What rules should “simplified people” keep accounting records by? How to simplify accounting with minimal losses?

must maintain accounting records. This rule is established by Art. 2 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. An exception is made only for individual entrepreneurs using this special regime.

Individual entrepreneurs have the right not to keep accounting if, in accordance with the requirements of tax legislation, they keep records of income or income and expenses for the purposes of calculating the single tax and other taxable items.

What does this mean in practice?

For the purposes of calculating the single tax under the simplified tax system, individual entrepreneurs have organized tax accounting in the book of income and expenses (clause 4, clause 1, article 2, clause 1, clause 2, article 6 of Law No. 402-FZ, article 346.24 of the Tax Code of the Russian Federation) .

For small businesses, it is recommended to maintain accounting records using the following accounting register systems:

- a unified journal and order form of accounting for enterprises, approved by letter of the USSR Ministry of Finance dated 03/08/1960 No. 63;

- journal-order form of accounting for small enterprises and business organizations, approved by letter of the USSR Ministry of Finance dated 06.06.1960 No. 176;

- simplified form of accounting in accordance with the Standard Recommendations given in Order of the Ministry of Finance of the Russian Federation dated December 21, 1998 No. 64n.

Features of accounting policies under the simplified tax system

If an entrepreneur applies a simplified taxation system, then he pays:

- Tax of 6% on income or 15% on income minus expenses.

- Pension contributions.

- Health insurance contributions.

- Contributions related to the provision of social guarantees.

If a company’s expenses make up less than 60% of its income, then of the taxable objects provided for by the simplified tax system, it is more profitable for it to switch to accounting with a simplified tax system of 6% (income) in 2020. It should be noted that this tax regime (USN 6%) has several advantages. When calculating the amount of tax to be paid, only the amount of receipts and payments that can reduce the accrued tax is required. But in this case, special attention must be paid to accounting expenses, since tax authorities check them especially meticulously.

And the transition to accounting under the simplified tax system “income” implies the payment of a single tax on your income, which replaces the profit tax, VAT and property tax, but this does not eliminate the need to pay transport tax, land tax and trade tax. Such taxes depend on the availability of vehicles and the land on which the activity is carried out. If the presence of import operations is implied, then VAT is charged.

VAT under a simplified taxation system. Accounting for input VAT

When applying the simplified tax system, clause 2 of art. 346.11 of the Tax Code of the Russian Federation provides for the replacement of VAT payment with the payment of a single tax. The exception is VAT, which is payable when importing products and goods into the customs territory of Russia. Of course, an enterprise that is under a simplified regime can, at the client’s request, issue invoices with the VAT amount allocated in them, although this will create significant problems for both parties.

Firstly, the counterparty will not be able to claim a deduction under such a document.

Secondly, according to clause 5 of Article 173 of the Tax Code of the Russian Federation, the simplifier will be obliged to pay the amount of tax invoiced to the budget. At the same time, the VAT charged to the buyer increases the company’s income, but it cannot be written off as an expense. Thirdly, the simplifier will have to submit a value added tax return to the controlling tax authority. From 01.01.14, the VAT return must be submitted only in electronic form, in accordance with paragraph 1, clause 5 of Art. 174 Tax Code of the Russian Federation. [goo_mid] Organizations that use the simplified tax system “income minus expenses” can include input VAT on purchased products, works and services in the calculation of the tax base. At the same time, in the tax base, VAT is reflected in the cost of intangible assets and fixed assets acquired by the enterprise, or under a certain item of expenses when purchasing products (works or services), and other tangible assets.

Input VAT is written off on expenses on the date of recognition of expenses for the acquisition of property.

If value added tax was paid on goods that are intended for subsequent resale, then the write-off occurs as they are sold.

The volumes of input VAT that were taken into account under a separate expense item are displayed in costs if the tax was fully paid to the supplier, and the cost of purchased goods (work or services), to which this amount of VAT relates, was written off as costs.

Cash and accrual method

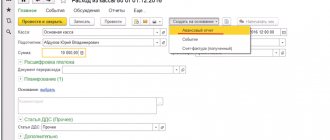

Typically, accounting is done on an accrual basis (double entry). But for organizations that have switched to simplified accounting, the current legislation allows for the possibility of maintaining it on a cash basis (clause 12 of PBU 9/99 and clause 18 of PBU 10/99). This is convenient because, according to the provisions of Article 346.24 of the Tax Code of the Russian Federation, this method takes into account paid income and expenses that are used when calculating tax. In this way, they are reflected in the book of income and expenses, which, when simplified, is a mandatory tax register.

