into the appearance card and returns it to the collector. Subsequently, this card is checked by a bank employee and compared with the cash order.

Accounting and postings

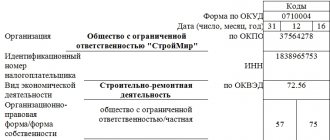

In the accounting of a business entity that transfers cash to the bank through collection, certain correspondence accounts are used, accompanied by the preparation of the necessary documents:

| Operation | Debit | Credit | Document |

| The cashier handed over the cash to the collector | 57 | 50 | RKO, receipt |

| The collected amount is credited to the bank account | 51 | 57 | Bank account statement |

| The corresponding commission has been paid to the bank | 91 | 51 | Bank account statement |

Registration in accounting

After depositing the cash for collection, the cashier is left with a receipt for the bag, on the basis of which the RKO is drawn up. The Bank of Russia in the Letter of the Central Bank of the Russian Federation dated October 16, 2015 No. 29-1-1-OE/4065 explained how to fill out the cash register for the collected amount of cash:

- In the “Issue” line, the full name of the cashier who generated and handed over the bag of cash to the collector is indicated.

- In the “Attachment” line, indicate the details of the primary document (date and number) - the receipt for the bag.

The collector does not sign the cash settlement; his data is not indicated in the order. The cashier also makes an entry in the cash book based on the issued consumables.

In accounting, the following entries are made:

Debit 57 “Transfers in transit” Credit 50 - funds were transferred to the collector for crediting to the current account (based on the receipt for the bag).

Debit 51 Credit 57 - money has been credited to the current account (based on the statement).

Cash collection services are classified as other expenses in accounting.

Debit 91.2 Credit 60 - collection services are reflected.

Debit 19 Credit 60 - VAT on collection services is reflected.

conclusions

Thus, the cash collection procedure of a business entity is carried out in strict accordance with the procedure provided for both by the generally binding norms of the Central Bank of the Russian Federation and by private agreements concluded between the enterprise and the collection service (serving bank).

Compliance with the established sequence of necessary actions is of great importance, since the participants in this procedure are financially responsible entities.

Important points are correct documentation and proper accounting.

Cash collection: accounting clearance

Based on the receipt remaining in the organization (with the signature and stamp of the collector), a cash expense order (RKO) is drawn up, in which:

- In the RKO line “Issue”, indicate your full name. cashier of the organization or other employee who transfers cash to collectors. It is erroneous to indicate the collector's data in the cash register - such a consumable is considered incorrectly issued.

- In the “Appendix” line, you should indicate the date and number of the receipt (letter of the Central Bank of the Russian Federation dated October 16, 2015 No. 29-1-1-OE/4065).

The next step is to make an entry in the Cash Book based on the RKO.

Next, the delivery of money to the collector is recorded in the accounting entry:

Account DT 57 “Transfers in transit” - Account DT 50 “Cash desk” cash was transferred to the collector for crediting to the bank account. Posting is done based on the receipt and consumables.

After accepting and crediting the money to the current account, based on the bank statement, we make the following entry:

Account DT 51 “Current account” - Account DT 57 “Transfers in transit” - money has arrived in the organization’s bank account.

The bank will typically charge a fee when accepting cash from customers and this will be reflected on the account statement. Let's do the wiring:

Dt account 91.2 “Other expenses” – Kt account 51 “Current account” - the bank withheld a commission for accepting and recalculating cash.

Collection of funds

In practice, accountants very often encounter situations when an employee, while collecting a collection bag, makes a mistake, as a result of which there are extra bills in the collection bag or a shortage occurs.

Let's consider the standard procedure for maintaining accounting records of business transactions related to underinvestment and overinvestment of funds.

The following accounts are used throughout the text:

- 50 - "Cash register";

- 51 – “Current accounts”;

- 57 – “Translations on the way”;

- 91-1 - "Other income";

- 91—2 - "Other expenses";

- 94 - “Shortages and losses from damage to valuables.”

Transferring funds to a collection bag.

In this case, a shortage occurs at the organization’s cash desk. The amount of the shortage must be recorded based on the results of the inventory. The accountant will make an entry on the debit of account 94 in correspondence with account 50 (Chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

The amount of the shortfall can be attributed to the financially responsible person (cashier) or written off as the organization’s losses.

But the amount of the shortfall can also be detected by the bank teller, who accepts the proceeds and recalculates it. In this case, the organization will receive a statement from the current account, which will indicate that more was credited to the current account than was transferred to the collectors.

Let's look at an example.

1) The transfer of funds to collectors is reflected in the entry

Dt 57 Kt 50, 100 rub.

2) Based on the results of the inventory, the amount of shortage in the organization’s cash register is reflected as follows:

Dt 94 Kt 50, 10 rub.

3) The collected funds have arrived in the current account

Dt 51 Kt 57, 110 rub.

It is impossible to reverse an accounting entry in which a cash account is involved, since this will entail adjustments to primary cash documents, which is directly prohibited (clause 4.7 of Bank of Russia Directive No. 3210-U dated March 11, 2014). Taking into account these restrictions, accountants, as a rule, reflect funds credited to the organization’s current account in excess of the amount reflected in the accounting records as other income:

4) Dt 51 Kt 57, 100 rub. – within the limits of amounts transferred to collectors according to accounting data

5) Dt 51 Kt 91-1, 10 rubles, - in excess of the amounts transferred to collectors according to accounting data

6) Dt 57 Kt 91-1, 10 rub.

