Accounts receivable are classified:

- by maturity (short-term - payments are expected within 12 months after the reporting date; long-term - payments are expected more than 12 months after the reporting date);

- according to the degree of possibility of collection (current - debt within the payment terms established by the contract; doubtful - the repayment period has already been violated, but the company is confident that the funds will be received; bad - debts that are unrealistic for collection).

Depending on the size of their operations, companies may establish their own classifications of accounts receivable.

How are accounts receivable different from accounts payable?

If we denoted the first with the words “you owe,” then accounts payable can be denoted as “you owe.” The second case includes loans to banks, debts for goods received from partners, fines or penalties.

Neither concept is absolutely good or bad. For example, the absence of accounts receivable indicates that the company carefully selects partners and does not make risky transactions. But remote control can bring additional income, albeit with additional risks. It all depends on the company’s management – it is important to choose a strategy.

The same goes for accounts payable. If it is, then there is the possibility of non-payment and bankruptcy. But additional investment can significantly improve a company's productivity and efficiency.

Availability and movement of accounts receivable

| Indicator name | Period | For the beginning of the year | Changes over the period | At the end of the period | |||||||

| accounted for under the terms of the contract | amount of reserve for doubtful debts | admission | dropped out | transfer from long-term to short-term debt | accounted for under the terms of the contract | amount of reserve for doubtful debts | |||||

| as a result of business transactions (amount of debt under the transaction transaction) | interest, penalties and other charges due | repayment | write-off to financial result | reserve restoration | |||||||

| Long-term accounts receivable - total | 2011 | — | ( — ) | — | — | ( — ) | ( — ) | — | ( — ) | — | ( — ) |

| 2010 | — | ( — ) | — | — | ( — ) | ( — ) | — | ( — ) | — | ( — ) | |

| Short-term accounts receivable - total | 2011 | 558 676 | ( — ) | 491 504 | — | ( 547 347 ) | ( 685 ) | — | — | 502 148 | ( — ) |

| 2010 | 321 756 | ( — ) | 583 358 | — | ( 345 885 ) | ( 553 ) | — | — | 558 676 | ( — ) | |

| including: buyers and customers | 2011 | 451 749 | ( — ) | 326 966 | — | ( 435 059 ) | ( 199 ) | — | — | 343 457 | ( — ) |

| 2010 | 210 623 | ( — ) | 449 913 | — | ( 208 410 ) | ( 377 ) | — | — | 451 749 | ( — ) | |

| suppliers and contractors | 2011 | 74 413 | ( — ) | 137 699 | — | ( 88 887 ) | ( 268 ) | — | — | 122 957 | ( — ) |

| 2010 | 86 439 | ( — ) | 101 418 | — | ( 113 323 ) | ( 121 ) | — | — | 74 413 | ( — ) | |

| taxes and fees | 2011 | ( — ) | — | ( 562 ) | ( — ) | — | — | ( — ) | |||

| 2010 | ( — ) | — | ( 368 ) | ( — ) | — | — | ( — ) | ||||

| other | 2011 | 31 952 | ( — ) | 26 313 | — | ( 22 839 ) | ( 685 ) | — | — | ( — ) | |

| 2010 | 24 326 | ( — ) | 31 465 | — | ( 23 784 ) | ( 553 ) | — | — | ( — ) |

Availability and movement of accounts payable

| Indicator name | Period | Balance at the beginning of the year | Changes over the period | Balance at the end of the period | ||||

| admission | dropped out | transfer from long-term to short-term debt | ||||||

| admission | as a result of business transactions (amount of debt under a transaction, operation) | repayment | write-off to financial result | |||||

| Long-term accounts payable - total | 2011 | — | — | — | ( — ) | ( — ) | ( — ) | — |

| 2010 | — | — | — | ( — ) | ( — ) | ( — ) | — | |

| Short-term accounts receivable - total | 2011 | 451 089 | 284 588 | — | ( 457 522 ) | ( 71 ) | — | 278 084 |

| 2010 | 284 972 | 457 375 | — | ( 290 921 ) | ( 337 ) | — | 451 089 | |

| including: advances received | 2011 | 130 561 | 138 300 | — | ( 129 126 ) | ( 55 ) | — | 139 680 |

| 2010 | 70 256 | 129 256 | — | ( 68 614 ) | ( 337 ) | — | 130 561 | |

| debt to staff | 2011 | 23 225 | 28 031 | — | ( 23 225 ) | ( — ) | — | 28 031 |

| 2010 | 26 072 | 23 225 | — | ( 26 072 ) | ( — ) | — | 23 225 | |

| debt to the budget and extra-budgetary funds | 2011 | 124 471 | 68 962 | — | ( 124 471 ) | ( — ) | — | 38 962 |

| 2010 | 81 712 | 124 471 | — | ( 81 712 ) | ( — ) | — | 124 471 | |

| debt to suppliers and other creditors | 2011 | 172 832 | 49 295 | — | ( 180 700 ) | ( 16 ) | — | 41 411 |

| 2010 | 106 932 | 180 423 | — | ( 114 523 ) | ( — ) | — | 172 832 |

Production costs

| Indicator name | For 20 11 g | For 2010 |

| Material costs | 1 074 512 | 1 174 533 |

| Labor costs | 553 359 | 426 588 |

| Contributions for social needs | 172 287 | 105 858 |

| Depreciation | 47 946 | |

| Other costs | 297 005 | 58 134 |

| Total by elements | 2 149 892 | 1 813 059 |

| Change in balances (increase [-], decrease [+]): | — 98 119 | -21 078 |

| work in progress, finished products, etc. | -10 674 | |

| Total expenses for ordinary activities | 2 052 411 | 1 781 307 |

APPENDIX B

Plan of technical and economic indicators of the workshop

1. Main technical and economic indicators of the workshop

| Item no. | The name of indicators | Unit change | Plan for the quarter | Incl. by month | |

| July | August | September | |||

| 1.1. Approved indicators | |||||

| Volume of commercial products | Thousand rub. | 10406.09 | 3185,17 | 4052,17 | 3168,75 |

| Volume of marketable products (stable labor intensity of the department) | Thousand LF | 40,04 | 12,23 | 15,56 | 12,25 |

| Volume of marketable products (current labor intensity of the department) | Thousands per hour piecework Let's wait. | 35,68 | 10,93 8,46 2,47 | 13,80 10,22 3,58 | 10,95 7,89 3,06 |

| 1.2. Estimated indicators | |||||

| Volume of commercial products | thousand n/h | 40,04 | 12,23 | 15,56 | 12,25 |

| Volume growth rate | % | ||||

| Output per 1 worker | rub. | ||||

| Output per 1 worker | LF | ||||

| Output per 1 production worker | rub. | ||||

| Output per 1 production worker | LF | ||||

| Number of production workers | people | ||||

| Payroll fund | thousand roubles. | 6049,05 | 1967,01 | 2123,00 | 1959,04 |

| Average salary of 1 worker | rub. | ||||

| Cost of commercial products | thousand roubles. |

2 LABOR AND WAGES 2.1 Use of production workers’ time

| Item no. | The name of indicators | Unit change | Plan for the quarter | Incl. by month |

| July | August | September | ||

| Number of man days | days | |||

| Total no-shows (17%) | >> | |||

| including: due to illness (4.4%) | >> | |||

| regular vacation (10.6%) | >> | |||

| student leave (0%) | >> | |||

| other (2%) | >> | |||

| Number of hours/hours total (page 1 *0.83) | hour. |

2.2 Working time budget per worker

| Item no. | The name of indicators | Unit change | Plan for the quarter | Incl. by month |

| July | August | September | ||

| Use of the working day | hour. | |||

| Number of working days | days | |||

| Number of working hours (page 2*8h) | hour. | |||

| Lost working time | % | |||

| Return of 1st worker 115% (line 3*0.83*1.15) | hour. | |||

| % processed 130 deal | hour. | |||

| 100 time | hour. |

2.3 Number of personnel

| The name of indicators | Plan for the quarter | Incl. by month |

| July | August | September |

| Total staff | ||

| including: production workers | ||

| Piece workers (TPdt/ Output of 1st worker) | ||

| time workers | ||

| auxiliary workers | ||

| Total workers | ||

| RSS | ||

| of which: managers | ||

| specialists | ||

| employees |

2.4 Structure of the workshop’s wage fund for the __ quarter (in thousand rubles)

| The name of indicators | Production workers | Auxiliary workers | ||||||

| Plan for the quarter | Incl. by month | Plan for the quarter | Incl. by month | |||||

| July | August | September | July | August | September | |||

| Total fund amount | 3646,48 | 1166,16 | 1322,14 | 1158,18 | 767,91 | 255,96 | 255,96 | 255,98 |

| Piece payment according to tariff | 1213,98 | 383,65 | 467,37 | 362,96 | 211,35 | 70,45 | 70,45 | 70,45 |

| Harmfulness | 0,00 | 0,00 | 0,00 | 0,00 | ||||

| Time-based payment according to the tariff | 732,70 | 233,84 | 249,43 | 249,43 | 252,94 | 84,31 | 84,31 | 84,32 |

| Personal mark | 10,50 | 3,50 | 3,50 | 3,50 | ||||

| Professional skills | 165,50 | 55,16 | 55,17 | 55,17 | 22,98 | 7,66 | 7,66 | 7,66 |

| Contract (personal allowances) | ||||||||

| Other payments 0.1% | 1,95 | 0,62 | 0,72 | 0,61 | 2,32 | 0,77 | 0,77 | 0,77 |

| Premium (41.84%) | 884,53 | 281,7 | 323,3 | 279,6 | 146,52 | 48,84 | 48,84 | 48,84 |

| Non-production payments | 148,50 | 49,5 | 49,5 | 49,5 | 15,00 | 5,00 | 5,00 | 5,00 |

| Length of service | 139,34 | 46,45 | 46,45 | 46,44 | 46,335 | 15,45 | 15,45 | 15,45 |

| Payment for next vacations | 349,48 | 111,77 | 126,72 | 111,00 | 70,44 | 23,48 | 23,48 | 23,48 |