The cash method in accounting distorts the real picture of the taxpayer’s economic life, including his financial statements. Thus, accounting is carried out on an accrual basis, and the cash method is left as a method of maintaining tax accounting. But there are still no recommendations for organizing the cash method.

Simple form of accounting (without accounting registers)

This form is suitable for small companies that carry out a small number of business transactions (usually no more than thirty per month), and do not carry out production of products and work associated with large expenditures of material resources.

In this case, “simplified” can keep records of all transactions by registering them only in the Book (journal) of recording facts of economic activity in form No. K-1 (Appendix 1 to the Standard Recommendations, approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n ).

The book (form No. K-1) is a register of analytical and synthetic accounting. As a rule, the Book is kept in the form of a statement and is opened for a month (if necessary, loose leaves are used to record transactions on accounts).

The book opens with records of the amounts of balances at the beginning of the reporting period (the beginning of the enterprise's activities) for each type of property, liabilities and other funds for which they are available.

In this case, the amounts for each transaction registered in the Book in the column “Amount” are reflected using the double entry method simultaneously in the columns “Debit” and “Credit” of the accounts of the corresponding types of property and the sources of their acquisition.

The identified financial result is reflected in the Book as a separate line.

At the end of the month, the total amounts of turnover on the debit and credit of all funds accounting accounts and their sources are calculated. And after calculating the final debit and credit turnover of funds and their sources (accounting accounts) for the month, the balance for each type (account) is displayed on the 1st day of the next month.

Peculiarities of accounting for individual entrepreneurs in a simplified manner

Individual entrepreneurs are luckier than legal entities: they do not have to do accounting. For them, there is a choice among free programs for maintaining accounting for individual entrepreneurs using the simplified tax system. Federal Law No. 402-FZ exempts individual entrepreneurs from accounting reporting. However, if you want to take into account the facts of economic activity, you can use any convenient rules; no one checks their compliance with the law.

For individual entrepreneurs, only tax accounting is required. It includes primary accounting documents, such as cash registers, an income book (or income and expenses), and tax returns. In addition, you must report to the Federal Tax Service on insurance premiums (if you have hired employees).

How to simplify accounting for “simplified people”?

“Kids” (small businesses using the simplified tax system) can conduct accounting in a simplified way.

However, the situation changes if the “kids” are subject to mandatory audit. In this case, companies are faced with the need to ensure full accounting.

The simplified method can also be used by non-profit organizations that have received the status of participants in the Skolkovo project (clause 4 and clause 5 cn.6 of Law No. 402-FZ).

If the “simplified” person is a “baby” or an NPO or a Skolkovo participant and is not subject to mandatory audit, then simplified accounting methods can be used and accounting (financial) statements can be generated using special (abbreviated) forms.

What is the essence of simplified accounting?

Important! Simplified accounting can be carried out:

?using a simple form of accounting (that is, without using registers for accounting of the property of a small enterprise);?according to the accounting form using accounting registers for the property of a small enterprise (clause 21 of Order No. 64n of the Ministry of Finance of the Russian Federation dated December 21, 1998).

Let's briefly consider the essence of two simplified methods of accounting.

Simplified accounting forms and forms, relevant in 2020

Bookkeeping on the simplified tax system from scratch usually begins with the questions: what accounting documents should an LLC have under the simplified tax system, what forms and forms of documents to use. Federal Law No. 402-FZ has granted broad powers to economic entities in this area, which the Ministry of Finance regularly confirms. For example, instead of a consignment note, it is convenient to use a universal transfer document (Letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3 / [email protected] ). This is what the UPD form, a universal transfer document, looks like:

Basic rules for primary and accounting and tax accounting registers:

- Only events that took place are recorded; the law specifically stipulates liability for records of imaginary transactions.

- All forms are approved in the accounting policy of the organization.

- The documents for which the Federal Tax Service has developed an electronic format have an established structure, but differences in appearance are allowed and have an expanded set of indicators.

- Some primary documents are unified (cash, bank). In addition, accounting, for example, in a travel agency or concert box office in a simplified manner, encounters ticket forms, in laboratories or research centers - with centralized forms of reports and protocols, etc. There are no unified registers.

