An objection to a tax audit report is a counter written document that is submitted by the person being audited if he does not agree with the facts stated in the report. In this material we will tell you what exactly can be objected to in this way, how and within what time frame to submit the said document and how to complete it. We’ll also talk about what happens after filing objections and what a sample objection to a tax audit report looks like (an example that every interested taxpayer can use will also be in the article).

What exactly is an objection to a tax audit report used for?

An objection drawn up on behalf of the company allows its management to appeal any actions, results and conclusions of the tax authorities who carried out the tax audit.

There are two main types of violations committed by tax authorities:

- procedural (i.e. errors in the order of the event);

- violations related to substantive law (i.e. incorrect interpretation of any documents, incomplete accounting of provided papers, etc.).

The tax office is obliged to respond to a written objection, regardless of which of these types of violations it is written about.

Right to appeal a claim

It must be said that demands for payment of taxes are essentially fair, that is, controllers do not demand payment of non-existent debts. Quite often, when receiving a request, the problem lies in the untimely transfer of some taxes and fees, delays in filing reports, or other violations that lead to fines. Sometimes situations occur when a taxpayer mistakenly indicates an inflated tax in a report, but transfers the correct amount to the budget - in this case, upon receipt of a request, it is necessary to adjust the previously submitted declaration. Or the transfer to the budget was made with an error in the payment details, so the payer is sure that he has fulfilled his obligations to the budget, but the Federal Tax Service Inspectorate lists him as arrears. In this case, a logical solution would be to undergo an additional reconciliation with the budget in order to verify the list of payments made.

However, if there are no apparent reasons for additional taxes or sanctions, and the taxpayer does not agree with the requirements put forward, then he is given the opportunity to defend his point of view about the correctness of the transferred tax amounts or the absence of debts.

What you shouldn't complain about

Everything related to the company’s activities in terms of documents, finance, accounting and taxes can and should be appealed in case of disagreement.

But there are some points against which it is not advisable to file an objection with the tax office. This:

- timing of the verification procedure (start and end dates),

- inaccuracies in the preparation of the protocol,

- minor procedural violations.

All these minor details should be ignored at this stage, focusing on the essence of the claim. Here the mark “at this stage” means that they should be reserved for the court, where, if something happens, they can try to discredit the act (i.e., declare it illegal).

In addition, it should be borne in mind that an objection drawn up in accordance with all the rules, with all the necessary papers attached, regarding the audit procedure may well lead to additional control measures on the part of the tax authorities. And their results, in turn, can easily reveal more serious errors and violations in the activities of the enterprise.

Deadline for consideration of objections

When determining the period for consideration of the materials of the report and the taxpayer’s objections, the following periods are taken into account:

- The review is carried out within 10 days from the date of expiration of the period established for filing objections.

- The period is calculated in working days.

- When assigning in-depth activities, the period of 10 days is counted from the date of completion of in-depth activities.

- The period can be extended within a month.

The arguments presented by the taxpayer in the form of an objection to the audit are considered only if they are significant. The absence of reasoned and, if necessary, documented facts of the person’s correctness does not allow accepting objections.

How to justify an objection

Before “starting a discussion” with the tax authorities, it is advisable to stock up on one hundred percent arguments and a set of convincing documents certifying the correctness of the organization, which must be added to the objection. To do this, it is necessary to carefully study the tax audit report, and recheck all identified controversial points several times.

If, at the time of writing the tax audit report, the company for some reason lacked some documents, but it managed to restore them as soon as possible or was able to correct minor inaccuracies in the existing papers, this must be reflected in the objection.

This will reduce the amount of additional tax assessed, if any, and also avoid all kinds of fines and penalties.

All your arguments must be carefully and thoroughly explained, indicating the circumstances that led to this or that shortcoming and referring to the legislation of the Russian Federation in the field of taxes, civil law, judicial practice and company regulations.

It will be difficult for tax authorities to argue with well-founded arguments; moreover, if something happens, they will become the evidence base when the company goes to court (if, of course, it comes to that). It should also be noted here that in court it will be possible to raise only those points of the tax audit report that were previously appealed to a higher tax office.

Sample response to a request to provide documents to the tax office

On the official website of the Federal Tax Service you can find a brochure entitled “Pre-trial settlement of tax disputes.” It reflects the process of drawing up and filing a complaint to higher authorities for individual entrepreneurs, legal entities, and individuals. Differences between types of complaints are also noted there.