Table

2.5 Structure of the salary fund for managers and specialists

| The name of indicators | Managers | Specialists | ||||||

| Plan for the quarter | Incl. by month | Plan for the quarter | Incl. by month | |||||

| July | August | September | July | August | September | |||

| Total fund amount | 946,20 | 315,4 | 315,4 | 315,40 | 661,62 | 220,54 | 220,54 | 220,54 |

| Salaries | 563,19 | 187,73 | 187,73 | 187,73 | 403,50 | 134,5 | 134,5 | 134,5 |

| Contract | ||||||||

| Personal allowances | 27,06 | 9,02 | 9,02 | 9,02 | 27,24 | 9,08 | 9,08 | 9,08 |

| Prize | 286,26 | 95,42 | 95,42 | 95,42 | 172,32 | 57,44 | 57,44 | 57,44 |

| Length of service | 66,69 | 22,23 | 22,23 | 22,23 | 54,06 | 18,02 | 18,02 | 18,02 |

| Non-production payments | 3,00 | 4,50 | 1,5 | 1,5 | 1,5 |

3. Cost

3.1 Cost estimate for workshop production

| Indicator name | Plan, thousand rubles |

| Basic materials | 1152,93 |

| Salaries of main production workers | 1629,5 |

| Salaries of other categories | 1022,69 |

| Depreciation | 483,76 |

| Electricity | 88,66 |

| Water, heat, air | 225,77 |

| Auxiliary materials | 94,18 |

| Services, including | 615,49 |

| instrumental production | 386,72 |

| mechanic service repair | 87,87 |

| energy service services | 106,43 |

| printing services | 8,69 |

| other services | 0,87 |

| workshop 24 | 24,91 |

| Builder services | 2,37 |

| Marriage | |

| Others | |

| Total costs | 5315,35 |

3.2 Commodity products by costing items

| Article title | September, thousand rubles |

| Materials | 1172,51 |

| Wage | 488,37 |

| Premium (49%) | 239,3 |

| Additional salary (25%) | 181,92 |

| S/s accruals (27.7%) | 251,96 |

| General production expenses (411%) | 2007,2 |

| Total cost | 3168,75 |

3.3 General production costs

| Name of overhead expense item | Plan, thousand rubles |

| Depreciation of equipment, vehicles and valuable tools | 474,18 |

| Equipment operation | 152,48 |

| Repair of equipment | 422,04 |

| In-plant movement of goods | 36,04 |

| other expenses | 208,14 |

| Maintenance of management staff | 402,76 |

| Maintenance of other shop personnel | 398,27 |

| Depreciation of buildings | 3,53 |

| Maintenance of buildings, structures and equipment | 268,9 |

| Repair of buildings, structures and equipment | 16,08 |

| Tests, experiments and research | |

| Occupational Safety and Health | 9,96 |

| Wear of MBP | 4,34 |

| Others | |

| Total | 2396,72 |

Appendix B

Report on the implementation of the plan for the procurement production workshop

Main technical and economic indicators of the workshop

| NN p/p | The name of indicators | units measured | 1st quarter 2012 | ||

| plan | fact | % | |||

| 1. | Gross output | n/hour. | 162 487 | 176 911 | 8,9 |

| 2. | Output per 1 worker (n/hour/average headcount) | n/hour. | 254,7 | 282,2 | 10,8 |

| 3. | Salary fund, total | thousand roubles. | 50 631 | 50 306 | -0,6 |

| incl. | production workers - piece workers | thousand roubles. | 30 160 | 30 532 | 1,2 |

| production workers - temporary workers | thousand roubles. | 3 737 | 3 399 | -9,0 | |

| temporary auxiliary workers | thousand roubles. | 4 417 | 4 248 | -3,8 | |

| auxiliary piece workers | thousand roubles. | 2 880 | 2 846 | -1,2 | |

| employees | thousand roubles. | 9 436 | 9 280 | -1,7 | |

| 4. | average salary | thousand roubles. | 26,41 | 26,74 | 1,3 |

| incl. | production workers - piece workers | thousand roubles. | 32,96 | 33,37 | 1,2 |

| production workers - temporary workers | thousand roubles. | 20,76 | 19,88 | -4,3 | |

| temporary auxiliary workers | thousand roubles. | 13,63 | 13,75 | 0,9 | |

| auxiliary piece workers | thousand roubles. | 22,86 | 22,59 | -1,2 | |

| employees | thousand roubles. | 25,37 | 25,78 | 1,6 | |

| 5. | Premium amount | % | 73,7 | -1,7 | |

| incl. | production workers - piece workers | % | 82,9 | -7,9 | |

| production workers - temporary workers | % | -4,3 | |||

| Table continuation | |||||

| temporary auxiliary workers | % | 52,4 | -4,7 | ||

| auxiliary piece workers | % | 58,8 | -2,0 | ||

| employees | % | 67,2 | 3,4 | ||

| 6. | Number | people | -1,9 | ||

| incl. | production workers - piece workers (average/payroll) | people | 0,0 | ||

| production workers - piece workers (payroll) | people | 0,0 | |||

| production workers - time workers (average/scheduled) | people | 0,0 | |||

| production workers - temporary workers (full-time) | people | 0,0 | |||

| auxiliary workers - temporary workers (average/registered) | people | — | 0,0 | ||

| auxiliary workers - temporary workers (full-time) | people | — | 0,0 | ||

| auxiliary piece workers | people | 0,0 | |||

| employees (average/registered) | people | 0,0 | |||

| employees (full-time) | people | 0,0 | |||

| 7. | Standards fulfillment rate (hours/timesheets worked by main piece workers) | 1,37 | 1,357 | -0,9 | |

| Compliance rate (n/hour/timesheets worked by auxiliary piece workers) | 1,25 | 1,326 | 6,1 | ||

| 8. | Hours worked per 1 employee (hours according to timesheet / average number of employees) | hour. | 409,0 | 0,0 | |

| incl. | production workers - piece workers | hour. | 13,2 | ||

| production workers - temporary workers | hour. | -2,7 | |||

| Table continuation | |||||

| temporary auxiliary workers | hour. | -3,7 | |||

| auxiliary piece workers | hour. | -6,0 | |||

| employees | hour. | -0,7 | |||

| 9. | Lost working time, total | % | 11,1 | 14,2 | 0,0 |

| incl. | production workers - piece workers | % | 15,3 | 13,8 | -9,8 |

| production workers - temporary workers | % | 10,2 | 17,5 | 71,6 | |

| temporary auxiliary workers | % | 9,0 | 15,2 | 68,9 | |

| auxiliary piece workers | % | 11,3 | 4,6 | ||

| employees | % | 9,9 | 34,3 | ||

| incl. | absenteeism | day | — | 0,0 | |

| 10. | Frame movement, all accepted | people | — | 0,0 | |

| incl. | production workers - piece workers | people | 0,0 | ||

| production workers - temporary workers | people | 0,0 | |||

| temporary auxiliary workers | people | 0,0 | |||

| auxiliary piece workers | people | — | 0,0 | ||

| employees | people | 0,0 | |||

| 11. | Retirement of personnel, total | people | — | 0,0 | |

| incl. | production workers - piece workers | people | 0,0 | ||

| production workers - temporary workers | people | 0,0 | |||

| temporary auxiliary workers | people | 0,0 | |||

| auxiliary piece workers | people | 0,0 | |||

| employees | people | 0,0 |

Workshop overhead costs

(in thousand rubles)

| NN | Name | 1st quarter 2012 | ||

| articles | articles | plan | fact | % |

| 2501-2502 | Maintenance of the management staff, workshop and other workshop personnel | 12345,35 | 12144,30 | -1,6 |

| Salaries of auxiliary shop personnel | 2591,23 | 2429,02 | -6,3 | |

| Depreciation of buildings, structures, equipment | 265,49 | 265,49 | 0,0 | |

| Maintenance of buildings, structures and equipment | 4578,26 | 4173,08 | -8,9 | |

