Manufacturing enterprises can produce products daily and sell them immediately, while individual accounting data is generated per calendar month. In particular, these are wages and contributions to compulsory social insurance, rent, payments for utilities, and costs of repairing fixed assets. Depreciation of fixed assets and intangible assets should not be included in this list, although “I really would like to.” After all, depreciation charges are recognized on the first day of each month following the month the non-current asset was taken into account (clause 21 PBU 6/01, clause 31 PBU 14/2007).

How to form the accounting cost of products in such conditions?

Paragraph 59 of the Regulations on Accounting and Accounting Reports in the Russian Federation (hereinafter referred to as PVBU) proposes to reflect finished products in the balance sheet in three ways:

- at actual production cost;

- according to standard (planned) production costs;

- for direct cost items.

Production costs include production costs associated with the use of fixed assets, raw materials, materials, fuel, energy, and labor resources in the production process.

Let's focus on the second method. For our situation, the first method is unsuitable, since products are accepted for accounting and shipped, the actual production costs of which have not yet been formed.

Receipt of goods from the supplier

Goods are material assets that an organization purchases from a supplier (seller) for the purpose of their further resale. Moreover, the sale of goods refers to the usual activities of the enterprise. Let's take a closer look at how to accept goods for accounting, at what cost they should be received and to what account.

Goods may be received at the enterprise warehouse by:

- Purchase price

- Sales price

- Registration prices

Moreover, wholesale trade enterprises can only use the first and third methods. Retailers can use any of the three presented.

Let us consider in more detail each of these methods of accounting for commodity values.

Accounting for goods at purchase price

If a trade organization chooses this method of accounting for goods, then its decision must be reflected in the order on accounting policies.

The purchase price includes the direct cost of the goods indicated in the supplier’s documents, minus VAT. In addition, this includes all associated costs associated with the receipt of goods at the warehouse (transportation costs, procurement costs, etc.).

Transportation and procurement costs (TZR) can either be included in the purchase price of the goods or be allocated separately to the account for accounting expenses for sales.

To reflect all transactions related to goods, there is account 41 “Goods”, this is an active account, the debit of which reflects the receipt of goods, and the credit their write-off (disposal).

When accepting goods for accounting, the accountant performs posting D41 K60. The cost of this transaction does not include VAT. That is, if the supplier presented an invoice with a allocated amount of value added tax, then VAT is allocated from the cost of the goods by posting D19 K60, after which it is sent for reimbursement from the budget D68/VAT K19.

If transportation and procurement costs are also included in the purchase price of the goods, then posting D41 K60 (76) is reflected, VAT on TZR is also allocated separately by posting D19 K60 (76).

Postings upon receipt of goods:

| the name of the operation | ||

| 41 | 60 | Goods are accepted for accounting at supplier cost (excluding VAT) |

| 19 | 60 | The amount of VAT charged by suppliers has been highlighted |

| 41 | 60 | The cost of equipment and equipment is reflected (if these costs are included in the purchase price) (excluding VAT) |

| 19 | 60 | VAT is allocated from the amount of TZR |

| 68.VAT | 19 | VAT is deductible |

| 44.TR | 60 | The cost of equipment and materials is reflected as part of sales expenses (if these expenses are allocated separately) |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

Accounting for goods at sales price

This method of accounting for goods is used only by retail enterprises. Its essence lies in the fact that commodity values are accounted for in account 41, taking into account the trade margin. For these purposes, additional account 42 “Trade margin” is introduced.

First, goods are debited to the account. 41 at the purchase price (posting D41 K60) excluding VAT, after which a trade margin is added using posting D41 K42.

When the goods are sent for sale, the trade margin will be deducted from the credit account 42 using the “reversal” operation (entry D90/2 K42). In this case, the amount of write-off of the trade margin must be proportional to the goods shipped.

If goods are sent for other needs, then the trade margin is written off to the account to which the goods are written off.