Documents must be submitted to the department office. It is recommended that you prepare a copy of the application. Tax authorities must make a note on it that it has been accepted for consideration. It is from this moment that the deadline for making a decision on the part of the higher inspection begins.

The appeal can be sent by mail in the form of a valuable letter with a list of attachments.

Sample response letter to the tax office

If it is necessary to respond to a request from the tax service, a covering letter is drawn up, which is an explanatory note to the updated VAT return or other tax information sent to the tax office.

When writing a cover letter, it is recommended to follow the general rules that are developed for writing a business letter. At the beginning of the response, indicate the name of the organization, as well as information about the official to whom the response is addressed.

Can tax authorities request documents again?

Unfortunately, citizens are often faced with situations where tax services act illegally.

Most often, taxpayers’ rights are violated in the following cases:

- Making demands for payment of taxes that do not correspond to legal reality.

- Refusal of tax deduction.

- Refusal to offset tax overpayments.

- Suspension of transactions on the current account.

- Late fulfillment of obligations.

- A requirement to present additional documents, whereas according to legal regulations they are not necessary.

If the rights of the taxpayer have been violated, then first of all he should file a complaint with a higher inspection to appeal against the actions of the resolution. This rule has been established since 01/01/2014 in accordance with paragraph 2 of Article 138 of the Tax Code of Russia.

You should not think that to solve the above problems, an accountant will necessarily have to seek help from lawyers. Having certain knowledge, you can completely cope with this task. The algorithm of actions is described in detail in this article.

Often, since tax services do not know all the specifics of the production activities of each subject of tax legal relations, the latter receive requests for documents that are not maintained in this organization.

It also happens that the list of documents is not available at the enterprise at the moment when the inspection is carried out due to the presence of objective reasons.

Attention! Among these reasons are:

- transfer of information at the request of government authorities;

- seizure of information by law enforcement agencies;

- destruction of information due to an emergency;

- destruction of materials after their storage period has expired;

- as a result of theft of materials.

If one of the above situations exists, after receiving the request, you should send a notification to the tax service that the requested document cannot be submitted. Copies of documents confirming the impossibility of providing the requested data are attached to the notification. These may be certificates issued by government or other authorities.

Important! Representatives of tax authorities are not authorized to demand the provision of information that they have already received during the process of conducting a desk or field audit.

The exception is materials presented in the original, as well as cases where documents at the tax authority were lost due to an emergency.

When an organization receives a request from the tax service to resubmit documents previously submitted, the recipient of such a request draws up a response notification addressed to the head of the department.

This document states that the documents have already been submitted previously, and therefore their resubmission is impossible. A copy of the registers of previously submitted information with the presence of marks from the tax authority is attached to the sent notification.

The taxpayer has the right not to submit tax documents when officials have not found any errors or inconsistencies in the submitted declaration.

In the presence of such circumstances, bringing a person to penalties established for such cases is not allowed. This is confirmed by the practice of the judiciary.

Attention! It is allowed not to submit materials that have previously been submitted to the tax authority for consideration, as evidenced by clause 5 of Art. 93 Tax Code of the Russian Federation.

There is a list of cases in which the tax authority, when conducting an audit, has the right to request information:

- when the declaration contains a claim for VAT refund. This is not any type of tax deduction. Based on clause 25 of the Supreme Arbitration Court Resolution No. 57, VAT refund is the excess of the declared deductions over the amount of tax payable;

- when the declaration declares the right to receive benefits. Benefits are considered to be relaxations provided for by tax legislation for a certain category of persons;

- when an amended tax return is submitted two years after filing the first return;

- when officials have discovered errors or inconsistencies in the submitted declaration.

So, taxpayers must remember the rule: the tax service must have certain grounds for requesting materials. The list of materials that may be requested by officials is also limited.

In accordance with established practice, it can be said that, regardless of the circumstances, the taxpayer may be subject to collection measures in the event of failure to comply with the requirements of the tax service.

Of course, the taxpayer has the right to appeal such a decision in court, but such a procedure takes a lot of time.

We suggest you read: Maternity leave

Remember! If there is a conflict situation with the tax authority, there are recommendations that should be used:

- the requirements must be fulfilled within the specified period, without delaying the procedure without objective circumstances;

- If there are any ambiguities in the authority’s requirements, you should contact the institution for clarification in writing.

When there are controversial situations in which the recipient of claims knows that his rights have been violated, he can turn to supervisory authorities or the court to protect his rights.

Watch the video. In what form should documents be submitted upon request by the tax authorities?