| Equipment repair | 6428,80 | 4358,72 | -32,2 | |

| Research workshop. appointments | — | — | 0,0 | |

| Occupational Safety and Health | 444,37 | 208,38 | -53,1 | |

| Equipment depreciation | 5693,73 | 3425,98 | -39,8 | |

| Other general shop expenses | 186,17 | 183,05 | -1,7 | |

| Repair of buildings, structures and equipment | 1902,11 | 159,33 | -91,6 | |

| Amortization of licenses and software | 238,57 | 177,18 | -25,7 | |

| Depreciation of production equipment | 1671,22 | 1921,15 | 15,0 | |

| Equipment operation | 8981,34 | 7259,08 | -19,2 | |

| In-plant movement of goods | 1672,31 | 1765,05 | 5,5 | |

| Write-off of tools, fixtures and equipment with a useful life of up to 1 year, as well as repair and sharpening of tools | 27514,9 | 26026,66 | -5,4 | |

| Other expenses for maintenance and operation of equipment | 99,90 | 81,05 | -18,9 | |

| Repair of production equipment | 2004,36 | 1116,80 | -44,3 | |

| Payment for two days of sick leave paid from the company’s funds | — | 115,83 | 0,0 | |

| Major repairs of fixed assets | 992,53 | 1 093,87 | 10,2 | |

| TOTAL | General production expenses | 77610,63 | 66904,00 | -13,8 |

Shop wage fund

(in thousand rubles)

| NN articles | Title of articles | 1st quarter 2012 | ||

| plan | fact | % | ||

| 1. | Production piece workers, total | 30160,26 | 30532,42 | 1,2 |

| incl. | basic salary | 17427,97 | 17742,77 | 1,8 |

| additional salary | 10049,01 | 10040,94 | -0,1 | |

| vacation pay | 2683,28 | 2730,62 | 1,8 | |

| incl. | additional staff costs, total | — | 18,09 | 0,0 |

| social expenses (loans to employees, funeral benefits, | — | 0,0 | ||

| payments in excess of employment contracts | — | 18,09 | 0,0 | |

| production workers - temporary workers | 3737,44 | 3399,42 | -9,0 | |

| incl. | basic salary | 2267,03 | 2067,15 | -8,8 |

| additional salary | 1133,51 | 1037,52 | -8,5 | |

| vacation pay | 336,90 | 289,56 | -14,1 | |

| incl. | additional staff costs, total | — | 5,19 | 0,0 |

| social expenses | — | 0,0 | ||

| payments in excess of employment contracts | — | 5,19 | 0,0 | |

| 3. | temporary auxiliary workers | 4416,51 | 4248,01 | -3,8 |

| incl. | basic salary | 2869,99 | 2669,98 | -7,0 |

| additional salary | 1192,50 | 1231,18 | 3,2 | |

| vacation pay | 354,02 | 337,35 | -4,7 | |

| incl. | additional staff costs, total | — | 9,49 | 0,0 |

| social expenses | — | 0,0 | ||

| payments in excess of employment contracts | — | 9,49 | 0,0 | |

| employees | 9436,17 | 9280,04 | -1,7 | |

| incl. | basic salary | 6298,60 | 5771,71 | -8,4 |

| additional salary | 2519,44 | 2974,05 | 18,0 | |

| vacation pay | 618,13 | 514,20 | -16,8 | |

| Table continuation | ||||

| incl. | additional staff costs, total | — | 20,07 | 0,0 |

| social expenses | — | 0,0 | ||

| payments in excess of employment contracts | — | 20,07 | 0,0 | |

| auxiliary piece workers | 2880,20 | 2846,05 | -1,2 | |

| incl. | basic salary | 1788,99 | 1792,02 | 0,2 |

| additional salary | 769,27 | 769,98 | 0,1 | |

| vacation pay | 321,95 | 282,96 | -12,1 | |

| incl. | additional staff costs, total | — | 1,10 | 0,0 |

| social expenses | — | 0,0 | ||

| payments in excess of employment contracts | 1,10 | 0,0 | ||

| 6. | UST | 15 877,75 | 15774,44 | -0,7 |

Production cost estimate

| p/p | Naming of expenditures | 1st quarter 2012 | |

| plan | fact | ||

| 1. | Raw materials | 31022,64 | 31022,64 |

| 2. | Wage | 33897,70 | 33931,85 |

| 3. | UST | 15774,44 | 15774,44 |

| 4. | General production expenses | 77610,63 | 66904,00 |

| TOTAL COSTS | 153276,54 | 142614,88 |

APPENDIX D

Statistics on costs, profitability indicators and factors limiting the business activity of organizations

Structure of costs for the production and sale of products (goods, works, services) by type of economic activity1 (as a percentage of the total)

| All costs | including | |||||||

| material costs | of them | labor costs | unified social tax2) | depreciation of fixed assets | other costs | |||

