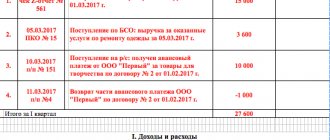

Payment

General information Account 67 is used to collect and process data on loans and borrowings,

O.I. Prokhorova author of the article, Ascon consultant on accounting and taxation All organizations are obliged

Intermediary services are generally considered to be the performance by an intermediary company of certain actions for the company ordering these services. At

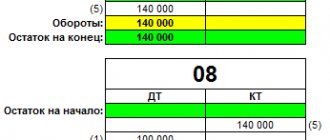

Accounting According to clause 6 of PBU 14/2007, intangible assets are accepted for accounting according to actual

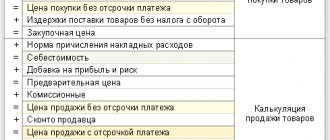

Cost is the most important part of calculating the final price of goods, works and services. Is an indicator of effectiveness

According to current regulations, vehicle owners have tax obligations to the state. For social

All owners of vehicles are required to pay transport tax (hereinafter referred to as TN). Road traffic counting procedure

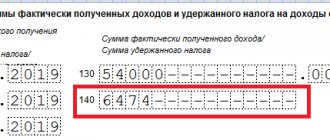

Employer reporting Marina Dmitrieva Leading expert - professional accountant Current as of June 27, 2019

Accounting is perhaps the most difficult topic that an entrepreneur has to deal with.

Invoice is a document according to which the buyer accepts for deduction of VAT on purchased goods and