Calculator for Legal Entity

Calculator for Individual Entrepreneur

Calculator for Legal Entity

| Taxes and fees | BASIC | simplified tax system 6% | simplified tax system 15% |

| 1. Insurance premiums | 60,400 rub. | 60,400 rub. | 60,400 rub. |

| 1.1 In the Pension Fund of Russia | 44,000 rub. | 44,000 rub. | 44,000 rub. |

| 1.2 V FSS | 5,800 rub. | 5,800 rub. | 5,800 rub. |

| 1.3 IN MHIF | 10,200 rub. | 10,200 rub. | 10,200 rub. |

| 1.4 From accidents | 400 rub. | 400 rub. | 400 rub. |

| 2. VAT | RUB 122,034 | — | — |

| 2.1 VAT accrued | RUB 152,542 | — | — |

| 2.2 VAT deductible | RUB 30,508 | — | — |

| 3. Income tax | RUB 63,513 | — | — |

| 3.1 Taxable income | RUB 847,458 | — | — |

| 3.2 Taxable expense | RUR 529,892 | — | — |

| 4. Tax simplified tax system | — | 30,000 rub. | RUB 65,940 |

| 4.1 Income accepted for tax purposes | — | 1,000,000 rub. | 1,000,000 rub. |

| 4.2 Tax accrued (for simplified tax system 6%) | — | 60,000 rub. | — |

| 4.3 Expenses accepted for tax purposes (for simplified tax system 15%) | — | — | RUB 560,400 |

| 4.4 Deduction of insurance premiums (for simplified tax system 6%) | — | 30,000 rub. | — |

| 4.5 Minimum tax (for simplified tax system 15%) | — | — | 10,000 rub. |

| 5. Total payable | RUB 245,947 | RUB 90,400 | RUB 126,340 |

| The tax burden | 24.59% | 9.04% | 12.63% |

| Financial result (profit (+)/loss (-)) | RUB 254,053 | RUB 409,600 | RUB 373,660 |

Calculator for Individual Entrepreneur

| Taxes and fees | BASIC | simplified tax system 6% | simplified tax system 15% |

| 1. Insurance premiums | RUR 99,785 | RUR 99,785 | RUR 99,785 |

| 1.1 To the Pension Fund for employees | 44,000 rub. | 44,000 rub. | 44,000 rub. |

| 1.2 To the Pension Fund for oneself (fixed) | RUB 26,545 | RUB 26,545 | RUB 26,545 |

| 1.3 To the Pension Fund for oneself (additionally) | 7,000 rub. | 7,000 rub. | 7,000 rub. |

| 1.4 In the Social Insurance Fund for employees | 5,800 rub. | 5,800 rub. | 5,800 rub. |

| 1.5 In the Compulsory Medical Insurance Fund for employees | 10,200 rub. | 10,200 rub. | 10,200 rub. |

| 1.6 In the MHIF for yourself | RUB 5,840 | RUB 5,840 | RUB 5,840 |

| 1.7 From accidents | 400 rub. | 400 rub. | 400 rub. |

| 2. VAT | RUB 122,034 | — | — |

| 2.1 VAT accrued | RUB 152,542 | — | — |

| 2.2 VAT To be deducted | RUB 30,508 | — | — |

| 3. Personal income tax | RUB 36,164 | — | — |

| 3.1 Taxable income | RUB 847,458 | — | — |

| 3.2 Taxable expense | RUR 569,277 | — | — |

| 4. Tax simplified tax system | — | 30,000 rub. | 60,032 rub. |

| 4.1 Income accepted for tax purposes | — | 1,000,000 rub. | 1,000,000 rub. |

| 4.2 Tax accrued (for simplified tax system 6%) | — | 60,000 rub. | — |

| 4.3 Expenses accepted for tax purposes (for simplified tax system 15%) | — | — | RUB 599,785 |

| 4.4 Deduction of insurance premiums (for simplified tax system 6%) | — | 30,000 rub. | — |

| 4.5 Minimum tax (for simplified tax system 15%) | — | — | 10,000 rub. |

| 5. Total payable | RUB 257,983 | RUB 129,785 | RUB 159,817 |

| The tax burden | 25.80% | 12.98% | 15.98% |

| 6. Financial result (profit (+)/loss (-)) | RUB 242,017 | RUB 370,215 | RUB 340,183 |

All individual entrepreneurs face the obligation to pay taxes. The size of the tax base is provided for by law, but it can be reduced in certain ways.