| raw materials and supplies | fuel | energy | ||||||

| Agriculture, hunting and forestry | ||||||||

| 62,3 | 40,2 | 12,6 | 3,7 | 19,7 | 3,0 | 5,5 | 9,5 | |

| 63,0 | 42,0 | 12,2 | 3,4 | 19,3 | 3,0 | 5,3 | 9,4 | |

| 2007 | 61,3 | 43,7 | 10,1 | 3,1 | 18,7 | 3,0 | 5,6 | 11,4 |

| 61,7 | 46,2 | 9,4 | 2,7 | 18,3 | 3,0 | 6,0 | 11,0 | |

| 60,3 | 44,2 | 7,2 | 3,2 | 18,6 | 3,0 | 7,4 | 10,7 | |

| 60,8 | 45,7 | 6,7 | 3,3 | 17,8 | 2,9 | 7,9 | 10,6 | |

| 62,4 | 47,7 | 7,3 | 3,1 | 16,9 | 3,6 | 8,1 | 9,0 | |

| Fishing, fish farming | ||||||||

| 53,4 | 23,5 | 24,3 | 1,0 | 19,2 | 3,6 | 3,8 | 20,0 | |

| 52,4 | 21,1 | 23,9 | 1,0 | 18,3 | 3,4 | 4,5 | 21,4 | |

| 50,9 | 21,5 | 22,7 | 0,9 | 18,6 | 3,4 | 4,2 | 22,9 | |

| 54,3 | 20,8 | 28,2 | 0,8 | 19,4 | 3,4 | 4,2 | 18,7 | |

| 50,7 | 21,0 | 22,5 | 0,8 | 21,1 | 3,2 | 3,9 | 21,1 | |

| 47,8 | 18,9 | 22,3 | 0,8 | 22,5 | 3,5 | 3,7 | 22,5 | |

| 51,1 | 18,4 | 23,8 | 0,8 | 21,1 | 4,3 | 4,0 | 19,5 | |

| Table continuation | ||||||||

| Mining | ||||||||

| 27,6 | 9,9 | 2,3 | 3,8 | 10,2 | 2,0 | 7,2 | 53,0 | |

| 29,6 | 9,9 | 2,3 | 3,6 | 9,9 | 2,0 | 7,2 | 51,3 | |

| 34,3 | 12,1 | 2,4 | 3,9 | 10,8 | 2,1 | 7,8 | 45,0 | |

| 32,0 | 10,7 | 2,6 | 3,8 | 10,3 | 1,8 | 7,8 | 48,1 | |

| 37,1 | 10,9 | 2,1 | 4,7 | 10,8 | 1,9 | 11,1 | 39,1 | |

| 37,9 | 12,7 | 2,2 | 4,6 | 9,7 | 1,7 | 10,8 | 39,9 | |

| 36,1 | 12,6 | 2,5 | 4,0 | 8,8 | 2,0 | 10,1 | 43,0 | |

| Manufacturing industries | ||||||||

| 68,8 | 55,9 | 2,8 | 3,6 | 11,3 | 2,7 | 2,4 | 14,8 | |

| 74,0 | 61,8 | 2,8 | 3,7 | 11,8 | 2,8 | 2,5 | 8,9 | |

| 2007 | 72,1 | 60,7 | 2,4 | 3,2 | 11,4 | 2,6 | 2,6 | 11,3 |

| 72,0 | 59,0 | 2,4 | 3,1 | 11,3 | 2,5 | 2,8 | 11,4 | |

| 70,4 | 53,5 | 2,3 | 3,6 | 11,6 | 2,5 | 3,5 | 12,0 | |

| 72,5 | 58,3 | 2,6 | 3,6 | 10,3 | 2,3 | 3,2 | 11,7 | |

| 73,7 | 59,4 | 2,3 | 3,3 | 9,7 | 2,7 | 3,0 | 10,9 | |

| Production and distribution of electricity, gas and water | ||||||||

| 59,9 | 11,5 | 22,0 | 14,2 | 14,3 | 3,3 | 6,3 | 16,2 | |

| 61,0 | 12,9 | 20,8 | 11,3 | 13,9 | 3,2 | 5,7 | 16,2 | |

| 61,0 | 9,5 | 20,3 | 10,4 | 14,3 | 3,1 | 5,9 | 15,7 | |

| 62,7 | 10,1 | 22,0 | 9,3 | 14,7 | 3,1 | 6,0 | 13,5 | |

| 63,9 | 9,3 | 19,6 | 9,3 | 14,3 | 2,9 | 6,5 | 12,4 | |

| 63,4 | 8,6 | 19,8 | 9,4 | 13,0 | 2,7 | 6,4 | 14,5 | |

| 100 | 63,8 | 8,0 | 20,4 | 9,6 | 13,0 | 3,5 | 7,0 | 12,7 |

| Table continuation | ||||||||

| Construction | ||||||||

| 57,5 | 47,0 | 5,0 | 1,4 | 21,1 | 4,9 | 2,4 | 14,1 | |

| 58,7 | 48,0 | 5,2 | 1,2 | 20,4 | 4,6 | 2,5 | 13,8 | |

| 59,7 | 53,0 | 4,2 | 1,0 | 19,6 | 4,3 | 2,0 | 14,4 | |

| 59,3 | 48,6 | 4,4 | 0,9 | 19,6 | 4,1 | 2,1 | 14,9 | |

| 56,9 | 44,1 | 3,6 | 1,0 | 19,2 | 4,0 | 2,7 | 17,2 | |

| 56,3 | 45,3 | 3,7 | 1,1 | 20,2 | 4,2 | 2,9 | 16,4 | |

| 57,4 | 46,7 | 4,1 | 1,0 | 19,1 | 5,0 | 2,6 | 15,9 | |

| Wholesale and retail trade; repair of vehicles, motorcycles, household products and personal items | ||||||||

| 54,6 | 15,2 | 0,9 | 0,8 | 10,8 | 2,0 | 11,8 | 20,8 | |

| 51,4 | 16,5 | 0,9 | 0,6 | 9,5 | 1,8 | 9,4 | 27,9 | |

| 2007 | 51,6 | 18,0 | 0,6 | 0,6 | 12,2 | 2,3 | 9,0 | 24,9 |

| 49,4 | 16,0 | 0,7 | 0,7 | 12,9 | 2,4 | 9,7 | 25,6 | |

| 44,4 | 11,0 | 0,5 | 0,8 | 13,6 | 2,5 | 14,2 | 25,3 | |

| 45,7 | 10,9 | 0,5 | 0,8 | 13,5 | 2,6 | 10,6 | 27,6 | |

| 47,0 | 11,5 | 0,8 | 0,9 | 13,9 | 3,4 | 9,5 | 26,2 | |

| Hotels and restaurants | ||||||||

| 41,4 | 32,7 | 0,8 | 2,8 | 25,3 | 5,1 | 3,8 | 24,4 | |

| 42,8 | 33,5 | 0,7 | 2,6 | 25,8 | 5,1 | 3,2 | 23,1 | |

| 42,1 | 34,2 | 0,7 | 2,4 | 25,7 | 5,1 | 3,1 | 24,0 | |

| 38,0 | 31,9 | 0,5 | 2,0 | 26,1 | 5,2 | 2,9 | 27,8 | |

| 38,9 | 31,1 | 0,5 | 2,5 | 25,7 | 5,2 | 3,7 | 26,5 | |

| 38,6 | 31,7 | 0,5 | 2,7 | 26,2 | 5,7 | 3,7 | 25,8 | |

| 37,6 | 31,7 | 0,5 | 2,6 | 25,1 | 7,2 | 4,0 | 26,1 | |

| Table continuation | ||||||||

| Transport and communications | ||||||||

| 31,7 | 10,1 | 9,1 | 4,1 | 21,2 | 4,7 | 9,8 | 32,4 | |

| 35,6 | 10,2 | 9,1 | 3,7 | 20,1 | 4,5 | 9,6 | 30,2 | |

| 38,2 | 10,1 | 8,4 | 3,6 | 20,9 | 4,5 | 9,8 | 26,6 | |

| 39,5 | 8,9 | 9,3 | 3,4 | 20,5 | 4,3 | 9,1 | 26,6 | |

| 36,7 | 7,9 | 6,2 | 3,6 | 21,2 | 4,3 | 9,8 | 28,0 | |

| 38,0 | 7,1 | 6,5 | 3,8 | 19,3 | 4,0 | 9,5 | 29,2 | |

| 39,4 | 6,2 | 7,4 | 3,3 | 19,1 | 5,1 | 8,8 | 27,6 | |

| Real estate transactions, rental and provision of services | ||||||||

| 35,6 | 18,5 | 2,8 | 3,8 | 31,6 | 6,4 | 3,9 | 22,5 | |

| 33,2 | 18,2 | 2,1 | 3,3 | 31,4 | ⇐ Previous13 Single-post wooden support and methods for strengthening corner supports: Overhead line supports are structures designed to support wires at the required height above the ground, water... Organization of surface water flow: The largest amount of moisture on the globe evaporates from the surface of the seas and oceans (88‰)… Mobile electrified feed dispenser: diagram and process of operation of the device...

| |||

| © cyberpedia.su 2017-2020 — Not the author of the materials. The exclusive right is reserved by the author of the text. If you do not want this material to appear on our website, please follow the link: Copyright Infringement |

Types of accounts receivable

Such debt can be divided into groups according to several criteria:

- by debt repayment period: long-term (the period of transfer of money is more than a year and short-term (the transfer period is less than a year). An example of the first type is a loan for a company employee. An example of the second is payment for goods delivered in the next three months;

- according to the risk of repayment: doubtful (without security - collateral or guarantee) and hopeless (when there is no possibility of returning the money, for example, in the event of bankruptcy of the debtor);

- by return period: overdue (the payment period specified in the written agreement has expired) and normal (the partner manages to meet the specified dates);

- based on the fact of occurrence: classification in this case depends on who turned out to be the debtor - partner, buyer, government organization, company employees, etc.

Explanations to the balance sheet and income statement

Explanations to the Balance Sheet and the Statement of Financial Results are included in the annual financial statements (Part 1 of Article 14 of Law No. 402-FZ dated December 6, 2011, Clause 4 of Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

As a rule, the information in the Explanations deciphers the numerical indicators of the Balance Sheet or the Statement of Financial Results. This follows from the provisions of paragraph 24 of PBU 4/99.

The Explanations also disclose information about the organization's accounting policies, as well as additional information. One that is not in the Balance Sheet and the Income Statement, but without it it will be difficult for users to assess the real financial position of the organization, the financial results of its activities and cash flows for the reporting period.

Who is obliged to draw up

All organizations that conduct accounting must draw up Explanations.

An exception is organizations that have the right to use simplified forms of accounting and reporting.

For example, these are small enterprises that are not subject to mandatory audit, as well as most non-profit organizations (clause 6 of Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, parts 4 and 5 of Article 6 of Law dated December 6, 2011 No. 402 -FZ).

These are general rules. However, there are situations when small businesses must draw up explanations. For example, if an organization makes changes to its accounting policies. In this case, the relevant information must be provided in additional information as part of the explanations.

Document form

Explanations can be made in text and (or) tabular form.

They are usually presented in table form. You can decide what to include in such a table yourself, taking into account Appendix 3 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010 (clause 4 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010).

If you are filling out such Explanations for the statistics department or tax office, then after the column “Name of the indicator”, additionally enter the column “Code” into the tables. Enter line codes in accordance with Appendix 4 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010. This procedure follows from paragraph 5 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

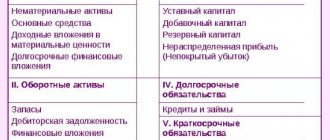

Main sections

Explanations to the Balance Sheet and the Statement of Financial Results include the following sections:

- intangible assets and R&D expenses;

- fixed assets;

- financial investments;

- stocks;

- accounts receivable and accounts payable;

- production costs;

- estimated liabilities;

- securing obligations;

- government assistance.

Fill in the section indicators based on the data for the reporting and previous periods (clause 35 of the Regulations approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

Intangible assets and R&D expenses

In this section, disclose information on the following lines of the Balance Sheet:

- line 1110 “Intangible assets”;

- line 1120 “Results of research and development”;

- line 1190 “Other non-current assets”.

The section “Intangible assets and R&D expenses” consists of five tables.