Results

All simplifiers, regardless of the chosen object of taxation, fill out Section I of the KUDIR. Filling out other sections of KUDIR is determined by what object of taxation, “income” or “income minus expenses,” is applied by the simplified tax payer. For simplifiers with the object of taxation “income”, from 01/01/2018 KUDIR has been supplemented with another section, which reflects the paid amounts of trade tax.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 22, 2012 N 135n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting statements of an organization on the simplified tax system in 2021: document forms

The LLC accountant's calendar on the simplified tax system for 2021 includes only annual reporting. This is not required from the individual entrepreneur either. Interim reports (monthly, quarterly) are relevant only if they are specified in the accounting policy.

The deadline for submitting annual reports is March 31. Composition - only the balance sheet and financial statements with attachments. In case of significant deviations from industry averages or losses over several years, tax authorities have the right to demand explanations for the balance sheet. The form is paper or electronic, not unified. The recommended format for submitting financial statements in electronic form is approved by Order of the Federal Tax Service of Russia dated March 20, 2017 No. ММВ-7-6/ [email protected] Place of submission - Federal Tax Service and Rosstat.

This is what the form of simplified annual financial statements looks like, which small businesses submit to the simplified tax system.

In recent years, the number of reports to other departments has increased significantly: SZV-M reports must be submitted monthly to the Pension Fund of the Russian Federation, and personal income tax declarations must be submitted quarterly. In this regard, although small businesses are allowed to conduct accounting in a simplified form, the total volume of accounting work has not become smaller, and the cost of outsourcing accounting services in an LLC using the simplified tax system does not decrease.

Zero reporting under simplified mode

If for some reason the enterprise did not carry out (or did not have time to begin after registration) economic activity, zero reporting must be submitted to the regulatory authority. For enterprises using the simplified tax system, such reporting is a zero declaration for the single tax. It should indicate the object of taxation, as well as information about the LLC or individual entrepreneur.

This document is submitted once a year, according to the deadlines approved by law. If an enterprise has decided to end its activities, then zero tax reporting is provided for less than a full year.

Zero reporting is also submitted when there are no employees in the organization. In such a situation, reports with dashes are submitted to the tax office in form 2-NDFL, and to the Pension Fund and Social Security - in forms RSF-1 and FSS-4.

Is it possible to hire an accountant?

If desired, an individual entrepreneur using the simplified tax system has the right to hire an accountant for professional accounting. There are several options here:

- Hiring a full-time specialist. This solution is suitable for individual entrepreneurs with complex financial statements or planning to hire staff. The entrepreneur will have to pay the accountant's salary every month, as well as contributions for him to the Pension Fund of the Russian Federation, the Social Insurance Fund, and pay maternity and sick leave. It is necessary to arrange a workplace for a specialist, purchase furniture and office equipment, provide an Internet connection, install accounting and reporting programs;

- Cooperation with a visiting accountant. Such employees often work part-time; it is easier for them to pay salaries without making contributions to funds.

- Remote accountant - the employee does not need a workplace; he has his own computer with accounting software and legal systems installed. The cost of such an accountant's services is lower than that of a full-time accountant.

- Outsourcing of accounting services - specialized companies enter into an agreement with the individual entrepreneur, providing guarantees and full support. Such organizations usually employ experienced and highly qualified specialists.

For a beginner individual entrepreneur who does not have accounting skills, or for an HOA, the services of a professional are the best option.

Features of filing a tax return

All taxpayers of the simplified system are required to fill out a tax return. Organizations submit a report at their location. Entrepreneurs send a report to the tax authorities at their place of registration, regardless of the area in which they operate. According to the law, the declaration is submitted for the tax period. The declaration form can be downloaded here.

Thus, the declaration is submitted:

- until March 31 of the following reporting year for taxpayers who are legal entities;

- until April 30 - for individual entrepreneurs.

Upon completion of business activity, the declaration is submitted by the 25th day of the last month after closure.

Organizations and individual entrepreneurs must submit a declaration to the tax authorities

When filling out the declaration, it is worth remembering the following points:

- The document is filled out either on a computer or in blue or black ink with capital printed characters.

- If the sheets of the document do not contain records, then they are not included in the declaration.

- Amounts used to calculate indicators must be rounded to whole rubles according to arithmetic rules. When calculating the values of some lines (for example, Pages 140, 141, 142, 143 and others), rounding down is used.

- If some cells are left blank or the value is zero, then a dash (“—”) is added.

