When is offset possible?

Offsetting counterclaims is a way of terminating (in whole or in part) already existing mutual obligations.

The amounts of mutual debt very rarely coincide; usually the debt of one party is greater than the debt of the other. Then offset is made for the smaller amount. And the party whose debt was greater will have part of the obligation remaining unpaid.

Settlement of obligations is possible only if the following conditions are met.

Uniformity of counter debts

Requirements are considered homogeneous when they have the same subject and can be compared. Let's say, monetary claims expressed in one currency are homogeneous. For example, one party has a debt to pay for work performed, and the other has a debt to repay the loan, while each party owes the other money, which means that such obligations can be credited.

The courts consider it possible, for example, to set off claims for payment of the customer’s debt for work performed and for payment of a penalty for the contractor’s violation of deadlines for completing work, because, despite their different legal nature, these claims are monetary, that is, homogeneous

In principle, the parties can agree on the offset of heterogeneous claims, such as when the debt of one party is expressed in rubles, and the other in foreign currency. But then the companies need to agree on the rate at which the foreign currency debt will be converted into rubles.

Arrival of the deadline for fulfillment of obligations

At the time of offset, the payment deadline for each claim under the contract must already have arrived. For example, a tenant cannot offset against rental payments the cost of inseparable improvements made at his own expense with the consent of the landlord. And all because the counter-obligation of the lessor to reimburse the cost of these improvements will arise only after the termination of the lease agreement (unless otherwise provided for in the agreement. Although the Supreme Arbitration Court believes that offsetting obligations with unfulfilled deadlines is also possible

If the parties have not established specific terms for repayment of debts in the agreement, then offset can be carried out at any time.

Not long ago, changes were made to the Civil Code of the Russian Federation, and from June 1, 2015, in cases provided for by law, it is allowed to set off a counterclaim that has not yet come due

Prohibition of offset

There are cases when netting is in principle unacceptable, for example:

- the parties provided for such a condition in the contract;

- offset is directly prohibited by law (for example, in most cases it is impossible to carry out offsets with a foreign partner in foreign economic activity

- according to the requirements, the statute of limitations has expired (3 years from the date of occurrence

IP tax navigator. Offset and refund of overpayment of taxes (fines, penalties)

An overpayment of taxes, even a very small one, is like the proverb: “It’s a small misfortune, but it doesn’t let you sleep.” Full immersion in the topic will make it easy to restore the balance in tax payments before the statute of limitations makes it excruciatingly painful.

In general, the action plan is simple: discovered ⇒ chose: refund or offset ⇒ submitted an application to the tax office ⇒ received a refund or offset of the overpayment.

BLANKS AND FORMS on the topic

| Form name | Form (download) | Sample (view) |

| Application for offset of overpayment (Appendix 9 to Order of the Federal Tax Service of Russia dated 03.03.2015 No. ММВ-7-8/ [email protected] ) | ||

| Application for refund of overpayment (Appendix 8 to Order of the Federal Tax Service of Russia dated March 3, 2015 No. ММВ-7-8/ [email protected] ) |

So, overpaid tax: how to get it back? – read below in full detail and with illustrations. (the article mainly talks about overpayment of “tax”, but everything stated is also true for fines and penalties for taxes - editor’s note)

What documents need to be completed

The decision to carry out mutual offset must be documented. This is done, in particular, so that in the future there will be no problems either with counterparties or with inspectors. After all, in the absence of documents, neither you nor your business partner will have confirmation of your actual expenses, which means there is a risk of saying goodbye to expenses and earning penalties and fines.

Of course, you must have “traditional” documents documenting your relationship with the counterparty and the facts of the occurrence of mutual debts: contracts, invoices, acceptance certificates for work performed/services rendered, invoices, etc.

And the credit itself can be issued in two ways.

METHOD 1. One of the parties declares a set-off. But before carrying out a unilateral set-off, we recommend that you sign a reconciliation act for mutual settlements with the counterparty. This document is optional, but it will help confirm the amount of debt (especially if some of the debt has already been paid) and avoid unnecessary disputes with the counterparty.

Please note that one signed act of reconciliation of mutual settlements is not sufficient for offset, since such an act reflects only the business transactions of the parties for a certain period of time and is a document confirming the state of mutual settlements. Whereas in order to set off, the document must contain a clear and unambiguous indication of the termination of the obligations of each party.