How to prepare documents before sending them to the Federal Tax Service

The Tax Code of the Russian Federation does not establish additional mandatory requirements for documents submitted at the request of the tax authority. The only requirement is certification in the prescribed manner, if necessary.

According to general practice, the number of documents requested by the tax authority often amounts to several thousand or hundreds of documents. This is a very time-consuming and usually pointless process.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

In this regard, a rule has developed according to which hundreds of documents are not required to be certified. Documents of the same type are put into one folder, bound and numbered. Next, an inventory is compiled for this folder. On the initial sheets, the employee indicates the register of documents that are transferred to the authority.

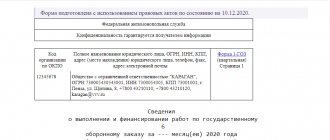

Kirov ………………………………………………………11/13/2016

From August 17 to October 12, 2021, the on-site tax audit department of the Federal Tax Service of Russia No. 8 in Moscow conducted an on-site tax audit of the correctness of the organization’s calculation of VAT for 2014–2015. On October 21, 2021, a tax audit report was drawn up. October 21, 2021 at the Federal Tax Service of Russia No. 18 in the city.

In accordance with the procedure established by Articles 101.2 and Article 139 of the Tax Code of the Russian Federation, Gazprom LLC presents its objections to the above decision.

According to the act, during the verification of the correctness of calculation and timely payment of VAT in January 2014, the tax inspectorate refused a tax deduction for VAT on materials purchased from Torgovaya LLC for a total amount of 413,000 rubles. (including VAT - 63,000 rubles) according to invoice dated January 16, 2012 No. 19.

According to the tax inspectorate, the details of the consignor and consignee of the goods are incorrectly indicated in the invoice.

Based on the results of the on-site tax audit, inspection officials recalculated the organization’s tax obligations to the budget for VAT, as a result of which the organization was asked to pay an additional VAT amount of 63,000 rubles to the budget. As well as penalties for late payment of taxes in accordance with Article 75 of the Tax Code of the Russian Federation.

In addition, in accordance with the above decision, the organization is brought to tax liability for committing a tax offense under Article 122 of the Tax Code of the Russian Federation. The fine is 20 percent of the amount of additional VAT charged.

We believe that the inspectors’ conclusions contradict the current legislation of the Russian Federation on taxes and fees for the following reasons.

Since the seller and the consignor of the goods are the same person, the “Consignor” column is rightfully indicated as “the same person.” This follows from the provisions of subparagraph “e” of paragraph 1 of Appendix 1 to Resolution of the Government of the Russian Federation of December 26, 2011 No. 1137 and is confirmed by the established arbitration practice in the Moscow region (Resolution of the Federal Antimonopoly Service of the Moscow District dated January 10, 2008

No. KA-A40/1317906). In the column “Consignee” it is also indicated “he”, which does not contradict the current legislation. Thus, the tax inspectorate unreasonably refused to confirm the application of tax deductions for VAT according to invoice No. 19 dated January 16, 2012.

Based on the above, in accordance with Article 140 of the Tax Code of the Russian Federation, we ask you to cancel the decision of the Federal Tax Service No. 18 for the city of Kirov and terminate the proceedings in the case due to the lack of grounds for bringing the organization to tax liability.

Director ______________ A.V. Ivanov

(position of the head of the organization)

M.P.

Submitting explanations to the Federal Tax Service regarding VAT has its own characteristics. As we have already noted, explanations for VAT must be submitted electronically if the payer’s responsibilities include submitting an electronic declaration (clause 3 of Article 88 of the Tax Code of the Russian Federation). In addition, these explanations must be presented in the approved format (approved.

Source: https://maksimovka.ru/otvet-nalogovuyu-postanovlenie/

Where and how to file an objection

The objection should be submitted to the address of the territorial tax service, whose specialists carried out the audit. The document can be transferred:

- personally “hand to hand”,

- by sending it by registered mail with return receipt requested.

Both of these methods ensure that tax authorities receive the objection in a timely manner.

Today, another proven option for document delivery has become widespread: through electronic services , but only on condition that the organization has an officially registered digital signature.

Presence of the taxpayer at the hearing

One of the important conditions for the legality of carrying out control activities is the invitation of the taxpayer to review the audit materials. The call is made in the form of a written notification. In the absence of a summons, the decision on the act may be canceled on a formal basis in court proceedings.

A manager or other person who has a power of attorney for the right to be present during the consideration of materials and provide explanations on emerging issues can act as a representative of the enterprise.