- The document should not be stapled, but connected with a paper clip.

- If the taxpayer applies the “Income” tax regime, the data in the sheets is filled out: title page, sections 1.1, 2.1.1 and 2.1.2. In the taxation regime “income minus expenses”, the following sheets are filled out: title page, sections 1.2 and 2.2.

- Section 3 is completed only when the individual entrepreneur or organization received targeted revenues, financing, etc. during the reporting year.

- It is necessary to fill out the lines with advance payments. Unlike previous forms, the declarations for 2021 include amounts not actually paid, but required (calculated) to be paid for certain reporting periods. That is why filling out must begin with section 2, and then move on to section 1.

- The declaration sheets under the simplified tax system must be signed by the taxpayer or his representative, and also indicate the date of completion. If an organization or individual entrepreneur has a seal, it is affixed only on the title page of the document.

The declaration is submitted with zero indicators if:

- There was no income during the reporting period.

- The entrepreneur has just registered and has not started any profit-generating activities.

- The entrepreneur’s work season has ended (possible if it is specified in the documents that the type of activity is seasonal).

Video: features of filling out a zero declaration

The nuances of drawing up an updated declaration

According to the Tax Code of our country, the taxpayer, if an error is identified, has the right to submit an updated return for the period in which the error was made. A sample zero declaration is here.

The algorithm for submitting an updated declaration is as follows:

- Find the error and determine the period to which it relates.

- Calculate the amount of arrears, calculate penalties and transfer these amounts to the budget.

- To draw up an updated declaration under the simplified tax system, the form of the document that was in force during the period of error is used. If in 2017 an error was found in the calculation for 2021, then the form for the updated declaration must be for 2021. On the title page of the declaration, the serial number of the clarifying document is indicated in a special field.

- Provide correct information (fill out the declaration again).

- Compose a cover letter for the updated declaration.

If, as a result of an error made in the document, an overpayment of tax occurs, the taxpayer may not submit an updated return.

The covering letter must include an explanation as to why the amended declaration is being submitted.

The covering letter contains the following details:

- name of the body to which the updated information is provided;

- details of the taxpayer's organization (name, TIN, address, telephone);

- outgoing letter number and date;

- signature of the chief accountant and director of the organization; seal, if the company has one.

The letter must contain the following information:

- for what period and for what tax an updated declaration is provided;

- what exactly is the error discovered by the accountant, which entails the need to submit an updated declaration;

- what exactly has changed - it is advisable to indicate not only new, but also old values of the changing indicators;

- the amount of tax and penalties to be paid, indicating the details of payment slips for their payment;

- amount of tax overpayment - if you want to refund or offset the overpaid tax, indicate the number and date of the application for refund or offset of tax.

For violation of the deadlines for submitting a tax return, including if the reporting document was not submitted at all, administrative penalties are applied to the taxpayer. The amount of the penalty depends on whether the tax was paid. If the tax has been paid, the fine will be 1 thousand rubles. In the event that the tax was not paid and the declaration was not provided, the fine will be 5% of the tax amount for each month, but not more than 30% of the total tax amount.

Table: examples of tax calculations

| Tax rate | How is tax calculated? |

| 6% rate | Only the income part of the activity is taken into account. For example, a taxpayer received income in the amount of 700 thousand rubles. Then the calculation of the tax amount will look like this: tax = 700 thousand rubles. * 0.06 = 42 thousand rubles. |

| Rate of 15% | Not only income, but also expenses are taken into account. For example, the taxpayer’s expenses amounted to 400 thousand rubles. with an income of 700 thousand rubles. The calculation formula will be as follows: tax = (700 - 400) * 0.15 = 45 thousand rubles. |

What expenses cannot be recognized?

Despite the fact that the list of accepted costs, named in Art. 346.16, includes all the main costs that arise when conducting business; some payments cannot be taken into account:

- entertainment expenses that the taxpayer has the right to take into account on the OSN cannot be taken into account by the simplifier;

- the amount of advances transferred to suppliers for goods, works and services that will be received in the future. These payments can be taken into account only after the receipt of goods, works and services;

- VAT, which the simplified taxation system payer allocated in invoices issued to customers and paid to the budget;

- the simplified tax itself.

The Ministry of Finance in its clarifications emphasizes that the list of accepted costs under the simplified tax system is closed. It will not be possible to take into account other costs (Letter dated March 23, 2017 No. 03-11-11/16982).