After signing the reconciliation report, you (or your counterparty) write a letter (application, notification) to the other party. The offset will take place only if such an application is received by the relevant party. Therefore, submit the application under a personal signature (the recipient must sign your copy of the document) or send it by registered mail with acknowledgment of receipt.

The date of unilateral offset and, accordingly, its reflection in accounting will be:

- the specific date from which the parties’ debts are considered repaid, if it is indicated in the application;

- the day of receipt of the application (letter, notification) by the counterparty, if a specific date is not specified by the initiator of the offset.

METHOD 2. The parties sign a two-sided document

- offsetting act;

- agreement on the offset of mutual claims.

Compared to the first quarter of 2014, 1.5 times more goods were paid using claims offset

This will help avoid disputes and misunderstandings between counterparties. And when offsetting heterogeneous obligations or obligations with unfulfilled deadlines, a bilateral agreement of the parties is required

The offset date will be the day the agreement (act) is signed, unless otherwise expressly stated in the document.

Please note that both in a unilateral statement and in a set-off agreement, it is important to define as accurately as possible the obligations (debts) of each party and indicate:

- the grounds for their occurrence (refer to contracts, primary documents, invoices) in order to confirm the reciprocity and homogeneity of obligations;

- amounts of liabilities;

- deadlines for each of them.

The document must determine which obligations are repaid by offset and indicate the remaining debt of one of the parties.

In the absence of these essential conditions, the offset may be declared invalid.

We will show you how you can fill out an application for a test using method 1.

127204, Moscow, Dmitrovskoe sh., no. 157

Mayskaya V.P. 125315, Moscow, Leningradsky Ave., 68

Ref. No. 36 from 05/28/2015

Application for offset of counterclaims

Limited liability company represented by General Director S.L. Rukodelnikov, acting on the basis of the Charter, in accordance with Art. 410 of the Civil Code of the Russian Federation declares a partial offset of counterclaims of the same type, the deadline for fulfillment of which has come.

Information on counterclaims and debt of LLCs and LLCs as of May 28, 2015:

| Debt accepted for offset | Number and date of the agreement, essence of the obligation | Number and date of the primary document, invoice | Amount of liability, rub. | Deadline for fulfilling the obligation |

| Debt of LLC to LLC | Payment for consulting services under agreement No. 12 dated March 20, 2015 | Act No. 12 of 05/08/2015; invoice No. 12 dated 05/08/2015 | 295,000 (including VAT 18% - 45,000 rubles) | 14.05.2015 |

| Debt of LLC to LLC | Payment for repairs of the premises under contract No. 96 dated 02/16/2015 | Act No. 96 dated May 15, 2015; invoice No. 96 dated 05/15/2015 | 377,600 (including VAT 18% - 57,600 rubles) | 25.05.2015 |

The offset is made in the amount of 295,000 (two hundred ninety-five thousand) rubles, including VAT of 45,000 (forty-five thousand) rubles.

After offsetting mutual homogeneous claims, the balance of the LLC's debt to the LLC as of May 28, 2015 is 82,600 (eighty-two thousand six hundred) rubles, including VAT 12,600 (twelve thousand six hundred) rubles. The LLC's debt to the LLC has been repaid in full.

I received the application for credit on May 28, 2015.

When will the inspectorate return (offset) the overpayment of taxes?

The tax office must make a decision on offset or refund of amounts within 10 working days after receiving your application. Tax authorities must notify of their decision within 5 working days after its adoption.

If the decision is positive, the following is carried out:

- credit – within 10 working days;

- return – within one month.

The period is generally counted from the date the Federal Tax Service receives the taxpayer’s application.

But. If an overpayment is detected by an entrepreneur, the tax authority has the right to not immediately believe it and initiate additional procedures:

- reconcile tax payments - no more than 15 working days (if there are no discrepancies - 10 working days);

- conduct a desk audit (if the presence of an overpayment follows from a declaration, for example, an annual or clarifying one) - no more than 3 months.

And after these procedures are completed, the countdown begins for the Federal Tax Service to make a decision and offset and return the overpayment, i.e. plus 10 business days for credit or plus a month for refund.