If the identified shortage of funds has already been attributed to the cashier as the financially responsible person (Dt 70 Kt 94, 10 rubles), this entry should be adjusted:

Dt 70 Kt 94 (reversible)

The balance of account 94, formed after the adjustment, will be written off as other expenses:

How to correctly collect revenue from a retail outlet, bypassing accounting

The article from the magazine “MAIN BOOK” is current as of August 26, 2011 N.A. Matsepuro, lawyer

More information about liability for non-receipt of revenue is written: 2010, No. 9, p.

40 For organizations selling retail, accounting departments and retail outlets are usually located at different addresses and at a considerable distance from each other. In such cases, retail outlets often hand over proceeds to collectors, bypassing the organization's centralized cash desk. And the accounting department carries out operations for the receipt and delivery of this revenue through account 50-2 “Operating cash desk” without reflecting them in the cash book.

Meanwhile, this procedure violates cash requirements, (hereinafter referred to as the Procedure); (hereinafter referred to as the Methodological Recommendations) and may impose a fine on the company for non-recording or incomplete receipt of revenue (from 40 thousand).

up to 50 thousand rubles); ; ; . How to properly register and record the collection of revenue from separate divisions so as not to be fined? Ideally, the delivery of revenue from retail outlets to collectors should look like this.

1 (hereinafter referred to as the Model Rules); ; 2; 3; 4, , ; 5; 6 (hereinafter referred to as the Regulations); 7; 8; 9; 10, , ; 11 “I don’t carry out collections through the main cash desk, but reflect them using the posting Dt 57 - Kt 50-2. Passed both an audit and a tax audit - there were no complaints. There is no business transaction, no primary document, no posting - this is the basic principle of accounting.

Therefore, I don’t see any point in writing out “balloons” for whatever reason.” Lyudmila, accountant,

Postings for basic cash transactions

To account for cash in the cash register, as well as to reflect cash turnover, use account 50.

Let's look at the basic cash register transactions using examples.

Cash receipts and write-offs

The issuance of funds to employees on account, as well as the issuance of wages, are the most common basis for the receipt of funds from the bank for their subsequent write-off.

Receipt of cash to the cash desk can be carried out by an accountable person when returning the balance of funds that were not used for business needs or during a business trip.

Let's look at each of the situations described above using examples.

Bonus LLC pays wages to employees through the cash register. The amount to be issued is RUB 964,000.

The following entries will be made in the accounting of Bonus LLC:

How to register the delivery of money to a collector in accounting

Today we’ll look at the topic: “how to register the delivery of money to a collector in accounting” and analyze it based on examples.

You can ask all questions in the comments to the article. Contents

- We discussed issues of synthetic and analytical accounting of cash transactions in a separate material.

How is the delivery of money to the collector documented in accounting?We'll talk about this in our consultation. Storing cash at the organization's cash desk in excess of the established limit is not allowed, except on salary payment days (paragraph 8, 9, paragraph 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

Therefore, excessively accumulated cash, incl.

Proceeds from the cash sale of goods must be handed over to the bank where the organization has a current account.

Video (click to play). An organization deposits cash into a bank, as a rule, through its employee (for example, a cashier) or a specialized organization - a collection service. To transfer cash to the bank through a collector, a transmittal sheet for the bag 0402300 is drawn up, which is a set of documents consisting of (clause

2.4 Regulations, approved. Bank of Russia April 24, 2008 No. 318-P):

- receipts for the bag.

statements for the bag;

- invoice for the bag;

In this case, the organization, as confirmation that the collector accepted the bag with cash from it for transfer to the bank, remains with a receipt for the bag, which must bear the signature of the collector employee and his stamp.

How to register the delivery of money to a collector in accounting

Most businesses have to periodically transfer funds to their bank to ensure their safety and not exceed the standard amount of cash. This responsible procedure involves performing certain actions, and the actual delivery of money to the collector is recorded as an accounting entry.

Let's consider how to correctly complete all the formalities. Cash is kept in the cash register for a certain amount of time, after which the surplus from the sale of goods, services, etc. must be transferred to the bank to the company's current account. This is done not only for security purposes, but due to the requirements established by the instruction of the Central Bank of the Russian Federation No. 3210-U.

This operation is usually performed by a cashier or a collection service specialist. The transfer of funds is documented with an advance statement for the bag 0402300.

We recommend reading: Letter to State Duma deputy Hansa Vera Anatolyevna

This statement is a package of documents consisting of 3 parts (see.

table). No. Name Explanation 1 Statement To be completed by the client of the financial institution.

It indicates the date, name of the organization, TIN, signatures of responsible persons, etc. 2 Invoice An accounting document transmitted along with the bag and containing various details (date and number, name of the bank, amount of cash, etc.) 3 Receipt Proves the fact of acceptance of the bag with cash in cash The company retains a receipt as confirmation.

It must have a signature and stamp made by an employee of the collection service.

Transferring money to the collector using the conveyance note