In Table 1.1 “Availability and movement of intangible assets”, disclose information on the original cost and accumulated depreciation (at the end and at the beginning of the period), receipts and disposals for the period, the results of revaluation, as well as information on the value of intangible assets subject to impairment in the reporting year , the amount of impairment loss recognized. Reflect the data both in general for all intangible assets and in the context of their individual types (paragraph 2, 3, 6, 8, paragraph 41 of PBU 14/2007, paragraph 35 of PBU 4/99).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

When revaluing, in the column “Original cost” the current market value or current (replacement) value is given (Note 3 to Appendix 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.2 “Initial cost of intangible assets created by the organization itself,” disclose information on intangible assets that the organization created independently (paragraph 11, clause 41 of PBU 14/2007). Indicate the data as of the reporting date, the previous year and the year that precedes the previous one (notes 2, 4 and 5 to Appendix 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.3 “Intangible assets with fully amortized cost”, indicate the name and initial cost of those tangible assets whose cost is fully depreciated, but the organization continues to use them (paragraph 9 of clause 41 of PBU 14/2007). Indicate the data as of the reporting date, the previous year and the year that precedes the previous one (notes 2, 4 and 5 to Appendix 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.4 “Availability and movement of R&D results”, indicate information on the amount of R&D expenses (clause 16 of PBU 17/02).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.5 “Unfinished and unregistered R&D and unfinished transactions for the acquisition of intangible assets,” write down the amount of costs both in general and by type for the reporting and previous year according to:

- unfinished research and development (balance at the beginning of the year, amount of expenses for the year, amount of written-off costs that did not give a positive result, amount of expenses accepted for accounting, balance at the end of the year);

- unfinished transactions for the acquisition of intangible assets (balance at the beginning of the year, amount of expenses for the year, amount of written-off costs that did not give a positive result, amount of expenses accepted for accounting, balance at the end of the year).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

Fixed assets

In this section, disclose information on the following lines of the Balance Sheet:

- line 1150 “Fixed assets”;

- line 1160 “Profitable investments in material assets”;

- line 1190 “Other non-current assets”.

The “Fixed Assets” section of the Explanations contains four tables.

In Table 2.1 “Availability and movement of fixed assets”, reflect information on the initial cost and accumulated depreciation of fixed assets (at the beginning and end of the reporting year and the previous year), as well as information on the receipt (disposal) of fixed assets, revaluation and accrued depreciation for the reporting period. period and previous year (clause 32 of PBU 6/01). Disclose the information by groups of fixed assets (paragraph 3, clause 27 of PBU 4/99, clause 32 of PBU 6/01). The cost of objects that are taken into account as part of fixed assets and as part of profitable investments in material assets should be reflected separately.

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In table 2.2 “Unfinished capital investments”, provide information on the value of unfinished capital investments (at the beginning and end of the reporting year and the previous year), as well as its changes for the reporting period and the previous year (excluding costs for future intangible assets and R&D ).

In table 2.3 “Changes in the value of fixed assets as a result of completion, additional equipment, reconstruction and partial liquidation”, disclose information about the increase (decrease) in the value of fixed assets as a result of their partial liquidation or completion, additional equipment or reconstruction (paragraph 5 of paragraph 32 of PBU 6 /01).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 2.4 “Other use of fixed assets”, reflect information on fixed assets that:

- leased, it does not matter whether they are listed on the balance sheet or not;

- rented, it does not matter whether they are listed on the balance sheet or not;

- are real estate objects, and they have begun to be used, although they are under state registration;

- transferred to conservation;

- used in a different capacity (for example, they are objects of collateral, etc.).

Reflect the information as of December 31 of the reporting year, as of December 31 of the previous year and as of December 31 of the year before.

Financial investments

In this section, disclose information on the following lines of the Balance Sheet:

- line 1170 “Financial investments”;

- line 1240 “Financial investments (except for cash equivalents).”

This section of the Explanations consists of two tables.

In table 3.1 “Availability and movement of financial investments”, disclose information about the initial cost (at the beginning and at the end of the period) of long-term and short-term financial investments, as well as their changes during the period (receipt, disposal, interest accrual) (clause 41 of PBU 19 /02). Disclose information by type of financial investment (clause 42 of PBU 19/02).

In table 3.2 “Other use of financial investments”, indicate information on financial investments that are pledged and transferred to third parties (except for sale), as well as on their other use as of the end of the period (paragraphs 7 and 8 of clause 42 of PBU 19 /02).

Reserves

This section discloses information on line 1210 “Inventories” of the Balance Sheet.

The section includes two tables, information in which must be reflected by type of inventory (clause 23 of PBU 5/01).

In table 4.1 “Availability and movement of inventories”, indicate the cost and the amount of the reserve for reduction in value (at the beginning and at the end of the period), as well as changes during the period (clause 27 of PBU 5/01). In table 4.2 “Inventories as collateral”, indicate unpaid inventories and inventories as collateral under the contract (as of the reporting date) (clause 27 of PBU 5/01).

Accounts receivable and payable

In this section, disclose information on the following lines of the Balance Sheet:

- line 1230 “Accounts receivable”;

- line 1410 “Borrowed funds”;

- line 1450 “Other obligations”;

- line 1510 “Borrowed funds”;

- line 1520 “Accounts payable.”

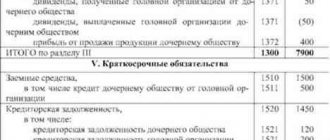

The section consists of two tables for information on accounts receivable and two for accounts payable.

In table 5.1 “Availability and movement of accounts receivable” for long-term and short-term accounts receivable by their types, indicate information on the availability of accounts receivable at the beginning and end of the period, its changes during the period (receipt, disposal), as well as information on the reserve for doubtful debts

In the column “At the beginning of the year”, reflect in aggregate the debit balance of accounts 60, 62, 66, 67, 68, 69, 70, 71, 73, 75, 76 as of January 1 of the reporting year.

In the “At the end of the period” column, indicate the balance of accounts receivable as of the end of the reporting year.

In the “Changes during the period” column, reflect the receipt and disposal of debts, as well as the transfer of debt from long-term to short-term.

Indicate the amounts of receivables in full according to the terms of the contracts (i.e., without taking into account the reserve for doubtful debts created for it) (clause 35 of PBU 4/99).

In Table 5.2, Overdue Receivables, disclose information on overdue receivables (that is, debts that have expired) as of the reporting date and as of December 31 of the previous two years. Indicate the amounts of debt by type in two estimates: according to the terms of the contracts (i.e., in full) and in the balance sheet estimate (i.e., minus the reserve for doubtful debts created for it).

Fill out Table 5.3 “Availability and movement of accounts payable” separately for long-term and short-term accounts payable by their types. Disclose information on debt balances at the beginning and at the end of the period, changes during the period (receipt, disposal) with the distribution of amounts of accounts payable arising within the framework of business activities and from accrued interest and fines (paragraph 10, paragraph 27 of PBU 4/99, p 2 and 17 PBU 15/2008).

In the column “At the beginning of the year”, reflect in aggregate the credit balance of accounts 60, 62, 66, 67, 68, 69, 70, 71, 73, 75, 76 as of January 1 of the reporting year.

In the “At the end of the period” column, indicate the balance of accounts payable as of the end of the reporting year.

In the “Changes during the period” column, reflect the receipt and disposal of debts, as well as the transfer of debt from long-term to short-term.

In table 5.4 “Overdue accounts payable,” disclose information on the balances at the end of the reporting period and as of December 31 of the previous two years of overdue accounts payable (i.e., debt that has expired) by type.

Production costs

The “Production Costs” section is presented in one table, which discloses information on the following lines of the Income Statement:

- line 2120 “Cost of sales”;

- line 2210 “Business expenses”;

- line 2220 “Administrative expenses”.

In the table “Production costs”, disclose information about the composition of costs in the context of their elements (paragraph 12, paragraph 27 of PBU 4/99, paragraph 2, paragraph 22 and paragraph 8 of PBU 10/99). Indicate the cost amounts for two periods: the reporting period and the previous period.

Estimated liabilities

The section consists of one table that explains the following lines of the Balance Sheet:

- line 1430 “Estimated liabilities”;

- line 1540 “Estimated liabilities”.

Indicate in the table the amounts of estimated liabilities for the balances at the beginning and end of the period, as well as the amounts of recognized, settled and excess liabilities. Disclose this information for each type of estimated liability (clause 24 of PBU 8/2010).

Security for obligations

The section consists of one table, which discloses information about off-balance sheet accounts 008 and 009.

Fill out the table separately for received and issued security for obligations by their types (paragraph 15, clause 27 of PBU 4/99). These types, in particular, can be a pledge, a guarantee of third parties, a bank guarantee, a letter of credit, and retention of the debtor’s property (clause 1 of Article 329 of the Civil Code of the Russian Federation).

State aid

The section consists of one table, which reveals information on the following lines of the Balance Sheet:

- line 1410 “Borrowed funds”;

- line 1510 “Borrowed funds”;

- line 1530 “Deferred income”.

In the table, disclose information on received budget funds and loans for the reporting year and for the previous year (paragraph 1, clause 22 of PBU 13/2000). Disclose the amounts of budget loans in terms of their intended purpose (paragraph 2, clause 22 of PBU 13/2000).

Additional information reflected in the Explanations

Does the organization have additional information that would be worth disclosing in the Notes? Then fill out a separate document in free form.

Typically, such a document includes the following sections:

- a brief description of the organization’s activities;

- accounting policy;

- the main factors that influenced the results of operations;

- information about related parties.