Legislative foundation

- Article 78 of the Tax Code of the Russian Federation (Part 1) “Credit or refund of amounts of overpaid taxes, fees, penalties, fines”

- Article 79 of the Tax Code of the Russian Federation (Part 1) “Refund of amounts of excessively collected taxes, fees, penalties and fines”

- Order of the Federal Tax Service of Russia dated 03.03.2015 N ММВ-7-8/ [email protected] “On approval of document forms used by tax authorities when carrying out offset and refund of amounts of overpaid (collected) taxes, fees, penalties, fines”

- Letter of the Ministry of Finance of Russia dated July 12, 2010 N 03-02-07/1-315 (the offset and return of excess payments to the budget is carried out by the inspection at the place of your registration that identified the overpayment)

- Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57, paragraph 33 (for overpaid payments, an appeal to the court is possible only after the inspection has refused to satisfy the claim or left it unanswered)

- Part 4 Art. 198 of the Arbitration Procedure Code of the Russian Federation (the period for going to court when challenging a decision or action (inaction) of the tax authorities is three months)

How to reflect netting in accounting

Now it’s time to find out what tax consequences await the company when offsetting mutual claims.

VAT. The offset does not affect VAT. That is, on the day of offset there is no need to adjust either the amount of VAT payable accrued on the date of shipment of goods (performance of work, provision of services) or the amount of deduction

Problems with the deduction should not arise in the case where you were given an advance payment for upcoming supplies of goods (work, services), from which you paid VAT to the budget, but subsequently you did not sell the goods (work, services), and the advance was credited against counter obligations

Income tax. There will be no income tax consequences for you when making an offset. You will reflect the proceeds from the sale of goods (work, services) to your counterparty and the costs of purchasing goods (work, services) from him in tax accounting even before the offset. And the fact of repayment of debt for sold goods (work, services) is not taken into account when reflecting income and expenses.

USNO. For simplified people, the date of recognition of income is not only the day the money is received, but also the day the debt is repaid in another way. Offsetting is that very different method. That is, on the basis of an act (agreement, application) of offset, you need to reflect income in the amount of the repaid debt of the counterparty. At the same time, the goods (work, services) you purchased will be considered paid (also for the amount of the repaid debt), which means that one of the conditions for recognizing expenses in the “income-expenditure” is met.

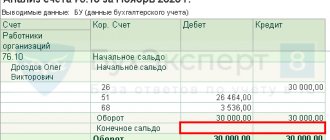

Accounting. Income from the sale of goods (works, services) and expenses for their purchase should be reflected in your accounts as usual. As a result, you, as a buyer of goods (works, services), will have accounts payable (balance on the credit of account 60 “Settlements with suppliers and contractors” or account 76 “Settlements with various debtors and creditors”) for their payment. At the same time, when selling goods (works, services), you generate accounts receivable (the balance in the debit of account 62 “Settlements with buyers and customers”).

On the date of offset, make a debit to account 60 “Settlements with suppliers and contractors” (account 76 “Settlements with various debtors and creditors”) – credit account 62 “Settlements with buyers and customers” for the amount of less debt. Thus, receivables and payables will be fully or partially repaid.

Pay attention to one more important nuance. If you decide to set off unilaterally, you need to take into account that subsequently you will not be able to refuse your decision

What to do if there is an overpayment of taxes?

Overpayment of tax can occur in two cases:

- you are mistaken - this is overpaid tax;

- The tax authority made a mistake - this is an excessively collected tax.

In the second case, the amount of excessively collected tax is subject to refund with interest (from the day following the collection to the day of refund or offset at the refinancing rate of the Bank of Russia in force during this period).

The distinctive criterion is the basis for the transfer to the budget.

Overpaid tax occurs if you have paid more than is required by law. The reasons may be different, for example:

- the entrepreneur himself (without the “help” of tax authorities) incorrectly calculated the amount of tax;

- error in the payment (incorrect amount, incorrect details, repeated payment, etc.);

- change in the tax regime (for example, in the middle of the year the right to use the simplified tax system was lost, and advance payments had already been made), changes in legislation;

- At the end of the year, the final tax amount is less than the advance payments made.

The common basis for these reasons is that the overpayment was made by the entrepreneur without the participation of the tax authority. If the tax authorities made a decision, made a demand, and you paid it, even voluntarily, this is already an excessively collected tax.