The value is calculated independently or using a calculator - this is necessary by order of the Federal Tax Service during their unscheduled inspections. If the income tax burden is too low, then in most cases there may be an error in the calculations. To avoid this, a calculator was created.

What is the tax system

The taxation system (regime) is the procedure for calculating and paying taxes and fees to the state budget.

The tax regime includes a number of mandatory elements (Article 17 of the Tax Code of the Russian Federation):

- Taxpayer is a person who is obliged to pay taxes (fees, contributions) under the legislation of the Russian Federation. Speaking about taxation systems, such persons will be an organization or an individual entrepreneur.

- The object of taxation is profit, income, possible income and other indicators that result in the formation of the tax base. For example, real estate is an object of taxation under the property tax; the tax base will be its cadastral value.

- Tax base is the monetary expression of the object of taxation. Under the simplified tax system, the object of taxation can be income, and the tax base will be its monetary value.

- Tax period is the period of time for which the tax base is calculated and the tax is calculated. Most often, the tax period is a quarter or a calendar year.

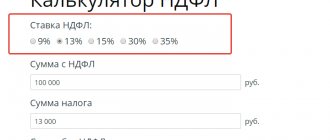

- Tax rate is the amount of tax charges per unit of measurement of the tax base. Most often the rate is expressed as a percentage. For example, the income tax rate is 20%.

- The procedure for calculating tax is the calculation formula.

- Procedure and deadlines for tax payment.

Basic taxation systems

- OSNO - general;

- USN - simplified;

- PSN - patent;

- Unified agricultural tax - unified agricultural tax;

- UTII is a single tax on imputed income (not applicable from 01/01/2021).

Tax collection occurs on the basis of declarations. The need to fill out a declaration depends on the tax regime.

Bond income tax

In accordance with the current rules for taxation of income from bonds, tax is calculated according to the same rules as on income from deposits, that is, provided that the coupon rate exceeds the key rate of the Central Bank of the Russian Federation + 5 percentage points.

With the entry into force of the provisions of Art. 214.2, coupons received on bonds will be subject to a 13 percent tax, regardless of the number of bonds, their issuer, coupon rate or actual income received.

Tax withholding will be carried out by the broker at the source of payments. We recommend that you first discuss with your broker the type of deduction to be applied in cases where the bonds are held in an individual investment account with a deduction for income.

What influences the ability to choose a tax system

The tax regime depends on various factors. For example, not every company can work on the simplified tax system if the indicators do not meet certain criteria.

The taxation system is selected when registering with the tax authorities. In some cases, taxpayers may voluntarily change regimes during the course of their activities. And sometimes you have to change the system due to changes in the financial performance of the company.

To choose a tax regime, you should take into account and analyze a number of indicators: field of activity, company size, planned income, book value of property, customer requests (for example, some buyers refuse to work with companies not on OSNO because they want to receive a VAT refund) and other indicators .

If the taxation system is not specified in the application for registration with the Federal Tax Service, OSNO will be assigned by default. This is due to the fact that absolutely all organizations and individual entrepreneurs can work on this system. Accounting on the general system is very labor-intensive; you need to take into account a lot of nuances in order to comply with the law. The tax burden will also be quite high.

However, for large companies with high incomes and large staff, OSNO is the only available option.

Representatives of small and medium-sized businesses were luckier. Here, many have a choice of special modes. UTII can only be used by enterprises with a certain type of activity. Very soon they will have to choose a different regime, since starting from 01/01/2021, UTII will be cancelled.

The most famous special regime is the simplified tax system. The advantage of this system is the relative simplicity of accounting. Entrepreneurs often cope with accounting without the help of an accountant. Tax on the simplified tax system is paid on income or on the difference between income and expenses. To work on a simplified system, the number of employees must be within 100 people, and the income should not exceed 150 million rubles per year. There are also a number of restrictions for working on the simplified tax system (Chapter 26.2 of the Tax Code of the Russian Federation).

The patent system, like UTII, cannot be used by everyone. But the scope for obtaining a patent is extensive (Article 346.43 of the Tax Code of the Russian Federation).

VAT burden

For companies using this type of tax, the fiscal service also calculates the share of deductions using the following formula:

Share of deductions = Total amount of deductions ÷ Total amount of accrued VAT × 100%, where:

- the amount of deductions is taken from line 190, section 3 of the VAT return;

- the VAT amount is from line 118, section 3 of the VAT return.