Postings to account 41:

| Debit | Credit | the name of the operation |

| 41 | 60 | Goods are accepted for accounting at supplier cost (excluding VAT) |

| 19 | 60 | The amount of VAT presented by the supplier is highlighted |

| 41 | 60 | The cost of equipment and equipment is reflected (if these costs are included in the purchase price) (excluding VAT) |

| 19 | 60 | VAT has been allocated from the TZR system |

| 68.VAT | 19 | VAT is deductible |

| 44.TR | 60 | The cost of equipment and materials is reflected as part of sales expenses (if these expenses are allocated separately) |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

| 41 | 42 | Trade margin reflected |

Accounting for goods at discount prices

This method involves the use of pre-established discount prices. When goods arrive, they are debited to the account. 41 already at the discount price. In order to reflect the difference between the accounting value and the purchase value, two additional accounts are introduced: 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets”.

At the purchase price, goods are debited to the account. 15 using wiring D15 K60 (excluding VAT). After which the goods are credited to the account. 41 at discount prices using wiring D41 K15.

On account 15, a difference has formed between the debit and credit values (purchase and accounting prices), this difference is called a deviation and is written off to the account. 16.

If the purchase price is greater than the accounting price (debit is greater than credit), then the entry for writing off the deviation has the form D16 K15. Posting is carried out exactly for the difference between the book value of the goods and the purchase price.

If the purchase price is less than the accounting price (credit is greater than debit), then the posting looks like D15 K16.

After the manipulations on the account. 16 reflects the deviation in debit or credit, which at the end of the month is written off as selling expenses. If the deviation is reflected in the debit of account 16, then the posting for writing off the deviation looks like D44 K16. If the deviation is reflected on credit account 16, then the “reversal” operation is performed - posting D44 K16.

Postings upon receipt of goods at accounting prices:

| Debit | Credit | the name of the operation |

| 15 | 60 | The cost of goods is reflected according to the supplier’s documents (excluding VAT) |

| 19 | 60 | The amount of VAT presented by the supplier is highlighted |

| 15 | 60 | The cost of TZR is reflected (excluding VAT) |

| 19 | 60 | VAT is allocated from the amount of TZR |

| 68.VAT | 19 | VAT is deductible |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

| 41 | 15 | Goods are capitalized at accounting prices |

| 16 | 15 | The deviation between the accounting and purchase price is reflected |

Production cost calculation

When planning the release of a particular product, the company will certainly make a preliminary estimate of the cost of producing a unit of product. As they say, it will draw up a planned cost estimate for the elements of upcoming costs. As a rule, it has to be done by an accountant.

The production cost of products must be distinguished from the full cost. The latter also includes administrative and commercial expenses. This component of costs is called overhead and is usually provided as a percentage of production costs or any of its items.

| Total Product Cost = Manufacturing Cost + Overhead | |

| — material costs; — labor costs; — contributions for social needs; — depreciation; — other costs | — administrative expenses; — commercial expenses |

Industry specific features of cost calculation are disclosed in departmental documents (letter of the Ministry of Finance of Russia dated April 29, 2002 No. 16-00-13/03). Let's mention a few as examples:

- Instructions for planning, accounting and calculating the cost of mining and processing of coal (shale) (approved by the Ministry of Fuel and Energy of the Russian Federation on December 25, 1996);

- Methodological recommendations (instructions) for planning, accounting and calculating the cost of products of the timber industry complex (approved by the Ministry of Economy of the Russian Federation on July 16, 1999);

- Methodological recommendations for accounting of production costs and calculating the cost of products (works, services) in agricultural organizations (approved by order of the Ministry of Agriculture of the Russian Federation dated 06.06.2003 No. 792).

Nevertheless, any calculation is made according to the same rules.

Accounting for transportation and procurement costs

Receiving goods, materials, fixed assets, obtaining services, and work is accompanied by certain costs, which include delivery costs and various procurement works; these costs are called transportation and procurement costs (TPP). Their accounting in accounting can be done in two ways.

Let's imagine a situation: a supplier delivers goods. He can bear the costs of delivering the goods, or he can pass them on to the buyer. In the latter case, the buyer needs to somehow take them into account in his accounting. If transportation and procurement costs are paid by the buyer, then the supplier, as a rule, highlights them as a separate line in the invoice. Also, transport and procurement services can be provided by a third-party organization, for example, delivery of goods will be carried out by a transport company, which will provide the buyer with documents indicating the amount for delivery.

The buyer, having received the goods and documents indicating the cost of delivery, must make certain entries in his accounting department.

