Payment

Remote work is a new form of labor relations in Russia. There are many questions about

Which depreciation group does the Data Storage System belong to Code OKOF (version from 01/01/2021) 330.28.23.23

Accounting account 09 shows information about deferred tax assets (DTA), formed due to differences in

What payroll taxes need to be withheld? “Salary” taxes that the employer must calculate, withhold and

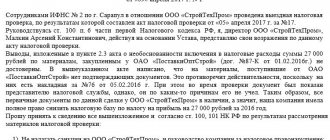

An objection to a tax audit report is a counter written document submitted by the person being audited,

When going on a business trip, the employee incurs expenses in the interests of the employer, therefore, these expenses are subject to

Calculator for a Legal Entity Calculator for an Individual Entrepreneur Calculator for a Legal Entity Taxes and

Dividends are part of the profit remaining after taxation, which is distributed among participants, shareholders. Amount

Currently, the procedure for carrying out a special assessment of working conditions is strictly mandatory for

Every citizen of the Russian Federation has obligations to the tax inspectorate. They must be paid according to the approved deadlines