Excessively collected tax - more was transferred to the budget than required by law, and this was caused by the actions of the tax authority. For example:

- the inspectorate assessed additional taxes, and the entrepreneur challenged them in court, but at the time of the court’s decision the money had already been transferred to the budget;

- the tax authority assessed tax, fines, penalties, reflected this in the decision based on the results of the tax audit and (or) in the request, the amounts were transferred to the budget, after which errors were identified. It does not matter whether the entrepreneur voluntarily paid the excess amounts or they were collected forcibly, it is important that the basis was “calculations” of the Federal Tax Service;

- The tax authorities identified an overpayment of taxes and independently carried out an offset against the arrears; later it turned out that there was an overpayment, but the debts in the repayment of which the overpayment was offset were accrued erroneously (an unlawful offset from the date of its implementation can be considered an excessively collected amount).

The resulting overpayment can be:

- offset against existing tax debts (fines, penalties);

- offset against future payments;

- return to the bank account.

The procedure for “offsetting” an overpayment is simpler than a refund; as a rule, the tax authorities are more willing to offset it. But offsets are only possible between taxes of the same level (see the next topic).

If there are tax debts (penalties, fines) that can be offset, first an offset will be made to pay them off; the remaining amount can be disposed of at your own discretion.

If there are debts that can be offset, tax authorities can independently direct the resulting overpayment to pay off the debt, without your application, notifying you “after the fact.” But they do not always show such independence. Therefore, you don’t have to wait for the Federal Tax Service and take the initiative: the test will be completed faster - less penalties.

If the overpayment is an excessively collected amount, there are no tax debts, and you want to offset the amounts against future payments, a question may arise, since the Tax Code does not directly indicate the possibility of such an offset (it only stipulates the return of such amounts). The approved application forms for this “option” require minor adjustments. However, the tax authorities may agree to this (internal regulations allow them such an offset). But it’s better to consult with the inspectorate first.

To return or offset tax overpayments, you must send an application to the Federal Tax Service. Application forms are approved by Order No. ММВ-7-8/09 (see below).

Settlement of loans and services

At the same time, when selling goods (works, services), you generate accounts receivable (the balance in the debit of account 62 “Settlements with buyers and customers”). On the date of offset, make a debit to account 60 “Settlements with suppliers and contractors” (account 76 “Settlements with various debtors and creditors”) – credit account 62 “Settlements with buyers and customers” for the amount of less debt. Thus, receivables and payables will be fully or partially repaid. *** Please pay attention to one more important nuance. If you decide to set off unilaterally, you need to take into account that subsequently you will not be able to refuse your decision. 9 Information letter of the Presidium of the Supreme Arbitration Court dated December 29, 2001 No. 65. Other articles of the magazine “MAIN BOOK” on the topic “Receivable / Creditor”: 2018

Registration and accounting of netting - loan and delivery

For offset, a statement from one party is sufficient. However, as a rule, the parties formalize the offset by a bilateral act. Since the provision of services is reflected in any case through account 90 “Sales”, in this situation it is advisable to make the following accounting entries: Debit 51 Credit 66 (67) – 500,000 rubles.

– a loan was received from company A Debit 66 (67) Credit 51 – 100,000 rubles. – part of the loan amount was returned to the lender Debit 62 Credit 90-1 – 400,000 rubles. – revenue from the provision of services to company A is reflected Debit 90-2 Credit 20 – expenses associated with the provision of services are written off Debit 66 (67) Credit 62 – 400,000 rubles. – reflects the offset of obligations under the loan agreement and the service agreement (offset act). We believe that you are not sufficiently aware of the capabilities of your accounting program.

How to offset a participant's loan with its dividends?

Good afternoon I’m asking for help and advice on the procedure for offsetting the founder’s loan with dividends. I’ve never paid dividends before, so I apologize in advance)

There are two founders in an LLC on the simplified tax system of 6%; on May 10, 2021, one founder (director) took out a loan of 800,000 rubles. at 6.3% per annum. This year it is planned to distribute profits (including from the amount of previous years) in the form of dividends and the director wants to offset monetary obligations, without actually paying/depositing funds from/to the current account, in order to exclude payment to the bank for these operations.

The action plan is as follows:

1.Additional agreement to the loan agreement that interest on the loan is paid separately from the total amount and that offset with dividends is possible. 2. On March 2, 2021, we approve annual reporting. 3. March 5, 2021, protocol on the distribution of profits and payment of dividends to the director in the amount of RUB 930,000. and it also contains a decision on the offset of 800,000 rubles. 4. March 5, 2021 - entries for accrual of dividends, netting and accrual of personal income tax in the amount of 120,900 rubles. 5. March 7, 2021 - Offset reconciliation report and offset agreement. — Payment by the director of interest on the account of the LLC is 41,701 rubles. (then -6% according to the simplified tax system) - Payment of the “balance” of dividends to the card is 9,100 rubles. — Payment (is it possible to withhold?) personal income tax 120,900 rubles.