Accounting for goods and materials can be done in two ways:

- included in the price of the goods

- included in selling expenses

In the first case, delivery costs are taken into account on account 41 and are included in the purchase price of the goods; in the second case, they are taken into account on account 44 “Sale expenses”.

Transport costs are included in the price of the goods

This method of accounting for goods and materials is not the most convenient and not the most widespread, but, nevertheless, it can be used.

Upon receipt, goods are taken into account as a debit to account 41. In this case, VAT is allocated separately from the cost of purchased goods.

Transportation and procurement costs for these goods are also debited to account 41; if their cost includes VAT, then the tax is also allocated to a separate sub-account for reimbursement from the budget.

Postings for accounting of goods and inventory in this case have the form:

| Debit | Credit | the name of the operation |

| 41 | 60 | The cost of the goods is reflected according to the supplier’s documents |

| 19 | 60 | VAT is allocated from the cost of goods |

| 41 | 60 | The cost of fuel and equipment is reflected |

| 19 | 60 | VAT is allocated from the cost of goods and materials |

| 68.VAT | 19 | VAT is deductible |

Accounting for different types of goods can be kept in different subaccounts of account 41. If several consignments of different goods came from one supplier, and the amount of goods and materials is total for the entire delivery, then when accepting the goods for accounting, it is necessary to determine the transportation costs for each consignment. To understand how to do this, consider an example:

Example:

The following goods were received from the supplier: 10 sofas in the amount of 300,000 and 5 cabinets in the amount of 200,000, with a total cost of 500,000. Delivery costs amounted to 20,000. The goods are accepted for accounting taking into account the TZR.

We calculate transportation costs for each batch of goods:

Sofa delivery costs = 20,000 * 300,000 / 500,000 = 12,000.

Shipping costs for cabinets = 20,000 * 200,000 / 500,000 = 8,000.

The cost of the sofas, taking into account the costs of their delivery, was 312,000, the price for 1 sofa was 31,200.

The cost of the cabinets, taking into account the costs of their delivery, was 208,000, the price for 1 cabinet was 20,800.

Transportation and procurement costs are reflected in selling expenses

Trade organizations whose main activity is the sale of goods have a special account 44 “Sales expenses”, the debit of which collects all the organization’s expenses, after which they are included in the cost of goods sold.

If an organization wants to take into account TZR separately, then for the amount of these expenses it makes the posting D44 K60 (76).

On account 44, as a rule, several sub-accounts are opened in accordance with the organization’s expenses. To account for transportation costs, a sub-account “TZR” is opened.

During the month, transportation costs are collected in the debit of account 44/TZR, after which at the end of the month they are included in the cost of goods sold for the month by writing off using posting D90/2 K44/TZR.

The amount of transportation expenses to be written off at the end of the month should be in proportion to the goods sold.

This amount can be calculated using the following formula:

TZR = debit balance of account 44/TZR * credit balance of account 41 / debit balance of account 41.

The balance is calculated by adding the turnover for the month to the initial (incoming) balance.

Let's look at an example:

Example:

The organization received goods worth 500,000. TZR amounted to 20,000. At the time the goods were accepted for accounting, goods worth 200,000 were in the warehouse. TZR on account 44 at the beginning of the month were equal to 12,000. During the month, goods worth 400,000 were shipped. What should the amount of TZR be written off from account 44?

TZR = (12,000 + 20,000) * 400,000 / (200,000 + 500,000) = 18,286.

It is this amount that will be written off at the end of the month using posting D90/2 K44/TZR.

An organization can use any method convenient for itself to account for transportation costs. The chosen method must be indicated in the accounting policy order.

Accounting price of finished goods and work in progress

Since finished products are reflected in the balance sheet at production cost (planned or actual - it does not matter), commercial and administrative expenses are written off monthly to cost of sales. There is no alternative to this option. However, it is provided for by PBU 10/99 (paragraph 2, clause 9) and is satisfactory for accountants.

So, throughout the month we can receive finished products and ship them at planned prices, and take into account production costs in the usual manner - as they arise in actual amounts (based on primary documents).

At the end of the month it is necessary to display the real financial result. It is determined by the actual costs of products sold. Meanwhile, this value cannot be determined without taking into account the costs “settled” in work in progress.