Main nuances in drawing up an objection

To date, there is no strictly established sample of an objection to a tax audit report. Employees of enterprises and organizations can draw up a document in any form, based on their understanding of it.

In this case, it is advisable to take into account some office work norms and rules for writing business documentation. In particular, the objection must indicate:

- addressee, i.e. the name, number and address of the exact tax office to which the objection is sent,

- sender information (company name and address),

- number of the objection and the date of its preparation.

In the main part it should be indicated

- the act in respect of which an objection is being drawn up,

- describe in detail the essence of the claim, including all available reasons and arguments.

The document must refer to the laws that confirm the correctness of the author of the objection and indicate all additional papers attached to it (marking them as a separate attachment).

Results

A desk tax audit report is issued by tax authorities only if violations were discovered during control of the declaration. You can send your objections to the inspection in writing if you can substantiate the fallacy of the conclusions set out in the inspection report.

If there are not enough arguments, filing objections is dangerous - they can provoke additional tax control measures.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to pay attention to when preparing a document

Neither the Federal Tax Service in its acts nor the law regulates the filing of an objection in any way. That is, it can be written by hand or printed on a computer on an ordinary A4 sheet or on company letterhead.

It is strictly important to comply with only one condition: the objection must be signed by the head of the enterprise or an employee authorized to create such documents. If the form is endorsed by a proxy, it must also indicate the number and date of the power of attorney.

It is not necessary to certify an objection with a stamp today, since starting from 2021, enterprises and organizations have every right not to use stamped products in their work (unless this norm is prescribed in the local regulations of the company).

The document should be drawn up in two copies , one of which should be submitted to the tax office, the second, after the tax specialist has marked the acceptance of the document, should be kept.

How to write about your disagreement with the inspectors’ conclusions

Objections must be submitted in writing.

First, get acquainted with the verification materials. Access to them is provided upon application, which is reviewed within 2 days. Familiarization occurs through visual inspection, making extracts, and making copies. The representative is allowed to access the inspection materials after confirmation of credentials. After familiarization, a protocol is drawn up (clause 2 of Article 101 of the Tax Code of the Russian Federation).

Rules for drafting: preparation and design

There is no legally approved form of objection. They are drawn up in any form, observing the requirements for drawing up an official document.

The name of the tax authority that conducted the audit and its address are usually indicated in the upper right corner. Below indicate the name (name, full name) of the person being checked, his address, telephone number.

The title includes the date and number of the act that is being disputed. For example, “Objections to the tax audit report No. ___ dated __.__.2017.”

The text of the act (fragments) is not rewritten, since each party has it. The text of the objections indicates what exactly they disagree with. They justify their positions with real documents or regulations. Attach copies of supporting documents if they are not included in the case materials. After describing the essence of the objections and justifying their positions, they offer to make a decision taking into account the presented documents.

After the text there is a list of appendices (copies of documents), containing the name, date of each document and the number of sheets (sheet numbers in the binder).

Below they put the date (day, month, year) and a signature with a full transcript. The official indicates his position.

When submitting copies of supporting documents with objections, they are stapled or stapled together with the objections and the sheets are numbered. On the reverse side, at the place where the firmware is fastened, indicate how many sheets have been stitched, sign and date it. A copy of each document is certified with the inscription “True”, the signature of the witness with a transcript (last name and initials) and an indication of the position and date of certification. The procedure for certification of submitted documents is established by letter of the Ministry of Finance of the Russian Federation dated 08/07/2014 No. 03–02-РЗ/39142.

If the person being checked has a seal, then the signatures are sealed.

Below is a diagram for filing objections.

Main stages of filing objections to a tax audit report

Differences in objections for different types of taxes

When drawing up objections, the norms established for each type of tax are taken into account.

| Position | Personal income tax | VAT | Income tax |

| Tax period for determining sanctions | Year | Quarter for normal activities | Year |

| Legislative norm of the Tax Code of the Russian Federation | Chapter 23 | Chapter 21 | Chapter 25 |

| Link to documents from counterparties | There are no grounds, records are kept by employee | Provides links to documents from each partner | Primary accounting documents from partners and independently generated ones are used - calculations, internal invoices, acts, certificates |

| Possible violations | Untimely withholding, transfer of tax, errors in providing deductions | Illegality of deductions, underestimation of the base, violation of the periods of application of deductions | Underestimation of the base, taking into account unjustified expenses, unreliability of primary accounting |

Depending on the type of tax, the list of supporting documents provided differs.