What should you pay attention to or change in this diagram to avoid errors? Thank you in advance!

Settlement without problems

To better understand the intricacies of design, implementation and reflection in accounting for offsets, I suggest you read this article. When it is possible and when it is not possible to carry out offsets The ability to pay off obligations by offsetting mutual claims is provided for in Art. 410 of the Civil Code of the Russian Federation. The same rule of law establishes the conditions necessary for mutual settlement between counterparties:

- Presence of counter debt. That is, each party acts as both a debtor and a creditor in relation to the other party.

- Uniformity of requirements. For example, a monetary claim can only be offset by a counter monetary claim. If a monetary claim is offset by the delivery of goods, then we are talking more about a barter transaction, but not about offset.

- The deadline for fulfilling the requirements has arrived (either not specified or determined by the moment of demand).

Answer (One)

Describe why you are complaining about this answer

First of all, we note that by virtue of Art. 17, 23 of the Civil Code of the Russian Federation, state registration as an entrepreneur does not create a new subject of civil law in the form of an individual entrepreneur, but only gives an individual (citizen) a special status associated with engaging in entrepreneurial activity (see, for example, the resolution of the Ninth Arbitration Court of Appeal dated 13.03. 2012 N 09AP-597/12). Also, in this case, no property of a citizen is legally separated (Article 24 of the Civil Code of the Russian Federation). This was confirmed by the Constitutional Court of the Russian Federation in resolution dated December 17, 1996 N 20-P (see also the determination of the Constitutional Court of the Russian Federation dated May 15, 2001 N 88-O, resolution of the Federal Antimonopoly Service of the Ural District dated June 10, 2009 N F09-3754/09-С2, Eighteenth Arbitration Court of Appeal dated February 18, 2009 N 18AP-498/2009).

Thus, a citizen (individual), being registered as an individual entrepreneur, remains the same person from the point of view of the law, i.e. In your situation, there is no need to re-execute the loan agreement. In our opinion, you can set off if the conditions established by Art. 410 of the Civil Code of the Russian Federation.

As a general rule, in order to terminate counter-obligations by offset, the following conditions must be simultaneously met ( Article 410 of the Civil Code of the Russian Federation):

— the requirements being read must be homogeneous. For example, the parties owe each other money: one has a debt for purchased goods, and the second has a debt to repay the loan;

— at the time of offset, each of the offset claims must be due (with the exception of cases where the law allows offset of a claim that has not yet matured). This condition is met even when, according to the terms of the contract, the obligation must be fulfilled on demand;

— offset must not be prohibited by law or contract. For example, according to the law, it is impossible to set off a claim for which the statute of limitations has expired (Article 411 of the Civil Code of the Russian Federation).

When the claims being offset are not equal in size, the offset is made for the smaller of the amounts.

To avoid possible disputes with the counterparty, it is better to draw up a bilateral agreement on offset.

Loan repayment services

Reflection of offsets in tax accounting

- Income tax

Accounting for transactions of offsetting mutual claims when calculating corporate income tax depends on which method of accounting for income and expenses is used. If an organization uses the accrual method, then the offset will not affect the calculation of income tax in any way.

In this case, neither income nor expenses arise, since income and expenses are taken into account regardless of the fact of their payment (clause 1 of Article 271, clause 2 of Article 272 of the Tax Code of the Russian Federation). Under the cash method, income and expenses are taken into account upon repayment of debt, including through the offset of mutual claims (clause

2 tbsp. 273 of the Tax Code of the Russian Federation). That is, on the date of offset, the organization must reflect in tax accounting income in the amount of the offset debt of the counterparty and expenses in the amount of its debt to the counterparty, repaid by offset.

Which taxes can be offset?

All taxes are divided into groups (types): federal, regional and local. This distribution is established by the Tax Code (Articles 12 – 15).

see types of taxes according to clause 7 of Art. 12, art. Art. 13 - 15 Tax Code of the Russian Federation

Federal taxes and fees:

- taxes under special tax regimes (STS, UTII, Unified Agricultural Tax, Patent)

- value added tax;

- excise taxes;

- personal income tax;

- corporate income tax;

- mineral extraction tax;

- water tax;

- fees for the use of objects of the animal world and for the use of objects of aquatic biological resources;

- National tax.