Brief description of the organization's activities

This section includes general information about the organization: its legal address, main activities, management structure, average annual number of employees, the presence of separate divisions, etc. Joint-stock companies here provide data on the number of shares that are issued and fully paid, as well as issued , but not paid or partially paid

.

In addition, this section must reflect data on the nominal value of shares owned by the company itself, as well as its subsidiaries and affiliates.

This procedure is provided for in paragraphs 27 and 31 of PBU 4/99.

Accounting policy

In this section, reveal the methods of accounting, without which it is impossible to reliably assess the financial position of the organization (clauses 17, 24 of PBU 1/2008). The list of possible accounting methods is presented in the table.

In addition, here it is necessary to explain all deviations from the accounting rules and assumptions adopted in the formation of accounting policies. For example, the Explanations should reflect the decision on the upcoming liquidation of the organization (in this case, the assumption of going concern is violated). This procedure is provided for in paragraphs 19, 20 of PBU 1/2008.

If the organization has decided to change its accounting policy, then all changes must also be indicated in the Explanations. It is also necessary to justify these changes and evaluate their results in monetary terms. This procedure is provided for in paragraphs 21 and 25 of PBU 1/2008. This means that you need to indicate the amount by which the valuation of financial statements items has changed due to changes in accounting methods.

Main factors influencing the results of operations

In this section, you need to analyze the factors that influenced the formation of the organization’s financial result in the reporting year. These include increased consumer demand, lower interest rates for bank loans, improved product quality, improved management structure, etc.

If force majeure circumstances occurred in the organization’s activities during the year, the Explanations must name them and disclose their consequences. For example, if there was a fire at the organization’s warehouse, indicate the amount of damage and expenses associated with eliminating the consequences of the fire. This procedure is provided for in paragraph 27 of PBU 4/99.

Related Party Information

Disclose information about related parties in the Explanations in a separate section (clause 14 of PBU 11/2008). Organizations that have the right to use simplified accounting methods may not include this section in the Explanations (clause 3 of PBU 11/2008, parts 4 and 5 of Article 6 of the Law of December 6, 2011 No. 402-FZ).

The organization independently establishes the list of related parties about which it is necessary to disclose information, taking into account the requirement of priority of content over form (clause 9 of PBU 11/2008).

Information about related parties must be disclosed:

- when performing transactions with related parties;

- regardless of the transactions, if the organization controls another organization or related organizations are controlled by the same organization (the same individual).

This procedure follows from paragraphs 10 and 13 of PBU 11/2008.

In the first case, for each related party, disclose at least the following information:

- the nature of the relationship (according to the controllability criterion in accordance with clause 6 of PBU 11/2008);

- types of operations;

- volume of transactions of each type (in absolute or relative terms);

- cost indicators for operations not completed at the end of the reporting period;

- conditions and terms for carrying out (completion) of settlements for transactions, as well as the form of settlements;

- the amount of reserves formed for doubtful debts at the end of the reporting period;

- the amount of written off receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection, including through the reserve for doubtful debts.

Disclose information separately for each of the following groups:

- main business company (partnership);

- subsidiary business companies;

- predominant (participating) business entities;

- dependent business companies;

- participants in joint activities;

- key management personnel;

- other related parties.

For key management personnel, indicate the amount of remuneration paid to them, both in aggregate and by the following types of payments:

- short-term remuneration after the reporting date (payable during the reporting period and 12 months after the reporting date, salary and taxes and contributions accrued from it, vacation pay, payment for treatment, medical care, utilities, etc.);

- post-employment benefits and other payments that ensure the payment of pensions, as well as other social guarantees;

- remuneration in the form of options of the issuer, shares, shares, participation interests in the authorized (share) capital and payments based on them;

- other long-term rewards.

This procedure follows from paragraphs 10–12 of PBU 11/2008.

in the second case, describe the nature of the relationship between related parties (clause 13 of PBU 11/2008).

How does debt arise?

The mechanism for the occurrence of such a process at various enterprises is most often standard. The company wants to expand its activities and increase profits, so it tries to sell goods on any terms.

In the modern market situation - with high competition - entrepreneurs strive to be loyal in order to attract customers. Therefore, goods are often offered in installments. Unfortunately, not all clients turn out to be decent payers and repay the debt. In this situation, there is a high risk of non-repayment of funds and, accordingly, the appearance of receivables.

It turns out that two factors influence the occurrence of this phenomenon:

- desire to increase profits;

- high competition.

Accounts receivable management

The appearance of debtors in a company is not a catastrophic situation. Whether the situation results in more income or bankruptcy depends on how you manage your debt. What is the best way to proceed?

There are methods that will allow you to stay afloat:

- The most basic one is inventory. To understand what to manage, you first need to understand the scale. Inventory is a record of property that will reveal all debts. The process can be initiated by management in any case. But most often, an inventory is carried out before drawing up an annual report or when a major theft is discovered at the enterprise;

- conducting an audit - the accounting department must review contracts and check payment terms. If they are about to expire, it is better to remind your partner or client about this;

- assessment of the cost of reimbursement work. If the counterparty still does not pay for the goods or order, you need to calculate whether it is worth repaying the debt. Sometimes legal costs and legal advice can exceed profits;

- searching for information about the debtor. It is necessary to find out why the client cannot return the money. If he is declared bankrupt, then you need to find out at what stage the process is. It may be possible to get into the register of creditors and repay the monetary debt with the help of a temporary manager or bailiff.

But the best way is to avoid large accounts receivable. How to do it? First, check the reputation of a potential partner or client. Secondly, indicate penalties in case of non-payment in a written agreement with the counterparty.

More about inventory

The concept of “inventory” is associated with the recalculation of a company’s computer equipment or office supplies. But the process is much broader - it is checking not only property, but intangible assets. That is, putting things in order and taking inventory of the organization’s obligations.

When inventory is required:

- when a new accountant joins the company;

- when significant changes occur in the company - reorganization or significant increase in staff;

- in unforeseen unpleasant situations, for example, when a theft or fire occurs at the enterprise.

Taking inventory is not a quick process. It can take a month or more - it depends on the size of the organization.

Inventory algorithm:

- Verification of documents.

- Detection of the counterparty's debt and execution of a special act.

- Sending debtors the amount of debt and the period of overdue.

The result of the process is the preparation of a certificate indicating the exact amount of the debt, the debtor’s details, as well as the origin and reason for the shortage. If it is proven that the money cannot be returned, then the debt can be written off, like any other obsolete item.

Accounts receivable turnover

The term refers to the difference between a company's revenue and debt. It is necessary to understand how effectively an organization copes with reducing the risk of damage. The quantitative indicator of turnover is a coefficient that can be calculated using the formula:

KO=amount of revenue/average cost

The average debt indicator is the sum of two debts (at the beginning of the reporting period and at the end), divided by 2.

There is no fixed norm - what the coefficient should be. The higher the better. The more effective the remote control is.

Collection of accounts receivable

Debt includes more than just the initial amount paid for a product or service. It should also include a late fee. Either at the tariff established in the contract, or at the rate of the Central Bank of the Russian Federation, if this clause is not specified in the agreement.

How does the collection process work?

- Pre-trial proceedings. It is necessary to prepare and send a letter to the debtor demanding payment of the required amount.

- Going to court. If the money is not returned after a written request, then you will have to either file a claim and submit it to the arbitration court (debt more than 400,000 rubles), or write an application asking for an order to pay the debt.

If the counterparty has initiated bankruptcy proceedings, then you need to try to get into the register of creditors. If successful, compensation will be paid after the sale of the property of the company or individual.

Before submitting your documents, you need to think carefully again about whether the game is worth the candle. That is, is it necessary to invest time and financial resources into debt? Will the proceeds cover expenses?

If you decide to go to court, then you should not delay filing a claim. Because the statute of limitations for such cases is three years. In some cases the period may be shorter.

Write-off of accounts receivable

If it is determined that the debt is uncollectible, then it must be written off. This does not mean that the amount can no longer be taken into account on the balance sheet. This needs to be done for the next five years, because there is a chance that the debtor will still have money.

The debt is written off if one of these documents is available:

- a certificate from the Unified State Register of Legal Entities, which confirms that the legal entity no longer conducts commercial activities;

- certificate from the tax office on the liquidation of the legal entity;

- a document from the bailiff confirming that it is impossible to compensate for the damage;

- protocol of the court decision, which states that the money will not be returned.

The write-off process can begin without the listed documents, if the company’s management independently decided to cancel the debt.

Sale of debt

If the company does not want to get involved in legal troubles, then the debt can be sold. In this case, the price for it will be less than the original amount. The monetary difference will be considered a reward to the buyer of the debt for the process of repaying the finances.

The easiest way to sell is through a bill of exchange. It itself confirms the existence of the debt, so no additional certificates are needed.

Another option is to enter into an assignment of claim agreement. But such an opportunity can only be realized if there is a corresponding clause in the contract.

The next way is through a factoring company. The scheme works like this:

- The company transfers the goods, but payment comes not from the recipient, but from the factoring company.