If the result of the calculations is more than 89%, then the enterprise will be classified as a risk group, so before each submission of a declaration it is worth checking the proportion of VAT deductions. In case of excess, it is better to transfer part of the deductions to the future or leave them as they are and prepare answers to questions from tax authorities and supporting documents.

Heading:

Taxes, fees, duties

tax burden tax burden on small enterprises types of activities

- Amelina Tatyana, General Director

Sign up 7800

9750 ₽

–20%

Algorithm for choosing a tax system

When opening a new business, an entrepreneur is able to estimate planned income, headcount and other parameters. It is enough to analyze the upcoming year of work.

First you need to consider the type of activity. For example, notaries cannot use the simplified tax system. The list of possible spheres for each special mode is given in Chapter. 26.1, 26.2, 26.3, 26.4, 26.5 Tax Code of the Russian Federation.

Then pay attention to the organizational and legal form. There is one limitation here - only individual entrepreneurs can acquire a patent.

If the organization is large and initially has more than 100 employees, then the simplified tax system and UTII should not be considered. Individual entrepreneurs with more than 15 employees will not be issued a patent.

An important indicator is income. Most newcomers to the economic market can qualify for the simplified tax system according to this parameter. The main thing is to keep within the limit of up to 150 million rubles per year. For individual entrepreneurs on a patent, the limit is 60 million rubles.

If an organization plans to work with large buyers, most likely they work for OSNO. When choosing a supplier, it is more profitable for them to enter into contracts with companies on OSNO in order to reduce their VAT.

Having chosen the simplified tax system, you will have to determine the accounting option. You can pay tax on income, or you can pay tax on income reduced by expenses. In the second option, accounting is more complicated. But it is often more profitable.

Having determined the priority tax regime for yourself, we recommend making a preliminary calculation of the tax burden. It is better to compare several possible systems.

An example of comparing the tax burden under different regimes for an LLC

LLC "More" under the leadership of director Kalkin O.R. in a month he begins work in Yekaterinburg. The company will sell swimsuits at retail. For convenience of calculations, we take monthly indicators. However, when analyzing and choosing a mode, you should take the planned indicators for the year.

The estimated profit per month will be 400,000 rubles (excluding VAT). The company's expenses for renting a store, purchasing goods, purchasing furniture for the sales area and other expenses will amount to 250,000 rubles per month excluding VAT, including a salary of 120,000 rubles (before deduction of personal income tax). Insurance premiums will amount to 36,240 rubles (120,000 x 30.2%). The area of the rented premises is 48 sq. m. m. Number of people: 4 people (director, two salespeople, manager).

More LLC has the right to apply OSNO (no restrictions), simplified tax system and UTII. The type of activity of the organization, parameters in terms of number, area and revenue fall within the established limits for special regimes.

Calculation of the tax burden under OSNO

Income tax: (400,000 - 250,000 - 36,240) x 20% = 22,752 rubles.

Let's assume that in the example all expenses (except salaries) are subject to VAT. Then the amount of VAT to be deducted will be: (250,000 - 120,000) x 20%) = 26,000 rubles.

VAT on income will be: 400,000 x 20% = 80,000 rubles.

VAT payable to the budget = 80,000 - 26,000 = 54,000 rubles.

Total mandatory payments to the budget for the month: 22,752 + 54,000 + 36,240 = 112,922 rubles.

Calculation of the tax burden for UTII

The tax on imputed income is calculated by multiplying the basic profitability (1,800 rubles for a trading floor, Article 346.29 of the Tax Code of the Russian Federation) by a physical indicator (the area of the hall), by deflator coefficients and by the tax rate.

K1 in 2021 = 2.005, K2 = 1.0

Imputed income = 1,800 x 48 x 2.005 x 1 = 173,232 rubles.

Tax on imputed income = 173,232 x 15% = 25,985 rubles.

More LLC has the right to save on tax by reducing it on insurance premiums. In this case, the tax should not be reduced by more than half. Since the contributions of More LLC are greater than the tax amount, the tax can be reduced by exactly half.

Total tax payable: 25,985: 2 = 12,993 rubles.

Total mandatory payments to the budget for the month: 12,993 + 36,240 = 49,233 rubles.

Calculation of the tax burden under the simplified tax system (Revenue)

When choosing such a system, expenses are not taken into account when calculating tax.