Regional taxes:

- corporate property tax;

- gambling tax;

- transport tax.

Local taxes and fees:

- land tax;

- property tax for individuals;

- trade fee.

Overpayment can be offset only between taxes of the same group (type), regardless of which budget the revenues go to and which BCC (budget classification code).

In addition, an entrepreneur can act as a tax agent: for example, transfer personal income tax to the budget from the salaries of his employees. It is also impossible to offset between taxes for which the individual entrepreneur acts as a tax agent and taxes for which the individual entrepreneur is the taxpayer.

Offsetting under loan and service agreements

Thus, when offsetting mutual claims under loan agreements with a foreign counterparty, it should be taken into account that regulatory authorities may have claims of violation of the repatriation rule provided for by currency legislation, in which case they will have to defend their position in court. Add to Bookmarks Print The material presented in this article is provided for informational purposes only and may not be applicable to your particular situation and should not be taken as a guarantee of future results.

Settlement of mutual claims under loan agreements with a foreign counterparty

For simplifiers, the date of recognition of income is not only the day the money is received, but also the day the debt is repaid in another way. 1 tbsp. 346.17 Tax Code of the Russian Federation. Offsetting is that very different method. That is, on the basis of an act (agreement, application) of offset, you need to reflect income in the amount of the repaid debt of the counterparty.

At the same time, the goods (work, services) you purchased will be considered paid (also for the amount of the repaid debt), which means that one of the conditions for recognizing expenses under the “income-expenditure” simplified tax system is met. 2 tbsp. 346.17 Tax Code of the Russian Federation. Accounting. Income from the sale of goods (works, services) and expenses for their purchase should be reflected in your accounts as usual.

What is the deadline to submit an application for a credit or refund of overpaid taxes?

Overpaid tax

The period for filing a claim with the tax authority is 3 years. In general, the period begins to count from the moment of payment.

Peculiarities:

- If the overpayment occurred when transferring advance payments (that is, at the end of the year the tax amounts turned out to be less than the advance payments already transferred), then the three-year period begins from the date of filing the annual declaration. Or from the statutory date for filing the return if the return is filed late.

- If the tax was paid in parts (several payments) and there was an overpayment, the period is calculated for each payment separately.

Rules for calculating the period:

- the term expires on the corresponding date and month of the last year of the term (i.e. the same date of the same month three years later);

- If the expiration date falls on a weekend or holiday, the expiration date is postponed to the next working day.

For example: an erroneous payment was made on October 28, 2014, since October 28, 2021 is a Saturday, then you must apply for a refund (offset) of the overpayment until October 30, 2021 inclusive.

The deadline for going to court when challenging the decision of the tax authorities is 3 months from the day the tax authority refused the offset (refund) or did not make a decision on the offset (refund) within the period established by the Tax Code (this is 10 working days).

You can also go to court with a material claim for offset or refund of overpaid taxes, i.e. file an application with the court not to appeal the decision of the tax authority, but to return (offset) the overpaid amount of tax. In this case, the general limitation period is 3 years. There is a fine line here, a legal one: if this is your case, contact a lawyer.

Overcharged tax

The deadline for contacting the tax authority is 1 month from the day you learned about the collection, or when the judicial act on the unlawful collection of taxes came into force.

The period for going to court is 3 years from the day you learned or should have known about the collection of excess payments.

PS Have you done everything and are waiting for a refund or credit? Be patient…

Settlement of mutual claims: when and how to carry out

The courts consider it possible, for example, to set off claims for payment of the customer's debt for work performed and for payment of a penalty for the contractor's violation of deadlines for completing work, because, despite their different legal nature, these claims are monetary, that is, homogeneous. Resolution of the Presidium of the Supreme Arbitration Court of June 19, 2012 No. 1394 /12. In principle, the parties can agree to set off heterogeneous claims.