Let us remind you that unfinished production means products that have not passed all stages (phases, processing stages) provided for by the technological process, as well as incomplete products that have not passed testing and technical acceptance (clause 63 of the PVBU).

Work in progress in mass and serial production can be reflected in the balance sheet (clause 64 of the PVBU):

- at actual production cost;

- according to standard (planned) production costs;

- by direct cost items;

- at the cost of raw materials, materials and semi-finished products.

Continuation of the example

We assumed that the team produces 10 sofas per month. The volume of work in progress depends on the organization of labor. Sofas can be made sequentially one after another, and then the cost of the “unfinished product” will not exceed the cost of one sofa. But if the sofas are made synchronously, all 10 at the same time, then the cost of the “unfinished” product will increase proportionately. Let's focus on the first option. Since the degree of readiness of a sofa can vary from 0 to 100 percent, we will take the planned production cost of work in progress equal to 50 percent of the planned production cost of one sofa, that is, 15 thousand rubles (30,000 rubles x 50%). You can go the other way and determine the cost work in progress through inventory. The easiest way to do this is to evaluate the “work in progress” at the cost of the materials actually contained in it. But the accounting policy of our enterprise involves accounting for the planned production cost of both finished products (30,000 rubles) and work in progress (15,000 rubles).

Product accounting at planned production costs is carried out using account 40 “Output of products (works, services)”.

Storage and disposal of goods

After goods are accepted for accounting, they can be stored in a warehouse for some time until they are sent to the buyer. The storage of goods in a warehouse must be properly organized so that there is no confusion either in accounting or in the warehouse itself. Proper organized storage will allow you to find the right item at any time in the shortest possible time.

There are two ways to store goods:

- Party

- Varietal

Batch method of storing goods

This method is characterized by grouping incoming goods into batches as they arrive at the warehouse. Each batch is stored separately.

When accepting goods into the warehouse, the storekeeper or other financially responsible person draws up a batch card in the MX-10 form for each individual batch. The card is drawn up in two copies, one copy is transferred to the accounting department, the other remains in the warehouse.

When goods are removed from a batch for sale, the storekeeper makes a note in the batch card about the number of disposed goods, the date of shipment and the document on the basis of which it was released from the warehouse.

After all the goods from the batch have been shipped, there is no need for a batch card for this batch and the document is transferred to the accounting department.

Thus, the batch card allows you to control the balance of goods in the warehouse for each batch and shows the number of valuables shipped.

This storage method is convenient if each subsequent batch is noticeably different from the previous one (in quality, price or other characteristics).

Variety method of storing goods

With this method, all goods are grouped not by batches, but by varieties, brands, and names. Grouping occurs regardless of the date of receipt of goods.

When the next batch arrives, the goods are divided by item and added to those already in stock.

To control the movement of goods using the varietal storage method, an accounting log form TORG-18 is used. When goods arrive at the warehouse, a receipt order is issued, on the basis of which a record of receipt is already made in the TORG-18 journal. Similarly, when goods are removed from the warehouse, an expense document is drawn up, on the basis of which an entry is made about the disposal in the TORG-18 journal.

A product label is attached to each variety, brand, or product name, which is issued using the unified TORG-11 form. The label is always located next to the product, which allows you to find out at any time what kind of commodity values are stored in a given place and in what quantities. This data is usually used in the inventory process.

Storing goods in a warehouse may also be accompanied by the execution of documents such as:

- Card of quantitative and cost accounting form TORG-28, which is used for more detailed accounting of goods (analytical) taken into account in quantitative and cost terms

- Invoice for internal movement, form TORG-13, is used when it is necessary to transfer goods from one division of an enterprise to another, that is, when moving goods within the organization

- Report on damage, damage, scrap goods and materials, form TORG-15, is filled out if damaged goods are identified that are subject to write-off

Disposal of goods

As a rule, goods are purchased for the purpose of their further sale. Therefore, they are removed from the warehouse when they are sold to customers.

The sale of goods belongs to the usual activities of the enterprise and is registered using account 90 “Sales”, this is a complex account with several sub-accounts:

- the credit of the first subaccount reflects the proceeds from the sale

- on the debit of the second - the cost of commodity assets

- on the debit of the third – accrued VAT payable

- on the debit or credit of the ninth subaccount - profit or loss from sales

Note that the posting reflecting the shipment of goods to customers has the form D62 K90/1.