Tax on simplified tax system = 400,000 x 6% = 24,000 rubles. In regions, the tax rate can be 1-6 percent.

More LLC has the right to save on tax by reducing it on insurance premiums. In this case, the tax should not be reduced by more than half. Since the contributions of More LLC are greater than the tax amount, the tax can be reduced exactly twice.

Tax payable = 24,000: 2 = 12,000 rubles.

Total mandatory payments to the budget for the month: 12,000 + 36,240 = 48,240 rubles.

Calculation of the tax burden under the simplified tax system (Income minus Expenses)

The general tax rate is 15%, but it varies depending on the region. In our example, the regional rate is 7%.

Tax on simplified tax system = 400,000 – (250,000 + 36,240) x 7% = 7,963 rubles.

Total mandatory payments to the budget for the month: 7,963 + 36,240 = 44,203 rubles.

Having calculated the approximate tax burden under different regimes, we conclude: It is profitable for LLC More to use the simplified tax system, taking into account expenses (the latest calculation option). However, in another region, at a rate of 15%, this regime will not bring benefits.

Why is it important to stick to predicted values?

If the current amounts differ from the planned ones, the money allocated for paying taxes will not be enough, which can lead to unpleasant consequences for the business. Carrying out business actions without a preliminary plan often provokes tax gaps (either there is no tax, or it is huge), which force significant funds to be withdrawn from turnover.

If the owner has the results of calculating the tax burden of the organization, it is easier for him to make the right decisions.

Finguru has developed a special algorithm that allows you to quickly estimate the expected tax amount. Accountants can not only understand what tax the client will need to pay based on transactions already performed, but also predict its amount at the end of the quarter. All this helps to adjust its size and effectively manage the movement of money, goods and services.

With us you can focus on business and not worry about finances.

Calculate the cost of accounting services in Finguru!

Which tax system to choose for individual entrepreneurs

Individual entrepreneurs, like legal entities, can work in different modes. Which mode is suitable for a particular entrepreneur depends on the turnover, number, and type of activity.

An individual entrepreneur has a wider choice of modes compared to an LLC. Individual entrepreneurs can work on a patent (PSN). This option is suitable for seasonal or temporary work. True, a patent will not be given if the number of employees is more than 15 people. In order not to lose the right to use PSN, annual income should not exceed 60 million rubles.

To apply the simplified tax system and UTII, an entrepreneur can employ up to 100 people. For the simplified system, there is a limit on income level - no more than 150 million rubles per year.

Having chosen the simplified tax system, you will have to determine the accounting option. You can pay tax on income, or you can pay tax on income reduced by expenses.

If an individual entrepreneur plans to work with large buyers using a common system, it is worth considering choosing OSNO.

An example of comparing the tax burden under different regimes for individual entrepreneurs

Individual entrepreneur Petr Olegovich Vasilkov plans to open a hairdresser in Yekaterinburg. Expected annual income 1,500,000 rubles (excluding VAT); number of employees - 4 people; the estimated costs will be 790,000 rubles (excluding VAT), including employee salaries of 510,000 rubles (before personal income tax). Insurance premiums for employees - 154,020 rubles (510,000 x 30.2%).

In addition, individual entrepreneurs pay fixed contributions for themselves, regardless of the regime and income received. In 2021, the amount of fixed contributions is 40,874 rubles.

Calculation of the tax burden of individual entrepreneurs under OSNO

Individual entrepreneurs on OSNO pay personal income tax on income instead of income tax.

If annual income minus expenses exceeds 300,000 rubles, the individual entrepreneur will pay 1% to the Pension Fund of the Russian Federation on the excess amount. In this example there is an excess. Vasilkov P.O. must pay 1% - 2,151 rubles (1,500,000 - 790,000 - 154,020 - 40,874 - 300,000) x 1%.

Personal income tax: (1,500,000 - 790,000 - 154,020 - 40,874 - 2,151) x 13% = 66,684 rubles.

Let's assume that in the example all expenses (except salaries) are subject to VAT. Then the amount of VAT to be deducted will be: (790,000 - 510,000) x 20% = 56,000 rubles.

VAT on income will be: 1,500,000 x 20% = 300,000 rubles.

VAT payable to the budget = 300,000 - 56,000 = 244,000 rubles.

Total mandatory payments to the budget: 66,684 + 244,000 + 154,020 + 40,874 + 2,151 = 507,729 rubles.