- The money is transferred to the seller at the moment when the buyer confirms the transaction.

- The factoring company receives compensation within the terms specified in the written agreement.

As a result, the seller receives instant payment, the buyer receives deferred payment, and the factoring company earns income in the form of a commission.

Short review

- What are accounts receivable? This is the buyer's duty to the seller. An important condition is that the goods have already been transferred, but payment has not yet been made.

- Accounts payable is an antonymous term. In this case, the debtor is the seller.

- Disclosure can be: short-term or long-term, doubtful or hopeless, expired or normal.

- Debt can be managed through inventory, accounting audits, and debt assessment.

- The money on the debt can be written off or sold to a third party.

Author: Mainfin.ru Team

Related terms

- What is deposit extension?

- What is capitalization of interest on a deposit?

- Limitation period for a loan

- Annuity payments when repaying a loan - what are they, calculation examples

- Explanation of current account, meaning of numbers, examples

- Current and current accounts - what are they, the difference?

09:33 02.12.2020

Credit cardCertificatesInstallment planDepositsLoansCurrent accountMicroloansBanksBenefitsSalariesMortgageDebit cardMoney transfersInsurance

Subscribe to Yandex.Zen

What accounting data is used?

To fill out table 5.1

“Availability and movement of accounts receivable”

When filling out table 5.1, data is used on balances at the beginning and end of the reporting year and on turnover on settlement accounts, as well as on balance and turnover on account 63 “Provisions for doubtful debts” (including analytical accounting data on these accounts).

Attention!

According to the clarifications of the Ministry of Finance of Russia, accrued revenue recognized in accounting in accordance with PBU 2/2008 and not presented for payment in the Balance Sheet is reflected in the composition of current assets as a separate indicator detailing the group of items “Receivables” (Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07 -04-18/01). If in the organization’s balance sheet the indicators on line 1230 “Accounts receivable” are formed taking into account accrued revenue not presented for payment, then the presence and movement of this revenue should be disclosed in table 5.1, regardless of which account the organization accounts for this asset in accordance with your working chart of accounts.

1. Line 5501 “Long-term accounts receivable - total. For the reporting year"

| Column “At the beginning of the year. Accounted for under the terms of the agreement" | = | Debit balances on accounts 62, 60, 73 <*>, 76 (analytical accounts for long-term accounts receivable) at the beginning of the reporting year |

| Column “At the beginning of the year. The amount of reserve for doubtful debts" | = | Credit balance on account 63 (analytical account for accounting for provisions for doubtful long-term debts) at the beginning of the reporting year |

| Column “Changes for the period. Admission. As a result of business transactions (amount of debt under the transaction, operation)" | = | Debit turnover on accounts 62, 60, 73 <*>, 76 (analytical accounts for long-term accounts receivable) <**>, except for turnover associated with the accrual of interest on a commercial loan, fines, penalties and penalties for violation of contract terms |

| Column “Changes for the period. Admission. Interest, fines and other charges due" | = | Debit turnover on account 76, subaccount 76-2 “Calculations for claims” (analytical accounts for long-term accounts receivable) <**> | + | Debit turnover on accounts 60, 62, 76 in connection with the accrual of interest on the granted commercial loan (analytical accounts for long-term accounts receivable) <**> |

| Column “Changes for the period. Out. Redemption" | = | Credit turnover on accounts 62, 60, 73 <*>, 76 (analytical accounts for long-term receivables) in connection with the repayment of long-term receivables <**> |

| Column “Changes for the period. Out. Write-off to financial result" | = | Credit turnover on accounts 62, 60, 73 <*>, 76 (analytical accounts for long-term accounts receivable) in correspondence with account 91, subaccount 91-2 <**> |

| Column “Changes for the period. Out. Restoring reserve" | = | Debit turnover on account 63 (analytical account for accounting for provisions for doubtful long-term debts) in correspondence with account 91, subaccount 91-1 |

| Column “Changes for the period. Out. Write-off from the reserve for doubtful debts" <***> | = | Debit turnover on account 63 (analytical account for accounting for provisions for doubtful long-term debts) in correspondence with settlement accounts (analytical accounts for accounting for long-term receivables) |

| Column “Changes for the period. Transfer from long-term to short-term debt" | = | Internal turnover on analytical accounts to settlement accounts: debit of analytical accounts of short-term receivables with a credit of analytical accounts of long-term receivables. This indicator is indicated in parentheses |

| Column “Changes for the period. Creation of a reserve for doubtful debts" <***> | = | Credit turnover on account 63 (analytical account for accounting for provisions for doubtful long-term debts) in correspondence with account 91, subaccount 91-2 |

| Column “At the end of the period. Accounted for under the terms of the agreement" | = | Debit balances on accounts 62, 60, 73 <*>, 76 (analytical accounts for long-term accounts receivable) at the end of the reporting period |

| Column “At the end of the period. The amount of reserve for doubtful debts" | = | Credit balance on account 63 (analytical account for accounting for provisions for doubtful long-term debts) at the end of the reporting period |

———————————

<*> In addition to interest-bearing loans reflected in account 73, subaccount 73-1 “Settlements on loans provided”, in respect of which the criteria for recognizing them as financial investments are met.

<**> In addition to turnover associated with the emergence and disposal of long-term receivables in one reporting period.

<***> This column is not present in Table 5.1, presented in the Example of the Explanations. However, organizations can add it themselves if they have the appropriate metrics.

2. Line 5521 “Long-term accounts receivable - total. For the previous year"

In general, data on the presence and movement of long-term receivables for the previous year is transferred from table 5.1 of the Explanations for this previous year.

Lines 5502, 5503, 5504…

For the indicated lines, a breakdown of the indicators of line 5501 “Long-term receivables - total” is provided. For the reporting year" by types of long-term receivables available to the organization. The indicators of these lines can be determined using formulas similar to those given above, using information on balances at the beginning and end of the reporting year and on turnover in those settlement accounts on which calculations of this type are reflected.

For information on the types of accounts receivable and the corresponding settlement accounts, see section. 3.1.2.3.1 “What is included in accounts receivable.”

Lines 5522, 5523, 5524…

For the indicated lines, a breakdown of the indicators of line 5521 “Long-term receivables - total” is provided. For the previous year” by type of long-term receivables that the organization had. In general, data on the availability and movement of long-term receivables by type for the previous year is transferred from Table 5.1 of the Explanations for this previous year.

For information on the types of accounts receivable and the corresponding settlement accounts, see section. 3.1.2.3.1 “What is included in accounts receivable.”

5. Line 5510 “Short-term accounts receivable - total. For the reporting year"

| Column “At the beginning of the year. Accounted for under the terms of the agreement" | = | Debit balances on accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76 (analytical accounts for short-term accounts receivable) at the beginning of the reporting year |

| Column “At the beginning of the year. The amount of reserve for doubtful debts" | = | Credit balance on account 63 (analytical account for accounting for provisions for short-term doubtful debts) at the beginning of the reporting year |

| Column “Changes for the period. Admission. As a result of business transactions (amount of debt under the transaction, operation)" | = | Debit turnover on accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76 (analytical accounts for short-term accounts receivable), except for turnover associated with the accrual of interest on a commercial loan, fines, penalties and penalties for violation of contract terms <**> |

| Column “Changes for the period. Admission. Interest, fines and other charges due" | = | Debit turnover on account 76, subaccount 76-2 “Calculations for claims” (analytical accounts for short-term accounts receivable) <**> | + | Debit turnover on accounts 60, 62, 76 in connection with the accrual of interest on the granted commercial loan (analytical accounts for short-term accounts receivable) <**> |

| Column “Changes for the period. Out. Redemption" | = | Credit turnover on accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76 (analytical accounts for short-term accounts receivable) in connection with the repayment of accounts receivable <**> |

| Column “Changes for the period. Out. Write-off to financial result" | = | Credit turnover on accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76 (analytical accounts for short-term accounts receivable) in correspondence with account 91, subaccount 91-2 <**> |

| Column “Changes for the period. Out. Restoring reserve" | = | Debit turnover on account 63 (analytical account for accounting for provisions for doubtful short-term debts) in correspondence with account 91, subaccount 91-1 |

| Column “Changes for the period. Out. Write-off from the reserve for doubtful debts" <***> | = | Debit turnover on account 63 (analytical account for accounting for provisions for doubtful short-term debts) in correspondence with settlement accounts (analytical accounts for accounting for short-term receivables) |

| Column “Changes for the period. Transfer from long-term to short-term debt" | = | Internal turnover on analytical accounts to settlement accounts: debit of analytical accounts of short-term receivables with a credit of analytical accounts of long-term receivables. This indicator is indicated without parentheses |

| Column “Changes for the period. Creation of a reserve for doubtful debts" <***> | = | Credit turnover on account 63 (analytical account for accounting for provisions for doubtful short-term debts) in correspondence with account 91, subaccount 91-2 |

| Column “At the end of the period. Accounted for under the terms of the agreement" | = | Debit balances on accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76 (analytical accounts for short-term accounts receivable) at the end of the reporting period |

| Column “At the end of the period. The amount of reserve for doubtful debts" | = | Credit balance on account 63 (analytical account for accounting for provisions for doubtful short-term debts) at the end of the reporting period |

———————————

<*> In addition to interest-bearing loans reflected in account 73, subaccount 73-1 “Settlements on loans provided”, in respect of which the criteria for recognizing them as financial investments are met.