Valuation of goods when written off for sale can be carried out in one of the following ways:

- Based on the average cost of each unit

- At average cost

- FIFO method

The organization chooses one of the methods for itself and reflects it in its accounting policies.

Write-off of the cost of goods for sale is recorded using posting D90/2 K41.

This also includes sales expenses, which are written off at the end of the month from account 44 in proportion to the shipped commodity values using posting D90/2 K44.

Selling expenses may include:

- Transport and procurement costs (if they are accounted for separately on the 44th account

- Staff salaries

- Expenses for renting premises and equipment

- Depreciation of fixed assets and intangible assets

- Advertising expenses

- Entertainment expenses

- Expenses for business travel, etc.

If an organization is a value added tax payer, then VAT must be charged on the cost of goods for payment to the budget; the corresponding entry has the form D90/3 K68/VAT.

Shipment is made on the basis of a delivery note.

These entries are made if the transfer of ownership of the goods occurs at the time of shipment. If the contract provides for the transfer of ownership at the time payment is received from the buyer, then slightly different entries are made in the seller’s accounting, and an additional account 45 Goods shipped is used.

Results

Since goods are the main current asset of trading companies, clear and organized inventory accounting is very important for them.

At the same time, the accounting procedure depends on the type of activity, the size of the business, the tax system and the type of legal relationship on the basis of which goods and materials are transferred (accepted) for possession, for safekeeping or sale. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Transfer of ownership of goods

As a result of the sale of goods, ownership rights are transferred from one person to another. A change of ownership of goods can occur at the time of shipment or at the time of payment for goods.

The Civil Code of the Russian Federation provides for the transfer of ownership at the time of transfer of commodity assets to the buyer, but there is a clause “unless the contract provides for a different procedure.”

Transfer of ownership of goods upon shipment

If ownership passes at the time of shipment to the buyer, then transactions for the sale of commodity assets in the seller’s accounting department must be reflected on the day of shipment.

Postings upon transfer of ownership at the time of shipment:

| Date of operation | debit | Credit | the name of the operation |

| Shipping day | 62 | 90/1 | Revenue from the sale of goods is reflected |

| Shipping day | 90/2 | 41 | The cost of goods intended for sale has been written off |

| Shipping day | 90/2 | 41 | Selling expenses are written off in proportion to the goods shipped |

| Shipping day | 90/3 | 68/VAT | VAT is charged on the cost of goods payable to the budget (if the seller is a payer of this tax) |

| Payment day | 51 | 62 | Payment received from buyer |

Transfer of ownership of goods upon payment

If an agreement is concluded between the buyer and seller, which stipulates that ownership passes at the time of payment, then the seller’s accountant must make slightly different entries.

In this case, account 45 “Goods shipped” is used, this account is used to reflect the movement of shipped goods, for which the proceeds from the sale cannot be recognized for some time by the seller.

This account can account for both shipped goods entering the debit of account 45 from the credit account 41 “Goods”, and shipped products entering the debit of account. 45 from credit account. 43 “Finished products”.

Also on the debit of the account. 45 reflects the costs associated with the shipment of commodity assets (for example, transportation and procurement costs), coming to the debit of account 45 from the credit of account 44 “Sales expenses”.

On loan account 45 reflects the write-off of shipped goods to the debit of account 90 “Sales” at the moment when sales revenue is recognized in the seller’s accounting.

Thus, if the agreement between the counterparties states that the transfer of ownership of the goods takes place at the time of payment, that is, at the time of recognition of revenue from sales, then the shipment of the goods is formalized using posting D45 K41, which will mean that the goods have been shipped, but also are listed on the seller's balance sheet.

After the buyer pays for the valuables received, posting D90/2 K45 will be made, which will mean that the goods are written off from the seller’s balance sheet and sent for sale.

As for value added tax, it must be charged at the time of shipment, that is, before the transfer of ownership occurs. The accrual of VAT is also reflected in account 45 using posting D45 K68/VAT. Thus, the goods will be listed on account 45 along with VAT.