Calculation of the tax burden of individual entrepreneurs with UTII

The tax on imputed income is calculated by multiplying the basic income (7,500 rubles for the provision of household services, Article 346.29 of the Tax Code of the Russian Federation) by a physical indicator (the number of employees together with individual entrepreneurs), by deflator coefficients and by the tax rate.

K1 in 2021 = 2.005, K2 = 1.0

Imputed income = 7,500 x 5 x 2.005 x 1 = 75,188 rubles.

Tax on imputed income = 75,188 x 15% = 11,278 rubles.

Individual entrepreneur Vasilkov has the right to save on tax by reducing it on insurance premiums. In this case, the tax should not be reduced by more than half. Since Vasilkov’s contributions are greater than the tax amount, the tax can be reduced exactly in half.

Total tax payable: 11,278: 2 = 5,639 rubles.

Total mandatory payments to the budget: 5,639 + 154,020 + 40,874 = 200,533 rubles.

Calculation of the tax burden of individual entrepreneurs on the simplified tax system (Revenue)

When choosing such a system, expenses are not taken into account when calculating tax.

If annual income exceeds 300,000 rubles, the individual entrepreneur will pay 1% to the Pension Fund of the Russian Federation on the excess amount. In this example there is an excess. Vasilkov P.O. must pay 1% - 12,000 rubles (1,500,000 - 300,000) x 1%).

Tax on simplified tax system = 1,500,000 x 6% = 90,000 rubles. In regions, the tax rate can be 1-6 percent.

Vasilkov has the right to save on tax by reducing it on insurance premiums. In this case, the tax should not be reduced by more than half. Since Vasilkov’s contributions are greater than the tax amount, the tax can be reduced exactly in half.

Tax payable = 90,000: 2 = 45,000 rubles.

Total mandatory payments to the budget: 45,000 + 154,020 + 40,874 + 12,000 = 251,894 rubles.

Calculation of the tax burden on the simplified tax system (Income minus Expenses)

The general tax rate is 15%, but it varies depending on the region. In our example, the regional rate is 7%.

If annual income exceeds 300,000 rubles, the individual entrepreneur will pay 1% to the Pension Fund of the Russian Federation on the excess amount. In this example there is an excess. Vasilkov P.O. must pay 1% - 12,000 rubles (1,500,000 - 300,000) x 1%).

Tax on simplified tax system = 1,500,000 – (790,000 + 154,020 + 40,874 + 12,000) x 7% = 35,217 rubles.

Total mandatory payments to the budget: 35,217 + 154,020 + 40,874 + 12,000 = 242,111 rubles.

Calculation of the tax burden of individual entrepreneurs on PSN

The PSN tax is not reduced by the amount of contributions.

The tax is calculated on potential income (PVI). The VDA is set by the regions and depends on the type of activity.

In our example, the PVD is 107,460 rubles. The tax rate is 6%. When providing household services, the cost of a patent is affected by the number of employees.

Tax on PSN: 107,460 x 5 people. x 6% = 32,238 rubles.

PVD for 5 people is 537,300 rubles. This means you will have to pay 1% to the Pension Fund on the excess. (537,300 - 300,000) x 1% = 2,373 rubles.

Total mandatory payments to the budget: 32,238 + 154,020 + 40,874 + 2,373 = 229,505 rubles.

UTII turned out to be a profitable system for individual entrepreneurs. It is important to understand that UTII will no longer be valid in 2021.

Tax rate

The standard rate is 20%. It is installed by default in the calculator. However, there are categories of taxpayers for whom the rate is lower, so if necessary, you can change the indicator to one that is relevant for a particular enterprise.

The transferred 20% is distributed between the federal and regional budgets in the ratio of 3% and 17%, respectively. The percentage of contributions to the federal budget never changes, but to the regional budget it can change depending on the benefits introduced by local authorities.

What if the tax burden is lower than normal?

In this case, the inspection:

- will call the director for a conversation , during which he will find out why the company pays little taxes. The head of the Federal Tax Service and/or his deputies will begin to look for connections with technical specialists and find out what schemes the company uses, how it understates income and “draws” expenses;

- An on-site tax audit will be scheduled . Of course, just because of a deviation from the norm of the tax burden, the inspectorate is unlikely to conduct a full-fledged on-site inspection, but if the company has other points that the inspection pays attention to, then the prospect of an on-site inspection becomes very real.