<**> In addition to turnover associated with the occurrence and disposal of short-term receivables in one reporting period.

<***> This column is not present in Table 5.1, presented in the Example of the Explanations. However, organizations can add it themselves if they have the appropriate metrics.

6. Line 5530 “Short-term accounts receivable - total. For the previous year"

In general, data on the presence and movement of short-term receivables for the previous year is transferred from table 5.1 of the Explanations for this previous year.

Lines 5511, 5512, 5513…

For the indicated lines, a breakdown of the indicators of line 5510 “Short-term accounts receivable - total” is provided. For the reporting year" by types of short-term receivables available to the organization. The indicators of these lines can be determined using formulas similar to those given above for line 5510, using information on balances at the beginning and end of the reporting year and on turnover on those settlement accounts on which calculations of this type are reflected.

For information on the types of accounts receivable and the corresponding settlement accounts, see section. 3.1.2.3.1 “What is included in accounts receivable.”

Lines 5531, 5532, 5533…

For the indicated lines, a breakdown of the indicators of line 5530 “Short-term accounts receivable - total” is provided. For the previous year” by types of short-term receivables that the organization had. In general, data on the availability and movement of short-term receivables by type for the previous year is transferred from Table 5.1 of the Explanations for this previous year.

For information on the types of accounts receivable and the corresponding settlement accounts, see section. 3.1.2.3.1 “What is included in accounts receivable.”

9. Line 5500 “Total. For the reporting year"

This line provides information on the availability and movement of all accounts receivable for the reporting year. The indicators of this line can be determined using the following formulas:

| Column “At the beginning of the year. Accounted for under the terms of the agreement" | = | Debit balances on accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76 at the beginning of the reporting year |

| Column “At the beginning of the year. The amount of reserve for doubtful debts" | = | Credit balance on account 63 at the beginning of the reporting year |

| Column “Changes for the period. Admission. As a result of business transactions (amount of debt under the transaction, operation)" | = | Debit turnover on accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76, except for turnover associated with the accrual of interest on a commercial loan, fines, penalties and penalties for violation of contract terms <**> |

| Column “Changes for the period. Admission. Interest, fines and other charges due" | = | Debit turnover on account 76, subaccount 76-2 “Calculations for claims” <**> | + | Debit turnover on accounts 60, 62, 76 in connection with the accrual of interest on the granted commercial loan <**> |

| Column “Changes for the period. Out. Redemption" | = | Credit turnover on accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76 in connection with the repayment of accounts receivable <**> |

| Column “Changes for the period. Out. Write-off to financial result" | = | Credit turnover on accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76 in correspondence with account 91, subaccount 91-2 <**> |

| Column “Changes for the period. Out. Restoring reserve" | = | Debit turnover on account 63 in correspondence with account 91, subaccount 91-1 |

| Column “Changes for the period. Out. Write-off from the reserve for doubtful debts" <***> | = | Debit turnover on account 63 in correspondence with settlement accounts |

| Column “Changes for the period. Transfer from long-term to short-term debt" | = | X |

| Column “Changes for the period. Creation of a reserve for doubtful debts" <***> | = | Credit turnover on account 63 in correspondence with account 91, subaccount 91-2 |

| Column “At the end of the period. Accounted for under the terms of the agreement" | = | Debit balances for accounts 62, 60, 68, 69, 70, 71, 73 <*>, 75, 76 at the end of the reporting period |

| Column “At the end of the period. The amount of reserve for doubtful debts" | = | Credit balance on account 63 at the end of the reporting period |

———————————

<*> In addition to interest-bearing loans reflected in account 73, subaccount 73-1 “Settlements on loans provided”, in respect of which the criteria for recognizing them as financial investments are met.

<**> In addition to turnover associated with the occurrence and disposal of receivables in one reporting period.

<***> This column is not present in Table 5.1, presented in the Example of the Explanations. However, organizations can add it themselves if they have the appropriate metrics.

The indicators of line 5500, determined by the above formulas, must coincide with the sum of the indicators of lines 5501 “Long-term accounts receivable - total. For the reporting year" and 5510 "Short-term accounts receivable - total. For the reporting year" according to the relevant columns:

| Column “At the beginning of the year. Accounted for under the terms of the contract" line 5500 | = | Column “At the beginning of the year. Accounted for under the terms of the contract" line 5501 | + | Column “At the beginning of the year. Accounted for under the terms of the contract" line 5510 |

| Column “At the beginning of the year. Amount of reserve for doubtful debts” line 5500 | = | Column “At the beginning of the year. Amount of reserve for doubtful debts" line 5501 | + | Column “At the beginning of the year. Amount of reserve for doubtful debts" line 5510 |

| Column “Changes for the period. Admission. As a result of business transactions (amount of debt under the transaction, operation)” line 5500 | = | Column “Changes for the period. Admission. As a result of business transactions (amount of debt under the transaction, operation)” line 5501 | + | Column “Changes for the period. Admission. As a result of business transactions (amount of debt under the transaction, operation)” line 5510 |

| Column “Changes for the period. Admission. Interest due, fines and other charges” line 5500 | = | Column “Changes for the period. Admission. Interest due, fines and other charges” line 5501 | + | Column “Changes for the period. Admission. Interest due, fines and other charges” line 5510 |

| Column “Changes for the period. Out. Redemption" line 5500 | = | Column “Changes for the period. Out. Redemption" line 5501 | + | Column “Changes for the period. Out. Redemption" line 5510 |

| Column “Changes for the period. Out. Write-off to financial result" line 5500 | = | Column “Changes for the period. Out. Write-off to financial result” line 5501 | + | Column “Changes for the period. Out. Write-off to financial result” line 5510 |

| Column “Changes for the period. Out. Restore reserve" line 5500 | = | Column “Changes for the period. Out. Restoring the reserve" line 5501 | + | Column “Changes for the period. Out. Restoring the reserve" line 5510 |

| Column “Changes for the period. Out. Write-off from the reserve for doubtful debts" <*> line 5500 | = | Column “Changes for the period. Out. Write-off from the reserve for doubtful debts" <*> line 5501 | + | Column “Changes for the period. Out. Write-off from the reserve for doubtful debts" <*> line 5510 |

| Column “Changes for the period. Creating a reserve for doubtful debts" <*> line 5500 | = | Column “Changes for the period. Creating a reserve for doubtful debts" <*> line 5501 | + | Column “Changes for the period. Creating a reserve for doubtful debts" <*> line 5510 |

| Column “At the end of the period. Accounted for under the terms of the contract" line 5500 | = | Column “At the end of the period. Accounted for under the terms of the contract" line 5501 | + | Column “At the end of the period. Accounted for under the terms of the contract" line 5510 |

| Column “At the end of the period. Amount of reserve for doubtful debts” line 5500 | = | Column “At the end of the period. Amount of reserve for doubtful debts" line 5501 | + | Column “At the end of the period. Amount of reserve for doubtful debts" line 5510 |

———————————

<*> This column is not present in Table 5.1, presented in the Example of the Explanations. However, organizations can add it themselves if they have the appropriate metrics.

10. Line 5520 “Total. For the previous year"

This line provides information on the availability and movement of all accounts receivable for the previous year.

In general, data on the availability and movement of accounts receivable for the previous year is transferred from table 5.1 of the Explanations for this previous year.

In addition, the indicators of this line can be determined by summing the indicators of the corresponding columns in lines 5521 “Long-term accounts receivable - total. For the previous year" and 5530 "Short-term accounts receivable - total. For the previous year."

An example of filling out lines 5501 and 5521 of table 5.1 “Availability and movement of receivables”

EXAMPLE 18.1

Indicators for accounts 60, 62 in terms of long-term receivables (the organization has no other long-term receivables):

rub.

| Index | As of 12/31/2016 |

| 1. Debit balance of account 62 | 500 000 |

| 2. Account debit balance 60 | — |

In 2021:

1. Settlements with suppliers and contractors:

Suppliers' debts were transferred from long-term to short-term - RUB 800,000.

2. Settlements with buyers and customers:

Transferred customer debt from long-term to short-term—RUB 500,000.

Fragment of the Explanations to the Balance Sheet and the Financial Results Report for 2015:

| Indicator name | Code | Period | For the beginning of the year | Changes over the period | At the end of the period | |||||||||

| accounted for under the terms of the contract | amount of reserve for doubtful debts | admission | dropped out | transfer from debt to short-term debt | creation (change) of a reserve | accounted for under the terms of the contract | amount of reserve for doubtful debts | |||||||