Postings when changing ownership when paying:

| Day of surgery | Debit | Credit | the name of the operation |

| Shipping day | 45 | 41 | Goods shipped without transfer of ownership |

| Shipping day | 45 | 68/VAT | VAT is charged on the cost of shipped goods |

| Payment day | 51 | 61 | Receipt of payment from the buyer |

| Payment day | 62 | 91/1 | Reflected sales revenue |

| Payment day | 90/2 | 45 | Sold goods written off |

Return of goods: accounting with the buyer and supplier

Upon receipt of the goods, the purchasing organization must carefully inspect the received valuables, conduct an external inspection for defects, malfunctions, damage to packaging, containers, and unpresentable appearance. In addition, it is necessary to carefully check the documents accompanying the goods and compare the data specified in the documents with the actual values received. Check that the documents are filled out correctly and that there is an invoice if the product is subject to VAT.

If the purchasing organization is satisfied with everything, it accepts the goods; if something is not satisfactory, then the buyer can return it to the supplier. How do I return goods? What are the features of return accounting for both parties to the transaction: supplier and buyer? What documents need to be completed? We'll talk about this below.

Documentation of returning goods

If the purchasing organization decides to return the goods to the supplier, then it must properly document this fact.

If inadequate quality of goods or incorrectly executed documents are detected at the acceptance stage, then the buyer draws up a statement of discrepancy, in which he states his complaints to the supplier and indicates what exactly is not satisfactory. For registration, you can use the existing unified TORG-2 form and fill out this document in the presence of the person who delivered the goods.

A letter of claim must be attached to the discrepancy report, in which the buyer states what he was not satisfied with and what further actions he expects from the supplier (replacement, refund if the goods have been paid for).

If the documents are drawn up in the presence of the forwarding driver or another person who delivered the goods, then the documents are transferred to this person along with the goods.

If a defect or discrepancy between documentary and factual data is detected later, after the driver’s departure, then the letter of claim along with the attached report is sent to the supplier in any other way.

Accounting for supplier returns

Having received a claim from the buyer, the supplier must take certain actions. Return the product or replace it with a quality one.

First of all, you need to find out whether payment has been received from the buyer.

If the item is paid for

If the buyer returns the paid goods, the supplier opens account 76 “Settlements with various debtors and creditors”, which will account for the received claim.

An accepted claim is reflected using posting D62 K76, posting is carried out for the amount of the claim indicated by the buyer.

If it is not planned to replace the product, then it is necessary to make transactions that neutralize the sales-related transactions made during its shipment. This is done using the “reversal” operation, that is, the same transactions are made for the same amounts, but they will be subtracted from those made earlier.

For example, if goods are shipped in the amount of 118,000 rubles, including VAT of 18,000 rubles, cost of 60,000 rubles, then the sales transactions will look like this:

- D62 K90/1 in the amount of 118,000 – revenue from the sale is reflected

- D90/3 K68/VAT – VAT charged on sales

- D90/2 K41 – cost written off

Postings for reversing a sale will look the same, only all amounts will be with a “-” sign, that is, they will be subtracted.

As a result of this, the sale is neutralized, but since the buyer paid for the goods, the supplier incurs a debt to the buyer. The supplier returns the money to the buyer, this is documented by posting D76 K51. Thus, account 76 will be closed, the sale will be reversed, and the buyer will return the goods.

If the item is not paid for:

If the buyer did not have time to pay for the goods, then the supplier simply makes transactions to reverse the sale and that’s it. There is no need to open account 76.

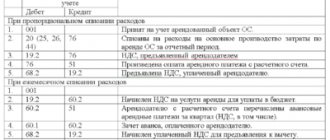

Postings when returning goods from the buyer:

| Debit | Credit | the name of the operation |

| 90/2 | 41 | The cost of goods is written off |

| 62 | 90/1 | Reflected revenue in connection with the sale |

| 90/3 | 68/VAT | VAT charged on sales |

| 51 | 62 | Payment received from buyer |

| 62 | 76 | A claim has been accepted from the supplier regarding the return of goods |

| 62 | 90/1 | Sales transactions are reversed (subtracted) |

| 90/3 | 68/VAT | |

| 90/2 | 41 | |

| 76 | 51 | Money returned to the buyer |