4 of the Resolution of the Plenum of the Supreme Arbitration Court dated March 14, 2014 No. 16, let’s say those when the debt of one party is expressed in rubles, and the other in foreign currency. But then the companies need to agree on the rate at which the foreign currency debt will be converted into rubles. Arrival of the deadline for fulfillment of obligations At the time of offset, the payment deadline for each claim under the contract must already have arrived. Especially for the site www.4dk-audit.ru One of the methods of settlements between organizations is the offset of mutual claims (Article 410 of the Civil Code of the Russian Federation). At the same time, the legislation does not provide for exceptions for any circle of persons who are parties to a transaction for offsetting mutual claims. It follows from this that mutual settlement can also be carried out with a foreign counterparty. However, it should be taken into account that offset is possible if the following conditions are simultaneously met: - organizations that intend to carry out offset must have counterclaims against each other; — counterclaims of organizations must be homogeneous; — deadline for fulfilling a counterclaim of the same type:

- has already arrived;

- was not specified in the contract;

- was determined by the moment of demand.

At the same time, there is no definition of a homogeneous requirement in civil legislation.

Naturally, income and expenses are taken into account for tax purposes, provided that they are accepted. Under the simplified tax system, income and expenses are determined using the cash method, so the date of repayment of debt through netting will be the date of recognition of both income and expense simultaneously (clause

Tax Code of the Russian Federation). In this case, it is necessary to take into account the rules for recognizing certain types of expenses under the simplified tax system. For example, expenses for the purchase of goods for further sale can be taken into account only after their actual sale (clause

2 p. 2 art. 346.17 Tax Code of the Russian Federation). If offset is carried out on the debt of counterparties for goods (work, services) supplied, then this will not affect the calculation of VAT in any way: the obligation to pay VAT arose at the time of shipment of goods (work, services), and the right to deduction is when the purchased goods are accepted for accounting (works, services).

Short period of property ownership

For the sake of you and me, let there be a large Ivantsov family, headed by Ivan Petrovich. Not long ago, the family purchased an apartment, but for reasons beyond our control decided to change it. Let Ivan Petrovich act as the seller and the buyer, which means he will be the main character of the story.

In order to qualify for tax deductions, and therefore take advantage of the offset, Ivantsov must meet two conditions:

- he receives official income and pays personal income tax at a rate of 13%;

- previously did not use the right to deduction (or did not use it fully after 2014).

Now let's take a closer look at what Ivan Petrovich needs to know.

Selling an apartment

If the owner has owned the residential space for less than three years (and from 01/01/2016 - less than 5 years), you will have to familiarize yourself with the tax legislation. The seller must pay 13% tax on the amount for which the property was sold.

The law says that the former owner can reduce the tax payment by the amount of the deduction, and the latter should not exceed 1 million rubles. What does this mean in practice?

In the year following the sale of the property, Ivan Petrovich must submit a 3-NDFL declaration to pay tax on this income. At the same time, he can take advantage of the deduction. After which the 13% payment should be made not from the actual cost of the apartment, but from the amount reduced by the tax benefit.

There are 2 options on how you can reduce the tax base:

- Tax deduction 1,000,000 rub. If the apartment is sold for less than 1 million rubles, a deduction is provided for the actual cost of housing.

- There is another option. If Ivantsov can confirm the expenses he incurred in purchasing this apartment, then he can claim a deduction for the entire amount spent.

For example, Ivan Petrovich bought an apartment a year ago for 1,950,000 rubles. Now he is selling this home for RUR 3,300,000. Since the seller still has payment documents from a year ago, he has a choice of how much to apply for a tax deduction.

Option 1. Deduction of 1 million rubles. Ivantsov must pay a tax of 13%*(3,300,000 rubles – 1,000,000 rubles)=299,000 rubles.

Option 2. Deduction for the amount of expenses. We receive a tax of 13% * (3,300,000 rubles – 1,950,000 rubles) = 175,500 rubles.

The second option is preferable if the apartment was purchased for an amount greater than the maximum deduction.

But very often a new apartment is sold at the same price for which it was purchased. In this case, the mathematics turns out to be even more interesting.

Let Ivantsov’s friend Sergei Petrovich Koltsov buy his apartment for 3 million rubles, and a year later he was forced to sell it. The same figure was indicated in the contract. Sergei Petrovich also has 2 options regarding which tax benefit to use: 1 million rubles or towards expenses.

Option 1. We subtract the benefit from the total sale amount and pay tax on the remaining amount: 13% * (3 million - 1 million) = 260,000 rubles.

Option 2. We compensate the income from the sale with the costs of purchasing the same property: 13% * (3 million - 3 million) = 0 rub.

As they say, think for yourself which option suits you best.